Small Modular Reactor Market Size and Growth 2025 to 2034

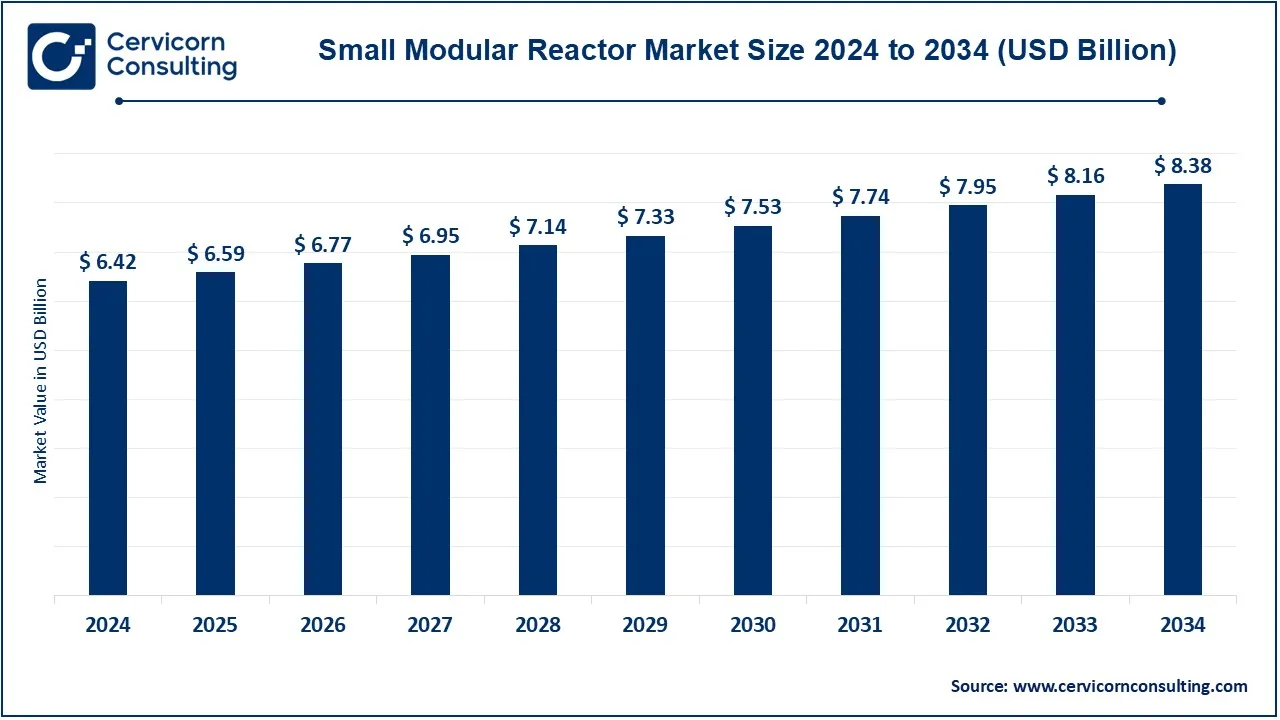

The global small modular reactor market size was reached at USD 6.42 billion in 2024 and is expected to be worth around USD 8.38 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.10% from 2025 to 2034.

The small modular reactor (SMR) market is experiencing rapid growth due to increasing demand for clean energy and decarbonization efforts. Governments and industries worldwide are investing in SMRs to replace fossil fuel power plants. The International Atomic Energy Agency (IAEA) estimates that SMRs could play a crucial role in meeting global net-zero targets by 2050. Many countries are streamlining regulations to accelerate SMR deployment, attracting private and public investments. The market growth is also driven by lower costs, scalability, and quicker deployment compared to traditional nuclear plants. Several pilot projects and commercial SMR plants are expected to be operational by 2030, creating a robust market. The demand for SMRs is rising in sectors like desalination, industrial heating, and hydrogen production, expanding their market potential.

A small modular reactor (SMR) is an advanced nuclear reactor that is smaller in size compared to traditional nuclear power plants. It is designed to generate up to 300 megawatts (MW) of electricity per unit, making it more flexible and cost-effective. SMRs are built using modular components, which means they can be manufactured in factories and transported to sites for assembly, reducing construction time and costs. SMRs use various reactor technologies, including pressurized water reactors (PWRs) and advanced cooling systems like liquid metal or gas-cooled reactors. They are designed with enhanced safety features, such as passive cooling and underground containment, reducing the risk of accidents. Due to their compact size, SMRs are ideal for remote locations, industrial use, and even hydrogen production.

Key Insights Related to the Small Modular Reactor (SMR):

- Over 80 SMR designs are currently under development worldwide.

- IAEA projects SMRs could contribute 10-20% of nuclear power generation by 2050.

- Global funding for SMR projects has increased by over 50% in the past five years.

- Investment in SMRs is projected to rise significantly due to climate change policies and energy security concerns.

- SMRs reduce carbon emissions by up to 90% compared to coal-based power plants.

- Private sector interest in SMRs has surged, with companies like NuScale Power and Rolls-Royce investing heavily.

Small Modular Reactor Market Report Highlights

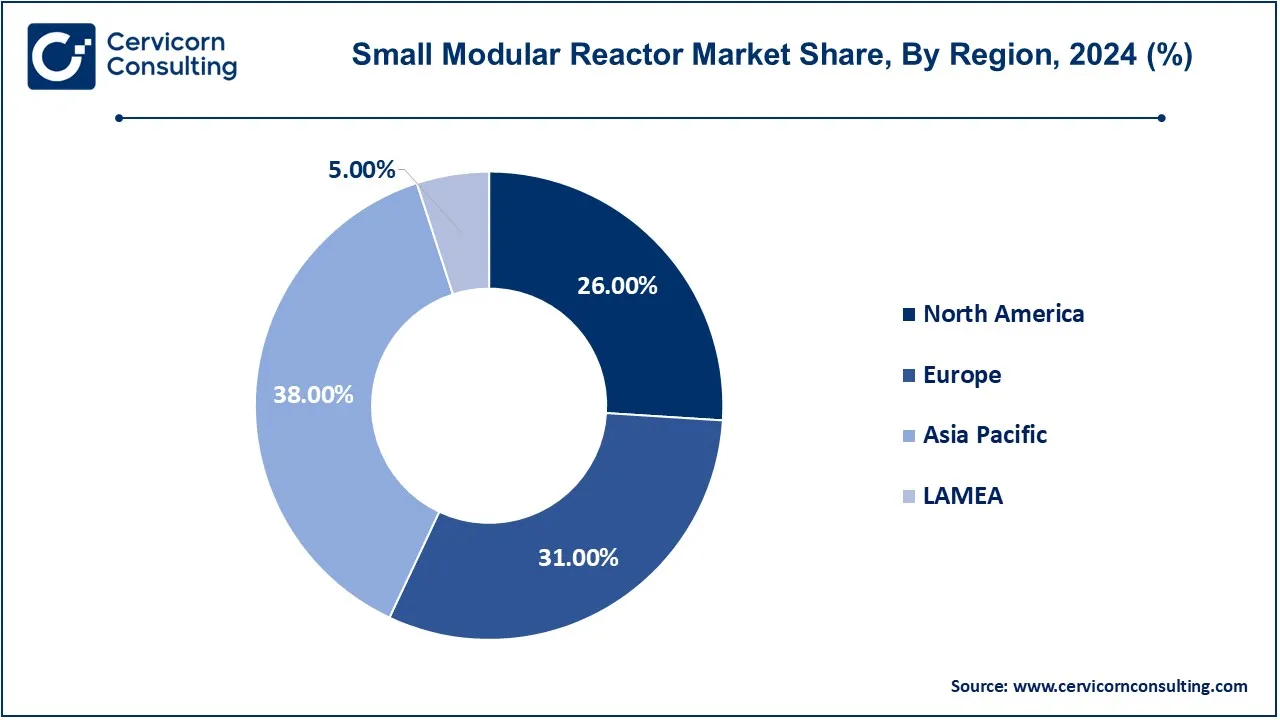

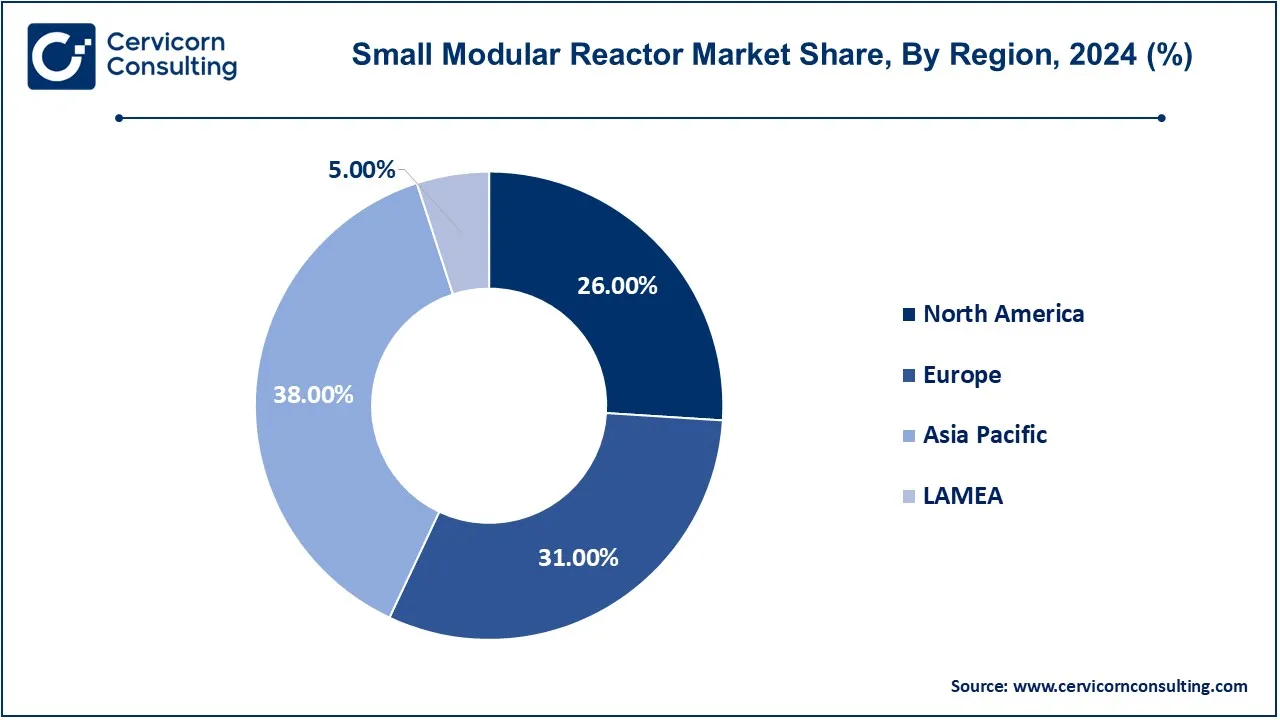

- The Asia-Pacific region has dominated the market and accounted revenue share of 38% in 2024.

- The Europe has recorded revenue share of around 31% in 2024.

- By type, the heavy-water reactors segment has accounted for 42.80% of the total revenue share in 2024.

- By application, the power generation segment has generated revenue share of 44.10% in 2024.

- By connectivity, the grid-connected segment has recorded revenue share of 69% in 2024.

- By deployment, the single-module power plants segment has captured revenue share of 64.80% in 2024.

- By power rating, the up to 100 MW segment has held revenue share of 45% in 2024.

Small Modular Reactor Market Growth Factors

- Globalization of Clean Energy: There is great global attention to issues of sustainability and carbon footprint reduction, and thus an increasing demand for clean energy alternatives. SMRs have been considered plausible alternatives toward fulfilling the climate goals of most nations because modular design allows power generation with low emissions. They are also preferred because they provide sufficient safety benefits and are thought to provide for a greater transition from fossil fuels to clean energy forms because of their small size.

- The Modular Construction: SMR construction utilizes modular construction methods that have the potential to affect the manufacturing and assembly process relatively straightforwardly. However, it is less time-consuming and cheaper than conventional reactor construction methods. Others provide the assembly of components that are manufactured off-site. Importantly, this assembly would be attractive to a utility that is in need to deploy the nuclear plants quickly.

- Better Siting Outside the Urban Areas: SMRs would seem best suited to remote sites and to nongrid areas, where conventional electric-power infrastructure may not exist. Such small installations can provide rural communities and small industries with electricity without the need for elaborate grid systems. This would create new markets for energy generation in such isolated areas and help bring about quicker access to electricity.

- The Global Trend of Sinking Greenhouse Gas Emissions: Efforts to combat greenhouse gases emissions have come about because of various international binding commitments. SMRs offer a clean alternative to fossil fuels, aiding many nations in their transition toward more sustainable forms of energy. Such transitions are critical for both global aspirations of net-zero targets and energy independence vision statements since they link with promoting economic stability.

Small Modular Reactor Market Trends

- Integrated Deployment of Smaller Modular Reactors in Hybrid Energy Systems: The integration of renewable sources, namely those of solar and wind, and with nuclear power into small modular reactors has the methodology of developing hybrid energy systems in order to supply steady generational baseload electricity to attenuate the irregularities of these renewables with additional supply factors. Such hybrid configurations of SMRs conceived as viable alternatives by utility providers to guarantee reliability of energy supply.

- Growing Applications in Desalination Schemes: The intense focus of research on SMRs includes considerations thereon of desalinating seawater for fresh water in arid regions using solar and wind energy. Customers find SMRs appropriate because of their compact nature, their capabilities, and their efficiencies with which they can be integrated. They have the greatest potential to supplement desalination plants with continuous power supply and assistance for addressing ongoing water shortages. Further, this reflects the tinkering-diversification of SMR utilities beyond electricity generation.

- Deployment in Small Grids: In recent years, the deployment of small modular reactors in small-scale grid setups is quickly gaining momentum and political backing as the base-load generation of stable geographical electricity from nearby sources of electricity supply becomes an option, especially in places where there is restricted access to large-scale sources of electricity. SMR technologies would present significant benefits to the area needing a stable, dependable load-following form of generation for energy security and demand variation management.

- Investment in Molten Salt and High-Temperature Gas-Cooled Reactors: Molten salt reactors and high-temperature gas-cooled reactors account for the increased investment in advanced reactor technologies. The new designs are intended to support evolving safety and efficiency, broadening the scope of use of SMR. The election of these types reflects the commitment of the industry in pursuit of next-generation nuclear solutions tackling salient safety and sustainability issues.

- Evolving Capital Options for Nuclear Financing: Investment opportunities in nuclear power are evolving to form various funding avenues for small modular reactor projects. Governments and private investors long realized its potential and are willing to finance the initiatives promoting the expansion of such projects. This advance will be critical in alleviating the capital challenge in nuclear energy projects, fostering a greater adoption of small modular reactors.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 6.42 Billion |

| Expected Market Size in 2034 |

USD 8.38 Billion |

| CAGR (2025 to 2034) |

3.10% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Type, Power Rating, Coolant, Deployment, Connectivity, Location, Application and Region |

| Key Companies |

Holtec International, Brookfield Asset Management, Moltex Energy, X Energy LLC, General Electric Company, NuScale Power, LLC., TerraPower, LLC., Terrestrial Energy Inc., Westinghouse Electric Company LLC., Rolls-Royce plc., ULTRA SAFE NUCLEAR, Mitsubishi Heavy Industries Ltd., General Atomics Corporation, Fluor Corporation |

Small Modular Reactor Market Dynamics

Drivers

- Global Energy Needs Are Rising: Population growth and economic expansion drive the demand for energy. These nuclear technologies will fulfill this ever-increasing energy need, given their efficient and scalable energy generation capability. In providing reliable energy with minimal environmental consequences, they are positioned to become a major avenue for future energy supply solutions.

- Increased Interest in Baseload Power Solutions: Baseload power generation is becoming more in demand for consistent and reliable energy, therefore generating interest in the applicability of SMRs. SMRs are capable, unlike other intermittent renewable sources of power generation, of supplying fairly reliable power generation, which becomes increasingly important as more countries load renewables into their energy mix.

- Decentralized Energy Demand Is Growing: This momentum builds toward decentralized energy systems driven by the ambition of independence and resilience. SMRs can offer localized solutions for energy, thereby decreasing transmission losses and providing secured energy systems. This tendency matches with the global trend toward distributed energy resources, positioning SMRs as an asset for both utilities and local communities.

- Military and Industrial Interests: The military and industrial sectors increasingly consider SMRs as a dependable power source for critical operations and remote locations. Because these sectors need an uninterrupted and secure supply of energy, SMRs are an attractive alternative. With their small size and modularity, they can be adapted for diverse applications while ensuring energy security.

Restraints

- High Initial Setup Costs: The large amount of capital needed to bring SMR facilities into operation serves as a vital hurdle. Though a modular concept may reduce the overall cost, the initial investment required ranges beyond most of the other sources of energy supply. The size of financial risk may dissuade potential investors from injecting money in with the SMR project, thereby causing delays in the commissioning.

- Regulatory Hurdles in Nuclear Licensing: The historical picture of nuclear energy problematics has often been able to limit its path for the development of SMR. Licensing and regulation, when put through, may take quite long, generally requiring an elaborate treatment including massive volumes of documentation and thorough safety assessments. This can, in turn, stretch project timelines and raise costs; hence, the discouragement, in catering, experienced by entities within the SMR development circle.

- Waste Disposal Challenges: Nuclear waste management is, and remains, highly contentious. In spite of advances in technology, long-term final disposal of radioactive waste from SMR remains an issue in terms of environmental and safety concerns. On matters pertaining to underground disposal of waste products, public opposition has complicated project approvals, as well as their implementation, efforts that form a bottleneck for the industry.

Opportunity

- Rising Demand for Clean Energy Solutions: The growing concern in the entire world to emit less carbon and more on replacing renewable sources of clean energy provides big opportunities for the SMRs. These small compact reactors can have low-carbon energy and rapidly speed up de-carbonisation of different kinds of industries where the demand can be seen regarding the reduction of fuel dependency. SMRs could be thus located close to load in remote regions providing reliable energy with limited infrastructure development requirements which encompasses both environmental and energy demand challenges.

- Energy Security and Reliability: SMRs are capable of offering stable and dependable electricity supply and that gives an opportunity for energy security. SMRs would be able to save electricity generation from natural calamities or temporal interruptions that would induce power outages. Their small footprint, ability to use a diverse range of environments and provide baseload energy give them significant advantages to locations that need dependable backup energy sources. This would provide both reliability and security of energy.

Challenges

- Economic feasibility for technology development: The main, immediate challenge for the SMR marketplace is this embedded demand for a cost-efficient and effective technology development that goes hand in hand with very affordable innovation for mass adoption. Since demand changes with market dynamics, a manufacturer needs to have such designs and manufacture processes that yield simultaneous cost downward pressure, as well as safeguard an optimum level of safety.

- Competition from the advanced renewables: The boom of solar and wind is a game changer on the SMR market. As advances in solar, wind, and other renewables make these technologies economically viable and considerably cheaper, the nuclear sector must prove that SMRs encompass an advantage in order to regain investment and support. Such competition inspires continuous innovation and constantly highlights the positives.

- Uncertainty of Very Long-Term Policy Support: The SMR market faces multiple challenges arising from inconsistent governmental policies and regulatory frameworks. It is also an unrevealed mix of different possibilities regarding power-planning policies over a long period, and regulators generally are acting in a preventive way. Thus, a continuous and, hence strong, protective regulatory environment becomes highly significant for industry stakeholders in terms of promoting SMR development and deployment.

Small Modular Reactor Market Segmental Analysis

The small modular reactor market is segmented into type, power rating, coolant, deployment, connectivity, location, application and region. Based on type, the market is classified into heavy-water reactors, light-water reactors, high-temperature reactors, fast-neutron reactors and molten salt reactors. Based on power rating, the market is classified into up to 100 MW, 101-200 MW, and 201-300 MW. Based on coolant, the market is classified into healy liquid metals, water, molten salt and gases. Based on deployment, the market is classified into single-module power plants and multi-module power plants. Based on connectivity, the market is classified into off-grid and grid-connected. Based on location, the market is classified into land and marine. Based on application, the market is classified into power generation, desalination, hydrogen generation and industrial.

Type Analysis

Heavy-water Reactors: Heavy-water reactors (HWRs) are reactor types that use heavy water as a moderator and coolant. This enables natural uranium to be used as fuel. Their design improves the efficiency of the fuel made easier by using less processed fuel than that required by light-water reactors. HWRs are noteworthy because of their ability to operate on different fuels, such as thorium. An example of this is the CANDU reactor, which has demonstrated the flexibility of fuel utilization and its success in many country configurations.

Light-water Reactors: Light-water reactors (LWRs) are the most commonly used nuclear reactor kinds in the world, using ordinary water as a coolant and neutron moderator. Their designs make extensive use of efficient heat exchange, allowing their application within various ranges of power generation. They utilize enriched uranium fuel and may be of two main types: PWRs or BWRs. LWRs have quite safe systems compared to their HWR counterparts, though their reliance on enriched fuel is a drawback.

Small Modular Reactor Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Heavy-water reactors |

42.80% |

| Light-water reactors |

31.40% |

| High-temperature reactors |

16.20% |

| Others |

9.60% |

High-Temperature Reactors: High-temperature reactors (HTRs) operate at temperatures much higher than those attained by classic reactors; therefore, they can operate at greater thermal efficiencies. Helium gas cools them, and graphite works as a moderator. This technology brings advantages concerning safety and fuel utilization. The other great perks of HTRs are readiness to produce either hydrogen or supply heat for further processes in the course of accomplishing higher temperatures. The integration of HTRs into systems of renewable energy only adds to the attractiveness of such reactors in a low-carbon energy future.

Fast-Neutron Reactors: The new feature of fast-neutron reactors (FNR) is that they could use fast neutrons in sustaining nuclear fission without the use of any moderator material. This characteristic allows for optimum utilization of a much wider range of fuels such as plutonium and depleted uranium. FNRs are perhaps best recognized as fertile breeders effectively recycling nuclear materials to reduce nuclear waste. Their benefits to sustainability and resource management notwithstanding, these reactors pose technical complexity and several challenges in terms of initial costs for mainstream deployment.

Molten Salt Reactors: Molten Salt Reactor (MSR) systems utilize molten salt as a coolant and a solvent for the fuel, permitting high-temperature operation and better thermal efficiency. The liquid fuel allows highly efficient removal of fission products with an associated dramatic improvement in safety and a considerable reduction in waste. MSRs can be therefore operated at much lower pressures than the conventional reactors, thus reducing the risks of explosion outbreaks to almost nil. Despite development and deployment challenges, inherent safety and long-term sustainability appeal in the changing nuclear paradigm are their attractive features.

Application Analysis

Power Generation: SMRs are mainly reported to be used for generation of power. SMRs can play a key role in providing reliable and low-carbon electricity to meet growing world energy needs. They are intended to provide stable baseload generation to complement renewable generation sources, which is important to guarantee the operation of the grid. SMRs are modular and flexible in size and also sit well with utilities as well as rural communities. They are key components in improving energy security and reducing GHG attributable to the replacement of fossil fuel generation.

Desalination: Desalination using SMRs provides an innovative approach to water scarcity in arid regions. SMR is able to heat and provide energy for desalination processes and produce freshwater. This is an important issue for supporting agricultural and industrial activities in water-stressed regions. Other than addressing the immediate needs of water supplies, the coupling of nuclear desalination technologies has the potential to contribute to sustainable development through reducing water production's environmental footprint.

Small Modular Reactor Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Power Generation |

44.10% |

| Desalination |

25.80% |

| Hydrogen Generation |

18.60% |

| Industrial |

12.50% |

Hydrogen Generation: Due to an increasing market demand for clean hydrogen in multiple energy applications, SMR has become one of the emerging applications. SMRs can produce hydrogen either through high-temperature electrolysis or through thermochemical processes; hence, SMRs provide a low-carbon alternative to the conventional hydrogen production process. However, the diminishing future scope of hydrogen production can partly be associated with SMRs that provide hydrogen flexibly as part of decarbonization. This application is in tandem with the global commitment toward lowering greenhouse gas emissions while ensuring sustainability in energy development and industrial applications.

Industrial Applications: SMRs are already in use for applications in industries providing heat and power to manufacturing processes; they emit fewer greenhouse gases, enjoy competition based on fewer geographical restrictions, and address remote site energy requirements while enabling energy supply across the plant uninterruptedly without engaging in extensive grid infrastructure. SMRs could also accelerate low-carbon energy solutions for hard-to-abate sectors such as cement and steel, enabling decarbonization with a significant reduction in carbon footprints associated with energy productivity gains. SMR introduction into the industrial facility could be done in such a way as to reduce footprints considerably, with resultant rest on some factor within an efficiency-focused interaction.

Small Modular Reactor Market Regional Analysis

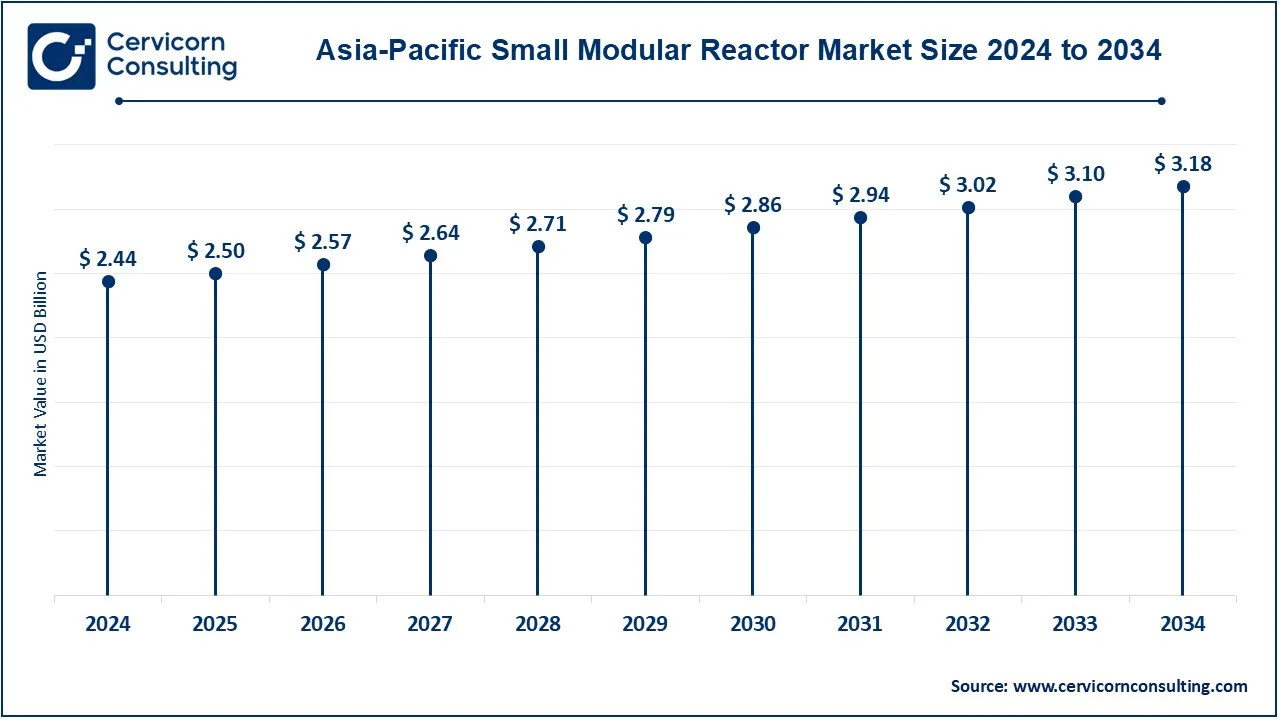

The global market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated SMR market in 2024.

What factors are contributing to Asia-Pacific's dominance in the small modular reactor market?

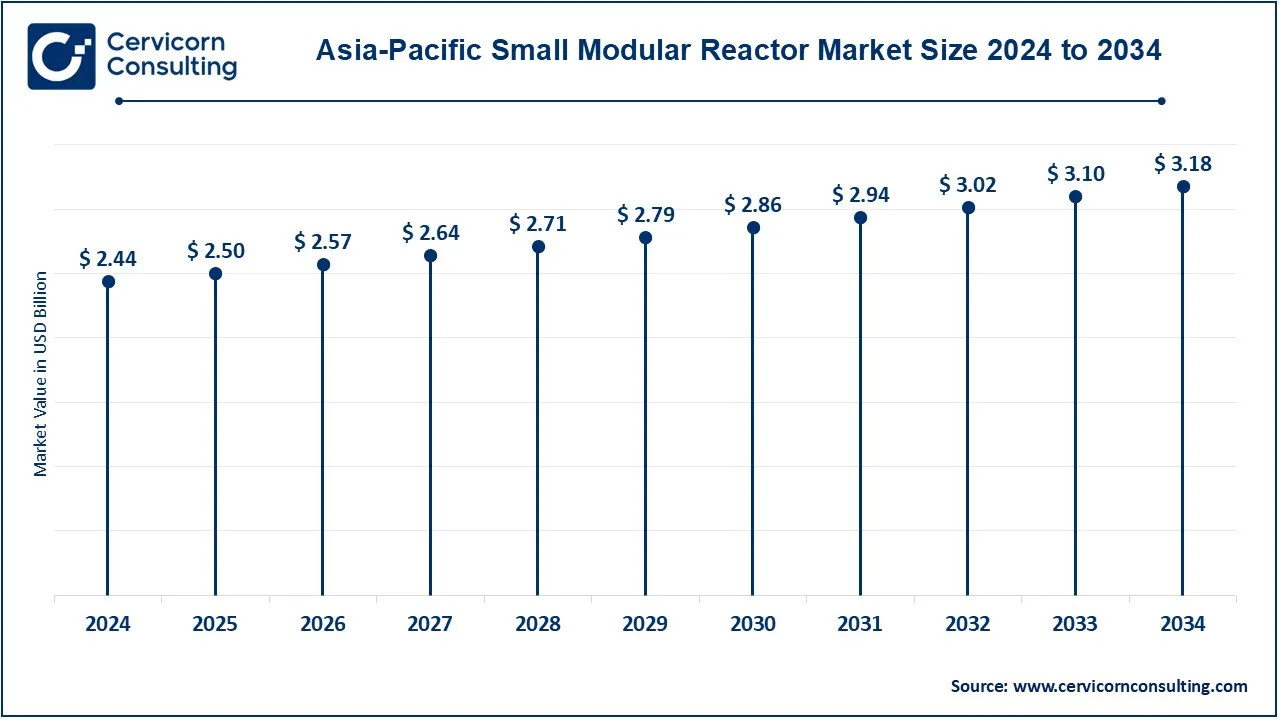

The Asia-Pacific small modular reactor market size was accounted for USD 2.44 billion in 2024 and is predicted to surpass around USD 3.18 billion by 2034. The Asia-pacific region with countries including China, Japan, and South Korea is showing an increased interest in SMRs as part of wider energy transition strategies. China is developing several SMR designs. Projects such as the ACP100 are in vogue. SMRs are leveraged by Japan as a means to enhance energy security after the Fukushima disaster. South Korea is focusing on its advancement of nuclear technologies including SMRs that are commercially inclined towards enhancing global clean energy initiatives. The preeminence of the low-carbon solutions for that region makes way for the development of the SMR market.

What are the driving factors of North America small modular reactor market?

The North America small modular reactor market size was valued at USD 1.67 billion in 2024 and is expected to reach around USD 2.18 billion by 2034. North America is a significant player with respect to the small modular reactor (SMR). The Nuclear Regulatory Commission (NRC), the United States nuclear safety authority, has been reviewing SMR designs one after another, including the NuScale Power Module, in an aim at regulatory approval that can hasten deployment. Canada has also shown commitment to nuclear innovation based on the plan for the integration of SMRs into its energy mix, especially for the remote areas. While both countries emphasize SMRs with the potential provision of clean energy, increasing grid resilience and energy independence are also being pursued.

What is driving Europe's growing momentum in the SMR market?

The Europe small modular reactor market size was estimated at USD 1.99 billion in 2024 and is projected to hit around USD 2.60 billion by 2034. Europe too is now gaining momentum in the SMR market, wherein countries dive into ideas to diversify their energy portfolios and reduce carbon emissions. It is the UK and France that lead the way, the latter exploring several SMR designs for complementing renewable resources. SMR development in the EU is receiving funding and policy framework support in achieving climate goals. Germany is mulling the SMR choice for energy safety by breaking free from fossil combustibles. The inter-country collaboration among European states is fostering innovations and making strides on the regulatory alignment for the SMR technology.

LAMEA small modular reactor market growth

The LAMEA small modular reactor market was valued at USD 0.32 billion in 2024 and is anticipated to reach around USD 0.42 billion by 2034. The increase of SMR adoption in the LAMEA region is motivated by countries striving to tackle energy shortages and increase grid stability. Nuclear power sources are being considered by Brazil and South Africa among other countries to diversify their energy mix. Others, such as the United Arab Emirates, are investing heavily in nuclear energy, with reference to the Barakah nuclear power plant. The opportunities provided by the SMRs for off-grid applications and/or remote areas would align well with energy challenges in the LAMEA region, providing a firm basis for innovative solutions.

Small Modular Reactor Market Top Companies

CEO Statements

Patrick Fragman, President and CEO of Westinghouse Electric Company

- "During the Great British Nuclear (GBN) competitive SMR technology selection process, I expressed confidence in the AP300 SMR design's readiness for market. With proven technologies and regulatory familiarity, the AP300 can reach the market quickly, economically, and with certainty."

Chris Cholerton, CEO of Rolls-Royce SMR

- "As the UK's only SMR company, we are already 18 months ahead of competitors in the regulatory approvals process and are well-positioned to deliver the first commercial, land-based SMR in the western world."

Recent Developments

- In June 2023, Fortum and Westinghouse Electric Company, a global leader in innovative nuclear technology, signed a Memorandum of Understanding (MoU) to assess the feasibility of developing and deploying new nuclear energy solutions in Finland and Sweden. The collaboration aims to enhance energy security in the Nordic region for future generations, with investment decisions slated for a later phase.

- In May 2023, NuScale Power Corporation and Nucor Corporation announced an MoU to explore the possibility of co-locating NuScale's VOYGR small modular reactor (SMR) power plants with Nucor's Electric Arc Furnace (EAF) steel mills. This initiative seeks to provide clean, reliable baseload electricity to support Nucor's operations and potentially expand their manufacturing partnership, focusing on net-zero steel products for NuScale projects.

- In April 2023, SNC-Lavalin entered into a strategic agreement with Moltex to advance Small Modular Reactor development in Canada. Leveraging SNC-Lavalin's expertise in engineering, licensing, regulatory affairs, and project management, this partnership aims to attract new customers and drive Moltex's commercial objectives in the nuclear energy sector.

Market Segmentation

By Type

- Heavy-water reactors

- Light-water reactors

- High-temperature reactors

- Fast-neutron reactors

- Molten salt reactors

By Power Rating

- Up To 100 MW

- 101-200 MW

- 201-300 MW

By Coolant

- Healy Liquid Metals

- Water

- Molten Salt

- Gases

By Deployment

- Single-Module Power Plants

- Multi-Module Power Plants

By Connectivity

By Location

By Application

- Power Generation

- Desalination

- Hydrogen Generation

- Industrial

By Region

- North America

- APAC

- Europe

- LAMEA

...

...