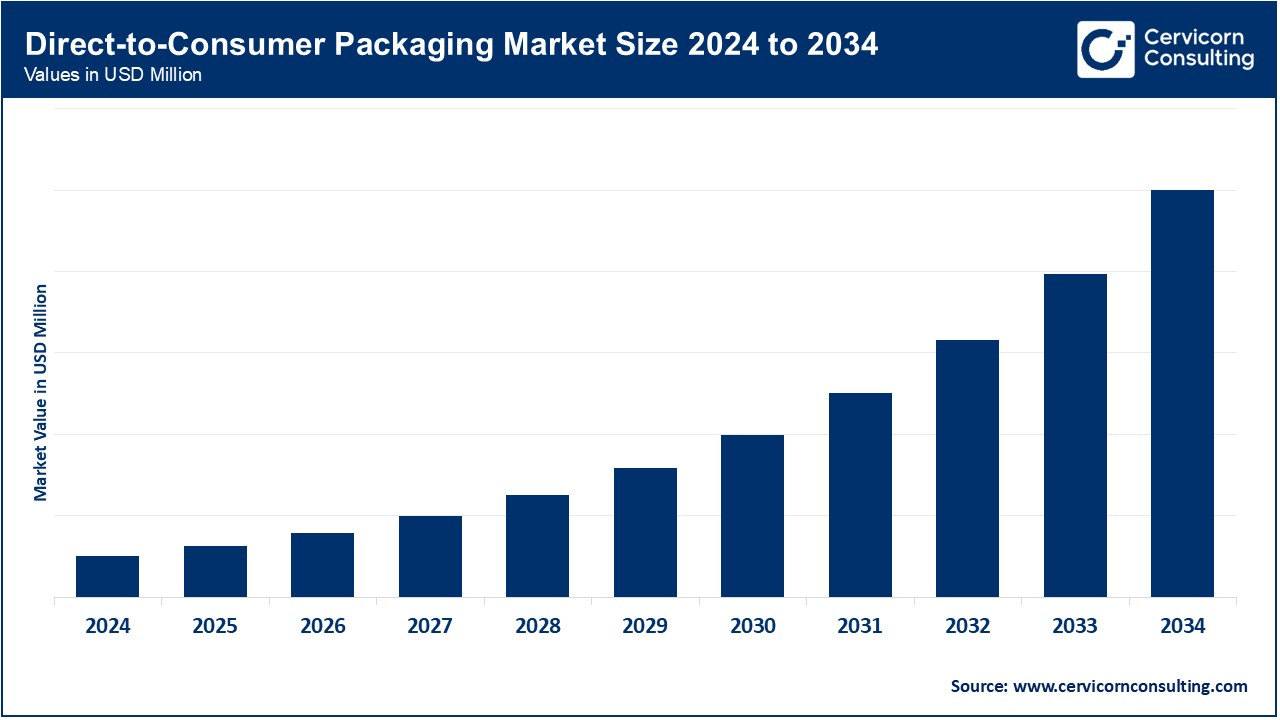

The global direct-to-consumer packaging market is expected to witness significant growth in upcoming decade (2024 to 2034). Advances in packaging technology, such as digital printing and smart packaging, enable more sophisticated and customizable packaging solutions. Technology enables better tracking and analysis of packaging performance, allowing brands to optimize designs and materials based on consumer feedback and operational data. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing direct-to-consumer packaging which is estimated to drive the market over the forecast period. Key players involved in the direct-to-consumer packaging market are focused on creating unique and engaging experiences where the emphasis is placed on tailored designs and unboxing experiences. There is growing consumer demand for environmentally friendly packaging. DTC brands are increasingly adopting sustainable packaging solutions to meet this demand and differentiate themselves in the direct-to-consumer packaging market.

Direct-To-Consumer Packaging Market: Marketing and Customer Engagement

Direct-to-Consumer packaging solutions refer to the offering of services, strategies and practices utilized to bypass traditional retail channels to reach out to consumers. This specific approach focuses on implementing an optimal experience for consumers and end users. Many Direct-to-Consumer (DTC) packaging brands are currently focusing on sustainable packaging solutions, using recyclable, biodegradable, or compostable materials to reduce environmental impact. DTC packaging should align with the brand’s online presence and marketing materials to ensure a cohesive brand experience. DTC packaging is all about creating a strong connection with the consumer, making every touchpoint, from opening the package to using the product, as positive and memorable as possible.

5 Key Factors Driving Direct-To-Consumer Packaging Market Growth

Growth in Online Shopping and Expansion of Ecommerce

The rise in online shopping has increased the demand for direct-to-consumer packaging solutions as brands seek to enhance the customer experience through direct interactions. More brands are leveraging digital platforms to reach consumers, driving the need for tailored packaging solutions that can enhance brand identity and engagement. In March 2024, according to the data published by the Direct Selling Association, by 2024, there will be 2.71 billion internet shoppers worldwide. This indicates that 33 percent of people shop online worldwide. This is a 2.7% rise over the prior year. By 2025, there will be 2.77 billion online shoppers, a reflection of the growth in eCommerce brought about by the ease and growing use of the internet. With 915.1 million online consumers, China is the leader in this trend, followed by the US with 270.11 million in 2024.

Emphasis over Customization and Personalization

Direct-to-consumer packaging solutions hold the ability to offer customized alternatives that is seen to act as a potential driver for the direct-to-consumer packaging market. Customized or personalized packaging solutions help brands to stand out in competitive marketplaces while offering unique and memorable unboxing experiences. For example, Coca-Cola started Share a Coke campaign to boost its customer base while it offered featured and personalized labels with consumers’ names which helped the company in gaining consumer engagement and brand loyalty.

Technology Barrier and Constantly Changing Consumer Preferences

Key players involved in the operation of direct-to-consumer packaging market are seen tackling with deployment cost along with rapidly evolving/changing consumer preferences, that are estimated the restrain the market’s growth. Custom packaging solutions and its deployment can be expensive, especially for small scale companies. Operating direct-to-consumer packaging involves supply chain concerns and complicated logistics, which is challenging in optimization purpose. Alongside, rapidly changing consumer preferences and implementation of advanced technologies for personalized solutions require significant investment and expertise, this can be a further barrier for startups with limited capital.

Global Logistic Expansion and Technology Advancements

As companies operating worldwide expand into new markets, there is a growing demand for direct-to-consumer packaging solutions that meet diverse regulatory and cultural requirements. Innovations such as smart packaging, which incorporates Quick Response (QR) codes or Near Field Communication (NFC) technology, offer opportunities for enhanced consumer engagement and tracking. Increasing expansion of logistic services has raised the demand for the direct-to-consumer packaging which is estimated to create lucrative opportunity for the growth of the direct-to-consumer packaging market over the forecast period.

Parkside’s Innovation of Sustainable Material in Malaysia: A Case Study

In April 2024, Parkside Flexibles (Asia) Sdn. Bhd., packaging company based in Malaysia, revealed the introduction of the Recoflex, a variety of recyclable paper-based flexible packaging materials providing barrier performance, heat sealability and durability. The newly launched range of papers is available as a laminate and single-ply or in various specifications.

The sustainable materials used by Parkside are claimed to be certified by Forest Stewardship Council and other recognized organizations. Such certifications are responsible to manage international standards for biodegradability. The initiatives taken by Parkside align well with the country’s broader environmental sustainability goals, including the reduction of single-use plastics and efforts to promote circular economy.

Asia Pacific dominated the global direct-to-consumer packaging market in 2024. Rapid urbanization in Asia Pacific countries has led to a growing middle class with higher disposable incomes. This demographic shift increases demand for convenient and personalized shopping experiences that direct-to-consumer models offer. High levels of smartphone penetration and internet usage have driven the growth of e-commerce in Asia Pacific region.

Asian Government Support for Direct-to-Consumer Packaging Market

| Country | Initiative | Key Factor | Impact on Market |

| China | E-commerce Packaging Regulations | Imposed strict guidelines for recyclable packaging | Significantly improved demand for green solutions for DTC packaging. |

| India | Green Packaging Initiative | Launched national policy with incentives for companies to use sustainable materials | Notably attracted multiple international companies in the country in year 2022. |

Consumers in the region are increasingly comfortable shopping online, which fuels the expansion of direct-to-consumer models. Improvements in logistics, payment systems, and digital platforms have made it easier for direct-to-consumer packaging brands to reach consumers. Investments in technology and infrastructure support faster and more efficient delivery services. The widespread use of social media platforms in Asia Pacific enables direct-to-consumer packaging brands to engage with consumers directly, build brand awareness, and drive sales through targeted advertising and influencer partnerships.

The Asia Pacific region has a large, tech-savvy, and carries younger population that is more inclined towards online shopping and trying new digital platforms. This demographic factor is more likely to embrace direct-to-consumer packaging models. Strong economic growth in several Asia Pacific countries has increased consumer spending power, allowing more people to afford and seek out premium and niche products offered by direct-to-consumer packaging brands. These factors collectively contribute to the rapid growth of the direct-to-consumer packaging market in the Asia-Pacific region, creating a dynamic and expanding landscape for direct consumer engagement.

North America region is anticipated to grow at is projected to host the fastest-growing direct-to-consumer packaging market in the coming years. Consumers in the area are significantly seeking convenience and personalized experience in shopping. Direct-to-consumer packaging solutions include customizable options along with improved representation. These factors align with consumer preferences as well as branding for key players that support the market’s expansion while supplementing major countries such as Canada and United States to be largest shareholders for the market.

The key players operating in the North America market are focused on introducing sustainable packaging solution and technology to meet the consumers demand in the region which is estimated to drive the growth of the direct-to-consumer packaging market in the North America region in the near future.

The paper & paperboard segment held the dominating share of the market in 2024. As consumers prefer paper-based packaging with multiple environmental concerns rising across the globe, the segment is observed to sustain its dominance. Paper and paperboard material often meet regulatory standards for packaging materials, specifically for currently emerging industries such as food and beverages and e-commerce. Such materials are biodegradable and recyclable. They can be easily customized and printed with various designs, making them suitable for diverse packaging needs and branding.

The key players operating in the market are focused on launching new products in paper based packaging, which is estimated to drive the growth of the segment over the forecast period.

The plastic segment is observed to grow at a notable rate during the forecast period. Being one of the most lightweight materials, plastic holds the ability to reduce the shipping cost and allows various packaging formats. On the other hand, plastic material is highly affordable and attractive to create DTC solutions. Innovations in sustainable plastic solutions and increased demand for customization are seen to promote the segment’s growth in the upcoming years. Plastic material for DTC packaging is highly utilized for cosmetics, food and beverages and healthcare products; the segment is seen to expand with its capability of protective features and resealable option offered.

In 2024, the rigid segment dominated the market. Rigid packaging thrives to offer extra superior protection during logistics while reducing the risk of damage. As companies involved in the direct-to-consumer packaging solutions and product offering focus on consumer satisfaction and maintaining product quality, the demand for rigid packaging solutions is observed to grow. Rigid packaging is more effective in meeting regulatory requirements for safety and tamper evidence, this factor along with the presence of aesthetically pleasant packaging options in rigid boxes, jars and bottle create significant growth factors for the segment to expand.

On the other hand, the flexible packaging segment is seen to exhibit at the fastest rate during the forecast period. Flexible packaging is widely made form eco-friendly or recyclable materials. The rising demand for sustainable packaging option is catered with this solutions, enhance appeal of packaging, easy customization and efficiency are few other factors that make flexible packaging more prominent in the market. Moreover, the spurge in e-commerce businesses that require compact packaging solutions and enhance consumer convenience offered by flexible packaging will support the expansion of the segment.

The food and beverages segment, in 2024, held the largest share. Direct-to-consumer solutions of packaging are capable of bypassing the traditional way of retailing products with faster delivery and door step offerings. The growing demand for high-value and convenient food products has supported the dominance of the segment.

As consumers show immense requirement for personalized food products such as organic products, plant-based beverages and functional foods, the segment will continue to grow. The worldwide food and beverage industry is rapidly innovating with the integration of innovative formulations and packaging, this constant innovation helps in attracting new consumers.

Moreover, the demand for ready-to-eat products such as packed meal, snack kits and ready-to-drink beverages is observed to supplement the growth of food and beverages segment in the direct-to-consumer packaging market. Unique labels. Individualized product designs and custom-sized packaging are few other areas to cater consumer preferences in the upcoming years.

On the other hand, the cosmetic and personal care segment is observed to expand at a notable rate during the forecast period. Particularly for the cosmetic industry, increasing online sales and penetration of social media advertising play vital role. Brands have started focusing on elegant and unique packaging to reflect the luxury offering through of their products. As direct-to-consumer brands keep focusing on innovative packaging with design-led solutions for cosmetic products along with sustainable and eco-friendly solutions, the segment thrives to expand.

Market Segmentation

By Material Type

By Packaging Type

By End Use

By Region