Drug Discovery Market Size and Growth 2025 to 2034

The global drug discovery market size was accounted for USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.25% during the forecast period 2025 to 2034. The drug discovery market is experiencing robust growth driven by factors such as increasing research and development (R&D) investments in the pharmaceutical and biotechnology sectors, the rising prevalence of chronic diseases, advancements in artificial intelligence (AI) and machine learning (ML) for drug discovery, and favorable government initiatives supporting drug development.

Drug discovery is the process of identifying and developing new medicines to treat diseases by understanding biological mechanisms and targeting specific molecules. It involves multiple stages, including target identification, lead compound discovery, preclinical testing, and clinical trials. Advances in technologies like artificial intelligence, genomics, and high-throughput screening have significantly accelerated the process, enabling faster and more cost-effective development of innovative therapies for various medical conditions.

Drug Discovery Market Report Highlights

- The U.S. drug discovery market size was valued at USD 23.14 billion in 2024 and is estimated to surpass around USD 43.45 billion by 2034.

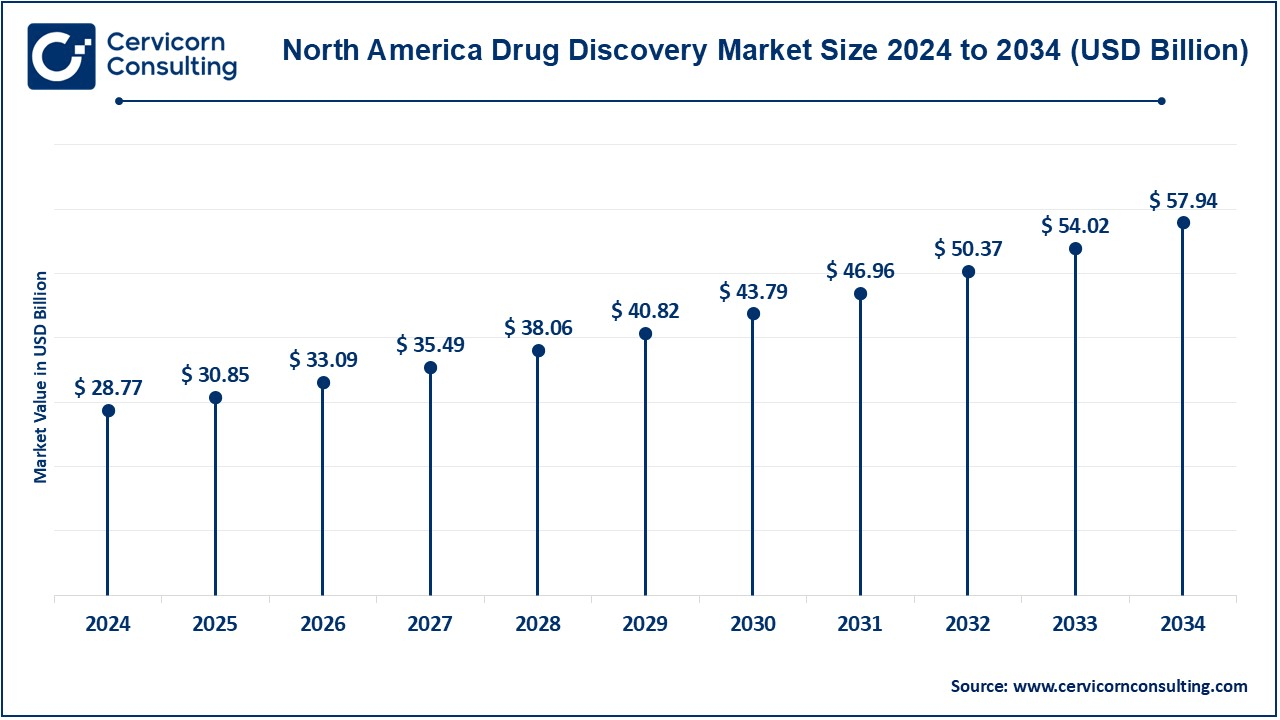

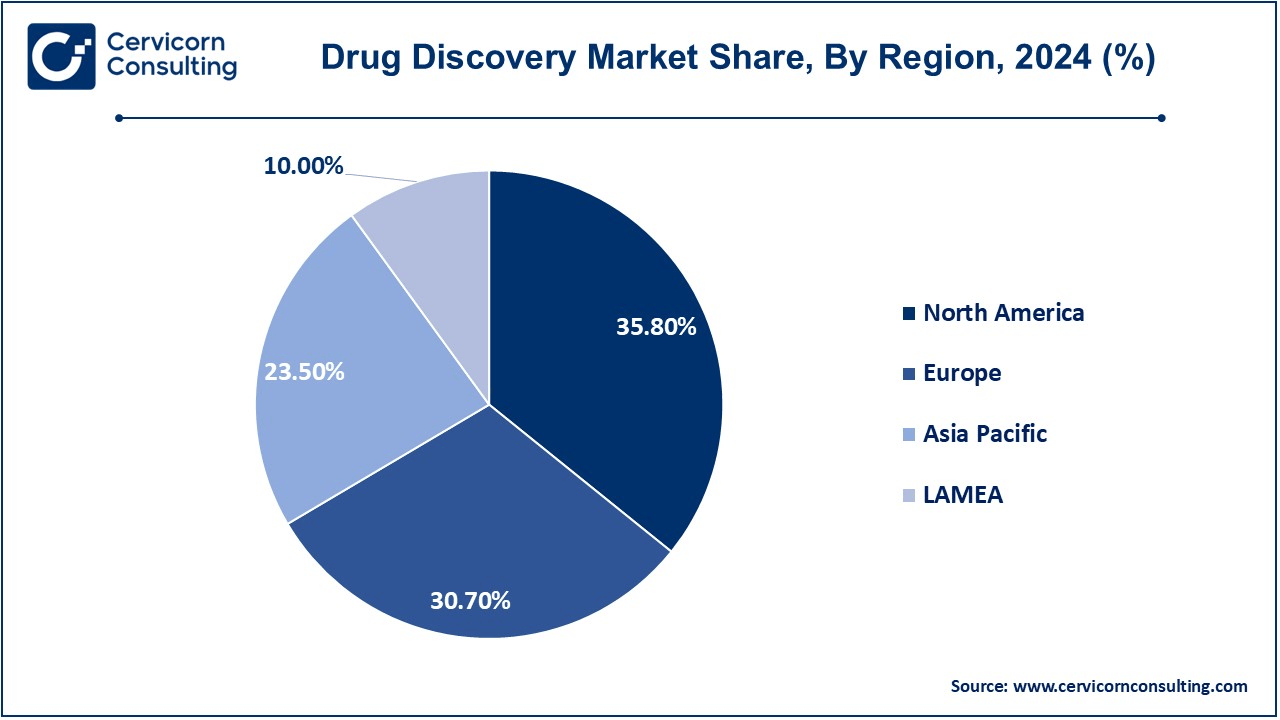

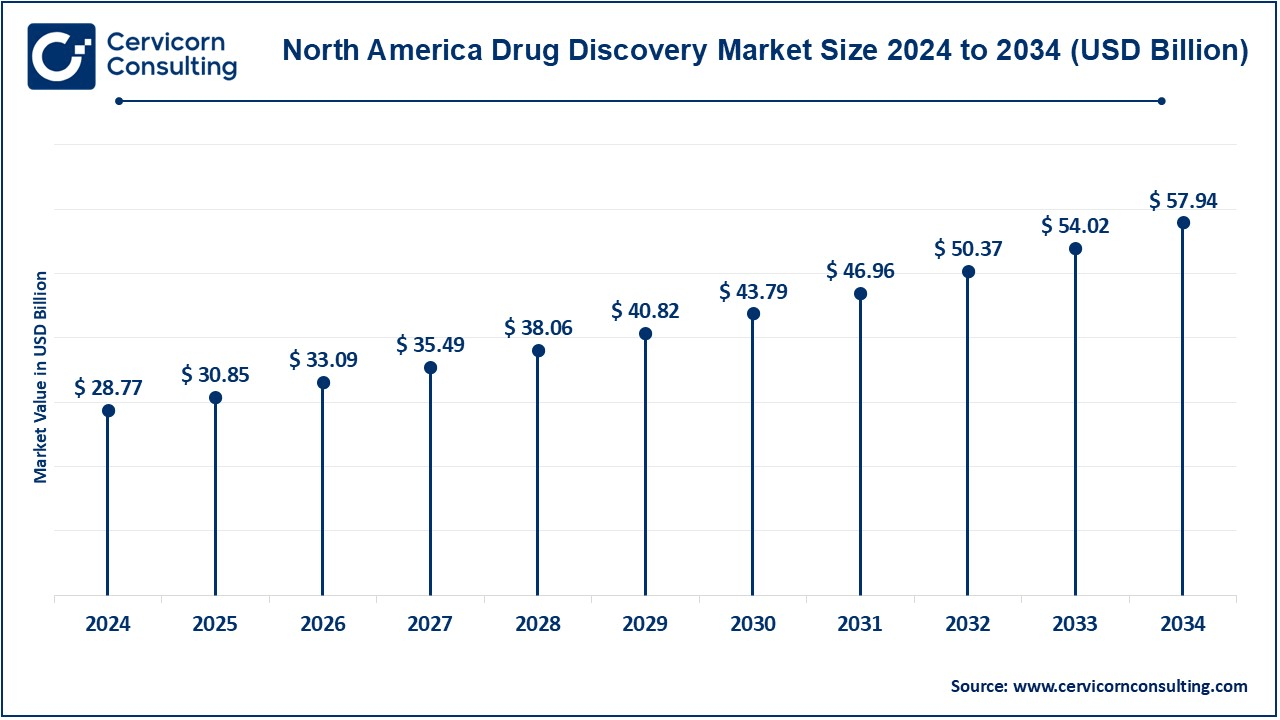

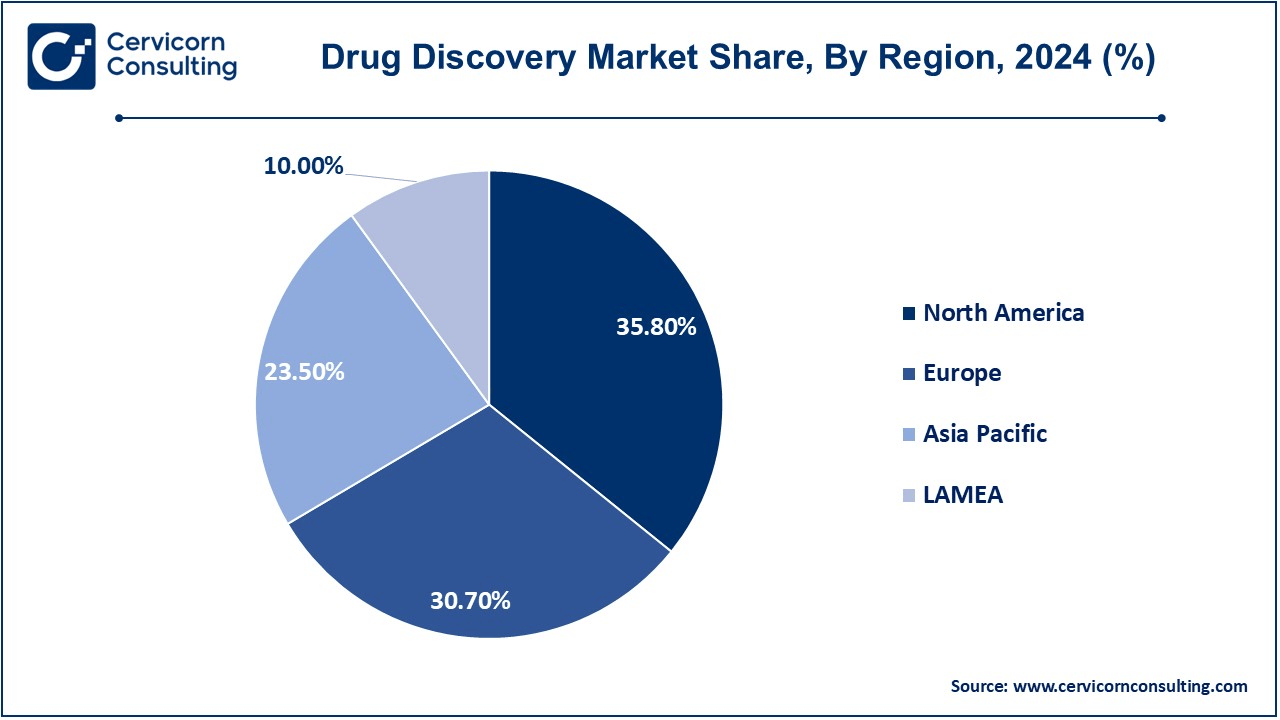

- The North America region is expected to dominate the market in 2024, holding a revenue share of 35.80%.

- Europe region has captured revenue share of 30.70 in 2024.

- By drug type, the biologic drugs has recorded revenue share of 78% in 2024.

- By technology, the high throughput screening segment has dominated the market in 2024.

- By end user, the pharmaceutical companies segment has leading the market in 2024.

Drug Discovery Market Growth Factors

- Biologics and biosimilars: The growth of biologics and biosimilars is driving the drug discovery market because they can target complex diseases like cancer, rheumatoid arthritis, and diabetes. Biologics are derived from living organisms and have higher specificity and fewer side effects than traditional drugs. Several blockbuster biologics whose patents expire will see cost-effective alternatives emerge in the form of biosimilars. Investment in the research and development of innovative biologics and biosimilars through the advanced platforms of recombinant DNA technology and monoclonal antibody production is being made by pharmaceutical companies. Such trends increase treatment options, as well as accessibility for patients, thus boosting market growth.

- Advances in Genomics and Proteomics: The genomics and proteomics fields have been transformed with drug discovery through understanding genetic and protein-level mechanisms underlying diseases. The next-generation sequencing and mass spectrometry allow the identification of drug targets at an accurate level, hence providing better therapy. This advance hastens the development of personalized medicine since scientists can now design treatments based on individual genetic profiles. Genomics-based drug discovery also assists in the identification of biomarkers for early disease detection and monitoring. This is very important in addressing complex diseases such as cancer and neurodegenerative diseases, thus encouraging innovation and market growth.

- High-throughput Screening (HTS): High-throughput screening is one of the technological revolutions in drug discovery. It enabled screening thousands of chemical compounds against very specific biological targets within very short periods. The entire lead compound identification has been made far easier with the automation, robotics, and complex data analytics. It saves time and costs in R&D. It has immense utility at the very early stages of drug discovery where speed and efficiency count the most. Continued innovations in assay technologies and miniaturization have made HTS even more accessible and less expensive, which contributes to its extensive use. The fact that HTS can screen candidates quickly for potential makes it an important growth factor for pharmaceutical and biotechnology industries.

Drug Discovery Market Trends

- AI in Drug Discovery: Artificial intelligence is transforming drug discovery increasingly more efficiently and accurately. It identifies targets, optimizes leads, and designs clinical trials by analyzing vast datasets with AI-driven algorithms that predict drug-receptor interactions, toxicity, and efficacy. AI has reduced dramatically the time and cost involved in R&D. Pharmaceutical companies employ AI platforms to identify new compounds, repurpose drugs already designed, and enhance the design of molecules. Additionally, AI assists in filtering possible candidates for clinical trials, and this tends to improve the possibility of success in drug development. As AI is becoming more ubiquitous, it has proved to be a game-changer in accelerating innovation and better outcomes in drug discovery.

- Increase in Orphan Drugs: A high trend in prominence is emerging for the drug discovery market with respect to orphan drugs, or medicines intended for rare diseases. Such drug development attracts certain incentives by the regulators, like offering tax credits as well as ensuring market exclusivity. In particular, researchers who are engaged with genomics as well as the personalized medicine technique can more vividly trace these rare diseases; hence, they bring opportunities to companies that develop medications. The market for orphan drugs is lucrative even though they serve smaller patient populations due to their high cost and need for effective solutions. Increasing awareness about rare diseases, patient advocacy, and supportive policies are driving the development of orphan drugs, contributing to market growth.

- Next-generation Sequencing (NGS): Nowadays, one might say that this is a state-of-the art next-generation sequencing whose discovery can examine the genetic code rapidly and not very expensively. Deciphering whole-genome and full transcriptomes reveal genetic variations in mutations and helps identify biomarkers of diseases by NGS; it accelerates the development in precision medicine research by enabling it to design concentrated therapies targeting given patient groups.Apart from this, NGS provides the possibility of identifying new drug targets and predicting response to treatment in a clinical setting. The application is from oncology to infectious diseases and rare genetic disorders where the molecular mechanisms play a significant role. Increasing NGS use is revolutionizing drug discovery, through better efficiency and innovation.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 86.18 Billion |

| Expected Market Size in 2034 |

USD 161.84 Billion |

| Projected CAGR 2025 to 2034 |

7.25% |

| Dominant Region |

North America |

| Fastest Expanding Area |

Asia-Pacific |

| Key Segments |

Drug Type, Technology, End-user, Region |

| Key Companies |

Pfizer Inc., GlaxoSmithKline PLC, Merck & Co. Inc., Agilent Technologies Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Bayer AG, Abbott Laboratories Inc., AstraZeneca PLC, Shimadzu Corp |

Drug Discovery Market Dynamics

Drivers

- Discovery of the silico drug: It is an approach that reduces the drug development process's complexity by using computational tools and simulations to identify and optimize drug candidates. This method is utilized in drug-receptor interaction predictions, compound libraries analysis, and least expensive experimental testing being avoided. Improvements in bioinformatics, AI, and molecular modeling technology have put the in silico methods into widespread use. Indeed, with these predictions, there could be greater accuracy in drug efficacy and toxicity, leading to quicker decision-making at early stages of development. Further, in silico techniques help reduce the overall R&D cost since it limits the dependence on physical resources at the laboratory stage. The rapidly increasing need to hasten the drug discovery timelines as well as curb costs is what is driving this revolutionary technology at an ever-higher rate of adoption in the market.

- Biologics and biosimilars adoption: The widespread incidence of chronic diseases, including cancer, autoimmune disorders, and diabetes, has caused a greater demand for biologics-these are drug therapies derived from living cells but are proteins. Some of these include monoclonal antibodies and vaccines. Biologics have been considered a serious drug discovery focus, as they are targeted and effective in treating such complex conditions. Moreover, the patents on many biologics have expired, thereby opening the pathway for the creation of biosimilars--highly similar, yet less expensive alternatives. This trend is mainly driving innovation in biopharmaceutical R&D with investment into developing biologics and biosimilars. With pharmaceutical companies continuing to focus on these advanced therapeutics, the demand for specific drug discovery platforms and technologies for biologics development is likely to take the market to further growth.

- More Contracting with CRO: Contract Research Organizations are playing a very important role in this drug discovery market by providing not only economy of scale but good quality at various stages of drug development. Out-sourcing to CROs allows pharmaceutical and biotechnology companies access to modern infrastructure, technical know-how, and specialized skills that would otherwise be too expensive to have in-house. This trend is more pronounced in the emerging markets such as Asia-Pacific, where the CRO offers competitive pricing with faster project timelines. The complexity of drug discovery continues to increase along with the cost of operations that need to be reduced and a faster time-to-market, resulting in an uptrend in the outsourcing activities. CROs also help companies to comply with regulatory requirements and concentrate on core business activities, thus further increasing the adoption of their services.

Opportunity

- Growth in Biologics and Biosimilars: The surge in interest toward biologics and biosimilars also has created the potential for tremendous growth. Biologics, including monoclonal antibodies, cell therapies, and vaccines, are now on the upswing due to higher specificity and efficiency in fighting the diseases. More high-value biologics have patents expired; hence the area of biosimilars, cheaper alternatives, also comes under high-growth areas. Companies are heavily investing in advanced technologies such as recombinant DNA and hybridoma techniques to innovate in this space. Open doors to more possibilities of treating and cure for chronic and rare diseases besides creating collaborations and funding which drivers opportunity in biologics-driven drug discovery.

- Orphan Drug Development: Orphan drugs are basically to aid rare disease patients suffering from the very few cases mostly. The rewards given by the regulatory agencies towards market exclusivity, tax benefits, and fast-track approval motivate the pharma companies to put in the resources for this specialized niche. Research in genomics and precision medicine facilitate searching and targeting of the rare disease mechanism. They do market to a limited scope, but are priced high and rising demand helps assure profitability. The awareness of rare diseases and advocacy efforts also contribute to this trend by driving innovation and fostering opportunities in drug discovery for orphan drugs.

- Growing Investment in Research and Development: Rising investments in research and development (R&D) are a key opportunity for the market, enabling innovation and advancements in therapeutic development. There are also huge amounts of money from governments, private sectors, and academia for the identification of new drug targets, new molecular pathways, and advanced technologies including AI and high-throughput screening. Such investment encourages innovative biologics platforms, small molecule platforms, and precision medicine platforms. In recent times, pharmaceutical firms in conjunction with research institutes have liaised to improve easy access to resources and expertise. It is anticipated that global R&D spending will go up, which will drive the market forward into breakthrough treatment options and fast drug discovery processes. Only just lastly last October 2023, was AstraZeneca announcing an intent of committing an additional USD 1.5 billion, which funds only the exclusive company research and development on oncology efforts. Extra funds can even help a corporation further concentrate efforts on innovations towards cancer solution drugs that might later be pushed further into candidate advancing through the stages of clinical trials.

Restraints

- High Drug Development Costs: It involves huge investments into preclinical research, clinical trials, regulatory approvals, and manufacturing with no promise of success. It takes more than a decade and billions of dollars to produce one drug on average. Moreover, the clinical trial failure rate is still on the higher side, and enhances financial risks for pharmaceutical firms. The small companies are facing serious problems in funding large R&D projects. Operational costs are increasing, and strict regulations are posing more fuel to the fire, and making drugs unaffordable and inaccessible to many.

- Intellectual Property Issues: It acts as a barrier for innovation and commercialization. Patent disputes, high licensing fees, and problems associated with patent expirations are also a challenge in revenue generation by pharmaceutical companies. The increase in competition due to generic and biosimilar manufacturers increases competition as patents on blockbusters expire. Other issues include discouraging investments in drug discovery due to weak IP protection frameworks especially in emerging markets. Organisational IP ownership and benefit-sharing in collaborative research is also more complex. These create uncertainties regarding returns on investments in R&D, restraining the new drug development and market-entry pace. For example, in July 2024, Sanofi filed a challenge against Amgen's patent for a cholesterol-lowering drug, and the case went on to become a long-drawn legal battle. The patent validity and infringement claims can center the dispute, creating uncertainty about the issue of market exclusivity and access to the drug. This may expose a firm to a high cost of financial expense as well as effective utilization of the resources, thus diverting attention away from drug innovation and slowing the pace at which new therapies find a place in the market.

Challenges

- High Attrition Rates in Drug Development: Most drugs fail in the clinical trial stages because of a variety of reasons, including lack of efficacy, toxicity, and unexpected side effects. In the average case, only a tiny fraction of those tested in the clinical trials successfully enter the market. This makes the development time much longer, and the pharmaceutical companies spend a lot more than they should on developing drugs.These failures attract tremendous financial risks, thus deterring smaller companies and erecting tremendous barriers to innovation and market entry.

- Complex Regulatory Approvals: The path tends to be laborious, costly, and time-consuming with varying requirements for each region and country by the FDA and EMA and other regulatory agencies. The agency demands significant clinical trial data before the drug is allowed in the market. Complexity is also added by the evolving regulatory landscape, especially for new drug classes and biologics. Moreover, post-market surveillance and continuous regulatory scrutiny increase the burden on companies. Such challenges often delay the launch of drugs and add to the costs of compliance, which may deter investments and hinder market growth.

Drug Discovery Market Segmental Analysis

The drug discovery market is segmented into drug type, technology, end-user and region. Based on drug type, the market is classified into small molecule drugs and biologic drugs. Based on technology, the market is classified into high throughput screening, pharmacogenomics, combinatorial chemistry, nanotechnology ands others. Based on end-user, the market is classified into pharmaceutical companies, contract research organizations and others.

Drug Type Analysis

Small Molecule Drugs: The drug discovery market share still stands the strongest since they are well-proven for their efficacy, relatively easy to synthesize, and can easily target intracellular pathways. Their application in treating chronic diseases like cancer, diabetes, and cardiovascular disorders is also extensive because of oral bioavailability and crossing cell membranes. Growth in the generics area coupled with innovative work in synthetic chemistry would add more to the growth in this area. However, the threat of biologic drugs is on the rise as biologics provide better specificity for complex diseases.

Drug Discovery Market Share, By Drug Type, 2024 (%)

| Drug Type |

Revenue Share, 2024 (%) |

| Small Molecule Drugs |

22% |

| Biologic Drugs |

78% |

Biologic drugs: They are the fastest growth in drug discovery, driven by breakthroughs in biotechnology and an increased demand for precision medicine. These include monoclonal antibodies, vaccines, and cell therapies from living organisms and treat chronic and rare diseases effectively. It is fueled by rising prevalence rates of autoimmune disorders, cancers, and infectious diseases. Despite the very high cost of the development process, the market penetration would be sustained by innovative platforms and the increasing use of biosimilars as patents for biologic drugs fall. For example, in May 2024, the European Commission approved Opdivo-an antibody drug, though biological, to treat various types of cancers among adults who have unresectable or metastatic urothelial carcinoma.

Technology Analysis

High throughput screening: In the case of high throughput screening, potential drug candidates become identified much faster compared to other earlier drug discovery tools. This is the capability for researchers to assay thousands of chemicals against a set biological target rapidly by means of automated devices. This type of screening process is extensively followed for lead identification, thereby allowing reductions in time as well as investment in early discovery research. As it combines more with AI as well as robots for efficiency and also accuracy, further increases its utility in the marketplace.

Pharmacogenomics: Pharmacogenomics has turned the science of drug discovery by allowing personalized medications. By comparing genetic differences, it allows anticipating the reaction a person may undergo to drugs with reduced adverse effect and improved effectiveness. Precision medicine and technological enhancements in genomics have driven people to opt for pharmacogenomics, especially concerning cancer, cardiovascular diseases, and neurological disorders.

Combinatorial Chemistry: Combinatorial chemistry represents the very core drug discovery technology since it accelerates compound library syntheses. Screening vast chemical libraries for lead-compounds against selective biological targets expedites identifying candidates. A vital tool applied to optimize drugs in terms of potency and economical benefits, such has rendered it irreplaceable within most pharmaceutical companies' arms. Addition of AI, along with computational chemistry, gives it an extension in value, acting as a mechanism in fast-tracking drugs in accelerated stages.

Nanotechnology: Nanotechnology is revolutionizing drug discovery because it can design nanocarriers for targeted drug delivery. The technology enhances bioavailability and solubility and stabilizes drugs with very poor solubility. Nanotechnology is highly utilized in the treatment of cancer and infectious diseases, among others as in gene delivery. The accuracy of the treatments with low side effects has encouraged this application of nanotechnology in the market.

Other Technologies: Bioinformatics, proteomics, and AI-driven platforms are just a few of the other technologies involved. These other technologies are a major driver for drug discovery in today's world. This would include target identification, data analysis, and predictive modeling to increase more rapid and improved drug development. Advanced adoption is accelerating further with precision medicine as well as more cost-effective drug development solutions.

Drug Discovery Market Regional Analysis

The drug discovery market is classified into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). There is a deeper analysis of the regions below:

Why does the North America holds the majority share in the drug discovery market?

The North America drug discovery market size was valued at USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. North America holds the majority share of the market because of high investment in R&D, well-established healthcare infrastructure, and prominent pharmaceutical and biotechnology firms in the region. Increase in the prevalence of chronic diseases such as cancer and diabetes in the U.S. have necessitated more new drugs in the region. The fast-track approval of the FDA along with orphan drug incentives has added to the growth of this market at a high rate. Advanced technologies such as AI are well placed in the region, which enhances the efficiency of drug discovery and hence makes North America a high-value market.

What factors contribute to Europe's significant share in the drug discovery market?

The Europe drug discovery market size was estimated at USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. Europe is also holding a significant share. The supporting role comes from EMA, government funding, and a stable pharmaceutical sector. Countries which are more developed in R&D as well as for innovation in the area of biologics and biosimilars tend to do very well in this category; Germany, UK, and Switzerland, for instance, are good examples. The stronger results are brought out through cooperative research between academies and companies. Concentration on precision medicine and therapy for rare diseases, as well as the importance of developing advanced healthcare technologies, would have worked as a steady engager for the growth of the drug discovery sector within the Europe region.

Why is Asia-Pacific witnessing strong growth in the drug discovery market?

The Asia-Pacific drug discovery market size was reached USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. In the recent past, growth in the Asia-Pacific region due to health care and health spending that expands with growing chronic burden across different diseases, though on the anvil are high-activity rapid increases in their respective clinical activities in China, India, and Japan. Favourable conditions are provided by the governments and cost-competitive manufacturing benefits are further sustained through the advancements with high throughput screening. Skilled workforce, improving regulatory frameworks, and so on attract global pharmaceutical companies to set up R&D operations, making Asia-Pacific a huge hub for drug discovery innovation.

LAMEA Drug Discovery Market Trends

The LAMEA drug discovery market size was valued at USD 80.35 billion in 2024 and is anticipated to reach around USD 161.84 billion by 2034. Improving healthcare infrastructure and increasing access to innovative treatments are driving steady growth in the LAMEA region drug discovery market. Latin America, led by Brazil and Mexico, is increasing investments in healthcare and pharmaceutical R&D. Countries in the Middle East, such as the UAE and Saudi Arabia, are boosting their biotech and healthcare sectors as part of economic diversification. Africa is gradually but surely on the move with initiatives along infectious diseases and global pharma firms collaborations, even though this field still faces limited funding and weak infrastructure.

Drug Discovery Market Top Companies

CEO Statements

Albert Bourla, CEO of Pfizer:

- “We’re going all-in on the development of our obesity drug. Our goal is to provide a once-daily pill that offers a more convenient alternative to the current injectable options available in the market”

Robert Michael, CEO, of AbbVie.:

- “We are taking a more cautious approach to investing in experimental psychiatric drugs following recent challenges in this area. While we are open to taking calculated risks, we plan to focus our resources on other high-impact opportusnities.”

Chris Viehbacher, CEO, Biogen:

- “We do not see a burning need for more acquisitions at this time. With new product launches expected to surpass current sales by 2028, we are confident in our pipeline, particularly in our Alzheimer’s treatments.”

Recent Developments

- In March 2024, C4 Therapeutics announced a strategic discovery research collaboration with Merck KGaA, Darmstadt, Germany, to target critical oncogenic proteins. Under this partnership, C4 Therapeutics will leverage its proprietary TORPEDO platform to identify protein degraders for the specified oncogenic targets. Merck KGaA, Darmstadt, Germany, will oversee the clinical development and commercialization of drug candidates arising from this collaboration.

- In May 2024, Google DeepMind introduced the third iteration of its "AlphaFold" AI model, designed to transform drug discovery by enhancing the prediction of protein structures with greater precision. This advanced AI model aims to accelerate the understanding of protein folding, facilitating improved insights into disease mechanisms and the development of targeted therapeutic treatments.

Market Segmentation

By Drug Type

- Small Molecule Drugs

- Biologic Drugs

By Technology

- High Throughput Screening

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- Other Technologies

By End-user

- Pharmaceutical Companies

- Contract Research Organizations

Others

By Region

- North America

- APAC

- Europe

- LAMEA

...

...