Silicon Carbon Battery Market Size and Growth 2025 to 2034

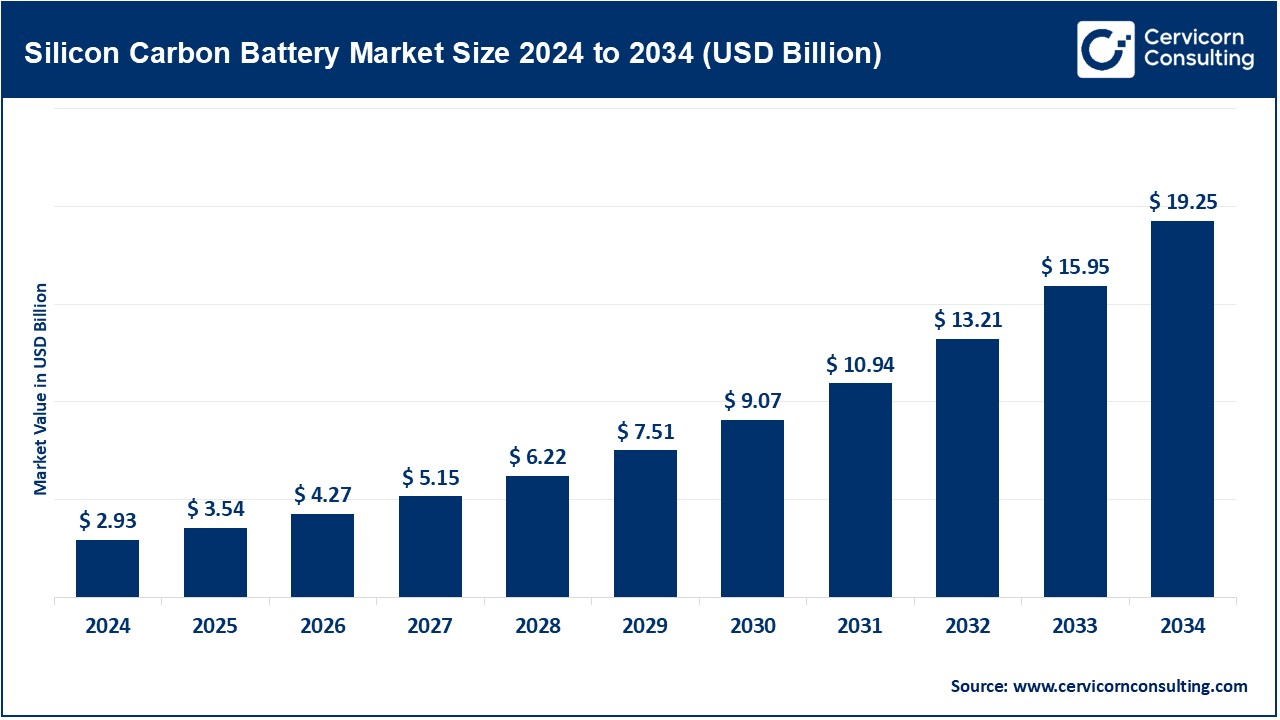

The global silicon carbon battery market size was valued at USD 2.93 billion in 2024 and is expected to hit around USD 19.25 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.71% over the forecast period 2025 to 2034.

Shifts within the automotive industry that now centre on electric vehicles have created a need for better batteries with higher power density—a prolonged life to make a case for interest in new silicon carbon-dependent cell technology development. It is predicted that further research and innovation on silicon anodes, cells' composition, and manufacturing methods in the future would also be advantageous towards improving these batteries' efficiency and cost-effectiveness. In comparison, silicon-carbon batteries offer a more sustainable option than lithium-ion since silicon is more abundant, making it less damaging to the environment. This is significant because more and more industries and governments are searching for greener technology. With all the promise silicon-carbon batteries held in the offing, the major problem in their manufacture is the cost since the scaling up of production is, in one way, difficult. Silicon also has the drawback that it gets expanded and contracted during charging cycles, which may cause material degradation. To improve this, as mentioned earlier, this stabilization will help further in integrating the silicon with carbon-based compounds or might also make use of certain coatings.

Silicon-carbon batteries are a type of battery that contains silicon and carbon as its constituent materials, usually in the anode. Silicon-carbon composites are being investigated as common graphite anodes used in lithium-ion batteries. Silicon has a higher capacity to store lithium ions than graphite, which could lead to larger batteries. Overall, research into silicon-carbon batteries is exciting and has great potential for high-capacity energy storage, particularly in traction electronics, electric vehicles, and renewable energy storage.

The silicon-carbon battery market is growing quickly, used in electric vehicles, consumer electronics, and renewable energy storage. Silicon-carbon batteries provide high energy density and better performance, leading to more innovation and investment. As technology improves, the market is expected to keep expanding, focusing on research, development, and creating new products across various industries.

Silicon Carbon Battery Market Growth Factors

- Increasing Competitive Pressure in EV & Battery Sector: As the electric vehicle market becomes more competitive, automakers are looking for ways to differentiate their products through better models, faster charging and longer batteries. Silicon-carbon batteries are one solution that can meet these needs, and companies in the automotive and battery industries are investing heavily in these technologies to stay ahead of the market. The need to innovate and remain competitive in the rapidly growing battery market is driving companies to use advanced materials such as silicon-carbon composites. The potential benefits of these products, including improved performance and energy efficiency, will become an important component for companies seeking to lead the way.

- Global Focus on Green Technologies: Global efforts towards a low-carbon economy driven by policies such as the Paris Agreement are driving investment in green technologies, including electric vehicles, renewable energy and advanced battery systems. Silicon-carbon batteries are an important part of this revolution, with the potential to efficiently and effectively deliver clean energy solutions. Silicon carbide batteries are gaining importance as governments and businesses aim to achieve renewable energy targets, enhancing energy efficiency and supporting global development goals.

- Rapid Growth and Expansion in Regional Market: The leaders in the silicon-carbon battery industry are Asia, particularly China, Japan, and South Korea. This leadership comes from their strong position in manufacturing electric vehicles and batteries. Companies in this region are investing heavily in research and development and developing resources for silicon-carbon composite batteries. The number of electric vehicles has increased in North America and Europe, and governments have provided subsidies to address the problem of electric vehicles. As these regions demand renewable energy, the demand for silicon-carbon batteries is increasing. In addition, Europe is working to create a regional model for battery production, including the introduction of carbon-carbon composites.

Silicon Carbon Battery Market Trends

- Need for more compact, potent gadgets: With silicon-carbon batteries, consumer gadgets might become more efficient, more powerful, and have longer battery lives. This advantage extends to laptops, smartphones, wearable technologies, and several other portable devices that gain from longer battery life. The rising demand for wearable technology and portable power sources like power banks is fueling the necessity for robust and enduring batteries. Silicon-carbon batteries can fulfill this requirement by delivering high power without adding to the device's size and weight.

- Cost Reductions and Manufacturing Scalability: Silicon-carbon batteries were previously considered expensive to manufacture, but technological advances are reducing production costs. The cost of silicon-carbon batteries is expected to decrease as manufacturing methods improve and economies of scale are achieved, making them less expensive and more suitable for a wide range of applications. The company is enhancing its manufacturing capacity for silicon-carbon batteries by enhancing efficiency and introducing automated production lines, which can lower costs and enhance supply chain reliability.

- Increased Focus on High-Performance Applications: Silicon-carbon batteries are being increasingly explored beyond consumer electronics and personal electric vehicles, including heavy-duty transportation (buses, trucks) and aviation applications. The demand for high-performance and long-lasting batteries in these sectors is faster than the demand for silicon-carbon solutions. Silicon-carbon batteries can also be used in hydropower storage and power systems, where fast power generation and long service life are important for providing power in remote or isolated locations.

- Battery Recycling and Second-Life Applications: As silicon-carbon batteries become more widely used, opportunities are emerging in the battery recycling industry. Advanced recycling techniques can extract valuable materials such as silicon, carbon and lithium from used batteries, reducing environmental impact and ensuring the sustainability of battery production. Silicon-carbon batteries that have reached the end of their service life can be used again in electric vehicles or energy storage systems as grid protection or backup power, reducing waste and extending battery life.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 3.54 Billion |

| Expected Market Size in 2034 |

USD 19.25 Billion |

| Projected CAGR 2025 to 2034 |

20.71% |

| Leading Growth Region |

Asia-Pacific |

| Key Segments |

Battery Type, Form, Component, End-User, Region |

| Key Companies |

Tesla, Inc., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution, Innovative Battery Technologies, Samsung SDI, Panasonic Corporation, BYD Company Ltd., Guoxuan (Gotion High-Tech Co., Ltd.), Sila Nanotechnologies, GME Batteries, Enovix Corporation, SK Innovation, Nissan Motor Co., Ltd., XALT Energy, A123 Systems LLC |

Silicon Carbon Battery Market Dynamics

Market Drivers

Increasing use of electric vehicles

- The shift to electric vehicles is growing because of environmental issues, government rules, and consumer interest in eco-friendly options. This trend is boosting the silicon-carbon battery market. These batteries have a higher energy density compared to traditional graphite batteries, leading to longer ranges and quicker charging times, which are important for electric vehicles.

Growing need for renewable energy storage

- The transition to renewable energy sources such as wind and solar power emphasises the need for improved energy storage systems. Silicon-carbon batteries are thought to be a viable choice due to their extended lifespans and high energy density. They are able to preserve renewable energy for use during periods of high or low demand. These batteries bridge power gaps, increasing security as electricity usage rises. In general, silicon-carbon batteries provide greater power densities and enhance energy storage.

Market Restraints

Unstable materials and deteriorating performance

- One of the main problems with silicon-carbon batteries is the high expansion of silicon during charging and discharging. Silicon can expand by up to 300% when it absorbs lithium ions, which can cause mechanical problems, cracking, and failure of the anode system. Over time, this will lead to a reduction in capacity, which will decrease the battery's lifespan. Although researchers are working to discover a solution, this problem is still quite prevalent. Even with their impressive initial energy density, silicon-carbon batteries possess a shorter cycle life compared to conventional graphite-based lithium-ion batteries. Lack of silicon during cycling can cause performance degradation and capacity loss during charge and discharge cycles, reducing battery life.

High Manufacturing Costs

- The manufacturing cost of silicon-carbon batteries is higher than that of traditional lithium-ion batteries. Producing high-quality silicon anodes is a complex and expensive process, involving the extraction and processing of silicon materials and advanced manufacturing processes. Until production costs come down, silicon-carbon batteries may remain too expensive for widespread adoption, especially in price-sensitive markets such as consumer electronics and low-cost electric vehicle models. Although demand for silicon-carbon batteries is increasing, production capacity is not yet sufficient to achieve the economies of scale needed to reduce costs. The technology is still in the development phase, and until large-scale, cost-effective manufacturing processes are established, prices will remain high.

Market Opportunities

Advances in battery technology

- The significant increase in energy density offered by silicon-carbon composites over traditional graphite anodes. Silicon has a greater energy density than graphite because it can contain more lithium ions. This results in longer battery life and improved performance for applications like energy storage systems and electric automobiles. Silicon-carbon batteries also promise fast charging, a key feature of electric vehicles. This is especially important as the electric vehicle market continues to grow and consumers expect charging times to be reduced to levels comparable to charging conventional gasoline vehicles.

Growing Technological Innovations and Strategic Initiatives

- Companies, research institutions and universities are making significant investments to improve the performance of silicon-carbon batteries. The ongoing development of new manufacturing techniques, cost-reduction strategies and advances in materials science are driving the commercialization of silicon-carbon composite batteries. It is likely that these technology developments will continue to drive industrial growth. Prominent companies including Samsung SDI, LG Energy Solutions, and Tesla are forming partnerships and investing heavily in research and development to speed up the development of silicon-carbon batteries. These partnerships will help increase battery performance and commercialise silicon-carbon batteries.

Market Challenges

Technical and Commercial Challenges

- Silicon-carbon battery technology is still under development and there is no universal standard for its design and manufacturing. This lack of standardization may hinder commercialization as companies may struggle with issues related to compatibility, performance expectations and integration with existing technologies. It is a complex project that need continual research and development in order to scale the production process for large-scale silicon-carbon batteries. To ensure the scalability, economic viability, and reliability of these batteries, several challenges must be addressed.

Limited Commercialization and Market Acceptance

- Although silicon-carbon batteries offer several advantages over traditional lithium-ion batteries, their adoption in the automotive sector has been slower than expected. Automotive manufacturers may be hesitant to move away from traditional lithium-ion technology due to concerns about long-term stability, cost and lack of large-scale production capacity. Given the critical nature of battery technology in electric vehicles, automakers require rigorous testing and validation to ensure the safety, performance and reliability of silicon-carbon batteries. The lengthy development and approval cycles could delay the commercial adoption of silicon-carbon batteries in mass-market vehicles.

Silicon Carbon Battery Market Segmental Analysis

Battery Type Analysis

Lithium-Ion Batteries (Li-ion): A basic type of battery in which the anode contains a silicon-carbon compound. Silicon is often combined with graphite in these batteries to increase energy density and performance.

Solid-State Batteries: These are newer types of batteries where silicon-carbon composites can play a role in improving performance. Solid-state batteries are considered safer and have the potential for higher energy densities.

Form Analysis

Pouch Cells: These are flexible, lightweight cells commonly used in consumer electronics and electric vehicles.

Cylindrical Cells: These are more commonly used in power tools, electric vehicles, and large energy storage systems.

Prismatic Cells: Electric vehicles use these square cells, which provide a high level of energy.

Component Analysis

Anode Materials: This section focuses on the use of carbon-silicon composites in anodes. Silicon provides higher energy density, while carbon improves the mechanical stability of the anode.

Electrolytes: Although rare, research is underway to create silicon-carbon-based electrolytes or to improve the contact between the electrolyte and the silicon-carbon anode.

Cathode Materials: Although silicon-carbon composites are primarily used in the anode, some advances could also include developments in cathode technology.

End-User Analysis

Electric Vehicles (EVs): Silicon-carbon batteries are being developed for portable electronics like laptops, tablets, and cell phones to ensure efficient and long-lasting battery life.

Consumer Electronics: Silicon-carbon batteries are being developed for portable electronics, such as laptops, tablets, and cell phones, to ensure efficient and long-lasting battery life.

Energy Storage Systems: Silicon-carbon batteries can be used in grid storage solutions and renewable energy (solar or wind) applications to store excess energy, making them ideal for backup power systems.

Aerospace and Defense: High-performance batteries with longer life and higher capacity are essential for aerospace and defense applications such as drones, satellites and other remotely piloted systems.

Silicon Carbon Battery Market Regional Analysis

The silicon carbon battery market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America Silicon Carbon Battery Market Trends

North America is rapidly growing in the market for silicon-carbon batteries, as battery technology has improved, interest in electric vehicles has risen, and renewable energy storage solutions are being developed. The US and Canada lead the way in those advances, which include significant investments in research, manufacturing, and integration of new battery technologies. Some of the leading research institutions and companies on improving battery technology are based out of North America.

Enhanced composite technologies based on silicon carbon are sought after to augment battery cycle life and performance while cutting down costs, which augurs well for the wider adoption of these technologies across many industries. North American companies, such as Tesla and Panasonic, have embarked upon the enormous investment required to construct advanced battery manufacturing facilities, thereby raising the demand for new battery materials such as silicon-carbon composites to enhance performance while curtailing cost.

Europe Silicon Carbon Battery Market Trends

In Europe, the transition to clean energy and electric vehicles acts as both a sign and a method of promoting, launching, deploying-and responding to the ever-growing availability of silicon-into-carbon batteries with ever-increasing energy density and efficiency. Europe is one of the largest markets for EVs, with Norway, Germany, the UK, and France being the front runners in the promotion of electric mobility. The European Union (EU) has imposed strict regulations on emissions, and various governments have approved a variety of incentives to drive EV adoption in their countries. These electrodes are central to the ability of the batteries to perform well under prevailing standards of the vehicles in question in terms of range and charging time while providing higher energy density than traditional graphite-based batteries.

Europe, with support from its research institutions, universities, and private-sector interests, has put in focus many aspects of innovation in battery technology. New silicon-carbon composite anodes are in the process of development to improve the performance of lithium-ion batteries. Germany, France, and the UK dominate the market due to their growing automotive sector, clean energy initiatives, and a whole bunch of efforts to control carbon emissions. UK-based Britishvolt is developing groundbreaking designs using silicon-carbon composite materials for its batteries. Silicon-carbon composite materials being used for various purposes are the key to Europe's sustainability and energy goals.

Asia-Pacific Silicon Carbon Battery Market Trends

The Asia-Pacific region is a buoyant and growing silicon-carbon battery market driven by key players, technical advancements, and green technologies, which promise development opportunities. Currently, with electric vehicles picking up momentum pacing across the Asia-Pacific, this market is leading globally. With increasing electric vehicle adoption, demand for silicon-carbon battery technologies which offer better energy performance and range compared to conventional graphite lithium-ion batteries is expected to grow.

Several companies and research institutes work towards next-generation battery technologies in the Asia-Pacific region, generating tremendous battery technology studies and development. Research has focused on silicon-carbon composite materials toward lithium-ion performance-enhancing characteristics such as capacity, life, and charge time. Countries such as Vietnam, Thailand, and Indonesia have emerged as additional electric vehicle and energy storage system markets around the world furthering growth opportunities for silicon-carbon battery applications.

LAMEA Silicon Carbon Battery Market Trends

LAMEA market dynamics are influenced by the desire for sustainability, energy independence, and cleaner technologies with Brazil, South Africa, and the UAE promoting electric mobility through incentives, policy support, and infrastructure development. Besides that, silicon-carbon batteries are beginning to take a central role in EV manufacturing to support answering the questions in terms of increased energy density and driving ranges. The region does not have as many established battery manufacturers in comparison with other regions; however, there is growing interest in the development of next-generation batteries, including silicon-carbon composite batteries, which exhibit improved performance at par with traditional graphite-based lithium-ion batteries.

The countries of the region aspire to boost local manufacturing and encourage innovation in battery technology. Argentina, Saudi Arabia, Chile, and Qatar are studying clean energy and electrical vehicle projects. Meanwhile, in Africa, Kenya and Nigeria are contemplating solar energy and electric mobility. As renewable energy infrastructures roll out, demand for efficient and long-lasting battery storage will rise, and so will momentum build in this market for the region.

Silicon Carbon Battery Market Top Companies

- Tesla, Inc.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution

- Innovative Battery Technologies

- Samsung SDI

- Panasonic Corporation

- BYD Company Ltd.

- Guoxuan (Gotion High-Tech Co., Ltd.)

- Sila Nanotechnologies

- GME Batteries

- Enovix Corporation

- SK Innovation

- Nissan Motor Co., Ltd.

- XALT Energy

- A123 Systems LLC

- Green Lithium

- Saft Group

- Tianjin Lishen Battery Co., Ltd.

- QuantumScape Corporation

- SolidEnergy Systems

- Farasis Energy, Inc.

- VARTA AG

- Enevate Corporation

CEO Statements

Gene Berdichevsky, CEO of Sila Nanotechnologies:

" Silicon-carbon composite anodes are a game-changer for the battery industry. By incorporating silicon into the anode structure, we can vastly increase energy density and improve the performance of batteries, particularly in electric vehicles and large-scale energy storage systems."

Zeng Yuqun, CEO of CATL (Contemporary Amperex Technology Co. Ltd.):

" Silicon-carbon composite technology is one of the most promising avenues for enhancing the performance of lithium-ion batteries. By improving energy density, charging speed, and longevity, these advancements will play a critical role in the adoption of electric vehicles and the integration of renewable energy. We are investing heavily in R&D to scale these technologies and bring the next generation of batteries to market."

Recent Developments

- In December 2024, Sionic Energy, a recognized leader in electrolyte and silicon battery technology for next-generation lithium-ion batteries, today announced that the world's lithium-ion battery producers – which are increasingly turning to blends of graphite and silicon-based material in the anode – no longer have to rely on graphite. Using Group14's silicon-carbon composite SCC55 for 100% of the anode material, Sionic can deliver the highest energy density performance in any silicon battery.

- In September 2024, C-BATT, a joint venture between US lithium-ion battery components producer X-BATT and carbon and graphite products manufacturer CONSOL Innovations, a wholly owned subsidiary of US-headquartered CONSOL Energy, launched the next phase of development and commercialization of Obsidia, its tunable silicon-carbon composite battery anode material made with domestically sourced carbon.

Market Segmentation

By Battery Type

- Lithium-ion Batteries (Li-ion)

- Solid-State Batteries

By Form

- Pouch Cells

- Cylindrical Cells

- Prismatic Cells

By Component

- Anode Materials

- Electrolytes

- Cathode Materials

By End-User

- Electric Vehicles (EVs)

- Consumer Electronics

- Energy Storage Systems

- Aerospace and Defense

By Region

- North America

- Europe

- APAC

- LAMEA

...

...

![]()