The cold storage market is witnessing a rapid growth rate on account of the rising demand for perishable food Type, growth of the pharmaceutical industry, and increased need for effective supply chain management. Improved technologies in refrigeration, strict government regulations regarding food safety, and increasing usage of e-commerce for grocery and food delivery services also support the growth of the market.

Moreover, Stringent food safety and storage regulations from the government, combined with the globalization of trade for Temperature type-sensitive products, are further providing an impetus for adequately equipped cold storage facilities. With consumers increasingly favoring frozen and processed foods, the market should continue its growth in the coming years, fuelled by the demand for efficient and scalable cold chain solutions. For instance, The USDA estimated gross refrigerated storage capacity in the US to be around 104.8 million cubic metres (3.70 billion cubic feet) in 2023. Usable refrigerated storage capacity, defined as the actual area used for storing commodities, represented 81% of the gross space. The total number of refrigerated warehouses was 900.

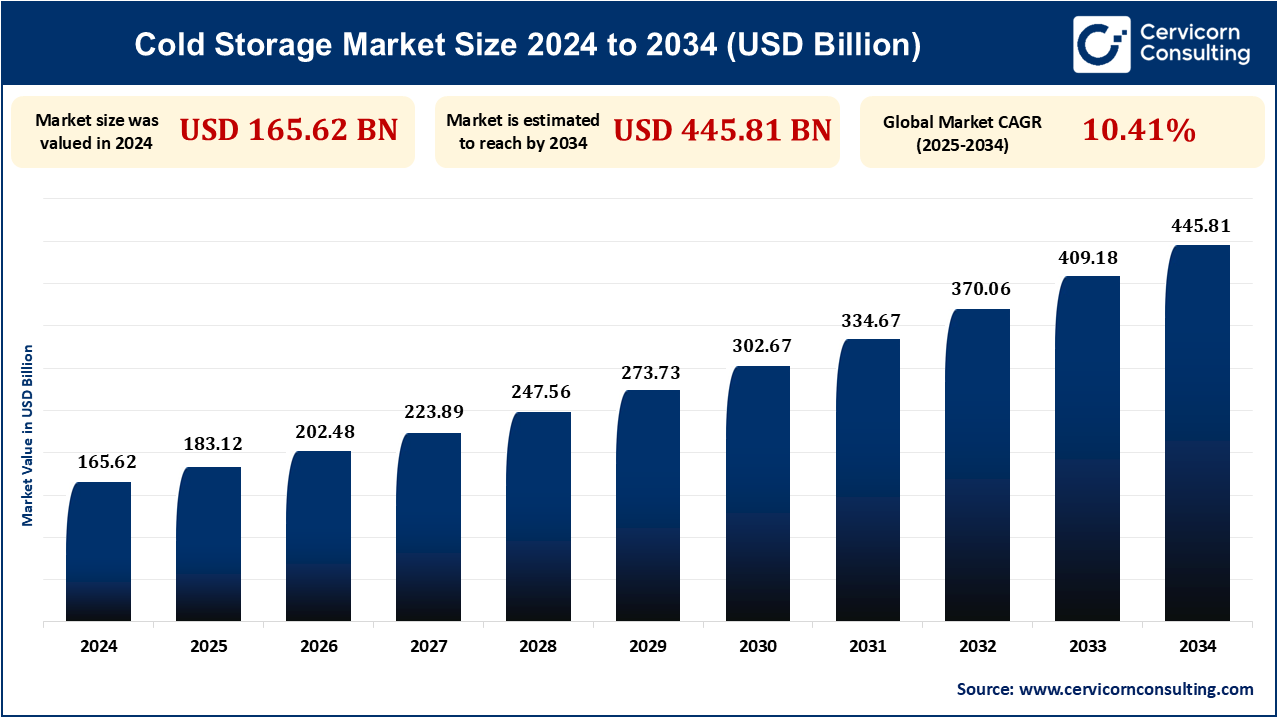

The global cold storage market size is calculated at USD 183.12 billion in 2024 and is expected to be worth around USD 445.81 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 10.41% over the forecast period 2025 to 2034.

Cold storage market is also moving towards automations and integration of newer technology, which are significantly boosting the level of efficiency and cost in operations. Automated storage and retrieval systems (AS/RS), Internet of Things (IoT)-based temperature monitoring, AI predictive maintenance, and robots are being implemented by organizations to increase warehouse operations.

These technologies minimize the extent of human intervention, lower energy consumption, and ensure quality control by means of temperature control in close proximity. For instance, NewCold, a global automated cold storage pioneer, has developed fully automated warehouses that have significantly enhanced logistics efficiency. AI analytics also provide predictive demand forecasting, enabling businesses to manage their inventory more effectively. Use of blockchain technology in cold chain logistics also provides traceability and transparency, minimizing product spoilage risks. Since the trend is shifting towards complete automation, those investing in smart cold storage systems are in a favorable position.

Increased need for frozen and cold food items as well as temperature-sensitive drugs has driven the growth of cold chain logistics. Cold chain logistics refer to temperature-regulated storage and transit facilities that maintain the quality of products from production to point of use by an end-consumer. The expansion is being driven by aggressive expansion in e-grocery platforms such as Amazon Fresh and Walmart+, which require quick cold storage facilities to meet rapidly rising customer needs for speed and freshness of delivery. The pharmaceutical industry's dependence on protected temperature-controlled delivery networks, especially for vaccines and biologics, has added to the demand for specialized cold storage facilities.

Companies are making investments in refrigerated high-tech trucks, air freight capacity, and insulation packaging materials to ensure product stability. Strategic partnerships among cold-storage operators and logistics service providers are also enhancing supply chain performance, reducing transit time and risk of spoilage. For instance, as of October, 2023. Gross refrigerated storage capacity in the United States totalled 3.70 billion cubic feet.

One of the significant restraints in the cold storage market is the high operational cost associated with maintaining temperature-controlled environments. Cold stores require continuous refrigeration, sophisticated insulation, and humidity control facilities, which are high electricity consumers. Most of the operational cost is spent on electricity charges, particularly in regions of high electricity tariff. In addition, food safety and pharmaceutical storage regulatory compliance involves investing in monitoring systems, equipment, and audits, all of which are costly. The need for alternative power sources, such as generators and renewable energy, adds to capital costs. While automation and energy-efficient technologies reduce the expenditure, the initial capital investment is still a handicap for small and medium-sized companies, limiting the expansion of cold storage facilities in emerging markets.

Cold storage has seen rising investment and consolidation, with firms competing to upgrade their technology and infrastructure capabilities. Investors are looking at long-term prospects for the expansion of the sector on the back of rising demand for perishables across the world. Private equity funds and real estate investment trusts (REITs) are buying cold storage warehouses aggressively, and big deals indicate very high market confidence.

For instance, Americold Realty Trust and Lineage Logistics, the two top cold storage companies, have grown aggressively by acquiring businesses to boost their presence in strategic markets. Mergers and acquisitions help companies grow in scale, expand technological capacity, and rationalize supply chain networks. Furthermore, government subsidies favoring cold storage infrastructure development further draw investments. With increased competition, financially stable companies with solid partnerships will reign supreme in the changing cold storage environment.

For instance, In September 2024, BGO and Yukon Real Estate Partners partnered to develop a sustainable cold storage warehouse in New Century, Kansas. Spanning 291,000 square feet, the facility will be leased by CJ Logistics America and primarily serve Flora Food Group. Designed to meet the increasing demand for modern cold storage solutions, the warehouse will feature advanced refrigeration systems, rail connectivity, and eco-friendly design elements to minimize its environmental impact. This initiative underscores a commitment to sustainability while enhancing supply chain efficiency in the region.

| Attributes | Details |

| Cold Storage Market Size in 2025 | USD 183.12 Billion |

| Cold Storage Market CAGR | 10.41% from 2025 to 2034 |

| Key Players |

|

| By Storage Type |

|

| By Temperature Range |

|

| By Construction |

|

| By Application |

|

| By Region |

|

Asia-Pacific (APAC) is the most rapidly growing market for cold storage, with fast industrialization, urbanization, and rising demand for perishable food items fueling market growth. The region's expanding middle-class population and shifting consumer preferences towards frozen and processed foods have greatly increased the demand for effective cold chain logistics. Nations such as China, India, and Japan are seeing significant investments in refrigerated warehousing and transportation facilities to keep pace with the surging food and pharmaceutical industries.

Government initiatives in favor of food safety, reduction in post-harvest losses, and upgradation of export facilities are also facilitating market growth. Increasing e-commerce business, particularly online meal and grocery delivery service, also augments demand for advanced cold storage solutions. Evolving technology in the form of AI-based temperature tracking and automatic cold store setup in warehouses are also propelling the rapid development of the region in the cold storage market.

For instance, in 2023, Uttar Pradesh had the highest capacity of cold chain storage equaling nearly 1.5 million metric tons, more than two times of the state in the second place. During the same period, India as a whole had cold chain storage capacity of 39.4 million metric tons.

North America dominates the world cold storage market with the largest market share in 2024, supported by sophisticated infrastructure, growing demand for frozen and processed food, and a well-developed logistics system. The availability of large players, ongoing investments in automation, and stringent regulatory requirements for food safety also enhance market growth. Increased adoption of online shopping for groceries and e-commerce-led cold chain logistics has driven the demand for larger refrigerated warehousing and transport facilities.

Furthermore, the use of temperature-controlled storage by the pharmaceutical industry, particularly for vaccines and biologics, drives the dominance in the region. The U.S. and Canada are the largest contributors, with government assistance towards green and energy-efficient cold storage warehouses. Increasing technological developments, including IoT-based tracking and AI-based inventory management, are further bolstering the North American cold storage market.

Refrigerated warehouses are climate-controlled storage warehouses that are equipped to store perishable goods such as food, drugs, and chemicals in a healthy condition. They employ the latest cooling technologies, insulation, and humidity control systems to deliver product integrity. They cater to industries requiring prolonged storage, such as grocery stores, food processing facilities, and health care centers. The increase in demand for frozen and processed food, along with increased grocery delivery through internet business, is fueling the expansion of refrigerated warehouses. Other technology innovations like automated storage and retrieval systems (AS/RS) enhance productivity and reduce energy consumption in such warehouses.

Frozen storage maintains temperatures at below -18°C to preserve items like meat, seafood, frozen fruits and vegetables, and prepared meals. It is a critical area for shelf life extension and preservation against microbial development in perishable items. Rising demand for frozen food, supported by convenience and urbanization, is driving growth in frozen storage facilities. Pharmaceuticals also depend on cold storage for some drugs and vaccines. Advances in freezing technology, including blast freezing and cryogenic freezing, are making cold storage more efficient and saving energy.

Cold storage is essential for frozen desserts and dairy like milk, butter, cheese, yogurt, and ice cream, which need strict temperature control to maintain quality. Dairy products are perishable and sensitive to temperature and need efficient cold chain logistics. Growth in the market is being fueled by demand growth for frozen desserts, plant-based dairy alternatives, and dairy-based snacks. Refrigeration and packaging innovations, as well as growing consumption of dairy products in developing economies, are driving demand for specialized storage solutions in this category. Fish, meat, and seafood need to be stored and transported in tightly regulated temperatures to avoid spoilage and bacterial growth.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2322

Ask here for more details@ sales@cervicornconsulting.com