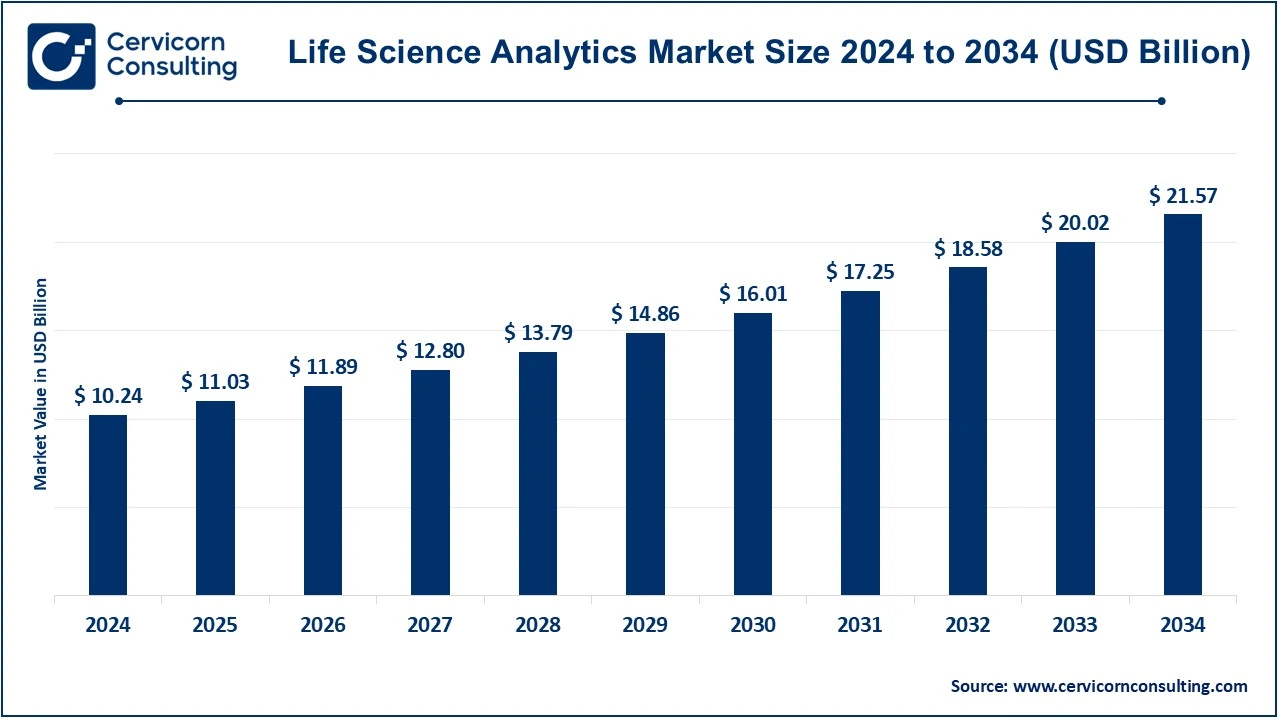

The global life science analytics market size was estimated at USD 10.24 billion in 2024 and is projected to surpass around USD 21.57 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 7.73% over the forecast period 2025 to 2034.

The life science analytics market is a growing sector dealing with data tailor-made for analysis tools and techniques to create better decisions in the life sciences industry. The key areas dealt with under this sector include drug discovery, clinical trials, patient outcomes analysis, and market research for pharmaceuticals, biotechnology, and medical devices. Increase in use and adoption of data-driven approach decisions to bring improvement in the efficiency of operations, personalized medicine, and real-time insights into regulatory compliance and risk management are the major drivers that propel the market.

The emergence of artificial intelligence (AI), machine learning, and big data analytics has provided delivery of even better predictions on specific health care services with more optimized solutions. Precision and cost-effectiveness in the life science analytics market, like everywhere else across health systems worldwide, resulted in broader and broader scopes for future opportunities for both established players and new entrants to innovate on healthcare data management and analysis.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 10.24 Billion |

| Expected Market Size in 2034 | USD 21.57 Billion |

| Projected CAGR 2025 to 2034 | 7.73% |

| Dominant Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Component, Type, Application, Delivery, End User, Region |

| Key Companies | Accenture, Cognizant, IBM, IQVIA, Oracle, SAS Institute Inc., Take Solutions Limited, Wipro Limited, Allscripts Healthcare Solutions, Inc., Cerner Corporation, Microsoft Corporation, Pyramid Analytics |

Increasing Global Healthcare Expenditures

Growth of Biotech and Pharmaceuticals Industry

High Implementation and Maintenance Costs

Data Privacy and Security Concerns

Rising Popularity of Cloud-Based Analytics Solution

Increasing Focus on Data Security and Privacy

Excessive Costs for Research and Development

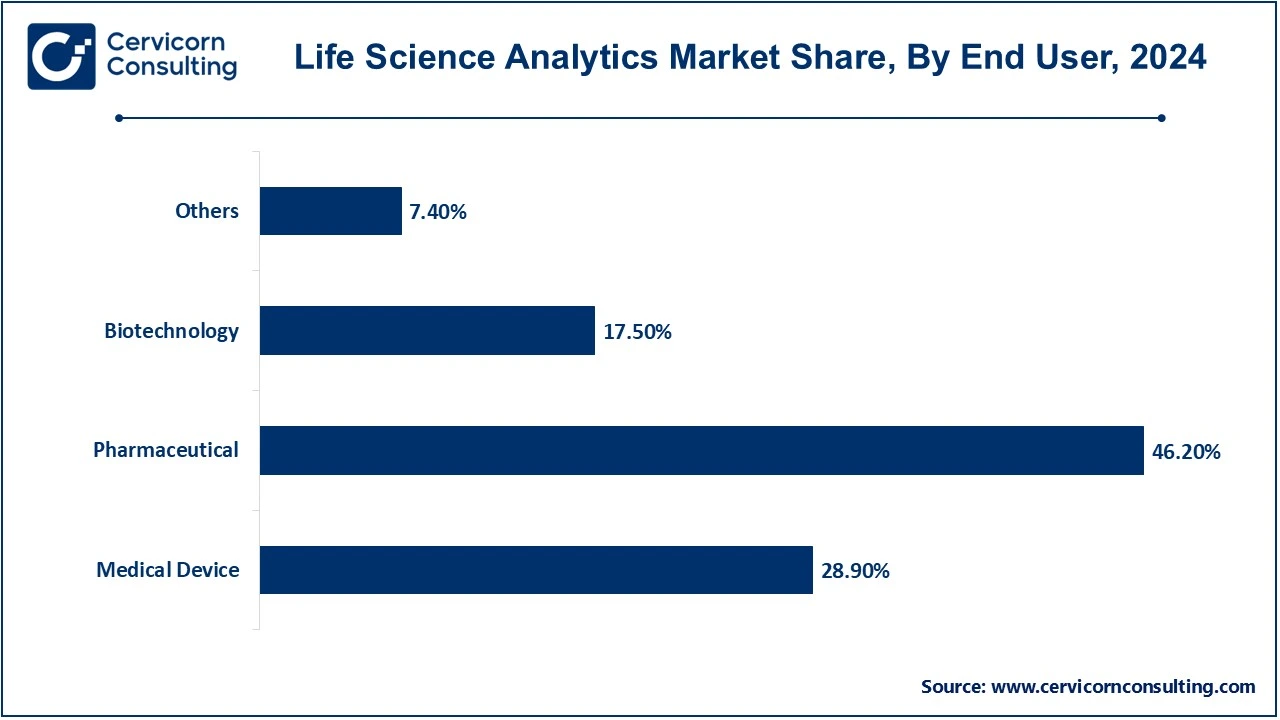

Potential Threats to the Environment

The life science analytics market is segmented into component, type, application, delivery, end user, region. Based on component, the market is classified into services, software. Based on type, the market is classified into reporting, descriptive, prescriptive, predictive. Based on application, the market is classified into research and development, pharmacovigilance, sales and marketing support, supply chain analytics, and regulatory compliance. Based on delivery, the market is classified into on-premises and on-demand. Based on end user, the market is classified into medical device, biotechnology, pharmaceutical, others.

Service: The services segment has dominated the market in 2024. Services and software complement each other in the field of life science analytics. This is because the presence of services is so important for implementation, customization, and optimization of analytics solutions. This can be seen in services such as consulting, system integration, training, and managed service-an effective means for the organization to adapt and adopt analytics tools for their activities.

Life Science Analytics Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Software | 43% |

| Services | 57% |

Software: Construct and furnish firm bases of information for processing, data integration, and analysis via visualization. Such tools are designed to handle vast amounts of structured and unstructured data, particularly data from clinical trials, electronic health records, and real-world evidence.

Descriptive: The descriptive segment has dominated the market in 2024. Descriptive analytics is targeted at summarizing and interpreting historical data in a way that presents insights into what happened in the past. It is an important tool in the life sciences sector that is applied in exploring and analyzing the demographics of patients in terms of treatment. The same way, descriptive analytics would include trends in sales and performance in clinical trials. Beyond recognizing what patterns exist by identifying some form of association between two variables, descriptive analytics can tell organizations about what has happened-a prerequisite before advanced analysis can take place.

Reporting: Reporting involves analytics, presenting well-structured data historically by dashboards, charts, reports, etc. Reporting analytics for life sciences gives a clear view of tired performance indicators (KPIs), clinical trial results, and patient care metrics by suggesting a retrospective view.

Predictive: The predictive analysis is expected to register the highest growth rate over the upcoming years. Predictive analytics use statistical algorithms, machine learning, and data modelling to forecast future events and trends on the basis of past data. The feature most significant among them is drug discovery, patient risk assessment, and clinical trial optimization-these play a critical role in the life sciences. Prescriptive-Actionable recommendation strategies to reach the desired outcome are managed by prescriptive analytics above prediction. Predictions, optimization algorithms, and decision support frameworks are then used, so pharmaceutical companies can steer through major trouble and get the job done. For instance, prescriptive analytics can suggest what trial design should be used to maximize the success rates of a given drug.

Sales and Marketing Support: The sale and marketing support segment has dominated the market in 2024. The sale and marketing offers the actionable insights about consumer behavior, market trends and competitive landscape. The companies can prepare the targeted marketing strategies and allocate the resources effectively by analyzing the prescription patterns, patient demographics and the healthcare data.

Research & Development: The research and development is expected to hit rapid growth over the forecast period. Life science analytics transformation of research and development into fully-data driven innovations in new drug discovery, clinical trials, and product development. The advanced analytics tools process really large amounts of data, such as genomic information and preclinical studies, for the identification of promising drug candidates and for the optimization of trial designs.

Regulatory Compliance: This is because the industry, as thoroughly as possible, leaves the patient treated under stringent guidelines. By developing analytical tools, firms can identify regulatory requirements, documentation management systems, and compliance tracking.

Supply Chain Analytics: It is the core of optimising operations, productivity, and cost-effective products in the life - sciences space, where it forms part of an organisation's plan for stock management or material management. Analytics can give information real time for an understanding of the processes of supply chains so that the business can predict demand, assess levels of inventory, and manage disruptions.

Pharmacovigilance: It includes monitoring, detecting, and preventing adverse effects associated to the drugs and medical products along with analytics has an important role in improving the process. The life science analytics tools analyze the data from the clinical trials, electronic health records, and post-market surveillance for identifying the safety signals and assess drug risks.

On-demand: It is yet another technology that provides flexibility and cost efficiency wherein its users could avail of flexible solutions. In particular, this kind of services delivered by life science analytics is cloud-based or on-demand delivery. And since accessing analytical tools and platforms through such mean would become available over the internet, this would cost organizations less upfront than investing heavily on infrastructure.

Life Science Analytics Market Revenue Share, By Delivery, 2024 (%)

| Delivery | Revenue Share, 2024 (%) |

| On-demand | 50.80% |

| On-premises | 49.20% |

On-Premises Delivery: On-premises refers to the application of life science analytics tools over the internal infrastructure of the organization-rendering the most control over the data and workings of the systems. It is primarily opted by institutions and organizations with strict data security and privacy policies such as managing sensitive patient or clinical trial data.

Medical Device: The medical device industry to improve product development, regulatory compliance, and market performance. Analytics tools help manufacturers by enabling them to evaluate real-time data regarding device use, clinical trials, and patient feedback, with the intention of further improving the safety and efficacy of their devices.

Pharmaceutical: The pharmaceutical industry uses it to reduce the time taken to discover drugs, optimize clinical trials, and improve market access strategies. Advanced analytics tools enable them to process enormous volumes of data, including genomic information, trial results, and real-world evidence, in their search for promising drug candidates, as well as to make predictions about the likelihood of successful treatment outcomes.

Biotechnology: The biotechnology companies uses the analytics from the life sciences for the innovations in the field of drug development, gene therapy, and biomanufacturing. The analytic tools can analyze the large data such as genomic and proteomic data to gain invaluable insight for the breakthroughs in the personalized medicine and regenerative therapies.

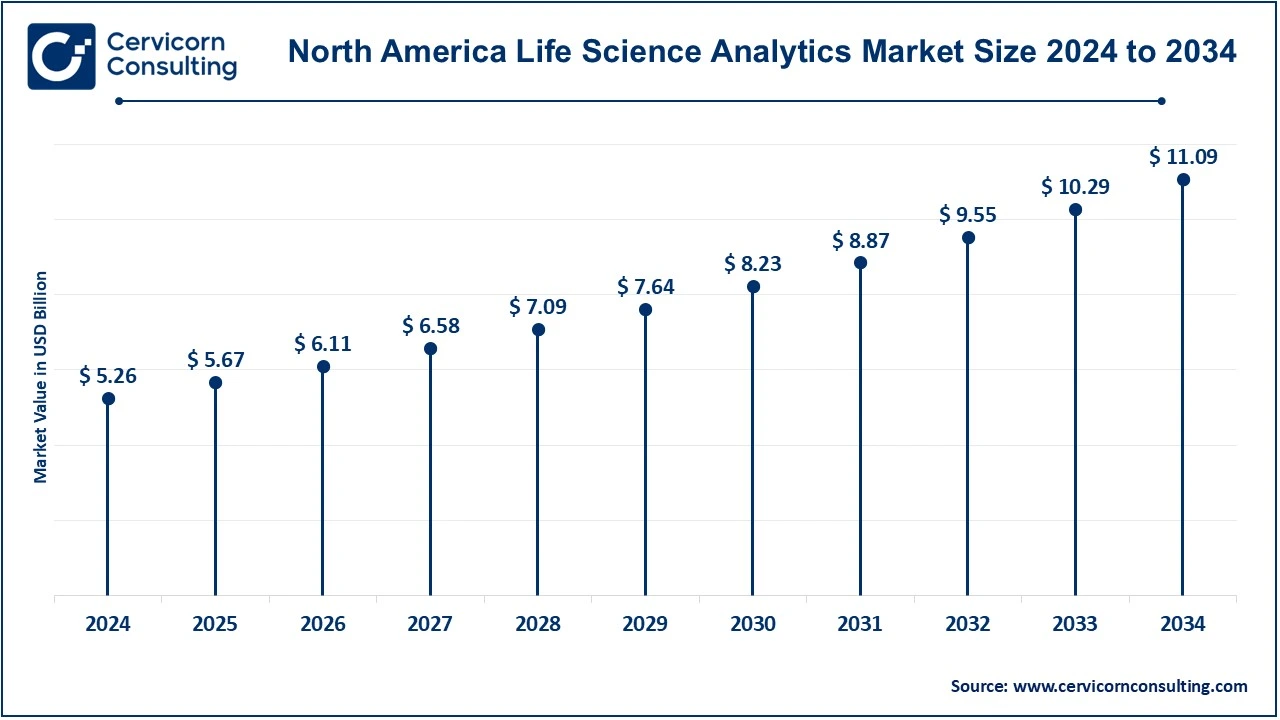

The life science analytics market segmentation is based on geography, which includes regions like North America, Europe, Asia Pacific, and LAMEA. Here's a brief overview of these regions:

The North America life science analytics market size was estimated at USD 5.264 billion in 2024 and is projected to surpass around USD 11.09 billion by 2034. Mostly innovations occurring at North America in life sciences analytics, as health delivery is most highly advanced, heavy investments are visible across the board in research and development projects, and quick roll-out of new-age technology is everywhere. Home to some of the biggest pharmaceutical, biotechnology, and medical devices firms in the world, North America intensifies the demand for analytics solutions in the direction of operational efficiency and swifter development of drugs. The U.S. life science analytics market size was valued at USD 4.21 billion in 2024 and is expected to hit around USD 8.87 billion by 2034.

The Europe life science analytics market size was estimated at USD 2.55 billion in 2024 and is expected to hit around USD 5.37 billion by 2034. Europe commands a substantial chunk of the life science analytics market, where one finds a very strong regulated framework-oriented clinical care facilities and an active attention towards healthcare innovations with policies mainly focused on personalized medicines. The region thus harbours many pharmaceutical giants and biotechnological start-ups that barely depend on R&D and help towards streamlining clinical trials, but also benefit from analytics.

The Asia-Pacific life science analytics market size was estimated at USD 1.76 billion in 2024 and is predicted to hit around USD 3.71 billion by 2034. Rapid growth in the Asia Pacific is propelled by the development of healthcare infrastructure, an increase in research and development funding, and the furtherance of digital health technologies. Critical countries are China, India, and Japan, where they are able to acquire larger footprints in patient population scales, low costs for conducting clinical trials, and government incentives in digitization of health.

Life Science Analytics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 51.40% |

| Europe | 24.90% |

| Asia Pacific | 17.20% |

| LAMEA | 6.50% |

The LAMEA life science analytics market size was valued at USD 0.67 billion in 2024 and is anticipated to reach around USD 1.40 billion by 2034. This part of the world dubbed LAMEA (Latin America, Middle East, and Africa) is now at the edge of becoming a significant market in life science analytics because of growing investments in health, increasing Latin American pharmaceutical activities, and the embracement of digital health technologies. Countries like Brazil and Mexico are topping the list due to improving access to healthcare services and government programs aimed at modernizing medical infrastructure.

New players in life science analytics market leverage both innovation and agility to stir competition within the vertical. The new upcoming companies target areas such as AI-powered predictive analytics, real-world evidence generation, and advanced data visualization tools meant for the life sciences vertical. Emerging startups are cloud and Software-as-a-Service (SaaS) levelled, to offer cheap and scalable analytics capabilities to the mass of smaller biotech companies and research organizations. A number of such companies also develop capabilities in unifying the unstructured data drawn from different sources, including genomics, wearable devices, and patient-generated health data for summary insights. New companies often form strategic alliances with well-established life science organizations, relevant research entities, and technology providers to accelerate innovation and market entry for their products as well.

CEO statements

Bob Farrell, CEO mPulse

Market Segmentation

By Component

By Type

By Application

By Delivery

By End User

By Region