The global in vitro fertilization market size was valued at USD 25.06 billion in 2024 and is expected to be worth around USD 43.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.6% from 2025 to 2034.

The global In Vitro Fertilization (IVF) market has been growing rapidly due to rising infertility rates, increasing awareness, and technological advancements. Factors like delayed pregnancies, lifestyle changes, and a higher prevalence of fertility disorders have contributed to the demand for IVF treatments. Additionally, supportive government policies and increased healthcare investments have boosted market expansion. Innovations such as genetic screening and improved embryo freezing techniques are further driving growth. Countries with strong healthcare infrastructure, such as the U.S., India, and China, are seeing significant IVF market development. The increasing number of fertility clinics, medical tourism, and insurance coverage for infertility treatments are accelerating this growth. The Asia-Pacific region, in particular, is witnessing substantial demand due to lower treatment costs and advanced medical facilities.

In the last few years, there have been many developments and trends in fertility treatment that have improved the overall experience and success rate for people who want to start a family. To help individuals and couples conceive, in vitro fertilization (IVF) is a cutting-edge assisted reproductive technology. In this process, a woman's ovaries are stimulated to produce a large number of eggs, which are then surgically removed and fertilized in a lab with sperm. After a few days of culture, the resultant embryos are then placed in the woman's uterus in the hopes of a fruitful pregnancy. IVF is widely used to treat fertility problems in males and females, and genetic disorders.

Significant advancements and modifications have been made in recent years in IVF, which has further enhanced patient outcomes and at the same time has increased the availability of various treatment options. Given the recent high success rate, the integration of new technologies into IVF and other reproductive procedures is being carried on by experts. To overcome the issues related to infertility, over the years, millions of people have used IVF in which an embryo is inserted into the uterus after the sperm and egg are successfully fertilized in a lab.

What is an In Vitro Fertilization (IVF)?

In Vitro Fertilization (IVF) is a medical procedure that helps couples conceive when they face difficulties in natural pregnancy. The process involves fertilizing an egg with sperm outside the body in a laboratory. Once fertilization occurs, the embryo is transferred into the woman’s uterus for implantation. IVF is commonly used for couples struggling with infertility due to factors like age, blocked fallopian tubes, or low sperm count. The treatment includes several steps: ovarian stimulation, egg retrieval, sperm collection, fertilization, embryo culture, and embryo transfer. IVF has helped millions of couples worldwide fulfill their dream of parenthood. With advancements in technology, success rates have improved significantly. However, IVF can be expensive, and multiple cycles may be required for a successful pregnancy.

Key Insights related to the In Vitro Fertilization (IVF):

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 25.06 Billion |

| Expected Market Size in 2034 | USD 43.76 Billion |

| Projected CAGR (2025 to 2034) | 5.78% |

| Prime Region | Asia-Pacific |

| Leading Growth Region | North America |

| Key Segments | Type, Instrument, Procedure, End User, Region |

| Key Companies | Boston IVF, Monash IVF, Cook Medical, TFP Thames Valley Fertility, Pelargos IVF, Ovation Fertility, Irvine Scientific, RSMC, INVO Bioscience, U.S. Fertility, Nova IVF, RMA Network (Reproductive Medicine Associates), Cooper Surgical Fertility, Oxford Gene Technology, Fortis Healthcare, Thermo Fisher Scientific, Genea Limited, Shady Grove Fertility, Group Ambroise Paré Clinic, Bangkok IVF Center, Bloom IVF Centre |

Greater Flexibility in Family Planning

Increasing Pregnancy Success Rate

High Costs Associated with IVF Procedures

Risk of Multiple Pregnancies

Recent Advancements and Innovative Techniques

Rising Healthcare Expenditure and Disposable Income

Risk of an Unsuccessful Cycle

Various Health Issues

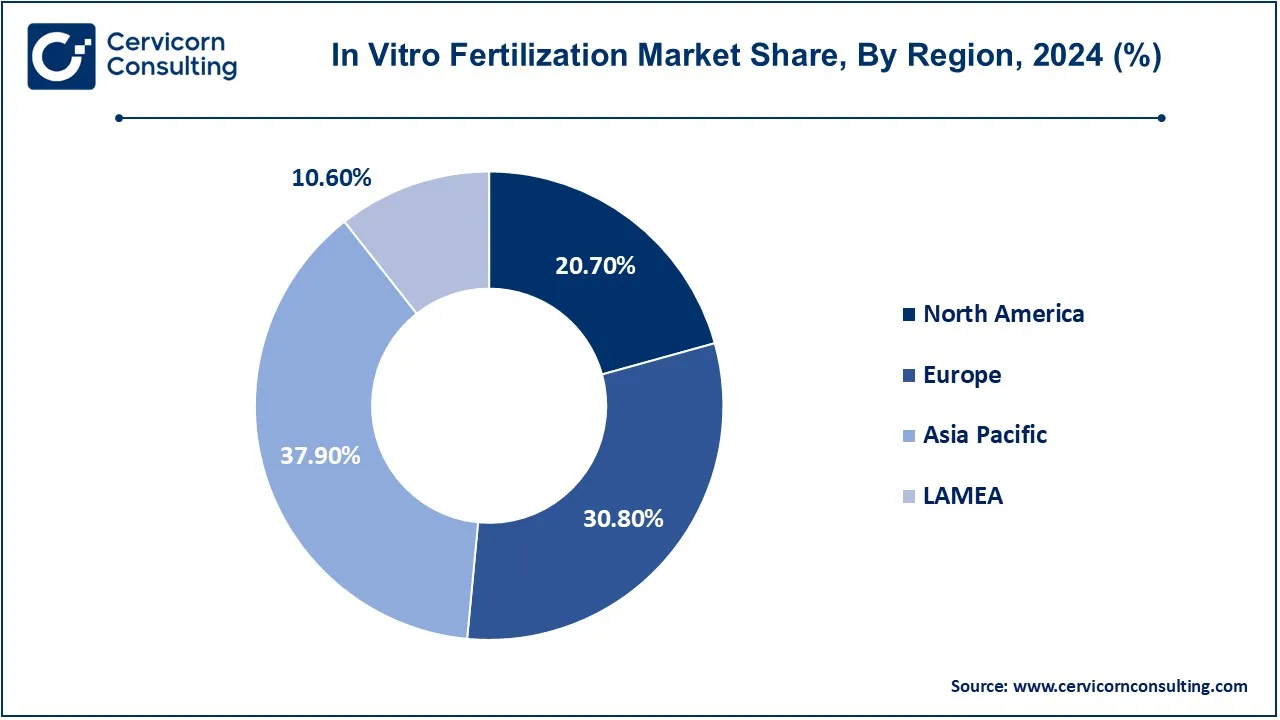

The in vitro fertilization market is segmented into type, instrument, procedure, end user, and region. Based on type, the market is classified into conventional IVF, IVF with ICSI, IVF with donor eggs, mini in vitro fertilization and others. Based on instrument, the market is classified into disposable devices, culture media and equipment. Based on procedure, the market is classified into fresh donor, fresh non-donor, frozen donor, frozen non-donor. Based on end user, the market is classified into hospitals and surgical centres, fertility clinics & IVF centres, research institute and cryobanks. Based on region, the market is classified into North America, Europe, Asia-Pacific, and LAMEA.

Conventional IVF: The success rate of conventional IVF is generally higher than that of other IVF techniques. The reason for this is that conventional IVF improves the probability of fertilization and embryo development by stimulating the ovaries to produce multiple eggs. Conventional IVF is a flexible option that can be used to treat a range of fertility issues, such as male and female infertility, tubal blockages, and unexplained infertility. Conventional IVF is a well-established and extensively studied procedure with decades of clinical experience, making it a trusted and reliable option for many fertility specialists and patients. These factors contribute to the growth of the segment.

IVF with ICSI: ICSI is a special form of in vitro fertilization (IVF) that is mainly used to treat severe cases of male infertility. IVF with ICSI uses special micromanipulation tools and equipment, as well as inverted microscopes, which allow embryologists to select and pick up individual sperm in a specially designed ICSI needle. Although the ICSI procedure has a success rate, it also carries some risks. An egg fertilized in this way may not develop into a viable embryo. Success rates of IVF with ICSI vary depending on the specifics of the individual case, the ICSI technique used, the skills of the person performing the procedure, the overall quality of the laboratory, the quality of the eggs, and the embryo transfer skills of the doctor specializing in infertility. Approximately 60% of IVF procedures today are performed using the ICSI technique, with success rates ranging from about 50% to 80%.

IVF with Donor Eggs: IVF using donated eggs is a fertility treatment option when a woman utilizes another woman's donated eggs. This technique is very helpful for people or couples who are having issues with the quality of their eggs, have a diminished ovarian reserve, or have genetic disorders that they do not wish to pass on to their offspring. When comparing IVF using donor eggs to IVF using the patient's eggs, the overall odds of achieving a clinical pregnancy are between 50 and 75 percent. It is 41% for those between the ages of 18 and 34 and 6% for those between the ages of 43 and 50.

Fresh Donors: The use of fresh donor eggs allows the eggs to be fertilized while they are still fresh. In this case, the egg donor can be selected from the patient's infertility program or an egg donation agency. A 2020 study analyzed 36,925 IVF cycles and found that fresh eggs have a better success rate of 47.7% live births.

Fresh Non-Donors: High success rate, higher birth rates as compared to frozen embryos, easy implantation, and fresh embryo transfer lead to better outcomes. The higher adoption of fresh non-donor cycles coupled with the rising infertility rates across the globe is the major driver of this segment. The increasing popularity of this cycle is expected to maintain its dominance throughout the forecast period.

In Vitro Fertilization Market Revenue Share, By Procedure, 2024 (%)

| Procedure | Revenue Share, 2024 (%) |

| Fresh Donor | 6.90% |

| Fresh Non-Donor | 42.40% |

| Frozen Donor | 19% |

| Frozen Non-Donor | 31.70% |

Frozen Donors: With the advancements in egg freezing, the use of frozen donor eggs has become a popular alternative to fresh eggs. Like fresh egg donors, frozen egg donors are screened stimulated, and monitored in an IVF program. Their eggs are retrieved and immediately frozen. Frozen eggs are sold in batches of 6 or 10, but that is likely not the number of eggs that will be used at the end of the treatment. Frozen eggs must survive the thawing process, and unfortunately, not all of them do. Frozen eggs are more economical in terms of time.

Frozen Non-Donor: Certain factors that contribute to a high percentage are the cost-effectiveness compared to fresh non-donor and the less invasive nature of the procedure. The frozen non-donor cycle is more convenient for both patients and endocrinologists. Additionally, this cycle places less strain on the physical and mental health of women, which further drives the growth of this segment in the coming years.

Fertility Clinics: Fertility clinics segment has dominated the market with highest revenue share in 2024. Fertility clinics are the first choice for couples when it comes to diagnosing fertility issues. Fertility clinics are specialized clinics that provide special care services related to pregnancy and fertility issues to couples and individuals. The increasing number of fertility clinics, increasing awareness about fertility clinics, and declining fertility rates are the major factors that have promoted the growth of the fertility clinic segment globally.

Hospitals: The hospitals segment is anticipated to experience a substantial CAGR throughout the forecast period. Widespread proliferation of hospitals, development of healthcare infrastructure in developing countries, 24/7 presence of healthcare professionals and availability of modern surgical instruments and equipment in hospitals are the major factors driving the demand for hospital services.

The Asia-Pacific in vitro fertilization market size was accounted for USD 9.50 billion in 2024 and is predicted to surpass around USD 16.59 billion by 2034. The market in Asia Pacific is expected to grow due to increasing awareness of infertility and the rise in medical tourism in this region. The presence of a broad population base and the promotion of medical administration are catalysts that are driving the growth of the in vitro fertilization market in China. In addition, the region is witnessing an increase in the number of registered fertility clinics, which is expected to lead to greater adoption of IVF treatments during the forecast period. For example, according to the Fertility Society of Australia, there were around 120 registered clinics in Australia in 2018, of which almost 98.0% offered IVF services. Cultural factors such as societal pressure to conceive and humiliation associated with infertility drive couples to seek IVF treatments in Japan. The technological innovations and high standard of medical infrastructure reinforce Japan's position as a frontrunner in the in vitro fertilization market in the Asia Pacific region.

The North America in vitro fertilization market size was valued at USD 5.19 billion in 2024 and is expected to reach around USD 9.06 billion by 2034. North America is also expected to witness an increase in demand for fertility treatments in the coming years. Lifestyle changes including inadequate nutrition, stress, increasing obesity, improper eating habits, increasing pollution, lack of exercise, and the prevalence of diseases such as diabetes have led to a higher incidence of infertility in the region. The in vitro fertilization market in Canada is characterized by an increased focus on completeness and accessibility, attempting to redress the imbalance in options for fertility therapies. The geographical differences in medical administration and ease of use are impediments to the in vitro fertilization distribution chain in Canada. The growth can be attributed to several factors such as standardization of procedures through regulatory reforms, automation, government promotion of egg/sperm storage, and introduction of more IVF treatments by industry players.

The Europe in vitro fertilization market size was estimated at USD 7.72 billion in 2024 and is projected to hit around USD 13.48 billion by 2034. There is a noticeable increase in medical tourism in Europe, with more Americans choosing to travel to the Czech Republic to receive lower-cost IVF treatments. Additionally, individuals who cannot afford to travel abroad are now seeking IVF treatments in the United States at about a third of the cost charged by clinics in the country. In July 2022, Fairtility received approval from the European Union to use AI for embryo evaluation. The new EU regulatory standards for medical devices have enabled the development of a commercially available AI tool that has the potential to increase the success rate of IVF procedures.

The LAMEA in IVF market was valued at USD 2.66 billion in 2024 and is expected to reach around USD 4.64 billion by 2034. The developing healthcare infrastructure, which subsequently boosts medical tourism in these regions for infertility treatment, is driving market growth in the LAMEA region. In Latin America, individual services participate voluntarily and report cycles start until termination, delivery, or miscarriage. Infertility is a universal problem with the highest prevalence in low-resource countries, particularly in sub-Saharan Africa, where infection-related fallopian tube damage is the most common cause. It is estimated that more than 180 million couples in developing countries suffer from primary or secondary infertility. In most African countries, the social stigma of childlessness still leads to isolation and abandonment. Infertility is a global problem with the highest prevalence in poor countries, particularly in sub-Saharan Africa, where infection-related fallopian tube damage is the most common cause. It is estimated that more than 180 million couples in developing countries suffer from primary or secondary infertility. In most African countries, the social stigma of childlessness still leads to isolation and neglect.

Monash IVF, Boston IVF, and Pelargos IVF are some of the leading market players in the in vitro fertilization industry. The main factor contributing to these companies' success in the international market is the comprehensive care that their highly skilled physicians and nurses provide along with IVF and ICSI treatments. In June 2023, Progyny, Inc. and Quantum Health, Inc. combined their efforts to launch Quantum Health's Comprehensive Care treatment platform for family formation and reproductive treatments. In May 2023, WuXiAppTec expanded its toxicology testing capabilities with in vitro procedures. This expansion includes new tests as well as a new service for customized IVAs. On the other hand, companies like Bloom IVF Centre and Bangkok IVF Center focus on offering IVF treatments at a comparatively low price, which subsequently boosts medical tourism in their clinics. Other treatment providers in the IVF market include Ovation Fertility, CMRE, Shady Grove Fertility, and Group Ambroise Paré Clinic.

CEO Statements

Christy Prada, CEO of Future Fertility

Dr. Kshitiz Murdia, CEO & Co-Founder of Indira IVF

Key players in the IVF market are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the IVF market include:

These advancements mark a notable expansion in the IVF market, driven by strategic acquisitions and innovative projects. The focus is boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Instrument

By Procedure

By End User

By Region