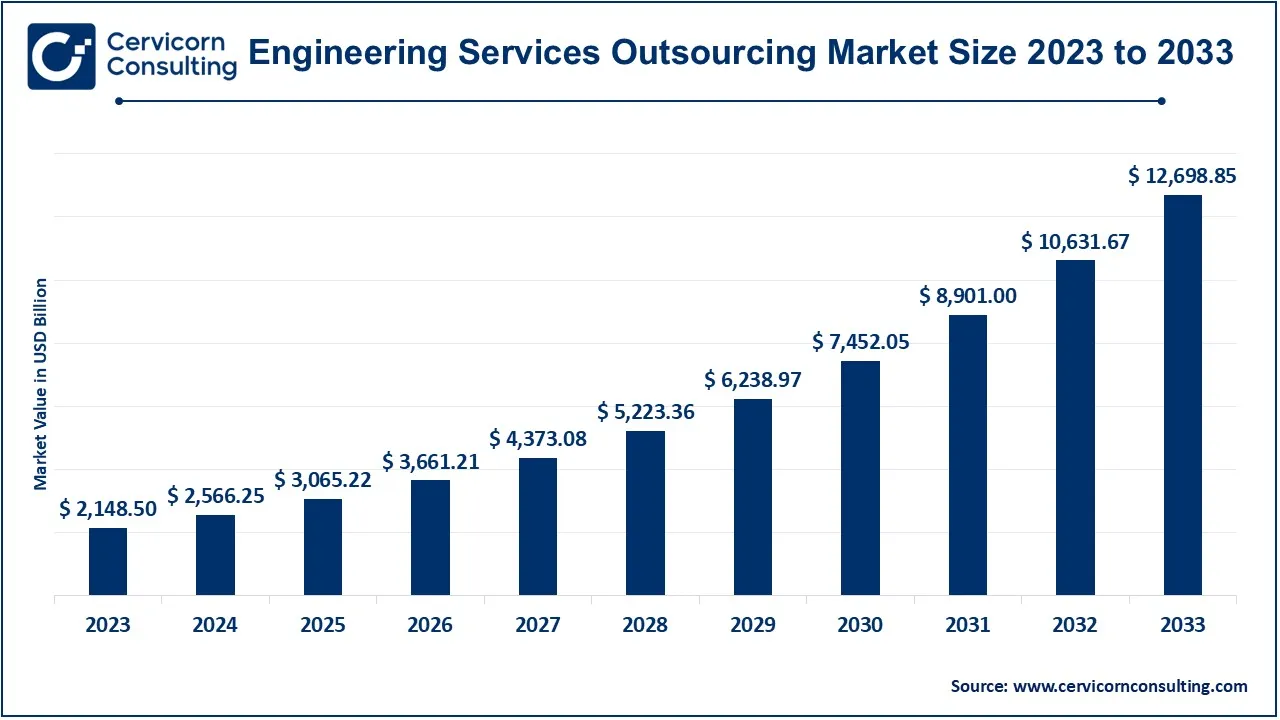

The global engineering services outsourcing market size was valued at USD 2,566.25 billion in 2024 and is expected to be worth around USD 12,698.85 billion by 2033, growing at a compound annual growth rate (CAGR) of 20.4% from 2024 to 2033.

The engineering services outsourcing (ESO) market has experienced significant growth over the last few years. A key factor driving this growth is the increasing demand for cost-effective solutions and enhanced technical expertise in various industries. As companies focus more on core competencies, they rely heavily on outsourcing partners to handle complex engineering tasks. This trend is especially prominent in the automotive, aerospace, and construction sectors, where technological advancements and demand for faster delivery of products have intensified the need for outsourcing. Furthermore, the digital transformation of industries and the rise of smart technologies are expected to further fuel ESO market growth. The ongoing adoption of automation, IoT, AI, and data analytics is reshaping engineering services, pushing companies to seek highly specialized skills. As emerging economies offer a skilled workforce at competitive rates, outsourcing engineering services to these regions continues to be a preferred strategy. Between March 2023 and February 2024, India exported 3,128 engineering service shipments through 273 exporters to 425 buyers, marking a 30% increase from the previous year.

Engineering services outsourcing (ESO) refers to the practice of hiring third-party service providers to manage and execute engineering tasks and projects, such as product design, development, testing, and manufacturing processes. It allows companies to focus on their core competencies while outsourcing specialized tasks to experts in different regions, often at a lower cost. ESO involves a wide range of engineering disciplines including mechanical, electrical, civil, and software engineering. It may involve activities such as research and development (R&D), design and drafting, prototyping, and project management.

The advancement in digital twin technology, 3D printing, and smart manufacturing solutions broadens the opportunities to grow for ESO and enables companies to advance while keeping the central business process intact. Due to the need for innovative, easily expandable services for clients and as industrialized nations and developing technological giants increasingly adopt ESO, the industry is predicted to progress correspondingly.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3,065.22 Billion |

| Projected Market Size (2033) | USD 12,698.85 Billion |

| Growth Rate (2024 to 2033) | 19.44% |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Service, Location, Product, End User, Region |

| Key Companies | HCL Technologies, Wipro, Tata Consultancy Services (TCS), Infosys, Tech Mahindra, Alten Group, Cyient, Capgemini, Quest Global, L&T Technology Services, AKKA Technologies, Altran (Capgemini Engineering), EPAM Systems, Cognizant, IBM, Accenture, RLE International, KPIT Technologies, IAV, Tata Technologies |

Increased Focus on Innovation and R&D

Cost Reduction and Efficiency Gains

Data Security and IP Concerns

Cultural and Communication Barriers

Emerging Markets and Smart Cities Development

Sustainable Engineering Solutions

Infrastructure Development and Readiness

Managing Quality and Consistency

The engineering services outsourcing market is segmented into services, location, product, end-users and region. Based on services, the market is classified into product design & development, automation & robotics, plant design & engineering, process engineering. Based on location, the market is classified into on-shore, and off-shore. Based on product, the market is classified into mechanical engineering, electrical engineering, embedded systems engineering, and software engineering. Based on end-users, the market is classified into aerospace & defense, automotive, manufacturing, consumer electronics, semiconductors, healthcare, telecom, energy & utilities, construction & infrastructure, others.

Product Design & Development: Outsourcing Engineering Services is important in product design and development since it breaks organizational barriers, resulting in shorter cycle time. Engineering outsourcing teams are involved with the creation of a new product alongside other tasks such as prototyping, testing and others which allow the company to perform its key activities while knowing that the engineering work is well done. This is because today there is stiff completion in such industries as automotive, aerospace and consumer electronics where technology is changing at a faster pace.

Automation & Robotics: There is an increasing demand for using automation and robotics in industries etc., and therefore the ESO providers play an important role of introducing automation systems of manufacturing, assembling etc. By outsourcing such services, companies can bring in the latest robotic services which increase productivity, minimize expenditures on personnel and increase the accuracy in manufacturing. This segment is particularly important for industries such as automotive, industrial manufacturing, and healthcare that are experiencing the advance of automation in their work.

Plant Design & Engineering: Outsourcing plant design as well as engineering services assist companies in planning and executing construction of massive structures to standards of compliance, safety and efficiency. ESO providers offer solutions on layout planning, choosing of machines, and the best operational strategies. This service tends to be most useful with energy, oil & gas, and industrial manufacturing organizations because plant infrastructure plays a significant role in organizational performance.

Process Engineering: As a kind of professional service, process engineering services are typically externalized to enhance manufacturing and production procedures, minimize undesirable by products, and lift efficiency. ESO providers also examine the processes and reconstruct them to reduce costs and minimize the impacts on the environment. This application is useful where industries like chemical, pharmaceuticals, and food processing have an area for improvement that would have easily noticeable effects on the enterprise’s general efficiencies, profitability, and sustainability.

Mechanical Engineering: Mechanical engineering outsourcing involves services that one outsources about the design, analysis, and manufacturing of mechanical systems. These services are adopted broadly in motor vehicles, aviation, and other machinery businesses. Mechanical engineering outsourcing means that a company can get access to talents specialized in specific fields such as modelling, testing, and material selection when the company can hardly afford to employ a team of such specialists.

Electrical Engineering: There is a rising trend of outsourcing of circuit design services, controls, and power distribution. Entrepreneurial organizations in the telecommunication industry, electronics, and renewable energy sectors engage the services of outside electrical engineers to organize efficient and creative product and systems engineering services in minimum periods with low expenditure.

Embedded Systems Engineering: An embedded system that integrates hardware and software components to provide functions is central in almost every sector of the economy such as automotive, healthcare, and consumer electronics industries. Outsourcing of embedded systems engineering enables businesses to harness specialized knowledge in firmware development, software integration, and real-time computing systems, to improve product functionality.

Software Engineering: ESO for software engineering is mainly concerned with new software applications, integration of software, and sustainment. It involves key industries including information technology and telecommunication, aerospace, and automobile industries, were sophisticated software controls critical operations. Outsourcing of software engineering reduces time to market on innovations hence assisting firms to get lower-cost products from software engineering

Aerospace & Defense: For aerospace and defense companies worldwide, engineering services outsourcing is essential to the creation of modern aircraft and spacecrafts, defense equipment, and satellite technologies. The external partners offer specialization in aspects of product design, simulation, testing, and compliance to ensure aerospace businesses develop new technologies that meet required safety and quality standards.

Automotive: The automotive industry especially depends on engineering services outsourcing for vehicle design, powertrain development and technology such as, electric vehicles and autonomous driving systems. Automotive engineering services providers enable auto makers to introduce products to the market faster, at lower costs, and with enhanced compliance to environmental and safety regulations.

Construction & Infrastructure: Bridges, roads, buildings, water and electric supply and other such structures have large construction and infrastructure firms outsourcing engineering services to manage complicated projects such as the development of cities, public transportation networks, and similar other requirements. ESO providers help in architectural design, structural engineers and project managers who see to it that project is delivered on time, to the required budget and more importantly, to code.

Telecom & IT: Communication sector and IT industries rely on outsourcing engineering services for the designing of network, development of software and hardware engineering. It assist organisations to design future communication processes, improve data networks and also deploy the latest solutions such as 5G, IoT, and others. Outsourcing also removes the barriers of cutting cost and the possibility of making these services scalable.

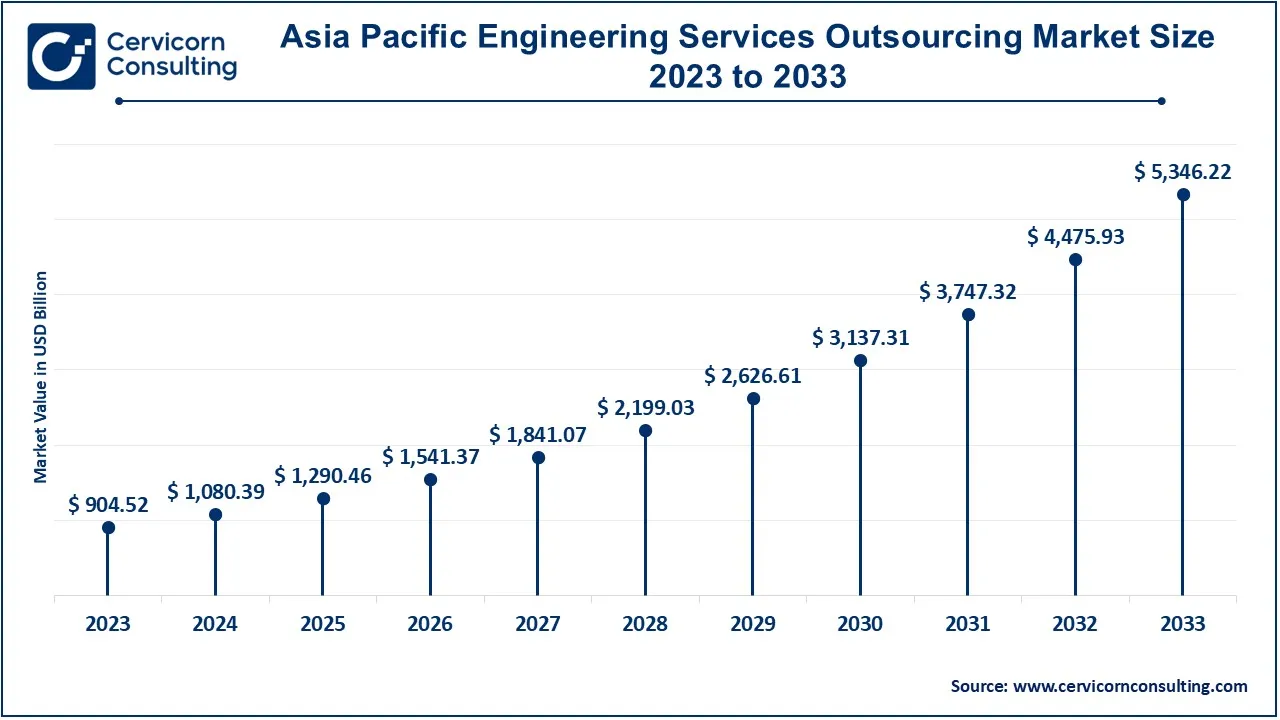

The Asia-Pacific engineering services outsourcing market size was estimated at USD 904.52 billion in 2023 and is expected to reach around USD 5,346.22 billion by 2033. The Asia-Pacific leads the ESO market, owing to the industrialization and urbanization of the region and the increasing demand for higher-skill engineering sectors in areas such as electronics, automotive, as well as telecommunication. Some of the important outsourcing locations are India, China, and Japan which provide more economical solutions for talent development. This is because, over the last couple of years, governments have taken steps to encourage the development of technology and fund smart infrastructure projects that are increasing the demand for ESO in the region.

The North America engineering services outsourcing market size was valued at USD 461.93 billion in 2023 and is projected to surpass around USD 2,730.25 billion by 2033. North America ESO market is growing, mainly because it has sound industrial infrastructure, high demand for innovative technologies, and most of its companies across sectors such as aerospace, automotive, and IT, etc. Outsourcing of high-tech engineering work is also very popular in the United States because of the global cost factor and the reasons related to skills. Canada is also experiencing an extension of ESO, especially in technology and infrastructure projects, due to the great governmental encouragement of innovation.

The Europe engineering services outsourcing market size was accounted for USD 567.20 billion in 2023 and is predicted to hit around USD 3,352.50 billion by 2033. Presently, large investments are flowing toward the ESO market, especially in Europe, which is a more innovative region involving key countries such as Germany, France, and the United Kingdom due to technological advancements and higher-quality engineering capability. Automotive, aerospace industries, and green technology sectors are well-established manufacturing industries well supported by regulatory frameworks. Another factor for this growth function is resulting from the European Union's renewed focus on sustainability and digitalization that seeks to outsource engineering services all across the continent.

The LAMEA engineering services outsourcing market was valued at USD 214.85 billion in 2023 and is anticipated to reach around USD 1,269.89 billion by 2033. The market for ESO in the LAMEA region is still developing, but it has great potential, especially in such countries as Brazil and countries of the Middle East area. Brazil is using ESO to stimulate innovative industrial development whereas the Middle East and specifically the countries of UAE to stimulate infrastructure and energetic projects. The current market in Africa can be defined as emerging and constantly developing due to the enhanced investments in technologies and its infrastructure System Service.

Among the newcomers in the ESO sector, such as Quest Global, companies stand out by providing a niche list of engineering solutions for various industries, including aerospace and automotive industries, which enhances product innovation by integrating modern technology practices. At the same time, Tata Technologies is actively developing its product proposition in the areas of product development and design engineering to enable clients to advance their digitalisation agendas. At the same time, giants such as HCL Technologies, which has an extensive background in IT and engineering services, remain the leaders of the market promoting themselves as full-service providers and strategic partners exclusive of the model.

These two companies have adopted the international market and their technological advantages to incorporate AI and IoT into outsourced engineering solutions that allow companies to grow at a faster pace. These development showcase how industry newcomers and market incumbents alike are expanding the ESO market through technology advancement and partnership. The proficiency coupled with knowledgeable investment, progression in applicable technology and profound affiliations guarantees that both innovative and start-up companies remain pioneers in the constantly shifting ESO environment.

CEO Statements

John Doe, CEO of TechGlobal Solutions:

"With the different businesses in the global setting experiencing the innovation challenge, the requirement for competent engineering service can never be felt stronger. ESO is indeed an innovation model concerning business as partners have the flexibility in terms of technology development time, costs as well as access to human capital. At TechGlobal, we pride ourselves on developing bespoke engineering solutions to meet our clients ‘needs and respond to technological advancements such as AI, IoT, and digital twin systems. Our purpose is very clear, namely, to turn vision into implementation to the best interest of businesses at that."

Raj Patel, CEO of Global Engineers Ltd:

"The general environment that engineering services have been moving through can be seen as undergoing massive transition and outsourcing has become a standard for those who intend to expand and future-proof their operations on a global level. As a leading engineering company, we pride ourselves in delivering engineering solutions to business that simplifies its operations and achieves program speed. However, our technological rendering including AI, IoT, and 3D printing turns our creations into a sustainable and economical cut for clients. Our research suggests that outsourcing engineering services does more than help firms address present requirements; it also prepares for future potential openings."

Stakeholders in the ESO market are also right now unveiling plenty technological independencies in the engineering solutions in varied industries, signifying a surge in varying specialized services such as product design, process engineering, and automation. These companies are driving change with emerging technologies like AI, IoT, and digital twin technology to smarten up working processes and products.

Some new trends visible in the ESO market include a transition to cloud solutions, 3D printing, and smart production, which makes it possible for a company to minimize expenses for numerous processes while outsourcing some tasks to talented specialists from different parts of the world:

All these points out to a tremendous growth of the ESO market by forming new partnerships and making huge investments, together with the rising need for specialized skills and knowledge. It has been observed that key players are aiming at integrated engineering solutions, enhancing digital design portfolios, and exploring advanced technologies like AI, IoT, and automation. All these efforts sought to assist enterprises to improve on product formulation, as well as cutting expenses across the aerospace, auto, and healthcare industries. ESO services are also benefiting from advanced solutions such as digital twins, additive manufacturing or 3D printing, and cloud computing.

Market Segmentation

By Services

By Location

By Product

By End-Users

By Region