Cold Chain Market Size and Growth 2025 To 2034

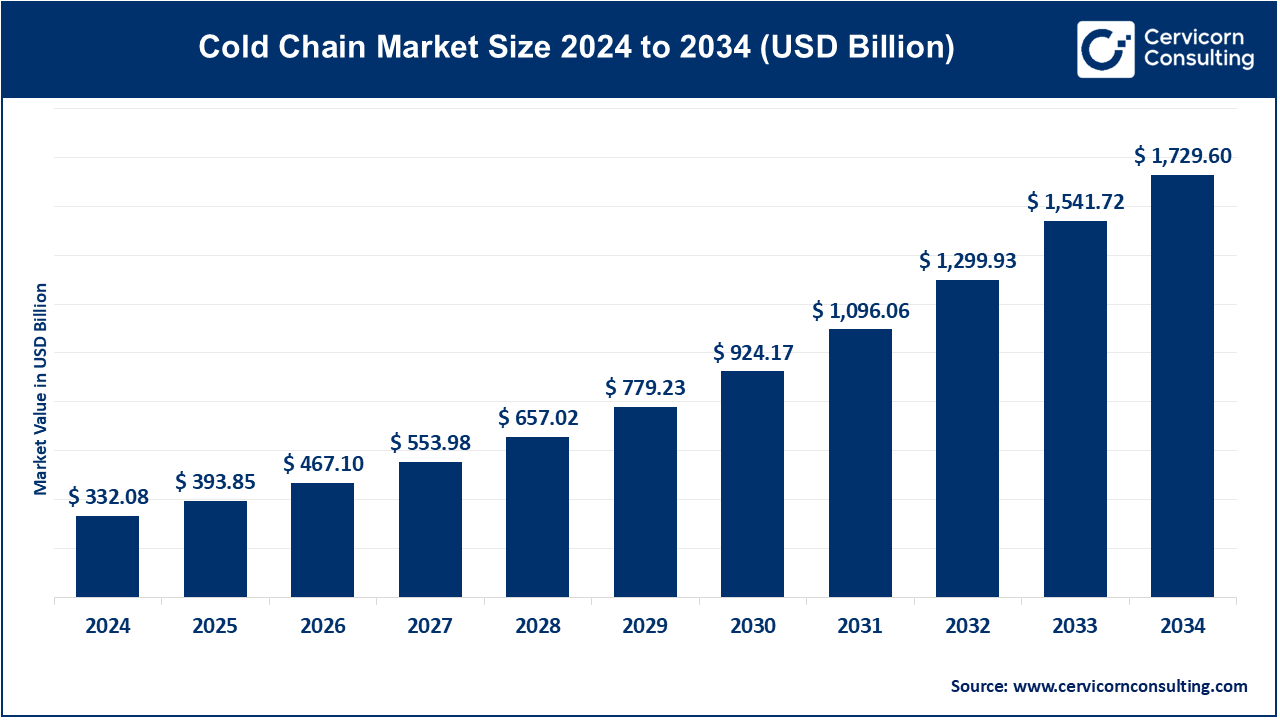

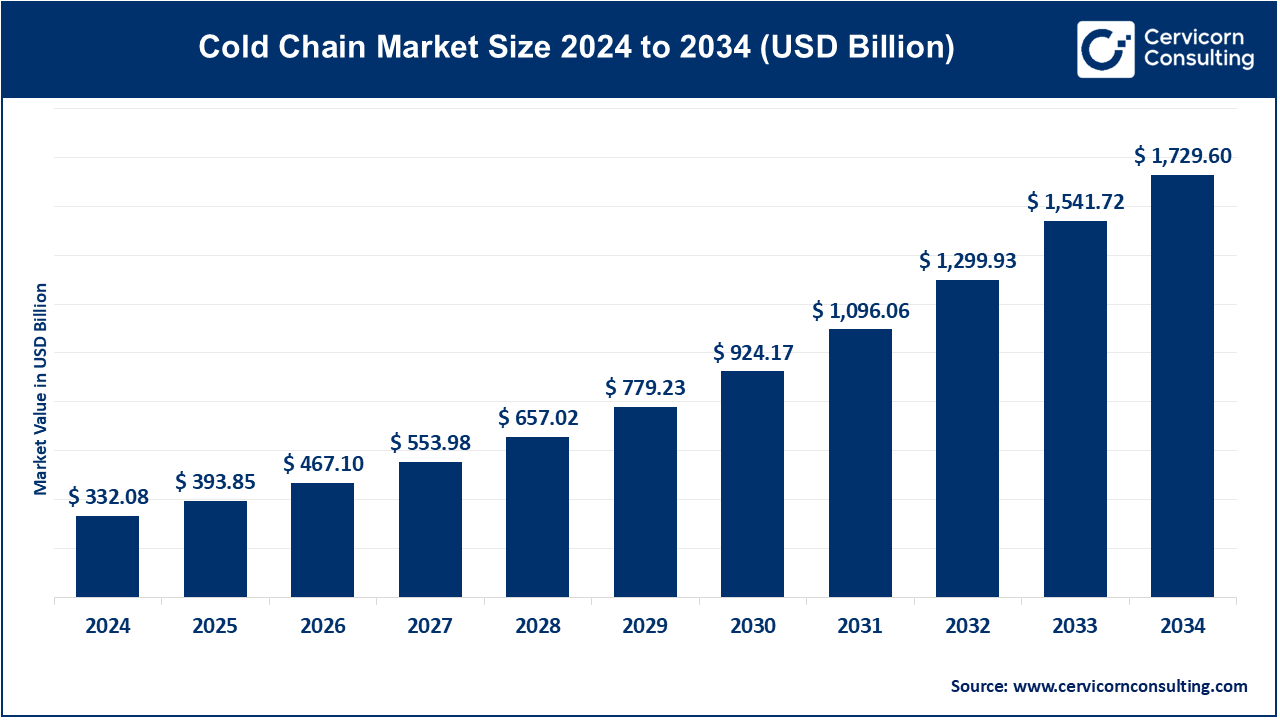

The global cold chain market size was valued at USD 332.08 billion in 2024 and is expected to reach around USD 1,729.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.06% over the forecast period 2025 to 2034.

The cold chain market is experiencing rapid expansion due to increasing globalization, urbanization, and the growing consumer demand for fresh, high-quality perishable products. The surge in online grocery shopping, especially for frozen and fresh food items, has significantly driven investments in cold storage and transportation infrastructure. The pharmaceutical industry is another major contributor to this growth, as temperature-sensitive drugs, vaccines, and biologics require specialized cold chain systems to ensure efficacy. Additionally, government regulations emphasizing food safety and pharmaceutical quality standards are pushing companies to adopt advanced cold chain solutions. Emerging technologies, such as IoT-enabled monitoring, AI-driven predictive analytics, and blockchain for traceability, are transforming the cold chain industry. These innovations are improving operational efficiency and minimizing losses due to temperature fluctuations. In regions like Asia-Pacific, the expansion of middle-class populations and rising disposable incomes are fueling demand for high-quality perishable products, further driving the need for enhanced cold chain logistics.

A cold chain is a temperature-controlled supply chain system used to store, transport, and distribute perishable goods, such as food, pharmaceuticals, and biologics, while maintaining their quality and safety. It relies on advanced refrigeration and monitoring technologies to ensure optimal temperature ranges throughout the supply chain. Key components of a cold chain include refrigerated storage facilities, temperature-controlled vehicles, and specialized packaging solutions. The cold chain can be classified into two main types, refrigerated storage, which includes warehouses and facilities that maintain goods at specific temperatures for extended periods, and refrigerated transportation, involving temperature-controlled trucks, containers, and cargo ships to transport goods across short or long distances. Another emerging type is cold chain monitoring, which uses IoT sensors and software to track and report real-time temperature data to ensure compliance with quality standards.

- “Surendra Ahirwar, Joint Secretary of DPIIT, indicates that India’s cold chain sector, crucial to the logistics ecosystem, is poised for substantial growth and innovation. This expansion reflects the sector’s increasing importance and potential for development in the coming years.”

- ” The NCCD is revising cold chain guidelines to serve as a roadmap for government bodies. The Joint Secretary highlighted the significance of industry initiatives, including innovations, infrastructure development, and collaborations between industry and academia, in enhancing the sector’s effectiveness and growth.”

- “U.S. frozen food sales exceeded $72 billion, according to the American Frozen Food Institute. CEO Alison Bodor noted that this growth is ongoing, which could put pressure on critical cold storage supply chains to meet increasing demand.”

Cold Chain Market Report Highlights

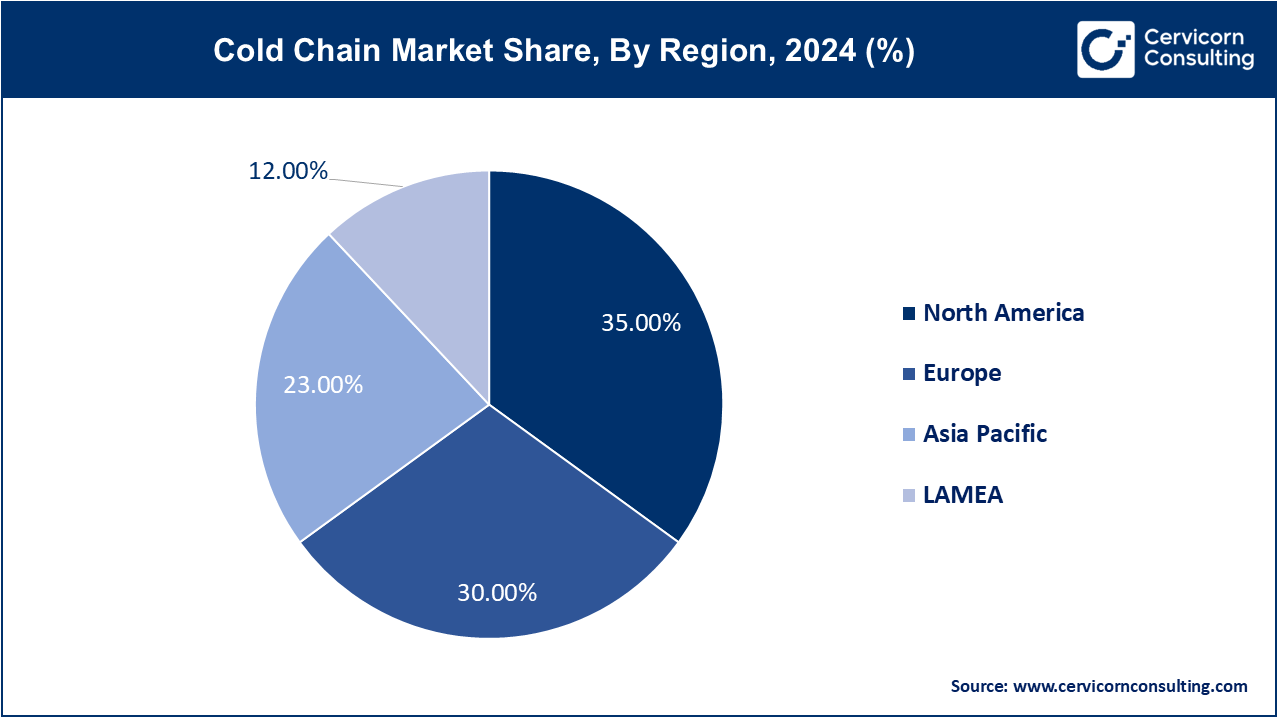

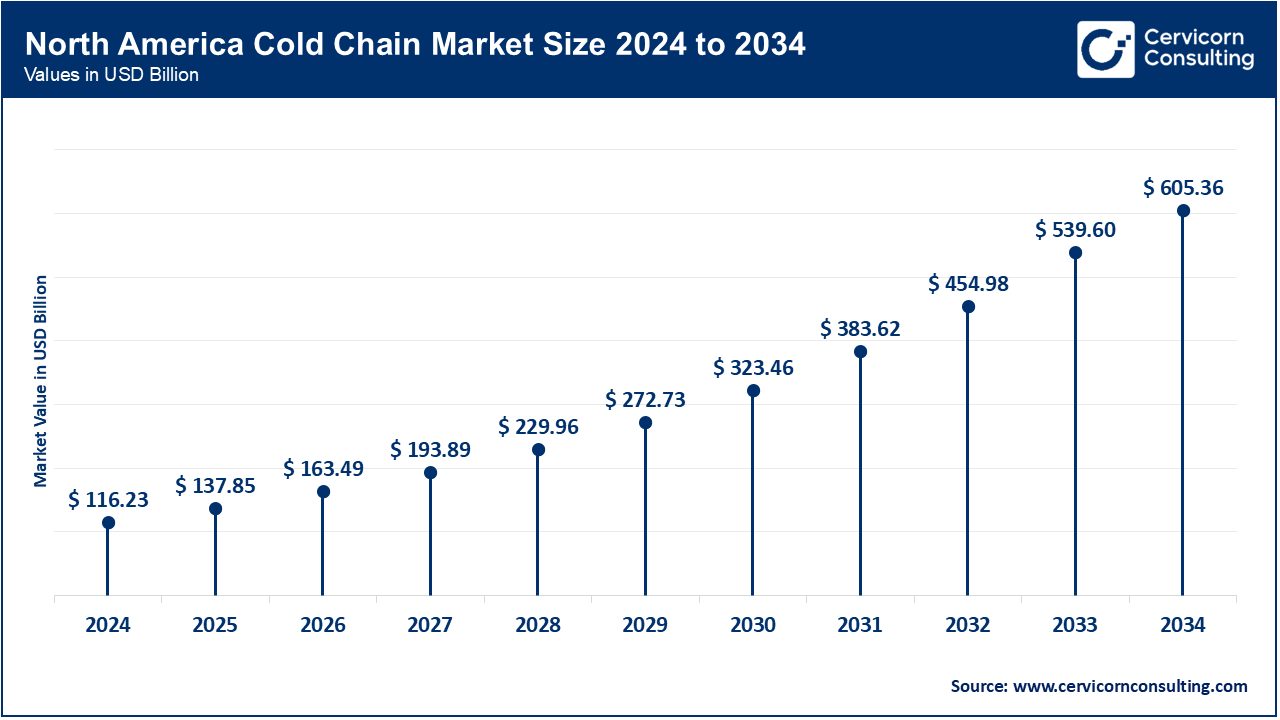

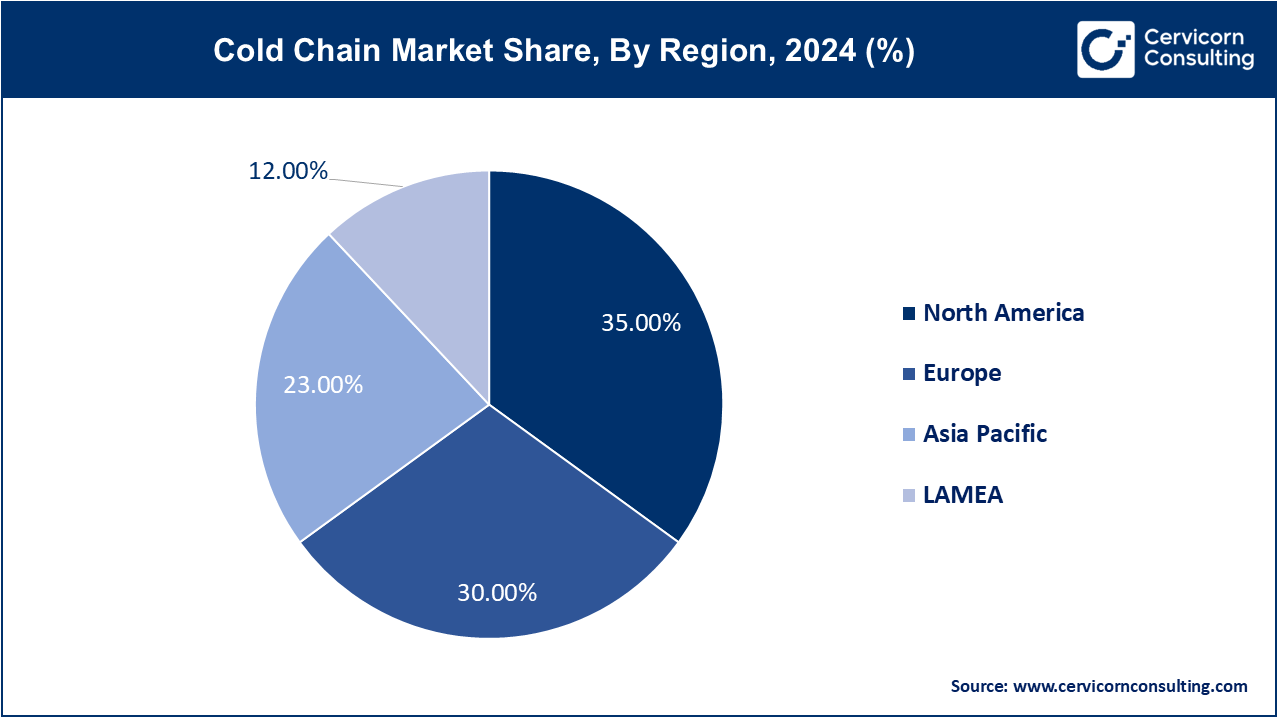

- North America has registered highest revenue share of 35% in 2024.

- Europe has generated second highest revenue share of 30% in 2024.

- Latin America and Middle East & Africa has recorded 12% market share combined.

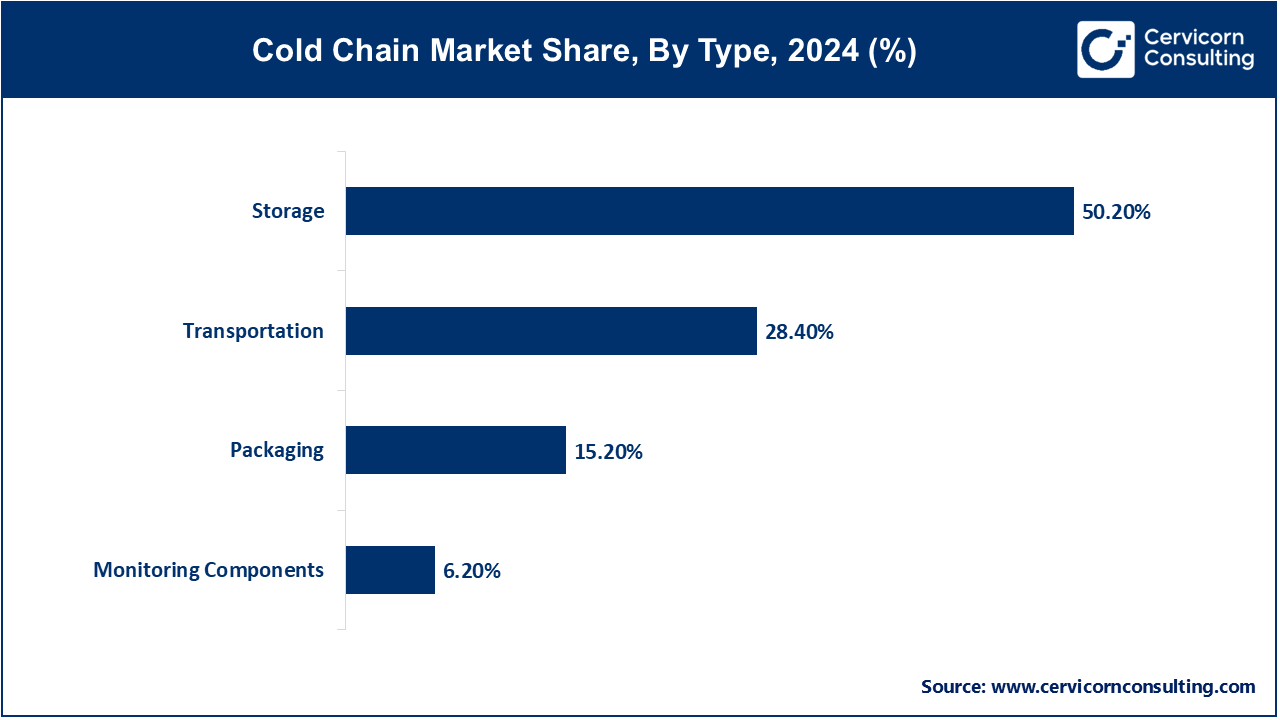

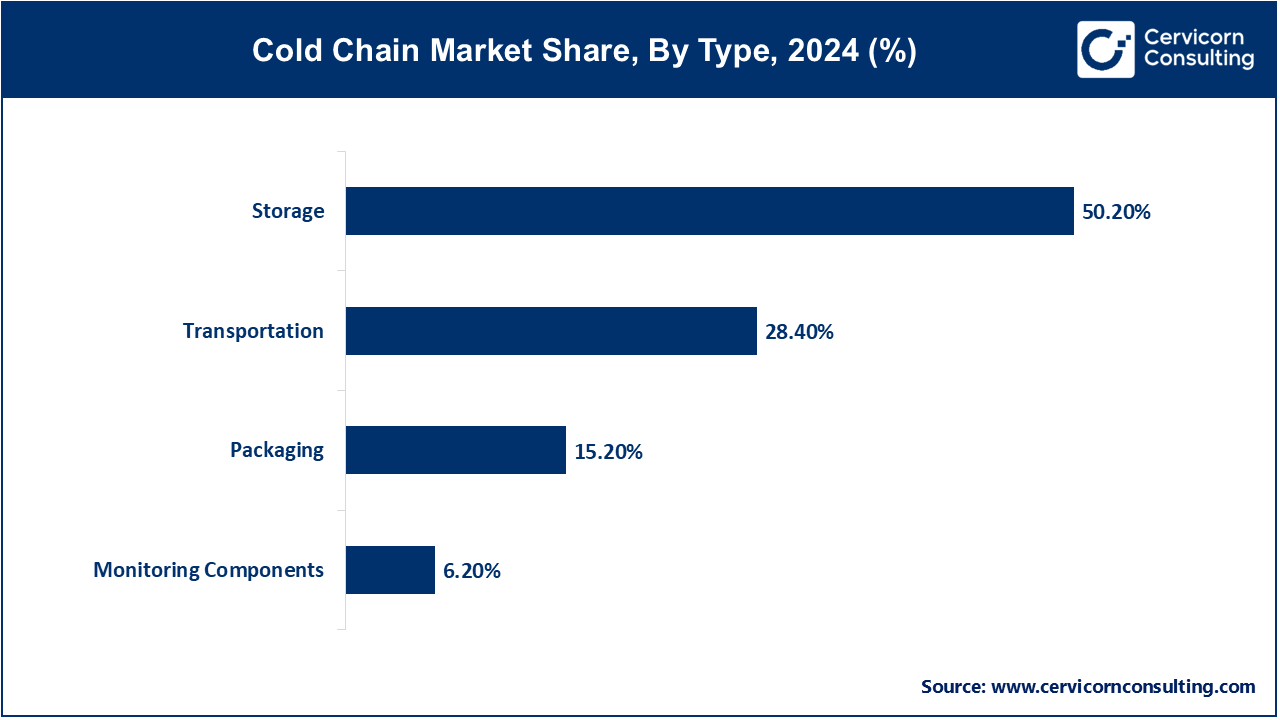

- By type, The storage segment has dominated the market with share of 50.2% in 2024.

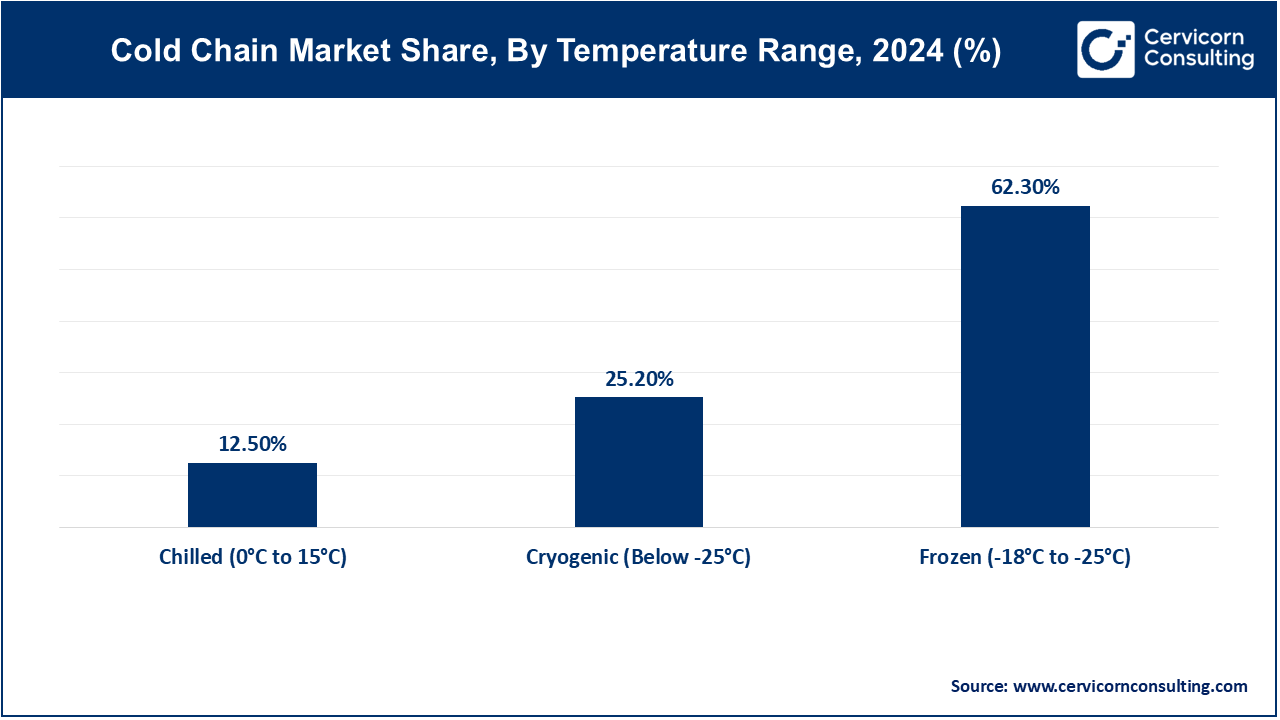

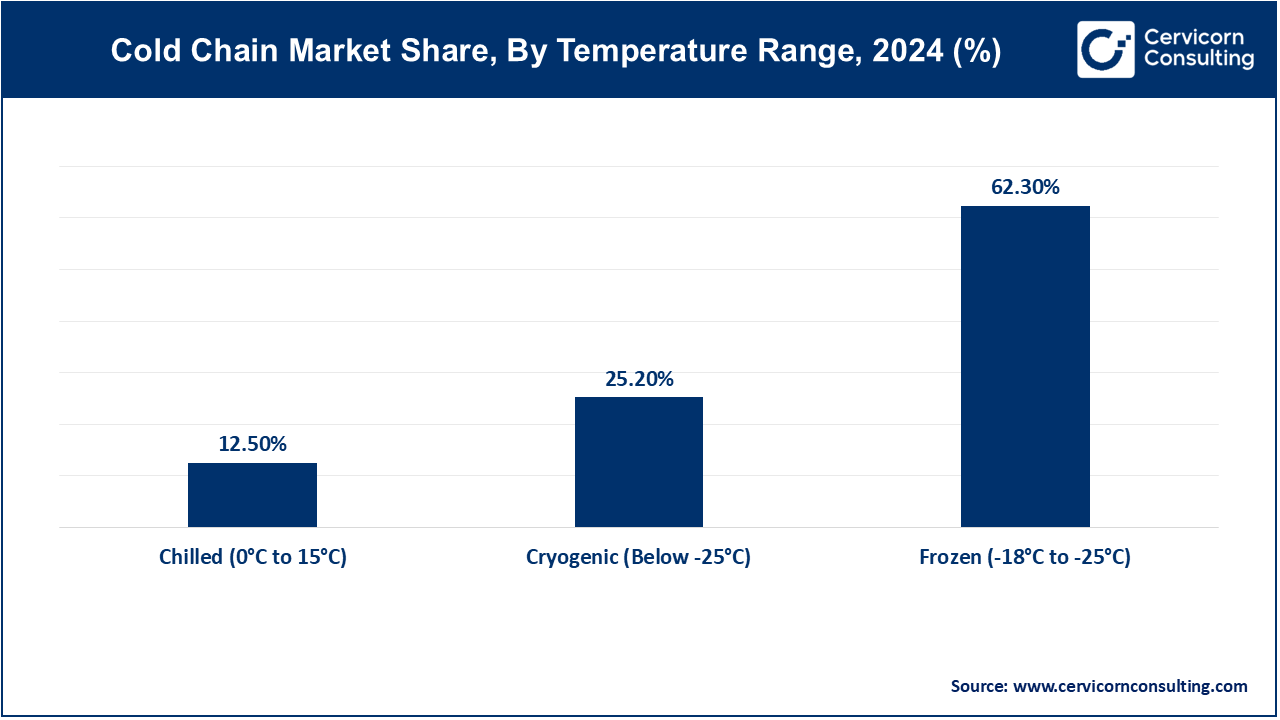

- By temperature range, The frozen (-18°C to -25°C) segment has captured highest market share of 62.3% in 2024.

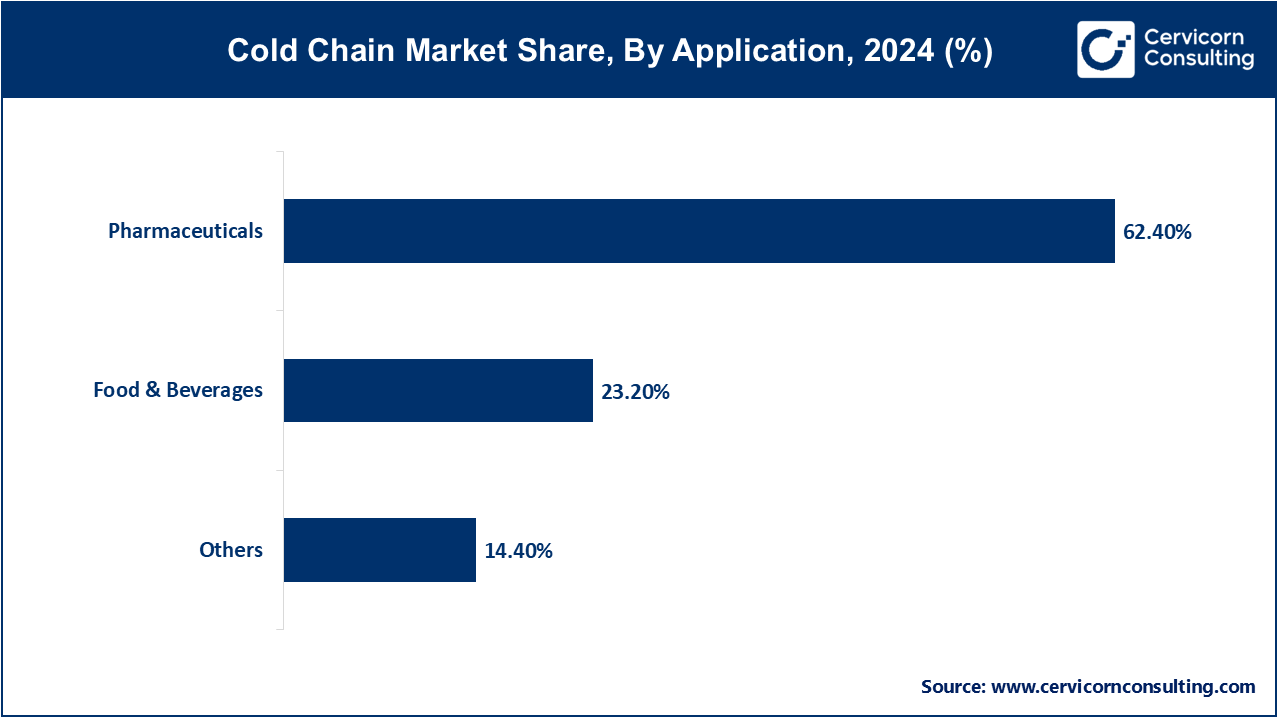

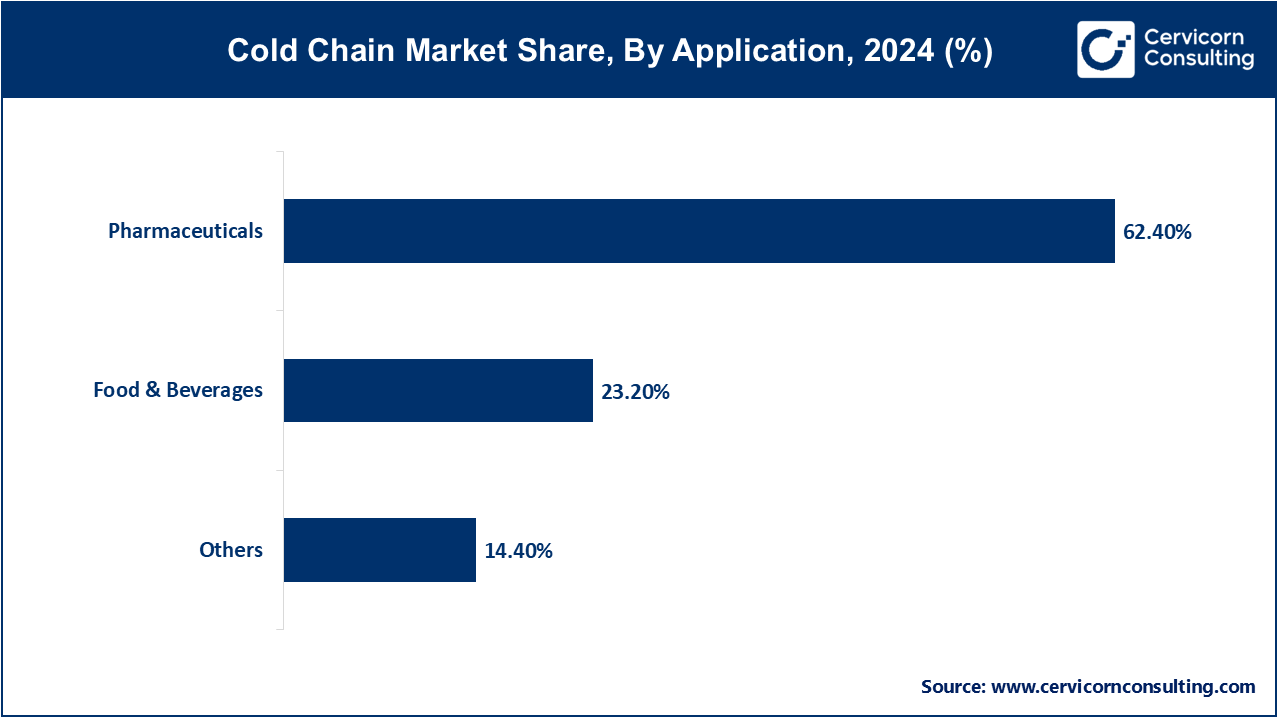

- By application, The pharmaceuticals segment has measured highest market share of 62.4% in 2024.

Cold Chain Market Growth Factors

- Rising Demand for Perishable Goods: The increasing consumption of fresh and frozen foods, along with the growth in the pharmaceutical sector requiring temperature-sensitive drug transportation, is driving the need for robust cold chain solutions.

- Technological Advancements: Innovations such as IoT-enabled monitoring systems, advanced refrigeration technologies, and blockchain for traceability are enhancing the efficiency, reliability, and transparency of cold chain logistics.

- Regulatory Compliance and Standards: Stringent food safety and pharmaceutical regulations worldwide are necessitating better temperature control and monitoring systems, boosting investments in cold chain infrastructure.

- Globalization and E-commerce: The expansion of international trade and the rise of e-commerce platforms offering fresh produce and temperature-sensitive products are increasing the demand for efficient cold chain logistics to ensure timely and safe delivery.

- Sustainability Initiatives: Growing awareness and demand for sustainable practices are leading to the adoption of energy-efficient refrigeration systems and eco-friendly packaging, driving innovation and investment in the cold chain market.

- Increasing Urbanization and Population Growth: Rapid urbanization and a growing global population are leading to higher demand for ready-to-eat meals, processed foods, and pharmaceutical products, which require effective cold chain logistics to maintain quality and safety during transportation and storage.

Cold Chain Market Trends

- Growth in the Pharmaceutical Industry: The increasing production and distribution of temperature-sensitive pharmaceuticals, including vaccines, biologics, and specialty drugs, necessitates advanced cold chain logistics to ensure product efficacy and safety.

- Consumer Preference for Fresh Produce: Consumers are increasingly demanding fresh and organic food products, driving the need for efficient cold chain systems to maintain the freshness and nutritional value of perishable goods throughout the supply chain.

- Expansion of Retail Chains: The growth of supermarket and hypermarket chains, especially in developing regions, is boosting demand for reliable cold chain infrastructure to support the storage and distribution of a wide range of perishable products.

- Technological Integration: The integration of technologies like AI, IoT, and blockchain in cold chain logistics presents opportunities for enhanced real-time monitoring, predictive maintenance, and improved traceability, leading to greater operational efficiency and reduced losses.

- Emerging Markets: Developing regions with expanding middle-class populations and changing dietary habits offer significant opportunities for cold chain market growth as these areas increasingly require advanced logistics solutions to meet rising consumer demands for fresh and frozen products.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 393.85 Billion |

| Market Size in 2034 |

USD 1,729.6 Billion |

| Market Growth Rate |

CAGR of 18.06% from 2025 to 2034 |

| Largest Region |

North America |

| Fastest Growing Region |

Asia-Pacific |

| Segment Covered |

By Type, Temperature Range, Application, Regions |

Cold Chain Market Dynamics

Drivers

Government Investments and Initiatives

- Governments worldwide are increasingly investing in cold chain infrastructure to tackle critical issues like food waste and food security, driven by rising populations and environmental concerns. Initiatives such as subsidies, tax incentives, and public-private partnerships are being implemented to encourage the development of efficient cold chain logistics. These efforts are vital for the distribution of vaccines and medicines, especially in remote areas, enhancing healthcare accessibility and outcomes.

Increasing Global Food Trade

- The globalization of food markets has led to a significant increase in the international trade of perishable goods, such as fresh produce, seafood, and dairy products. This trend necessitates robust cold chain logistics to maintain product quality and safety over long distances and varying climatic conditions. As consumer preferences shift towards diverse and exotic foods, suppliers are under pressure to deliver products that meet stringent quality standards.

Restraints

High Operational Costs

- The cold chain market is characterized by significant operational costs, primarily due to the need for specialized equipment and technology to maintain temperature-controlled environments. Refrigeration units, insulated containers, and energy-intensive transportation methods contribute to high expenses. Additionally, maintenance costs for these systems can be substantial, as any equipment failure can lead to spoilage and product loss. These costs are often passed on to consumers, affecting the overall competitiveness of products in the market.

Infrastructure Challenges in Developing Regions

- In many developing countries, the lack of adequate infrastructure poses a significant barrier to the growth of the cold chain market. Poor road networks, unreliable electricity supply, and limited access to advanced refrigeration technology hinder the establishment and expansion of cold chain logistics. These challenges lead to inefficiencies in the transportation and storage of perishable goods, resulting in increased spoilage rates and higher costs for producers and consumers.

Opportunities

Adoption of Renewable Energy Solutions

- The integration of renewable energy sources such as solar and wind power into cold chain operations presents a significant opportunity to reduce energy costs and environmental impact. As sustainability becomes a priority for businesses and consumers alike, companies that invest in renewable energy for refrigeration and transportation can enhance their competitiveness while reducing their carbon footprint. Advances in energy storage technology, such as battery systems, can further improve the reliability and efficiency of cold chain logistics, especially in regions with unstable power supplies.

Development of Smart Cold Chain Technologies

- The increasing use of smart technologies, including IoT devices, AI, and big data analytics, offers significant opportunities to improve the efficiency and transparency of cold chain operations. These technologies enable real-time monitoring and control of temperature, humidity, and other critical factors throughout the supply chain, reducing the risk of spoilage and enhancing product quality. Predictive analytics can help companies anticipate and address potential disruptions before they occur, optimizing logistics and reducing waste.

Challenges

Complex Regulatory Compliance

- The cold chain market is subject to a complex web of regulations that vary significantly across different regions and countries. Ensuring compliance with these regulations, which govern food safety, pharmaceutical standards, and environmental practices, can be challenging for companies operating in multiple markets. Navigating these regulatory requirements often requires significant time and resources, including investments in compliance systems and processes.

Logistical and Infrastructure Limitations in Remote Areas

- Delivering cold chain services to remote and rural areas poses significant logistical challenges due to inadequate infrastructure and accessibility issues. These regions often lack reliable transportation networks, making it difficult to ensure timely and consistent delivery of perishable goods. Additionally, the absence of essential infrastructure, such as cold storage facilities and power supply, exacerbates the difficulty of maintaining the necessary temperature controls. These limitations increase the risk of spoilage and product loss, impacting both supply chain efficiency and customer satisfaction.

Cold Chain Market Segmental Analysis

Type Analysis

Refrigerated Storage: The refrigerated storage segment has dominated the market with share of 50.2% in 2024. Refrigerated storage involves facilities designed to maintain controlled temperatures for perishable goods, such as cold stores and bulk storage facilities. Trends include the adoption of energy-efficient refrigeration systems and automation technologies to enhance storage capacity and reduce operational costs. There is also increasing use of advanced monitoring systems to ensure precise temperature control and compliance with safety regulations.

Refrigerated Transportation: The refrigerated transportation segment has registered market share of 28.4% in 2024. refrigerated transportation refers to vehicles equipped to transport temperature-sensitive goods, including road, rail, air, and sea transport. Trends in this segment include the development of smart logistics solutions, such as IoT-enabled tracking systems and advanced insulation materials, which enhance route optimization and real-time monitoring. There is also a growing emphasis on sustainability, with companies investing in energy-efficient and eco-friendly transportation options.

Temperature Range Analysis

Chilled (Above Freezing): The chilled temperature segment has recorded market share of 12.5% in 2024. Chilled storage maintains temperatures above freezing, typically between 0°C to 8°C (32°F to 46°F), essential for preserving the freshness of perishable goods like dairy products, fruits, and vegetables. Growing consumer demand for fresh produce and convenience foods is driving advancements in chilled storage technology, including energy-efficient refrigeration systems and improved insulation materials to reduce energy consumption and extend shelf life.

Frozen (Below Freezing): The frozen segments has covered highest market share of 62.3% in 2024. Frozen storage involves maintaining temperatures below 0°C (32°F), crucial for preserving meat, seafood, and frozen foods. It prevents microbial growth and spoilage by keeping products solidified. The expansion of global frozen food markets and increased online grocery shopping are spurring investments in advanced freezing technologies, such as blast freezing and automated storage systems, to enhance efficiency and reduce waste.

Cryogenic (Ultra-low Temperature): The cryogenic segment has captured market share of 25.2% in 2024. Cryogenic storage involves extremely low temperatures, often below -150°C (-238°F), used for specialized applications like pharmaceuticals, vaccines, and scientific research. Rising demand for biologics and high-value pharmaceuticals is driving innovations in cryogenic storage, including advancements in cryogenic containers and monitoring systems to ensure precise temperature control and enhance the safety and effectiveness of sensitive products.

Application Analysis

Food and Beverages: The food & beverages segment has measured market share of 23.2% in 2024. This segment includes the storage and transport of perishable items such as dairy products, fruits, vegetables, meat, seafood, and beverages, requiring controlled temperatures to maintain quality and safety. Growing consumer demand for fresh and organic products is driving innovation in cold storage solutions. Enhanced tracking technologies and energy-efficient systems are improving efficiency and reducing costs in this segment.

Pharmaceuticals and Healthcare: The pharmaceuticals and healthcare segment has generated dominating market share of 62.4% in 2024. This segment encompasses the cold chain logistics for temperature-sensitive pharmaceuticals, including vaccines, biopharmaceuticals, and clinical trial materials, which must be stored and transported within strict temperature ranges. The rise in global vaccination campaigns and the development of advanced biologics are driving growth. Increased use of IoT and blockchain technologies for real-time monitoring and traceability is enhancing the reliability and compliance of pharmaceutical cold chains.

Chemicals: The chemicals segment involves the transportation and storage of temperature-sensitive chemicals, including specialty and industrial chemicals, that require specific temperature conditions to maintain stability and safety. Increased demand for specialty chemicals and stringent safety regulations are boosting the need for advanced cold chain solutions. Innovations in temperature-controlled containers and monitoring systems are improving the efficiency and safety of chemical logistics.

Others: The others segment has accounted market share of 14.4% in 2024. This segment covers various other applications of cold chain logistics, including biotechnology products, cosmetics, and certain consumer goods requiring temperature control. The expansion of e-commerce and increased consumer awareness of product quality are driving demand. Companies are investing in flexible and scalable cold chain solutions to cater to diverse and emerging needs, incorporating advanced technologies for better efficiency and sustainability.

Cold Chain Market Regional Analysis

Why is North America leading in the cold chain market?

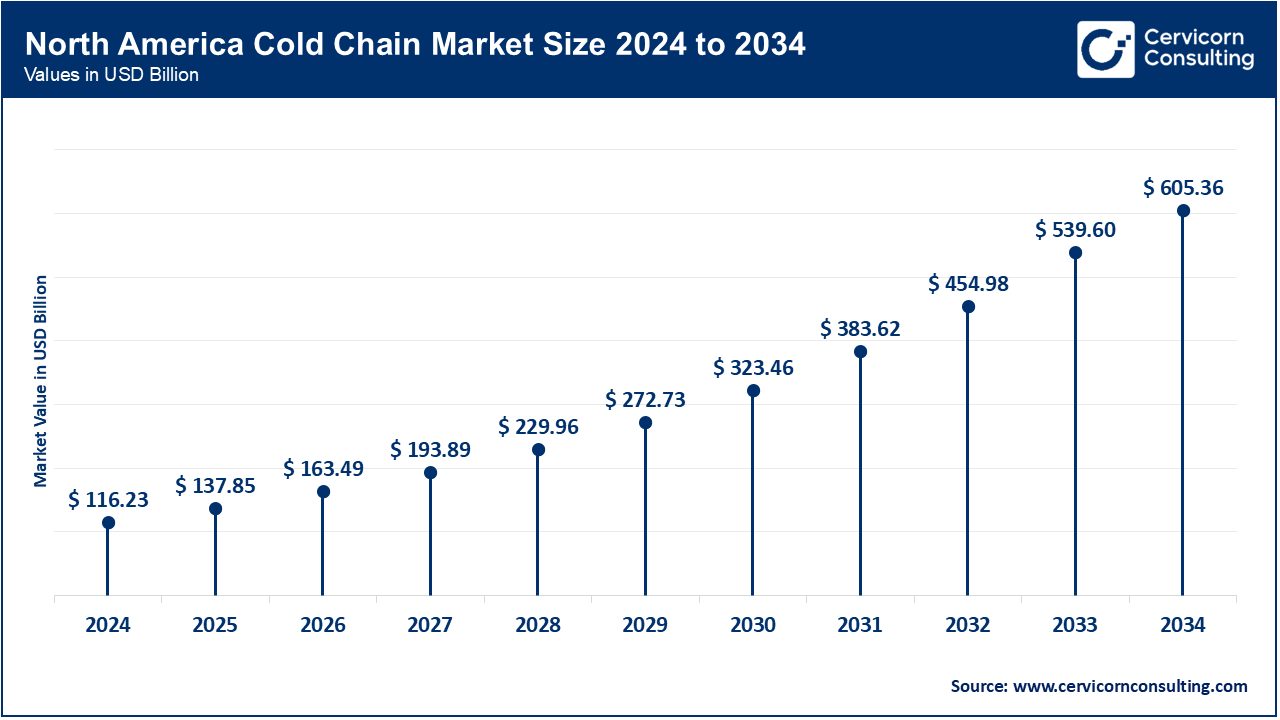

The North America market size is calculated at USD 116.23 billion in 2024 and is projected to grow around USD 605.36 billion by 2034. North America includes the U.S., Canada, and Mexico, where cold chain logistics support diverse industries, including food, pharmaceuticals, and chemicals. Increased focus on sustainability and energy efficiency is driving innovation. The adoption of advanced technologies, such as IoT and AI for real-time monitoring and automation, is enhancing operational efficiency. Moreover, there is a growing emphasis on expanding infrastructure to meet the demands of e-commerce and consumer expectations for fresh goods.

Europe Cold Chain Market Trends

The Europe market size is predicted to hit around USD 518.89 billion by 2034 from USD 99.62 billion in 2024. Europe encompasses countries like Germany, the U.K., France, and others, with a strong emphasis on regulatory compliance and advanced cold chain practices. The European market is experiencing a rise in demand for traceability and transparency due to stringent regulations. The adoption of green technologies and renewable energy in cold chain operations is prominent, driven by the European Union’s sustainability goals and initiatives to reduce carbon emissions in logistics.

Why is Asia-Pacific experiencing rapid growth in the cold chain market?

The Asia Pacific market size is expected to reach around USD 367.81 billion by 2034 increasing from USD 76.38 billion in 2024. Asia-Pacific includes countries such as China, India, Japan, and Australia, with a rapidly growing cold chain market due to economic expansion and rising consumer demand. The region is witnessing significant investment in infrastructure development and modernization of cold chain facilities. The rise of e-commerce and increasing consumption of perishable goods are driving the adoption of advanced cold chain technologies. Additionally, there is a focus on improving logistics efficiency to cater to the diverse and expanding market.

LAMEA Cold Chain Market Trends

The LAMEA market size is estimated to reach around USD 207.55 billion by 2034 from USD 39.85 billion in 2024. LAMEA includes Latin America (e.g., Brazil, Argentina) and the Middle East & Africa (e.g., GCC countries, South Africa), where cold chain logistics support a range of industries, including agriculture and pharmaceuticals. The region is experiencing growth in cold chain infrastructure, driven by increasing urbanization and a demand for higher-quality goods. Investments in mobile refrigeration units and decentralized cold storage solutions are addressing challenges related to infrastructure and accessibility, enhancing supply chain efficiency in remote areas.

Cold Chain Market Top Companies

New players such as Zymergen Inc. and Temasek Holdings are leveraging innovations in biotechnology and sustainable practices to enter the cold chain market, focusing on advanced materials and eco-friendly solutions. Lineage Logistics and Americold Realty Trust dominate the market through their extensive global networks and cutting-edge technologies. They lead with innovations like IoT-enabled temperature monitoring, automated storage systems, and energy-efficient refrigeration. Their market dominance stems from large-scale infrastructure, strategic acquisitions, and a strong focus on operational efficiency and sustainability.

Recent Developments

- In 2023, Sonoco ThermoSafe and Cargolux have entered a global partnership, with Sonoco providing its Pegasus ULD passive temperature-controlled containers for Cargolux's air freight pharma services. The Pegasus is the first FAA and EASA-approved container for pharmaceutical use globally.

- In 2023, Intelsius has launched the ORCA Pallet, a high-performance, multi-use temperature-controlled shipper for large pharmaceutical payloads. Available in three sizes and temperature ranges, it features a collapsible design to address budget and storage challenges.

- In 2023, Americold has expanded its Santa Perpetua Barcelona facility, adding 11 loading bays and 12,000 pallet positions. The upgrade increases capacity to over 20,000 pallet positions, enhancing storage for chilled, frozen, and ambient products for regional customers.

- In 2023, Canadian Pacific Kansas City (CPKC) and Americold have partnered to co-locate Americold’s warehouses on the CPKC network. This collaboration aims to optimize North American temperature-controlled logistics by constructing a Kansas City facility, enhancing connectivity between the U.S. Midwest and Mexico.

- In 2023, Lineage Logistics has opened its expanded cold storage facility at the Port of Aarhus, Denmark, adding 18,000 pallet spaces to reach a total of 27,500. This increase will enhance storage for shellfish and fish producers, boosting trade between Greenland, Denmark, and globally.

- In 2022, Cold Chain Technologies has expanded its ‘TRUEtemp Naturals’ portfolio with seasonal solutions, featuring eco-friendly, recyclable, and repulpable designs. These pharmaceutical-grade solutions aim to enhance time-temperature performance and help CCT increase its waste reduction commitment from 50 to 60 million pounds by 2025.

Market Segmentation

By Type

- Refrigerated Storage

- Cold Stores

- Bulk Stores

- Ports

- Others

- Refrigerated Transportation

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

- Packaging

- Monitoring Components

By Temperature Range

- Chilled (Above Freezing)

- Frozen (Below Freezing)

- Cryogenic (Ultra-low Temperature)

By Application

- Food and Beverages

- Dairy Products

- Fruits and Vegetables

- Meat and Seafood

- Bakery and Confectionery

- Beverages

- Ready-to-eat Meals

- Others

- Pharmaceuticals and Healthcare

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

- Blood and Blood Components

- Others

- Chemicals

- Specialty Chemicals

- Industrial Chemicals

- Others

By Region

- North America

- APAC

- Europe

- LAMEA

...

...