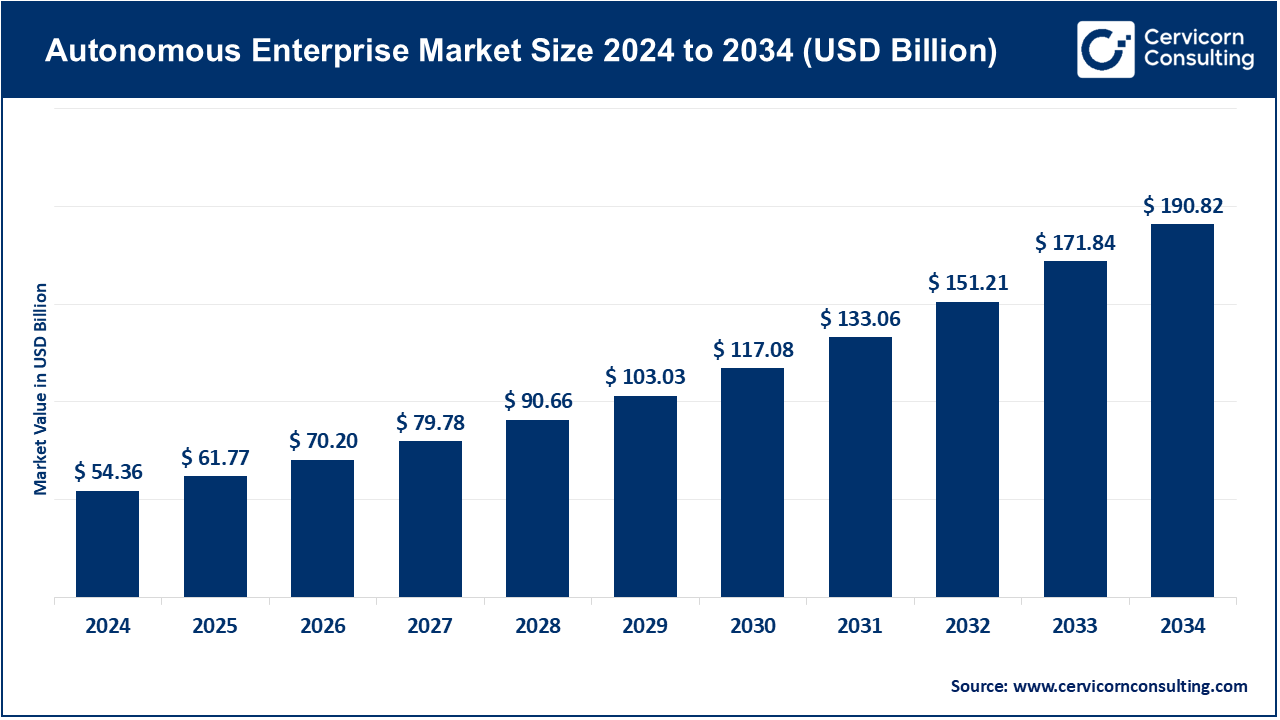

The global autonomous enterprise market size was valued at USD 54.36 billion in 2024 and is expected to reach around USD 190.82 billion by 2034, rising at a compound annual growth rate (CAGR) of 13.38% from 2025 to 2034.

The market for autonomous enterprises is experiencing significant growth, driven by advancements in AI, big data, and automation. Businesses are increasingly investing in AI-powered solutions to improve operational efficiency, reduce human errors, and enhance scalability. The demand for cloud-based AI platforms, predictive analytics, and real-time monitoring tools is accelerating market expansion. Governments and enterprises worldwide are adopting automation to boost productivity and competitiveness. The rise of AI-driven customer service, intelligent supply chains, and autonomous finance operations is fueling growth. The future outlook remains promising, with industries like banking, healthcare, and logistics expected to see widespread adoption.

Autonomous Enterprise Market: AI Enabling

Autonomous enterprises run on self-learning software agents, which are responsible for providing smart products and services to the machine-customer-prevalent market. The concept of autonomous enterprise involves automating all the processes that take place in an organization, which is why AI has become a crucial part of such organizations. In fact, moststeps that occur in autonomous enterprises use AI for analyzing, decision-making, and other actions that otherwise may require human interaction.

What is an Autonomous Enterprise?

An autonomous enterprise is a business that leverages AI, automation, and data analytics to operate with minimal human intervention. It uses machine learning (ML), robotic process automation (RPA), and predictive analytics to optimize operations, improve decision-making, and enhance customer experiences. In an autonomous enterprise, AI-driven systems handle repetitive tasks, monitor processes in real-time, and predict outcomes to enable proactive decision-making. These enterprises integrate IoT, cloud computing, and blockchain for seamless data flow and security. The goal is to increase efficiency, reduce costs, and improve agility while allowing human employees to focus on strategic and creative tasks. Industries like finance, healthcare, retail, and manufacturing are rapidly adopting autonomous systems to streamline operations and enhance productivity.

Key Insights Beneficial to the Autonomous Enterprise Market

Worldwide Spending on Public Cloud Services 2022-2023 (U.S. Million Dollars)

| End User | 2022 | 2023 |

| Cloud Application Infrastructure Services | 11,976 | 138,962 |

| Cloud Management and Security Services | 34,487 | 42,401 |

| Cloud System Infrastructure Services | 114,786 | 150,310 |

Another factor that needs to be considered is autonomy, which indicates self-learning, self-driving, and self-optimizing, all achieved using AI. Therefore, it is not possible to develop an autonomous enterprise without the help of AI and machine learning. With time, when there are more powerful AI systems, organizations will be able to achieve better results and productivity.

Autonomous Enterprise Market Top Applications & Investment Opportunities

Report Scope

| Area of Focus | Details |

| Mrket Size in 2025 | USD 61.77 Billion |

| Projected Market Size in 2034 | USD 190.82 Billion |

| Growth Rate 2025 to 2034 | 13.38% |

| Regional Leader | North America |

| Rapidly Growing Region | Asia-Pacific |

| Key Segments | Offering, Business Function, Application, Vertical, Region |

| Key Companies | IBM, Microsoft, Atos, Check Point, NICE, UiPath, Cisco, AWS, Blue Prism, Oracle, Nintex, Automation Anywhere, AutomationEdge, Digitate, Fetch.ai, Mendix, Rossum, HPE, SAP, Appian, Palo Alto Networks, Sage, Tangentia, Synder, Drivenets, Pegasystems, Rocketbot |

Cloud & IoT Infrastructure, to be the Major Driver

Internet of Things (IoT) and cloud-based systems, along with artificial intelligence, play a crucial role in enhancing automated processes. Integration of IoT in the autonomous enterprise is useful in making decisions based on real-time data insights, improves efficiency, streamlines operations, saves cost, optimizes resources, enhances customer experience, minimizes disruptions, and provides adaptability & scalability for fulfilling evolving needs. One of the major needs for automation is high speed and proper data management, which can be done with the help of cloud-based systems. The data stored on the cloud can be easily accessed and transferred without reducing the speed of the systems.

Data Privacy Concerns: Limitation for the Industry’s Expansion

For automated operations and systems, organizations have to implement different equipment, software, AI models, cloud-based systems, IoT, and so on, which will lead to the generation of a large amount of data. As the data is majorly stored, managed, and transferred on servers, it becomes vulnerable to data theft and data privacy. Compared to hardware storage of data, software storage of data is more prone to cyber-attacks, which can lead to financial losses. It becomes highly important for organizations to take proactive measures to prevent anything that can raise data privacy concerns.

Generative AI: A Promising Opportunity for the Market

Generative AI refers to AI tools that generate new content, such as text, music, audio, video music, and so on. With the help of generative AI and low-code platforms, organizations will operate with more agility. Generative AI will be able to enhance efficiency, increase agility, increase employee satisfaction, and, most importantly, be able to do innovation. Generative AI will further make operations more autonomous in organizations. With generative AI, employees have to focus only on more important tasks and leave aside mundane or repetitive tasks.

For instance,

By offering, the market is segmented into service and solutions. The services segment to sustain its dominance in the market.

The service segment accounted for the largest market share in 2024. Automation and artificial intelligence technologies are coming together to build self-driving systems that not only boost productivity by relieving humans of boring and time-consuming tasks but also enhance speed and effectiveness. There are several business sectors where autonomous solutions are beneficial.

One of the key benefits of the autonomous enterprise is enhanced efficiency at the enterprise size. Automating mundane or repeated processes, such as data input or rules-based approvals, may help firms operate more quickly and accurately while freeing up employees to take on higher-value jobs. Business executives may also prevent costly errors and make better judgments by utilizing AI to evaluate data and make predictions.

Based on business function, the market is segmented into accounting and finance, IT, human resource, sales and marketing, supply chain and operations. The IT segment is projection to lead the market.

The IT segment led the autonomous enterprise market in 2024. The segment is observed to sustain the dominance in the upcoming years with the rising requirement of workflow automation in the IT industry. Many enterprises are focused on adapting cloud-based technologies such as containers and serverless systems, this recent trend is seen to promote the segment’s expansion in the upcoming period. Moreover, the segment’s growth is supported by the rise of edge computing, self-healing IT infrastructure and AI-powered solutions.

The supply chain and operations segment is observed to experience a notable growth in the predicted timeframe. The rising adoption of AI and ML along with robotic process automation is observed to promote the segment’s growth. The segment is seen to expand rapidly with the rising emphasis over seamless integration of end-to-end supply chain automation and green supply chains. Automation in supply chain and operations also offer energy and cost savings, this advanced efficiency gain factor will supplement the segment’s growth while carrying autonomous delivery systems and supply chain resilience as recent trends.

Based on application, the market is segmented into process automation, order management, credit evaluation and management, predictive maintenance, customer and employee management, and others. The process automation segment has dominated the market in 2024.

The process automation segment held the largest share in 2024. Processes are the major component of developing any product or service, which requires resources, effort, and time. Any error during processes can lead to financial loss and reduced productivity. Various systems, equipment, and software are involved in operations, which can be automated. Automation will reduce human interaction, which will mitigate the chances of human errors. Also, automation will help in better resource allocation, resource management, time management, and other aspects needed to increase productivity. Various tools that are used in process automation include integrated systems, workflow orchestration, robotic process automation (RPA), AI, business rules, and intelligent document processing (IDP).

The order management segment is expected to grow at the fastest rate during the forecast period. Orders from all sales channels are centrally located, order processing and routing are expedited, and real-time order fulfillment tracking is provided via an automated ordering system. Businesses utilize technology extensively to cut expenses and order fulfillment time while avoiding errors associated with human order management. With a single, user-friendly cloud-based interface, AI-driven automated order management systems let users process and monitor every order digitally in any format or channel.

E-commerce is rising, and almost all industries are involved in e-commerce in one way or another. With the rise in demand for e-commerce, the need for automated ordering systems is at its peak. The following infographic shows the future of e-commerce and how it will grow in the upcoming years.

Based on vertical, the global market is segmented into BFSI, IT and ITes, Telecom, Retail and Ecommerce, Media and Entertainment, Healthcare, Transportation and Logistics, Manufacturing, Government and Logistics, Manufacturing, Government and Defense, Others. The IT & ITes segment held the largest share in 2024.

By vertical, the IT & ITeS segment held the largest share of the autonomous enterprise market in 2024. Human error is a common occurrence in manual procedures, including incorrect data input and calculation. By adhering to preset rules and procedures, automation helps to reduce these mistakes, improving accuracy and data integrity. Automation may significantly shorten turnaround times in the IT and ITES sectors, where prompt service delivery is essential. In the IT and ITES sectors, automation is driven by the need to streamline workflows, boost productivity, lower error rates, and maintain competitiveness in a quickly changing digital environment.

Besides this, the BFSI segment is anticipated to grow at the fastest rate in the autonomous enterprise market during the forecast period. Automation may play a crucial role in banking by offering an effective platform for gathering and analyzing consumer data to acquire important insights. Process optimization and streamlining are additional benefits of automation. By reducing the need for human interaction, automation in banking enables banks to respond to consumer requests more rapidly and precisely.

Additionally, it lowers banks' operating expenses, enabling them to charge less for improved client service. By using sophisticated security protocols, encryption, and fraud detection systems, automation improves the security of financial transactions while safeguarding the funds and data of its clients.

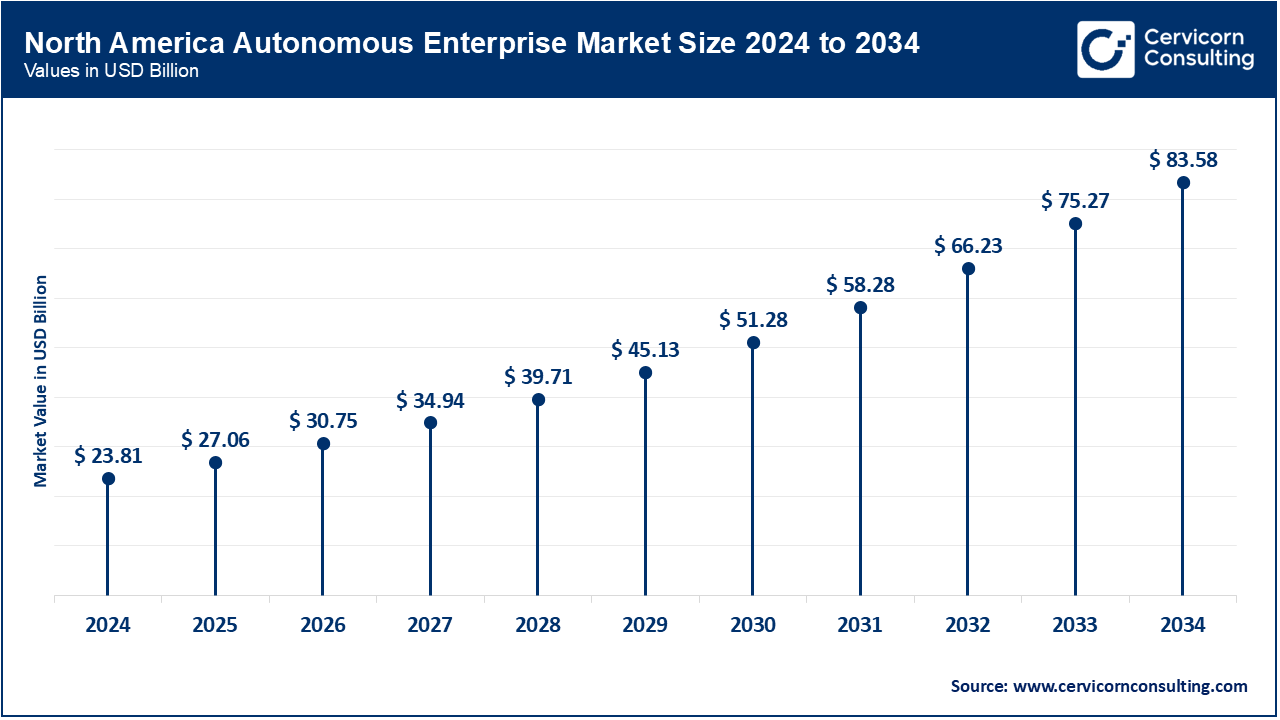

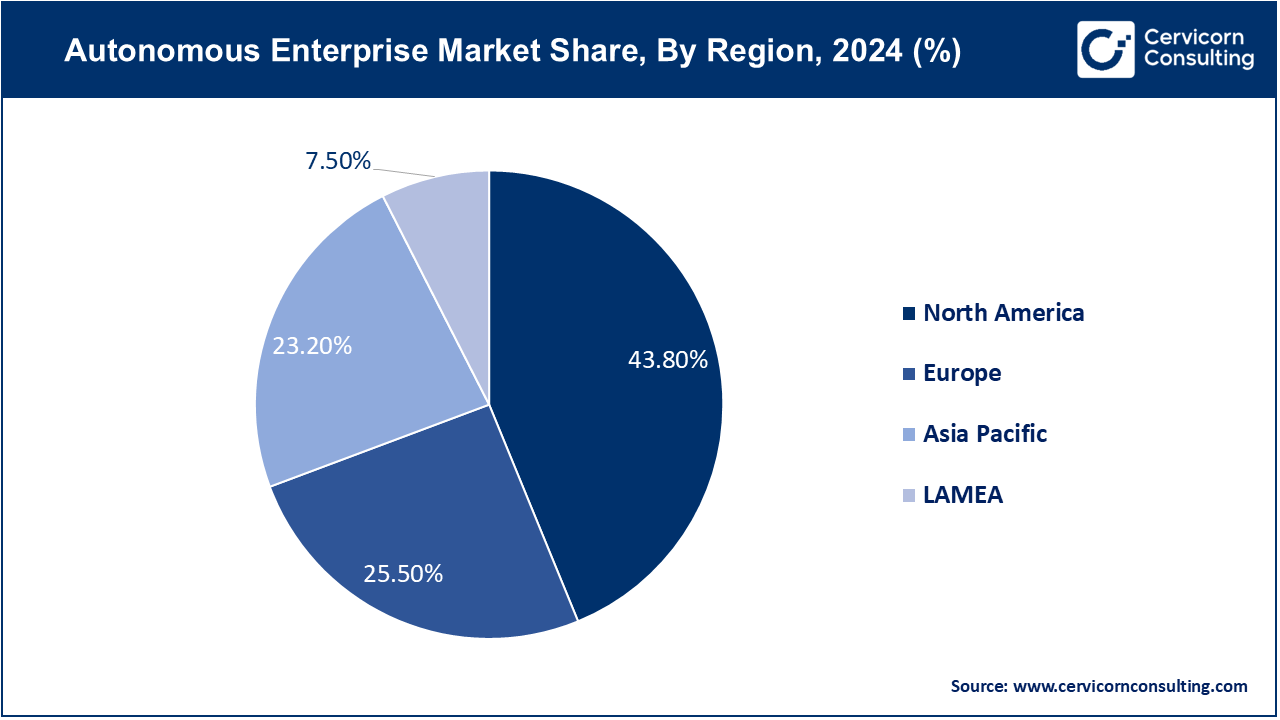

Based on region, the global market is segmented into North America, Asia-Pacific, Europe, Latin America, Middle East and Africa. North America dominated the autonomous enterprise market in 2024.

The North America autonomous enterprise market size was valued at USD 23.81 billion in 2024 and is expected to reach around USD 83.58 billion by 2034. North America has always been ahead in technological advancements, which has ensured that North America remains ahead of other regions in different sectors. With the growing usage of AI and machine learning, key players in North America are adopting autonomous solutions in different operations. The countries that majorly contribute to the growth of the market are the U.S. and Canada.

The U.S. held the major share of North America’s autonomous enterprise market in 2024. The main reason for the dominance is the presence of key players in the U.S. For instance, AWS, Check Point, Microsoft, Palo Alto Networks, Nintex, UiPath, Cisco, Mendix, AutomationEdge, Digitate, HPE, Pegasystems, Synder, and others are some of the key players that are based in the U.S. These companies are heavily contributing to the market by providing various autonomous solutions in the U.S. as well as other countries on a global level.

The Asia-Pacific autonomous enterprise market size was valued at USD 13.86 billion in 2024 and is projected to surpass around USD 48.66 billion by 2034. The Asia Pacific is expected to grow at the fastest rate during the forecast period. The market is growing significantly in Asia Pacific due to countries like China, Japan, India, and South Korea. These countries are seen rapidly adopting AI technologies across multiple industries, while government encouraging development of manufacturing and autonomous operations support the market’s expansion in Asian area.

Many companies in the region are using AI, machine learning, and IoT to automate various processes and actions. The major contributor to the growth of the autonomous enterprise market is the technological advancements in China. China is known for continuous innovation and the presence of various large organizations that use automated systems.

China Automation Trends

Segments Covered in the Report

By Offering

By Business Functions

By Application

By Vertical

By Region