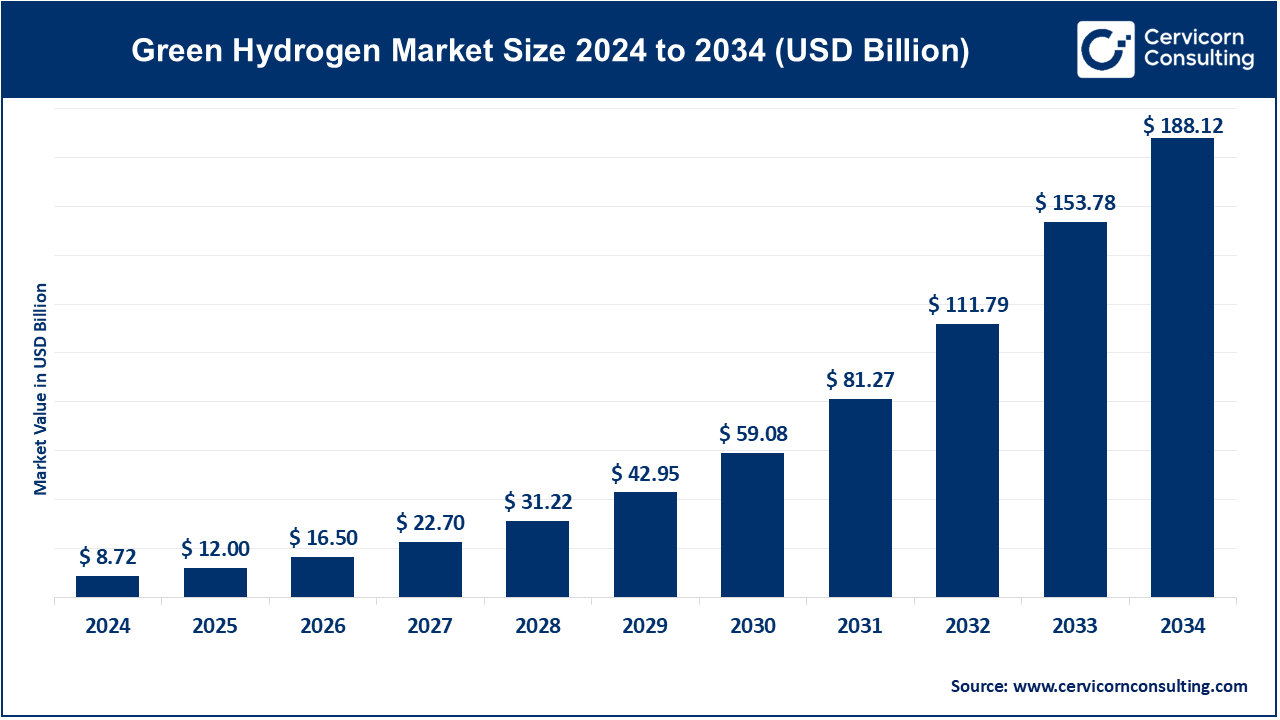

The global green hydrogen market size was calculated at USD 8.72 billion in 2024 and is expected to reach around USD 188.12 billion by 2034, growing at a compound annual growth rate (CAGR) of 35.95% from 2025 to 2034.

The green hydrogen market is poised for significant expansion as countries and industries prioritize decarbonization to meet climate goals. Several factors, including rising environmental awareness, government policies supporting clean energy, and advancements in renewable energy technologies, are driving the demand for green hydrogen. Countries like Germany, Japan, and the United States are investing heavily in green hydrogen production and infrastructure, with major industries in steel, chemicals, and transportation exploring its potential as an alternative fuel source. Additionally, the increased focus on carbon reduction targets has led to the development of new projects and collaborations between energy companies and technology providers to scale green hydrogen production. As the technology for electrolysis continues to mature, costs associated with producing green hydrogen are expected to decrease significantly. This trend is further supported by increasing investments in renewable energy projects and research into more efficient electrolyzer designs.

Green hydrogen refers to hydrogen produced using renewable energy sources such as wind, solar, and hydropower. Unlike traditional hydrogen production, which often relies on fossil fuels (like natural gas) and emits CO2, green hydrogen is generated through a process called electrolysis. This process involves using electricity from renewable sources to split water molecules (H2O) into hydrogen (H2) and oxygen (O2). The key advantage of green hydrogen is its sustainability, as it produces no greenhouse gas emissions when created and used. Green hydrogen can play a critical role in decarbonizing industries like transportation, manufacturing, and power generation, helping reduce reliance on fossil fuels and mitigate climate change.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 12 billion |

| Market size in 2034 | USD 188.12 billion |

| Market Growth Rate | CAGR of 35.95% from 2025 to 2034 |

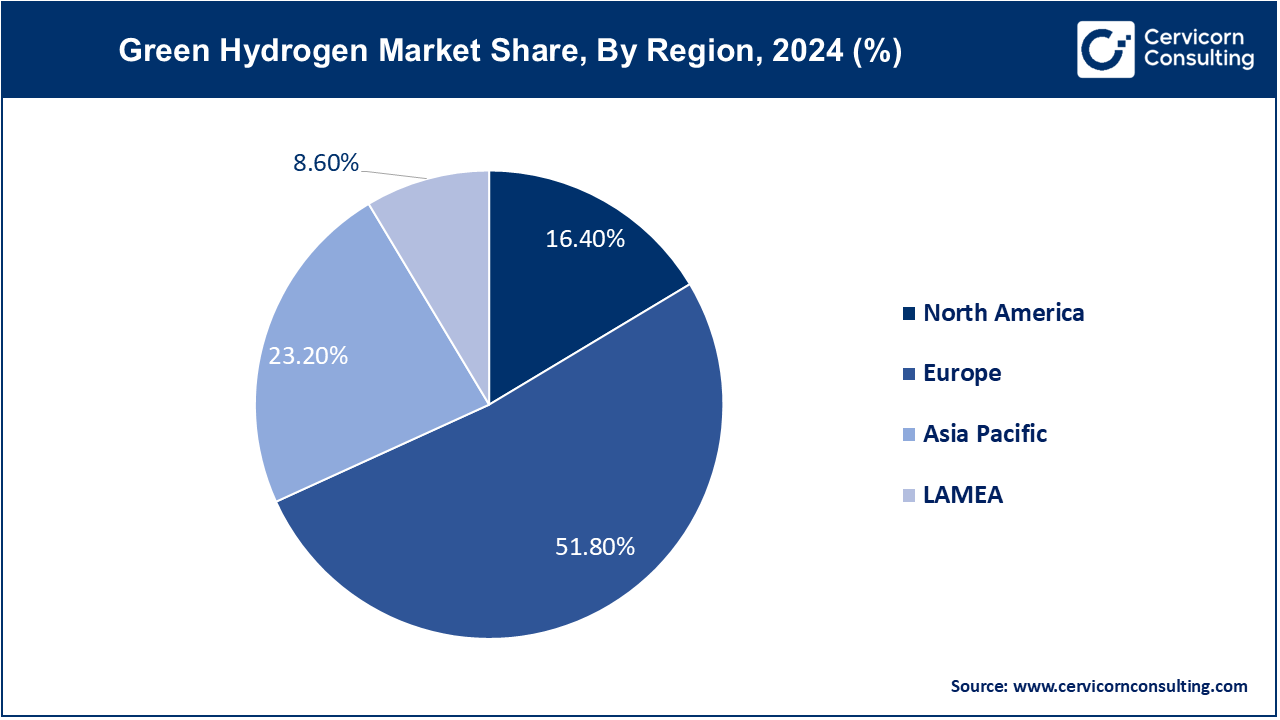

| Largest Region | Europe |

| Fastest Growing Region | North America |

| Segment Covered | By Technology, Application, End-Use, Regions |

Industrial Demand for Clean Alternatives:

Advancements in Hydrogen Infrastructure:

High Production Costs:

Limited Technological Maturity:

Cross-Sector Collaboration:

Decentralized Energy Systems:

Scaling Up Production:

Regulatory and Policy Uncertainty:

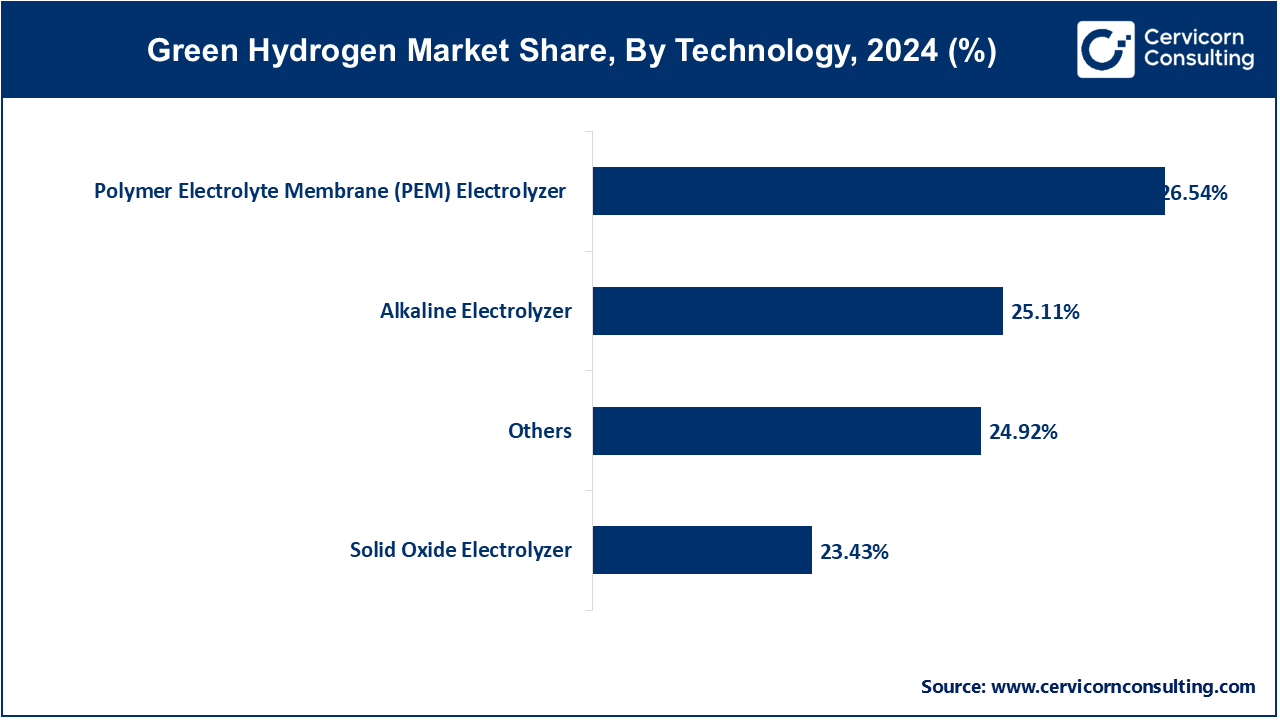

Alkaline Electrolyzer: The Alkaline electrolyzers segment has captured market share of 25.11% in 2024. Alkaline electrolyzers use an alkaline electrolyte solution (typically potassium hydroxide) to split water into hydrogen and oxygen. They are known for their reliability and long operational lifespan. In this market alkaline electrolyzers are seeing trends towards cost reduction through improved materials and manufacturing processes, making them competitive for large-scale industrial applications and renewable energy integration.

Polymer Electrolyte Membrane (PEM) Electrolyzer: The PEM electrolyzer segment has covered market share of 26.54% in 2024. PEM electrolyzers employ a solid polymer electrolyte membrane to facilitate proton exchange during electrolysis. They operate at lower temperatures and pressures compared to alkaline electrolyzers, offering advantages in efficiency and responsiveness to fluctuating electricity inputs. In this market, PEM electrolyzers are trending towards compact designs and enhanced efficiency, catering to applications requiring flexibility and rapid response times.

Others: The others segment has accounted market share of 24.92% in 2024. Other electrolyzer technologies, such as Solid Oxide Electrolysis Cells (SOECs), are also emerging in the green hydrogen market. SOECs operate at high temperatures and can directly convert steam into hydrogen, potentially achieving higher efficiencies and integration with industrial processes. Research focuses on reducing costs, increasing durability, and expanding their applicability in both stationary and mobile hydrogen production systems.

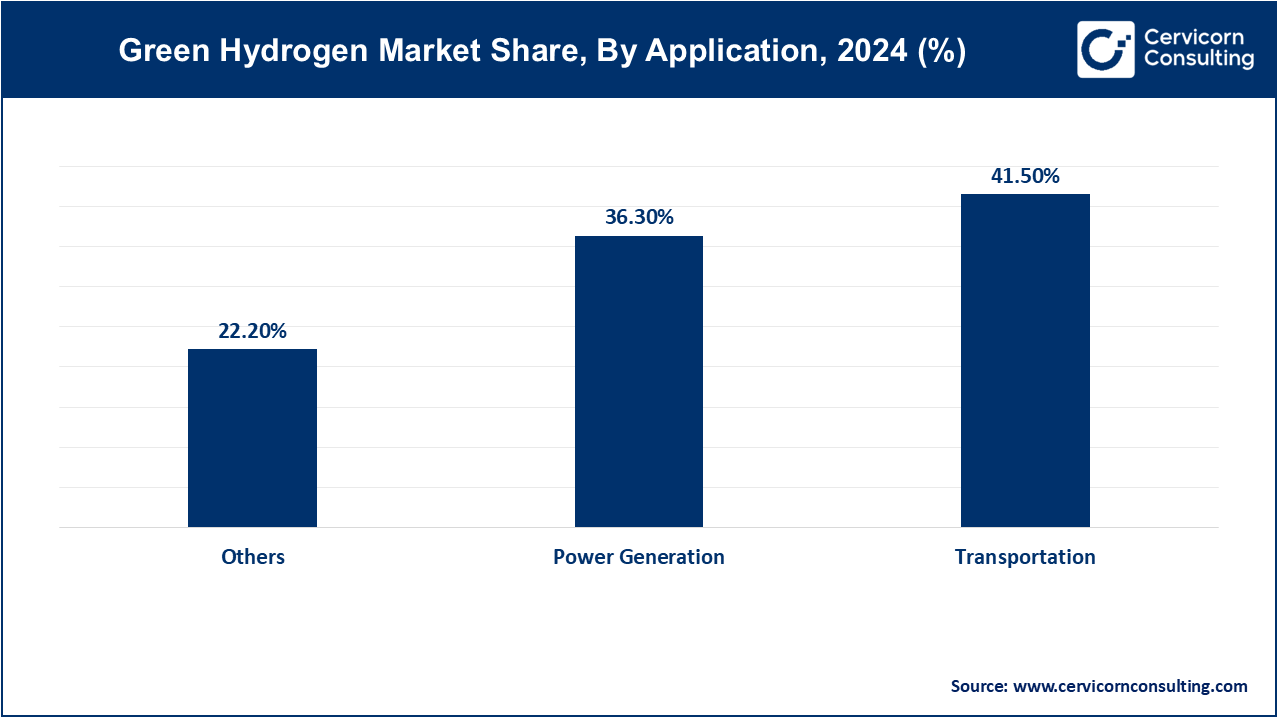

Power Generation: The power generation segment has registered market share of 36.3% in 2024. Green hydrogen is increasingly used in power plants to generate electricity through fuel cells, offering a clean energy alternative to fossil fuels. This application is witnessing growth as countries aim to integrate renewable sources more effectively into their energy mix, enhancing grid stability and reducing greenhouse gas emissions.

Transport: The transport segment has garnered market share of 41.5% in 2024. In transportation, green hydrogen powers fuel cell vehicles, providing zero-emission mobility solutions with fast refueling times. The transport sector is seeing increasing investment in hydrogen infrastructure, particularly for heavy-duty vehicles and fleets, as governments and companies prioritize decarbonization of the transportation sector.

Industry Energy: Used as a clean fuel and feedstock in industries like chemicals, steel, and refineries, green hydrogen reduces carbon emissions in industrial processes. It enables industries to meet stringent environmental regulations and sustainability targets, driving adoption despite initial infrastructure and cost challenges.

Heating: Green hydrogen is utilized in residential and commercial heating systems, offering a renewable alternative to natural gas. This application is gaining traction in regions with established hydrogen infrastructure and supportive policies aimed at reducing carbon emissions from heating.

Others: The others segment has measured market share of 22.2% in 2024. Green hydrogen finds applications in energy storage, grid stabilization, and as a feedstock for synthetic fuels and chemicals, contributing to overall decarbonization efforts across various sectors. Its versatility and potential for sector coupling make it a promising solution for achieving climate goals while diversifying energy sources.

Automotive: Green hydrogen is increasingly used in fuel cells for zero-emission vehicles, offering a sustainable alternative to fossil fuels and addressing concerns over air quality and greenhouse gas emissions. The automotive sector is witnessing growing investments in hydrogen fueling infrastructure and advancements in fuel cell technology to enhance efficiency and range.

Chemical: In the chemical industry, green hydrogen serves as a sustainable feedstock for the production of ammonia, methanol, and other key chemicals. This application reduces the carbon footprint associated with chemical manufacturing processes, aligning with global sustainability goals and driving innovation in hydrogen production technologies.

Petroleum Refinery: Within petroleum refining, green hydrogen plays a crucial role in desulfurization processes and upgrading heavy crude oils. By replacing traditional hydrogen sources derived from fossil fuels, green hydrogen enables refineries to produce cleaner fuels while reducing emissions and complying with stringent environmental regulations.

Power and Energy: Green hydrogen is utilized for energy storage and generation, facilitating the integration of renewable energy sources like wind and solar into the grid. This application addresses the intermittency of renewables by providing a reliable energy storage solution and supports grid stability, making it a key enabler of the transition to a low-carbon energy system.

Industrial: Industries such as metallurgy, electronics, and glass production utilize green hydrogen as a clean energy source for various processes. Its high energy density and versatility make it suitable for replacing fossil fuels in energy-intensive industrial applications, contributing to emissions reduction efforts and enhancing operational sustainability.

Others: Emerging applications of green hydrogen include residential heating and grid balancing services. As technologies advance and costs decline, green hydrogen is expected to find new applications in sectors seeking to decarbonize their operations and reduce reliance on conventional energy sources. These developments are expanding the market's versatility and driving broader adoption across diverse industries.

The North America green hydrogen market size is calculated USD 1.43 billion in 2024 and is projected to grow USD 30.85 billion by 2034. In North America, there is a strong emphasis on developing hydrogen infrastructure to support fuel cell vehicles and renewable energy integration. Government initiatives and private investments are driving innovation in electrolyzer technologies and expanding hydrogen production capacities, particularly in the United States and Canada.

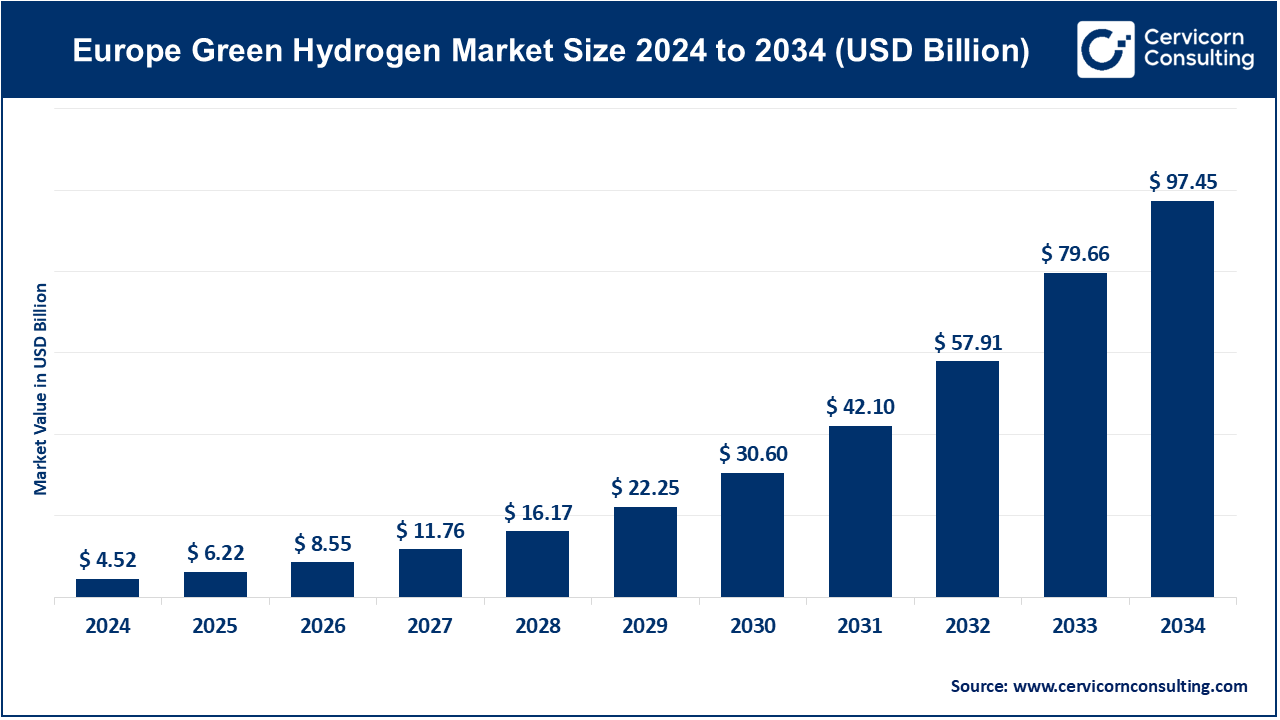

Europe green hydrogen market size is estimated at USD 4.52 billion in 2024 and is expected to hit around USD 97.45 billion by 2034. Europe leads in green hydrogen adoption, supported by ambitious decarbonization targets and robust policy frameworks. The European Union's hydrogen strategy aims to scale up production capacities and establish a hydrogen economy, with investments in hydrogen production hubs, cross-border transport, and industrial applications.

Asia-Pacific green hydrogen market size is measured USD 2.02 billion in 2024 and is projected to grow around USD 43.64 by 2034. The Asia-Pacific region is investing heavily in green hydrogen to address energy security and reduce dependence on imported fossil fuels. Countries like Japan, South Korea, and Australia are leading the development of hydrogen economies, focusing on renewable energy integration, hydrogen refueling infrastructure, and industrial applications.

LAMEA countries has generated market share of 8.6% in 2024. also countries are exploring green hydrogen as a means to diversify their energy mix and capitalize on abundant renewable resources. Initiatives in countries like Chile, Saudi Arabia, and South Africa focus on leveraging solar and wind resources for hydrogen production, supporting local industries, and exporting hydrogen to global markets.

New players entering the green hydrogen market are often characterized by their focus on innovation and technology development. Companies like Enapter and Green Hydrogen Systems are adopting novel electrolyzer technologies and modular systems to reduce costs and enhance efficiency. They leverage advancements in renewable energy integration to compete in the rapid growing market. Key players dominating the market include established giants like Air Liquide, Linde plc, and Siemens Energy. These companies possess extensive experience, robust infrastructure, and strong global presence. They lead by investing in large-scale projects, forming strategic partnerships, and influencing regulatory frameworks to shape the industry's growth trajectory.

Market Segmentation

By Technology

By Application

By End-Use

Ny Regions