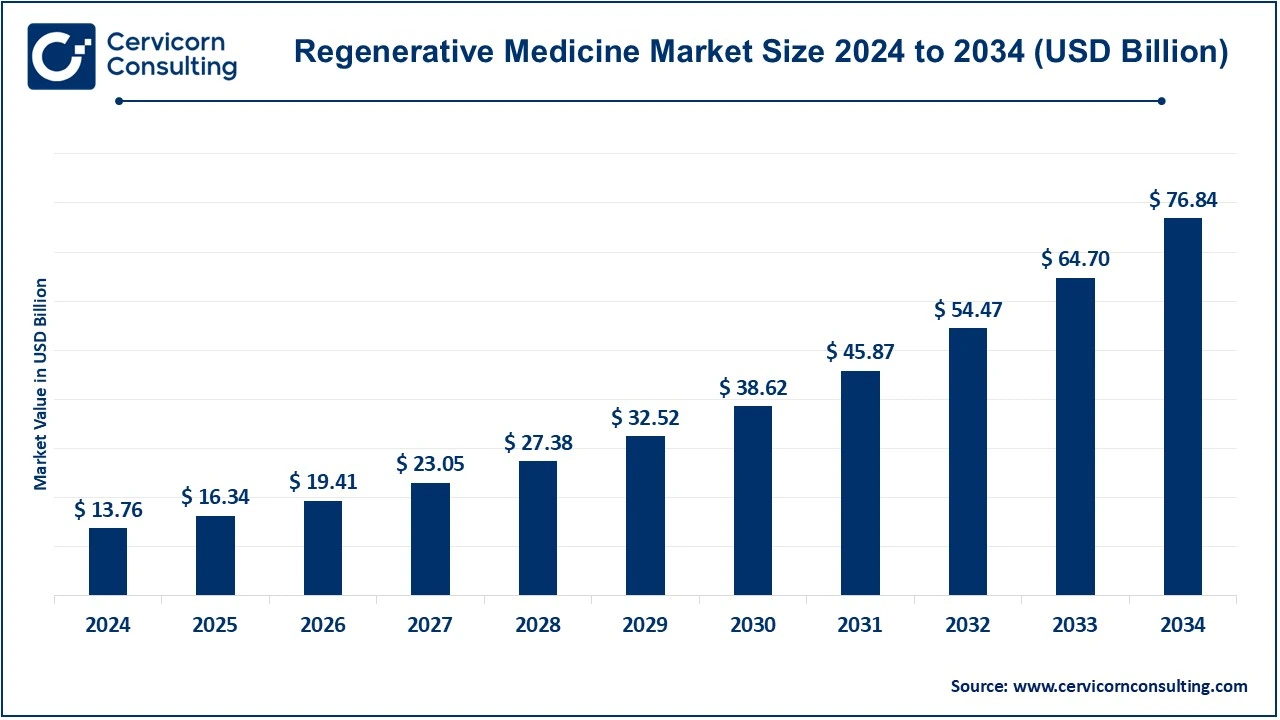

The global regenerative medicine market size was valued at USD 13.76 billion in 2024 and is expected to be worth around USD 76.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.76% over the forecast period 2025 to 2034. The U.S. regenerative medicine market size was estimated at USD 5.47 billion in 2024 and is expected to reach around USD 30.55 billion by 2034

The advancement in therapies that may cure or replace damaged tissues and organs is on the increase due to high demand. Additionally, an increasing tendency to diseases such as diabetes, heart disease, and neurodegenerative disorders boost the market growth. Improved treatments are being seen through the development of gene editing, tissue engineering, and 3D bioprinting. This, along with supportive regulatory frameworks and research and development investments, adds to the further commercialization of products within the regenerative medicine market, which increases growth.

CEO Statements

Mojdeh Poul, CEO of Integra LifeSciences Corporation

Christopher Boerner, CEO of Bristol-Myers Squibb Company

Daniel Lee, CEO of Tissue Regenix

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 16.34 Billion |

| Expected Market Size in 2034 | USD 76.84 Billion |

| Projected CAGR 2025 to 2034 | 18.76% |

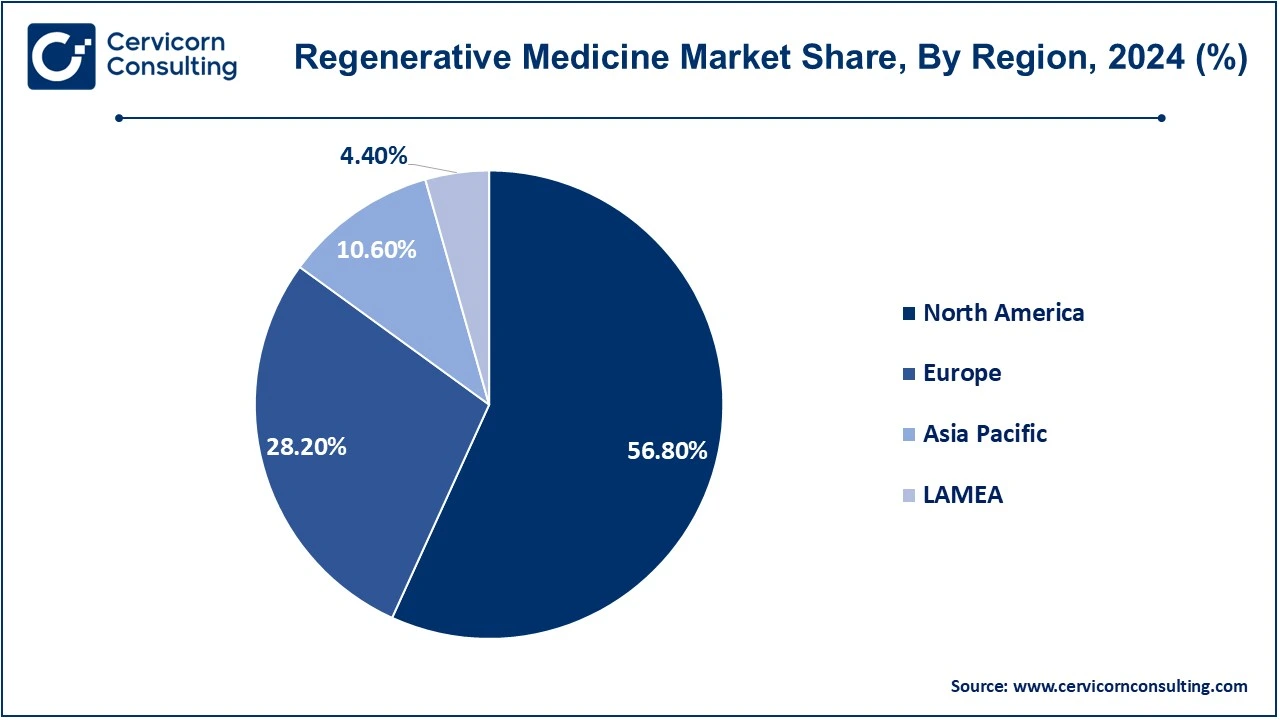

| Dominant Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Product, Application, End User, Region |

| Key Companies | Integra LifeSciences Corporation, Bristol-Myers Squibb Company, Tissue Regenix, Smith & Nephew, MIMEDX, Novartis AG, Allergan Aesthetics (AbbVie Inc.), Stryker, American CryoStem Corporation, Kite (Gilead Sciences, Inc.), AlloSource, bluebird bio, Inc., CRISPR Therapeutics, Janssen Global Services, LLC (Johnson & Johnson Services, Inc.), Tegoscience |

The regenerative medicine market is segmented into product, application, end user, region. Based on product, the market is classified into cell therapy, gene therapy, tissue engineering, and platelet rich plasma. Based on application, the market is classified into orthopedics, wound care, oncology, rare diseases, dermatology, musculoskeletal, and others. Based on end user, the market is classified into hospitals, clinics, and others.

Cell Therapy: The cell therapy segment has dominated the market in 2024. Cell therapy is the procedure used in treating or preventing disease through the use of living cells. It's used to transplant healthy cells within the patient's body that have been damaged to the site where the old damaged cells exist. In this approach, the focus primarily goes to stem cells for potential regeneration of tissues in an effort to heal damaged bodies. The applications can vary, including the treatment of cardiovascular diseases, neurological conditions, and orthopedic, thus presenting a possibility in healing damaged tissues or organs by biological regeneration.

Gene Therapy: Gene therapy is the alteration or replacement of genes in a patient's cells to prevent disease or treat it. The most applied form in this regard is regenerative medicine that seeks to correct genetic defects responsible for muscular dystrophy, cystic fibrosis, inherited retinal diseases, and several others. This has presented a new management avenue of genetic disorders since correcting genes can be introduced in the host cells through vectors viral and non-viral vectors, which also facilitate tissue regeneration, healing, and sometimes present life-long solutions.

Tissue Engineering: It has been a discipline combining the cells, biomaterials, and growth factors towards creating functional tissue substitutes, especially for damaged or diseased organs. The objective of such treatment, either through regeneration or repair of tissues, cannot naturally happen. Tissue engineering of organs and tissues for the purpose of transplantation is steadily advancing in orthopedics, dentistry, and reconstructive surgery. The use of scaffolds, which encourage cell growth, gives patients other options besides organ donation and enhances outcomes in regenerative medicine through tissue regeneration and repair.

PRP (Platelet Rich Plasma): Platelet Rich Plasma (PRP) therapy is the injection of isolated concentrated platelets from a patient's own blood into damaged tissues to enhance healing. It is rich in growth factors and applied for the stimulation of tissue repair, improvement of healing, and diminishment of inflammation. It is the most commonly used treatment in regenerative medicine for sports injuries, osteoarthritis, chronic pain, and wound healing. It has been noted that PRP might hasten recovery and enhance results by amplifying natural healing processes within the body.

Oncology: The oncology segment has dominated the market in 2024. In oncology, approaches in regenerative medicine have been more and more recently applied to cancer treatment and recovery. Gene therapy, immunotherapy, and cell-based therapies, such as CAR-T cell therapy, are also pursued to target and kill these cancerous cells. Regenerative techniques are applied to recover tissues that were damaged from anticancer treatment either chemotherapeutically or radiolytically. All this promises better survival rates reduction in side effects and enhanced quality of life for patients.

Orthopedics: The most critical area in the field of orthopedics are bone repair and regeneration, joint repair and regeneration, and soft tissue repair and regeneration. Some techniques include stem cell therapy, tissue engineering, and PRP injections. In the case of osteoarthritis, cartilage damage, and tendon injuries, such treatments can be employed. Through promoting tissue regeneration, thereby reducing the use of invasive surgeries, the approach in orthopedics regenerates healing, reduces pain, and accelerates recovery in a very effective way, hence allowing patients to have choices towards conventional orthopedic treatment and surgical interventions.

Regenerative Medicine Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Dermatology | 13.70% |

| Musculoskeletal | 20.10% |

| Immunology & Inflammation | 17.40% |

| Oncology | 29.60% |

| Cardiovascular | 4.30% |

| Ophthalmology | 2.10% |

| Others | 12.80% |

Wound care: Wound care is one area of regenerative medicine concerned with the acceleration of healing chronic wounds or hard-to-heal wounds, including diabetic ulcers, burns, and pressure sores. The use of products such as stem cells, growth factors, and bioengineered tissues helps accelerate tissue regeneration and minimize scarring. It is also very important to patients with compromised healing capacities due to conditions such as diabetes. Regenerative therapy in wound care is aimed at restoring skin integrity, reducing infection risks, and improving the healing process of complex wounds.

Rare Diseases: These interventions appear promising for the treatment of rare diseases, more of genetic origins, or where more established interventions can offer little benefit. Promising gene therapy for metabolic inherited disorders, rare syndromes of genetic origin, and other orphan diseases appear to be tissue engineering and stem cell therapies. These therapies attempt to repair or replace defective genes, rebuild damaged tissues, and hold much promise for patients suffering from disorders with few treatment options; thus, they play a crucial role in rare disease management.

Hospitals: The hospitals accounts for the highest market share in 2024. Hospitals are among the biggest end-users of regenerative medicine products and therapies. Such hospitals can offer advanced treatments such as cell therapies, gene therapies, and tissue engineering for some complex or chronic conditions facing patients. Hospitals use regenerative medicine technologies in surgeries and the post-operative recovery of patients and also specialize in special treatments for heart diseases, cancers, or orthopedic injuries. The increasing area demands that hospitals become integral to advancing medical care and further patient outcomes with cutting-edge regenerative therapies.

Clinics: Recent centers include clinics and centers devoted particularly to regenerative medicine: accepting modern advanced therapies such as injections using PRP, stem cell therapy, and gene therapy. This is a more patient-driven approach to the treatment process with fewer invasive procedures to heal and regenerate patients. The major complaints that patients bring include non-surgical intervention of musculoskeletal injuries and pain management, even some chronic conditions. Clinics are personalized; they also have shorter recovery times in comparison to the traditional ways of treatment, which may attract people looking for regenerative alternative therapies.

Others: This category includes research institutes, pharmaceutical companies, and firms in biotechnology. Organizations under this category deal with the research, development, testing, and commercialization of the products of regenerative medicine. Research institutes have done studies and clinical trials on therapeutic effects to further understand its effectiveness. Biotech firms place more emphasis on the processes of innovation and manufacturing. Most of the rehabilitation centers as well as specialized centers have increased the scope for usage of regenerative medicine.

The regenerative medicine market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

The North America regenerative medicine market size was valued at USD 7.82 billion in 2024 and is expected to be worth around USD 43.65 billion by 2034. The U.S. leads this field globally. It has an advanced healthcare structure, strong research and development capabilities, and a favorable regulatory environment such as FDA approval of therapies that include CAR-T cell therapy and stem cell treatments. Under this new "Home as a Health Care Hub" initiative, by the FDA, the home environment is considered an integrated addition to the healthcare system. It also touches upon disparities in healthcare access experienced by a large percentage of communities that are considered to be both minority and low-income. A prototype home is being designed, in collaboration with an architectural firm, to integrate augmented reality and virtual reality, focusing on chronic conditions such as diabetes. This effort would be looking into improving the way medical devices can be incorporated to provide care in more innovative ways with better outcomes for health. Canada also is growing because of governmental support in researching medicine and its clinical trials. The North American market would continue to rise with growing chronic diseases and an aging population with demand for personalized medicine.

The Europe regenerative medicine market size was estimated at USD 3.88 billion in 2024 and is poised to grow around USD 21.67 billion by 2034. Growth opportunities are high, because the region's healthcare systems are advanced and it has invested much in biotechnology research. Key players in the country include United Kingdom, Germany, France, and Switzerland. The EMA has been very progressive in approving stem cell therapies, gene therapies, and tissue engineering products. For instance, this is the gene-editing treatment Casgevy, for which the EMA approved in December 2023 for beta-thalassemia and severe sickle cell disease. Using the technology known as CRISPR/Cas9, Casgevy modifies patients' blood stem cells to enhance the production of fetal hemoglobin, which may obviate the need for frequent transfusions and painful crises, so early trials have shown major efficacy, with most subjects remaining transfusion-free or crisis-free for over a year. The therapy awaits marketing approval EU-wide and additional research that would establish the drug's long-term safety and effectiveness. The UK has grown exponentially in the regenerative medicine sector because of funding the government has provided for research in stem cells and the founding of various biotech firms. Because Europe is rapidly aging, there is increased demand for new therapies aimed at the treatment of degenerative age-related diseases, thereby enhancing the growth prospects of the market.

The Asia-Pacific regenerative medicine market size was accounted for USD 1.46 billion in 2024 and is expected to grow around USD 8.15 billion by 2034. The Asia-Pacific region is increasingly emerging as a significant market for regenerative medicine driven by rapid growth in biotechnology, growing investments in healthcare infrastructure, and increasing awareness of regenerative treatment. Key players of the region are China, Japan, South Korea, and India. Japan is an example of one of the first countries where approval has been given to stem cell-based therapies in the clinic. It involves the historic approval of autologous stem cell therapies for macular degeneration and more. South Korea has significantly advanced in regenerative medicine, having a very developed biotechnology sector and increasing government support for stem cell research. The market in China and India is growing, driven by increasing demand for healthcare, a growing burden of chronic diseases, and improving regulatory frameworks. A large population base and growing healthcare expenditure will support the continued growth of the regenerative medicine market in this region.

The LAMEA regenerative medicine market was valued at USD 0.61 billion in 2024 and is anticipated to reach around USD 3.38 billion by 2034. This is the most minor market in regenerative medicine at present but shows quite promising growth potential. A few countries in Latin America, such as Brazil, Mexico, and Argentina, have commenced investing more in regenerative medicine primarily in the fields of stem cell studies and tissue engineering. The Middle East, especially in the United Arab Emirates, Saudi Arabia, and Qatar, has experienced a heightened interest in advanced healthcare technologies, especially in regenerative therapies. This region has heavily invested in biotech startups and clinical trials. In Africa, although the market for regenerative medicine is still at its very inception, some countries such as South Africa and Egypt are making steps towards access to cutting-edge medical technologies. Demand could thus increase in the future led by growth in healthcare infrastructure along with a rise in regenerative medicine awareness in that part of the world, although probably predominantly in solutions to highly debilitating disease burdens like cardiovascular and injury conditions. Regulatory barriers are large, and so is this matter of cost and easy accessibility to health care as these are also huge issues restricting expansive augmentation.

Strategically, the acquisitions in this regenerative medicine market include steps toward increased technological capacity and diversification of the products. This would bring therapy development forward, leading companies to invest in high-value technologies like gene therapy and stem cell-based treatments for more aggressive competition and upgrade their offerings to include 3D bioprinting. Such endeavors also focus on strengthening the R&D capabilities to accelerate the pace of commercializing next-generation treatments of different diseases, such as orthopedic, cardiovascular, and neurological diseases. Acquisition for the sake of new intellectual property access, integrating complementary technologies, and building a competitive edge in a rapidly growing space such as regenerative medicine is also on the rise. Such collaboration by the health systems, biotech companies, and the regulatory bodies ensure that with every increment in market growth, a corresponding pace with which the treatments are said to transition from the laboratory to patients is maintained.

Key Developments in Regenerative Medicine Market Some notable examples are:

Market Segmentation

By Product

By Application

By End User

By Region