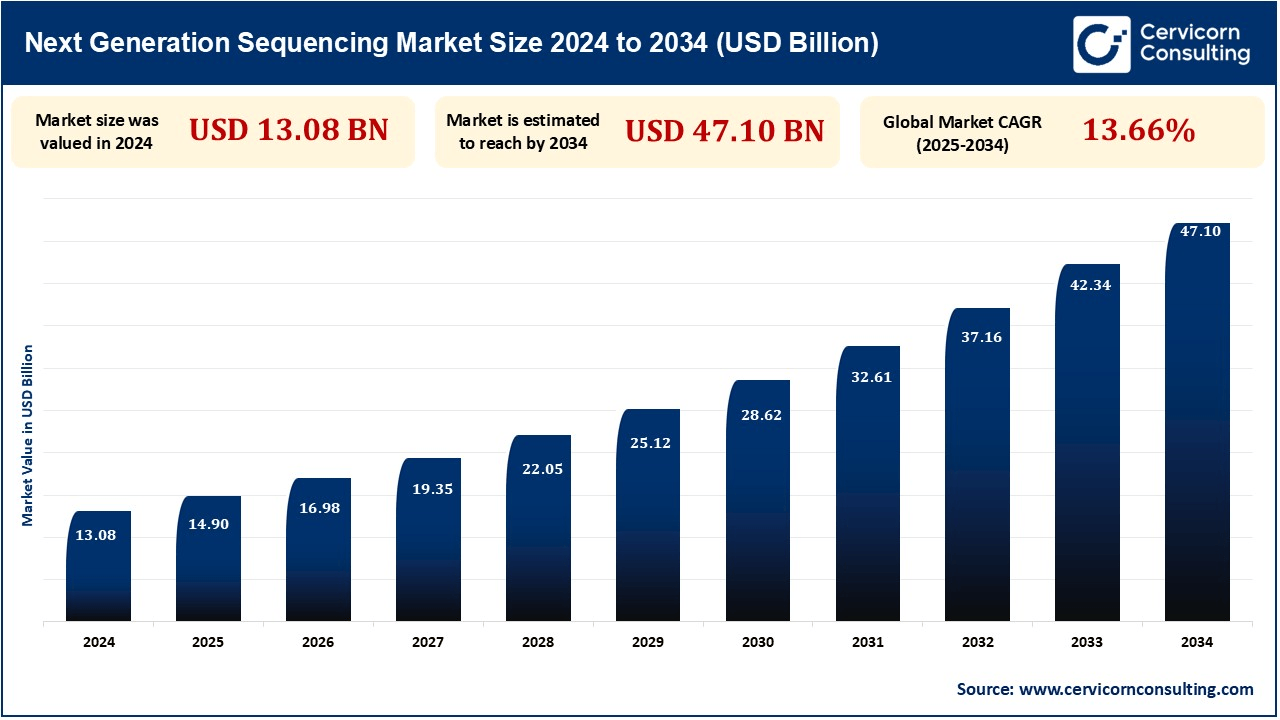

The global next generation sequencing market size is projected to surge around USD 47.10 billion by 2034 up from USD 13.08 billion in 2024 and is exhibiting at a compound annual growth rate (CAGR) of 13.66% over the forecast period 2025 to 2034.

The next generation sequencing (NGS) market is growing with high growth due to increased demand for precision medicine, development in bioinformatics, and increased cases of genetic diseases and cancer. Low sequencing costs have been driving NGS at affordable prices, which is spurring adoption across clinical diagnostics, drug discovery, and personalized medicine. Government funding and private investment in genomics research are further driving the market to grow.

Additionally, the combination of cloud computing and artificial intelligence in data analysis is also improving scalability and efficiency. Increasing use of NGS in agriculture, forensic science, and microbiology further drives its swift uptake. As the regulatory structures mature and tech advancements persist, the NGS sector is well placed to witness consistent growth in the next few years.

Precision medicine is transforming the healthcare sector by individualizing treatments according to the genetic profile of a person. Next Generation Sequencing (NGS) holds the key to discovering genetic mutations affecting disease susceptibility and response to treatment. Oncologists apply NGS for identifying cancer mutations and propose targeted therapeutics, enhancing patient outcomes. The increasing application of pharmacogenomics makes it more concrete to require NGS in the creation of personalized drugs. Further, whole-genome and exome sequencing is making rare disease diagnosis more accurate. As the healthcare industry moves towards personalized therapy, the application of NGS in clinical decision-making is driving market growth further.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing NGS through enhanced data analysis, minimized processing time, and better variant interpretation. AI-based bioinformatics platforms can identify patterns in complicated genomic data, enhancing accuracy in detecting mutations related to disease. Machine learning algorithms aid in forecasting patient response to treatments, streamlining precision medicine applications. AI also improves error correction in sequencing processes, providing improved quality data. The use of AI also assists in automating workflows, minimizing manual intervention and enhancing efficiency. With advancing AI technology, its application in NGS will further grow, enabling genomic research to be quicker, more precise, and scalable.

Use of next generation sequencing (NGS) in clinical laboratories poses a big challenge due to the fact that it is complex. NGS has to be done through special devices, specialists, and quality control processes in order to have high accuracy and consistency in patient diagnosis. Laboratories must invest in advanced sequencing instruments, bioinformatics pipelines, and storage space, increasing the cost of operations. Genomic data interpretation is difficult and demands trained bioinformatics and genetic counseling resources. CLIA and CAP accreditation requirements also make adoption difficult. There are no set protocols and harmonization with current laboratory workflows preventing clinical application at scale, a primary growth inhibitor in the NGS market.

The increasing pace of the development of next generation sequencing technology would present enormous chances for business growth. Long-read sequencing, single-cell sequencing, and nanopore sequencing, in essence, are improvements in sequencing by raising accuracy, increasing speed, and cost-effectiveness. The advances in automation, bioinformatics, and cloud computing make the processing and storage of data even so efficient, thereby putting an even higher value for scientists and doctors. Advances in real-time and portable sequencing technology are growing application in infectious disease monitoring, cancer, and individualized medicine. With reducing prices and improving accuracy, adoption of NGS will likely increase in clinical diagnostics, drug development, and agri-genomics, driving market expansion and emerging business opportunities.

| Attributes | Details |

| NGS Market Size in 2025 | USD 14.90 Billion |

| NGS Market CAGR | 13.66% from 2025 to 2034 |

| Key Players |

|

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By Workflow |

|

| By End User |

|

| By Region |

|

The Asia-Pacific region is witnessing rapid growth in NGS adoption, driven by increasing government spending in genomics research, strengthening healthcare infrastructure, and increasing incidence of genetic disorders. China, Japan, and Indian markets are at the forefront of expansion with gigantic-scale sequencing programs and growth in biotechnology. Decreasing costs of sequencing and increased consciousness about personalized medicine also contribute to regional growth.

North America leads the NGS market owing to robust government investment, well-established healthcare infrastructure, and established major market players such as Illumina and Thermo Fisher Scientific. The U.S. is ahead in genomic studies, precision medicine programs, and cancer diagnostics via NGS. Increasing clinical receptiveness of NGS, together with regulatory authority approvals of NGS-based tests, also fuel the market additionally.

For instance, according to the Canada Cancer Society, approximately 6,700 Canadians were diagnosed with leukemia in 2021, including 4,000 men and 2,700 women. Similarly, data from the American Cancer Society (2023) estimates around 59,610 new leukemia cases and 20,380 new acute myeloid leukemia (AML) cases in the United States in 2023. The rising incidence of these diseases is driving the demand for NGS technology-based devices, as they play a crucial role in early detection, diagnosis, and treatment planning. This growing adoption of NGS solution.

The sequencing by synthesis (SBS) is the most common NGS technology, which is sold by Illumina predominantly. SBS depends on incorporating fluorescently labeled nucleotides onto DNA strands with real-time base calling. SBS is accurate, scalable, and cost-effective and is well-suited for whole-genome sequencing, transcriptomics, and epigenomics. Ongoing improvements in SBS technology, such as increased throughput and lower costs, have further entrenched its leadership in the NGS market.

Academic and clinical research organizations are significant consumers of NGS technology, applying it to basic and translational research. NGS is also broadly applied across genomics, transcriptomics, epigenetics, and disease studies to reveal genetic variation, biomarkers, and therapeutic targets. Government initiatives and large-scale genomic initiatives like the Human Genome Project and precision medicine efforts similarly propel NGS use in the academic community.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2317

Ask here for more details@ sales@cervicornconsulting.com