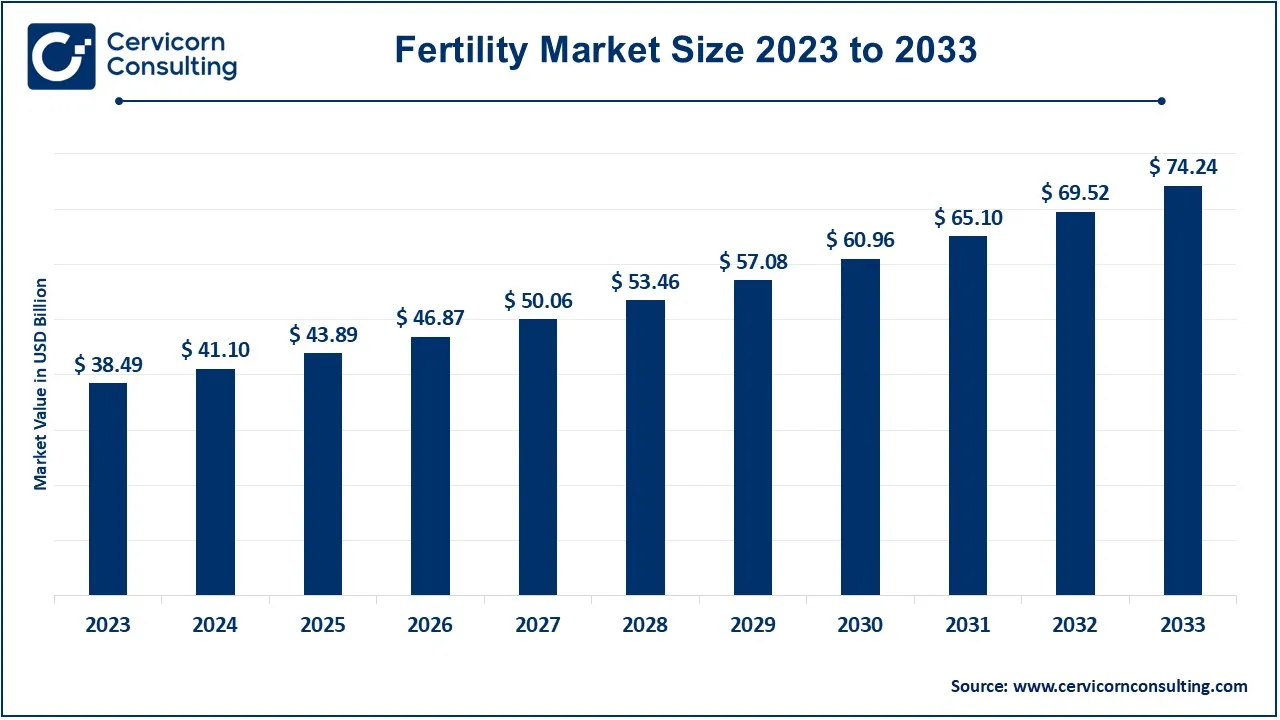

The global fertility market size was valued at USD 41.10 billion in 2024 and is expected to be worth around USD 74.24 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.78% from 2024 to 2033.

The fertility market has been experiencing steady growth in recent years, driven by various factors such as rising awareness about infertility treatments, advancements in assisted reproductive technologies (ART), and the increasing prevalence of delayed parenthood. The rising number of individuals and couples seeking fertility assistance, especially in developed countries, has contributed to the market's expansion. Fertility clinics, genetic testing services, egg freezing technologies, and fertility drugs have become more widely available, fueling the industry's growth. Additionally, societal changes, such as a shift in family planning practices, also contribute to the growing demand for fertility services. The market is projected to continue expanding due to factors like advancements in biotechnology, increasing investments in research and development, and the growing acceptance of fertility treatments. In June 2022, AIVF, an Israeli healthtech startup specializing in AI-driven in-vitro fertilization (IVF) solutions, raised USD 25 million in Series A funding led by Insight Partners, with participation from Adam Neumann's Family Office.

Fertility refers to the ability of an individual or a population to reproduce. In biological terms, it refers to the capacity to conceive and give birth to offspring. Fertility is often measured by the number of children born to a woman during her lifetime, but it can also be looked at from a broader societal level, considering birth rates and reproductive health. Factors influencing fertility include genetics, age, health, lifestyle, environmental conditions, and access to healthcare. Issues like infertility, which can be caused by various medical conditions, lifestyle choices, and age-related factors, have led to the growing demand for fertility treatments. Technologies such as In Vitro Fertilization (IVF) and other assisted reproductive technologies (ART) have provided new opportunities for individuals struggling with fertility challenges. Fertility is an important part of human biology, and its study is crucial for understanding population dynamics, public health, and societal growth.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 43.89 Billion |

| Estimated Market Size (2033) | USD 74.24 Billion |

| Growth Rate (2024 to 2033) | 6.78% |

| High-impact Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Type, Offering, End User, Region |

| Key Companies | Boston IVF Fertility Clinic, INVO Bioscience, San Diego Fertility Center, Celmatix, FUJIFILM IRVINE SCIENTIFIC, Thermo Fisher Scientific, AB Scientific Ltd., Rocket Medical PLC, Vitrolife, Merck KGaA (EMD Serono Inc.), IVFtech APS, Hamilton Thorne Ltd., Esco Micro Pte Ltd., Genea Biomedx Ltd., Carolinas Fertility Institute, progyny Inc., Cook Medical, LifeGlobal Group (Cooper Surgical), Oxford Gene Technology (Sysmex Corporation), King’s Fertility Limited, Monash IVF Group |

Increased Use of Non-Invasive Prenatal Tests

Growing Adoption of Holistic and Integrative Approaches

High Costs of the Procedures

Regulatory Compliance

Growing Robotic-Assisted Reproductive Surgery

Rising Epigenetic Modifications

Treating Poor Responders

Limited Success Rate

The fertility market is segmented into type, offering, end-users and region. Based on type, the market is classified into male fertility, and female fertility. Based on offering, the market is classified into assisted reproductive technology (ART), and fertility drugs. Based on end-users, the market is classified into fertility clinics, hospitals, and clinical research institutes.

Male Fertility: Inadequate physical activity and nutrition are among some of the many factors that are affecting male fertility. In cases where there is a low sperm count or issues related to motility, treatments like intracytoplasmic sperm injection (ICSI) are considered worldwide. Owing to the high success rate, provided by the ICSI procedure—which involves directly injecting sperm into an oocyte or egg—is growing in popularity among patients. Infections or hormonal imbalances are two of the specific causes of male infertility that can be treated with a variety of drugs and hormone therapies. These treatments are also considered to be effective solutions for male infertility.

Female Fertility: Medical conditions such as polycystic ovary syndrome (PCOS), endometrial tuberculosis, and sexually transmitted diseases (STDs) are some of the reasons leading to infertility in females. In addition, to the above medical conditions deterioration of egg quality in women because of delayed pregnancy also contributes to the rise in female infertility rates. The average age at which women and men get married and have their first child has increased. This trend is now clearly pronounced as more people are pursuing higher education and are career-oriented.

ART: The assisted reproductive technologies (ART) segment has captured largest revenue share of 86.76% in 2023. For several reasons, assisted reproductive technologies (ART) are leading the fertility industry. IVF with intracytoplasmic sperm injection (IVF with ICSI), intrauterine insemination (IUI), and IVF without intracytoplasmic sperm injection (IVF without ICSI) are some of the few ART methods used for treating infertility. The success rates of ART procedures have grown as a result of growing technological advancements, particularly in the field of IVF. A rise in the adoption and acceptance of ART as a way to get pregnant in the infertile population further contributes to its dominance. Both developing and developed nations have a growing number of reproductive clinics and facilities that are offering these cutting-edge services. All these factors make ART the largest procedure segment of the infertility treatment market and this is likely to continue in the future.

Fertility Drugs: In 2023, the fertility drugs segment has accounted 13.24% of the total revenue share. Fertility drugs are expected to contribute positively to the market and the availability of various products to treat these conditions. The procedure of in vitro fertilization (IVF) involves fertilizing an egg outside of the body, and this procedure is becoming very common and is thus predicted to propel market expansion. Further, innovative medications are being introduced by market players for treating infertility. Currently, Oxolife (OXO-001), a first-in-class product candidate aims to improve embryo attachment to the uterine lining by promoting a stronger binding. In addition, the American biopharmaceutical business Ferring Pharmaceuticals unveiled a drug Trisequens, which is a novel medication prescribed for female infertility.

Fertility Clinics: The fertility clinics segment has held dominating postion in 2023, accounted for 73.81%. Fertility clinics offer a wide range of treatments such as IVF, ICSI, egg and sperm donation, fertility preservation, and genetic testing. Their ability to provide a full spectrum of services under one roof makes them the first choice for patients. Fertility clinics are providing individualized treatment plans to meet the unique needs of each patient which in turn maximizes patient satisfaction. These clinics have specialized reproductive medicine professionals on their list of staff, consisting of fertility counselors, embryologists, and genetic specialists, who guarantee high-quality care. To perform all the complex procedures fertility clinics are well-equipped with state-of-the-art technology and laboratories.

Hospitals: The hospital segment has captured revenue share of 18.29% in 2023. Hospitals provide a wide range of medical services, which also include reproductive health care. Family planning, obstetric and gynecological care, and prenatal care are among the few services that are included in the category of reproductive care. Additionally, hospitals offer a wide range of medical services to meet different healthcare needs. However, the scope of reproductive services in hospitals varies by facility.

Clinical Research Institutes: The clinical research institutes segment has captured revenue share of 7.90% in 2023. Clinical research institutes play a major role in the commitment to innovation in infertility treatment. The goal of research institutes is to advance fertility treatment through groundbreaking research. Success is based on practicing and developing medicine of the highest quality and rigorous evidence base by conducting fertility research and collaborating with other leading institutions in the field of reproductive medicine.

The North America fertility market size was estimated at USD 21.14 billion in 2023 and is expected to reach around USD 40.78 billion by 2033. The infertility treatment market is being further stimulated by the increasing number of fertility clinics in the United States. The establishment of these facilities throughout the nation is a direct result of the growing awareness of infertility issues among a significant number of individuals and couples, which has resulted in a demand for treatment services that are specifically designed to address this issue.

The expansion of fertility clinics is facilitating the process of seeking assistance and enhancing access to treatment for patients. The success rates of these clinics are increasing as a result of the advancements in medical practices and technology. Consequently, a growing number of patients are seeking treatment. Increasing fertility clinics and a rise in the number of people who are seeking reproductive services in the area are two main indicators of shifting social norms.

The Europe fertility market size was reached at USD 7.57 billion in 2023 and is projected to surpass around USD 14.60 billion by 2033. In Europe, the demand for fertility treatments has increased drastically in recent years. Many factors, that include rising infertility rates, delaying parenthood, and shifting lifestyle preferences, are adding up to this trend. The laws regarding fertility treatment differ throughout Europe. Certain countries have more lenient legislation, facilitating a wider array of reproductive services, whereas others enforce some stringent regulations.

Advanced reproductive therapy (ART) and basic fertility examinations are two of the many services provided by the many fertility clinics in Europe. In most cases, these clinics provide specialized care and support to individuals or couples in need of reproductive therapy. Due to differences in laws & regulations and costs among European nations, few individuals opt for cross-border reproductive treatment, requiring travel to another country for reproductive care.

The Asia-Pacific fertility market size was worth USD 6.10 billion in 2023 and is predicted to hit around USD 11.76 billion by 2033. The demand for fertility treatment has increased as a result of lifestyle changes, delayed reproduction, and an increase in infertility cases. Advances in assisted reproductive technologies (ART), such as intracytoplasmic sperm injection (ICSI), preimplantation genetic diagnosis (PGT), and in vitro fertilization (IVF), have increased the availability and efficacy of fertility treatments. People can now afford fertility treatments more easily owing to financial aid or subsidies from various governments in the Asia-Pacific.

The de-stigmatization of infertility and high knowledge related to reproductivity and available treatments have further led to an increase in the number of people seeking assistance. ART laws are still being updated in many countries in the Asia Pacific to improve their inclusivity and accessibility to a larger group of individuals.

The LAMEA fertility market was valued at USD 3.68 billion in 2023 and is anticipated to reach around USD 7.10 billion by 2033. Rising population suffering from infertility, low-cost healthcare facilities, and rising disposable income all contribute to market growth. Furthermore, the market is expected to profit from the introduction of new and more permissive rules that allow single people and LGBTQ+ couples to receive fertility treatments. Private clinics accounted for about 90.1% of all services provided in Brazil, according to the National Library of Medicine, making them a major provider in the Brazilian market. Due to the scarcity of insurance and funding options, access to these treatments is typically conditioned upon an individual's financial circumstances.

However, due to rising healthcare costs, research, and technological advancements, the Middle East's market expansion offers new growth opportunities. Additionally, advancements in ART, amplified public awareness regarding infertility treatments, and a rise in the number of IVF clinics are said to promote the growth of fertility services.

The South African market is witnessing growth; however, it remains constrained and challenging to access for a significant segment of the population due to high costs and limited availability, particularly in the public sector. Improving access to affordable fertility services could effectively meet unmet needs.

The global market is highly competitive and includes various SMEs and large companies including Autodesk, Siemens, Rockwell Automation, and ABB Group. Agreements, acquisitions, mergers, and contracts are some of the key strategies adopted by these companies. Moreover, the companies give great importance to using cutting-edge technologies in software for smart manufacturing applications. In June 2022, Mankind Pharma developed and launched a generic version of Dydrogestrone tablets for the treatment of pregnancy-related complications in patients in India. This drug was an equivalent version of Abbott Duphaston tablets.

CEO Statements

Dr. Somesh Mittal, CEO of ART Fertility Clinics

" India needs global standard assisted reproduction and ART Fertility Clinics brings the right kind of expertise and advancement to it. They adhere to the highest clinical practice standards and patient care protocols that match the best in class from the world while maintaining the highest ethical standards. The highly qualified doctors, with international peer-reviewed original research papers in their names, are known for their professional excellence in patient care."

Tammy Sun, CEO and Co-founder, Carrot

"Fertility care is complex, and patients are often left on their own to make care decisions based on limited knowledge, this lack of education can lead to unnecessary treatments, worsening the patient experience without improving outcomes."

Key players in the fertility market are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the fertility industry include:

These advancements mark a notable expansion in the fertility market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Offering

By End-Users

By Region