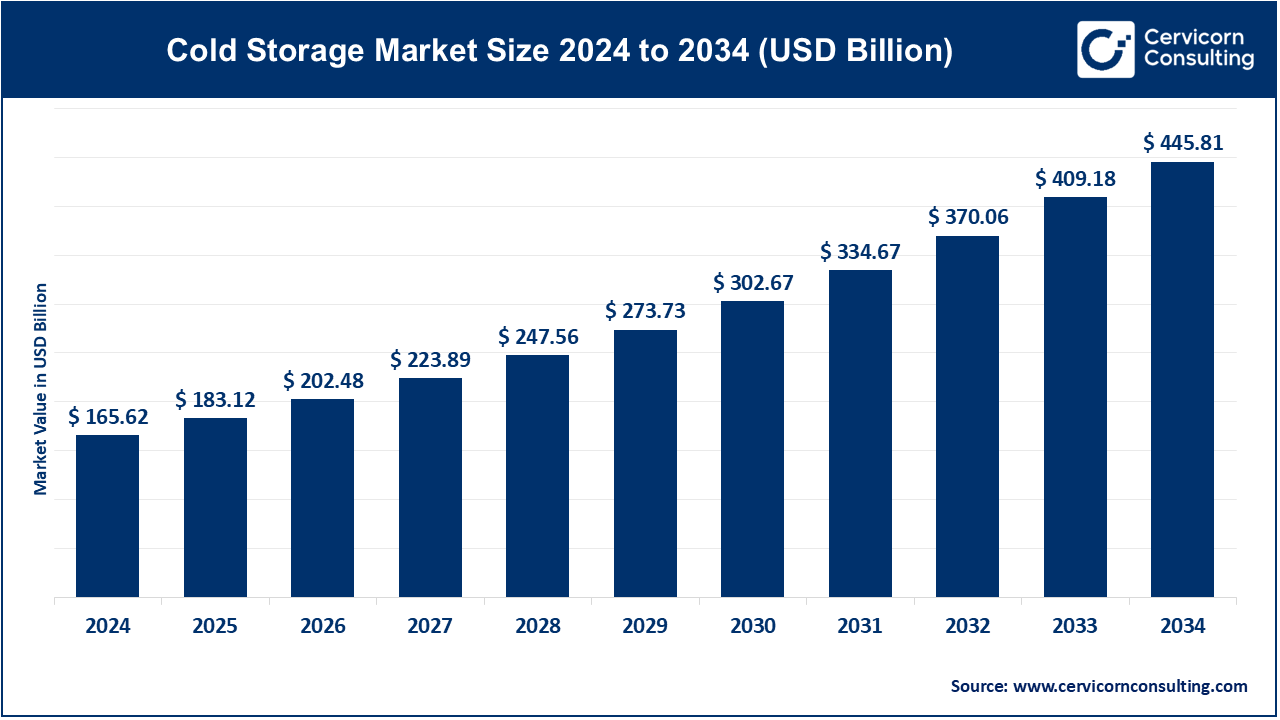

The global cold storage market size was accounted at USD 165.62 billion in 2024 and is projected to surpass around USD 445.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.41% over the forecast period 2025 to 2034.

The cold storage market has witnessed significant growth in recent years, driven by the increasing demand for perishable goods in the food industry and the rise in global trade of temperature-sensitive products. The expansion of e-commerce and online grocery shopping has further accelerated this demand, as consumers seek more convenient and reliable ways to purchase perishable goods. Moreover, the global pharmaceutical industry, particularly with the growth of vaccines and biologic drugs, has increased the need for specialized cold storage facilities to handle sensitive products. The cold storage market is expected to continue expanding due to factors such as advancements in refrigeration technologies, the rise in international trade, and increased consumer preference for fresh and frozen foods. This growth is supported by both the growing demand for temperature-controlled logistics and the need for improved storage solutions to meet evolving global health and food safety standards.

The cold storage market pertains to facilities designed for preserving perishable goods under controlled temperatures to maintain their quality and extend shelf life. Key driving factors include the expanding global food industry, increasing demand for processed foods, and stringent regulations on food safety and quality. Additionally, the growth of online grocery retailing and pharmaceuticals requiring temperature-controlled storage contribute to market expansion.

What is cold storage?

Cold storage refers to the practice of storing perishable goods at low temperatures to extend their shelf life and preserve their quality. This method is essential for a wide range of industries, including food, pharmaceuticals, and biotechnology. Cold storage helps in reducing spoilage and maintaining the safety and quality of items like meats, fruits, vegetables, dairy products, and medicines. Cold storage facilities play a critical role in ensuring food security, minimizing food wastage, and meeting the rising consumer expectations for fresh and safe food products worldwide. The types of cold storage facilities are generally categorized into two: refrigerated storage and frozen storage. Refrigerated storage maintains a temperature above freezing, typically between 1°C and 15°C, suitable for items like fresh produce and dairy. Frozen storage, on the other hand, keeps items at temperatures below 0°C, ensuring the long-term preservation of meats, ice creams, and certain pharmaceuticals.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 183.12 Billion |

| Market Size by 2034 | USD 445.81 Billion |

| Market Growth Rate | CAGR of 10.41% from 2025 to 2034 |

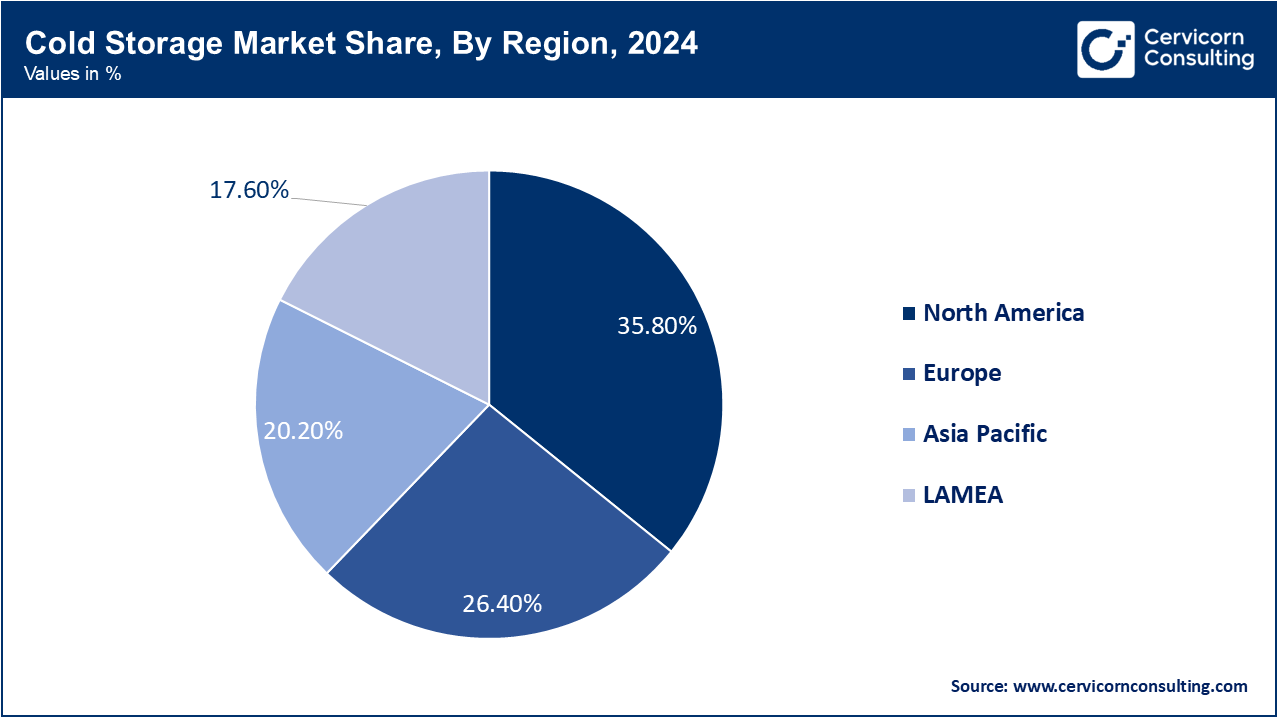

| Largest Region | North America |

| Fastets Growing Region | Asia Pacific |

| Segments Covered | Storage Type, Temperature Range, Application, Construction, Region |

Globalization of Food Trade

The globalization of food trade has increased the demand for cold storage facilities to store and transport perishable goods across long distances. As countries import and export more fresh produce, dairy, meat, and seafood, the need for reliable and efficient cold storage solutions becomes crucial to maintain product quality and safety during transit.

Expansion of Retail and E-commerce

The growth of retail and e-commerce, especially in the grocery sector, drives the need for extensive cold storage infrastructure. Online grocery shopping and the trend of home delivery services require robust cold storage logistics to ensure that perishable goods remain fresh from warehouses to consumers' doorsteps, thus boosting the demand for cold storage facilities.

High Operational Costs

Cold storage facilities require significant energy consumption to maintain low temperatures, leading to high operational costs. These costs include electricity for refrigeration, maintenance of advanced cooling systems, and skilled labor. The substantial financial investment needed to operate and maintain these facilities can limit the market's growth, especially for smaller players.

Infrastructure Limitations in Developing Regions

In developing regions, the lack of adequate infrastructure, such as reliable electricity and transportation networks, hampers the establishment and efficiency of cold storage facilities. Poor infrastructure can lead to inconsistent temperature control and increased spoilage, making it challenging to expand cold storage services in these areas and thus restraining market growth.

Expansion of E-commerce in Perishables

The surge in online grocery shopping and meal kit deliveries presents significant opportunities for the cold storage sector. As more consumers purchase perishable goods online, the demand for reliable cold storage solutions to maintain the freshness and quality of these products during transit and storage will continue to grow, driving market expansion.

Technological Advancements in Refrigeration

Innovations in refrigeration technology, such as energy-efficient cooling systems and advanced temperature monitoring solutions, offer opportunities for the cold storage industry. These advancements can reduce operational costs, enhance storage efficiency, and improve product shelf life, making cold storage more accessible and attractive to businesses looking to preserve perishable goods effectively.

High Initial Investment Costs

Establishing cold storage facilities requires substantial capital investment in infrastructure, advanced refrigeration systems, and technology. This high initial cost can be a significant barrier for small and medium-sized enterprises (SMEs), limiting their ability to enter the market and compete with larger, established players.

Energy Consumption and Sustainability Concerns

Cold storage facilities are energy-intensive, leading to high operational costs and environmental impact. Balancing the need for effective refrigeration with the demand for sustainable practices poses a challenge. Companies must invest in energy-efficient technologies and renewable energy sources to address these concerns while maintaining cost-effectiveness and regulatory compliance.

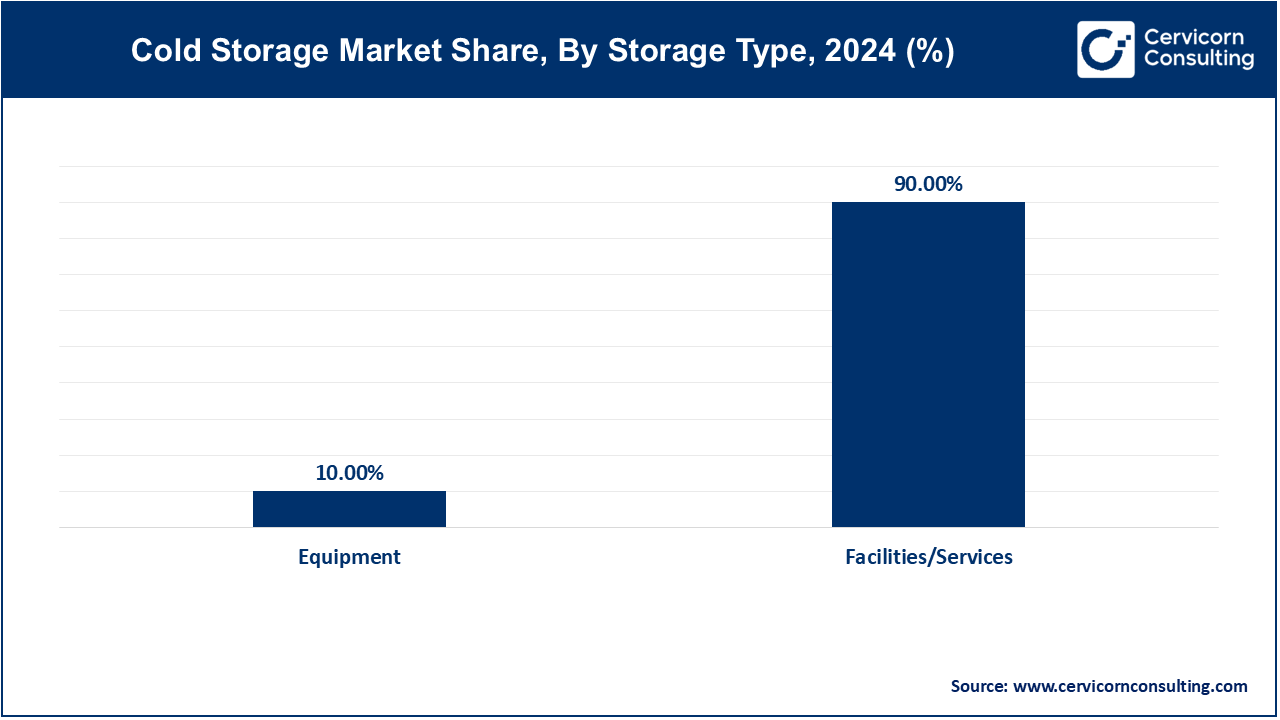

Facilities/Services: The facilities/services segment has accounted market share of 90% in 2024. The facilities/services refer to refrigerated warehouses and distribution centers offering storage and logistics solutions for perishable goods. Market trends include the adoption of energy-efficient facilities and the expansion of cold chain networks to meet global food safety standards. Drivers include the rising demand for fresh and frozen foods due to changing consumer preferences and increasing international trade of perishable goods.

Equipment: The equipment segment has generated market share of 10% in 2024. This segment in the cold storage market encompasses refrigeration systems, temperature monitoring devices, and packaging solutions crucial for maintaining product integrity. Market trends involve advancements in refrigeration technology for energy efficiency and sustainability. Drivers include stringent regulatory requirements for food safety and quality, prompting investments in state-of-the-art refrigeration and monitoring equipment to ensure compliance and minimize product loss.

Chilled (0°C to 15°C): The chilled segment involves storage solutions maintaining temperatures between 0°C and 15°C, ideal for fresh produce, dairy, and beverages. Market trends include the development of smart refrigeration systems for real-time temperature monitoring. Key drivers are the rising demand for fresh and minimally processed foods and stringent regulations on food safety and quality.

Frozen (-18°C to -25°C): The frozen segment has covered largest revenue share of 62% in 2024. This segment includes storage solutions maintaining temperatures between -18°C and -25°C, essential for frozen foods like meat, seafood, and prepared meals. Market trends involve the adoption of energy-efficient and environmentally friendly refrigeration technologies. Drivers include the growing frozen food industry and increasing international trade of frozen products requiring reliable cold chain logistics.

Deep-frozen (Below -25°C): The deep-frozen segment caters to storage needs below -25°C, crucial for long-term preservation of products like ice cream, certain pharmaceuticals, and high-value meats. Market trends focus on ultra-low temperature storage solutions and advanced insulation techniques. Key drivers are the increasing demand for premium frozen foods and the need for specialized storage in the pharmaceutical industry for vaccines and biologicals.

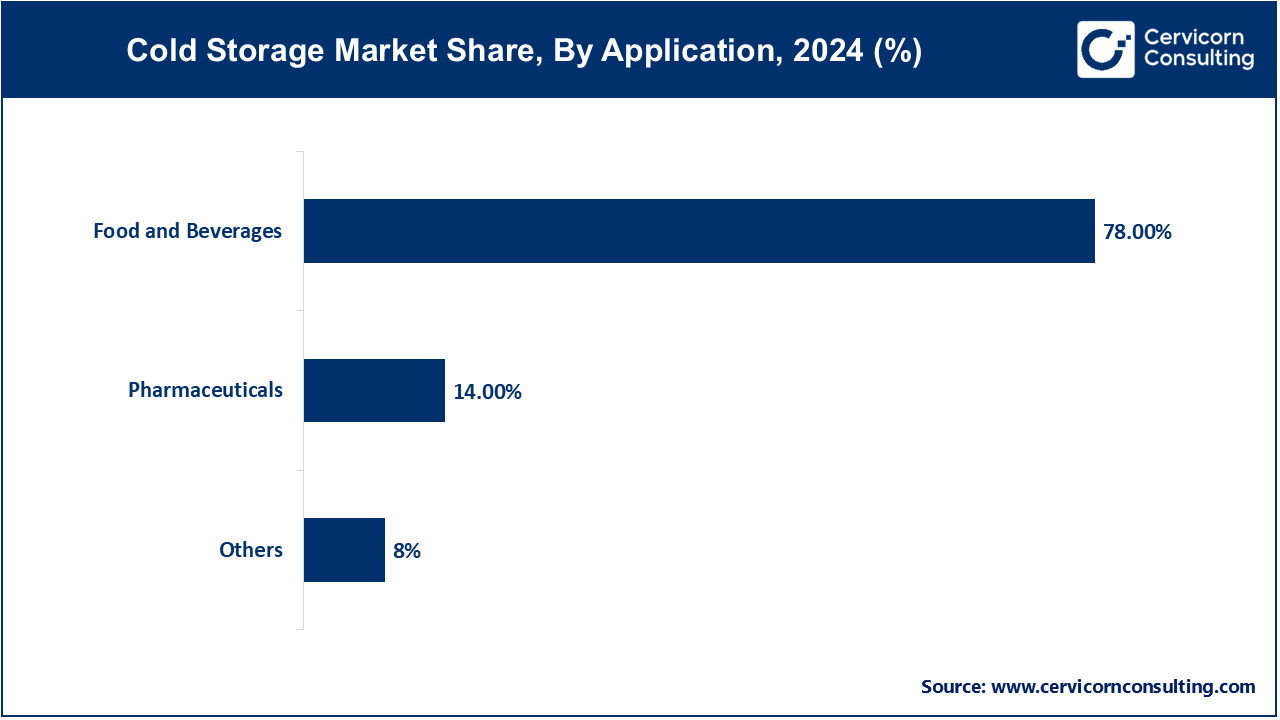

Food & Beverages: The food & beverages segment dominates the cold storage market with revenue share of 78% in 2024, driven by the need to preserve perishable items and maintain food safety. Market trends include advancements in IoT-enabled refrigeration systems and automation. Key drivers are the rising demand for processed and frozen foods and stringent food safety regulations.

Pharmaceuticals: The pharmaceuticals segment is growing rapidly (market share of 14%) due to the need for temperature-controlled storage for vaccines, biologics, and other temperature-sensitive drugs. Trends include the development of ultra-low temperature freezers and enhanced monitoring systems. Drivers include the growth of the biopharmaceutical industry and increased demand for temperature-sensitive vaccines and medications.

Others: In 2024, the other aaplication segment has held revenue share of 8%. This segment includes various applications such as cosmetics, chemicals, and floral products requiring temperature-controlled environments. Market trends involve customization of cold storage solutions to meet diverse industry needs. Key drivers include the expanding global trade of temperature-sensitive goods and the need for specialized storage solutions in niche markets.

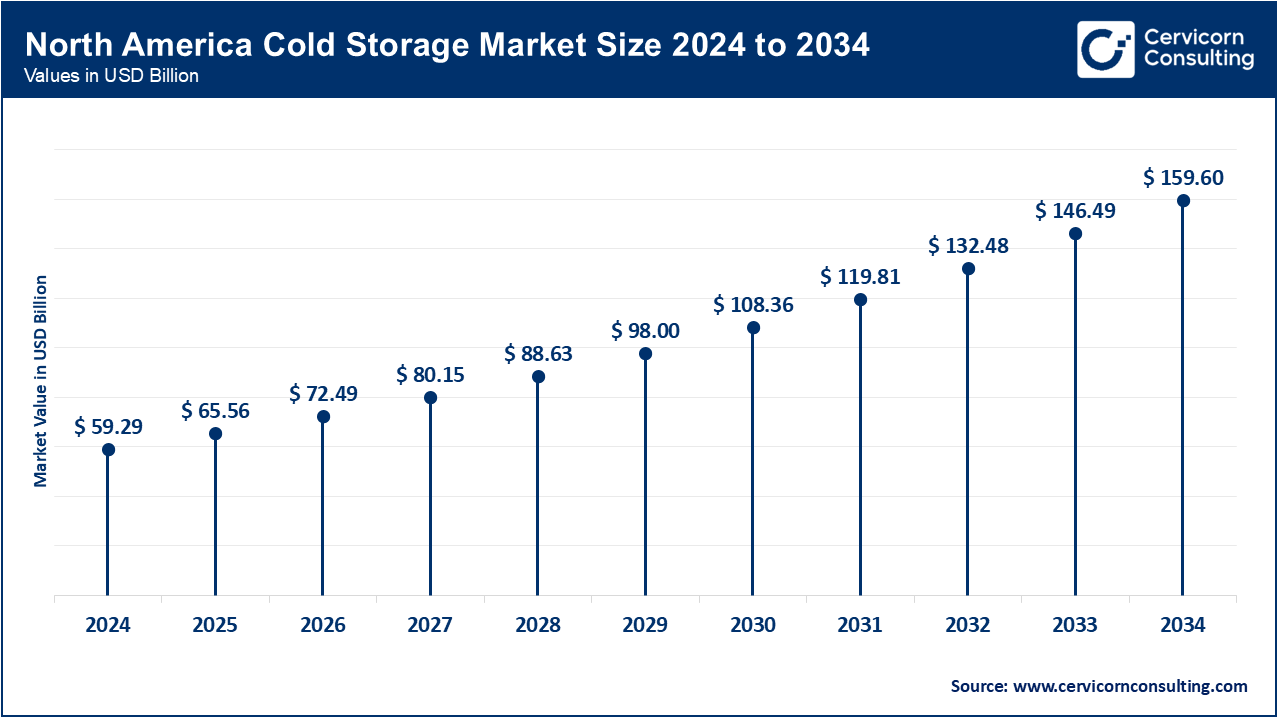

The North America cold storage market size is calculated at USD 59.26 billion in 2024 and is expected to reach around USD 159.6 billion by 2034. North America's cold storage market is highly developed, driven by advanced infrastructure, a strong food and beverage industry, and stringent food safety regulations. The presence of major pharmaceutical companies also boosts the demand for temperature-controlled storage. Technological advancements and increased investments in automation and IoT-enabled refrigeration systems further enhance the region's market growth.

The Europe cold storage market size was valued at USD 43.72 billion in 2024 and is expected to be worth around USD 117.69 billion by 2034. Europe market is characterized by a strong emphasis on food safety and sustainability. The region has a well-established logistics network, supporting efficient cold chain management. Increasing demand for organic and fresh produce, along with the growth of the pharmaceutical sector, drives the market. Trends include the adoption of energy-efficient refrigeration systems and regulatory compliance with stringent environmental standards.

The Asia-Pacific cold storage market size was valued at USD 33.46 billion in 2024 and is projected to grow around USD 90.05 billion by 2034. Asia-Pacific market is experiencing rapid growth due to rising disposable incomes, urbanization, and increasing demand for frozen and processed foods. The expanding pharmaceutical industry and the need for efficient vaccine storage also drive market growth. Significant investments in cold chain infrastructure and government initiatives to improve food security are key factors contributing to the market's expansion.

The LAMEA cold storage market is growing steadily, driven by the rising demand for perishable food products and the expanding pharmaceutical sector. Challenges include underdeveloped infrastructure and high energy costs. However, investments in improving cold chain logistics and increasing awareness about food safety and quality standards are fostering market growth in these regions.

New players such as RSA Logistics, Al Rai Logistica K.S.C, Gulf Drug LLC, Oxford Logistics Group, and Wared Logistics are leveraging advanced technologies such as IoT, blockchain for traceability, and AI for optimizing storage efficiency and logistics. Key players dominating the market include Americold Logistics, Inc., LINEAGE LOGISTICS HOLDING, LLC, United States Cold Storage, Swire Group, and Preferred Freezer. These leading companies drive the market with extensive global networks, advanced cold chain solutions, and strategic acquisitions. They continually innovate through collaborations and investments in automation and sustainable practices. For instance, LINEAGE LOGISTICS has integrated AI for predictive analytics, while Americold has partnered with food manufacturers to expand its storage facilities, ensuring efficient supply chain management.

CEO Statements

Fred Boehler, CEO of Americold Logistics, Inc.

Greg Lehmkuhl, CEO of Lineage Logistics Holding, LLC

David Harlan, CEO of United States Cold Storage

Jeff Harrison, CEO of VersaCold Logistics Services

David O’Brien, CEO of Swire Group

These statements highlight how the key players are shaping the future of cold storage, ensuring safety, efficiency, and sustainability in the market.

Market Segmentation

By Storage Type

By Temperature Range

By Construction

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cold Storage

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Storage Type Overview

2.2.2 By Temperature Range Overview

2.2.3 By Construction Overview

2.2.4 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cold Storage Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Globalization of Food Trade

4.1.1.2 Expansion of Retail and E-commerce

4.1.2 Market Restraints

4.1.2.1 High Operational Costs

4.1.2.2 Infrastructure Limitations in Developing Regions

4.1.3 Market Opportunities

4.1.3.1 Expansion of E-commerce in Perishables

4.1.3.2 Technological Advancements in Refrigeration

4.1.4 Market Challenges

4.1.4.1 High Initial Investment Costs

4.1.4.2 Energy Consumption and Sustainability Concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cold Storage Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cold Storage Market, By Storage Type

6.1 Global Cold Storage Market Snapshot, By Storage Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Facilities/Services

6.1.1.2 Equipment

Chapter 7 Cold Storage Market, By Temperature Range

7.1 Global Cold Storage Market Snapshot, By Temperature Range

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Chilled (0°C to 15°C)

7.1.1.2 Frozen (-18°C to -25°C)

7.1.1.3 Deep-frozen (Below -25°C)

Chapter 8 Cold Storage Market, By Construction

8.1 Global Cold Storage Market Snapshot, By Construction

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Bulk Storage

8.1.1.2 Production Stores

8.1.1.3 Ports

Chapter 9 Cold Storage Market, By Application

9.1 Global Cold Storage Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Food & Beverages

9.1.1.2 Pharmaceuticals

9.1.1.3 Others

Chapter 10 Cold Storage Market, By Region

10.1 Overview

10.2 Cold Storage Market Revenue Share, By Region 2023 (%)

10.3 Global Cold Storage Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Cold Storage Market Revenue, 2021-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Cold Storage Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Cold Storage Market Revenue, 2021-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Cold Storage Market Revenue, 2021-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Cold Storage Market Revenue, 2021-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Cold Storage Market Revenue, 2021-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Cold Storage Market, By Country

10.5.4 UK

10.5.4.1 UK Cold Storage Market Revenue, 2021-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Cold Storage Market Revenue, 2021-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Cold Storage Market Revenue, 2021-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Cold Storage Market Revenue, 2021-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Cold Storage Market, By Country

10.6.4 China

10.6.4.1 China Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Cold Storage Market Revenue, 2021-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Cold Storage Market Revenue, 2021-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Cold Storage Market, By Country

10.7.4 GCC

10.7.4.1 GCC Cold Storage Market Revenue, 2021-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Cold Storage Market Revenue, 2021-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Cold Storage Market Revenue, 2021-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Cold Storage Market Revenue, 2021-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 RSA Logistics

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Cloverleaf Cold Storage

12.3 Swire Group

12.4 Nordic Logistics

12.5 Gulf Drug LLC

12.6 Al Rai Logistica K.S.C

12.7 Oceana Group Limited

12.8 Burris Logistics

12.9 Agro Merchants Group

12.10 Oxford Logistics Group