Microcarrier Market Size and Growth 2025 to 2034

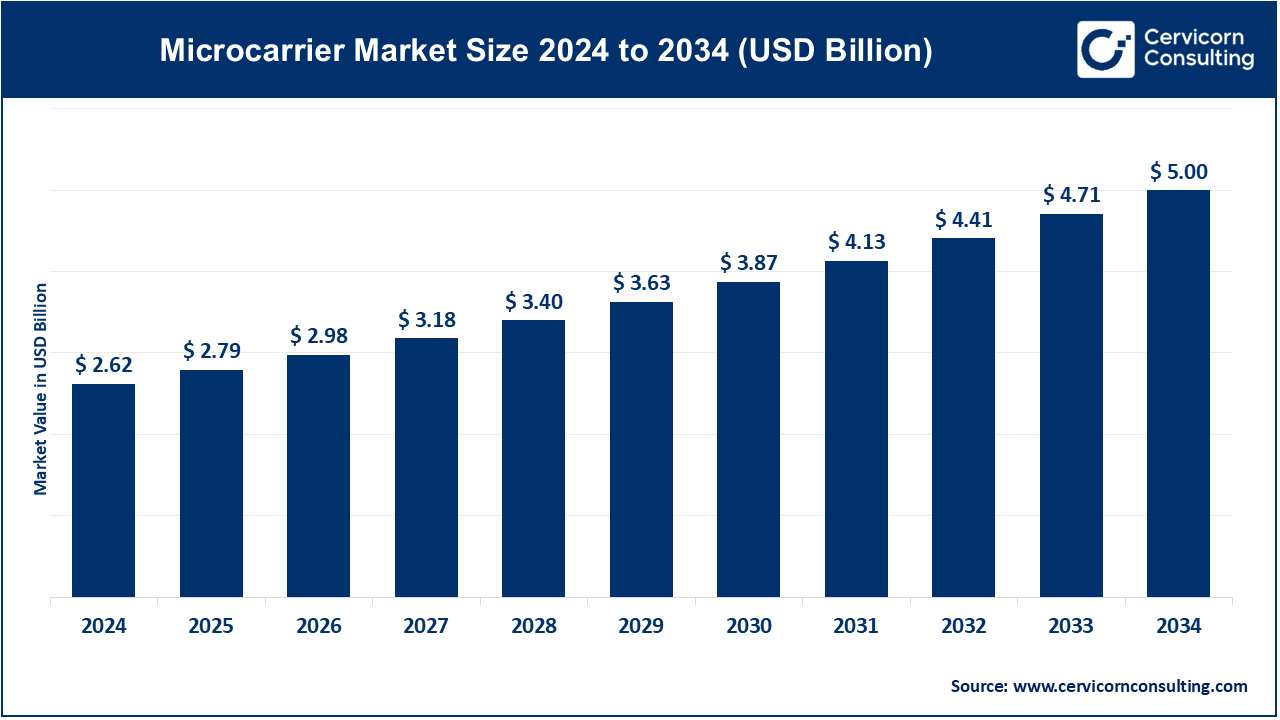

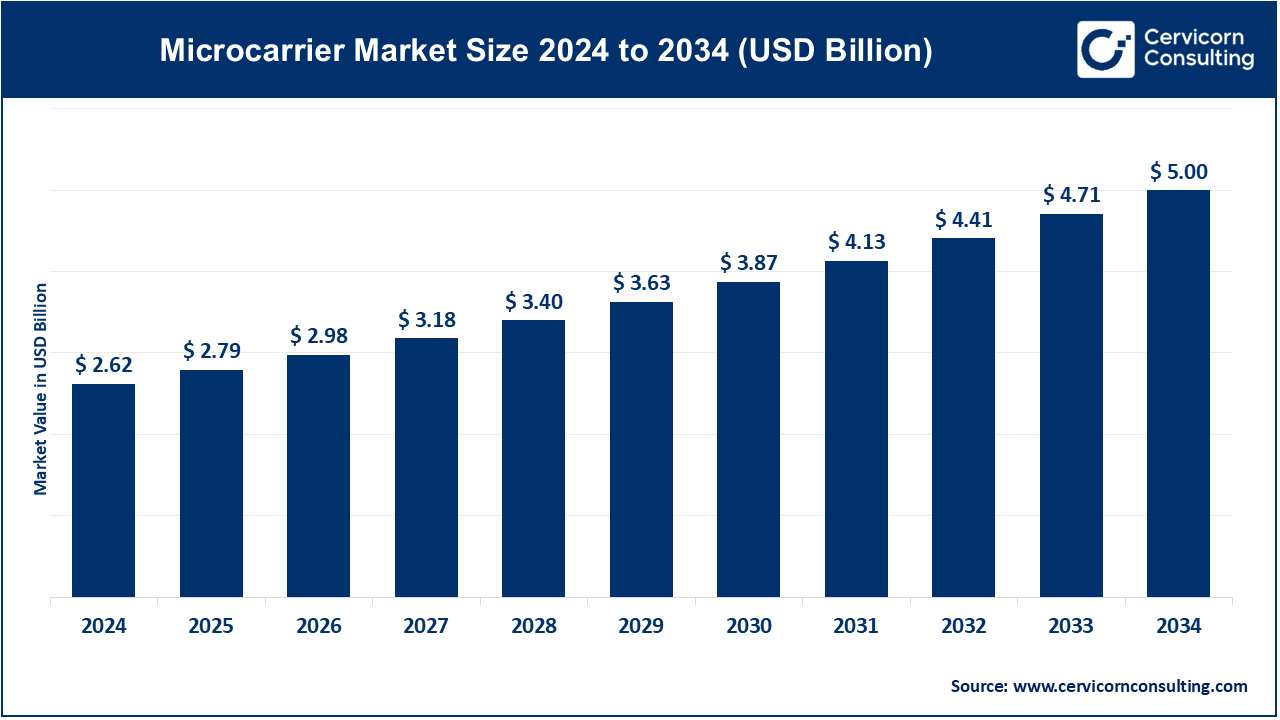

The global microcarrier market size was valued at USD 2.62 billion in 2024 and is expected to be worth around USD 5.00 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.68% from 2025 to 2034.

The microcarriers market has seen significant growth in recent years, driven by the increasing demand for biopharmaceuticals, cell therapies, and vaccine production. With the rising adoption of cell-based therapies, including regenerative medicine, the market is expected to continue expanding. The growing need for personalized medicine, which involves using the patient's own cells for treatment, is further propelling the use of microcarriers in cell culture applications. Additionally, advancements in microcarrier technology are enhancing their efficiency and suitability for a broader range of applications, further boosting market growth. Moreover, the rising investment in research and development, coupled with regulatory support for biopharmaceutical manufacturing, is anticipated to accelerate the adoption of microcarriers in both clinical and commercial settings. In May 2024, Sartorius AG partnered with Sanofi to develop and commercialize a platform aimed at streamlining and optimizing downstream bioprocessing operations. This collaboration seeks to enhance efficiency and productivity in the production of biopharmaceuticals, potentially leading to more sophisticated microcarrier-based bioprocessing technologies.

A microcarrier is a small, spherical support material used in bioreactors for cultivating cells in biotechnological processes. These tiny beads or particles, typically made from materials like polystyrene, collagen, or dextran, provide a surface area for cells to attach and grow. Microcarriers are commonly used in cell culture for the production of vaccines, antibodies, and other biologic drugs. The advantage of using microcarriers lies in their ability to maximize cell growth in a limited space, offering a high surface-to-volume ratio that enhances cell proliferation. Microcarriers are generally suspended in culture media, allowing cells to grow in a three-dimensional structure, mimicking the natural environment of tissues.

Microcarrier Market Report Highlights

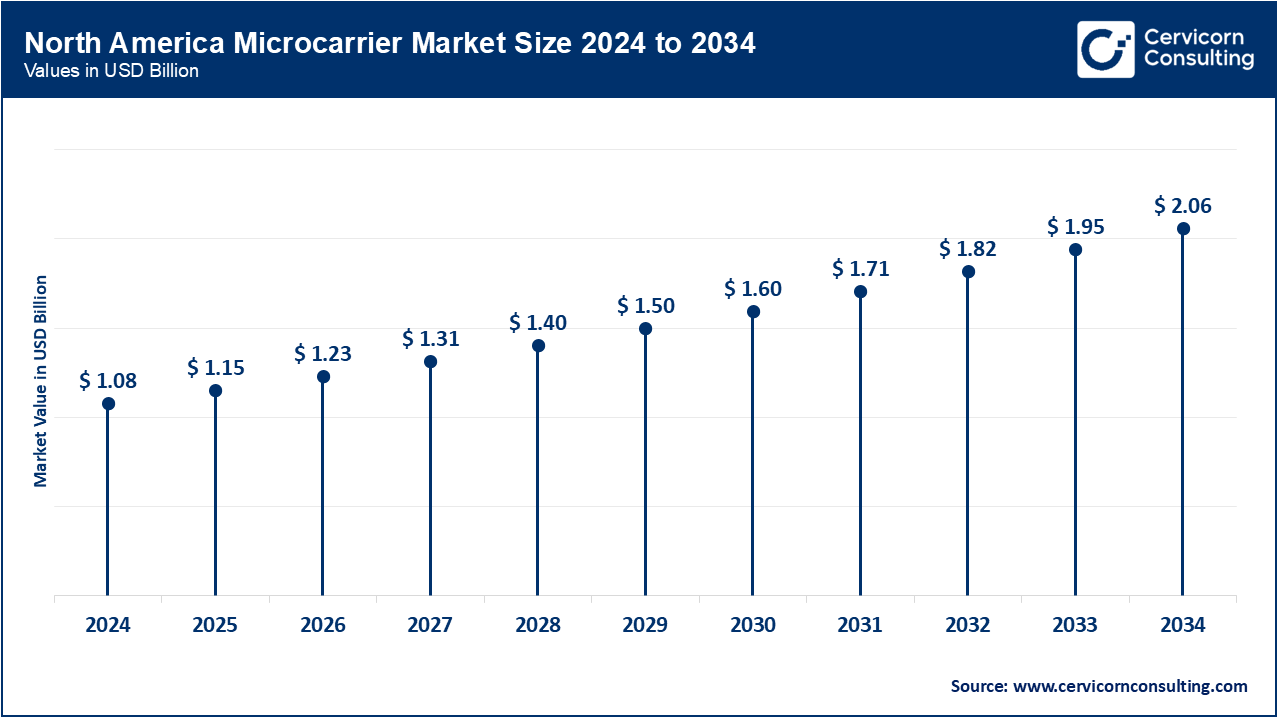

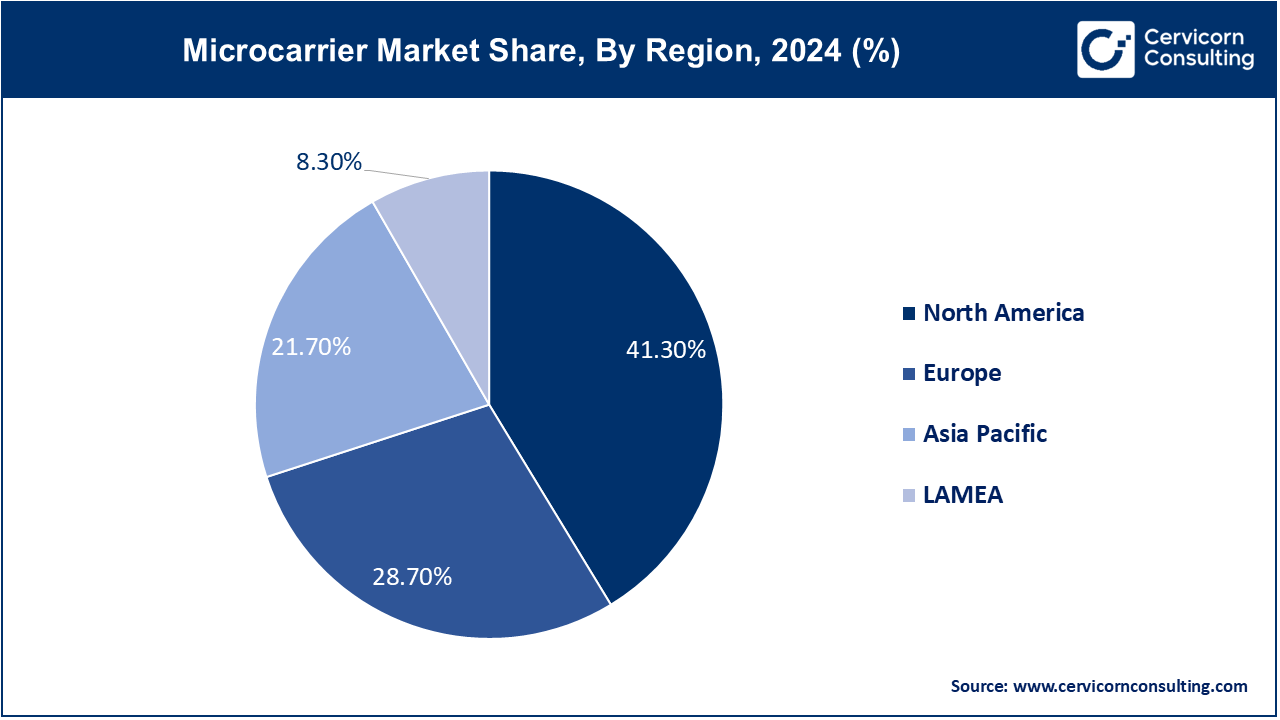

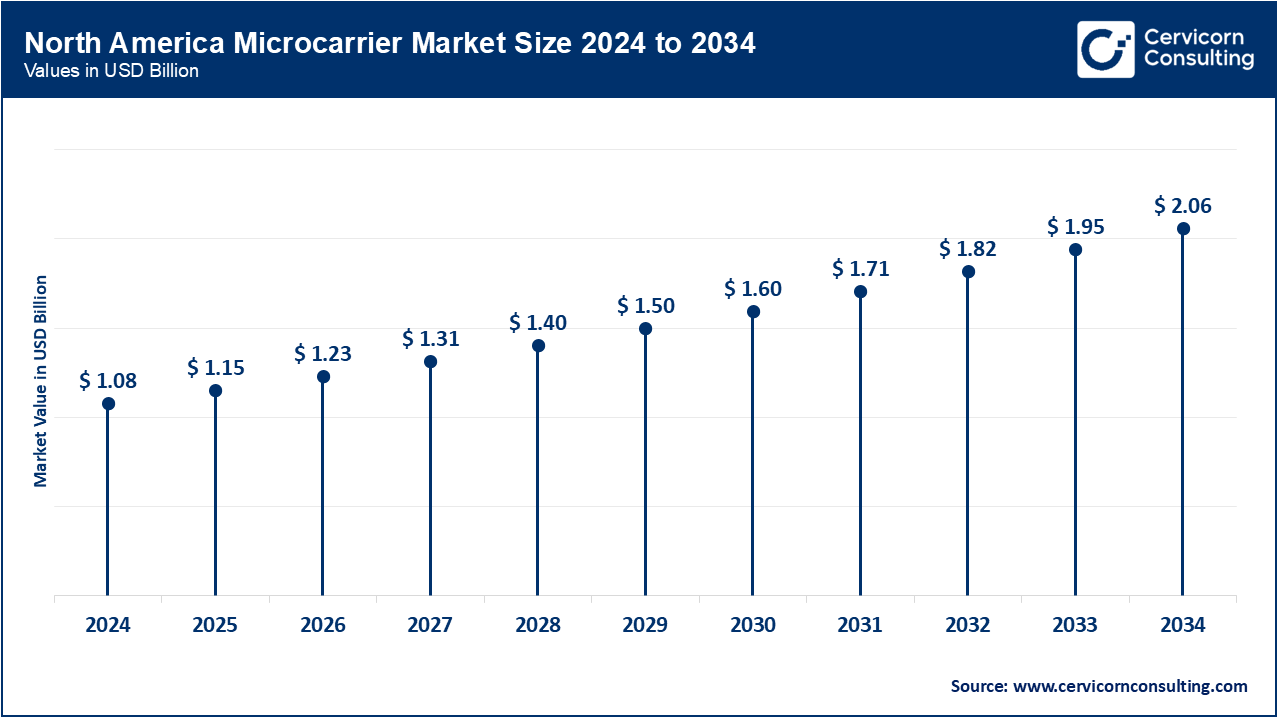

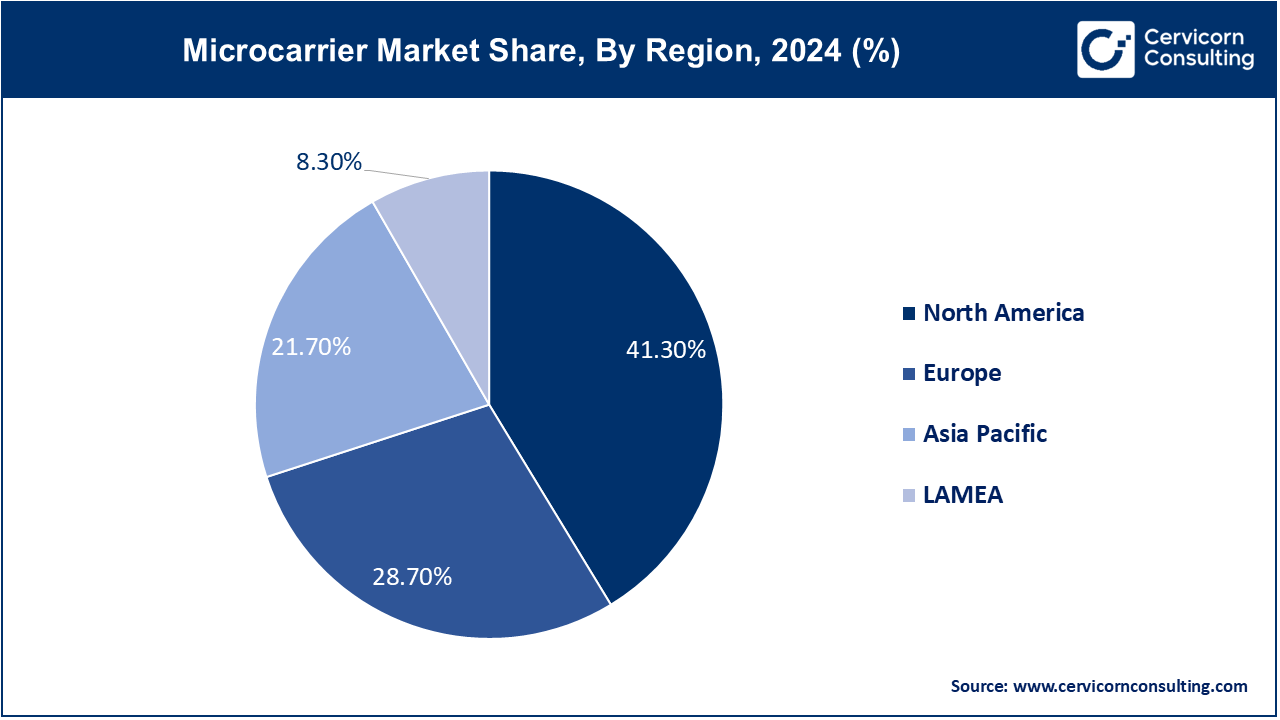

- North America region is dominating the market in 2024, accounted revenue share of 41.3%.

- Europe has generated revenue share of around 28.7% in 2024.

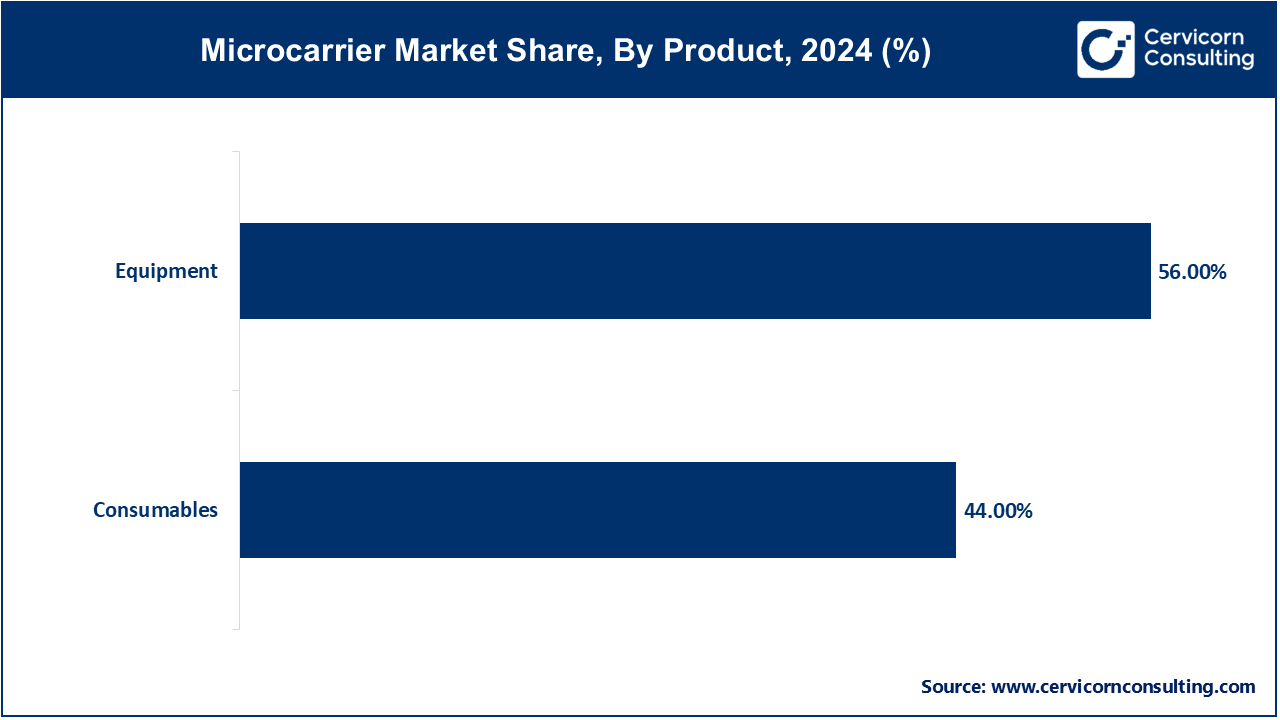

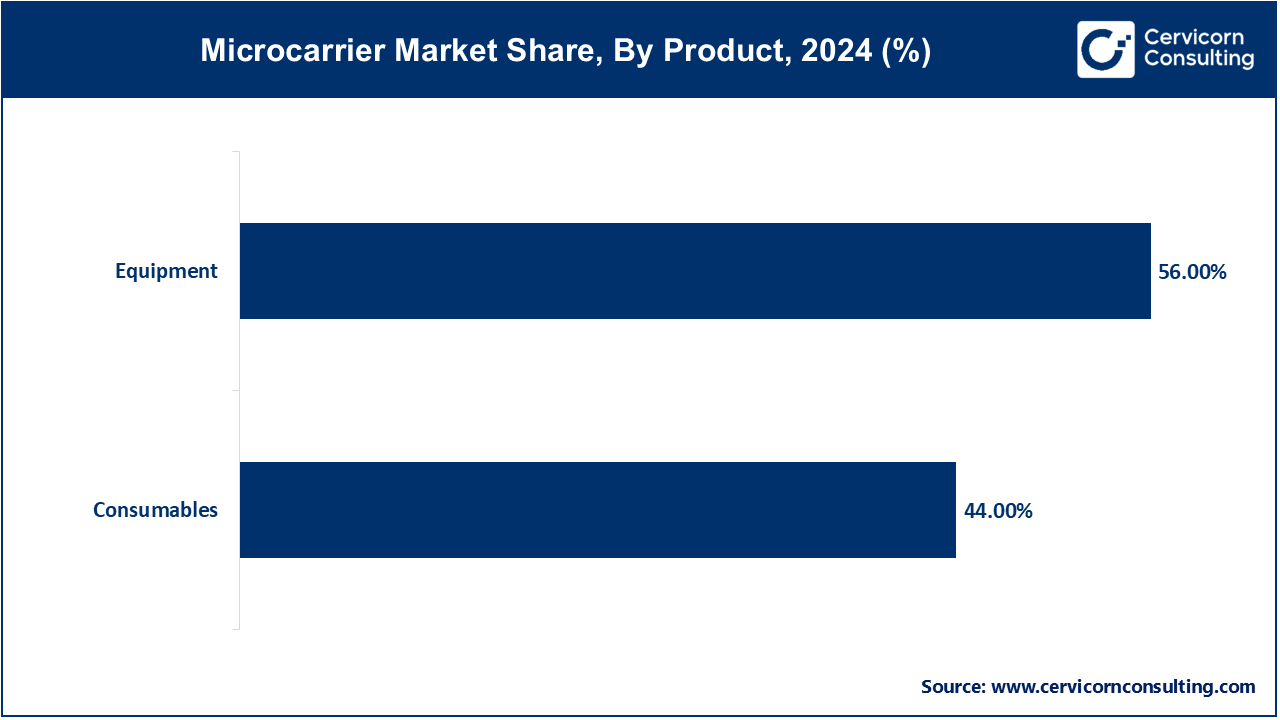

- By product, the equipment segment has accounted 56% of the total revenue share in 2024.

- By application, the cell therapy segment has reported revenue share of 48.90% in 2024.

- By end user, the pharmaceutical & biotechnology companies segment has generated revenue share of 44% in 2024.

Microcarrier Market Growth Factors

- Rising demand for biopharmaceuticals: Biopharmaceuticals, including monoclonal antibodies and therapeutic proteins, require cell-culture methods that are well suited for large-scale production. The requirement for efficacious treatments for chronic diseases, including cancer, cardiovascular disorders, and autoimmune diseases, has incited increased demand for these biologics. This increased demand raises the need for innovative cell growth technologies, such as microcarriers. Microcarriers facilitate high-density cultures of a scale that are essential to large-scale production and drive the market's growth.

- Advancements in cell therapy: Cell therapy is an expanding discipline that finds great applications in cancer treatment and degenerative conditions, among many others. Microcarriers allow for a viable way to bring to bear mass large-scale cell culture techniques whereby therapeutic cells, like stem cells and immune cells, can be produced. As such, with the evolving nature of cell therapies, more efficient systems such as microcarriers to expand cell cultures seem to have become a burning issue, giving a substantial fillip to market growth in areas, including regenerative medicine and immune therapy.

- Increase in vaccine production: Cavernious demand for vaccines, which is soaring due to a plethora of emerging infections in the world and various pandemics, leads to the increased demand for scaling up vaccine production. And because microcarriers provide tremendous surface area for cell growth in bioreactors, they present an easy way with which to upscale vaccine production for virus vector-based vaccine preparations. This allows for high vaccine volumes to be manufactured quickly and efficiently, which is especially important in the event of an urgent response to a possible public health crisis. The ongoing hotbed of vaccine methodologies is precipitating further demand for microcarrier technologies.

- Growing regenerative medicine sector: Landing a niche in the spectrum of regenerative medicine involves sustaining cell-and-tissue repair or replacement from large-scale cell culture processes. Fortunately, microcarriers are convenient for burgeoning adherent cell cultures deployed in regenerative treatments, such as stem cell therapies. These advancements in this space, sitting on top of heavy investment, are pushing further into microcarriers whereby large-scale cell culture solutions become economically viable and available for clinical applications.

- The biomanufacturing competence is expanding: Together with the increasing investments in large-scale production facilities to manufacture biologics and cell-based therapies, the global biomanufacturing industry is rapidly evolving. Microcarriers have played an important role in growth in adherent cells in bioreactors; hence they are important for enhancing productivity and thereby yield. As a result of the fast expansion of biopharmaceutical companies and CMOs for increasing their manufacturing capacity to meet the increasing demand, there is growing adoption of microcarriers for improving the scalability and process efficiency for bioprocessing operations.

Microcarrier Market Trends

- Increased use of 3D cell culture systems: Where 2D culture cannot adequately replicate saturated in vivo environments of cell growth, with increasing popularity, 3D cell culture systems are replacing the excessively traditional 2D culture systems. The microcarriers integrate into the 3D culture transition by providing a surface for subobtaining adherent cells in bioreactors that allow better cell differentiation, cell viability, and function. 3D cell culture systems are increasingly growing in demand, thereby positively impacting to cater to microcarriers in fulfilling research and therapeutic prospects.

- Integration of microcarriers with perfusion systems: Increasingly, in cultured cell processes, perfusion systems are developing their footing-breathing space by continuously supplying fresh media and removing waste products to achieve higher cell densities. Integrated with these systems, among others, microcarriers allow sustained high-productivity cell cultures-Such integration is a growing trend that forwards efficiency and scalability in cell-based manufacture, thus displaying its significance in the biopharma and cell therapy arenas.

- Focus on biodegradable microcarriers: Shifting to biodegradables in plastic is the key trend in the market because of the rising environmental concerns. The biodegradable microcarriers are biosustainable by these concerns with the crutches of biocompatibility for clinical and industrial applications. These biodegradable microcarriers are more appealing in regenerative medicine and stem cell therapies, where the generation of waste products is to be curbed and therapeutic cells are to be compatible.

- Adoption of magnetic microcarriers: Magnetic microcarriers, while becoming increasingly popular since they permit easier and more efficient harvest of cells, can rust, hence presenting quite a challenge during cell expansion and in separating the magnetic microcarriers with harvested cells by controlling ambient conditions. The fast separation of magnetic microcarriers provides a faster recovery of cells from cultures, thus eliminating the need for additional detachment enzymes or other agents, enhancing cell recovery and reducing processing times during biopharmaceutical manufacturing and research applications.

- Expansion of gene therapy research: Gene therapy, which involves modifying a patient's genes to treat or cure diseases, is a rapidly growing area of research. Microcarriers are used in the production of viral vectors, which are essential for delivering gene therapies. As gene therapy development accelerates, the demand for scalable, efficient production methods like microcarrier-based cultures is increasing, driving innovation and growth in this segment of the market.

- Growing demand for high-density cell cultures: As cell-based therapies and biologics require increasingly large quantities of cells, there is a rising demand for high-density cell cultures. Microcarriers allow for the cultivation of cells at much higher densities compared to traditional methods, improving productivity and efficiency. This trend toward high-density cultures is driving the adoption of microcarriers in both research and industrial bioprocessing applications, particularly in the production of biologics and vaccines.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 2.79 Billion |

| Projected Market Size in 2034 |

USD 5.00 Billion |

| Growth Rate 2025 to 2034 |

6.68% |

| Top-performing Region |

North America |

| Quickest Growing Region |

Asia-Pacific |

| Key Segments |

Product, Cell Type, Therapy, Application, End User, Region |

| Key Companies |

Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, Corning Incorporated, Eppendorf SE, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., DenovoMATRIX GmbH |

Microcarriers Market Dynamics

Market Drivers

- Increasing reliance on biologics and biosimilars: Biologics are widely recognized as a highly effective class of therapeutics to address an array of diseases. To produce these drugs at large scale, high levels of efficiency are required in the production system. Microcarriers have emerged as a preferred cell culture platform, which allows significant capacity expansion to manufacture biologics used to treat prevalent diseases globally. Also, to cater to the rising demand for biosimilars, microcarrier system plays a vital role in developing a high-quality, scalable platform for the commercial-scale human recombinant insulin production. Therefore, the popularity of biologics and biosimilars is boosting the growth of the microcarrier market.

- Increased efficiency and cost-effectiveness in large-scale production: Microcarriers offer a cost-efficient alternative in comparison to traditional two-dimensional (2D) cell culture techniques. These systems permit cell growth in suspension, which increases cell density in the bioreactors, therefore, reducing the required size of the bioreactors and saving space. The space availability and scalability associated with microcarriers can reduce the operational cost associated with large-scale production; thereby, enhancing their preference among pharmaceutical and biotechnology industries when it comes to commercial-scale biomanufacturing.

- High incidence of chronic diseases: Chronic diseases, such as cancer, diabetes, and autoimmune diseases, are on a rise and growth in the patient population increases the demand for biologics and cell therapy. Biomanufacturing necessitates the requirement of scalable bioprocessing methodologies to quickly manufacture them in higher quantum, which includes cell culture technologies such as microcarriers. Thus, growing incidence of these diseases directly catapult demand for microcarrier-based systems in cell culture applications.

- Surge in demand for vaccines: As the demand for vaccines increases globally, particularly in response to pandemics and new infectious diseases, microcarriers plays a pivotal role while manufacturing virus-based vaccines, by allowing the growth of cells to high densities in bioreactors and expanding their scale to any desired level. For instance, uptake of microcarriers by the renowned vaccine manufacturer, such as NIID, JP, for Dengue virus vaccines production. The systems would allow the expansion in the production of cell-based vaccines and offer advantages in terms of vaccine purity, antigen presentation, and longevity. Such notable advancements justify the growth of the microcarrier market.

- Expansion of bioprocessing industry: The bioprocessing industry is rapidly expanding as more biopharmaceuticals, including cell-based therapies and biologics, are brought to market. Microcarriers are essential in large-scale bioprocessing to cultivate cells efficiently. This growing demand for advanced bioprocessing solutions, including bioreactors and microcarriers, is driving market growth as companies invest in expanding production capabilities to meet increasing demands in pharmaceuticals and regenerative medicine.

Market Restraints

- High initial cost of microcarrier systems: The high initial cost of implementing a microcarrier system could serve as an entry barrier especially for small companies or research institutions; for example, it involves the investment for bioreactors, the microcarriers, and ancillary equipment. Success can often be stymied, in which case there were likely barriers for acceptance by small companies or research organizations that have little to no capital. In addition, they suffer from high operational costs and maintenance of the systems, heaping additional financial burdens that act as impediments, especially for those applications needing cost sensitivity.

- Technical challenges with cell detachment: A primary challenge in using microcarriers that stem from the very early stages of cell culture is the fast detachment of the cells without damaging them. Cells must be carefully detached from the microcarriers and too rigorous detachment may lead to low yield or damage to the cells in subculturing. This technical challenge will slow down the manufacturing processes and ultimately reduce the overall productivity of cell-based production, hindering market growth, especially in biopharmaceuticals.

- Limited Knowledge on Microcarrier Technology: The effective best use of microcarriers depends on specialist knowledge and experience of passing cells through bioreactor and process optimization. The lack of trained professionals experienced with microcarrier-based cell culture systems could pose a constraint astonishingly on the sectoral whittle-down to completion since very limited access to skilled manpower hinders market growth, especially in developing countries.

Market Opportunity

- Advancements in Biopharmaceutical Production: Adoption of microcarriers in biopharmaceutical manufacturing is gaining momentum, and this presents sound prospects. Due to the growing demand for biologics and vaccines, microcarriers enable efficient cell culture processes, particularly for adherent cells. Thus, microcarriers are an attractive choice to support high-replicate cell cultures in great volumes since their large-scale production meets the industry's requirement for scalability, thereby driving their demand.

- The Rise of Personalized Medicine: The transition to personalized medicine hastens research in cell-based therapies. Microcarriers play a very critical role in scaling up the production of cells used in regenerative medicine and immunotherapy. The trend also provides opportunities for innovation in customized microcarrier solutions that fit the shifting contours of therapeutic requirements.

- Advent of 3D Cell Culture Technology: There is increasing demand for the drug discovery and tissue engineering industry of 3D cell culture technology. This offers significant opportunities to the microcarrier manufacturer to produce the advanced microcarrier specific to the 3D culture applications due to these systems being similar in many aspects of in vivo.

Market Challenges

- Compatibility between microcarrier and cell: These are typically the main issues in microcarrier technology, in which the surface chemistry of the microcarrier is compatible with the specific cell type being cultured. Compatibility necessitates different types of attachment, growth, and detachment; therefore, it is a challenge to develop a universally compatible set of microcarriers for all cell types. This drawback might result in cell death and loss in cell yield and limit the performance of microcarrier-based systems for some cell types and applications.

- Prospective Costs: Microcarriers should, in principle, allow for large-scale production with a much greater productivity. However, large operational costs are incurred along with the maintenance of the bioreactor, buying of consumables, and maintenance, or ensuring poisonous conditions. These constant costs might pose an insurmountable barrier to the smaller company or research institute, particularly since many such institutions are loath to adopt and maintain microcarrier-based systems, particularly when it comes to price-sensitive markets.

- Non-biodegradable carriers have a negative impact on the environment: The large-scale production, utilization of synthetic, non-biodegradable microcarriers has brought to light the environmental concerns regarding their contribution to plastic waste generation and overall environmental degradation. The industry remains under increasing pressure to develop biodegradable alternatives that would have less, hopefully none, environmental effects. This brings further challenges in seeking for their market-wide acceptance in the cost, performance, and scalability aspects.

Microcarrier Market Segmental Analysis

The microcarrier market is segmented into product, application, therapy, cell type, end user and region. Based on product, the market is classified into equipment, and consumables. Based on application, the market is classified into vaccine manufacturing, cell therapy, biologics manufacturing, and other. Based on therapy, the market is classified into cell & gene therapy, and other (Tissue Engineering and Regenerative Medicine Applications). Based on cell type, the market is classified into stem cells, immune cells, and other. Based on end user, the market is classified into pharmaceutical & biotechnology companies, research institutes, and contract research organizations.

Product Analysis

Based on product, the microcarrier market is segmented into equipment and consumable. The cell-therapy segment has dominated the market in 2024. The equipment segment has dominated the market in 2024 and accounted highest revenue share.

Equipment: The equipment segment has accounted revenue share of 56% in 2024. The equipment segment provides for devices which are used in the microcarrier market, including bioreactors, and cell culture systems, and ancillary hardware for growing large-scale cultures of cells. Such machinery is thus a necessary basis in terms of ensuring optimal conditions for cell proliferation as well as product yield in vaccine production, biologics, and any other therapies. The growing demand for large-scale cell culture systems is projected to strengthen this segment as biopharmaceutical companies are broadly expanding their production capabilities for biologics and regenerative medicine.

Consumables: The consumables segment has accounted revenue share of 44% in 2024. The consumables consist of microcarriers, culture media, and reagents used during cell culture processes. Microcarriers provide a large surface area for cell attachment; thus, they are useful for developing small- and large-scale high-density biomanufacturing. The continued demand for consumables during a single production cycle provides stability for the market. As industries focus on biopharmaceuticals, cell therapy, and vaccine production, consumables have become critical to large-scale high-quality cell cultures.

Application Analysis

Based on application, the microcarrier market is segmented into vaccine manufacturing, cell-therapy, biologics manufacturing (Conjo), and others. The cell-therapy segment has dominated the market in 2024.

Vaccine Manufacturing: The vaccine manufacturing segment has captured revenue share of 33.40% in 2024. Microcarriers are widely used in vaccine production for further and additive production of viruses, as they allow high-density cultures of the adherent cells required for viral vaccines. With vaccines gaining the advantage of throbbing demand in the wake of emerging infectious diseases requiring rapid production, microcarriers emerged to become popular due to their flexibility and efficiency in producing viral vectors and vaccine components on large scales.

Cell-therapy: The cell-therapy segment has generated revenue share of 48.90% in 2024. Used in cell-based therapeutics, stem cells and immune cells are expanded in high numbers using microcarriers. Cell engineering for regenerative medicine and cancer therapy are also parts of cell therapy. As such microcarrier-based systems emerge in propelling the clinical application needs for large cell yields with growing need of advanced therapies, this segment would probably witness tremendous growth as cell-based therapies gain traction globally.

Biologics Manufacturing (Conjo): For monoclonal antibodies and therapeutic proteins, efficient cell culture techniques for mass production of biologics operate. In this respect, microcarriers forcefully support large-scale biomanufacturing due to a good high-cell-density growth inside bioreactors. As with the increase in demands for unique biologics in treating chronic diseases, this particular application drives the microcarrier market towards newer and advanced cell culture systems.

Other: The "Other" segment includes diverse research and industrial applications for microcarriers, such as gene therapy, tissue engineering, and diagnostic research. High-density cell cultures for testing, development, and commercialization require these applications, and microcarriers are essential in this regard for scale-up and efficiency demanded by the market. Meanwhile, expanding R&D efforts across the biotechnology and pharmaceutical industries are attributing to soaring shares of this segment.

End User Analysis

Based on end user, the microcarrier market is segmented into pharmaceutical & biotechnology companies, research institutes, and contract research organizations (CROs). The pharmaceutical & biotechnology companies segment has dominated the market in 2024.

Pharmaceutical & Biotechnology Companies: The pharmaceutical & biotechnology companies segment has accounted 44% of the total revenue share in 2024. These companies are the principal users of microcarriers in large-scale biomanufacturing processes, including the production of biologics and vaccines. Given the concentrated investment of pharmaceutical companies in biopharmaceuticals, there is a concurrent rise in the demand for efficiently scalable cell-culture systems like microcarriers. This segment currently is a key focus area for growth in the microcarrier market due to a steeper emphasis on biologics and cell therapies.

Research Institutes: The research institutes segment has accounted revenue share of 33% in 2024. Research institutes employ microcarriers for experimental cell culture, pushing for advances in cell therapy, vaccine research, and biomanufacturing technologies. These entities are chiefly responsible for innovation, exploring new microcarrier applications in drug development and regenerative medicine. The expansion of this end-user segment continues with further amplified academic and government-funded research.

Contract Research Organizations (CROs): The CROs segment has reported revenue share of 23% in 2024. CROs play a very important and critical role as outsourcing bodies in research and development services for biopharmaceutical companies by employing microcarriers for vaccine development, biologics production, and cell-therapy studies. The increasing trend of outsourcing R&D to specialized CROs has intensified demand for microcarrier systems to enable these organizations to yield efficient high-powered research results to their clients.

Microcarrier Market Regional Analysis

The microcarrier market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). North america has dominated the market in 2024. Here’s an in-depth look at each region.

Why is North America region leading the microcarriers market?

The North America microcarrier market size was valued at USD 1.08 billion in 2024 and is projected to hit around USD 2.06 billion by 2034. North America serves as a major market for microcarriers driven by affluent biopharmaceutical industries operational in the U.S. and Canada. This market is further boosted by advanced healthcare infrastructure, increasing biologics demand, and increased investments in R&D. U.S. leads in the region, supported by many biotech companies and research institutions, using microcarriers for vaccine production and cell therapy. Support from government initiatives for biologics manufacturing and innovation also bolsters the growth of this market, establishing North America as a focal point for microcarrier development.

Europe Microcarrier Market Growth

The Europe microcarrier market size was estimated at USD 0.75 billion in 2024 and is predicted to reach around USD 1.43 billion by 2034. The European microcarrier industry is primarily contributed to by Germany, France, and the U.K., the major players in biopharmaceutical and vaccine development. In response to the innovative health care technologies spearheaded by a strong biotechnology sector, there is a growing demand for microcarrier systems within the region. Moreover, state support for biologics and cell-based therapies serves to bolster growth for the market. The investment in life-sciences R&D within the European Union, along with the expansion in biologics manufacturing capability, further spark an increasing demand for effective cell culture solutions such as microcarriers.

Why is Asia-Pacific witnessing rapid growth in microcarrier market?

The Asia-Pacific microcarrier market size was accounted for USD 0.57 billion in 2024 and is expected to be worth around USD 1.08 billion by 2034. Asia-Pacific is an emerging microcarrier market with countries like China, India, and Japan witnessing acceleration in growth. Rapidly developing healthcare investments create a situation where these developing countries turn their focus on biologics manufacturing, cell therapy development, and vaccine manufacturing thanks to government support. With the growing biopharmaceutical industry in China and the high-end R&D strength from Japan, the market demand for scalable microcarrier systems gets a fillip from these developments. Earlier, the increasing interest in regenerative medicine and biotechnology in this region is expected to considerably boost market growth in the next few years.

LAMEA Microcarrier Market is Expanding Gradually

The LAMEA microcarrier market was valued at USD 0.22 billion in 2024 and is anticipated to reach around USD 0.41 billion by 2034. In LAMEA, the microcarrier market is expanding gradually, notably in Brazil, Mexico, South Africa and UAE. Infrastructure and other investments in biotechnology basically underpin the Industrial Yuan; especially, this in tune particularly with Latin Americas and the Middle East. Hence, Brazil and Mexico are experiencing an increase in biopharmaceutical activities including the production of vaccines. For UAE and South Africa, it is imminent that they serve as likely hubs for biomanufacturing and cell therapy research, buoyed by government efforts to deepen local healthcare and life sciences capacities.

Microcarrier Market Top Companies

The microcarrier market is significantly dominated by some of the key players include Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, and Corning Incorporated.The companies extensively utilize their strong distribution networks, cutting-edge products, and a competitive edge via strong research and development capabilities. Heavily relies on technological innovation and strategic partnerships in extending their microcarrier solutions in accordance with the changing needs in biopharmaceutical industries. The high product quality and customer support which these players stay focused on would take on the market advancement to allow the drive of core developments in cell culture technologies and biomanufacturing processes.

CEO Statements

Marc N. Casper, CEO of Thermo Fisher Scientific, Inc:

- "We remain committed to driving innovation in the bioproduction space, particularly through our advanced microcarrier technologies, to meet the increasing demand for biologics and cell therapies”

Belen Garijo, CEO of Merck KGaA:

- "Our investment in microcarrier research is pivotal for advancing cell culture processes, ensuring that we provide our clients with the tools necessary to excel in biologics manufacturing."

Joachim Kreuzburg, CEO of Sartorius AG:

- "With our focus on innovation, we are proud to enhance our microcarrier product line, empowering researchers to explore new possibilities in cell therapy and regenerative medicine”

Recent Developments

Recent product launches in the microcarrier industry illustrate a trend toward innovation and strategic collaboration among key industry players. Companies like Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, and Corning Incorporated are actively enhancing their technologies to support the growing demand for efficient cell culture solutions. This includes the introduction of novel microcarriers designed for improved scalability and performance in cell therapy and vaccine manufacturing. The competitive landscape is characterized by significant investment in R&D, aiming to meet the complex requirements of biopharmaceutical applications. Some notable examples of key developments in the microcarrier industry include:

- In June 2023, Teijin Frontier Co., Ltd., a member of the Teijin Group specializing in fibers and product innovation, launched a new line of nonwoven microcarriers. These innovative microcarriers are designed to accelerate large-scale, high-quality cell cultures by supporting a variety of cell types in three-dimensional environments, enhancing attachment and growth.

- In October 2023, Kuraray Co., Ltd., based in Chiyoda-ku, Tokyo, and led by President Hitoshi Kawahara, introduced PVA hydrogel microcarriers for cell cultures in regenerative medicine. These advanced microcarriers are set for release in Japan in January 2024, with plans for future expansion into the United States and global markets.

- In October 2023, Semarion, a biotechnology company specializing in cell culture solutions, launched its Early Adopter Programme for the SemaCyte Microcarrier Platform. This initiative aims to promote the early adoption of their cutting-edge microcarrier technology within the scientific and research community.

These developments underscore significant advancements in the microcarrier market, with companies like Thermo Fisher Scientific, Inc. and Merck KGaA leveraging innovative technologies to enhance cell culture efficiency. These firms are focusing on the design and production of next-generation microcarriers that promote better cell attachment and growth, catering to the increasing demand in biopharmaceuticals and regenerative medicine. Their commitment to research and development is evident in new product offerings aimed at improving scalability and yield, positioning them as leaders in a rapidly evolving market.

Market Segmentation

By Product

- Equipment

- Bioreactors

- Single-use Bioreactors

- Stainless-steel Bioreactors

- Culture Vessels

- Filtration and Separation Equipment

- Cell Counters

- Other

- Consumables

- Media

- Serum-based Media

- Serum-free Media

- Other Media

- Reagents

- Microcarrier Beads

- Cationic Beads

- Collagen-coated Beads

- Protein-coated Beads

- Untreated Beads

- Other Microcarrier Beads

- Other Consumables

By Application

- Vaccine Manufacturing

- Cell Therapy

- Biologics Manufacturing

- Other

By Therapy

- Cell & Gene Therapy

- Other (Tissue Engineering and Regenerative Medicine Applications)

By Cell Type

- Stem Cells

- Hematopoietic Stem Cells (HSCs)

- Mesenchymal Stem Cells (MSCs)

- Induced Pluripotent Stem CELLS (iPSCs)

- Other

- Immune Cells

- Other

By End user

- Pharmaceutical & Biotechnology Companies

- Research Institutes

- Contract Research Organizations

By Region

- North America

- APAC

- Europe

- LAMEA