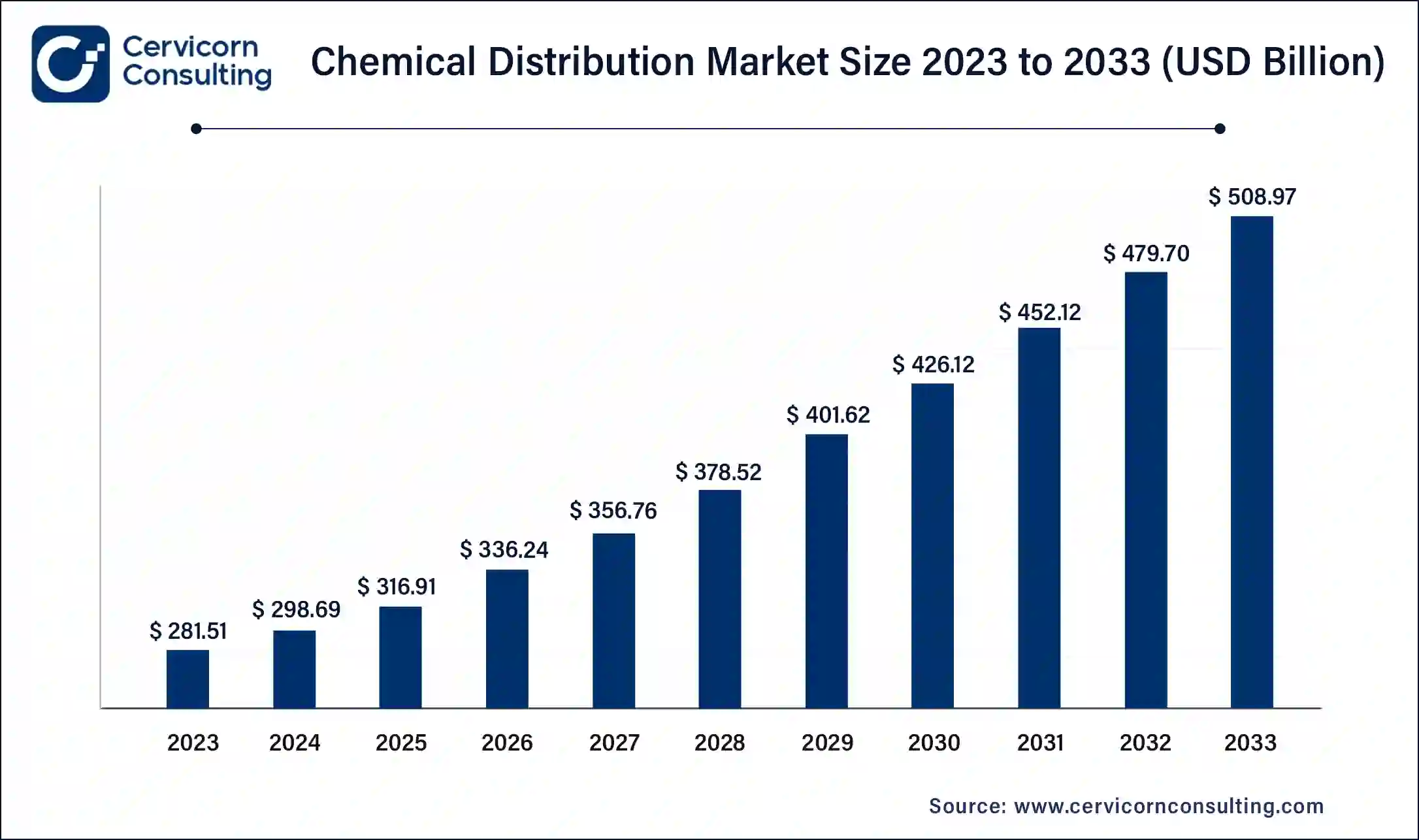

The global chemical distribution market size was calculated at USD 298.69 billion in 2024 and is expected to hit around USD 521.10 billion by 2034 from USD 316.91 billion in 2025, growing at a CAGR of 5.72% from 2025 to 2034.

The global chemical distribution market is experiencing significant growth due to increased demand across industries like healthcare, automotive, food, and agriculture. The rise in industrialization and urbanization, particularly in emerging markets, is driving the demand for chemicals in various applications such as manufacturing, energy, and construction. The growing focus on sustainability and the implementation of green chemistry practices are also influencing market trends, with an increasing demand for eco-friendly chemicals. Additionally, advancements in digital technology and e-commerce are transforming the distribution model, allowing chemical distributors to reach a broader customer base. As a result, the market is projected to continue expanding, driven by these evolving trends and the diversification of applications for chemicals in diverse sectors.

Chemical distribution refers to the process of transporting, selling, and providing chemicals and raw materials from manufacturers to various end-users. Chemical distributors act as intermediaries, offering a wide range of chemicals, including specialty chemicals, industrial chemicals, and bulk chemicals, to industries such as agriculture, pharmaceuticals, manufacturing, and consumer goods. The role of chemical distributors is critical in ensuring that chemicals reach their destination safely and in compliance with regulations. They also offer value-added services like technical support, logistics, and inventory management, which adds to the efficiency of the supply chain. The different types of chemicals distributed include commodity chemicals, fine chemicals, and specialty chemicals, with each type serving specific market needs.

| Area of Focus | Details |

| Market Size in 2025 | USD 316.91 Billion |

| Market Size by 2034 | USD 521.10 Billion |

| Growth Rate | CAGR of 5.72% from 2025 to 2034 |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | Type, End Use, Distribution Channel, Region |

Advancements in Chemical Manufacturing Processes:

Rising Urbanization and Infrastructure Development:

Stringent Regulatory Compliance:

Volatility in Raw Material Prices:

Expansion of Emerging Markets:

Increased Focus on Circular Economy:

Supply Chain Disruptions:

Safety and Environmental Concerns:

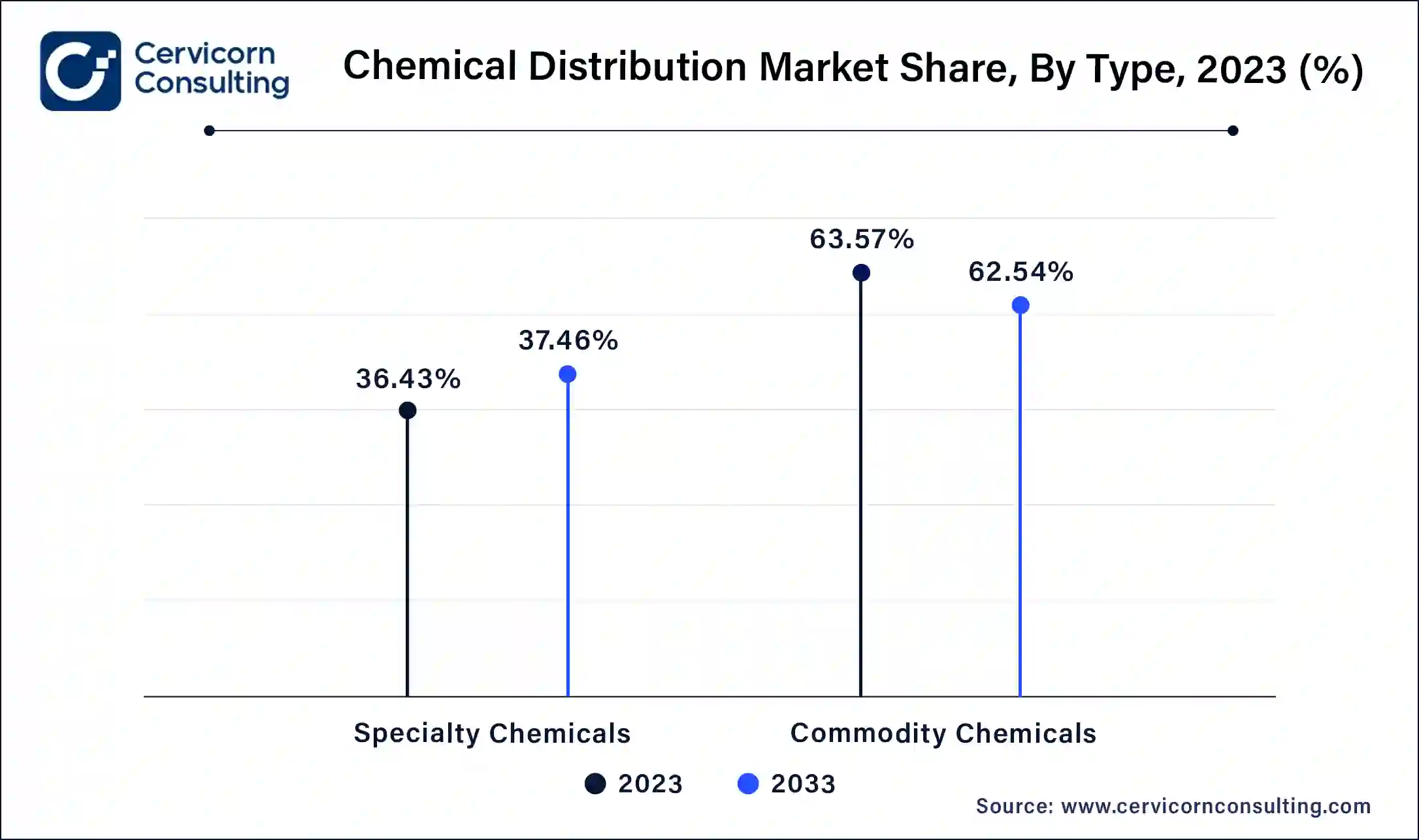

The chemical distribution market is segmented into type, end user, distribution channel and region. Based on type, the market is classified into specialty chemicals and commodity chemicals. Based on end user, the market is classified into construction, automotive & transportation, electronics, medical & pharmaceutical, agriculture, packaging, energy, food & beverage, textile, and others. Based on distribution channel, the market is classified into direct sales, distributors, online platforms, and others.

Commodity Chemicals: Commodity chemicals are basic, bulk chemicals produced in large quantities for wide-ranging industrial applications. Trends include increased automation in manufacturing and improved logistics for efficient distribution. The demand is driven by sectors like agriculture, construction, and manufacturing, with a focus on cost reduction and scalability.

Specialty Chemicals: Specialty chemicals are designed for specific applications with unique properties, such as additives and performance enhancers. Trends involve advancements in formulation technology and a shift towards eco-friendly products. Demand is growing in industries like automotive, electronics, and personal care, driven by innovation and customization needs.

Fine Chemicals: Fine chemicals are high-purity, complex chemicals used in pharmaceuticals, agrochemicals, and advanced materials. Trends include increasing investment in R&D and expanding production capacities to meet growing demand. The market is driven by innovations in drug development and biotechnology, emphasizing precision and quality.

Others: The "Others" segment includes niche and emerging chemical technologies, such as advanced materials and renewable chemicals. Trends feature growing research into novel applications and technologies, including green chemistry and bio-based products. This segment is expanding as new applications and technologies emerge, driving innovation and market diversification.

Specialty Chemicals: Specialty chemicals are used for specific applications, offering unique properties or performance characteristics tailored to particular industries such as pharmaceuticals, electronics, and agriculture. Trends in this segment include growing demand for advanced materials, increased focus on sustainability, and innovations in formulations. Distributors are focusing on providing high-value, customized solutions to meet the evolving needs of specialized industries.

Commodity Chemicals: Commodity chemicals are basic chemicals produced in large volumes for widespread use in various industries, including agriculture, construction, and manufacturing. Trends include increasing production efficiency, cost reduction, and expanding applications in emerging markets. The market is driven by steady demand for fundamental materials, with distributors focusing on optimizing logistics and supply chain management to handle large-scale transactions and maintain competitive pricing.

Direct Sales: Direct sales involve chemicals being sold straight from manufacturers to end-users, bypassing intermediaries. Trends include increased focus on personalized customer service and tailored solutions, allowing manufacturers to build stronger relationships and offer specialized products. This channel is growing as companies seek to streamline their supply chains and improve efficiency.

Distributors: Distributors act as intermediaries between manufacturers and end-users, handling logistics and warehousing. Trends include consolidation among distributors to enhance market reach and operational efficiency. The role of distributors is evolving with a focus on value-added services, such as technical support and customized solutions, to meet diverse customer needs.

Online Platforms: Online platforms facilitate the purchase of chemicals through e-commerce and digital channels. Trends include the expansion of digital marketplaces and increased use of online tools for ordering, tracking, and managing inventory. The rise of online platforms is driven by the need for convenience, accessibility, and faster transaction times in the chemical distribution market.

Others: The "Others" segment includes alternative distribution methods such as direct partnerships and specialized chemical service providers. Trends involve exploring innovative approaches like decentralized distribution networks and collaborative models with industry-specific partners. This segment is growing as companies seek to address niche market needs and develop more flexible distribution strategies.

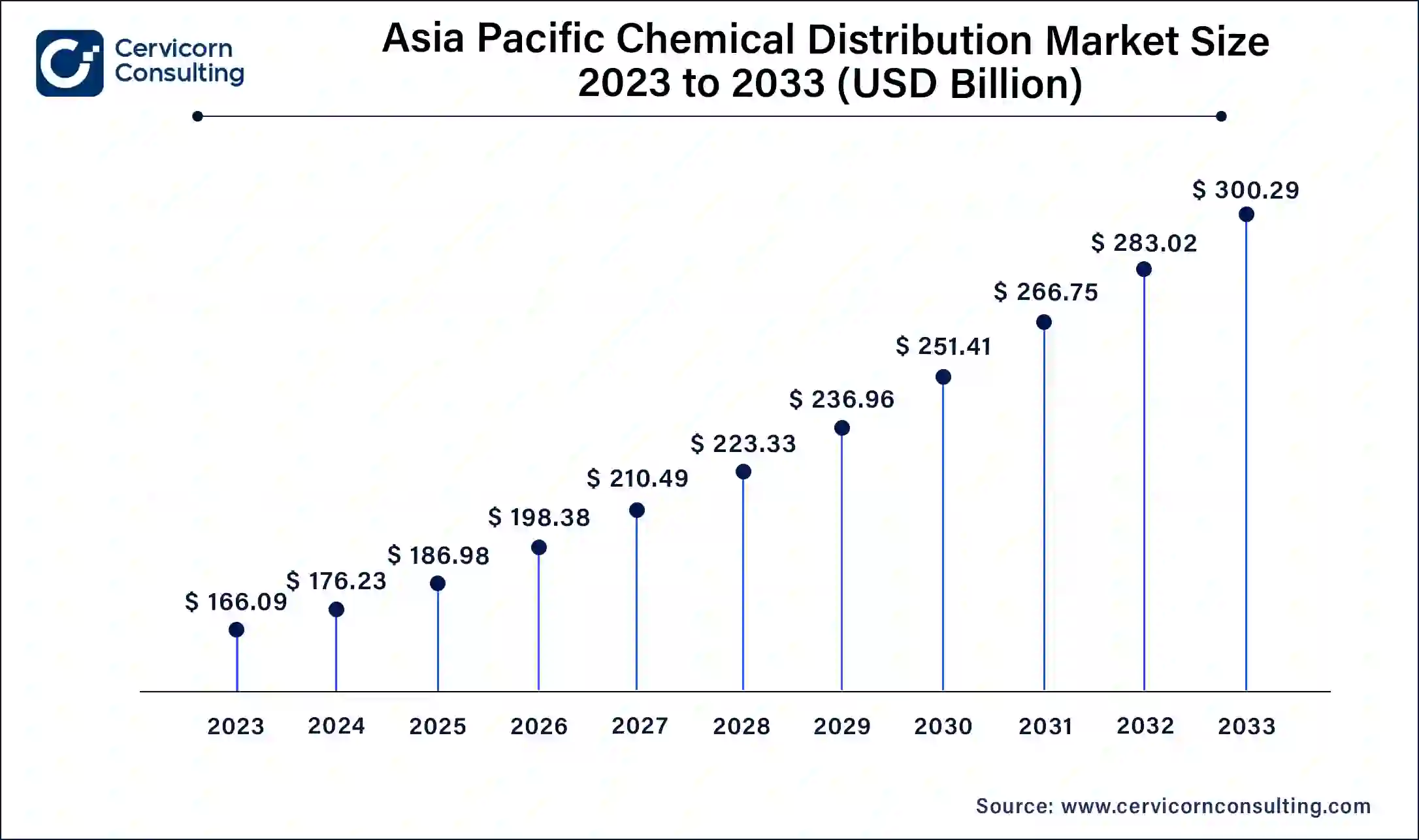

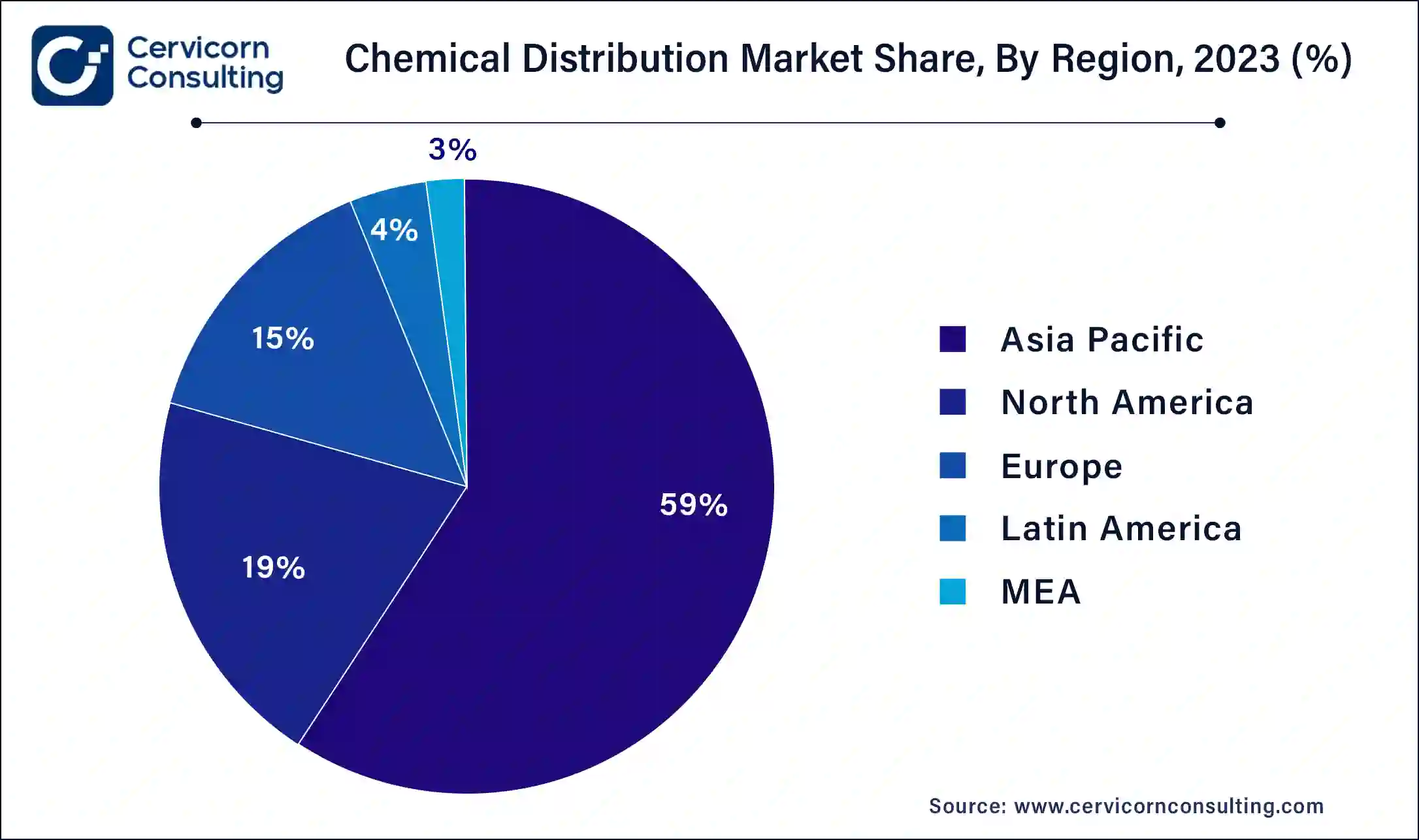

The Asia Pacific chemical distribution market size was valued at USD 175.75 billion in 2024 and is projected to be worth around USD 306.62 billion by 2034. Trends include a surge in demand for chemicals across various industries, such as manufacturing and construction. Distributors are expanding their networks and investing in infrastructure to meet the growing needs of emerging markets. The region also sees increasing adoption of technology to streamline distribution processes.

The North America chemical distribution market size calculated at USD 46.33 billion in 2024 and is projected to grow USD 80.82 billion by 2034. In North America, the chemical distribution market is experiencing growth driven by advancements in technology and innovation. Trends include increased investment in automation and digitalization of distribution processes to enhance efficiency and transparency. Additionally, there is a focus on sustainable practices and regulatory compliance, with distributors adapting to stricter environmental and safety standards.

Europe chemical distribution market size is expected to grow USD 101.2 billion by 2034. Europe's chemical distribution market is characterized by strong regulatory frameworks and a focus on sustainability. Trends include significant investments in green chemistry and circular economy initiatives. Distributors are adapting to stringent EU regulations by offering eco-friendly products and enhancing their sustainability practices. Additionally, there is a growing emphasis on integrating digital solutions to improve supply chain transparency.

The LAMEA region is experiencing growth, due to increased industrial activities and infrastructure development. Trends include a focus on building local distribution networks and partnerships to better serve regional markets. There is also a growing interest in sustainable and cost-effective solutions as companies in the region seek to improve their supply chain efficiency and environmental impact.

New players like IMCD N.V. and Azelis Holdings S.A. are leveraging innovations such as advanced digital platforms and specialized chemical solutions to enter the market. They focus on integrating technology to enhance efficiency and customer service. Key players dominating the market include Brenntag SE and Univar Solutions Inc., known for their extensive global networks and broad product portfolios. Their dominance stems from their established market presence, comprehensive distribution capabilities, and investment in technology and sustainability, allowing them to effectively meet diverse customer needs and drive industry growth.

The chemical distribution industry has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their offerings and profitability. Some notable examples of key development in the chemical distribution sector include:

Market Segmentation

By Type

By End User

By Distribution Channel

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Chemical Distribution

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By End Users Overview

2.2.3 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Chemical Distribution Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancements in Chemical Manufacturing Processes

4.1.1.2 Rising Urbanization and Infrastructure Development

4.1.2 Market Restraints

4.1.2.1 Stringent Regulatory Compliance

4.1.2.2 Volatility in Raw Material Prices

4.1.3 Market Opportunity

4.1.3.1 Expansion of Emerging Markets

4.1.3.2 Increased Focus on Circular Economy

4.1.4 Market Challenges

4.1.4.1 Supply Chain Disruptions

4.1.4.2 Safety and Environmental Concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Chemical Distribution Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Chemical Distribution Market, By Type

6.1 Global Chemical Distribution Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Commodity Chemicals

6.1.1.2 Specialty Chemicals

6.1.1.3 Fine Chemicals

6.1.1.4 Others

Chapter 7 Chemical Distribution Market, By End Users

7.1 Global Chemical Distribution Market Snapshot, By End Users

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Specialty Chemicals

7.1.1.2 Commodity Chemicals

Chapter 8 Chemical Distribution Market, By Distribution Channel

8.1 Global Chemical Distribution Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Direct Sales

8.1.1.2 Distributors

8.1.1.3 Online Platforms

8.1.1.4 Others

Chapter 9 Chemical Distribution Market, By Region

9.1 Overview

9.2 Chemical Distribution Market Revenue Share, By Region 2023 (%)

9.3 Global Chemical Distribution Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Chemical Distribution Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Chemical Distribution Market, By Country

9.5.4 UK

9.5.4.1 UK Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Chemical Distribution Market, By Country

9.6.4 China

9.6.4.1 China Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Chemical Distribution Market, By Country

9.7.4 GCC

9.7.4.1 GCC Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Chemical Distribution Market Revenue, 2021-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Brenntag SE

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Univar Solutions Inc.

11.3 IMCD N.V.

11.4 Nexeo Solutions

11.5 Azelis Holdings S.A.

11.6 Corteva Agriscience

11.7 Harima Chemicals, Inc.

11.8 Helm AG

11.9 SABIC Innovative Plastics

11.10 Kraton Corporation