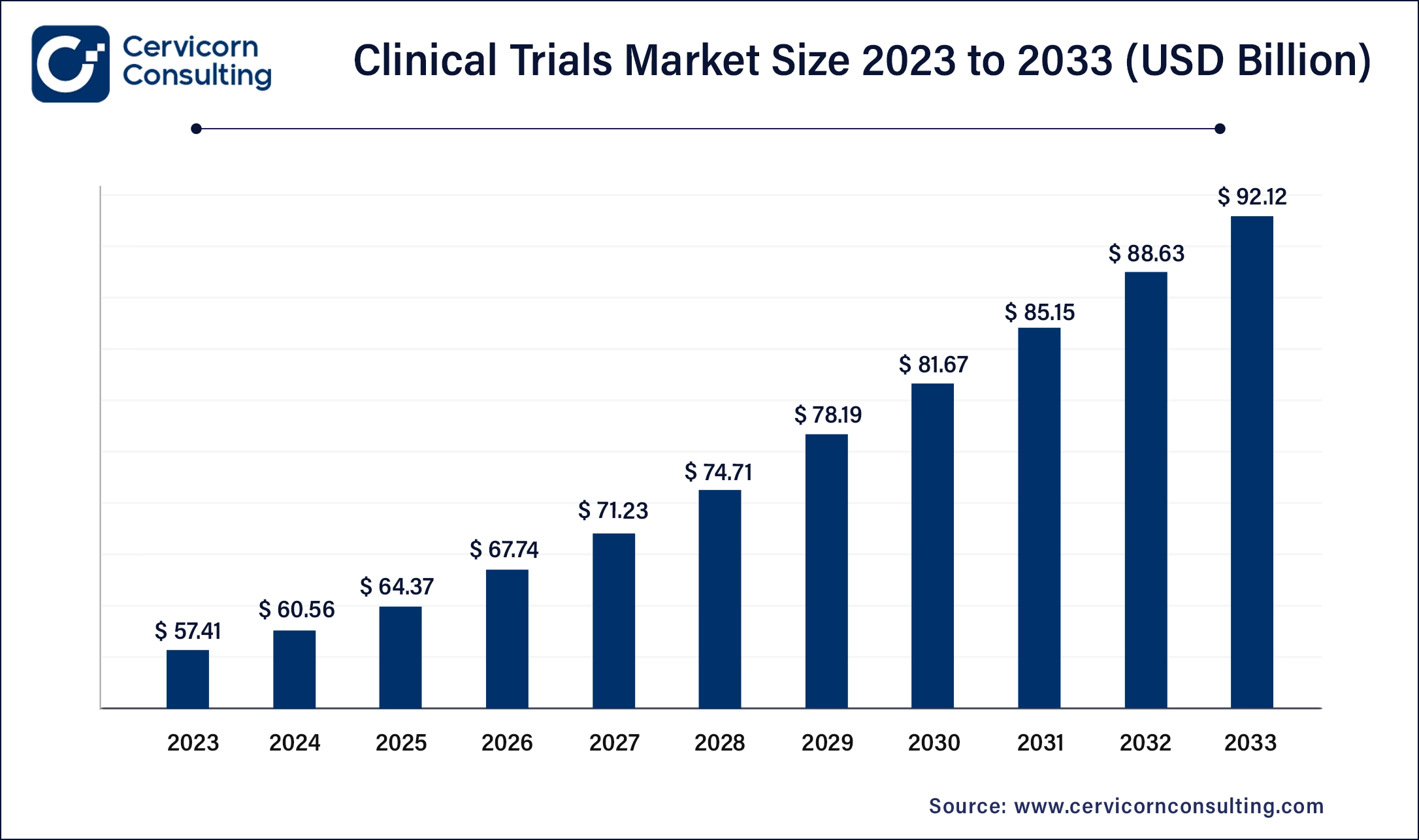

The global clinical trials market size was valued at USD 64.37 billion in 2025 and is expected to be worth around USD 99.08 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.84% over the forecast period 2026 to 2035. The global clinical trials market has been experiencing steady growth, driven by increasing demand for innovative treatments, a rise in chronic diseases, and technological advancements in research methodologies. Key factors fueling this growth include the adoption of artificial intelligence in trial design, the expansion of biopharmaceutical companies, and the surge in personalized medicine, which tailors treatments to individual patient profiles. Additionally, the COVID-19 pandemic accelerated the adoption of virtual and decentralized trials, allowing patients to participate remotely and reducing logistical challenges. Regions like North America and Europe dominate the clinical trials market due to their robust healthcare infrastructure, while emerging markets in Asia-Pacific, including India and China, are becoming increasingly significant due to lower operational costs and large patient pools.

The clinical trials market encompasses the systematic investigation of new drugs, treatments, or medical devices in human subjects to assess their safety, efficacy, and potential side effects. It plays a crucial role in pharmaceutical and biotechnology industries, guiding the development and regulatory approval of new therapies. The market's growth is driven by advancements in medical research, increasing prevalence of chronic diseases, and stringent regulatory standards demanding rigorous clinical validation of new healthcare innovations.

Clinical trials are research studies conducted to evaluate the safety, efficacy, and side effects of medical interventions such as drugs, devices, or treatment regimens. These trials are essential in advancing medical science by ensuring new treatments meet regulatory standards before being made available to the public. Clinical trials typically occur in phases, starting with small-scale studies (Phase I) to assess safety, followed by Phase II and III trials that evaluate effectiveness and compare the new intervention to existing treatments. Some common types of clinical trials include interventional trials, observational studies, and expanded access trials, each designed to address specific research questions. With advancements in technology, decentralized trials and adaptive trials are emerging, making clinical research more accessible and efficient.

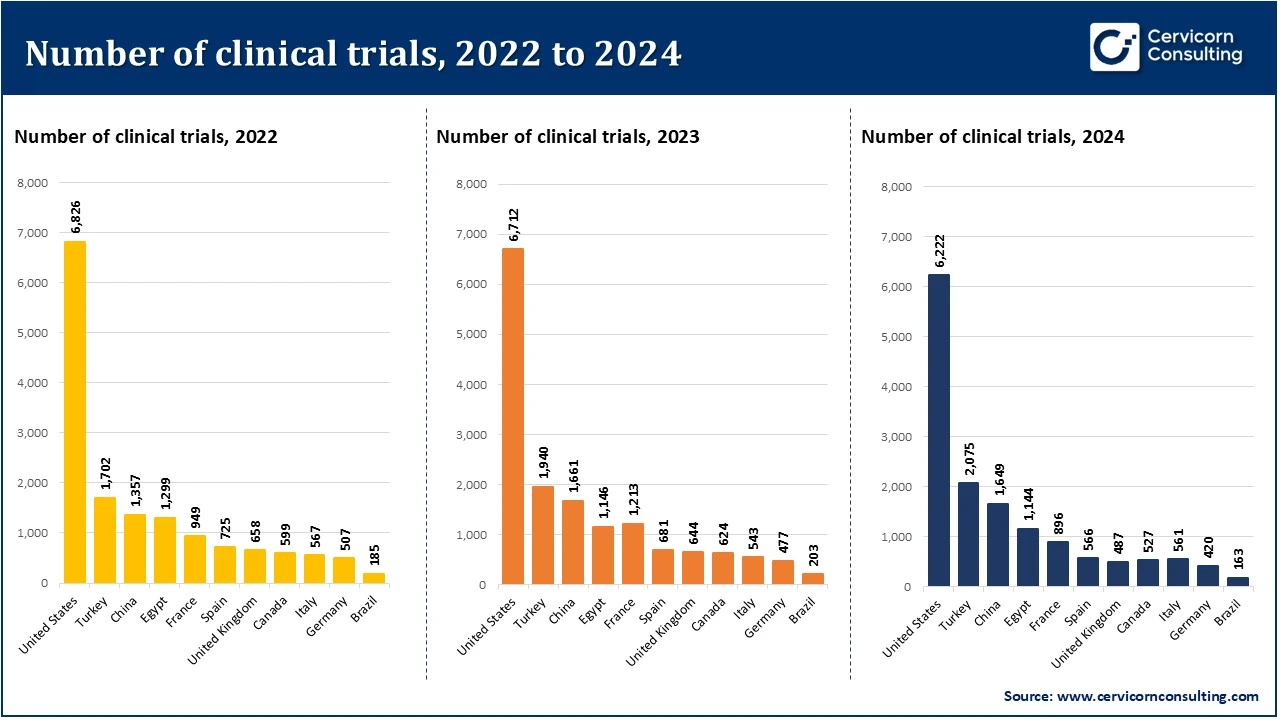

Global Trends in Clinical Trials (2022–2024)

Between 2022 and 2024, the overall number of clinical trials experienced a gradual decline. The highest volume of trials was recorded in 2022, followed by a slight decrease in 2023 and 2024. Despite the decline, the leading countries remained consistent across the years, indicating a stable distribution of research activity. A few nations continued to dominate the clinical trial landscape, contributing the majority of global studies.

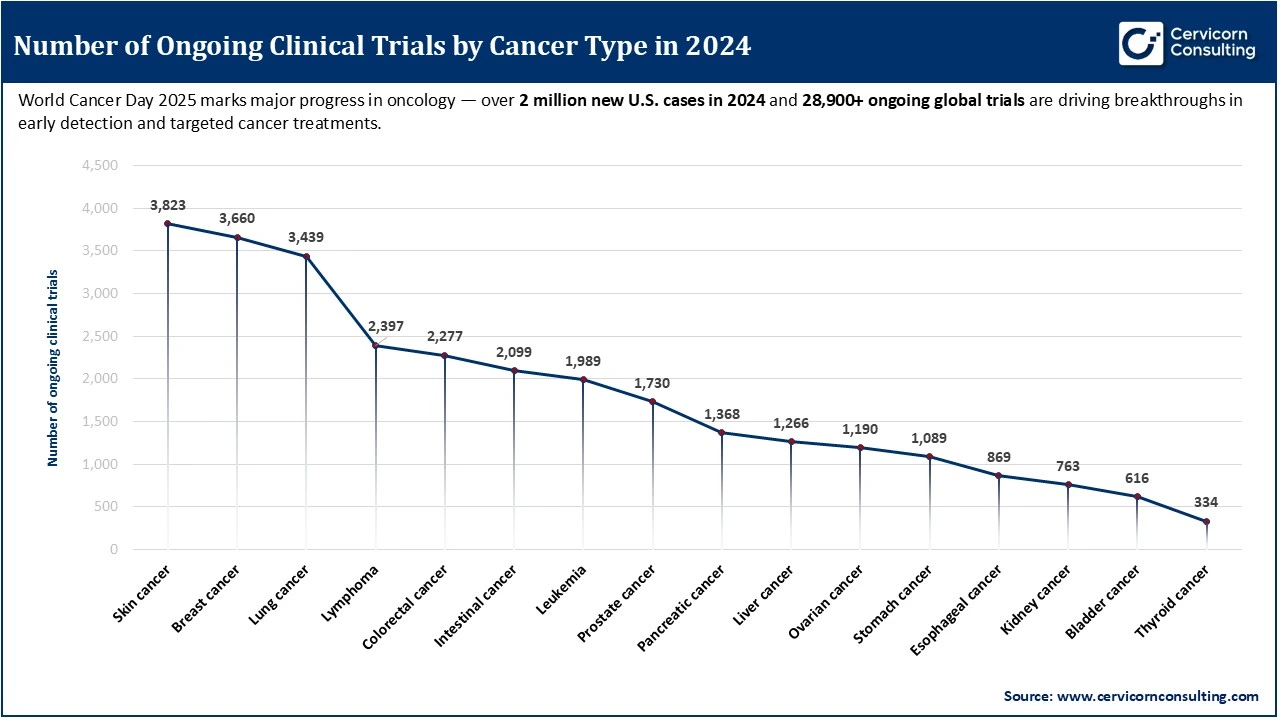

Focus on Oncology in 2024

In 2024, cancer research was at the forefront of global clinical trial efforts, with 28,909 ongoing oncology studies exploring new treatments and therapies. These trials are vital in driving breakthroughs in early detection, precision medicine, and targeted therapies, especially as the global burden of cancer continues to rise. With over 2 million new U.S. cancer cases diagnosed in 2024 alone, clinical trials have become essential tools in advancing care and improving outcomes for patients across a wide range of cancer types, including skin, breast, and lung cancers, which saw the highest number of trials.

Improving Survival and Quality of Life for Cancer Patients

As treatment advances continue, long-term survival is becoming more achievable for many patients. As of 2024, the U.S. had 18.97 million cancer survivors, a number expected to reach 26 million by 2040. Notably, 70% of survivors have lived at least five years post-diagnosis, and 11% have surpassed 25 years. These figures highlight not only the success of modern treatments but also the growing need for comprehensive post-treatment care and quality-of-life support. The progress made through clinical trials is not just extending lives, it is reshaping the entire cancer care journey.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 67.74 Billion |

| Projected Market Size in 2035 | USD 99.08 Billion |

| Expected CAGR 2026 to 2035 | 4.84% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Phase, Indication, Therapeutic Area, Design, End-Users, Region |

| Key Companies | IQVIA, Holdings Inc., PPD, Inc., ICON plc, Parexel International Corporation, Covance Inc. (LabCorp Drug Development), Syneos Health, Inc., Medpace Holdings, Inc., PRA Health Sciences, Inc., Charles River Laboratories International, Inc., WuXi AppTec Inc. |

Patient-Centric Approaches

Digital Transformation in Healthcare

Recruitment and Retention Challenges

High Costs and Budget Constraints

Virtual and Decentralized Trials

Real-World Evidence (RWE) Generation

Patient Recruitment and Retention

Data Quality and Integrity

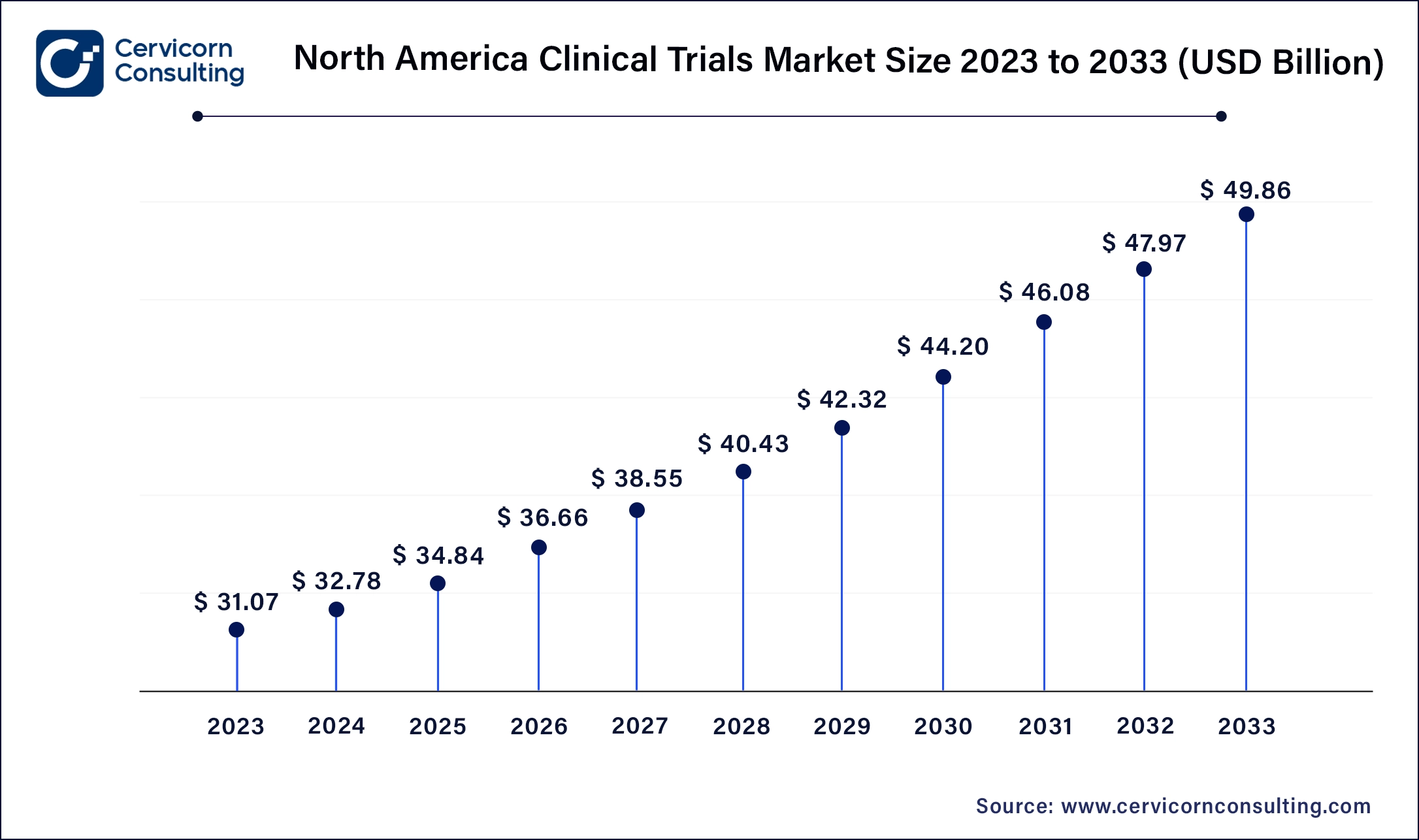

North America leads in the market with revenue share 53.9% in 2025 due to robust healthcare infrastructure, advanced research facilities, and strong regulatory frameworks. Trends include a focus on precision medicine, incorporating genomic data in trials, and increasing adoption of decentralized trials leveraging telemedicine and digital health technologies. The North America market size was valued at USD 34.84 billion in 2025 and is anticipated to reach around USD 53.62 billion by 2035. The United States has accounted 80% revenue share in 2025.

Asia-Pacific is growing rapidly at a CAGR of 6.34% during the forecast period, driven by a large patient pool, lower trial costs, and evolving regulatory environments. The Asia Pacific market size is calculated at USD 11.36 billion in 2025 and is projected to hit around USD 17.49 billion by 2035. Trends include a shift towards conducting more phase I and II trials, increasing adoption of virtual and hybrid trials, and investments in biotech hubs like China and India for oncology and infectious diseases research.

Clinical Trials Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 53.90% |

| Europe | 24.40% |

| Asia-Pacific | 17.81% |

| LAMEA | 3.89% |

Europe has accounted revenue share of 24.4% in 2025. The europe market is expected to reach around USD 24.12 billion by 2035 from USD 15.67 billion in 2025. Europe emphasizes patient-centric trials, with a strong emphasis on ethical standards and regulatory compliance. Trends include a rise in adaptive trial designs, collaborative efforts among academic institutions and pharmaceutical companies, and expansion of trials in rare diseases and orphan drugs.

LAMEA has captured revenue share of around 3.89% in 2025. LAMEA regions are emerging as attractive destinations for market due to improving healthcare infrastructure and cost-effectiveness. Trends include a rise in vaccine trials, infectious disease research, and collaborations with global pharmaceutical companies to conduct multinational trials in diverse patient populations.

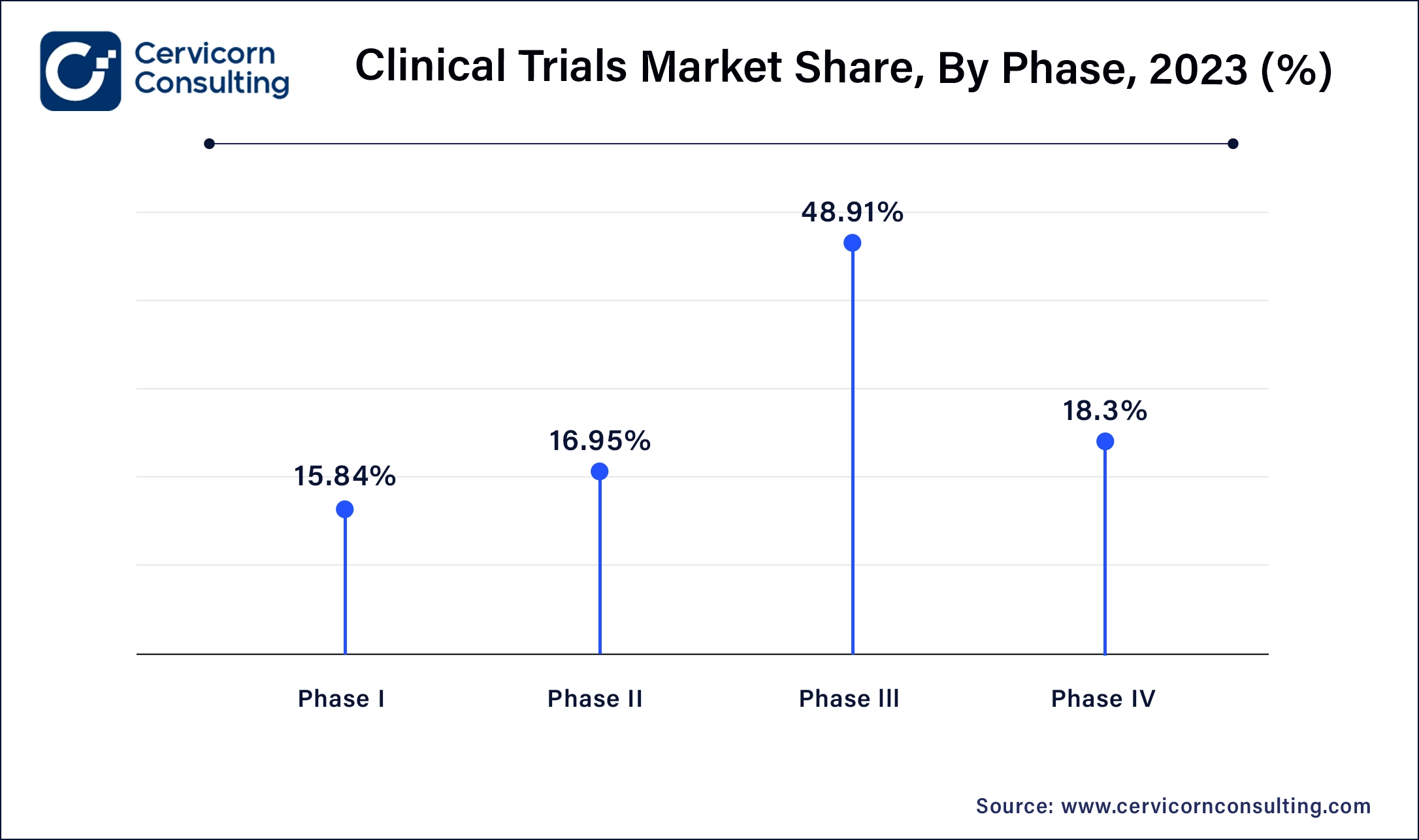

Phase I: Phase I segment has generated market share of 15.84% in 2025. Phase I clinical trials involve testing a new drug or treatment in a small group of healthy volunteers to evaluate its safety, dosage range, and potential side effects. Trends include increased focus on biologics and personalized medicine, advancements in adaptive trial designs, and the integration of biomarkers to enhance early-stage drug development efficiency.

Phase II: Phase II segment has captured 16.95% market share in 2025. Phase II segment assess the effectiveness and further evaluate safety of a drug or treatment in a larger group of patients with the targeted disease or condition. Trends include the use of adaptive trial designs for flexible protocols, emphasis on patient-centric approaches to improve recruitment and retention, and growing utilization of real-world evidence to supplement trial data.

Phase III: Phase III segment has accounted market share of 48.91% in 2025 and is aim to confirm the efficacy and safety of a drug or treatment in a larger patient population, often across multiple sites and regions. Trends include globalization of trials to access diverse patient populations, adoption of virtual and decentralized trial models for improved efficiency, and increased regulatory scrutiny on data quality and patient safety.

Phase IV: Phase IV segment has captured market share of 18.3% in 2025, Phase IV also known as post-marketing studies, monitor the drug or treatment after it has been approved for market use. Trends include the use of real-world data to assess long-term safety and effectiveness, expansion of observational studies and registries, and focus on comparative effectiveness research to inform healthcare decisions and regulatory policies.

Autoimmune/Inflammation: Autoimmune and inflammatory conditions focus on developing therapies to modulate immune responses. Trends include biologics targeting specific cytokines, personalized medicine approaches using biomarkers, and novel anti-inflammatory agents addressing unmet medical needs.

Pain Management: Pain management aim to innovate treatments for acute and chronic pain. Trends include opioid alternatives, non-pharmacological interventions, and personalized pain management strategies integrating digital health technologies.

Oncology: Oncology evaluate new cancer treatments, including immunotherapies, targeted therapies, and combination therapies. Trends include biomarker-driven trials for precision medicine, immunotherapy advancements, and CAR-T cell therapies for hematologic malignancies.

CNS Conditions: CNS disorders focus on neurodegenerative diseases and psychiatric disorders. Trends include neuroprotective therapies, disease-modifying treatments for Alzheimer's and Parkinson's, and digital therapeutics for mental health.

Diabetes: Diabetes explore treatments for type 1 and type 2 diabetes, emphasizing insulin therapies, oral antidiabetic agents, and regenerative medicine approaches. Trends include continuous glucose monitoring, personalized diabetes management, and therapies addressing diabetes-related complications.

Obesity: Obesity seek to develop interventions for weight management and obesity-related comorbidities. Trends include pharmacotherapy for appetite control, metabolic surgery innovations, and behavioral interventions using digital health platforms.

Cardiovascular: Cardiovascular diseases focus on treatments for heart disease, hypertension, and stroke. Trends include novel anticoagulants, gene therapy for cardiovascular disorders, and digital health tools for remote monitoring and prevention.

Others: Other indications encompass diverse areas such as dermatology, rheumatology, and rare diseases. Trends include orphan drug development, gene therapy advancements for rare disorders, and innovative treatments for skin conditions leveraging biotechnology and personalized medicine.

Oncology: Oncology segment has generated 38.41% market share in 2025. Oncology focus on developing new treatments for cancers. Trends include personalized medicine, immunotherapy advancements, and targeted therapies based on genetic mutations, aiming to improve survival rates and reduce side effects.

Infectious Diseases: Infectious diseases segment has captured market share of 9.51% in 2025. Infectious diseases evaluate vaccines, antivirals, and antibiotics. Trends include global efforts against emerging infections, vaccine development for pandemics, and novel approaches for antibiotic-resistant pathogens.

Neurology: Neurology investigate treatments for neurological disorders like Alzheimer's and Parkinson's disease. Trends include biomarker-driven trials, gene therapies for rare neurogenetic disorders, and interventions targeting neuroinflammation and neurodegeneration.

Metabolic Disorders: Metabolic disorders focus on diabetes, obesity, and metabolic syndrome. Trends include innovative therapies for insulin resistance, personalized nutrition approaches, and biopharmaceuticals targeting metabolic pathways and hormone regulation.

Immunology: Immunology study treatments for autoimmune diseases and immune system disorders. Trends include biologics targeting cytokines and immune cells, personalized immunotherapies, and novel therapies for chronic inflammatory conditions.

Cardiology: Cardiology segment has generated market share of 9.17% in 2025. Cardiology explore treatments for heart diseases and conditions. Trends include regenerative medicine for cardiac repair, advanced devices for heart failure management, and personalized approaches in preventive cardiology.

Genetic Diseases: Genetic diseases focus on inherited disorders like cystic fibrosis and muscular dystrophy. Trends include gene therapy advancements, CRISPR-based approaches for genetic correction, and clinical trials targeting specific gene mutations.

Women's Health: Women's health investigate treatments for conditions like breast cancer, osteoporosis, and reproductive health issues. Trends include hormone replacement therapies, novel contraceptives, and personalized approaches in gynecological care.

Others: Other segemt has garnered market share of 31.56% in 2025. Other therapeutic areas include dermatology, rheumatology, and rare diseases. Trends include orphan drug development, biologics for skin disorders, and personalized treatments for rare genetic conditions, expanding the scope of clinical trials across diverse medical specialties.

Interventional: Interventional study segment has captured 76.5% in 2025. Interventional studies involve testing the effects of a treatment or intervention on participants, aiming to evaluate efficacy and safety. Trends include increasing use of randomized controlled trials (RCTs), adaptive trial designs, and incorporation of biomarkers to personalize treatments.

Treatment Studies: Focused on assessing the effectiveness of therapies, treatment studies evaluate new drugs or combinations against existing standards. Trends include comparative effectiveness research, patient-centered outcomes, and regulatory incentives for orphan drugs.

Observational Studies: Observational studies segment has accounted market share of 20.52% in 2025. Observational studies observe participants without intervening, analyzing real-world data to understand health outcomes. Trends include cohort and case-control studies, leveraging electronic health records (EHRs), and conducting pragmatic trials to assess interventions' effectiveness in diverse populations.

Expanded Access: Known as compassionate use, expanded access trials provide investigational treatments to patients outside clinical trials. Trends include streamlined access programs, regulatory frameworks ensuring patient safety, and ethical considerations in balancing access with clinical trial integrity.

Others: This category includes diverse trial designs such as crossover studies, bioequivalence studies, and dose-escalation trials. Trends encompass innovative trial methodologies like virtual trials, decentralized trials, and adaptive designs to enhance efficiency and patient-centricity in clinical research.

Hospitals: Hospitals participate by providing facilities and medical expertise to conduct trials on-site. Increasing hospital participation in clinical trials due to advanced medical infrastructure, access to diverse patient populations, and collaborative partnerships with pharmaceutical companies and CROs to streamline trial management and patient recruitment.

Laboratories: Laboratories contribute by conducting specialized tests and analyses on biological samples collected during trials. Growing demand for specialized laboratory services in clinical trials, driven by advancements in biomarker research, genomic testing, and personalized medicine. Laboratories are adopting automation and digital technologies to enhance efficiency, accuracy in data processing, and compliance with regulatory standards.

Clinics: Clinics serve as trial sites, providing outpatient care and medical supervision to trial participants. Increasing prevalence of decentralized clinical trials conducted in clinics, leveraging telemedicine, mobile health apps, and remote monitoring technologies. This trend enhances patient convenience, reduces trial costs, and accelerates recruitment timelines by reaching broader geographic areas and diverse patient demographics.

Others: Includes academic research institutions, contract research organizations (CROs), and patient advocacy groups involved in various aspects. Academic institutions drive innovation in clinical trial methodologies and therapeutic discoveries. CROs offer specialized services in trial management, data analytics, and regulatory compliance, catering to pharmaceutical and biotech companies. Patient advocacy groups influence trial design and recruitment strategies, emphasizing patient-centric approaches and ethical considerations in research.

In the clinical trials market, new players adopting innovation include Veristat, a CRO specializing in biotech and pharmaceutical trials with a focus on rare diseases and oncology. Additionally, Clincierge offers patient recruitment solutions through technology-driven approaches. Key players dominating the market include IQVIA, known for its comprehensive data analytics and clinical trial management solutions. PPD, with its global reach and broad therapeutic expertise, and ICON plc, renowned for its strategic consulting and operational excellence, are also significant players. These leaders maintain dominance through extensive service offerings, global presence, and strong client relationships, ensuring robust growth and market leadership.

The clinical trials industry has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability.

By Phase

By Indication

By Therapeutic Area

By Design

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Clinical Trials

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Phase Overview

2.2.2 By Indication Overview

2.2.3 By Therapeutic Area Overview

2.2.4 By Design Overview

2.2.5 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Clinical Trials Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Patient-Centric Approaches

4.1.1.2 Digital Transformation in Healthcare

4.1.2 Market Restraints

4.1.2.1 Recruitment and Retention Challenges

4.1.2.2 High Costs and Budget Constraints

4.1.2.3 Virtual and Decentralized Trials

4.1.2.4 Real-World Evidence (RWE) Generation

4.1.3 Market Challenges

4.1.3.1 Patient Recruitment and Retention

4.1.3.2 Data Quality and Integrity

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Clinical Trials Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Clinical Trials Market, By Phase

6.1 Global Clinical Trials Market Snapshot, By Phase

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

6.1.1.1 Phase I

6.1.1.2 Phase II

6.1.1.3 Phase III

6.1.1.4 Phase IV

Chapter 7 Clinical Trials Market, By Indication

7.1 Global Clinical Trials Market Snapshot, By Indication

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

7.1.1.1 Autoimmune/Inflammation

7.1.1.2 Pain Management

7.1.1.3 Oncology

7.1.1.4 Cns Condition

7.1.1.5 Diabetes

7.1.1.6 Obesity

7.1.1.7 Cardiovascular

7.1.1.8 Others

Chapter 8 Clinical Trials Market, By Therapeutic Area

8.1 Global Clinical Trials Market Snapshot, By Therapeutic Area

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

8.1.1.1 Oncology

8.1.1.2 Infectious Diseases

8.1.1.3 Neurology

8.1.1.4 Metabolic Disorders

8.1.1.5 Immunology

8.1.1.6 Cardiology

8.1.1.7 Genetic Diseases

8.1.1.8 Women's Health

8.1.1.9 Others

Chapter 9 Clinical Trials Market, By Design

9.1 Global Clinical Trials Market Snapshot, By Design

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

9.1.1.1 Interventional

9.1.1.2 Treatment Studies

9.1.1.3 Observational Studies

9.1.1.4 Expanded Access

9.1.1.5 Others

Chapter 10 Clinical Trials Market, By End-Users

10.1 Global Clinical Trials Market Snapshot, By End-Users

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

10.1.1.1 Hospitals

10.1.1.2 Laboratories

10.1.1.3 Clinics

10.1.1.4 Others

Chapter 11 Clinical Trials Market, By Region

11.1 Overview

11.2 Clinical Trials Market Revenue Share, By Region 2024 (%)

11.3 Global Clinical Trials Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Clinical Trials Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Clinical Trials Market, By Country

11.5.4 UK

11.5.4.1 UK Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Clinical Trials Market, By Country

11.6.4 China

11.6.4.1 China Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Clinical Trials Market, By Country

11.7.4 GCC

11.7.4.1 GCC Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Clinical Trials Market Revenue, 2022-2035 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 IQVIA Holdings Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 PPD, Inc.

13.3 ICON plc

13.4 Parexel International Corporation

13.5 Covance Inc. (LabCorp Drug Development)

13.6 Syneos Health, Inc.

13.7 Medpace Holdings, Inc.

13.8 PRA Health Sciences, Inc.

13.9 Charles River Laboratories International, Inc.

13.10 WuXi AppTec Inc.