Renewable Energy Certificate Market Size and Growth 2025 to 2034

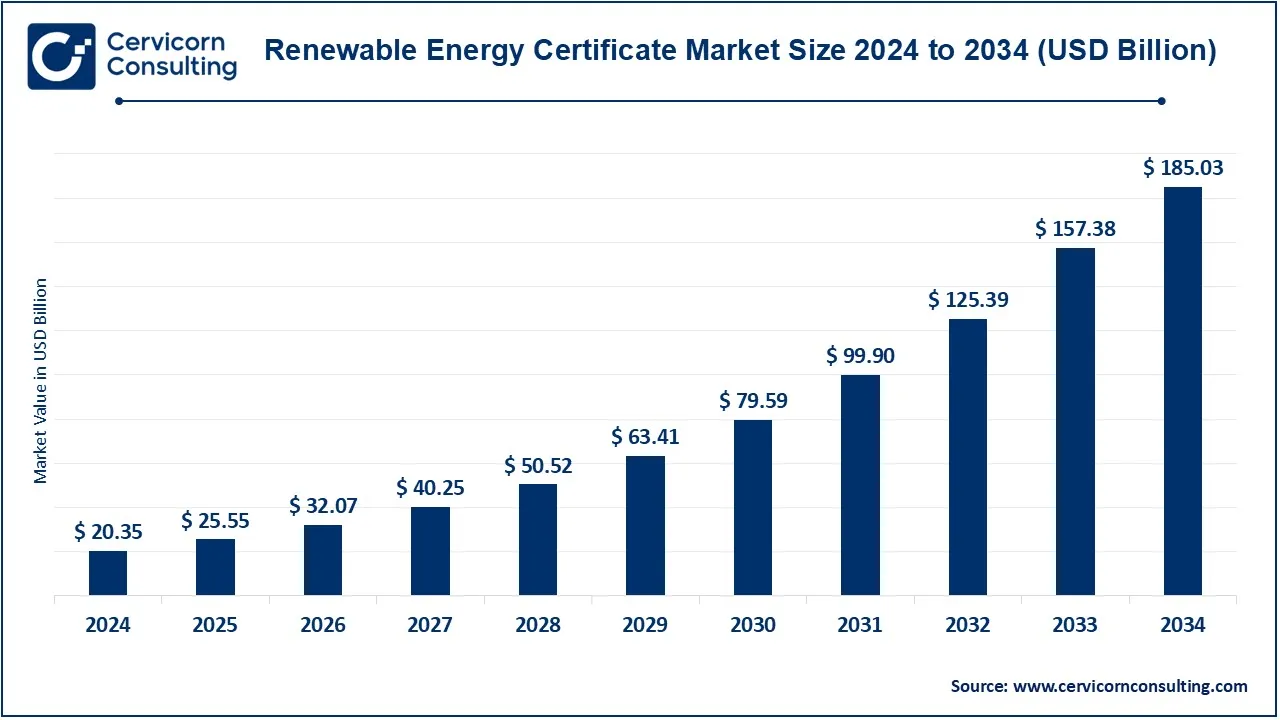

The global renewable energy certificate market size was valued at USD 16.22 billion in 2024 and is expected to be worth around USD 185.03 billion by 2034, growing at a compound annual growth rate (CAGR) of 26.80% from 2025 to 2034.

The renewable energy certificate (REC) market has grown significantly due to rising global awareness of climate change and corporate sustainability goals. Companies are increasingly purchasing RECs to meet their renewable energy targets without directly investing in renewable energy infrastructure. Additionally, government policies promoting clean energy adoption have fueled demand. The voluntary REC market has particularly expanded, with businesses and institutions adopting RECs as part of their sustainability strategies. As renewable energy capacity grows worldwide, REC prices fluctuate based on supply and demand dynamics. Countries with strict renewable energy targets, such as the U.S., EU nations, and India, are seeing higher REC market participation. The integration of blockchain in REC transactions has also improved transparency and efficiency, further encouraging market expansion.

What is a Renewable Energy Certificate (REC)?

A renewable energy certificate (REC) is a market-based instrument that represents proof that one megawatt-hour (MWh) of electricity was generated from a renewable energy source, such as wind, solar, or hydropower. These certificates are purchased by businesses, organizations, and individuals to support clean energy production and reduce their carbon footprint. RECs help bridge the gap between renewable energy producers and consumers who want to claim renewable energy usage without directly generating it. When a renewable energy provider produces electricity, they receive RECs, which can be sold separately from the actual electricity. Buyers of RECs can legally claim that they are using renewable energy, even if they purchase conventional grid electricity. The benefits of RECs include promoting investment in renewable energy projects, reducing greenhouse gas emissions, and helping organizations meet sustainability goals.

Key Insights related to the Renewable Energy Certificate (REC):

- Increase in REC Transactions: The global REC market witnessed a 20% annual increase in trading volume over the past five years.

- Corporate Adoption: Over 60% of Fortune 500 companies now use RECs as part of their sustainability programs.

- Government Policies: More than 40 countries have established REC frameworks to promote renewable energy adoption.

- Emission Reduction Impact: RECs contributed to a 15% reduction in carbon emissions among companies using them.

Renewable Energy Certificate Market Report Highlights

- The U.S. renewable energy certificate market size was estimated at USD 4.42 billion in 2024.

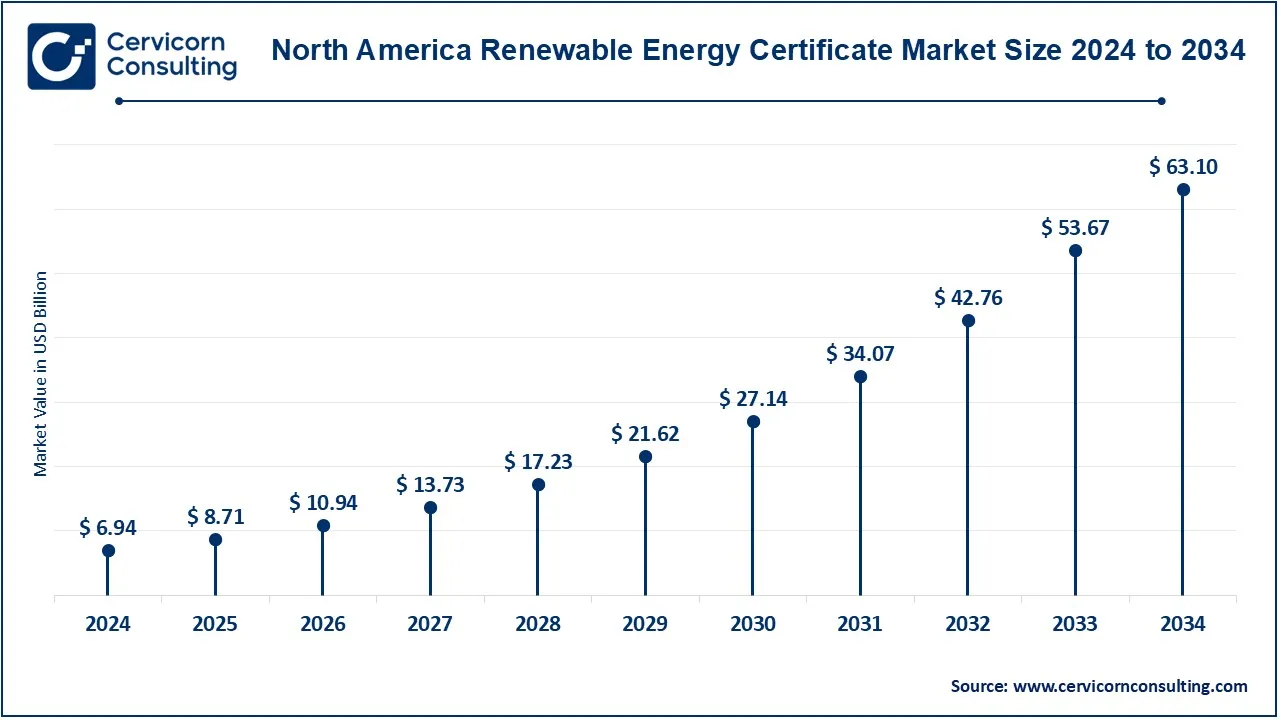

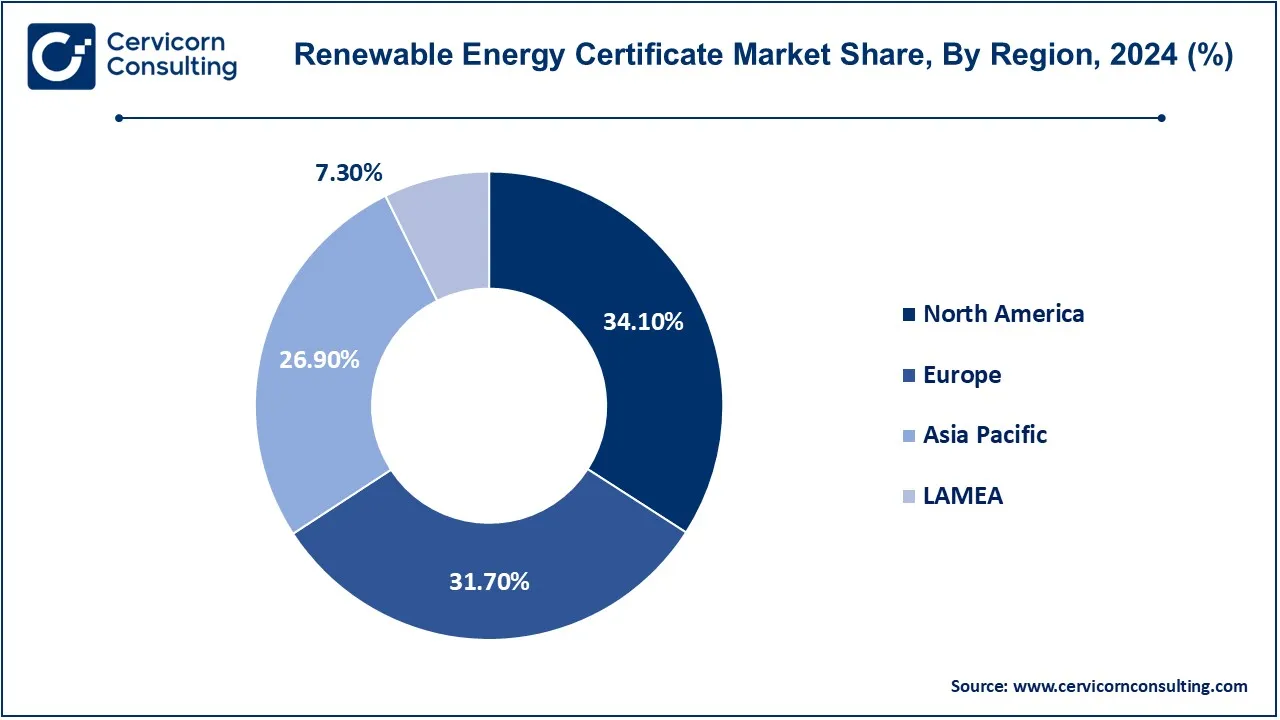

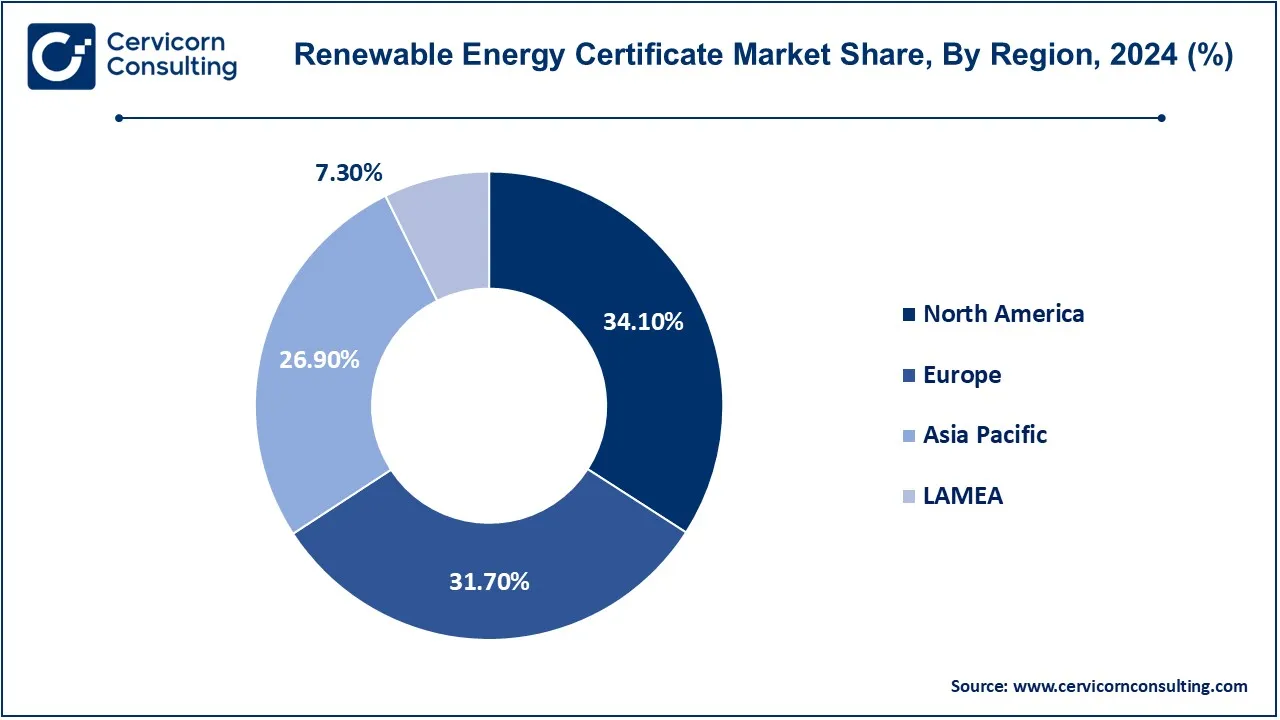

- North America has lead the market in 2024 and accounted for 34.10%.

- Europe has generated revenue share of 31.70% in 2024.

- By energy type, the solar energy segment has accounted for 51% in 2024.

- By capacity, the greater than 5000 KWH segment has captured revenue share of 43% in 2024.

- By end user, the valuntary segment has recorded revenue share of 70% in 2024.

Renewable Energy Certificate Market Growth Factors

- Regulatory Developments: Governments in different regions have put various plans and policies to incorporate renewable energy systems with promotion of REC purchases to meet regulated demands. Renewable Portfolio Standards regulation and its compliance target are becoming stricter in countries in the EU, the U.S., and parts of Asia Pacific. These measures represent initiatives aimed at reducing carbon emission levels and it is recommended that organizations purchase Renewable Energy Certificates (RECs) and manipulate demand in all the industries that they operate. The support from the regulations tends to facilitate the expansion of the market since the corporations and the utility companies intend to meet the set standards.

- Corporate Sustainability Drivers: More and more companies are being involved with the sustainability agenda, thus working towards removing carbon emissions or even more ambitious goals of using 100% renewable energy. Many aspects like social burden on consumers, vigilant investors, and, finally, implementation of ESG principles are responsible for the corporate responsibility towards the consequences of pollution that they create. This is the case with companies like Google, Microsoft, and Amazon, which are actively engaging in purchasing huge quantities of RECs for carbon offsetting; this created a huge global market for RECs.

- Growing demand for energy: There is bent toward an increasingly rising energy demand across the globe, especially in the developed economies due to industrial growth, urbanization, and worldwide population explosion. The RECs allow companies and individuals to support renewable projects without direct investment in renewable infrastructure and therefore expose them to investment as demand increases ever higher. Thus, demand pressure is one of the powerful reasons for going toward establishing the REC market, under which consumers, be they corporate or residential, could contribute toward clean energy goals.

- Technological Innovation: Technological innovation in renewable energy is one of the powerful forces driving REC market growth. Storage alternatives, especially for renewable energy, tackle the variabilities and reliability issues developed mainly by wind and solar energy. Other innovations involve digital REC tracking platforms and blockchain for transparency, which increase efficiencies in the verification and trading process on RECs; efficiency, in turn, opens up the market by attracting more players into the market and boosting REC uptake.

Renewable Energy Certificate Market Trends

- Multi-sector Expansion: RECs have become increasingly prevalent across various sectors from production to retailing and to technology. As organisations in different sectors become conscious of their wishes to holistically reduce carbon footprint and meet renewable energy targets, demand for REC purchase rises steeply. Into that ever-expanding space sprouted disparate industries, meaning that RECs, by virtue of diversification of their use, are no longer to be seen as limited to traditional energy buyers, but rather as a useful tool which appeals to corporate social responsibility and decarbonisation agendas in a number of separate industries.

- Blockchain for Transparency: Blockchain technology is increasingly being applied in the REC industry to provide transparency, security, and verifiability. By recording transactions on a decentralized ledger, blockchain ensures that RECs are tracked accurately, preventing double counting and fraud. This trend bolsters buyer confidence in the REC market and improves the market’s appeal to environmentally conscious consumers and investors. Blockchain integration is a key component of digital transformation in the energy sector.

- Energy-as-a-Service (EaaS): The REC industry is witnessing the rise of the energy-as-a-service model, wherein companies provide bundled energy solutions, including RECs. EaaS providers offer access to renewable energy without the need for upfront infrastructure investment, making it easier for businesses to meet green energy goals. This model provides an affordable and scalable way for companies to access RECs and achieve sustainability targets, especially attractive for small- and medium-sized enterprises.

- REC Corporate Buying Surge: Corporate purchasing of RECs has surged like never before as more companies make commitments for renewable energy and carbon reduction. Having made large REC purchases including by major tech firms, including Apple and Facebook, and thanks to demand arising from corporate commitments to 100% renewable energy, the background to this trend reflects the increased corporate responsibility towards environmental sustainability facing global pressures toward ESG investment.

- Solar RECs Dominate: RECs based on solar power are leading the market as installations of solar energy are rapidly growing. The cheaper and more abundant supply of solar makes it a better way for REC generation, particularly in locations that are highly optimally located for solar. Therefore RECs based on solar are becoming more widely available and often comparatively cheaper, thus making them an attractive option for both corporate and consumer REC purchases.

- Rapidly Growing Asia-Pacific Market: The Asia-Pacific region is behind REC adoption at a whirlwind pace, particularly imbued by the ambition-laden countries of China, India, and Japan. The growth of this booming demand for RECs is supported by government incentives, rising environmental awareness and international pressure for emission reductions. Rapid REC growth in Asia has created a regional centre core where this industry is already a heavy player in the global sustainable development enterprise.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 25.55 Billion |

| Expected Market Size in 2034 |

USD 185.03 Billion |

| CAGR (2025 to 2034) |

26.80% |

| High-impact Region |

North America |

| Booming Region |

Asia Pacific |

| Key Segments |

Energy Type, Capacity, End User, Region |

| Key Companies |

General Services Administration, U.S. Environment Protection Agency, Green-e Energy, Central Electricity Regulatory Commission, Western Area Power Administration, Defense Logistics Agency Energy, Environmental Tracking Network of North America |

Renewable Energy Certificate Market Dynamics

Drivers

- Mandatory RPS Standards: Many governments throughout the world have instituted renewable portfolio standards that specify the minimum percentage of electricity generated by the Utilities through renewable sources. Such an arrangement forces the utility to purchase RECs when it lacks credible renewable generation for meeting the specified standard; thus, it enhances the demand for the certificates and creates the fundamentally driving force for the RPS in directing the entire REC commodity arena. States adopting RPS standards include North America, Europe, and parts of Asia.

- Corporate Carbon Goals: Increasing expectations for corporations to reduce their environmental impacts are consequent upon an increasing number of entities setting carbon reduction and neutrality goals. To meet these goals, firms purchase vast amounts of RECs to offset emissions, especially when they do not have a viable option to procure renewable energy directly. Growing corporate demand fueled by a mixture of pressures from consumers, investors, and regulatory frameworks assure that their RECs supply is heating up.

- Developing Economies’ Demand: Developing economies in several areas are increasingly becoming aware of the importance of renewable energy and its key role in achieving sustainable development. In pursuing a transition to renewable energy, many countries in Asia, Africa, and Latin America are including RECs in their transition strategy. Growing demand for energy and government policies favoring renewable adoption have lent some necessary credence on the REC market growth in these regions that are generically expected to be significant forces behind REC growth.

- Rising Electric Vehicle Use: With rising numbers of electric vehicle (EV) installations, so rises the clean energy for powering these electric vehicles. Corporations and households then use RECs accordingly to ensure that the electricity being generated and used for operation purposes by electric vehicles is renewable. The mentioned consumer opting for EVs is also creating an indirect impetus to purchase RECs in those regions from which EVs are more being utilized.

Restraints

- Initial Costs for REC Initialization Remain Disproportionately High: Even while demand increases, RECs tend to be expensive, particularly for smaller businesses and ordinary users. The startup investment costs constitute a barrier for many, as the purchase of RECs represents an additional spending which not all entities can afford. Economic factors in combination with its cost, make it challenging for REC reach, which, in turn, propounds a considerable restraint to the market growth, especially within the less developed world.

- Renewable Energy Variation Causes Uncertainty in the Supply of RECs: The variability of supply often causes recs to lose stability as a result of the intermittency of renewable sources like wind or solar. The variation makes fluctuations in their availability and pricing, thereby rendering the supply inconsistent. Buyer undertaking sourcing from RECs may not opt for procurement of otherwise stable, predictable RECs because of such inconsistency, whereby the current status quo is dampened.

- Invariable REC Standards: The issue with RECs is that no globally acceptable definition or consensus could be reached on their genesis, certification, and tracking. Each region can have its own set of REC rules or requirements where international companies find it difficult to put forth a common strategy for their REC purchasing. Lack of standardization affects international REC trading and limits global market growth.

Opportunity

- Government Mandates and Policy Support: Internationally, more governments steadily adopt renewable energy targets and mandates, in which REC markets are set to improve. This means in countries where renewable energy policies dictate that quotas for renewable energy must be set up, there will be demand for RECs as it will be imperative for companies and utilities that have to purchase those instruments to comply with those mandates. This evolving policy background will ensure demand growth for very large opportunities for providers and certificate buyers.

- Sustainable Corporate Goals are Several in Number: Many a firm is setting high standards of sustainability, wanting to achieve net-zero emissions. And, in efforts to achieve such goals, corporations have the option of utilizing RECs as the most cost-effective and scalable mechanism for tackling their carbon footprints. As the concern for CSR rises and the level of clean energy demand increases, there is a huge scope for REC market growth since these companies are working toward fulfilling their commitment toward sustainability.

- Increase in Energy Consumption and Demand for Clean Energy: Global energy demand is on the increase, particularly in developing nations, thereby making a case for the need of clean and renewable energy sources more than ever. The increase in energy consumption in respect to industry, households, almost all transport activities, and commerce see an increase in energy demand for REC. This opens up an array of opportunities for the firms and institutions to invest in renewable energy generation and REC transactions which support the global move toward sustainable energy consumption through measures against climate change.

Challenges

- Notified and Regulated Cross-Border Compatibility of RECs: The ways and standards for RECs differ greatly from country to country, hence hampering cross-border REC trading. Since different countries have different frameworks and certification procedures, the compatibility issues arise. This fragmentation makes it difficult to trade these RECs internationally and provides a major challenge for foreign corporations seeking to save the carbon costs uniformly across regions.

- Scalability Issues: It can be extremely challenging to ensure sufficient stock of RECs to meet sustained growing demand. As corporate and individual REC purchases rise, sustaining a balanced supply-demand ratio may be quite challenging as renewable energy generation varies in output. This highlights again the importance of scalable solutions that can be put in place to support REC demand and prevent market saturation.

- Moving Out of Fossil Fuels: Though renewable energy production increases, fossil fuels still remain a primary supply in many jurisdictions. Thus, it becomes difficult to shift the momentum towards RECs. Respective inventions of other fossil fuels are widely spread around the world, especially in developing countries, and this adds to the high-difficulty level of shifting towards the RECs. The envisaged shift requires large investments in infrastructure that could contribute more to producing these fuels' supply, changing public policy perspectives, and constructing elongated periods for the transitory period of the transition towards the market for RECs.

Renewable Energy Certificate Market Segmental Analysis

The REC market is segmented into energy type, capacity, end user and region. Based on energy type, the market is classified into wind power, solar energy, gas power, and hydro-electric power. Based on capacity, the market is classified into 0-1000 KWh, 1000-5000 KWH, and greater than 5000 KWH. Based on end use, the market is classified into voluntary and compliance.

Type Analysis

Solar Energy: Solar energy segment has lead the market in 2024. Solar RECs are electric energy sources derived from solar energy and are increasingly available due to advances in photovoltaic technologies and decreasing installation costs. Solar RECs can be found worldwide, notably in the sun-rich Southwestern US, the Middle East, and Australia. Very few renewable energy resources that can be cheap, burn little fuel, and be maintained are as popular with corporations and individuals as solar energy. Solar REC is one of the major means of meeting sustainability commitments and renewable energy portfolio standards (RPS) worldwide.

Wind Power: From wind-based generation the RECs for wind energy ensure that the power produced long with other sources like hydro and thermal is from wind farms only which is one of the key contributors to the renewable energy targets in the world. The increasing number of clamoring offshore as well as onshore wind projects all over the globe particularly in Europe and North America and Asia is also one of the reason for the rise in the market of wind power based RECs. More than most of the other forms of energy, wind energy is very clean and helps support carbon neutrality strategies very well, hence to meet sustainability targets corporations and governments focus more on wind RECs because of the availability of vast wind resources in many areas.

Renewable Energy Certificate Market Revenue Share, By Energy Type, 2024 (%)

| Energy Type |

Revenue Share, 2024 (%) |

| Wind Power |

31% |

| Solar Energy |

51% |

| Gas Power |

5% |

| Hydro-electric Power |

13% |

Gas Power: Biogas-derived energy contributes to the undermining, although gas power lags behind wind or solar in this matter. This category of REC supports energy from biomass and biogas instead of traditional fossil fuels and reduces carbon emissions from its use towards long-term renewable energy objectives. Gas-based RECs make sense in areas with a strong focus on agricultural sustainability and waste-to-energy projects, where the production of renewable electricity from biomass can have relatively continuous output.

Hydropower: Hydropower RECs are a major contender in the creation of global renewable energy certificates, along with regions wealthy in water resources, including Canada, Brazil, and some European regions. The RECs represent energy from hydropower, which has proven reliable as a renewable resource since it can generate energy continually and produce minimal emissions. However, although hydropower has fairly rare emissions, it carries a fair burden of environmental considerations, such as impacts on whole ecosystems, which may change the nomenclature of REC certification to votes in certain regions.

Capacity Analysis

Greater than 5000 kWh: The greater than 5000 kWh segment has held highest revenue share in 2024. The high-capacity REC supply quantity above 5000 KWh is well-placed for large-scale industrial and business businesses with huge energy needs. This segment responds to the needs of very large end-users, such as industrial manufacturing sites, large commercial buildings, and utilities that are highly committed to meeting stringent renewable energy goals. These RECs offer measurable opportunities for large-scale carbon offset in energy-intensive sectors and thus help organizations with huge energy footprints realize a meaningful impact on renewable energy take-up and support worldwide goals of carbon neutrality.

Renewable Energy Certificate Market Revenue Share, By Capacity, 2024 (%)

| Capacity |

Revenue Share, 2024 (%) |

| 0-1000 KWh |

23% |

| 1000-5000 KWH |

34% |

| Greater that 5000 KWH |

43% |

1000-5000 KWh: 1000-5000KWh RECs give spare opportunities for medium-level businesses or organizations wishing to offset moderate electricity needs. This category would be appropriate for commercial facilities, such as office buildings, schools and community centers, that wish to reach sustainability goals. This allows those with an energy demand between that of residential and that of large loads a chance for adding RECs as an economical and effective means to mitigate carbon resource expense and opens space in the market for RECs that exists between smaller one and larger-scale renewable commitments.

0-1000 KWh-RECs: 1000 KWh RECs are small-scale buyers or organization projects working to offset moderate electricity usages. This complement restriction works strongly in tandem with the energy use of a small business or household; this, however, makes it easy for first-time participants to add up to contribute toward the renewable energy goals. These RECs appeal to homeowner mark-or small business interested in doing their part to reduce emissions by offsetting to balance their share of the carbon footprint since they don't intend to lay down large sums of capital upfront, thus opening those opportunities into the renewable marketplace.

Renewable Energy Certificate Market Regional Analysis

The global market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America region has dominated the market in 2024.

Why is North America leading the renewable energy certificate market?

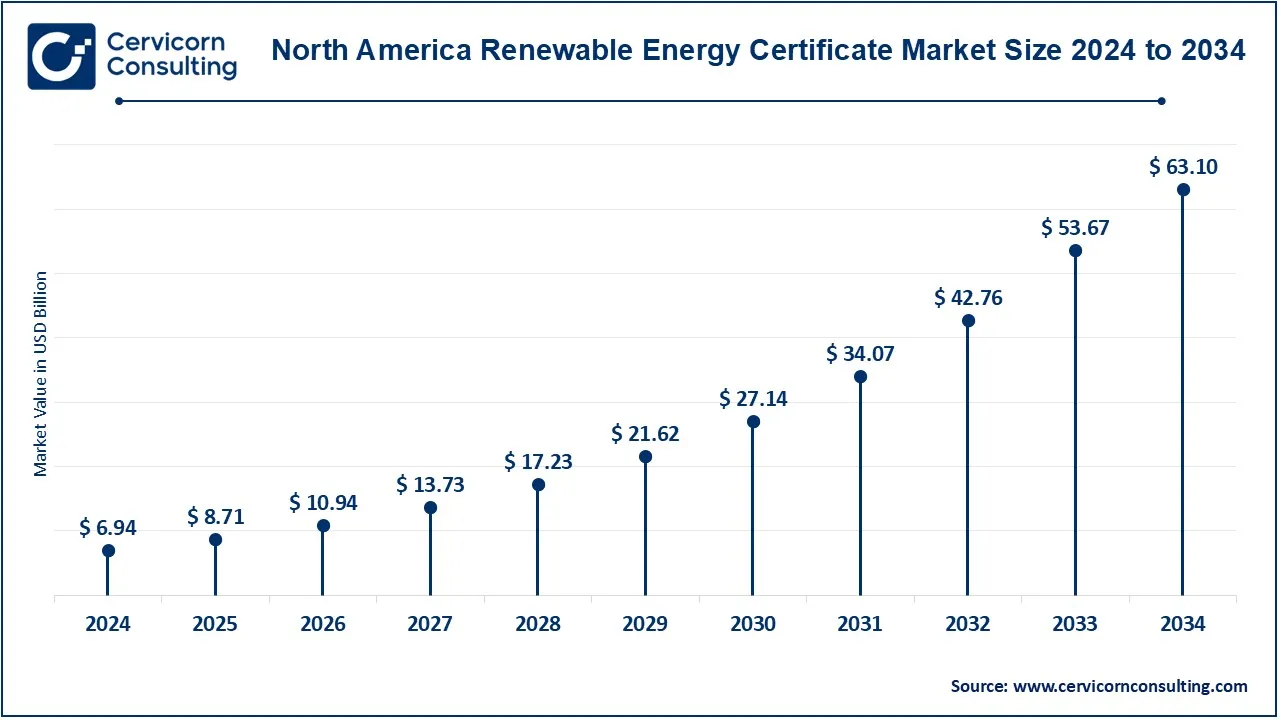

The North America renewable energy certificate market size was valued at USD 5.53 billion in 2024 and is expected to reach around USD 63.10 billion by 2034. The REC market in North America has been robust and dynamic through the years, mainly due to developments in the United States and Canada. In the United States, there are RPS systems whereby regional authorities induce corporations and consumers toward the procurement of RECs. Canada bears substantial responsibility, especially with renewable energy based on hydro, due to its huge water resources. Corporate commitments to mitigate carbon footprints, in addition to government incentives in each of these regions, will stimulate further uptake of RECs.

Why is the Europe renewable energy certificate market experiencing sustainable growth?

The Europe renewable energy certificate market size was estimated at USD 5.14 billion in 2024 and is projected to hit around USD 58.65 billion by 2034. The REC market in Europe is predominated by Germany, the United Kingdom, and Nordic countries, as the EU Renewable Energy Directive put forth a strong demand from these arranges. The strict climate policies enforced in the European Union are supposed to drive the demand for RECs as "Fit for 55" aims at drastic emission reductions. Companies in these countries are incentivized to purchase RECs in order to meet renewable energy quotas and push for national climate goals, which has developed into a mature market for certificates with well-established regulations.

Why is the Asia Pacific region experiencing rapid growth in the renewable energy certificate market?

The Asia-Pacific renewable energy certificate market size was accounted for USD 4.36 billion in 2024 and is predicted to surpass around USD 49.77 billion by 2034. The REC Market within Asia-Pacific is growing at a very fast pace, with major contributors like China, Japan, and Australia. China, being the biggest consumer of energy on earth, has surprised to extend its renewable generating capacity and substantial REC Market. Japan's Green Power Certification Program and Australia's Renewable Energy Target allow this REC growth, as both these nations are leading the push for greater incorporation of renewable projects into their economic activities. With growing industrial activities in past days and the establishment of sincere commitment on the part of industries for sustainable development, REC seems to enjoy a positive upside growth.

LAMEA renewable energy certificate market growth

The LAMEA renewable energy certificate market was valued at USD 1.18 billion in 2024 and is expected to reach around USD 13.51 billion by 2034. Brazil and South Africa, among other countries, are the main players in the REC market in LAMEA. Brazil is still one of the big producers of RECs because there is a big opportunity for hydro resources in certain states, while South Africa is another supporter that is racing toward renewable energy, aiming to meet demands for its power supply. The UAE emerges as one of the markets in development that is interested in adopting RECs, as the countries of the Middle East begin to seriously weigh alternatives for rebalancing their energy mix. With heightened REC absorption facilitated by regional investment seeking greenhouse gas neutrality, we are moving firmly and steadily toward a thriving REC market.

Renewable Energy Certificate Market Top Companies

CEO Statements

Vincent Manier, CEO of ENGIE Impact

- “RECs provide a tangible pathway for enterprises to meet sustainability goals within a globally interconnected energy market,” stressing that verified renewable sourcing is essential to achieving net-zero goals.

David Antonioli, CEO of Verra

- “Shifting our focus towards REC mechanisms will better support middle-income countries in verified renewables tracking, aligning with their environmental targets,” explaining Verra’s strategic pivot from voluntary carbon markets to REC programs.

Adnan Amin, CEO of IRENA

- “Certified renewable attributes help emerging economies attract green investments and foster corporate renewable energy adoption,” highlighting IRENA’s efforts to expand REC adoption, especially in developing regions.

Recent Developments

- In March 2024, KBank and INNPOWER announced a partnership to launch a renewable energy certification platform in Thailand, aiming to drive the country's shift toward renewable energy. Through this initiative, large enterprises are encouraged to align with net-zero emission goals. KBank is also rolling out various products and services to support businesses in their sustainability journeys.

- In December 2023, the University of Oklahoma introduced a program to certify professionals in the renewable energy business, providing essential skills for those looking to advance in this rapidly evolving industry.

Market Segmentation

By Energy Type

- Wind Power

- Solar Energy

- Gas Power

- Hydro-electric Power

By Capacity

- 0-1000 KWh

- 1000-5000 KWH

- Greater than 5000 KWH

By End Use

By Region

- North America

- APAC

- Europe

- LAMEA

...

...