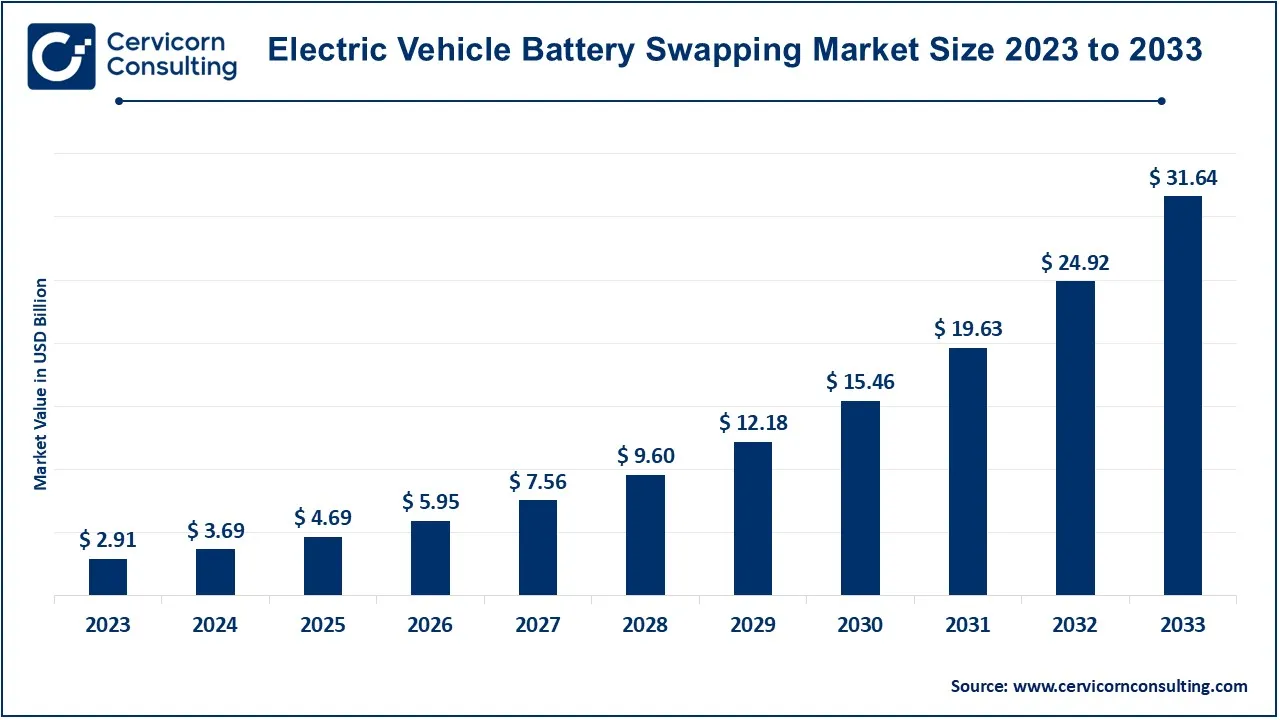

The global electric vehicle battery swapping market size was valued at USD 3.69 billion in 2024 and is expected to be worth around USD 31.64 billion by 2033, growing at a compound annual growth rate (CAGR) of 26.95% from 2024 to 2033.

The EV battery swapping market is rapidly growing due to increased demand for sustainable transport solutions, rising fuel prices, government subsidies, and urban congestion have accelerated adoption. China, India, and European nations are driving the growth, with companies investing in large-scale battery swap networks. As battery technology advances, swapping will become even more efficient, encouraging higher adoption rates among consumers and businesses. Fleet operators, such as ride-hailing and delivery services, benefit significantly from battery swapping as it reduces downtime and operational costs. The market is also expanding through partnerships between automakers, battery manufacturers, and infrastructure providers. With ongoing technological innovations and policy support, battery swapping is set to play a crucial role in the future of electric mobility.

One of the notable trends is the demand for more sustainable solutions, including efforts towards the more environmentally suitable measures in battery production and disposal. Such emphasis on green solutions is not only useful for increasing the eco-efficiency of energy storage but also contributes to the general objectives of developing a low carbon economy. The existence of battery swapping market is giving increased accessibility and more convenient use of electric vehicles to promote a healthier future in the transport industry.

What is Electric Vehicle Battery Swapping?

Electric vehicle (EV) battery swapping is a method where a depleted battery is replaced with a fully charged one at a swapping station, eliminating the need for long charging times. Instead of waiting hours for a charge, users can exchange their battery in just a few minutes. This technology is mainly used for two-wheelers, three-wheelers, and commercial fleets, where uptime is critical. Battery swapping addresses key EV challenges such as range anxiety, high battery costs, and charging infrastructure limitations. The system typically operates on a subscription or pay-per-use model, making EV adoption more affordable. Automated battery swap stations use robotic systems to replace batteries quickly, ensuring minimal human effort. Some companies also offer AI-driven solutions to optimize battery life and energy efficiency.

Key Insights Beneficial to the EV battery swapping Market:

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 3.69 Billion |

| Estimated Market Size (2033) | USD 31.64 Billion |

| Growth Rate (2024 to 2033) | 26.95% |

| Front-runner Region | Asia-Pacific |

| Rapidly Expanding Region | North America |

| Key Segments | Vehicle Type, Technology, Service Type, Station Type, Battery Type, Battery Capacity, Application, Region |

| Key Companies | NIO, Gogoro, Ample, Aulton, BAIC BluePark, Renren Charge, Sun Mobility, Geely, Energica Motor Company, Swap Mobility, Karma Automotive, Tritium, Shell Recharge Solutions, Blink Charging |

Two-Wheelers: This segment consists of electric scooters and motorcycles which are fast gaining acceptance in urban centres as a form of transport given their cheap, convenient and manoeuvrable in comparison to cars. Battery swapping in two-wheelers involves users charging their batteries through swapping with used batteries and fresh charged ones in stations without downtime. This model is ideal in cities where a charging network is either limited, or where turnaround time can greatly influence customer adoption.

Three-Wheelers: This includes electric rickshaws and such like vehicles. Prolific to numerous developing nations these vehicles enable cheap and convenient means of transport. Battery swapping is likely to benefit their operational sustainability by reducing charging time, which results in a constant power supply during the day. Due to their increased utilization in urban areas, an effective battery swapping mechanism can enable descent service provision, coupled with lower cost of operations.

Passenger Vehicles: This segment covers electrical cars for private use only This segment includes electrical cars which can be used privately. Battery swapping can reduce the range anxiety problem this is because instead of charging batteries that have run out of power users can swap them within the shortest time possible. This is particularly advantageous where a person does not have any set up for charging at home or does many long runs. When customer needs change and preference is likely to incline towards EVs, battery swapping could extremely help in boosting the pace of market share achieved by the passenger vehicles.

Commercial Vehicles: These encompass coaches and more prodigal vehicles such as trucks, buses among others whose uses are more of commercial. Battery exchange also helps to cut the downtimes, and these vehicles would remain on the roads longer as these are important in logistics and public transport. As more and more focus is directed towards electrification of commercial fleet, battery swapping systems can provide more rapid charge in busy depots and result in overall lower TCO.

Public Transportation: This application concentrates specifically on buses and taxis since the vehicles need to be recharged quickly and effectively to continue providing their services. Battery swapping is most suitable for public transport since it reduces the time that vehicles are out of service. As the batteries are changed in a short space of time, it will mean that the transit agencies will have the assurance that their fleets will have power all day hence enhancing the services reliability and satisfaction.

Fleet Operations: In this segment, battery swapping services middle and service vehicles for logistical purposes, which require minimal charging times. Deliveries companies that own their own fleet have to ensure timely availability of the vehicles to coincide with demand. Battery swapping also facilities easy battery exchange whereby drivers can exchange batteries within shortest time possible hence enhances operational efficient thus minimizing delivery time.

Personal Use: This application will be intended for individual customers who drive electric vehicles as their means of daily transportation. Battery swapping is another advantage as it is easier than recharging as this can improve the ownership experience mainly from clients with no home charging option. It gives every user an option to change batteries as part of their embodying routine which makes the use of electric vehicles more desirable and removes concerns of charging infrastructure, particularly for city driving.

Standardized Batteries: This technology can also be described by creating batteries that can be easily exchanged and that can be used in all forms of vehicles. It is a requirement because standardization guarantees a smooth exchange of batteries and encourages as many manufacturers as possible to take part in the construction of battery swap stations to allow as many cars as possible using battery swapping services. Standardized batteries can bring the factor cost advantages, better conversion of supply chain, and general advancement in battery swap systems.

Proprietary Systems: In proprietary systems where battery construction is unique to meet the brand or model needs of the car. Of course, such systems may have certain benefits in terms of the speed and effective control in personified car models, but they also restrain opportunities for other car brands. The absence of standardization in battery swapping may stifle battery swapping adoption due to the costs of locking oneself into a system where battery swapping is not easily accessible.

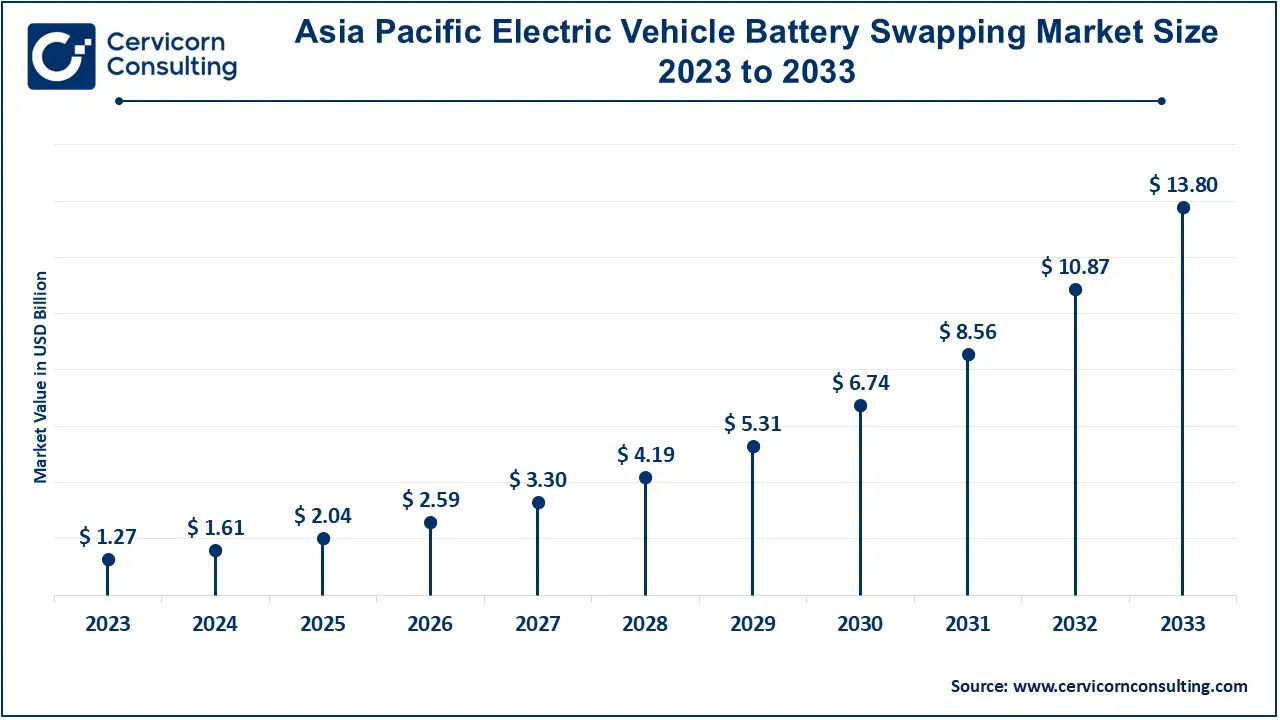

The Asia-Pacific electric vehicle battery swapping market size was estimated at USD 1.27 billion in 2023 and is expected to reach around USD 13.80 billion by 2033. There has been an exponential growth of the EV battery swapping business across the Asia-Pacific region due to increased investment from countries as Japan, China, and South Korea. For these nations, battery swapping is a critical element of their transition plans. What is trendy in the battery industry now is having battery technology, setting up of battery infrastructure and forming battery swapping systems. There is great pressure to develop appropriate forms of infrastructure that would support the emerging energy needs and at the same time minimize impacts on the environment.

The North America electric vehicle battery swapping market size was surpassed at USD 0.65 billion in 2023 and is projected to hit around USD 7.12 billion by 2033. The North America region is on the upswing, as more stakeholders turn their attention to green technologies and smarter ways to managing energy. Among the world’s regions, the United States and Canada lead here, with government incentives being rather important in promoting the technology. We have observed a very aggressive deployment of battery swapping stations, coupled with an increasing awareness of the aspects of integrating smart grid solutions. The utilities are aiming at improving costs and the energy delivery utilizing near real time information for improving on remote control possibilities.

The Europe electric vehicle battery swapping market size was accounted for USD 0.81 billion in 2023 and is predicted to surpass around USD 8.80 billion by 2033. In the current market, the EV battery swapping industry is most active in Europe, owing to government support and explicit objectives on sustainability. Battery swapping technology has found acceptance across the EU due to the efforts of the EU in promoting energy efficiency and low carbon technology. That is why some of the leading economies like the UK, Germany, and France have deployment targets backed by strong policies. Sophisticated battery swapping systems are essential for improving energy availability, utilization of renewable energy and giving consumers greater control over their power usage.

The LAMEA electric vehicle battery swapping market was valued at USD 0.18 billion in 2023 and is anticipated to reach around USD 1.93 billion by 2033. Across LAMEA region is still at its inception and several countries are still in the process of diversifying their energy sources and options. A large number of countries are starting to adapt battery swapping systems to solve energy accessibility and climate change issues. Initial projects are under development that leverage the region’s wealth of renewable energy sources for batteries.

Players currently entering the EV battery swapping sector and pioneering innovation include NIO Power Swap and Ample technology that has enhanced the battery exchange system and management platforms to make the systems user-friendly and make the operations efficient. At the same consolidated players like Gogoro and Aulton consistently dominate the market delivering references and drawing on the knowledge of the EV market international connections. Gogoro has a great reputation for having a battery swap network for scooters while Aulton is innovating and expanding its networks and significantly investing in evolving battery technology.

The battery swapping technology can hardly remain limited to newcomers; mature players or both newcomers and mature players have their important roles in constantly evolving the battery swapping technology as well as adopting it into the nascent yet fast-evolving EV ecosystem.

CEO Statements

NIO - William Li, CEO

Gogoro - Horace Luke, CEO

Ample - Khaled Hassounah, Co-Founder and CEO

Strategic Launches and Expansions highlight the rapid advancements and collaborative efforts in the EV battery swapping sector. Industry players are involved in various aspects of EV battery swapping, including technology, component, and material, and play a significant role in advancing the market. Some notable examples of key developments in the EV battery swapping industry include:

Market Segmentation

By Vehicle Type

By Technology

By Service Type

By Station Type

By Battery Type

By Battery Capacity

By Business Model

By Application

By Region