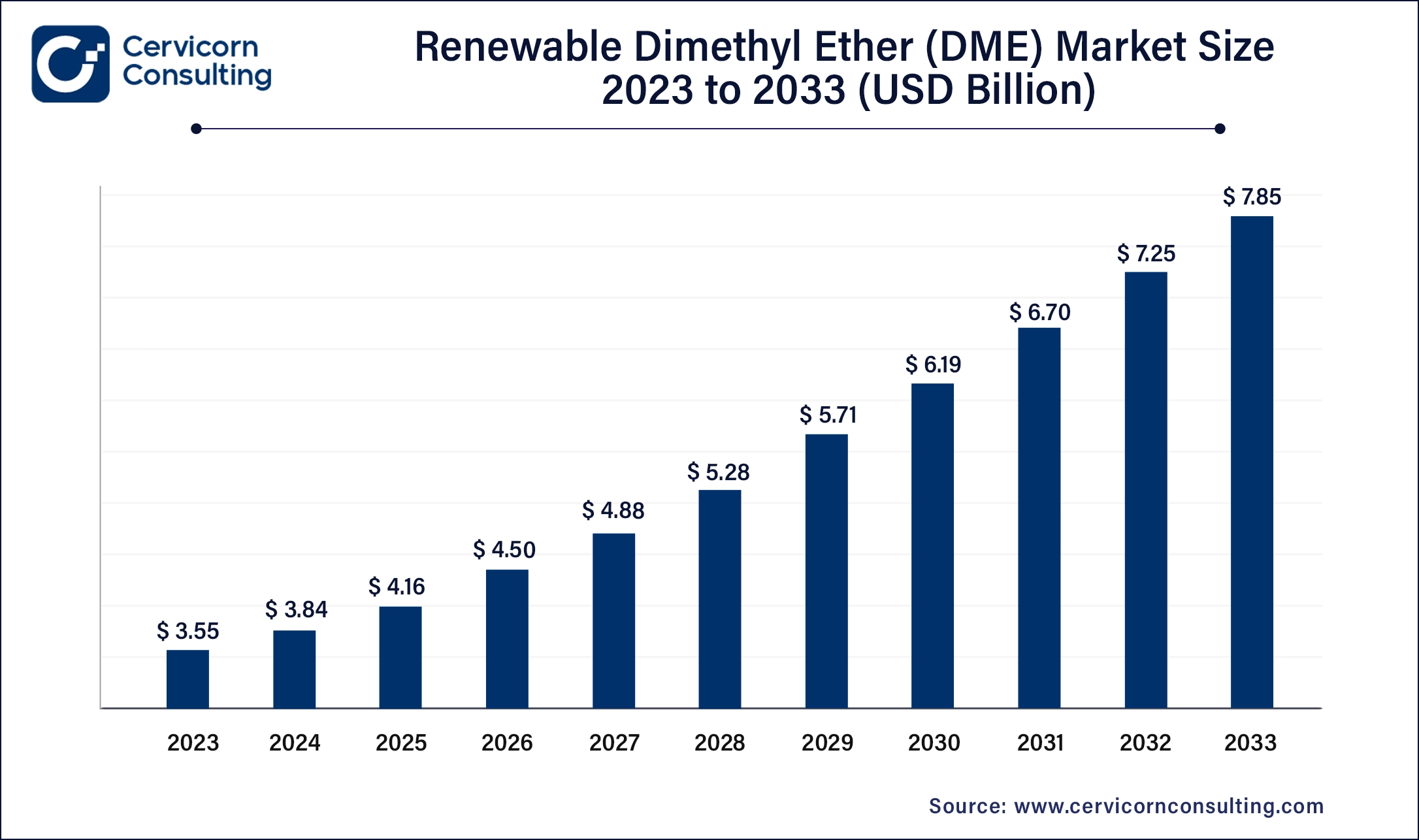

The global renewable dimethyl ether (DME) market size was valued at USD 4.16 billion in 2025 and is projected to grow around USD 8.44 billion by 2035, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2026 to 2035.

The renewable dimethyl ether (DME) market has been expanding rapidly, driven by the increasing global demand for cleaner energy sources and the shift towards decarbonizing industries. Several factors contribute to the market growth of renewable DME, including the rise in government policies and initiatives supporting clean energy technologies, particularly in Europe, North America, and Asia. With advancements in production technologies, the scalability of renewable DME production is improving, which will lead to a more affordable and widespread adoption of this renewable fuel. As the transportation and industrial sectors continue to seek alternatives to fossil fuels, renewable DME is expected to see significant growth, with the market projected to reach new heights in the coming years. The growth of renewable energy infrastructure and the rising awareness of climate change are key drivers of this shift towards sustainable fuel solutions like renewable DME.

The renewable dimethyl ether (DME) market focuses on producing and utilizing DME derived from sustainable sources such as biomass, waste, and renewable hydrogen. DME is a versatile, eco-friendly fuel and chemical feedstock, offering a cleaner alternative to conventional fuels in transportation, power generation, and household applications. It can be used as a diesel substitute, blended with LPG, or as an aerosol propellant. The renewable DME market is driven by the increasing demand for sustainable energy solutions, stringent environmental regulations, and technological advancements in DME production. Its growth is supported by the global shift towards reducing carbon emissions and enhancing energy security.

What is Renewable DME?

Renewable DME is a clean and sustainable alternative to conventional fuels, produced from renewable resources such as biomass, waste, or green hydrogen. It is a versatile, eco-friendly compound with applications in the transportation and energy sectors. Renewable DME can be used as a substitute for liquefied petroleum gas (LPG), propane, or diesel in various combustion engines, serving as an efficient fuel for vehicles and power generation. It is produced through the methanol-to-dimethyl ether (MTD) process, which utilizes renewable feedstocks to create a carbon-neutral fuel. Renewable DME's key advantages include high energy density, ease of storage and transport, and lower emissions compared to conventional fuels, making it an attractive option for reducing greenhouse gas emissions and transitioning to a more sustainable energy system.

Renewable Dimethyl Ether (DME) Specifications

| Property | Specification |

| Chemical Formula | CH3OCH3 |

| Molar Mass | 46.07 g/mol |

| CAS Number | 115-10-6 |

| Physical State | Colorless gas (liquefies at -25.2 °C) |

| Odor | ethereal |

| Boiling Point | -25.9 °C |

| Melting Point | -141.4 °C |

| Flash Point | -41 °C |

| Autoignition Temperature | 370 °C |

| Lower Explosive Limit (LEL) | 2.8% (in air) |

| Upper Explosive Limit (UEL) | 17.4% (in air) |

| Density (liquid at 25 °C) | 0.661 g/cm³ |

| Cetane Number | 55.3 |

| Property | Specification |

Decarbonization Initiatives in the Transportation Sector:

Advancements in Agricultural Waste Utilization:

High Initial Capital Investment:

Feedstock Supply Chain Challenges:

Collaboration with Automotive Manufacturers:

Expansion into Marine and Aviation Fuels:

Lack of Established Infrastructure:

Regulatory and Policy Uncertainty:

The renewable dimethyl ether (DME) market is segmented into product type, application, source and region. Based on product type, the market is classified into pure DME, blended DME, aerosol grade DME, industrial grade DME, and others. Based on application, the market is classified into transportation fuel, industrial applications, power generation, household, and others. Based on source, the market is classified into methanol, biomass, waste, and others.

Pure DME: Pure DME is utilized primarily as a clean-burning alternative fuel in transportation and power generation. Its demand is driven by increasing regulations on emissions and advancements in DME production technologies, enhancing its viability as a sustainable energy source.

Blended DME: Blended DME involves mixing DME with other fuels like LPG or diesel. This segment benefits from its versatility in applications such as household cooking and heating, as well as in transportation, where it serves as a cost-effective and cleaner-burning alternative.

Aerosol Grade DME: Aerosol Grade DME is high-purity DME used as a propellant in consumer products. The market for Aerosol Grade DME is expanding due to its environmentally friendly characteristics and the rising demand for sustainable aerosol products.

Industrial Grade DME: Industrial Grade DME serves diverse industrial applications, including refrigerants, solvents, and chemical feedstock. Its demand is bolstered by its properties as a versatile and eco-friendly alternative to traditional industrial chemicals.

Others: Other applications of DME include niche uses in pharmaceuticals, cosmetics, and as a chemical intermediate. These segments are characterized by specialized requirements and niche markets, driving innovation in DME production and application technologies.

Transportation Fuel: Renewable DME serves as a sustainable alternative to diesel, powering buses, trucks, and marine vessels. Trends include engine optimization for DME, blending with conventional fuels, and infrastructure development for DME refueling stations to support its use in transportation.

Industrial Applications: In industries, Renewable DME acts as a cleaner fuel for heating, powering industrial processes, and as a chemical feedstock. Trends focus on replacing fossil fuels, enhancing energy efficiency, and meeting stringent emissions standards.

Power Generation: Renewable DME is utilized in power plants and off-grid applications for electricity generation. Trends include integrating DME into renewable energy systems, improving power plant efficiency, and exploring co-generation opportunities to maximize energy output.

Household: Renewable DME is gaining traction as a cooking and heating fuel in households, offering a cleaner and more sustainable alternative to traditional fuels. Trends involve promoting DME for residential use, developing efficient household appliances compatible with DME, and enhancing safety standards.

Others: Other applications of Renewable DME include aerosol propellants, refrigerants, and specialized industrial uses. Trends encompass expanding DME's role in diverse industrial sectors, exploring new applications through research and development, and adapting production methods to meet specific market demands.

Methanol: Methanol serves as a primary source for producing DME through catalytic dehydration. The trend in using methanol involves advancements in efficient methanol synthesis technologies and increasing integration of renewable sources in methanol production, supporting the growth of renewable DME as a sustainable fuel and chemical feedstock.

Biomass: Biomass, derived from agricultural residues, energy crops, and forest residues, plays a crucial role in renewable DME production. The trend involves innovations in biomass conversion technologies like gasification and pyrolysis, aiming to enhance efficiency and sustainability. Biomass-derived DME contributes to reducing carbon footprint and promoting circular economy practices in the energy sector.

Waste: Waste materials, including municipal solid waste (MSW) and industrial waste, are increasingly utilized as feedstock for renewable DME production. The trend focuses on developing waste-to-energy technologies, such as gasification and anaerobic digestion, to convert waste into valuable DME. This approach addresses waste management challenges while contributing to renewable energy production and reducing landfill dependence.

Others: Other sources for renewable DME production include renewable hydrogen and carbon dioxide. Renewable hydrogen, produced through electrolysis using renewable energy sources, offers a sustainable pathway for DME synthesis. Carbon dioxide can also be utilized in synthetic processes to produce DME, contributing to carbon capture and utilization (CCU) initiatives. These alternative sources demonstrate the diversification and innovation potential in the renewable DME market.

North America is focusing on advancing renewable energy technologies, including DME. The trend involves leveraging abundant biomass resources and enhancing waste-to-energy capabilities to produce renewable DME. Policies promoting renewable fuels and reducing carbon emissions drive market growth. Additionally, collaborations between research institutions and industry players are fostering innovation in DME production technologies, aiming to establish North America as a leader in sustainable energy solutions.

Europe leads in renewable energy adoption and stringent environmental regulations. The trend in the European DME market includes extensive research and development in biomass conversion technologies and waste management solutions. Governments incentivize renewable fuel production and encourage the use of DME in transport and industry. Strategic investments in infrastructure for DME distribution and blending with conventional fuels further support market expansion, addressing energy security and climate goals.

Asia-Pacific is experiencing rapid industrialization and urbanization, driving energy demand. The trend in this region focuses on scaling up renewable DME production from diverse biomass sources and advancing waste-to-energy technologies. Countries like China and Japan prioritize reducing air pollution and dependence on fossil fuels, promoting renewable DME as a cleaner alternative. Investments in infrastructure development for DME distribution and adoption of DME in transportation contribute to market growth.

LAMEA regions exhibit varying levels of economic development and energy resource availability. The trend involves leveraging abundant biomass resources in Latin America and Africa for renewable DME production. Countries like Brazil and South Africa are investing in bioenergy projects and waste-to-energy initiatives to diversify their energy mix. In the Middle East, initiatives focus on integrating renewable hydrogen with DME production, aligning with regional sustainability goals and economic diversification strategies. Regulatory support and international partnerships drive market development in LAMEA, aiming to achieve energy security and environmental sustainability.

In the renewable DME market, new players like Oberon Fuels and Gron Fuels LLC have embraced innovation by focusing on advanced biofuel technologies and sustainable production methods. They leverage biomass and waste-to-energy solutions to produce DME, targeting environmentally conscious consumers and industries. Key established players such as Mitsubishi Heavy Industries and Johnson Matthey dominate through extensive R&D investments, global market presence, and established infrastructure. They leverage economies of scale and strategic partnerships to maintain leadership, influencing industry standards and regulatory frameworks, thereby shaping the trajectory of renewable DME adoption worldwide.

By Product Type

By Application

By Source

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Renewable Dimethyl Ether

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Application Overview

2.2.3 By Source Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Renewable Dimethyl Ether Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Decarbonization Initiatives in the Transportation Sector

4.1.1.2 Advancements in Agricultural Waste Utilization

4.1.2 Market Restraints

4.1.2.1 High Initial Capital Investment

4.1.2.2 Feedstock Supply Chain Challenges

4.1.3 Market Opportunities

4.1.3.1 Collaboration with Automotive Manufacturers

4.1.3.2 Expansion into Marine and Aviation Fuels

4.1.4 Market Challenges

4.1.4.1 Lack of Established Infrastructure

4.1.4.2 Regulatory and Policy Uncertainty

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Renewable Dimethyl Ether Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Renewable Dimethyl Ether Market, By Product Type

6.1 Global Renewable Dimethyl Ether Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

6.1.1.1 Pure DME

6.1.1.2 Blended DME

6.1.1.3 Aerosol Grade DME

6.1.1.4 Industrial Grade DME

6.1.1.5 Others

Chapter 7 Renewable Dimethyl Ether Market, By Application

7.1 Global Renewable Dimethyl Ether Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

7.1.1.1 Transportation Fuel

7.1.1.2 Industrial Applications

7.1.1.3 Power Generation

7.1.1.4 Household

7.1.1.5 Others

Chapter 8 Renewable Dimethyl Ether Market, By Source

8.1 Global Renewable Dimethyl Ether Market Snapshot, By Source

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

8.1.1.1 Methanol

8.1.1.2 Biomass

8.1.1.3 Waste

8.1.1.4 Others

Chapter 9 Renewable Dimethyl Ether Market, By Region

9.1 Overview

9.2 Renewable Dimethyl Ether Market Revenue Share, By Region 2024 (%)

9.3 Global Renewable Dimethyl Ether Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Renewable Dimethyl Ether Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Renewable Dimethyl Ether Market, By Country

9.5.4 UK

9.5.4.1 UK Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Renewable Dimethyl Ether Market, By Country

9.6.4 China

9.6.4.1 China Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Renewable Dimethyl Ether Market, By Country

9.7.4 GCC

9.7.4.1 GCC Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Renewable Dimethyl Ether Market Revenue, 2022-2035 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Oberon Fuels

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Chemrec

11.3 Grön Fuels LLC

11.4 Mitsubishi Heavy Industries

11.5 Akzo Nobel N.V.

11.6 Cornerstone Chemical Company B.V.

11.7 Chinese Energy Holdings Limited

11.8 ENN Energy Holdings Limited

11.9 Grillo-Werke AG

11.10 Aemetis, Inc.