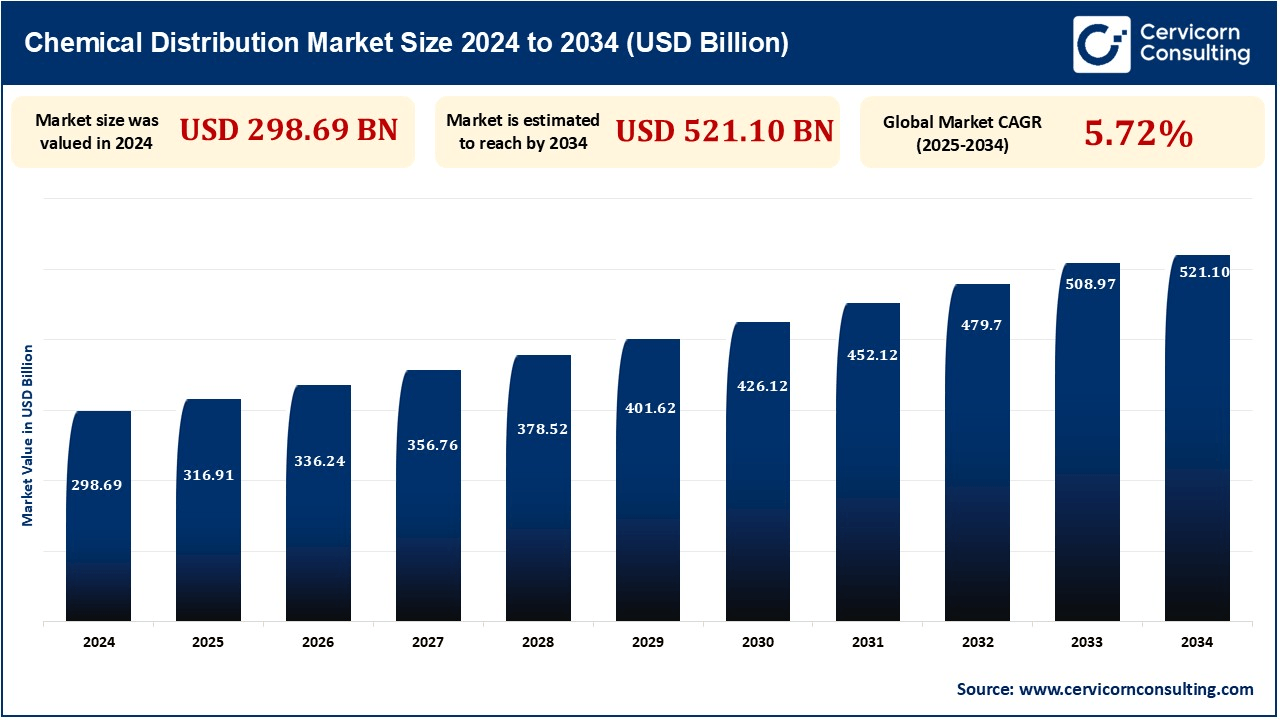

The global chemical distribution market size is expected to surge around USD 521.10 billion by 2034 from USD 298.69 billion in 2024, exhibiting at a compound annual growth rate (CAGR) of 5.72% over the forecast period 2025 to 2034. The chemical distribution industry is experiencing elevated growth rates with the growing demand across various end-user industries, such as pharmaceuticals, agriculture, construction, and automotive. Increasing complexity of worldwide supply chains has also further enhanced the necessity of effective chemical distribution networks in delivering raw materials and specialty chemicals timely and securely.

Additionally, automated and digitalization of logistics enhanced the operational efficiency, reducing expenses and improving the traceability. Moreover, environmentally stringent regulatory environments and sustainability policies are forcing enterprises to adopt environmentally friendly distribution procedures, such as green packaging and route optimization. The industry is also benefiting from the growth in emerging markets, particularly in the Asia-Pacific, where urbanization and industrialization are creating real opportunities.

Growing emphasis towards sustainability has fueled the use of green chemicals across sectors like manufacturing, personal care, and agriculture. Increasing environmental regulations and sustainability drives among corporations are nudging manufacturers toward utilizing biodegradable, non-toxic, and energy-efficient substitutes. Distributors are expecting to add more low-VOC products, bio-based chemicals, and green solvents to their portfolio. For instance, organizations such as Brenntag and Univar Solutions are making investments in green product lines so that they can ride on this growing demand and enable industries to switch over to greener chemical applications.

Chemical industry is facing growing demand for specialty chemicals based on their use in the field of pharmaceuticals, electronics, paints, and food processing. At the same time, sectors such as agriculture and construction demand bulk chemicals such as solvents, acids, and polymers. This is the trend changing network of distributors since companies are investing in segmented storage and transportation facilities to meet diverse customer needs. For example, Brenntag AG expanded its specialty chemicals portfolio, focusing on niche areas calling for high-purity and performance-driven formulations.

For instance, In May 2024, Scottish green chemicals manufacturer Celtic Renewables launched a crowdfunding campaign on Crowdcube, aiming to raise a minimum of £2.75 million to enhance its operational capabilities and drive revenue growth. The company's innovative production of bioacetone and biobutanol supports the development of cosmetics, paints, household cleaners, and other consumer goods, contributing to a reduced carbon footprint. Celtic Renewables recently delivered its first batch of bio-based chemicals to Caldic, its distribution partner, which specializes in custom solutions for food processing, pharmaceuticals, personal care, and industrial manufacturing. This partnership is expected to accelerate market adoption of sustainable chemical alternatives across multiple industries.

The chemical distribution business has high cost of transportation, warehousing, and regulatory compliance that hinders the growth of the chemical distribution market. Special storage facilities, temperature control conditions, and handling of hazardous substances increase the cost. Increases in fuel prices, supply chain disruptions, and prohibitive global trade regulations also increase the cost. Automating processes, tracking systems, and environmentally friendly modes of transportation are investments being made by companies to reduce costs. For example, Tricon Energy has adopted AI-powered logistics optimization to streamline operations and minimize inefficiencies in bulk chemical transportation.

Pressure on green and biodegradable chemicals is forcing material opportunity for chemical distributors. Players in the industry are turning to bio-based solvents, vegetable surfactants, and nontoxic industrial chemicals as a way of pushing back against stringent green regulation and corporate ESG goals. Certain distributors such as Univar Solutions and Brenntag AG are expanding their portfolios into green chemistry products as a way of meeting escalating market demand. The increased use of environmentally friendly coatings, adhesives, and detergents in the automobile, packaging, and textile industries is also driving this opportunity. For instance, in 2024, Synthos launched Synthos Synexil SAB O5, a dispersion for producing eco-friendly construction chemicals.

| Attributes | Details |

| Chemical Distribution Market Size in 2025 | |

| Chemical Distribution Market CAGR | |

| Key Players |

|

| By Type |

|

| By End User |

|

| By Distribution Type |

|

| By Region |

|

North America is a significant chemical distribution industry due to sound industrialization, a sound manufacturing base, and high demand for specialty chemicals. The United States and Canada spearhead the sector in the continent, with vast applications in vehicle, pharmaceuticals, agriculture, and construction sectors. Stringent environmental regulation has driven green chemicals and bio-based chemicals demand. Having prominent chemical distributors such as Univar Solutions, Brenntag, and Nexeo Solutions ensures a robust supply chain. In addition, advancements in chemical logistics, digitalization, and e-commerce platforms are transforming the distribution environment to make supply chain management easy and enhance market penetration in various sectors.

Asia-Pacific is the biggest and most rapidly expanding chemical distribution market, fueled by industrialization, urbanization, and increasing chemicals demand in manufacturing and agriculture. The region is dominated by nations such as China, India, Japan, and South Korea, driven by increasing construction, electronics, automotive, and pharmaceutical industries. China is the largest producer and consumer of chemicals globally, with well-developed supply chains and government-supported initiatives underpinning the sector. The region is observing increasing investments in specialty chemicals, digital supply chains, and e-commerce-based platforms for chemical distribution, which are transforming it into a strategic location both for domestic consumption and international chemical trade. China dominates chemical production globally, particularly in the area of primary chemicals, accounting for 44% of global production and 46% of the world's capital in 2022. The country is set to be world-leader and self-sufficient by expanding its area into consumer and specialty chemicals. On the other hand, India is a key growth driver of Asia-Pacific's chemical distribution business and ranks fifth in the world with a diversified industry of 80,000+ products. The industry is a prominent driver of the supply of raw materials to other end-user industries, which is responsible for India's growth.

Commodity chemicals are standard, volume-produced chemicals that are basic raw materials for many industries. Examples include acids, bases, salts, polymers, and petrochemicals like ethylene, benzene, and methanol. Since they are produced on a large scale, commodity chemicals are economical and widely accessible. Commodity chemicals find widespread use in construction, agriculture, and manufacturing industries in end-use products like fertilizers, adhesives, coatings, and industrial solvents. Industrialization, population growth, and development of infrastructure, especially in emerging markets like China, India, and Brazil, where urbanization is increasing exponentially, fuel commodity chemical growth.

Construction is one of the largest users of commodity and specialty chemicals, including cements, adhesives, sealants, water repellents, and thermal insulation materials. These enhance durability, fire retardation, and strength in residential, commercial, and industrial structures. Some specialty chemicals, such as polyurethane foams, epoxy resins, and flame retardants, have strong demand in energy-efficient and green building projects. As infrastructure development and urbanization are flourishing, particularly in the Middle East and Asia-Pacific regions, the need for protective materials, coatings, and chemical additives is consistently rising.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2314

Ask here for more details@ sales@cervicornconsulting.com