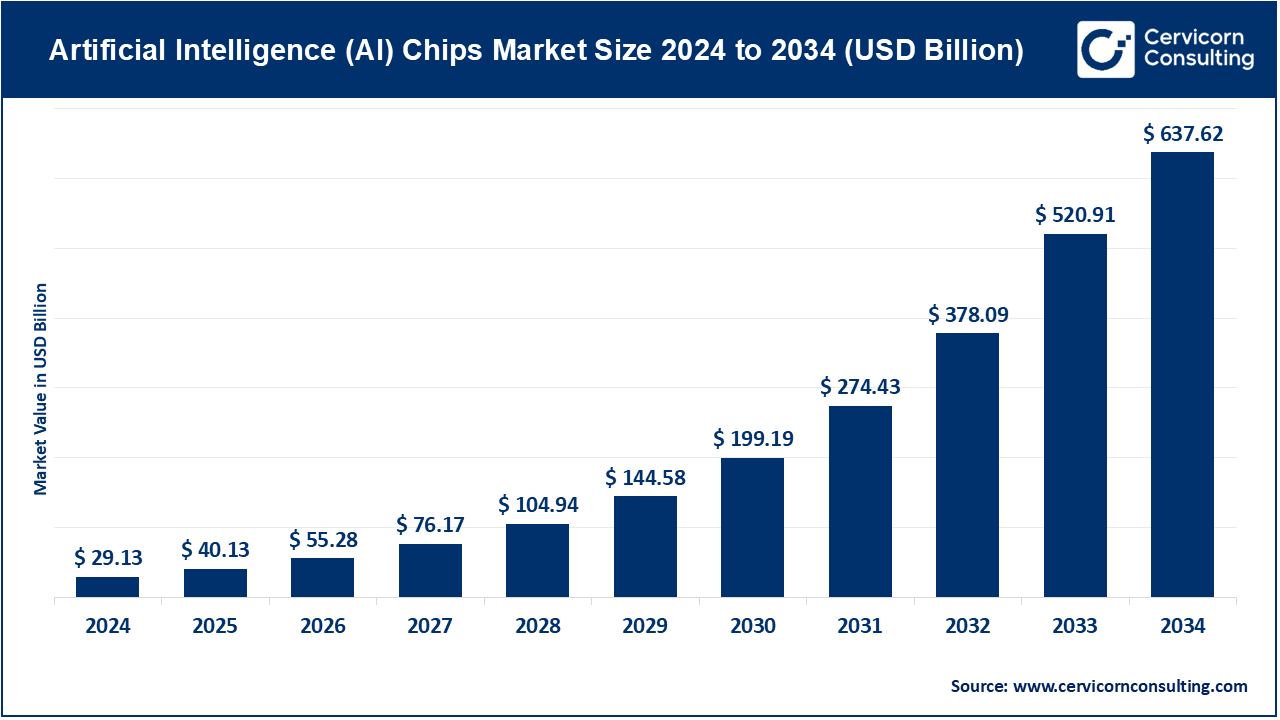

The global artificial intelligence (AI) chips market size was valued at USD 29.13 billion in 2024 and is projected to reach around USD 637.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 36.15% over the forecast period 2025 to 2034.

The artificial intelligence (AI) chip market is witnessing robust growth, fueled by advancements in artificial intelligence and machine learning technologies. Industries such as automotive, healthcare, finance, and telecommunications are adopting AI at an unprecedented rate, driving the demand for specialized hardware that can efficiently process vast amounts of data in real-time. The automotive sector, for example, is leveraging AI chips for autonomous vehicles, enabling faster decision-making and improved safety features. Similarly, in healthcare, AI chips are helping with diagnostic imaging and personalized treatments, allowing for quicker analysis and improved patient outcomes. Moreover, as more devices become connected through the Internet of Things (IoT), the need for AI chips at the edge of networks is becoming more pronounced. Edge AI chips process data locally on devices, reducing the need for latency and enhancing performance for applications like smart cities, security systems, and wearable technologies.

The artificial intelligence (AI) chips market encompasses the development and distribution of specialized semiconductor chips designed to accelerate AI computations in various applications. These chips, including GPUs, ASICs, FPGAs, CPUs, and NPUs, power AI tasks such as machine learning, natural language processing, and computer vision. Key drivers include the surge in data generation, advancements in AI algorithms, and the need for high-performance computing in sectors like healthcare, automotive, and finance. The market is segmented by chip type, technology, application, industry vertical, and region, catering to diverse demands from data centers, enterprises, and public cloud providers globally.

Artificial intelligence (AI) chips are specialized hardware designed to accelerate the processing of AI-related tasks, particularly those involving machine learning, deep learning, and neural networks. These chips are optimized to handle large volumes of data and complex algorithms with high efficiency, enabling faster and more accurate AI applications. Key types of AI chips include Graphics Processing Units (GPUs), which excel at parallel processing tasks, and Tensor Processing Units (TPUs), designed specifically for machine learning tasks. Additionally, there are Field-Programmable Gate Arrays (FPGAs), which can be reprogrammed for specific AI applications, and Application-Specific Integrated Circuits (ASICs), which are custom-designed for particular AI tasks.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 40.13 Billion |

| Market size in 2034 | USD 637.62 Billion |

| Market Growth Rate | CAGR of 36.15% from 2025 to 2034 |

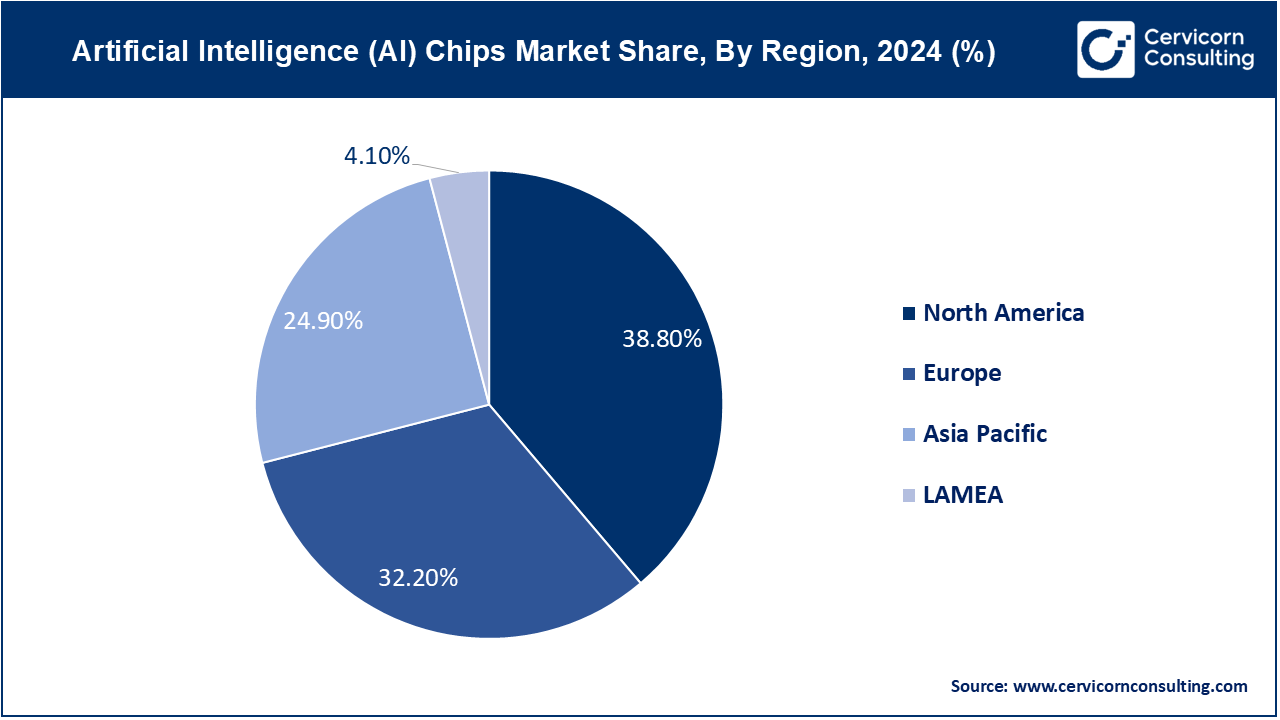

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Chip Type, Technology Type, Processing Type, Application, Industry Vertical, Regions |

Proliferation of Big Data:

Advancements in AI-Powered Healthcare Solutions:

High Development and Manufacturing Costs:

Limited Skilled Workforce:

Expansion into Emerging Markets:

Collaboration with Industry Verticals:

Heat Dissipation and Power Consumption:

Ethical and Regulatory Concerns:

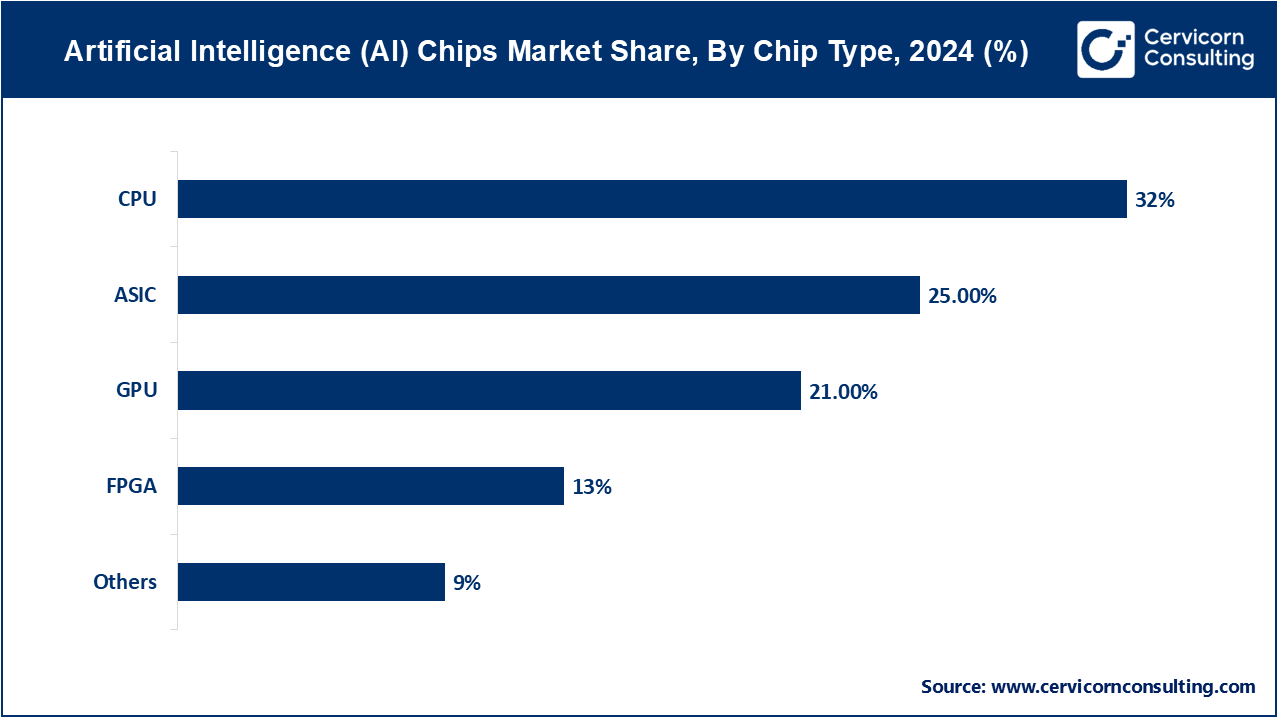

Graphics Processing Unit (GPU): The graphics processing unit (GPU) segment has accounted market share of 21% in 2024. GPUs are specialized processors designed to accelerate graphics rendering and parallel processing tasks. In AI, they excel at handling large-scale matrix operations essential for training deep learning models. Trends include increasing GPU integration in data centers and the development of more energy-efficient models to support edge computing and real-time AI applications, driving enhanced performance and scalability in AI workloads.

Application-Specific Integrated Circuit (ASIC): The Application-Specific Integrated Circuit segment has generated market share of 25% in 2024. ASICs are custom-designed chips tailored for specific applications, offering high efficiency and performance for targeted tasks. In the AI market, ASICs like Google’s TPU are optimized for deep learning tasks, providing faster and more power-efficient processing than general-purpose chips. Trends involve growing adoption in specialized AI applications, such as autonomous vehicles and IoT devices, due to their superior performance and energy efficiency.

Field-Programmable Gate Array (FPGA): The field-programmable gate array (FPGA) segment has covered market share of 13% in 2024. FPGAs are reconfigurable chips that can be programmed post-manufacturing for specific tasks. They offer flexibility and high performance in AI applications, particularly in low-latency and real-time processing. Trends include increasing use in edge computing and custom AI solutions, as well as advancements in ease of programming and integration with AI frameworks to enhance adaptability and efficiency in various AI-driven scenarios.

Central Processing Unit (CPU): Central Processing Unit (CPU) segment has measured market size of 32% in 2024. CPUs are general-purpose processors essential for overall system operation, capable of handling a wide range of tasks including AI workloads. In AI, they are often used in conjunction with other specialized chips for comprehensive processing. Trends show continuous improvements in CPU architectures to enhance AI performance, support for multi-threading, and integration with AI accelerators, facilitating more efficient AI inference and general computing tasks.

Neuromorphic Processing Unit (NPU): NPUs are designed to mimic the neural structure of the human brain, enabling efficient and power-saving AI computations. These chips excel in processing sensory data and performing cognitive tasks. Trends include increasing development and adoption of NPUs for edge devices and IoT applications, where power efficiency and real-time processing are critical, and advancements in bio-inspired computing to enhance AI model efficiency and capabilities.

Others: The other segment has reported market share of 9% in 2024. This category includes emerging and hybrid chip technologies like tensor processing units (TPUs) and quantum processors. These chips offer specialized solutions for complex AI tasks. Trends involve the exploration of novel architectures and materials to push the boundaries of AI processing capabilities, focusing on extreme efficiency, scalability, and integration with existing AI ecosystems to address the growing computational demands of advanced AI applications.

Machine Learning: Machine learning involves algorithms that enable systems to learn from data and make predictions or decisions. AI chips for machine learning optimize processing speed and efficiency, facilitating tasks like pattern recognition and data analysis across industries.

Natural Language Processing: NLP focuses on enabling machines to understand and interpret human language. AI chips enhance NLP applications by accelerating tasks such as speech recognition, language translation, and sentiment analysis.

Context-Aware Computing: Context-aware computing involves systems that adapt based on the user's environment or situation. AI chips for context-aware computing improve real-time responsiveness and personalization in applications like smart homes, wearable devices, and IoT.

Computer Vision: Computer vision enables machines to interpret and understand visual information from the world. AI chips enhance computer vision capabilities in applications such as autonomous driving, surveillance, and augmented reality by accelerating image processing and object detection tasks.

Predictive Analysis: Predictive analysis uses data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data. AI chips optimize predictive analysis by processing vast amounts of data quickly and accurately, aiding decision-making in industries like finance, healthcare, and marketing.

Others: Other AI chip applications include robotics, autonomous systems, recommendation systems, and gaming. These chips optimize performance, energy efficiency, and scalability, driving innovation in AI-powered technologies across diverse sectors.

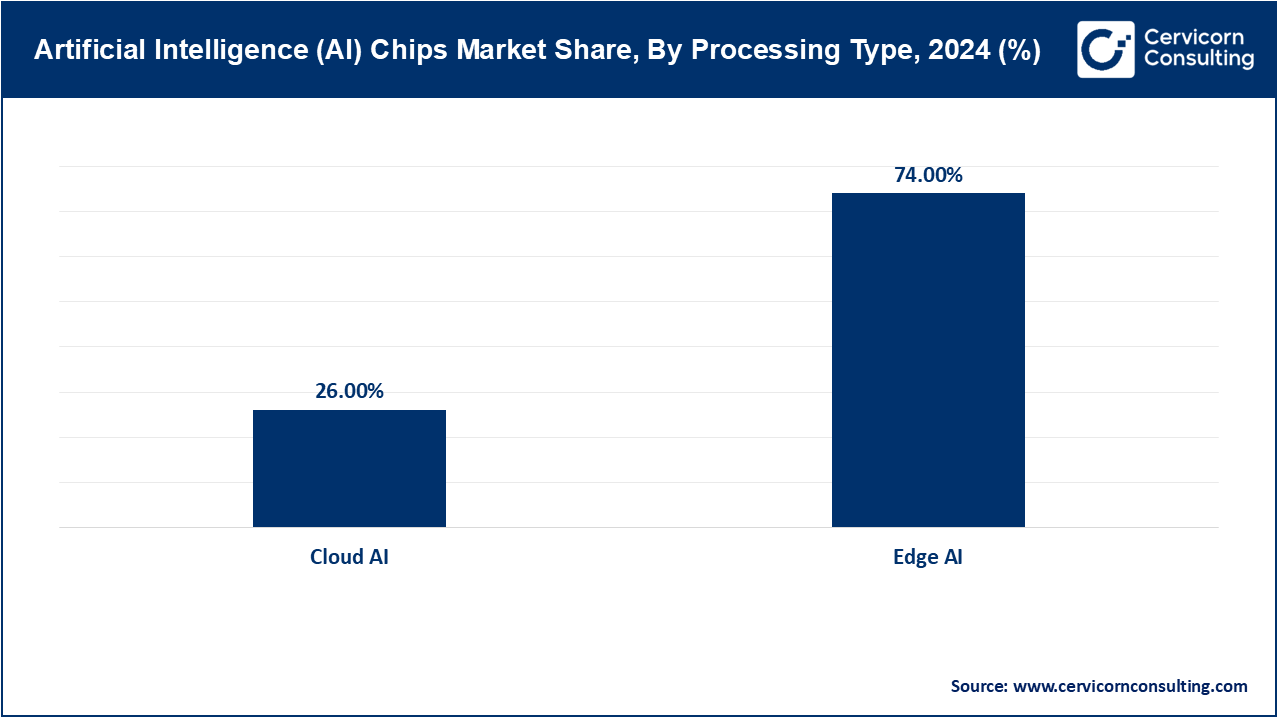

Edge AI: The edge AI segment has accounted market size of 74% in 2024. Edge AI involves processing data locally on devices (e.g., smartphones, IoT devices) rather than transmitting it to a centralized server or cloud. This approach enhances real-time processing, reduces latency, and improves privacy by keeping data localized. Trends include the integration of AI chips into edge devices for autonomous operations, smart home applications, and industrial IoT, catering to demands for faster decision-making and enhanced user experiences.

Cloud AI: The cloud AI segment has registered market share of 26% in 2024. Cloud AI refers to AI computations performed on remote servers accessed via the internet. It enables scalability, extensive data storage, and collaborative processing capabilities across global networks. Trends include the development of specialized AI chips optimized for cloud environments, supporting large-scale data analytics, machine learning training, and complex AI applications in sectors like finance, healthcare, and e-commerce. Emphasis is on enhancing performance efficiency and cost-effectiveness for cloud-based AI services.

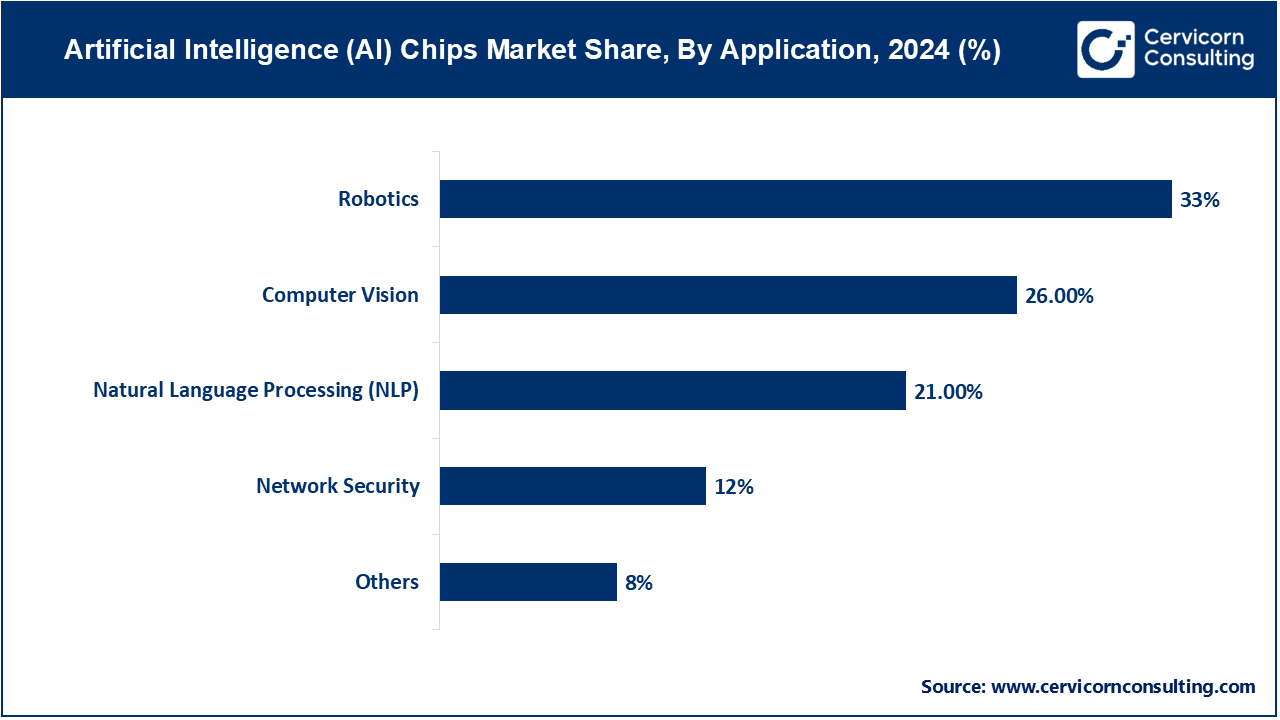

Natural Language Processing (NLP): The natural language processing (NLP) segment has recorded market share of 21% in 2024. NLP involves AI chips processing and understanding human language, enabling applications like virtual assistants and language translation. Trends include enhanced deep learning models for better context understanding and real-time language processing, driving demand for efficient AI chips tailored for NLP tasks.

Computer Vision: The computer vision segment has calculated market share of 26% in 2024. Computer Vision AI chips enable machines to interpret visual information, supporting applications such as facial recognition and autonomous vehicles. Trends focus on improving accuracy and speed in image and video analysis, prompting advancements in GPU and ASIC designs optimized for computer vision tasks.

Robotics: The robotics segment has captured highest market share of 33% in 2024. AI chips in robotics facilitate autonomous decision-making and movement in robots. Trends include integration of AI with sensor fusion for environment perception and development of AI-specific processors for robotic control systems, enhancing capabilities in industrial automation and consumer robotics.

Network Security: The network security segment has measured market share of 12% in 2024. AI chips in network security enable real-time threat detection and response, enhancing cybersecurity measures. Trends involve AI-enabled chips for pattern recognition in network traffic and encryption/decryption processes, addressing evolving cybersecurity threats with efficient and scalable hardware solutions.

Speech Recognition: Speech recognition AI chips convert spoken language into text or commands, used in applications like virtual assistants and voice-controlled devices. Trends focus on improving accuracy through AI algorithms and hardware optimizations, driving the demand for AI chips capable of processing complex speech data in real time.

Others: The other segement has generated market share of 8% in 2024. Other AI chip applications span diverse sectors like healthcare diagnostics, financial trading algorithms, and climate modeling. Trends include customized AI chip designs for specific industry needs, fostering innovation in AI-driven solutions across various domains beyond traditional applications.

Healthcare: AI chips in healthcare optimize diagnostics, drug discovery, and personalized medicine, enhancing patient care efficiency. They also support remote monitoring, robotic surgeries, and data-driven insights for proactive healthcare management.

Automotive: AI chips improve autonomous driving capabilities, safety features, and in-car experiences, driving the evolution of smart vehicles. They enable real-time decision-making, adaptive cruise control, and advanced driver-assistance systems (ADAS), enhancing road safety and vehicle efficiency.

Consumer Electronics: AI chips power devices with advanced functionalities like voice recognition, image processing, and smart assistants, enhancing user interaction. They enable seamless integration of AI into smartphones, smart home devices, and wearables, offering personalized experiences and efficient task automation.

Retail: AI chips enable personalized shopping experiences, inventory management, and predictive analytics, revolutionizing retail operations. They facilitate dynamic pricing strategies, customer behavior analysis, and virtual shopping assistants, enhancing customer engagement and operational efficiency.

BFSI (Banking, Financial Services, and Insurance): AI chips enhance fraud detection, risk assessment, and customer service, transforming financial operations. They support algorithmic trading, credit scoring, and chatbot services, improving decision-making speed and accuracy while ensuring regulatory compliance.

IT and Telecom: AI chips optimize data processing, network management, and cybersecurity, facilitating faster and more secure communication. They support cloud computing, edge computing, and network traffic analysis, enhancing operational efficiency and reducing latency in data-intensive applications.

Manufacturing: AI chips improve automation, predictive maintenance, and quality control in manufacturing processes, boosting efficiency and reducing downtime. They enable predictive analytics for supply chain optimization, robotic assembly, and adaptive manufacturing, enhancing production throughput and product quality.

Others: AI chips find applications in diverse sectors like agriculture, energy, and entertainment, revolutionizing operations with enhanced automation and decision-making capabilities. They enable precision farming, energy grid management, and content recommendation systems, driving efficiency and innovation across various industries.

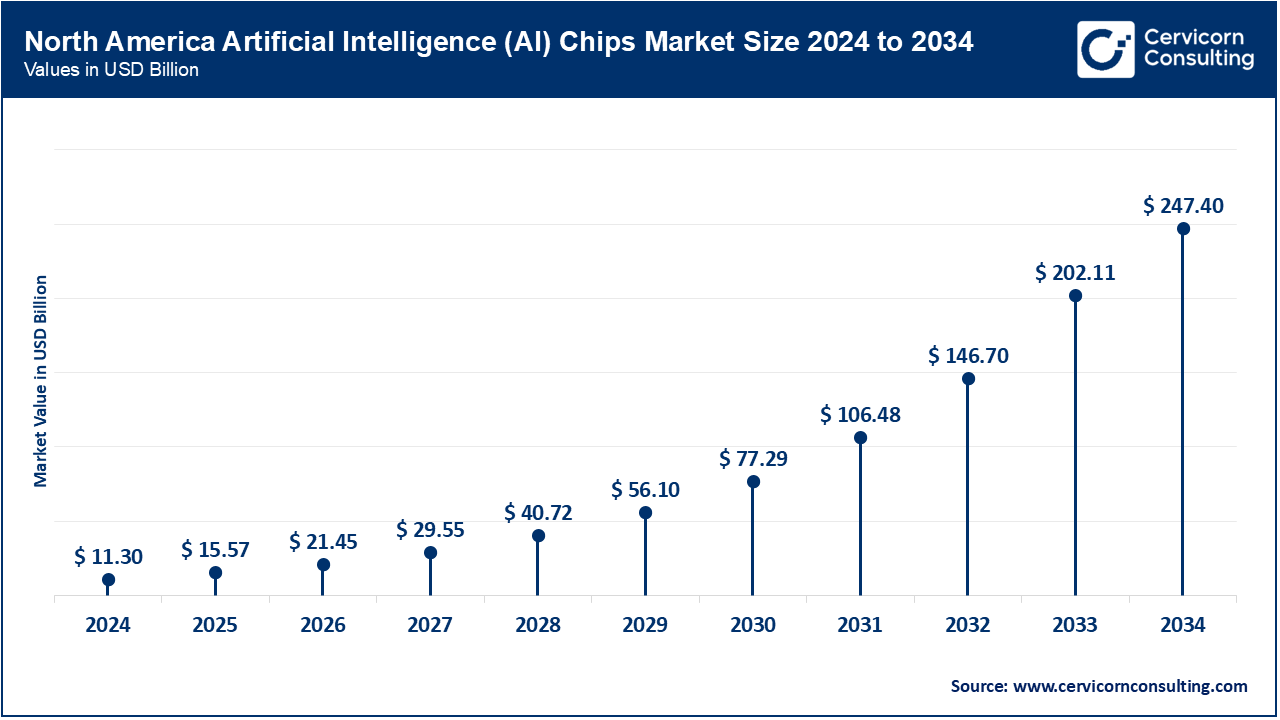

The North America artificial intelligence (AI) chips market size is calculated at USD 11.3 billion in 2024 and is expected to reach around USD 247.4 billion by 2034. AI chip development focuses on high-performance computing for applications in healthcare, autonomous vehicles, and fintech. There's a strong emphasis on AI ethics and regulation, driving innovation in transparent AI algorithms, data privacy solutions, and AI-driven cybersecurity technologies.

The Europe artificial intelligence (AI) chips market size is registered at USD 9.38 billion in 2024 and is projected to reach around USD 205.31 billion by 2034. AI chip adoption centers around industrial automation, smart cities, and sustainable energy solutions. Emphasis is placed on AI chip designs for energy efficiency, integration with IoT devices, and advancing AI in healthcare for personalized medicine and elderly care, supporting demographic shifts towards an aging population.

The Asia-Pacific artificial intelligence (AI) chips market size was valued at USD 7.25 billion in 2024 and is anticipated to grow around USD 158.77 billion by 2034. Rapid growth in AI chip manufacturing and deployment for smart manufacturing, robotics, and consumer electronics dominates. Investments in AI chip startups and research initiatives drive innovation in AI-powered healthcare solutions, smart agriculture, and enhancing urban mobility with AI-driven transportation solutions.

AI chip market growth is driven by applications in agriculture, mining automation, and smart city initiatives. Focus areas include AI chip solutions tailored for harsh environments, localized AI algorithms for regional healthcare challenges, and advancing AI in education for personalized learning solutions to address diverse socioeconomic needs.

New players like Graphcore Ltd. and Horizon Robotics are adopting innovative approaches in AI chip development, focusing on specialized architectures for machine learning and edge computing applications. They emphasize efficiency and performance improvements tailored to emerging AI needs. Key players like NVIDIA, Intel, and AMD dominate the market through extensive R&D investments, strategic partnerships, and acquisitions. They lead with scalable AI chip solutions spanning data centers to edge devices, setting industry standards and influencing AI ecosystem developments. Their established market presence and technological advancements reinforce their dominance through comprehensive product offerings and ecosystem support.

Market Segmentation

By Chip Type

By Technology

By Processing Type

By Application

By Industry Vertical

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) Chips

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Chip Type Overview

2.2.2 By Technology Overview

2.2.3 By Processing Type Overview

2.2.4 By Application Overview

2.2.5 By Industry Vertical Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Artificial Intelligence (AI) Chips Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Proliferation of Big Data

4.1.1.2 Advancements in AI-Powered Healthcare Solutions

4.1.2 Market Restraints

4.1.2.1 High Development and Manufacturing Costs

4.1.2.2 Limited Skilled Workforce

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Collaboration with Industry Verticals

4.1.4 Market Challenges

4.1.4.1 Heat Dissipation and Power Consumption

4.1.4.2 Ethical and Regulatory Concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) Chips Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Artificial Intelligence (AI) Chips Market, By Chip Type

6.1 Global Artificial Intelligence (AI) Chips Market Snapshot, By Chip Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Graphics Processing Unit (GPU)

6.1.1.2 Application-Specific Integrated Circuit (ASIC)

6.1.1.3 Field-Programmable Gate Array (FPGA)

6.1.1.4 Central Processing Unit (CPU)

6.1.1.5 Neuromorphic Processing Unit (NPU)

6.1.1.6 Others

Chapter 7 Artificial Intelligence (AI) Chips Market, By Technology

7.1 Global Artificial Intelligence (AI) Chips Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Machine Learning

7.1.1.2 Natural Language Processing

7.1.1.3 Context-Aware Computing

7.1.1.4 Computing Vision

7.1.1.5 Predictive Analysis

7.1.1.6 Others

Chapter 8 Artificial Intelligence (AI) Chips Market, By Processing Type

8.1 Global Artificial Intelligence (AI) Chips Market Snapshot, By Processing Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Edge AI

8.1.1.2 Cloud AI

Chapter 9 Artificial Intelligence (AI) Chips Market, By Application

9.1 Global Artificial Intelligence (AI) Chips Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Natural Language Processing (NLP)

9.1.1.2 Computer Vision

9.1.1.3 Robotics

9.1.1.4 Network Security

9.1.1.5 Speech Recognition

9.1.1.6 Others

Chapter 10 Artificial Intelligence (AI) Chips Market, By Industry Vertical

10.1 Global Artificial Intelligence (AI) Chips Market Snapshot, By Industry Vertical

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

10.1.1.1 Healthcare

10.1.1.2 Automotive

10.1.1.3 Consumer Electronics

10.1.1.4 Retail

10.1.1.5 BFSI (Banking, Financial Services, and Insurance)

10.1.1.6 IT and Telecom

10.1.1.7 Manufacturing

10.1.1.8 Others

Chapter 11 Artificial Intelligence (AI) Chips Market, By Region

11.1 Overview

11.2 Artificial Intelligence (AI) Chips Market Revenue Share, By Region 2023 (%)

11.3 Global Artificial Intelligence (AI) Chips Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Artificial Intelligence (AI) Chips Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Artificial Intelligence (AI) Chips Market, By Country

11.5.4 UK

11.5.4.1 UK Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Artificial Intelligence (AI) Chips Market, By Country

11.6.4 China

11.6.4.1 China Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Artificial Intelligence (AI) Chips Market, By Country

11.7.4 GCC

11.7.4.1 GCC Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Artificial Intelligence (AI) Chips Market Revenue, 2021-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2021-2023

12.1.3 Competitive Analysis By Revenue, 2021-2023

12.2 Recent Developments by the Market Contributors (2023)

Chapter 13 Company Profiles

13.1 NVIDIA Corporation

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Intel Corporation

13.3 Advanced Micro Devices, Inc. (AMD)

13.4 Qualcomm Technologies, Inc.

13.5 IBM Corporation

13.6 Google LLC (Alphabet Inc.)

13.7 Huawei Technologies Co., Ltd.

13.8 Xilinx, Inc.

13.9 Arm Holdings (SoftBank Group Corp.)

13.10 Samsung Electronics Co., Ltd.