The Automotive AI market is driving the transformation toward autonomous, connected, and smart vehicles, covering applications ranging from advanced driver-assistance systems (ADAS) to predictive maintenance, in-vehicle personalization, and smart manufacturing. Automotive OEMs, tech giants, and Tier 1 suppliers are increasing their investments to remain competitive amid stricter safety regulations, rising consumer demand, and global supply-chain diversification.

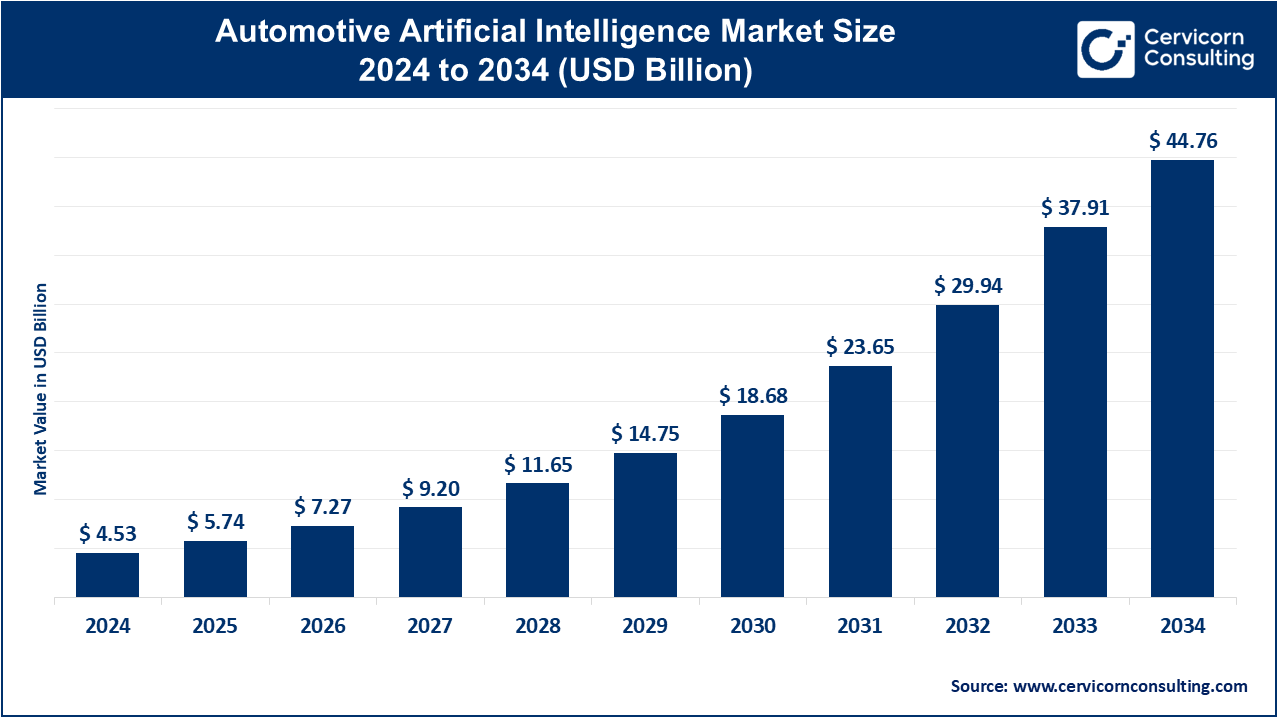

The global automotive artificial intelligence (AI) market size was reached at USD 4.53 billion in 2024 and is projected to exceed around USD 44.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 25.74% over the forecast period 2025 to 2034.

The automotive artificial intelligence (AI) market is rapidly evolving, driven by the growing demand for automation, enhanced safety features, and the integration of intelligent technologies within vehicles. Key players in the industry, including automakers, tech companies, and startups, are investing heavily in AI solutions to revolutionize the driving experience. AI is not only transforming autonomous vehicles but also improving existing systems like advanced driver assistance systems (ADAS) and vehicle diagnostics. Additionally, AI technologies are increasingly being used for predictive maintenance, reducing vehicle downtime and preventing costly repairs by analyzing data from sensors and diagnostics. The increasing adoption of electric vehicles (EVs) is also contributing to the expansion of artificial intelligence in the automotive market, as these vehicles are more reliant on advanced software for their operation. Furthermore, governments worldwide are setting stricter regulations for vehicle safety, which is accelerating the demand for AI-based safety technologies.

Automotive artificial intelligence (AI) refers to the use of AI technologies in the automotive industry to enhance vehicle safety, performance, and the overall driving experience. AI is employed in various areas, including autonomous driving, predictive maintenance, and smart in-car experiences. Key types of automotive AI include autonomous driving systems, which use AI to enable vehicles to drive without human intervention; AI-powered driver assistance systems (ADAS), which assist with tasks like parking, lane-keeping, and collision avoidance; and AI-driven infotainment systems, which provide personalized in-car experiences. These technologies rely on machine learning, deep learning, and computer vision to process and analyze data in real-time, making driving safer and more efficient.

Key Global Trends in Automotive AI

Global Deployment & Tech Adoption Snapshot

| Region | Strategic Highlights & Developments |

| North America - ADAS & Autonomous Fleets | Approximately 75% of newly manufactured vehicles feature AI-driven driver-assist systems. Tesla is launching its robotaxi fleet in Austin in June 2025, while Waymo operates across six U.S. cities, averaging 250,000 autonomous rides per week. Regulatory frameworks from the NHTSA support AV deployment on public roads. |

| Europe – Regulatory Pilots & Robotaxis | The U.K. Automated Vehicles Act will enable trials for commercial driverless taxis in 2026, positioning the region for a projected GBP 42 Bn autonomous mobility market and 38,000 new jobs by 2035. Collaborations include Uber–Wayve pilots in London using end-to-end AI without HD maps. |

| China – Mass Deployment & Chip Sovereignty | With over 150,000 autonomous test vehicles on public roads, China leads in scaled AV testing. Companies like Baidu’s Apollo Go, WeRide, and Pony.ai operate robotaxi fleets in more than 20 cities. Xpeng has launched a proprietary 2,200 TOPS AI chip for VW EVs, while Horizon Robotics holds a 49% share of China’s AV chip market. |

| Global – AI Infrastructure & Ecosystem Collaborations | Leading OEMs such as BMW, Volvo, and Mercedes-Benz are collaborating with NVIDIA to build sovereign AI clouds and digital twin factories throughout Europe. Startups like Applied Intuition (valued at USD 6 Bn) and Cerence are powering next-generation applications, from L4 autonomy platforms to in-cabin AI assistants and gesture controls. |

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 5.74 Billion |

| Market size in 2034 | USD 44.76 Billion |

| Market Growth Rate | CAGR of 25.74% from 2024 to 2034 |

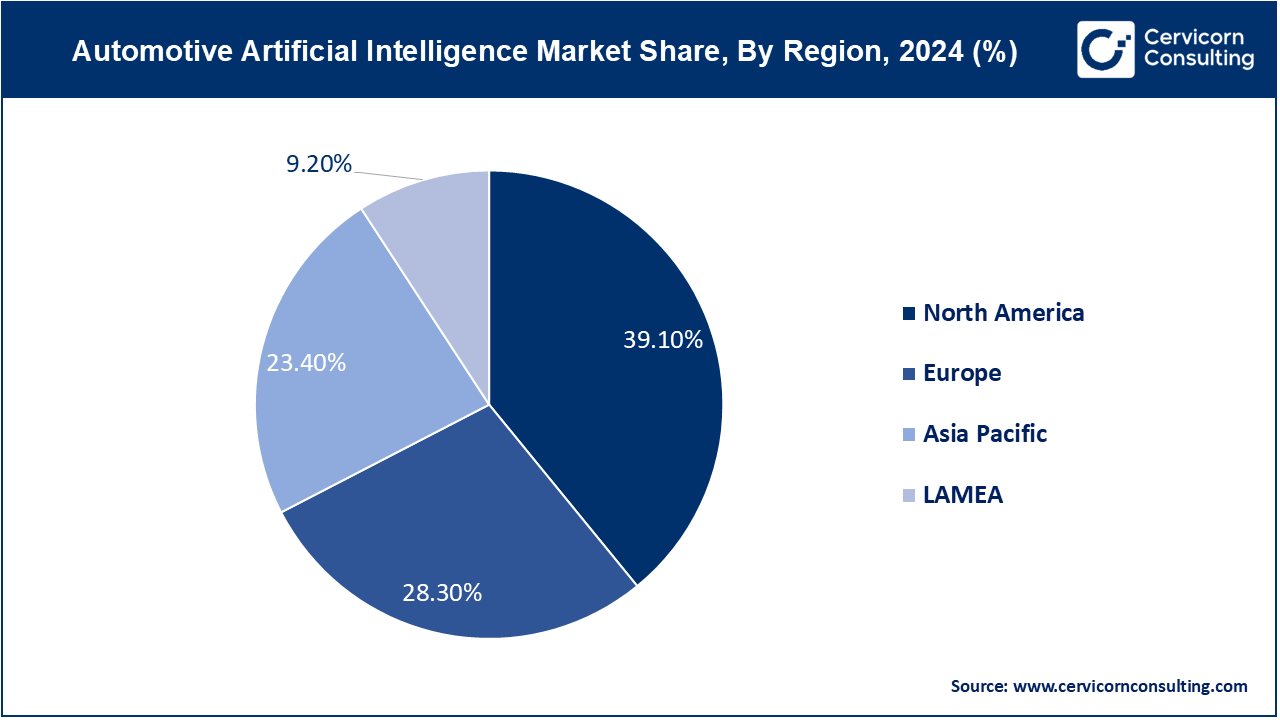

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Level of Autonomy, Component, Vehicle Type, Application, Technology, Regions |

Demand for Personalized In-Vehicle Experiences:

Integration of AI in Vehicle Cybersecurity:

High Cost of Implementation:

Data Privacy Concerns:

Augmented Reality (AR) and Virtual Reality (VR) Integration:

AI in Vehicle-to-Everything (V2X) Communication:

Safety and Liability Concerns:

Skill Gap and Training Needs:

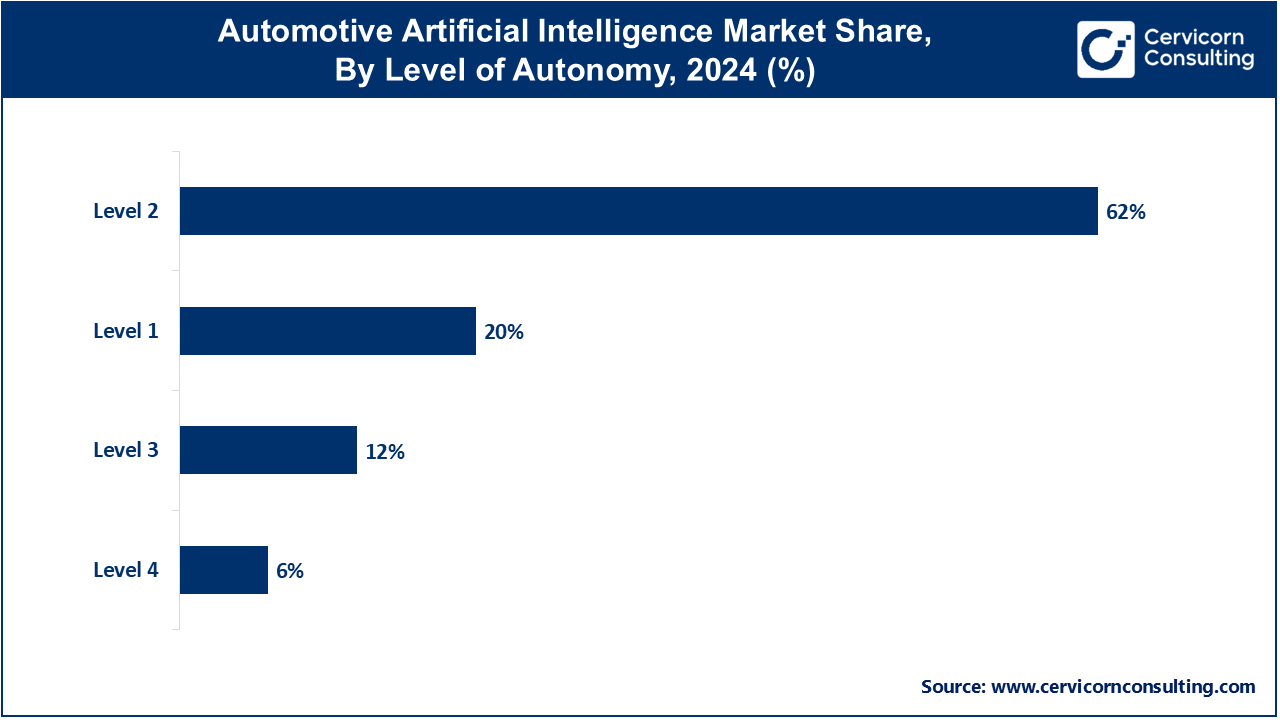

Level 1 (Driver Assistance): The level 1 (driver assistance) segment has accounted market share of 20% in 2024. Basic driver assistance features like adaptive cruise control and lane-keeping assist offer partial automation. The driver retains full control and must remain engaged, overseeing the vehicle's operation and intervening as needed.

Level 2 (Partial Automation): The level 2 (partial automation) segment has captured highest market share of 62% in 2024. This level combines automated functions such as steering, acceleration, and braking under specific conditions. While the AI can manage these tasks, the driver must monitor the environment and be ready to take control at any time, maintaining overall responsibility.

Level 3 (Conditional Automation): The level 3 (conditional automation) segment has recorded market share of 12% in 2024. Vehicles at this level can handle most driving tasks under certain conditions, allowing the driver to disengage from active driving duties. The AI monitors the environment and makes decisions independently, though the driver must be prepared to intervene if prompted by the system.

Level 4 (High Automation): The level 4 (high automation) has measured market share of 6% in 2024. At Level 4, vehicles are capable of performing all driving tasks and monitoring the environment without human intervention in predefined conditions or environments. While the driver may have the option to take control, the AI manages most driving situations independently, offering increased safety and convenience.

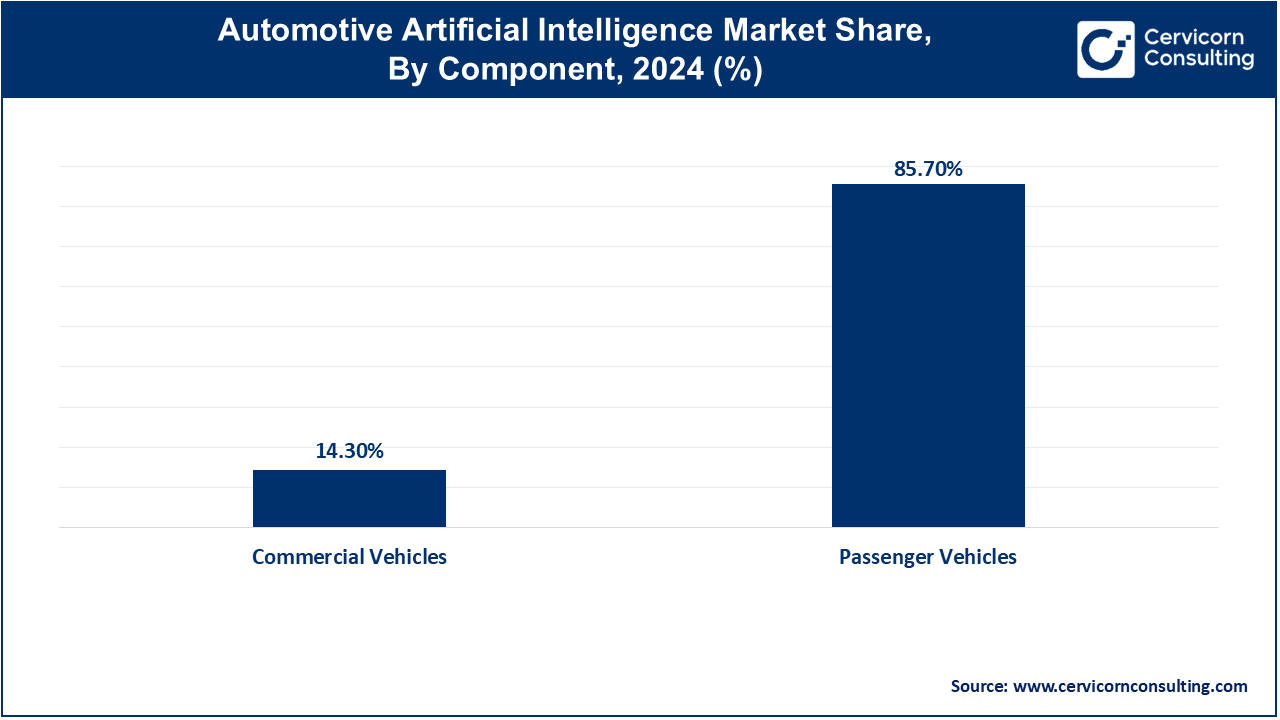

Hardware: The hardware segment has covered largest marked share of 76.4% in 2024. In the Automotive AI Market, hardware refers to physical components like processors, sensors (LiDAR, radar, cameras), and connectivity modules. These components enable AI applications such as autonomous driving and driver assistance systems. Trends include advancements in sensor miniaturization, increasing computing power for real-time data processing, and the development of specialized AI chips optimized for automotive applications, enhancing vehicle perception and decision-making capabilities.

Software: The software segment has generated market share of 23.6% in 2024. Automotive AI software encompasses algorithms, machine learning models, and software platforms facilitating AI functionalities in vehicles. It enables tasks like natural language processing, autonomous navigation, and predictive maintenance. Trends include the adoption of open-source AI frameworks, cloud-based AI platforms for data integration, and the evolution towards AI-driven software updates and customization, enabling automakers to deliver enhanced user experiences and continuously improve vehicle performance and safety.

Autonomous Driving: AI enables vehicles to operate autonomously, using advanced sensors and algorithms to perceive surroundings and navigate safely without human intervention, revolutionizing transportation with potential applications in ride-sharing and logistics.

Connected Car: AI facilitates seamless connectivity between vehicles and external systems, enhancing navigation with real-time updates, enabling predictive maintenance alerts, and supporting personalized in-car services, fostering a more integrated and efficient driving experience.

Driver Assistance: AI-driven features like adaptive cruise control and automated emergency braking systems assist drivers in monitoring surroundings, enhancing safety by reacting to potential hazards and reducing the likelihood of accidents.

Predictive Maintenance: AI analyzes large volumes of vehicle data to predict component failures before they occur, optimizing maintenance schedules, minimizing downtime, and extending the lifespan of automotive systems and components.

Infotainment: AI enhances in-car entertainment and communication systems with intuitive interfaces, voice recognition capabilities, and personalized content recommendations, transforming the driving experience into a more interactive and enjoyable journey.

Cybersecurity: AI-powered cybersecurity solutions monitor and protect vehicle networks from cyber threats, detecting anomalies and responding in real-time to safeguard sensitive data and maintain the integrity of connected automotive systems.

Others: Emerging applications include AI-driven fleet management solutions for optimizing logistics and operational efficiency, as well as AI-powered energy management systems that enhance sustainability efforts by optimizing vehicle energy consumption and reducing emissions.

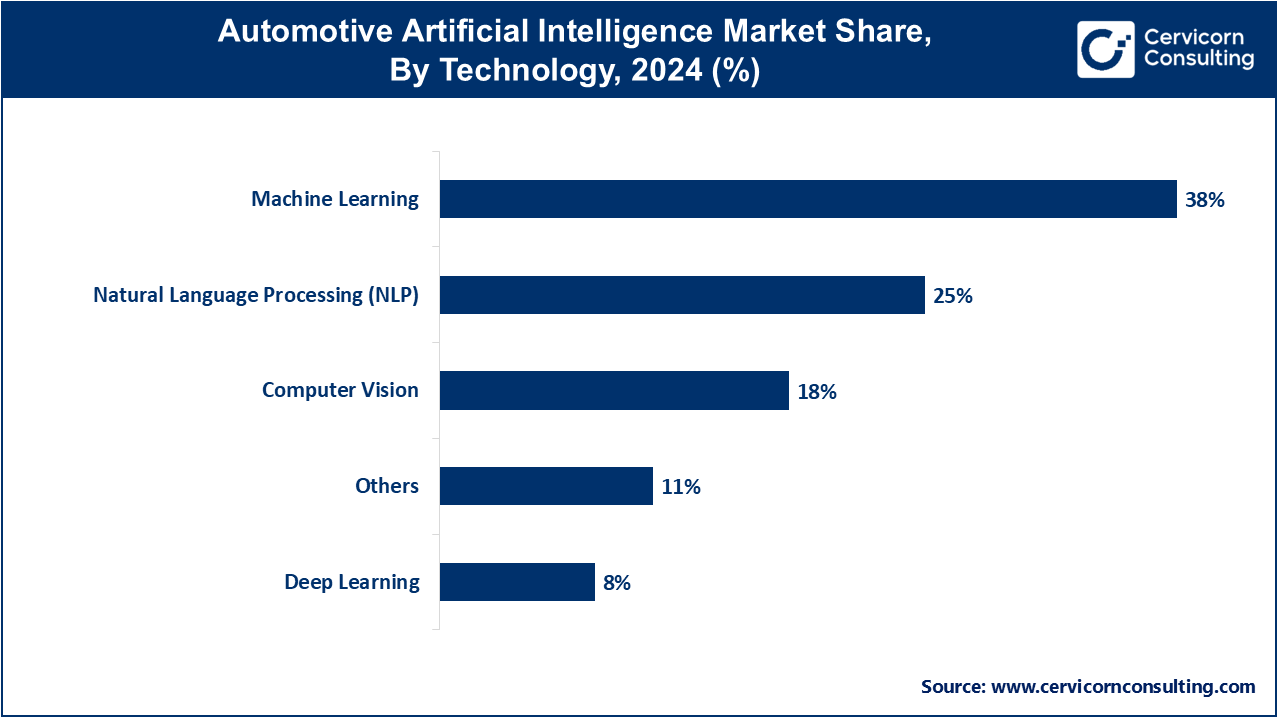

Machine Learning: The Machine learning segment has dominated the market with share of 38% in 2024. AI technology enabling vehicles to learn from data, improving decision-making in tasks like autonomous driving and predictive maintenance. Trends include the use of supervised and unsupervised learning algorithms to enhance vehicle capabilities and efficiency.

Computer Vision: The computer vision segment has achieved revenue share of 18% in 2024. Enables vehicles to interpret visual data from cameras and sensors, identifying objects, pedestrians, and road markings. Trends focus on enhancing accuracy and real-time processing capabilities for safer autonomous driving.

Natural Language Processing (NLP): The Natural language processing segment has touched market share of 25% in 2024. AI enables vehicles to understand and respond to human language inputs, facilitating voice commands and interactive communication. Trends include improving NLP accuracy and expanding language support for seamless in-car interactions.

Deep Learning: This segment has registered 8% market revenue share in 2024. Subset of machine learning using neural networks to process complex data and improve decision-making. Trends involve applying deep learning models for advanced driver assistance systems (ADAS) and autonomous vehicle perception tasks.

Others: This segment has considered 11% of market share in 2024. This category encompasses emerging AI technologies like reinforcement learning and generative adversarial networks (GANs), exploring potential applications in automotive cybersecurity, personalized driving experiences, and adaptive vehicle behavior.

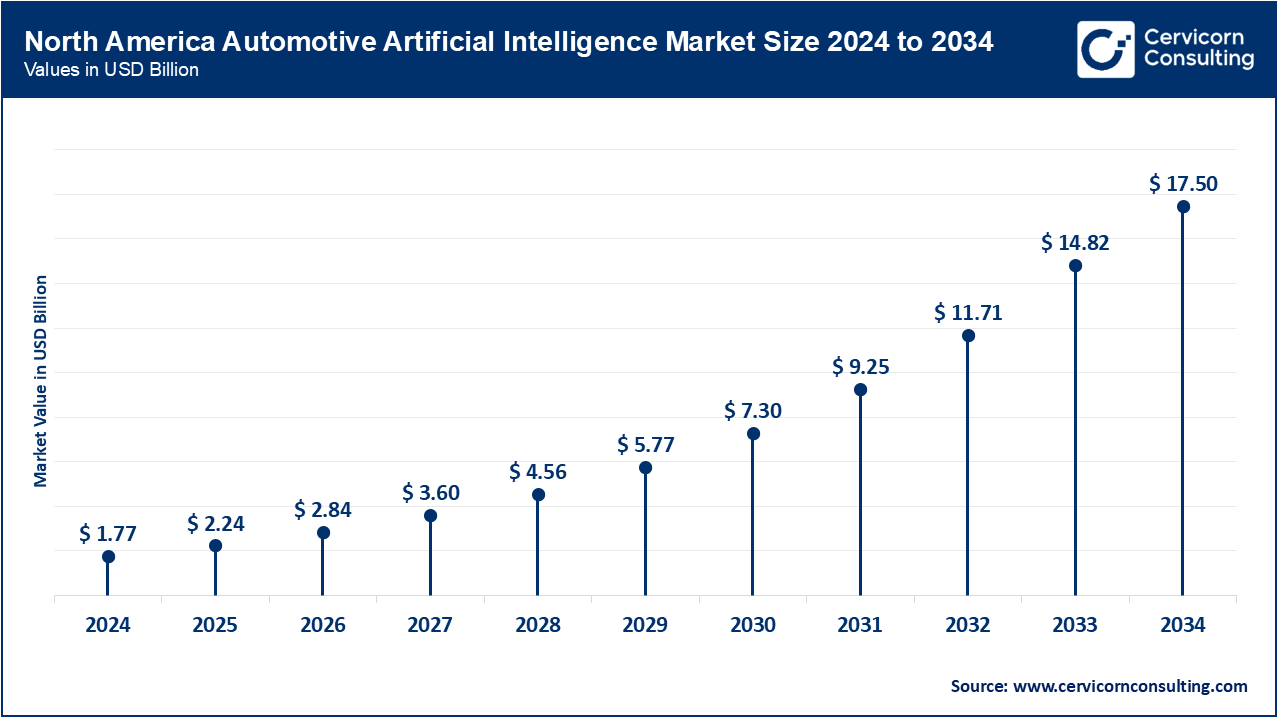

The North America automotive AI market size is registered USD 1.77 billion in 2024 and is forecasted to hit around 17.5 billion by 2034. North America leads in AI adoption for vehicles, focusing on autonomous driving technologies and advanced driver assistance systems (ADAS). The region benefits from strong investments in AI research and development by tech giants and automotive manufacturers. Regulatory support for testing and deploying autonomous vehicles further accelerates innovation. Partnerships and acquisitions between technology companies and automakers are common, aiming to integrate AI solutions that enhance safety and efficiency on North American roads.

The Europe automotive AI market size is generated USD 1.28 billion in 2024 and is anticipated to reach around 12.67 billion by 2034. In Europe, AI adoption in automotive focuses on safety, sustainability, and connectivity. There is a significant emphasis on connected cars and cybersecurity solutions to support vehicle-to-everything (V2X) communication and smart infrastructure development. The region's stringent environmental regulations drive the integration of AI to reduce emissions and improve energy efficiency in vehicles. Strategic alliances between automotive OEMs and AI startups are prevalent, fostering collaboration for innovative AI-driven solutions that cater to European market demands.

The Asia-Pacific automotive AI market size is accounted USD 1.06 billion in 2024 and is estimated to surpass around USD 10.47 billion by 2034. Asia-Pacific leads in adopting AI for urban mobility and smart city initiatives. The region addresses challenges such as traffic congestion and air pollution through AI-powered autonomous vehicles and smart transportation systems. Emerging markets within Asia-Pacific present growth opportunities for AI applications in electric vehicles (EVs) and shared mobility solutions. Government initiatives support the integration of AI into transportation infrastructure and smart city development, positioning Asia-Pacific as a key driver of AI innovation in automotive technologies.

LAMEA focuses on enhancing vehicle connectivity and improving road safety through AI technologies. The region is investing in AI solutions to upgrade road infrastructure and optimize transportation systems. There is increasing interest in AI-powered electric and hybrid vehicles, driven by growing environmental awareness and government incentives. Local innovation plays a crucial role, with AI solutions tailored to address regional mobility challenges and meet consumer preferences across diverse markets within LAMEA.

New players entering the automotive AI market are often startups and technology firms specializing in AI solutions for autonomous driving, connected vehicles, and predictive maintenance. Companies like Argo AI, TuSimple, and Aurora are innovating with advanced AI algorithms and sensor technologies to compete in autonomous vehicle development. Dominating the market are established giants such as Waymo, Tesla, and NVIDIA. These key players leverage extensive resources, technological prowess, and strategic partnerships to lead in AI-driven automotive innovations. They focus on developing proprietary AI platforms, enhancing safety features, and scaling autonomous driving capabilities, setting industry standards and shaping the future of automotive AI.

Market Segmentation

By Level of Autonomy

By Component

By Vehicle Type

By Application

By Technology

By Region