Healthcare CDMO Market Size and Growth 2025 to 2034

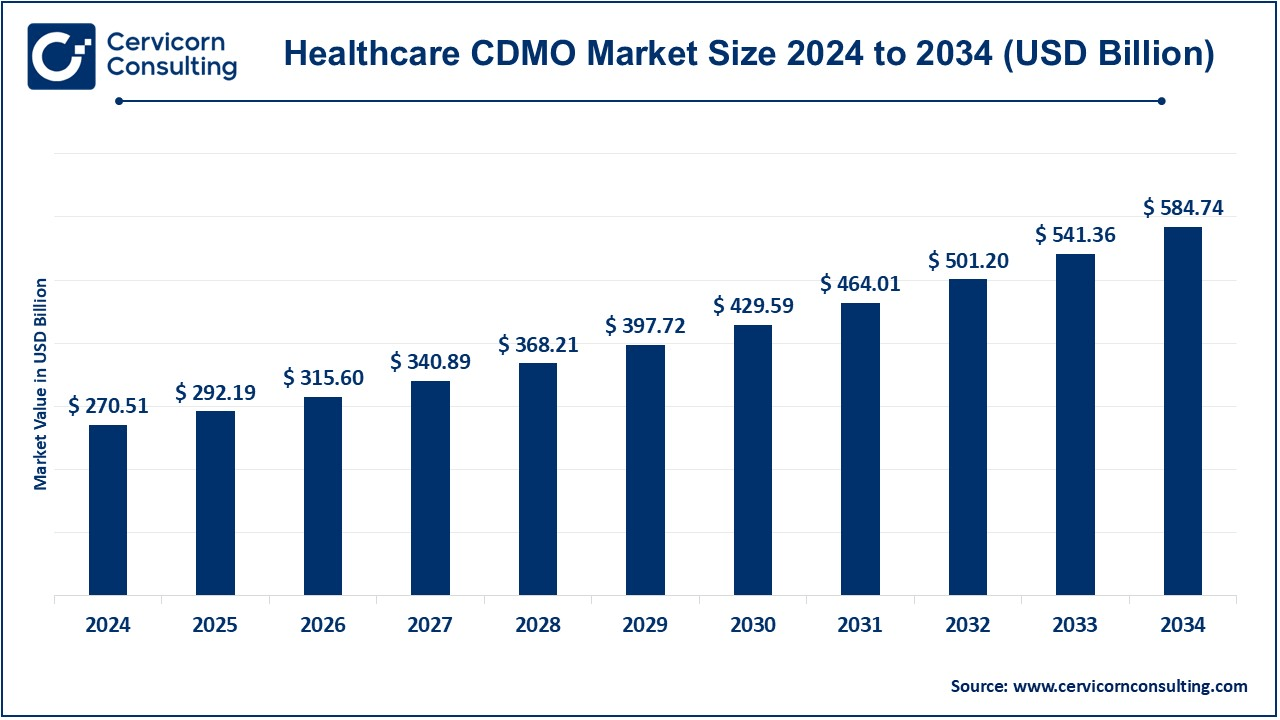

The global healthcare CDMO market size was valued at USD 270.51 billion in 2024 and is expected to surpass around USD 584.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.01% over the forecast period 2025 to 2034. The healthcare contract development and manufacturing organizations market is growing vigorously owing to the rising demand for contract manufacturing and development services across the pharmaceutical and biotechnology industries. Demand on the market is increasing due to the rapidly increasing needs of biologics, vaccines, and complex drug formulations. Healthcare CDMOs are extremely relevant in providing the experience in product development, manufacturing, and adherence to regulatory guidelines. Besides that, increasing costs within drug product manufacturing combined with the necessity for smaller, more flexible, and efficient production runs lead to a push for companies to outsource to specialized service providers.

Healthcare contract development and manufacturing organization (CDMO) is through which outsourced services for pharmaceutical and healthcare products development, manufacturing, and commercialization are provided. Healthcare CDMOs help the pharmaceutical companies with upscaling production, developing formulations, and fulfilling the stringency of compliance with manufacturers and regulatory requirements for the small molecule drugs and biologics. These organizations serve as the backbone of flexible and cost-effective manufacturing solutions emerging from the ever-increasing demand for personalized and specialized therapies. Engaging with these firms allows companies to cut back on overheads, assure themselves of high standards in production, and speed up time-to-market for their products, particularly in regulated environments.

Healthcare CDMO Market Report Highlights

- The U.S. healthcare CDMO market size was valued at USD 76.88 billion in 2024 and is projected to hit around USD 166.18 billion by 2034.

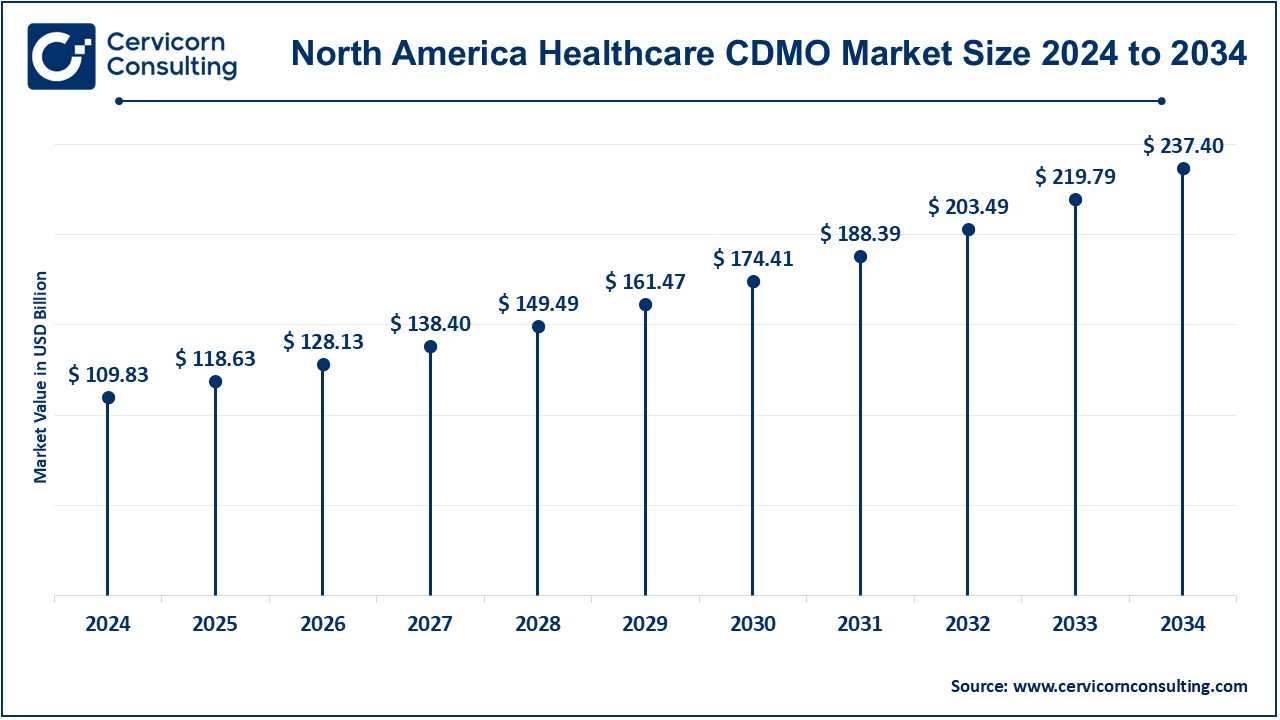

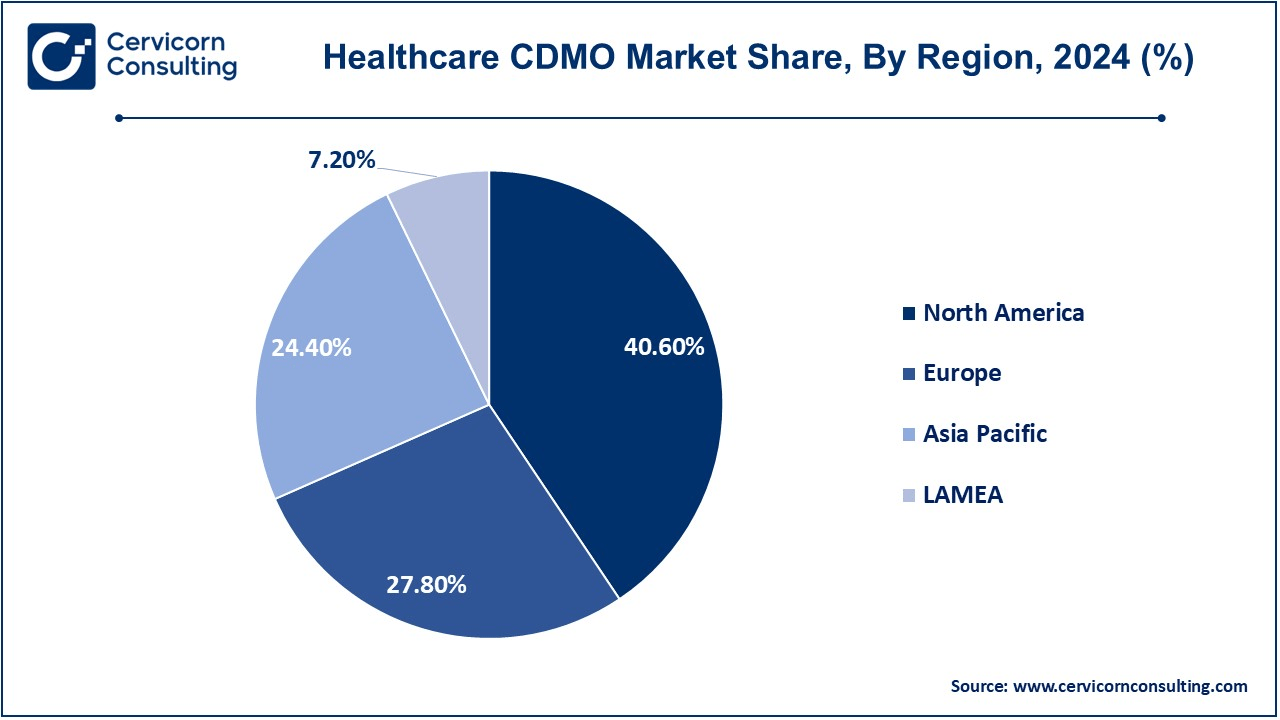

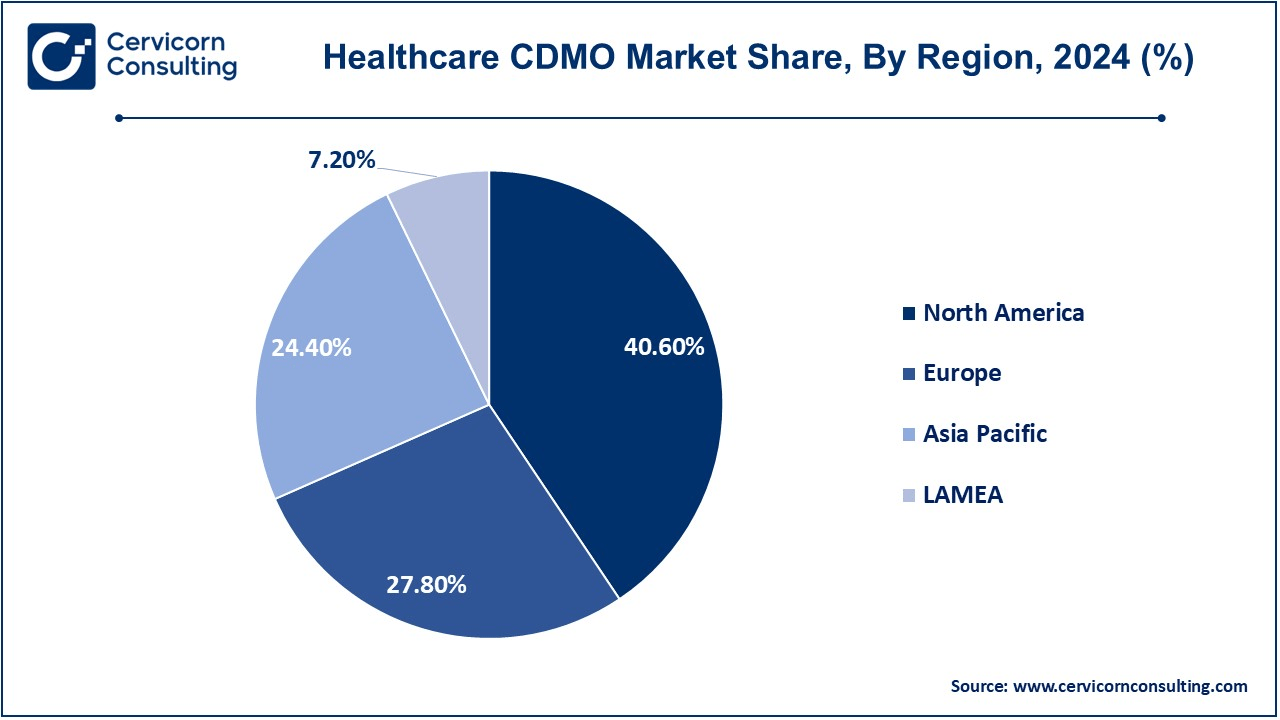

- The North America region is expected to dominate the market in 2024, accounted for a revenue share of 40.60%.

- The Europe region accounted for a revenue share of 27.80% in 2024.

- The Asia-Pacific is expected to witness strong growth over the forecast period.

- By service, the contract manufacturing segment has held revenue share of 74.50% in 2024.

Healthcare CDMO Market Growth Factors

- The increasing prevalence of chronic diseases is driving the demand for advanced drug formulations: Increasing trends of chronic diseases worldwide include diabetes, cardiovascular conditions, and cancer. These areas demand novel and innovative drug formulations, and the drugs used usually require long-term treatment with very specialized medicines. Hence, CDMOs play a critical role in developing complex and personalized drugs that meet the demands for new and targeted therapies against the diseases of this century.

- Expansion of pharmaceutical production capacity in growing markets: In emerging Asian, African, and Latin American markets, it is a phenomenal growth phase, driven by improvements in healthcare accessibility, the escalating cost of healthcare delivery, and political will for investment in the pharma sector. CDMOs are responding with new manufacturing footprints in those regions, fulfilling the need of growing drug market demand and being able to do so in some of the best production cost areas.

- Contract manufacturing services are becoming increasingly adopted among small and medium-sized pharmaceutical companies: The smaller and medium-sized pharmaceutical companies are not well equipped to build huge manufacturing facilities. Outsourcing their production to CDMOs provides these companies with advanced manufacturing technologies, reduces overhead costs, and increases time-to-market. This trend is continuing as the companies seek expertise and scalability that only CDMOs can offer to enable them to compete in the global pharmaceutical market.

Healthcare CDMO Market Trends

- Increasing partnership between CDMOs and pharma companies: Now that companies are looking for specific manufacturing expertise, more and more pharmaceutical companies join forces with CDMOs. The partnership is usually an agreement taken with the CDMO for long-term services on end-to-end development to final filling, packaging, and labeling of the drug. This ensures core competencies in R&D for the pharma company, which can leave the production with all its efficiency and scalability in the hands of the CDMO.

- Investment in high-tech facilities and specialized production capabilities: With the rise in demand for complex drugs, biologics, and gene therapy, CDMOs are investing mainly in advanced manufacturing facilities.It equips itself to handle advanced formulations and can adhere to biologics-related strict regulatory, stringent requirements concerning sterile production and cell therapies.The investment here is in high-tech facility and thus stays on par with an ever-changing market to address the needs of an entire pharmaceutical world.

- Artificial intelligence and machine learning for maximum production: From better predictive analytics and optimized production processes and quality control to increased AI-based monitoring and optimization of operational efficiency, artificial intelligence and machine learning is revolutionizing pharmaceutical manufacturing in ways that were hardly imaginable in the pharmaceutical manufacturing space.These technologies also allow for an early prediction of problems but contribute towards reduced downtime as well as the overall quality of the product with a production process responsive to the needs of markets yet still ensuring regulatory standards are upheld.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 292.19 Billion |

| Expected Market Size in 2034 |

USD 584.74 Billion |

| Predicted CAGR 2025 to 2034 |

8.01% |

| Dominant Region |

North America |

| Fastest Growing Region |

Asia-Pacific |

| Key Segments |

Service, Region |

| Key Companies |

Catalent Inc., Lonza, Recipharm AB, Siegfried Holding AG, Thermo Fisher Scientific, Inc., Labcorp Drug Development, Jabil Inc, Syngene International Limited, IQVIA Inc., Almac Group, Ajinomoto Bio-Pharma, Adare Pharma Solutions, Alcami Corporation, Vetter Pharma International |

Healthcare CDMO Market Dynamics

Drivers

- Expanding pharmaceutical pipeline leading to increased manufacturing demand: Continuous pharmaceutical pipeline expansion backed by advances in drug research and development is also a key market driver for CDMOs. With new therapeutic developments by pharma companies across these therapeutic areas- oncology, immunology, and biologics- CDMOs ensure the availability of infrastructure and specialization for their mass production while staying within the stringent regulatory framework of such production processes.

- Models of outsourcing backed by governmental regulation: The pharmaceutical industry has witnessed support from the governments of many countries for the outsourcing model. These policies have resulted in making the pharmaceutical business cost-effective, foreign investment-friendly, and a more favorable business environment for CDMOs, which helped the market to grow. These regulations have been imposed to make the pharmaceutical sector competitive while maintaining the quality standards of the industry in favor of pharmaceutical companies and contract manufacturers.

- Increased efficiency through automation and digitalization: The pharmaceutical manufacturing industry continues to change with the advanced technological capabilities in terms of automation and digitalization. Robotics, artificial intelligence, and data analytics make production more precise, efficient, and cost-effective. Improvements do not just streamline manufacturing but also significantly improve compliance with very stringent regulations, meaning demand for services in the pharma industry with a CDMO will go up.

Restraints

- Lack of experienced workforce to produce specialized drugs: The drug manufacturing process is very complex, especially in the case of biologics and personalized medicines, which require a very high number of skilled workers. There is a lack of specialized talent in areas such as biopharmaceuticals, sterile manufacturing, and gene therapy production. It becomes hard for the CDMOs to meet the required labor due to the need to create opportunities in training programs and workforce development to ensure the continuous production standards and avoid delays.

- Potential for IP dispute between CDMOs and clients: The biggest challenge that CDMOs face is intellectual property. As they manufacture proprietary drugs, it is always subject to the risks of disputes that may arise involving formulation processes or technologies and patent rights, which may bring delays in production timelines, incur expensive legal battles, and create further deterioration in relations between the CDMO and its client. Thus, clear agreements and protections are indispensable.

- Growing competition from low-cost manufacturing regions: This development, especially in Asia, brings with it high competition for the CDMOs located in the costlier regions. Pharmaceutical companies are attracted more and more towards cost-effective options of production overseas. This pressure has been building on CDMOs located in costlier regions, and they need to become more efficient, cut costs, or provide specialized services that distinguish them in a global market.

Opportunities

- This growth of the cell and gene therapy market requires specialized manufacturing: Cell and gene therapies are expected to advance at a very fast pace, bringing with them massive opportunities for CDMOs. These are complex, personalized treatments requiring specialized manufacturing capabilities. Investment in this niche will allow CDMOs to tap into the high-growth segment of the market, servicing the production of gene-editing tools, viral vectors, and other complex biologics expected to be pivotal in future therapeutic approaches.

- Increasing number of new drug formulations approved by the regulatory authorities: As regulatory bodies worldwide make their processes for approving new drug formulations smoother, the opportunity is open for CDMOs to gain leverage from the increased quantities of new drugs entering the market. As drug approvals are on the rise, companies are now investing in new and innovative drugs with the help of CDMOs manufacturing the same at scale and meeting regulatory standards.

- Demand in complex generic drugs and complex injectable products: This provides an opportunity for CDMOs to offer specialized manufacturing services to the increasing demand for complex generics and injectable drug formulations. Several blockbusters are close to the patent expiration date. This has brought a massive opportunity for generic biologics and complex injectables. CDMOs can, therefore, rely on their strength in managing complicated formulations to contribute to the supply of these products to the world pharmaceutical market.

Challenges

- Navigating the complex and changing regulatory landscape: Pharmaceuticals is a very regulated industry. The drug has to be manufactured by the set of rules and requirements of every country. In this scenario, it is quite tough for CDMOs to continue updating the real-time regulatory standards while staying in compliance with the regions without compromising the process of production and distribution. It's a very complicated situation that demands to be kept track of continuously and adapted to constantly. Such vigilance is expensive and resource-consuming.

- Building resilience in supply chains during global disruption: A pandemic, geopolitical tension, or a natural disaster can disrupt the entire pharmaceutical supply chain at the global level. CDMOs need to ensure resilient and flexible supply chains for the timely production and delivery of drugs. To avoid such risk, CDMOs must diversify the chain, improve forecasting, and formulate contingency plans to keep the supply of drugs unimpeded without delay.

- Maintaining speed with a horizon of rapid technological advancements and digitalization: Technology intensity is higher for health and pharma industries, and it is coming from digital tools and advanced technologies, such as artificial intelligence, automation, and cloud-based platforms. The implication for a CDMO is that there is a requirement for investment in upgrading digitization infrastructures to compete, become more efficient, and leave behind decreased operational efficiency, the compromise on quality product, and failure to fulfill demands of clients within this digitized world.

Healthcare CDMO Market Segmental Analysis

Service Analysis

Contract Development

- Small Molecule: Contract development for small molecules deals with the development of simple, small-molecular chemical compounds that are generally used in medicinal formulations. It basically includes stages ranging from drug discovery to preclinical testing, to formulation development support in clinical trails. CDMOs thus have the competencies of delivering an efficient method for synthesizing small molecules toward viable drugs; scalable, fit for regulatory demands, and will be applicable either in the use in the clinics or for commerce.

- Large Molecule: Large molecule contract development emphasizes the development of biologics, which contain proteins, antibodies, and other substances that are biologically derived. These molecules are inherently more sophisticated and require advanced knowledge and technology to produce. The process entails designing the biologic, optimizing production in mammalian or microbial cells, and having the safe and effective product. CDMOs help pharmaceutical companies scale up from early development to clinical and commercial production within the stringent regulatory frameworks in place.

Healthcare CDMO Market Share, By Services, 2024 (%)

| Services |

Revenue Share, 2024 (%) |

| Contract Development |

25.50% |

| Contract Manufacturing |

74.50% |

Contract Manufacturing

- Small Molecule: Contract manufacturing for small molecules entails the mass production of chemical-based drugs once the drug has been developed and passed through all required testing. The CDMO offers facilities as well as technical expertise in making these drugs in various scales starting from clinical trial batches up to full commercialization. Synthesis, purification, and final formulation for small molecule drugs, with uniformity, quality, and adherence to regulatory guidelines for every step of the process.

- Large Molecule: Contract manufacturing of large molecules involves developing and producing biologics, among others. While small molecules require less production technology, biologics need more complex technologies to manufacture therapeutic proteins, antibodies, and more complex biologics. Large molecule CDMOs provide all upstream and downstream manufacturing services about cell line development, fermentation or cell culture, purification, and final formulation. Scaling and maintaining standards in biological manufacturing is critical.

- High Potency API: Active Pharmaceutical Ingredient: Specialized in high potency API manufacturing, it deals with extremely potent pharmaceutical ingredients for the therapy of conditions such as cancer or diseases requiring very small but highly effective doses. High potency APIs demand special handling and specific manufacturing processes, safety procedures, and therefore CDMOs offer specialized facilities and expertise for their manufacture under controlled environments that provide high purity and quality with reduced risks to personnel and strict compliance with regulatory standards.

- Dose Formulations Finished: Finished dose formulations are the last steps in drug production where APIs are processed into finished dosage forms of tablets, capsules, injectables, or topical products. CDMOs in this segment provide formulation, blending, tableting, encapsulation, and packaging services. The objective is to ensure that the final product is stable, effective, and meets all regulatory requirements, including those for packaging, labeling, and shipping.

- Medical Devices: Manufacturing of medical devices is an important service in the market of healthcare CDMO since many new biologic drugs may be delivered via specific medical devices. The list includes injectors, infusion pumps, diagnostic equipment, and others. CDMOs in this category design, develop, and manufacture medical devices with regard to compatibility with drug formulations, adherence to regulatory requirements, and patient safety. Such a service involves deep understanding of drug development as well as device engineering.

Healthcare CDMO Market Regional Analysis

The healthcare CDMO market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

Why is North America leading the healthcare CDMO market?

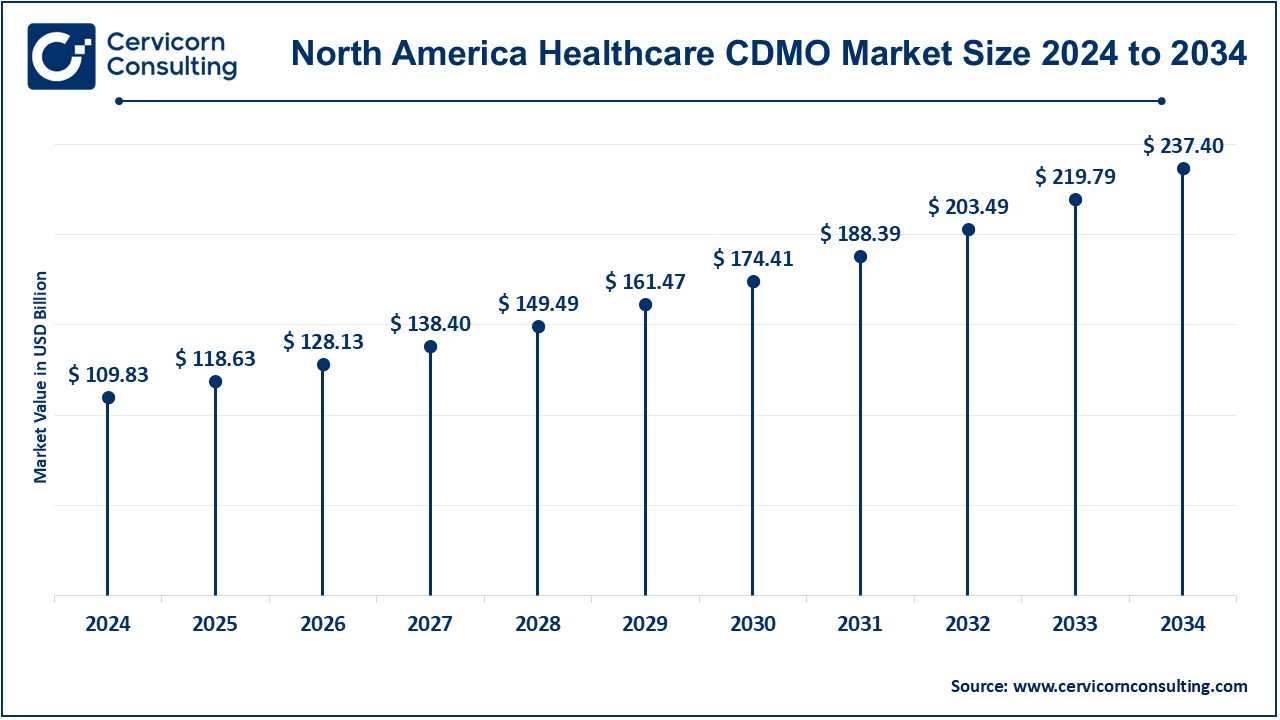

The North America healthcare CDMO market size was valued at USD 109.83 billion in 2024 and is forecasted to reach around USD 237.40 billion by 2034. North America is the largest region, due to the presence of large pharmaceutical and biotechnology companies along with advanced healthcare infrastructure. The United States is the key player in this region, having numerous large pharmaceutical companies and leading CDMOs. Growth in demand for biologics, innovative drug therapies, and clinical trials are also driving the growth of the demand for contract development and manufacturing services. Canada too has a share in this growth, particularly because of its solid healthcare system and increasing investments in biotech research. The primary drivers in this region include regulatory support, well-established supply chains, and focus on drug innovation.

What factors are driving the growth of Europe healthcare CDMO market?

The Europe healthcare CDMO market size was estimated at USD 75.20 billion in 2024 and is recorded around USD 162.56 billion by 2034. Europe is another important region, which is known for its strong pharmaceutical and biotechnology sectors. The major countries in Europe are Germany, the United Kingdom, France, Switzerland, and Italy. Germany is a leader in pharmaceutical manufacturing and innovation, especially in generics and biologics, while the UK is a leader in biotech and life sciences. Home to several major pharma companies, Switzerland is contributing to the dominant drug manufacturing hub in the region. Europe is well-established regarding regulatory frameworks; rising interest in personalized medicine, biologics, and biosimilars created a boom scenario for CDMOs. Furthermore, the pharmaceutical industry is out bounding due to reduced production costs.

Why is Asia-Pacific fastest growing region for the healthcare CDMO market?

The Asia-Pacific healthcare CDMO market size was accounted for USD 66 billion in 2024 and is forecasted to reach around USD 142.68 billion by 2034. Asia-Pacific is one of the fastest growing regions, especially due to growth in pharmaceuticals and biotech sectors in places like China, India, Japan, and South Korea. These countries are on the rise regarding pharmaceutical manufacturing capabilities, with China and India taking the lead - India is colloquially termed as the "pharmacy of the world". China has emerged as a significant player in biologics manufacturing and is rapidly building its capabilities in the biopharmaceutical industry. Japan and South Korea have been leaders in technology-driven pharmaceutical manufacturing, mainly in biologics and high-tech medical devices. The region enjoys lower production costs, an available skilled workforce, and good government policies; hence, this region is increasingly becoming an attractive outsourcing destination for global pharmaceutical companies.

LAMEA Healthcare CDMO Market Trends

The LAMEA healthcare CDMO market was valued at USD 19.48 billion in 2024 and is anticipated to reach around USD 42.10 billion by 2034. The LAMEA region is the combination of Latin America, the Middle East, and Africa. It has diverse market trends and growth opportunities for the market. Latin America comprises Brazil, Mexico, and Argentina, and this region is a rising pharmaceutical manufacturing region, and there is growing demand for generics, vaccines, and biologics. The Middle East, such as in the United Arab Emirates and Saudi Arabia, is expected to increase rapidly due to its investments in infrastructure for health, pharmaceuticals, and medical appliances. Africa remains a big place with multiple divergent markets slowly growing, particularly within South Africa and Nigeria, since the demand for healthcare services and pharmaceutical products are increasing as of late because more people become healthcare conscious and begin investing. Despite the challenges presented by regulatory complexity and infrastructure constraints, the LAMEA region presents a massive opportunity for the expansion of the presence of CDMOs.

Healthcare CDMO Market Top Companies

- Catalent Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific, Inc.

- Labcorp Drug Development

- Jabil Inc

- Syngene International Limited

- IQVIA Inc.

- Almac Group

- Ajinomoto Bio-Pharma

- Adare Pharma Solutions

- Alcami Corporation

- Vetter Pharma International

CEO Statements

Alessandro Maselli , CEO of Catalent Inc.

- "As the CEO of Catalent, I am deeply committed to advancing healthcare through our expertise as a leading Contract Development and Manufacturing Organization. Our goal is to provide innovative, high-quality solutions that enable our partners to bring life-changing therapies to market faster and more efficiently. By leveraging our comprehensive capabilities in drug development, manufacturing, and supply chain services, we ensure that every patient can benefit from safe and effective treatments. At Catalent, we remain focused on delivering excellence, fostering collaboration, and meeting the evolving needs of the global healthcare industry."

Wolfgang Wienand, CEO of Lonza:

- “At Lonza, we enable a healthier world by supporting our healthcare customers on the path to commercialization. Working across five continents, our global community of around 18,000 colleagues helps pharmaceutical, biotech, and nutrition companies to bring their treatments to market”.

Greg Behar, CEO of Recipharm AB:

- "As a leading Contract Development and Manufacturing Organization (CDMO), Recipharm is committed to delivering the highest standards of quality, innovation, and reliability to our clients in the healthcare sector. Our focus is on supporting the development and manufacturing of life-saving medicines, ensuring that we provide scalable solutions that meet the evolving needs of the pharmaceutical industry. We are proud of our partnerships with global healthcare companies and remain dedicated to improving patient outcomes through excellence in both service and manufacturing capabilities."

Recent Developments

- In November 2023, Novel acquisition by Jabil retargets at enhancing the reuse of electronic components, which might otherwise be discarded. Jed Pecchioli, Jabil supply chain vice president, said that through this partnership, customers and the environment will be benefitted since it will strengthen the circular economy. Retronix helps in re-ball and re-tinning services for surface-mounted components, thereby allowing recovery and resale of used parts. This increases demand on Retronix because manufacturers now have shortages that have to be replenished. Jabil would want to upscale and standardize the best practice on Retronix to allow the maximum effects on its customers and the overall industry.

- In October 2024, The Thermo Fisher Scientific Accelerator Drug Development services will be launched from 8-10 October 2024 at CPHI Milan 2024. It's a combination of both a contract development and manufacturing organization and also a contract research organization in order to deliver the tailor-made solutions for the biotech and the pharmaceutical companies. All drug development services for small molecules, biologics, and cell and gene therapies will be included. The company has recently completed expansions in Ohio and Oregon, which will help to enhance its R&D and manufacturing capabilities. This is a testament to Thermo Fisher's commitment to speeding innovation and responding to global health challenges.

- In October 2024, Almac Group announced that it will invest USD 11.26 million to improve global analytical services and create over 100 new jobs. It is going to expand the existing analytical laboratories in five facilities across the UK and Ireland, and other facilities across the world. The group said that there was a growing demand for analytical services from all over the world. Almac provides analytics for drug substances and drug products across the entire development cycle with over 700 analysts. Enhanced instrumentation and a digitization initiative enhance information sharing. Almac is devoted to a total USD 409.6 million investment program for strengthening its competitive position by providing entire analytical solutions to its clients globally.

Market Segmentation

By Services

- Contract Development

- Small Molecule

- Preclinical

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Other Preclinical Services

- Clinical

- Phase I

- Phase II

- Phase III

- Phase IV

- Laboratory Services

- Bioanalytical Services

- Analytical Services

- Large Molecule

- Cell Line development

- Process Development

- Upstream

- Microbial

- Mammalian

- Others

- Downstream

- MABs

- Recombinant Proteins

- Others

- Others

- Contract Manufacturing

- Small Molecule

- Large Molecule

- MABs

- Recombinant Proteins

- Others

- High Potency API

- Finished Dose Formulations

- Solid Dose Formulation

- Liquid Dose Formulation

- Injectable Dose Formulation

- Medical Devices

- Class I

- Class II

- Class III

By Region

- North America

- APAC

- Europe

- LAMEA

...

...