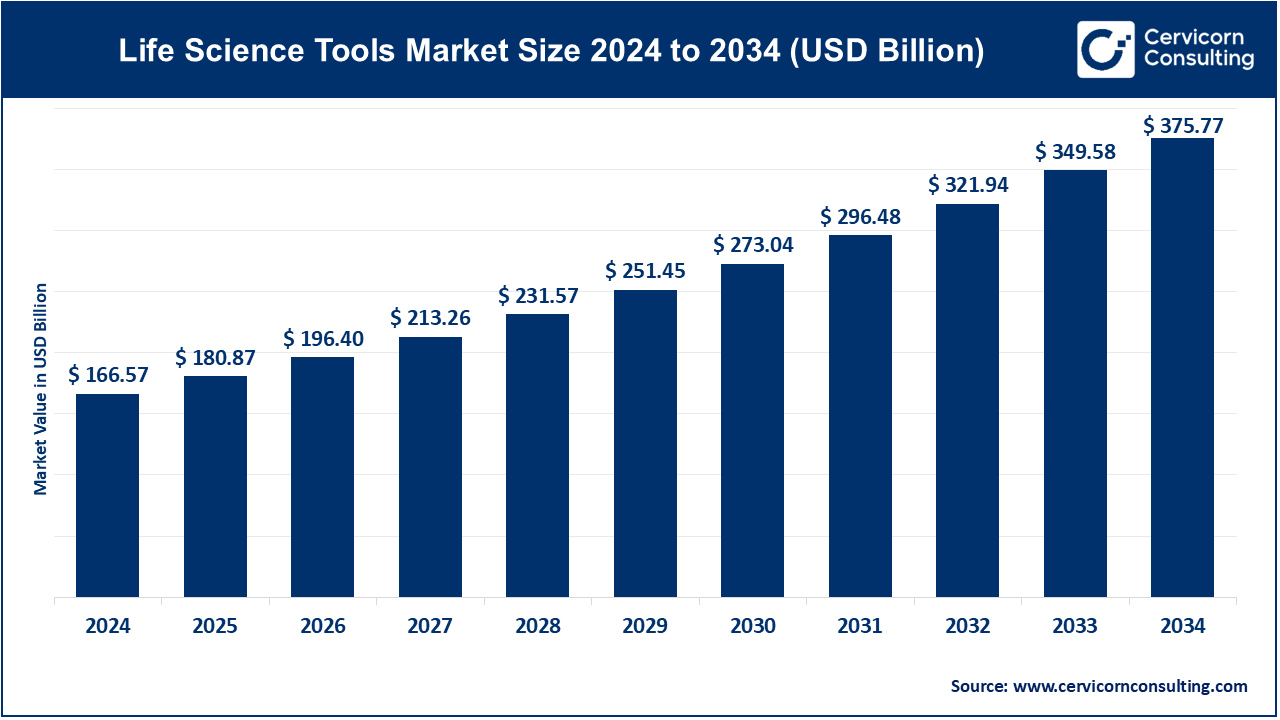

The global life science tools market size was worth USD 166.57 billion in 2024 and is estimated to reach around USD 375.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.48% from 2025 to 2034.

The life science tools market has been witnessing significant growth, fueled by rising healthcare demands, advancements in biotechnology, and an increasing focus on personalized medicine. The global market for life science tools is projected to expand at a healthy compound annual growth rate (CAGR), driven by increasing government investments in healthcare infrastructure, the rise in chronic diseases, and the need for early diagnostics. Furthermore, innovations in genomics, such as next-generation sequencing, have driven demand for advanced life science instruments, propelling market growth. The integration of artificial intelligence (AI) and machine learning (ML) technologies is also expected to further enhance the capabilities and efficiency of life science tools, supporting the development of novel therapies and diagnostics. Moreover, emerging markets in Asia-Pacific and Latin America are contributing to the expansion of the global life science tools market as researchers and healthcare providers in these regions adopt advanced technologies.

Life science tools refer to a range of instruments, reagents, and equipment that aid in the study, analysis, and manipulation of biological systems. These tools play a vital role in advancing research and innovation across various sectors, including genetics, molecular biology, diagnostics, and drug development. Common examples include PCR machines, centrifuges, microscopes, spectrophotometers, and other analytical instruments used in laboratories and healthcare settings. Life science tools are integral to fields such as genomics, proteomics, cell biology, and microbiology, enabling researchers to conduct experiments, analyze data, and develop new therapies. They are essential in both basic and applied research and are critical for accelerating scientific discoveries.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 180.87 Billion |

| Market Growth Rate | CAGR of 8.48% from 2025 to 2034 |

| Market Size by 2034 | USD 375.77 Billion |

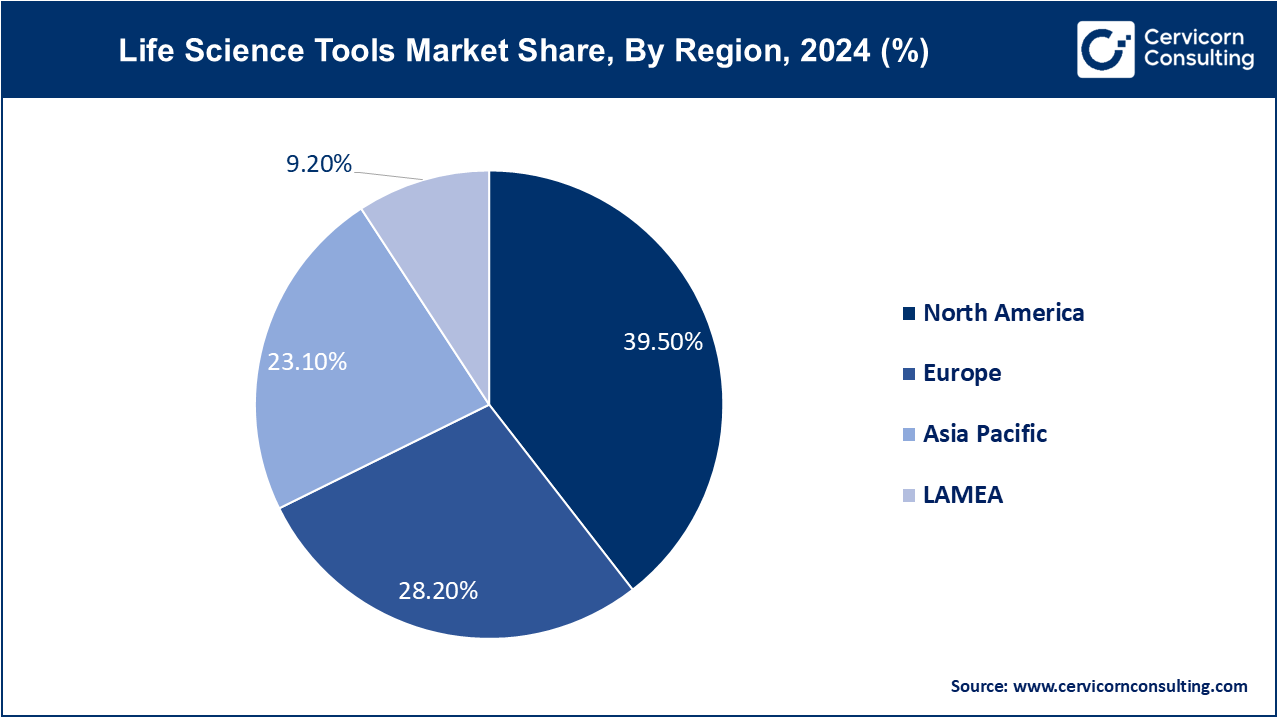

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Technology, Product, End-use and Regions |

Expanding Applications in Agricultural Biotechnology

Aging Population and Chronic Diseases

High Costs of Advanced Technologies

Regulatory and Compliance Challenges

Expansion in Emerging Markets

Advancements in Personalized Medicine

Data Management and Integration

Intellectual Property and Patent Issues

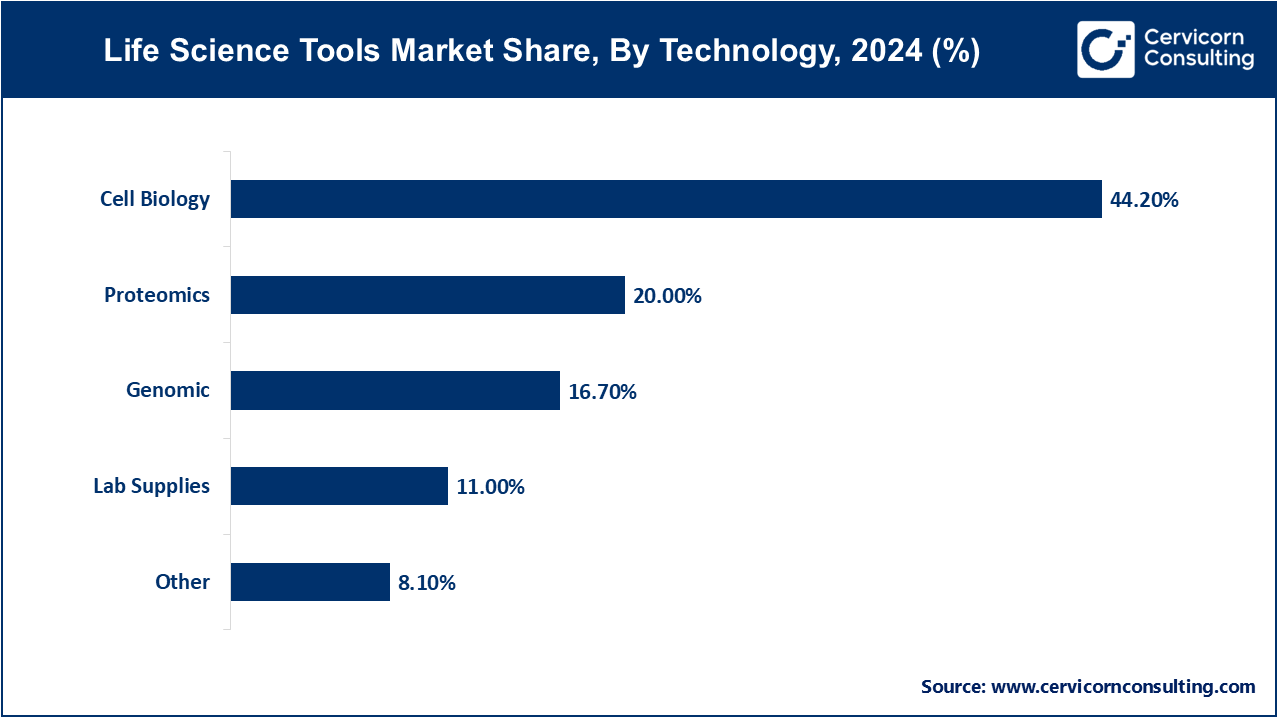

Genomic Technology: Genomic segment has achieved market share of 16.70% in 2024. Genomic technologies in the Life Science Tools market, such as next-generation sequencing (NGS) and microarray analysis, are pivotal for studying genetic variations, gene expression, and genome structure. Trends include the adoption of single-cell sequencing for heterogeneous cell populations and the integration of NGS with bioinformatics for comprehensive genomic analysis. Drivers include decreasing costs of sequencing, advancements in bioinformatics algorithms for data interpretation, and the growing applications in personalized medicine, agriculture, and environmental studies.

Proteomics Technology: In 2024 proteomics technology segment has reported market share of 20%. Proteomics technologies focus on the study of proteins, crucial for understanding biological functions, disease mechanisms, and drug responses. Trends include the adoption of mass spectrometry for high-throughput protein profiling and the development of protein microarrays for multiplexed biomarker discovery. Drivers include advancements in mass spectrometry sensitivity and resolution, innovations in protein labeling and quantification techniques, and the increasing demand for precision medicine and biomarker-driven diagnostics.

Cell Biology Technology: Cell biology technology segment has acquired highest market share of 44.20% in 2024. Cell biology technologies encompass cell culture systems, flow cytometry, and cell imaging techniques critical for studying cell behavior and function. Trends include the shift towards 3D cell culture models for better physiological relevance and the integration of live-cell imaging for dynamic cellular analysis. Drivers include advancements in biomaterials for cell culture, automation of cell imaging platforms, and the application in drug discovery, regenerative medicine, and cancer research.

Lab Supplies & Technologies: Lab supplies & technologies segment has exceeded market share of 11% in 2024. Lab supplies and technologies encompass consumables, laboratory equipment, and automation solutions crucial for scientific research and diagnostic laboratories. Trends include the development of connected and automated laboratory systems, enhancing workflow efficiency and data management. Drivers include the global expansion of healthcare infrastructure, adoption of personalized medicine approaches, and the emphasis on sustainability and cost-effectiveness in laboratory operations.

Other Analytical & Sample Preparation Technology: This segment has covered market share of 8.10% in 2024. This segment includes various technologies such as chromatography, spectrophotometry, and sample preparation techniques essential for analyzing biomolecules and isolating analytes. Trends include the development of automated sample preparation systems and miniaturized analytical platforms for point-of-care testing. Drivers include the demand for faster and more accurate analytical methods, advancements in detection technologies, and the integration of multiple analytical techniques for complex sample analysis in clinical diagnostics and environmental monitoring.

Cell Culture Systems & 3D Cell Culture: Cell culture systems and 3D cell culture technologies are pivotal in the Life Science Tools market for studying cellular behavior and responses to drugs. Trends include the increasing adoption of organoid models and bio-printing techniques to create more physiologically relevant models. Drivers include advancements in biomaterials, such as hydrogels and scaffolds, enabling better mimicry of human tissues, and the growing demand for personalized medicine and regenerative therapies.

Liquid Chromatography: Liquid chromatography (LC) plays a crucial role in separating and analyzing biomolecules in life science research, including proteins, peptides, and metabolites. Trends include the adoption of high-resolution LC systems and the integration of LC with mass spectrometry for comprehensive analysis. Drivers include the need for accurate quantification of biomarkers in drug discovery and clinical diagnostics, advancements in column technologies and detection methods, and the expanding applications in metabolomics and proteomics research.

Mass Spectrometry: Mass spectrometry (MS) is essential for identifying and quantifying biomolecules based on their mass-to-charge ratio, crucial for proteomics, metabolomics, and drug metabolism studies. Trends include the development of high-resolution MS systems and the integration of MS with LC for enhanced analytical capabilities. Drivers include improvements in ionization techniques, software for data analysis, and the increasing adoption in clinical laboratories for disease biomarker profiling and therapeutic drug monitoring.

Flow Cytometry: Flow cytometry enables the analysis of cells and particles based on their physical and chemical properties, essential for immunology, cancer research, and hematological studies. Trends include the adoption of multiparametric flow cytometry and the development of imaging flow cytometry for high-content analysis. Drivers include advancements in fluorophore technology, automated sample handling systems, and the expanding applications in cell sorting, cell signaling studies, and infectious disease research.

Cloning & Genome Engineering: Cloning and genome engineering technologies encompass methods for manipulating DNA and producing recombinant proteins in life science research. Trends include the adoption of CRISPR/Cas9 for precise genome editing and the development of synthetic biology tools for therapeutic applications. Drivers include the demand for personalized medicine, advancements in gene delivery technologies, and the application of genome editing in developing disease models and gene therapies.

Microscopy & Electron Microscopy: Microscopy techniques, including light microscopy and electron microscopy, provide detailed visualization of biological structures and processes. Trends include the adoption of super-resolution microscopy for nanoscale imaging and the integration of live-cell imaging techniques for dynamic studies. Drivers include improvements in imaging resolution, automated imaging platforms, and the application of advanced microscopy in neuroscience, pathology, and microbiology research.

Next Generation Sequencing (NGS): NGS technologies enable rapid sequencing of DNA and RNA, revolutionizing genomics and molecular diagnostics. Trends include the adoption of whole genome sequencing and RNA sequencing for comprehensive genomic profiling and transcriptome analysis. Drivers include cost reductions in sequencing, advancements in bioinformatics tools for data analysis, and the expanding applications in oncology, infectious diseases, and rare genetic disorders.

PCR & qPCR: Polymerase chain reaction (PCR) and quantitative PCR (qPCR) are fundamental for amplifying and quantifying nucleic acids in life science research, essential for genetic analysis and pathogen detection. Trends include the development of digital PCR for absolute quantification and the integration of multiplex PCR for simultaneous detection of multiple targets. Drivers include improvements in PCR sensitivity and speed, adoption in clinical diagnostics and environmental monitoring, and the demand for rapid and accurate molecular testing.

Nucleic Acid Preparation: Nucleic acid preparation technologies involve the extraction and purification of DNA and RNA from biological samples for downstream analysis. Trends include the development of automated systems for high-throughput processing and magnetic bead-based purification methods for enhanced purity. Drivers include the need for standardized sample preparation workflows, advancements in extraction chemistries, and the application in genetic testing, infectious disease diagnostics, and forensic sciences.

Nucleic Acid Microarray: Nucleic acid microarrays enable high-throughput analysis of gene expression, mutations, and polymorphisms in life science research. Trends include the adoption of microarray platforms for pharmacogenomics and personalized medicine applications and the development of multiplexed arrays for simultaneous detection of multiple targets. Drivers include advancements in microarray printing technologies, bioinformatics tools for data analysis, and the expanding role in biomarker discovery and disease profiling.

Sanger Sequencing: Sanger sequencing remains valuable for sequencing short DNA fragments with high accuracy, critical for genetic analysis and validation in life science research. Trends include the automation of Sanger sequencing workflows and integration with NGS platforms for hybrid sequencing approaches. Drivers include improvements in sequencing chemistry and detection sensitivity, adoption in clinical genetics and molecular diagnostics, and the application in forensic sciences and evolutionary biology.

Transfection Devices & Gene Delivery Technologies: Transfection devices and gene delivery technologies facilitate the introduction of nucleic acids into cells for gene editing and therapy applications. Trends include the development of non-viral delivery systems and CRISPR/Cas9-based tools for precise genome modifications. Drivers include advancements in biocompatible delivery vehicles, improvements in transfection efficiency, and the expanding use in developing gene therapies, cell-based vaccines, and genetically modified organisms.

NMR: Nuclear magnetic resonance (NMR) spectroscopy plays a critical role in analyzing molecular structures and interactions in life science research, particularly in metabolomics and drug discovery. Trends include the adoption of high-field NMR systems for enhanced sensitivity and multi-dimensional analysis. Drivers include advancements in NMR probe technology, software for data processing, and the application in studying protein-ligand interactions, metabolic pathways, and disease mechanisms.

Others: This segment includes emerging and specialized technologies in life science research, including digital pathology, biosensors, and microfluidics. Trends include the development of miniaturized diagnostic devices for point-of-care testing and wearable sensors for real-time health monitoring. Drivers include the demand for decentralized testing solutions, advancements in sensor technologies, and the application of novel platforms in remote and resource-limited settings.

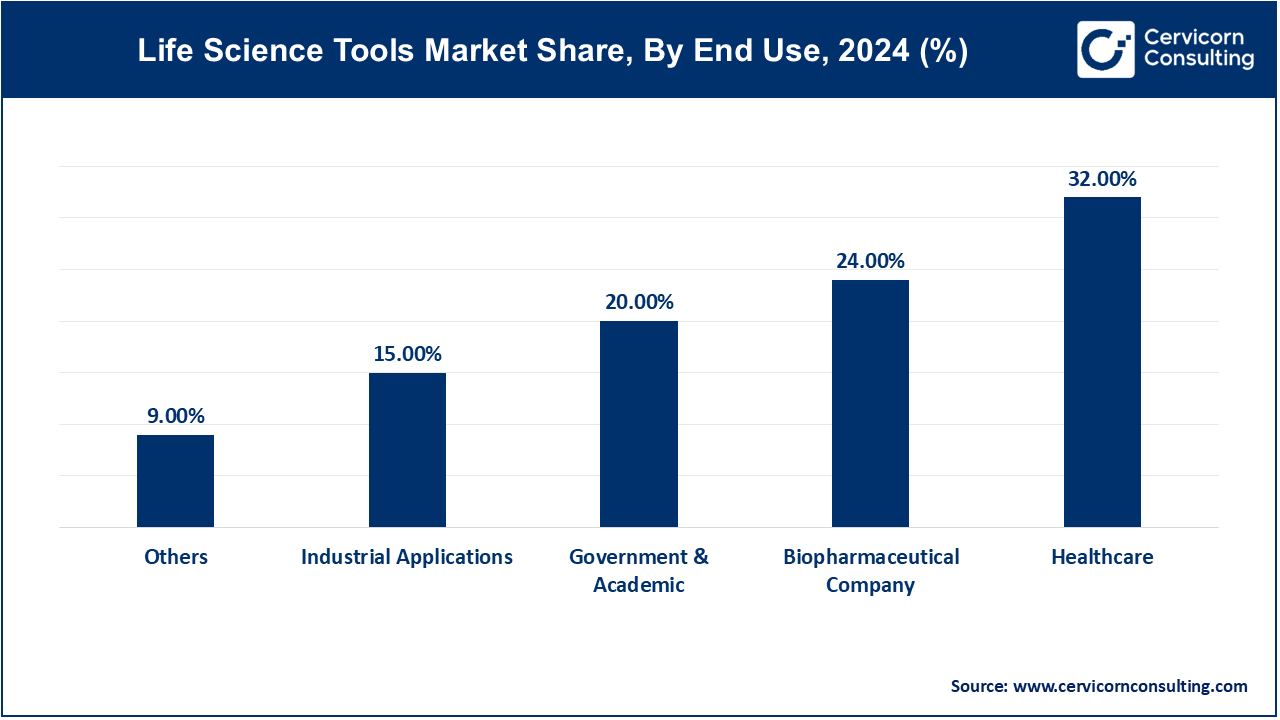

Government & Academic: Government and academic segment has registered market share of 20% in 2024. Government and academic institutions are significant users of Life Science Tools, conducting research across various disciplines from basic science to applied research. Trends include increasing funding for life sciences research, especially in genomics, proteomics, and infectious diseases. Drivers include government initiatives to promote scientific research, collaborations between academia and industry for translational research, and the demand for advanced tools to address global health challenges such as pandemics and climate change.

Biopharmaceutical Company: The biopharmaceutical companies segment has covered market share of 24% in 2024. Biopharmaceutical companies utilize Life Science Tools for drug discovery, development, and manufacturing of biologics and pharmaceuticals. Trends include the adoption of high-throughput screening technologies, automation in laboratory workflows, and advancements in bioprocessing technologies. Drivers include the rising demand for personalized medicine, investments in biotechnology research, and regulatory pressures to improve drug safety and efficacy through advanced analytics and biomarker discovery.

Healthcare: The healthcare segment has recorded highest market share of 32% in 2024. Healthcare providers rely on Life Science Tools for clinical diagnostics, patient monitoring, and therapeutic decision-making. Trends include the integration of molecular diagnostics and point-of-care testing for rapid disease diagnosis and management. Drivers include the aging population driving demand for diagnostic tools, advancements in diagnostic imaging technologies, and the shift towards personalized and precision medicine approaches to improve patient outcomes and reduce healthcare costs.

Industrial Applications: Industrial applications segment has captured market share of 15% in 2024. Industries outside of healthcare, such as agriculture, food and beverage, and environmental monitoring, utilize Life Science Tools for quality control, environmental testing, and agricultural research. Trends include the adoption of rapid testing technologies, biosensors for environmental monitoring, and genetic tools for crop improvement. Drivers include regulatory requirements for product safety and environmental protection, advancements in biotechnology for sustainable agriculture, and the need for efficient and reliable analytical methods in industrial settings.

Others: The others segment has accounted market share of 9% in 2024. This segment includes diverse sectors using Life Science Tools, including veterinary diagnostics, forensic sciences, and environmental research. Trends include the development of specialized tools for niche applications, such as wildlife conservation and forensic DNA analysis. Drivers include emerging infectious diseases necessitating rapid diagnostic tools, advancements in forensic technologies for crime investigation, and the growing importance of environmental sustainability driving demand for bioanalytical tools.

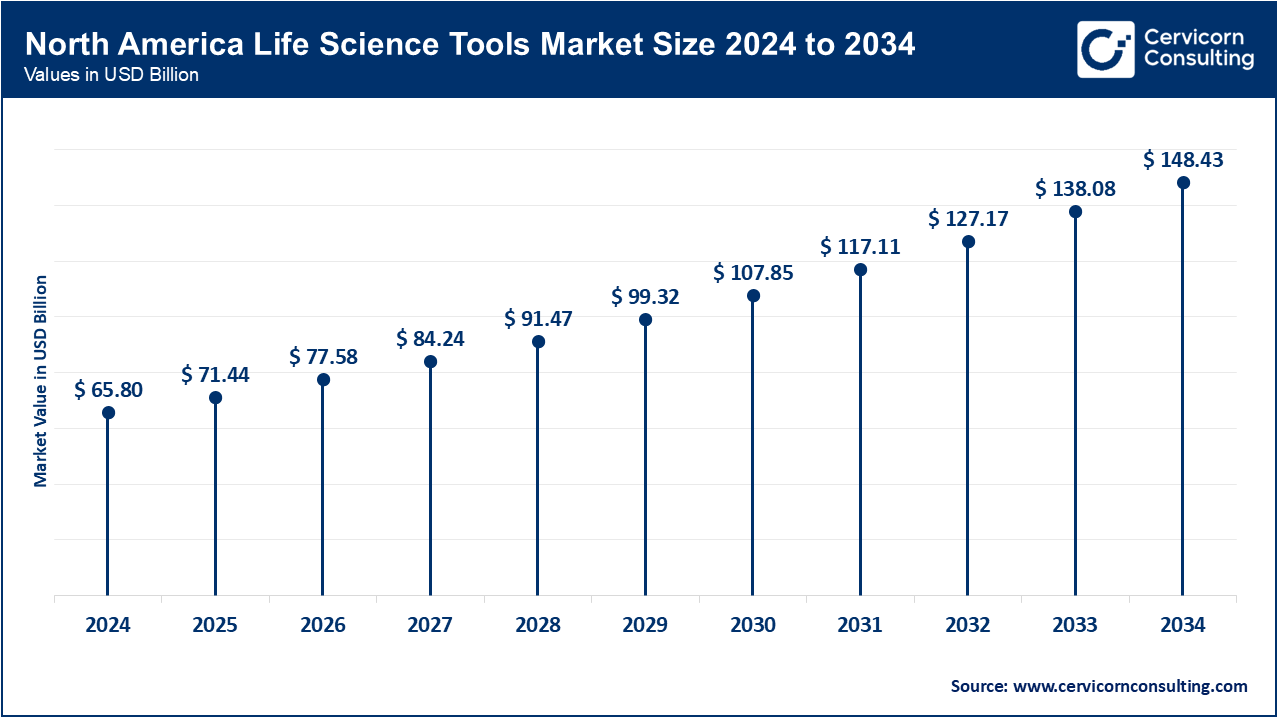

North America dominates the Life Science Tools Market due to rapidly growing research infrastructure, high healthcare expenditure, and strong presence of key market players. North America market size is expected to reach around USD 148.43 billion by 2034 increasing from USD 65.80 billion in 2024. The region benefits from significant investments in biotechnology and pharmaceutical industries, driving innovation in genomics, proteomics, and personalized medicine.

Asia-Pacific is experiencing rapid growth in the Life Science Tools Market fueled by expanding healthcare infrastructure, rising investments in biotechnology, and increasing research collaborations. Countries like China, Japan, and India are leading the adoption of genomic technologies and diagnostic advancements, Asia Pacific market size is calculated at USD 38.48 billion in 2024 and is projected to grow around USD 86.80 billion by 2034. driven by growing healthcare needs and government initiatives promoting scientific innovation.

Europe is a key market for Life Science Tools with advanced healthcare systems, supportive regulatory frameworks, and substantial government funding for research. Europe market size is measured at USD 46.97 billion in 2024 and is expected to grow around USD 105.97 billion by 2034. The region emphasizes precision medicine and environmental sustainability, fostering growth in genomic research, clinical diagnostics, and biopharmaceutical manufacturing.

LAMEA represents an emerging market for Life Science Tools with improving healthcare infrastructure, increasing investments in healthcare R&D, and expanding pharmaceutical manufacturing capabilities. LAMEA market size is forecasted to reach around USD 34.57 billion by 2034 from USD 15.32 billion in 2024. The region shows potential for growth in clinical diagnostics, genetic testing, and agricultural biotechnology, supported by government initiatives to enhance healthcare access and address infectious diseases and chronic conditions.

New players such as Twist Bioscience and 10x Genomics are leveraging innovative technologies in synthetic biology and single-cell analysis, respectively. Twist Bioscience specializes in synthetic DNA and gene synthesis, contributing to advancements in personalized medicine and biotechnology research. Meanwhile, 10x Genomics focuses on single-cell and spatial genomics solutions, enabling researchers to explore cellular diversity and disease mechanisms with unprecedented detail. Key players dominating the market include Thermo Fisher Scientific and Illumina, Thermo Fisher Scientific leads with its comprehensive portfolio of analytical instruments, reagents, and laboratory equipment, bolstered by strategic acquisitions like Qiagen, enhancing its capabilities in molecular diagnostics and genetic testing. Illumina dominates genomic sequencing technologies, driving innovation through advancements in next-generation sequencing (NGS) platforms and collaborations with pharmaceutical companies for precision medicine initiatives. Collaboratively, Thermo Fisher Scientific partnered with Biognosys to integrate mass spectrometry and proteomics for biomarker discovery in precision medicine. Illumina collaborated with GRAIL for early cancer detection through liquid biopsy tests, leveraging NGS technology to enhance diagnostic accuracy and treatment outcomes. These collaborations and innovations underscore the market leaders' commitment to advancing life sciences through transformative technologies and strategic partnerships.

Marc N. Casper, President and CEO of Thermo Fisher Scientific

"Our teams continue to execute at a high level, driving strong operational and financial performance. We are focused on advancing our mission to enable our customers to make the world healthier, cleaner and safer."

Francis deSouza, President and CEO of Illumina

"We continue to see strong demand for our comprehensive genomic solutions, driven by broad adoption of our sequencing and array platforms."

Robert Friel, Executive Chairman of PerkinElmer

"Our innovative technologies are helping to advance science and improve global health outcomes, positioning PerkinElmer as a leader in diagnostics and discovery solutions."

Mike McMullen, President and CEO of Agilent Technologies

"Agilent's strong performance is a testament to our team's dedication and our commitment to delivering innovative solutions to our customers. We remain focused on driving growth and creating long-term value."

Thomas Joyce, Jr., Chairman and CEO of Danaher Corporation

"We are pleased with the progress across our portfolio, driven by strong execution and ongoing investments in innovation. Our life sciences and diagnostics businesses continue to deliver differentiated solutions to our customers worldwide."

These statements highlight the strategic priorities, market outlooks, and commitments to innovation and customer satisfaction from key executives in the Life Science Tools Market.

Market Segmentation

By Technology

By Product

By End-use

By Regions