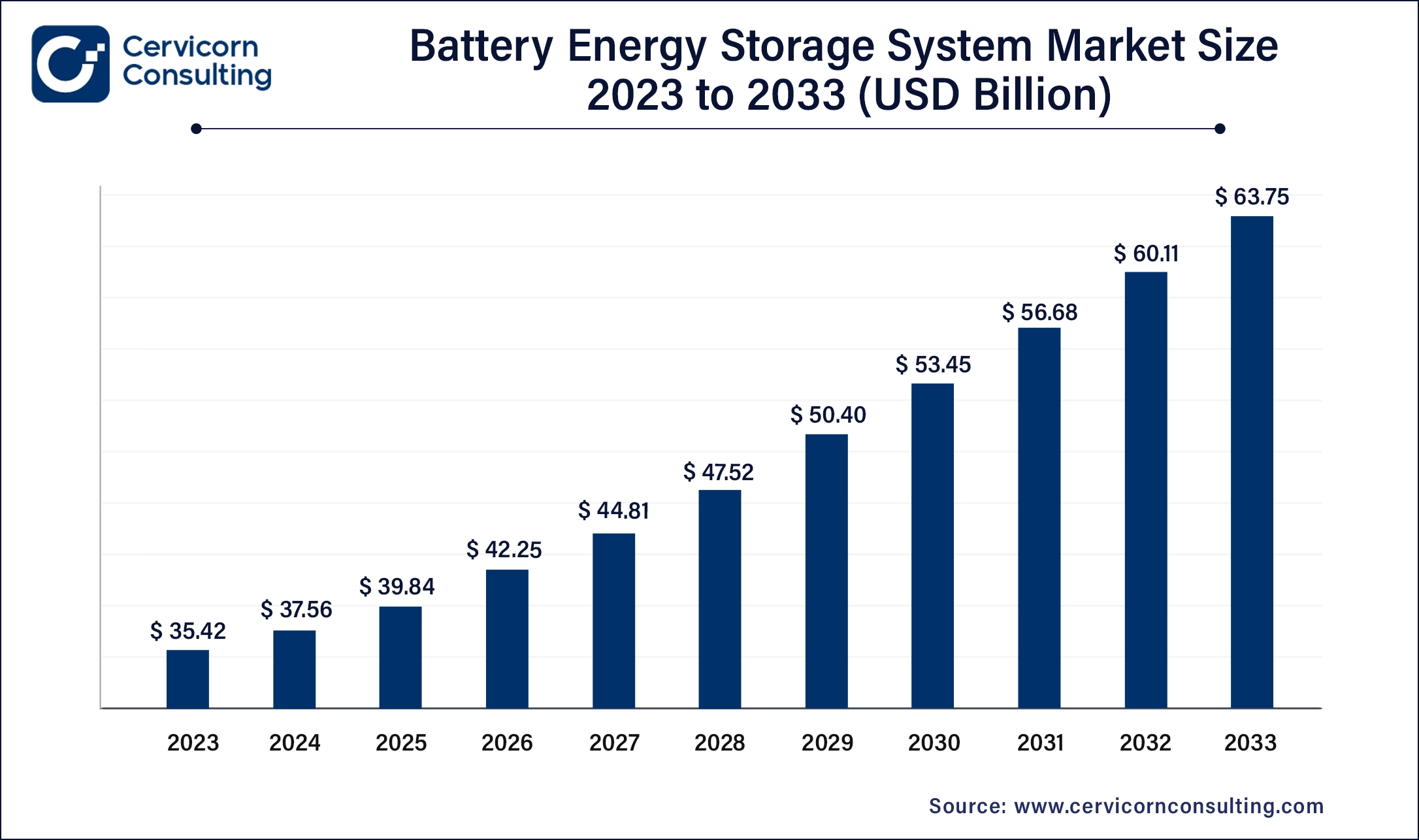

The global battery energy storage system (BESS) market size was valued at USD 37.56 billion in 2024 and is projected to hit around USD 65.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.68% over the forecast period 2025 to 2034.

The battery energy storage system (BESS) market is growing rapidly due to the increasing adoption of renewable energy and the rising demand for efficient energy storage solutions. Market growth is fueled by government incentives, technological advancements, and the push toward reducing carbon emissions. As of recent years, the energy storage market is expanding significantly, with projections for continued growth driven by declining battery costs and increased interest from utilities and commercial entities. The demand for BESS is anticipated to further surge in the coming years, particularly with the development of large-scale grid storage systems, and as electric vehicle (EV) adoption increases, adding more focus on energy storage infrastructure. The global transition to cleaner energy systems and the need for reliable, flexible grid solutions are key drivers of the market’s expansion.

The battery energy storage system (BESS) market focuses on technologies that store energy for later use, improving grid stability and enabling renewable energy integration. Key technologies include lithium-ion, lead-acid, flow, and sodium-based batteries. Applications span residential, commercial, and utility-scale sectors, supporting energy management, peak shaving, and backup power. The market is driven by the growing need for sustainable energy solutions and advancements in battery technologies. Geographically, North America, Europe, and Asia-Pacific are significant regions, each with distinct growth drivers and market dynamics. The market also includes various ownership models like customer, utility, and third-party-owned systems.

A battery energy storage system (BESS) is a system designed to store electrical energy for later use, providing backup power, load leveling, or integration with renewable energy sources. BESS typically uses rechargeable batteries like lithium-ion, lead-acid, or sodium-sulfur to store energy and discharge it when needed. These systems are increasingly used to enhance grid reliability, support renewable energy integration (such as solar or wind), and provide peak shaving to reduce energy costs. There are several types of BESS, including stationary and mobile units, with stationary systems being more common in grid-scale applications. Different battery chemistries have unique advantages, such as lithium-ion’s high energy density and longer lifespan, while lead-acid batteries are less expensive but offer shorter lifespans and lower efficiency.

“The battery energy storage system market is at the forefront of the global transition to cleaner, more sustainable energy. As renewable energy sources like solar and wind continue to expand, BESS plays a crucial role in ensuring grid stability and energy security. At Cervicorn Consulting, our detailed market research and bespoke consulting services offer critical insights into this dynamic sector, helping companies navigate the rapidly changing technological landscape and make informed decisions. We understand the unique challenges and opportunities within the BESS market, and our tailored reports empower businesses to identify growth avenues, investment opportunities, and strategic partnerships that can accelerate their success in this thriving industry. As the market grows, we believe that innovations in battery technology and energy storage solutions will be key to driving further expansion and supporting the global shift toward sustainable energy.” - Senior Analyst at Cervicorn Consulting.

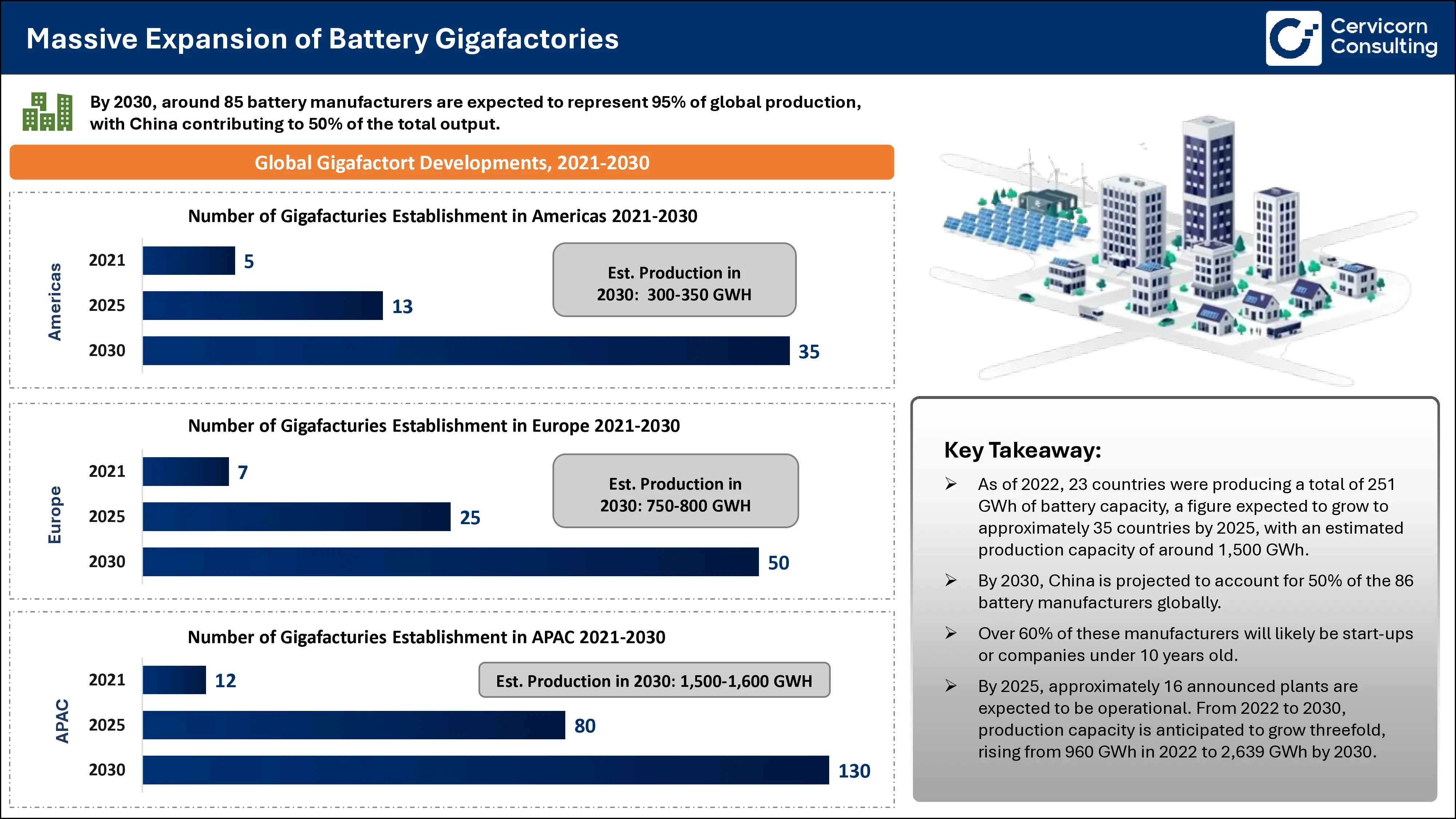

The Role of Battery Gigafactories in Driving BESS Market Growth

Battery gigafactories are playing a pivotal role in accelerating the growth of the BESS market. These large-scale production facilities, dedicated to manufacturing high-capacity batteries, are essential in meeting the increasing global demand for energy storage solutions. As the adoption of renewable energy sources like solar and wind rises, the need for efficient, scalable energy storage solutions becomes more critical to stabilize grids and ensure reliable energy distribution.

The establishment of gigafactories, especially in key regions like China, Europe, and North America, is enabling the rapid scaling of battery production. Companies such as Tesla, CATL, and Panasonic are at the forefront of this transformation, investing billions into new facilities that produce advanced lithium-ion and solid-state batteries. These factories are not only reducing production costs but also advancing battery technologies, which improves energy density, efficiency, and lifecycle, all of which contribute to lowering the overall cost of energy storage systems.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 39.84 Billion |

| Expected Market Size in 2034 | USD 65.27 Billion |

| CAGR (2025 to 2034) | 5.68% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Storage System, Connection Type, Ownership, Energy Capacity, Application, Region |

| Key Companies | Tesla, Inc., LG Energy Solution, Ltd., Samsung SDI Co., Ltd., BYD Company Limited, Panasonic Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, and General Electric Company |

Increasing Demand for Energy Independence and Security:

Declining Costs of Battery Technologies:

High Initial Capital Costs:

Limited Battery Recycling Infrastructure:

Integration with Renewable Energy Sources:

Advancements in Battery Technologies:

Technological Limitations and Performance Variability:

Regulatory and Policy Uncertainties:

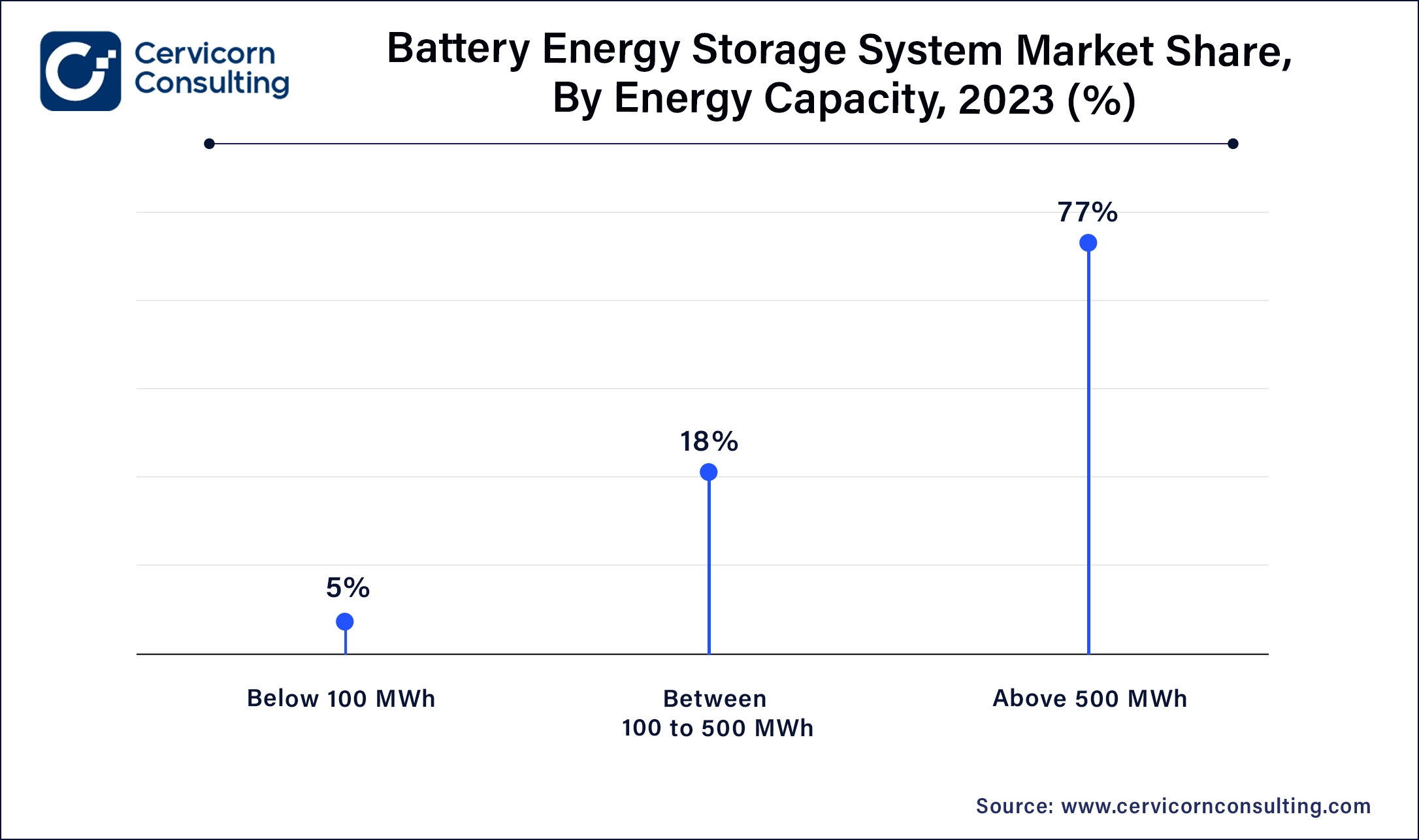

The BESS market is segmented into technology, connection type, storage system, ownership, energy capacity, application and region. Based on technology, the market is classified into lithium-ion batteries, lead-acid batteries, flow batteries, sodium-based batteries, others. Based on storage system, the market is classified into front-of-the-meter and behind-the-meter. Based on connection type, the market is classified into on-grid and off-grid. Based on ownership, the market is classified into customer-owned, third-party owned, utility-owned. Based on energy capacity, the market is classified into below 100 MWh, between 100 to 500 MWh, above 500 MWh. Based on application, the market is classified into residential, commercial and utility.

Lithium-ion Batteries: Lithium-ion batteries segment has reported market share of 48% in 2024. Lithium-ion batteries are widely used due to their high energy density, long cycle life, and relatively low maintenance requirements. They are prevalent in residential, commercial, and utility-scale applications. Trends include advancements in solid-state lithium-ion technologies and efforts to improve safety and reduce costs, driving broader adoption and innovation.

Lead-Acid Batteries: Lead-acid batteries segment has registered market share of 25% in 2024. Lead-acid batteries are an older technology known for their reliability and cost-effectiveness. They are commonly used in backup power and off-grid applications. Recent trends include improvements in deep-cycle performance and hybrid designs, although they face competition from newer technologies with higher energy density and efficiency.

Flow Batteries: Flow batteries segment has accounted market share of 16% in 2024. Flow batteries use liquid electrolytes to store and release energy, offering scalability and long cycle life. They are ideal for large-scale energy storage solutions, such as grid stabilization. Current trends focus on enhancing efficiency, reducing costs, and expanding commercial applications, particularly in renewable energy integration.

Sodium-Based Batteries: Sodium-based batteries segment has exhibited market share of 11% in 2024. Sodium-based batteries, including sodium-sulfur and sodium-ion types, are emerging as a cost-effective alternative to lithium-ion batteries. They offer advantages like lower material costs and high-temperature operation. Trends include ongoing research to enhance performance and safety, with potential applications in grid energy storage and large-scale deployments.

Others: This category includes various emerging technologies, such as solid-state batteries, zinc-air, and nickel-based systems. These alternatives aim to address limitations of conventional batteries, such as safety concerns and cost. Current trends involve significant R&D efforts to improve performance, increase energy density, and develop commercial viability.

Front-of-the-Meter: FTM segment has noted market share of 80% in 2024. Front-of-the-meter (FTM) energy storage systems are large-scale installations located on the utility side of the electric meter. They are used for grid stabilization, load shifting, and integrating renewable energy sources into the grid. The FTM segment is growing due to increased investments in grid infrastructure and renewable energy integration. Regulatory incentives and advancements in large-scale battery technologies are driving this growth, enhancing grid reliability and supporting energy transition goals.

Behind-the-Meter: BTM segment has garnered market share of 20% in 2024. Behind-the-meter (BTM) storage systems are installed at residential or commercial properties and are used to manage energy consumption, reduce utility bills, and provide backup power. The BTM segment is expanding due to rising consumer interest in energy independence and cost savings. Technological advancements in battery efficiency and declining costs are driving adoption. Additionally, incentives and rebates for residential solar and storage systems are contributing to market growth.

On-grid: On-grid segment has reported market share of 58% in 2024. On-grid Battery Energy Storage Systems (BESS) are integrated with the main power grid, allowing them to store excess electricity generated during low-demand periods and discharge it during peak demand times. This connection type supports grid stability, enhances energy reliability, and facilitates the integration of renewable energy sources. The trend is toward expanding on-grid systems to accommodate increasing renewable energy installations and enhance grid resilience.

Off-grid: Off-grid segment has generated market share of 42% in 2024. Off-grid Battery Energy Storage Systems (BESS) operate independently of the main power grid, providing energy storage for remote or isolated locations. These systems are crucial for areas with limited or no grid access, supporting energy independence and reliability. Trends include increased use in remote communities and rural areas, driven by advancements in battery technology and a push for sustainable energy solutions.

Customer-owned: Customer-owned BESS are installed and maintained by individual homeowners or businesses. This model allows users to manage their own energy storage, often in conjunction with solar panels, enhancing energy independence and reducing electricity bills. The trend is growing, driven by decreasing battery costs, incentives for renewable energy adoption, and increasing awareness of energy management and sustainability.

Third-party Owned: Third-party owned BESS involve external entities, such as energy service providers or financing companies, installing and maintaining storage systems at customer sites. These arrangements often include performance-based contracts or power purchase agreements. The trend is rising due to the lower upfront costs for customers and the expansion of service models that make energy storage more accessible to a broader audience.

Utility-owned: Utility-owned Battery Energy Storage Systems are managed and operated by energy utilities to support grid stability and manage peak demand. Utilities invest in large-scale storage systems to enhance grid reliability, integrate renewable energy, and reduce operational costs. This segment is expanding as utilities increasingly seek to leverage storage solutions for grid modernization and to meet regulatory requirements for renewable energy integration.

Below 100 MWh: Below 100 MWh segment has generated market share of 4.5% in 2024. Battery Energy Storage Systems (BESS) with a capacity below 100 MWh are typically used for smaller-scale applications, such as residential, commercial, and small industrial uses. These systems are suitable for localized energy storage needs, supporting short-term energy supply and demand balancing. The segment is experiencing growth due to increasing adoption in residential solar setups and small-scale commercial applications. Advances in battery technology and declining costs are making these systems more accessible and attractive to individual consumers and small businesses.

Between 100 to 500 MWh: Below 100 to 500 MWh segment has accounted share of 18.7% in 2024. BESS with capacities between 100 and 500 MWh are designed for medium to large-scale applications, including commercial facilities, industrial operations, and utility-scale projects. These systems provide substantial energy storage to support grid stability, peak shaving, and backup power. This segment is expanding due to rising investments in grid infrastructure and renewable energy integration. These systems help manage variability in energy supply, improve grid resilience, and facilitate the transition to cleaner energy sources. Growing demand for large-scale energy storage solutions is driving innovation and investment.

Above 500 MWh: Above 500 MWh segment has captured highest share of 76.8% in 2024. Battery Energy Storage Systems with capacities above 500 MWh are used in large-scale applications, such as utility-scale energy storage projects and large grid stabilization efforts. These systems offer significant energy storage capabilities for grid management, large renewable energy farms, and regional energy reserves. The market for large-scale BESS is growing rapidly as utilities and large energy providers invest in energy storage to enhance grid reliability and support the integration of renewable energy sources. Technological advancements and decreasing costs are enabling more extensive deployments, making this segment a key focus for energy infrastructure development.

Residential: Residential BESS are designed for individual homes to store electricity from various sources, such as solar panels or the grid, for later use. They help manage energy consumption, reduce electricity bills, and provide backup power during outages. increasing adoption of residential solar installations and advancements in battery technology are driving growth. Homeowners are increasingly interested in energy independence and sustainability, leading to higher demand for residential BESS solutions.

Commercial: Commercial BESS serve businesses and industrial facilities by providing energy storage for peak shaving, load management, and backup power. They help optimize energy costs, improve operational efficiency, and support sustainability goals. Businesses are leveraging BESS to manage peak demand charges and integrate renewable energy sources. Growing focus on energy efficiency and carbon reduction initiatives in commercial sectors is fueling the expansion of BESS applications.

Utility: Utility-scale BESS are large-scale installations designed to support the electricity grid by storing and dispatching energy on a larger scale. They enhance grid stability, enable load shifting, and integrate renewable energy sources. Increasing investment in grid modernization and renewable energy integration drives the growth of utility-scale BESS. Advances in large-scale battery technologies and regulatory support for grid reliability and sustainability are key trends in this segment.

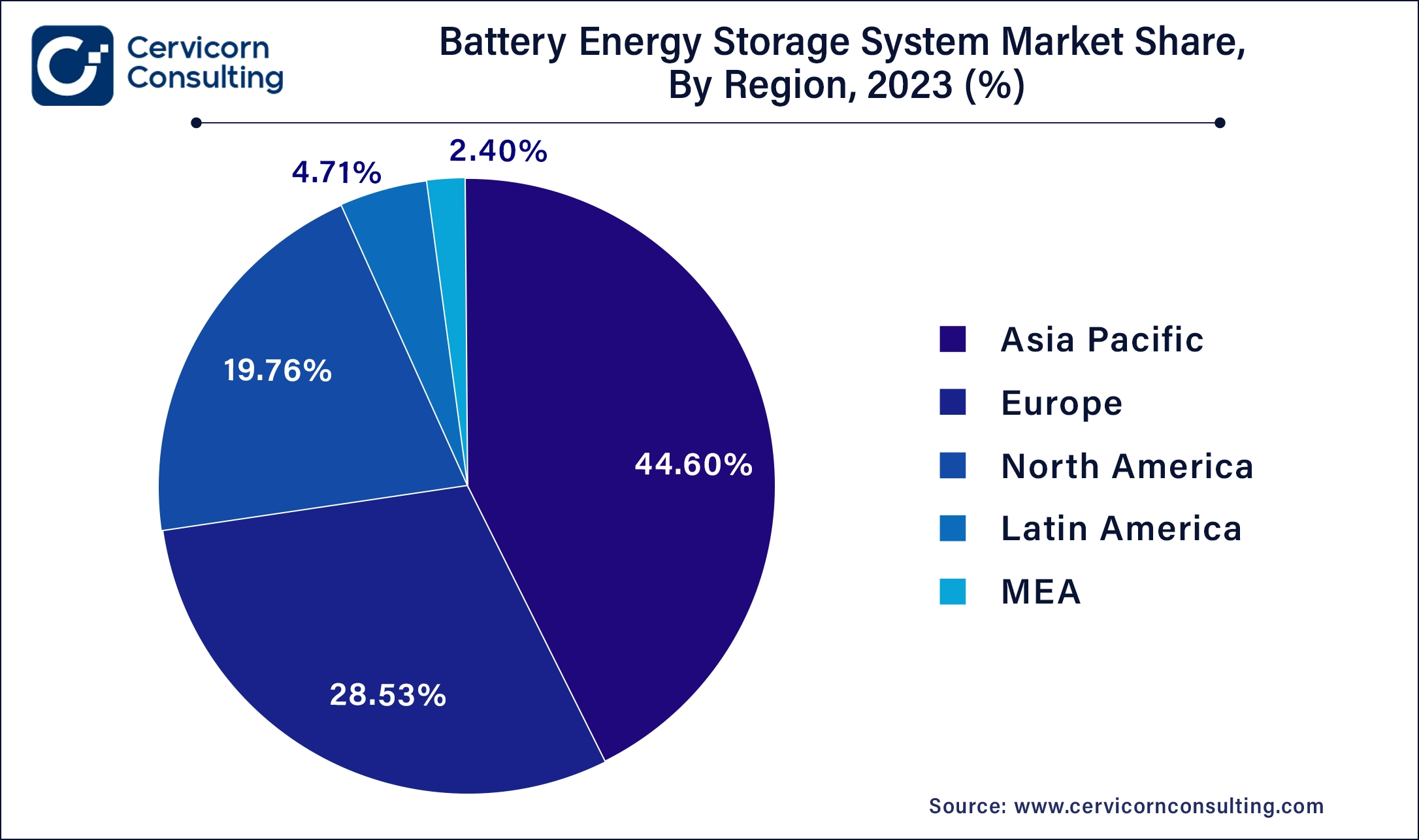

The North America BESS market was valued at USD 7.45 billion in 2024 and is projected to grow USD 12.94 billion by 2034 from USD 7.45 billion in 2024. is experiencing robust growth in the BESS market due to increased investment in renewable energy projects, energy storage incentives, and supportive regulatory policies. The integration of BESS with solar and wind energy projects is expanding, driven by state-level mandates and federal initiatives aimed at reducing greenhouse gas emissions and enhancing grid resilience.

The Europe BESS market size was estimated at USD 10.76 billion in 2024 and is expected to hit around USD 18.69 billion by 2034 from USD 11.41 billion in 2025. Europe is at the forefront of adopting BESS technology, driven by aggressive climate goals and regulatory support for renewable energy. The European Union’s Green Deal and national policies promote energy storage to stabilize the grid and integrate intermittent renewable sources. High-profile projects and subsidies for energy storage systems are contributing to rapid market growth.

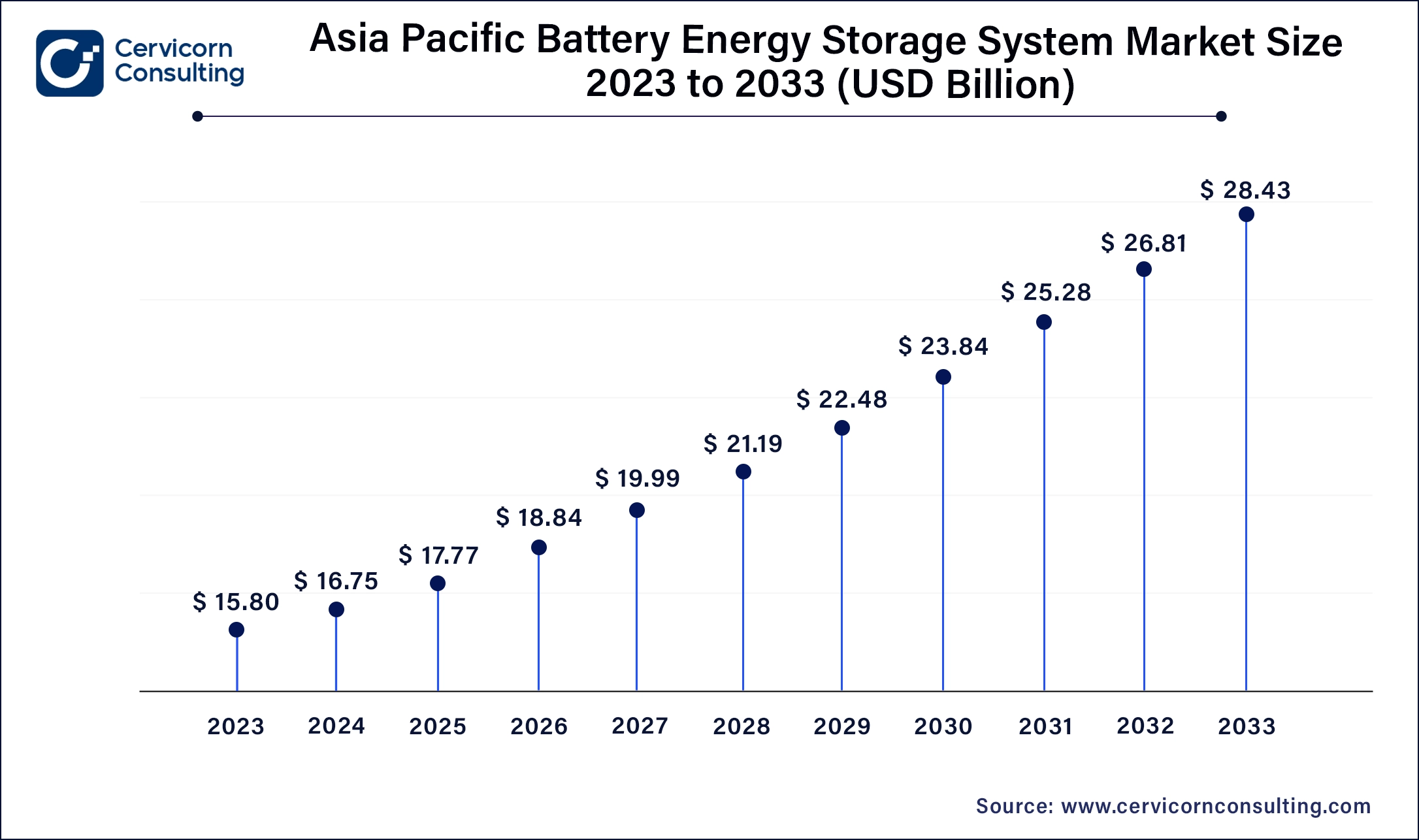

The Asia Pacific BESS market size was worth USD 16.68 billion in 2024 and is expected to reach around USD 28.99 billion by 2034 from USD 17.7 billion in 2025. The Asia-Pacific region is witnessing significant growth in the BESS market due to rapid industrialization, urbanization, and increasing demand for reliable energy solutions. Countries like China and India are investing heavily in energy storage to support large-scale renewable projects and improve grid stability. Technological advancements and favorable government policies are accelerating adoption in this region.

In the LAMEA region, the BESS market is emerging (7.11% market share in 2024) with growth driven by the need for reliable energy access and integration of renewable resources. Investments in grid infrastructure and renewable energy projects, along with decreasing battery costs, are supporting market expansion. However, adoption rates vary significantly across countries due to different levels of economic development and regulatory support.

New players like Eos Energy Enterprises and Fluence Energy are innovating with unique technologies, such as zinc-based batteries and modular systems, to enhance energy density and lower costs. Tesla, Samsung SDI and LG Energy Solution dominate the market through advanced lithium-ion technologies and large-scale production capabilities. Tesla’s Powerwall and Powerpack systems and LG’s RESU series offer high performance and efficiency, solidifying their market leadership through technological advancements and extensive deployment across residential, commercial, and utility-scale applications.

Market Segmentation

By Technology

By Storage System

By Connection Type

By Ownership

By Energy Capacity

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Battery Energy Storage System

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Connection Types and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Storage System Overview

2.2.3 By Connection Type Overview

2.2.4 By Ownership Overview

2.2.5 By Energy Capacity Overview

2.2.6 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Battery Energy Storage System Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Demand for Energy Independence and Security

4.1.1.2 Declining Costs of Battery Technologies

4.1.2 Market Restraints

4.1.2.1 High Initial Capital Costs

4.1.2.2 Limited Battery Recycling Infrastructure

4.1.2.3 Integration with Renewable Energy Sources

4.1.2.4 Advancements in Battery Technologies

4.1.3 Market Challenges

4.1.3.1 Technological Limitations and Performance Variability

4.1.3.2 Regulatory and Policy Uncertainties

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Battery Energy Storage System Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Battery Energy Storage System Market, By Technology

6.1 Global Battery Energy Storage System Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Lithium-ion Batteries

6.1.1.2 Lead-Acid Batteries

6.1.1.3 Flow Batteries

6.1.1.4 Sodium-Based Batteries

6.1.1.5 Others

Chapter 7 Battery Energy Storage System Market, By Storage System

7.1 Global Battery Energy Storage System Market Snapshot, By Storage System

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Front-of-the-meter

7.1.1.2 Behind-the-meter

Chapter 8 Battery Energy Storage System Market, By Connection Type

8.1 Global Battery Energy Storage System Market Snapshot, By Connection Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 On-grid

8.1.1.2 Off-grid

Chapter 9 Battery Energy Storage System Market, By Ownership

9.1 Global Battery Energy Storage System Market Snapshot, By Ownership

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Customer-owned

9.1.1.2 Third-party Owned

9.1.1.3 Utility-owned

Chapter 10 Battery Energy Storage System Market, By Energy Capacity

10.1 Global Battery Energy Storage System Market Snapshot, By Energy Capacity

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

10.1.1.1 Below 100 MWh

10.1.1.2 Between 100 to 500 MWh

10.1.1.3 Above 500 MWh

Chapter 11 Battery Energy Storage System Market, By Application

11.1 Global Battery Energy Storage System Market Snapshot, By Application

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

11.1.1.1 Residential

11.1.1.2 Commercial

11.1.1.3 Utility

Chapter 12 Battery Energy Storage System Market, By Region

12.1 Overview

12.2 Battery Energy Storage System Market Revenue Share, By Region 2023 (%)

12.3 Global Battery Energy Storage System Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Battery Energy Storage System Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Battery Energy Storage System Market, By Country

12.5.4 UK

12.5.4.1 UK Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UK Market Segmental Analysis

12.5.5 France

12.5.5.1 France Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 France Market Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 Germany Market Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of Europe Market Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Battery Energy Storage System Market, By Country

12.6.4 China

12.6.4.1 China Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 China Market Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 Japan Market Segmental Analysis

12.6.6 India

12.6.6.1 India Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 India Market Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 Australia Market Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia Pacific Market Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Battery Energy Storage System Market, By Country

12.7.4 GCC

12.7.4.1 GCC Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCC Market Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 Africa Market Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 Brazil Market Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Battery Energy Storage System Market Revenue, 2021-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 13 Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2021-2023

13.1.3 Competitive Analysis By Revenue, 2021-2023

13.2 Recent Developments by the Market Contributors (2023)

Chapter 14 Company Profiles

14.1 Tesla, Inc.

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 LG Energy Solution, Ltd.

14.3 Samsung SDI Co., Ltd.

14.4 BYD Company Limited

14.5 Panasonic Corporation

14.6 ABB Ltd.

14.7 Siemens AG

14.8 Schneider Electric SE

14.9 General Electric Company

14.10 Enphase Energy, Inc.