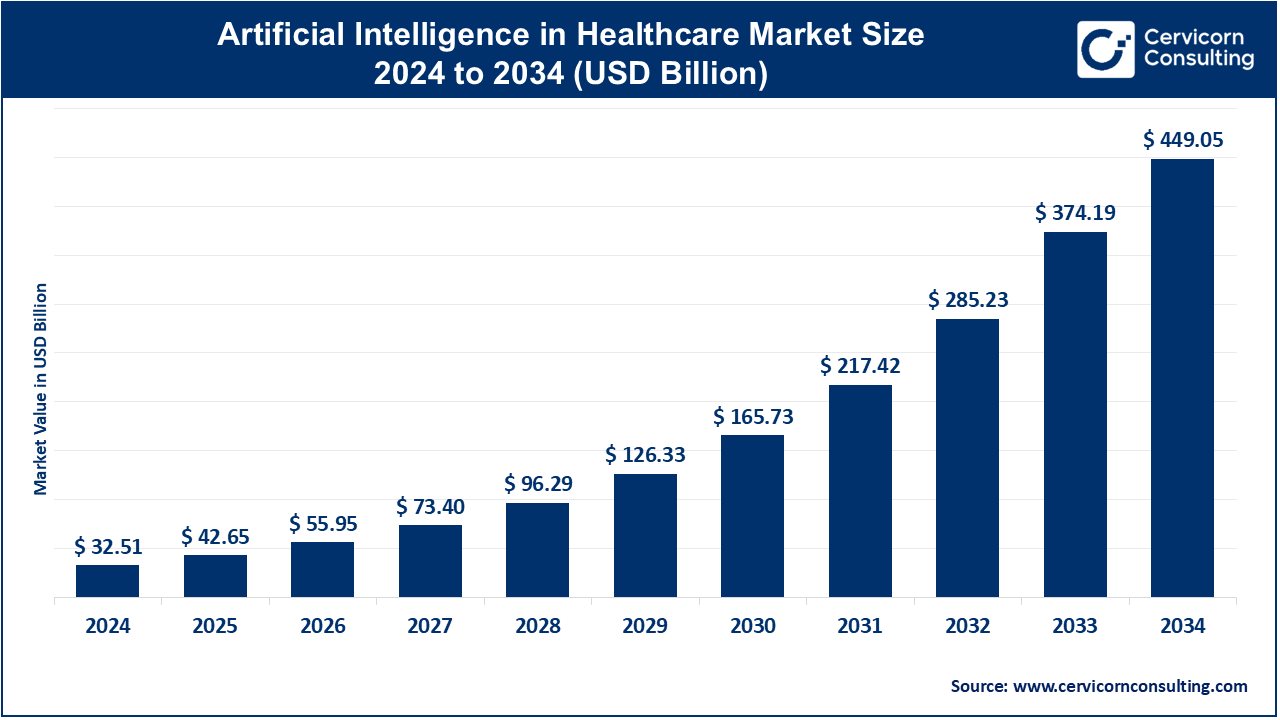

The global artificial intelligence (AI) in healthcare market size was accounted for USD 32.51 billion in 2024 and is expected to surpass around USD 449.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 30.02% over the forecast period 2025 to 2034.

The artificial intelligence (AI) in healthcare market has experienced robust expansion in recent years, as the healthcare industry increasingly adopts advanced technologies to address challenges such as rising costs, inefficiencies, and a growing demand for personalized care. Artificial intelligence (AI) has proven to be an essential tool in transforming healthcare by enhancing diagnostic accuracy, automating administrative tasks, improving patient outcomes, and optimizing operational efficiencies. Factors fueling market growth include the rising prevalence of chronic diseases, an aging population, and the shift toward value-based care models. Additionally, advancements in AI algorithms, access to big data, and the increasing availability of cloud-based healthcare solutions are enabling healthcare providers to adopt AI more efficiently. Partnerships between tech companies and healthcare providers are also accelerating the development of AI solutions tailored to specific healthcare needs.

Artificial intelligence (AI) in healthcare refers to the use of advanced algorithms and machine learning models to analyze complex medical data and assist in decision-making processes. It involves the development of systems capable of simulating human intelligence to perform tasks such as diagnosis, treatment recommendations, drug discovery, and patient care. AI technologies can process large amounts of health data, including medical images, electronic health records (EHRs), and genomics, enabling healthcare professionals to make more accurate and timely decisions. Common types of AI in healthcare include machine learning, deep learning, natural language processing (NLP), and robotics. Machine learning models are used to predict disease progression, while NLP assists in extracting valuable insights from unstructured data.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 42.65 Billion |

| Market Size in 2034 | USD 449.05 Billion |

| Market Growth Rate | CAGR of 30.02% from 2025 to 2034 |

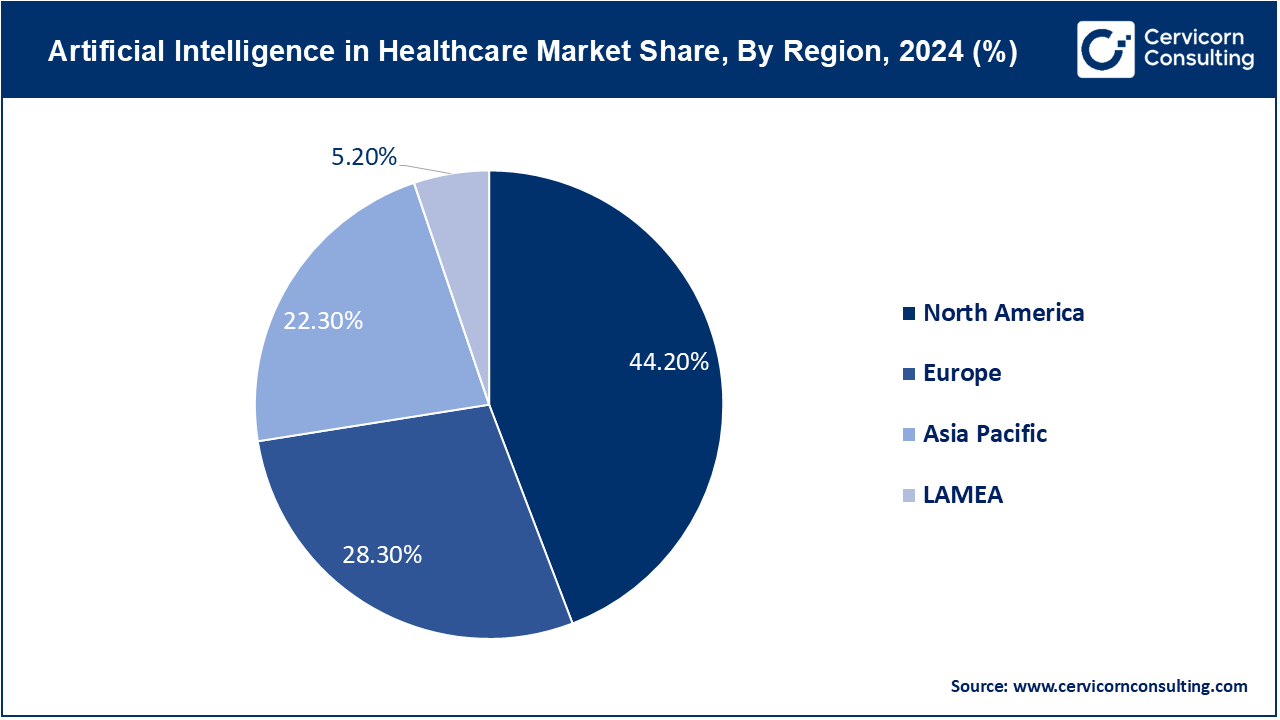

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segments Covered | By Offering, Technology, Application, End Users, Region |

Data Integration and Interoperability:

Ethical and Regulatory Considerations:

Data Privacy and Security Concerns:

The integration of AI in healthcare involves handling sensitive patient data, raising concerns about data privacy, security breaches, and compliance with stringent regulations like HIPAA. Ensuring robust cybersecurity measures, implementing secure data handling practices, and addressing patient consent and data anonymization issues are crucial for maintaining trust and mitigating risks associated with AI applications in healthcare.

High Implementation Costs and Integration Complexity:

The deployment of AI technologies in healthcare requires significant upfront investment in infrastructure, AI systems, and training healthcare professionals. Integrating AI solutions with existing healthcare IT systems and workflows can be complex and costly, posing challenges in achieving seamless interoperability and hindering the widespread adoption and scalability of AI-driven innovations in healthcare.

Predictive Analytics for Disease Prevention:

AI in Drug Repurposing and Clinical Trials:

AI algorithms can accelerate drug discovery by identifying existing drugs for new indications (drug repurposing) and optimizing clinical trial designs. These applications streamline research and development processes, potentially shortening time-to-market for new treatments and enhancing pharmaceutical innovation.

Ethical and Legal Issues:

Clinical Validation and Adoption:

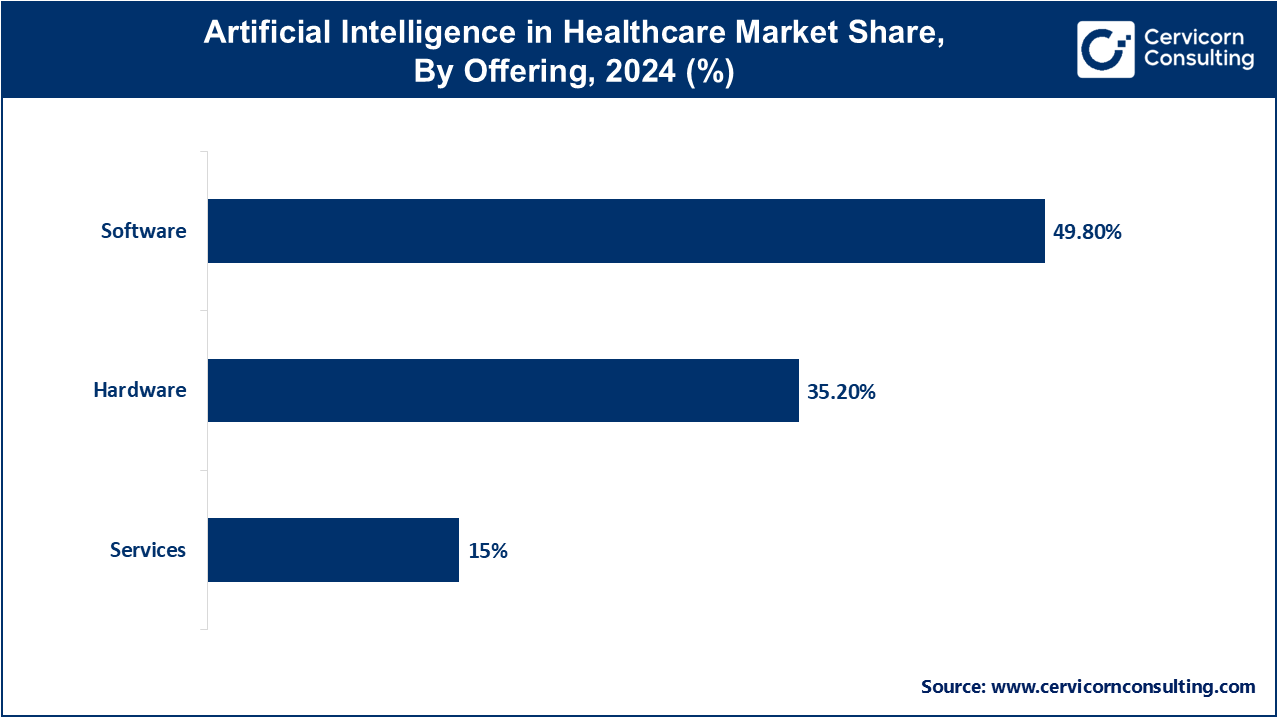

Hardware: The hardware segment has captured market share of 35.2% in 2024. AI hardware in healthcare includes specialized processors and chips designed to optimize AI computations for medical imaging, genomic analysis, and robotic surgeries. Trends focus on developing more efficient and powerful AI hardware solutions to meet the growing demand for real-time data processing and AI-driven medical devices.

Software: The software segment has generated market share of 49.8% in 2024. AI software solutions in healthcare encompass machine learning algorithms, predictive analytics platforms, and AI-driven decision support systems. These tools analyze patient data to improve diagnostics, personalize treatment plans, and enhance operational efficiency in healthcare settings. Trends include integrating AI software with electronic health records (EHR) systems, enhancing interoperability, and expanding AI applications across various medical specialties.

Service: AI services in healthcare involve consulting, implementation, and maintenance of AI solutions tailored to healthcare providers' needs. Service trends emphasize personalized AI consulting to optimize AI integration, training healthcare professionals in AI technologies, and providing ongoing support to ensure the effective deployment and utilization of AI in clinical practice.

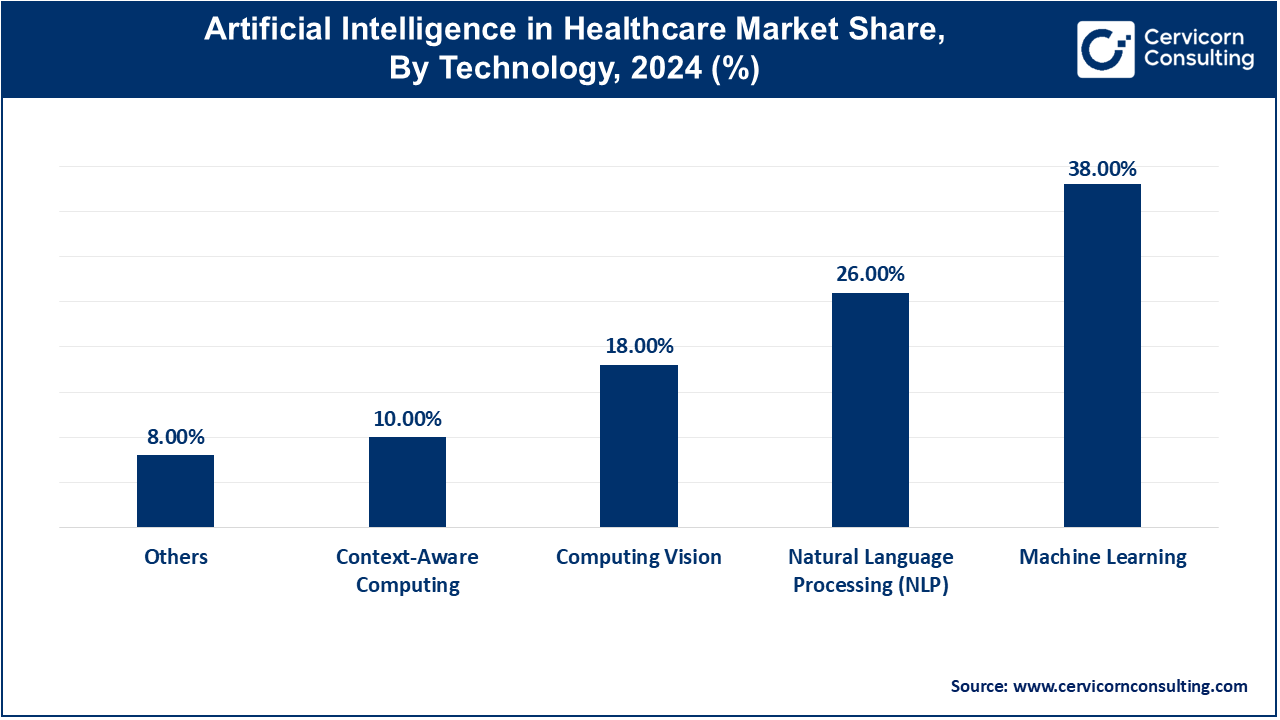

Machine Learning: The machine learning segment accounted market share of 38% in 2024. Machine learning algorithms analyze vast amounts of healthcare data to improve diagnostics, treatment planning, and patient monitoring by identifying patterns and making predictions.

Natural Language Processing: The NLP segment has recorded 26% in 2024. NLP enables AI systems to understand, interpret, and generate human language, facilitating tasks such as medical transcription, patient communication, and clinical documentation. It enhances interoperability between healthcare systems and improves information retrieval for clinical decision-making.

Context-Aware Computing: Context-aware AI adapts to situational factors in healthcare settings, incorporating patient data, environmental conditions, and caregiver interactions to deliver personalized care plans and optimize operational workflows.

Computer Vision: In 2024, the computer vision segment has reported market share of 18%. AI-powered computer vision interprets medical images such as X-rays, MRIs, and CT scans, aiding in diagnostic interpretation, surgical planning, and real-time intraoperative guidance. It enhances accuracy and efficiency in medical imaging analysis.

Predictive Analysis: AI-driven predictive analytics forecast patient outcomes and disease progression based on historical data and real-time inputs. This capability supports preventive interventions, early detection of health risks, and personalized treatment strategies, ultimately improving patient outcomes and reducing healthcare costs.

Others: Emerging AI technologies in healthcare include robotic-assisted surgery for precision procedures, virtual health assistants for patient engagement and remote monitoring, and blockchain for secure healthcare data management and interoperability. These innovations are transforming healthcare delivery by enhancing efficiency, accuracy, and patient-centric care across various applications.

Patient Data & Risk Analysis: AI utilizes patient data to predict health risks and outcomes, enabling proactive interventions and personalized treatment plans, thereby improving overall patient management and outcomes.

Medical Imaging & Diagnostics: AI enhances diagnostic accuracy and efficiency by analyzing medical images such as MRI scans and X-rays. It identifies patterns and anomalies not always visible to the human eye, aiding in early detection and precise diagnosis of diseases.

Precision Medicine: AI integrates genetic, clinical, and lifestyle data to tailor medical treatment to individual patients, optimizing therapy effectiveness and minimizing adverse effects.

Drug Discovery: AI expedites drug development by analyzing vast datasets to identify potential drug candidates, predict their efficacy, and optimize clinical trial designs. This accelerates the discovery of new treatments and reduces research and development costs.

Research: AI facilitates data analysis, pattern recognition, and hypothesis generation in medical research. It supports researchers in uncovering new insights, understanding disease mechanisms, and improving healthcare practices through evidence-based decision-making.

Mental Health: AI assists in diagnosing mental health conditions, monitoring patient progress, and personalizing treatment plans. It offers tools for early intervention, therapy optimization, and mental health support, addressing growing concerns in mental healthcare.

Cybersecurity: AI enhances healthcare data security by detecting and mitigating cybersecurity threats, ensuring compliance with privacy regulations like HIPAA, and safeguarding patient information across digital platforms.

Others: AI applications extend to operational efficiencies, virtual health assistants, and remote patient monitoring, transforming healthcare delivery by improving workflow efficiencies, enhancing patient engagement, and expanding access to quality care.

Hospital & Healthcare Providers: AI in healthcare providers enhances diagnostics, patient monitoring, and operational efficiency, optimizing resource allocation and improving patient outcomes. It supports decision-making in treatment planning and personalized medicine, streamlining workflows and reducing healthcare costs.

Healthcare Payers: AI aids payers in fraud detection, claims processing, and personalized member engagement, optimizing operational costs and enhancing customer satisfaction. It enables predictive analytics for risk assessment and cost management, improving efficiency in healthcare payment systems.

Pharmaceutical & Biotechnology Companies: AI accelerates drug discovery, clinical trials, and personalized medicine, leveraging big data analytics and machine learning to expedite research processes. It enhances precision in drug development and regulatory compliance, driving innovation and efficiency in pharmaceutical and biotech sectors.

Others: AI applications in academia, research institutes, and government healthcare initiatives drive innovation in healthcare policy, education, and public health strategies. It supports epidemiological studies, disease surveillance, and healthcare planning, fostering collaborative advancements in AI-driven healthcare solutions for broader societal benefits.

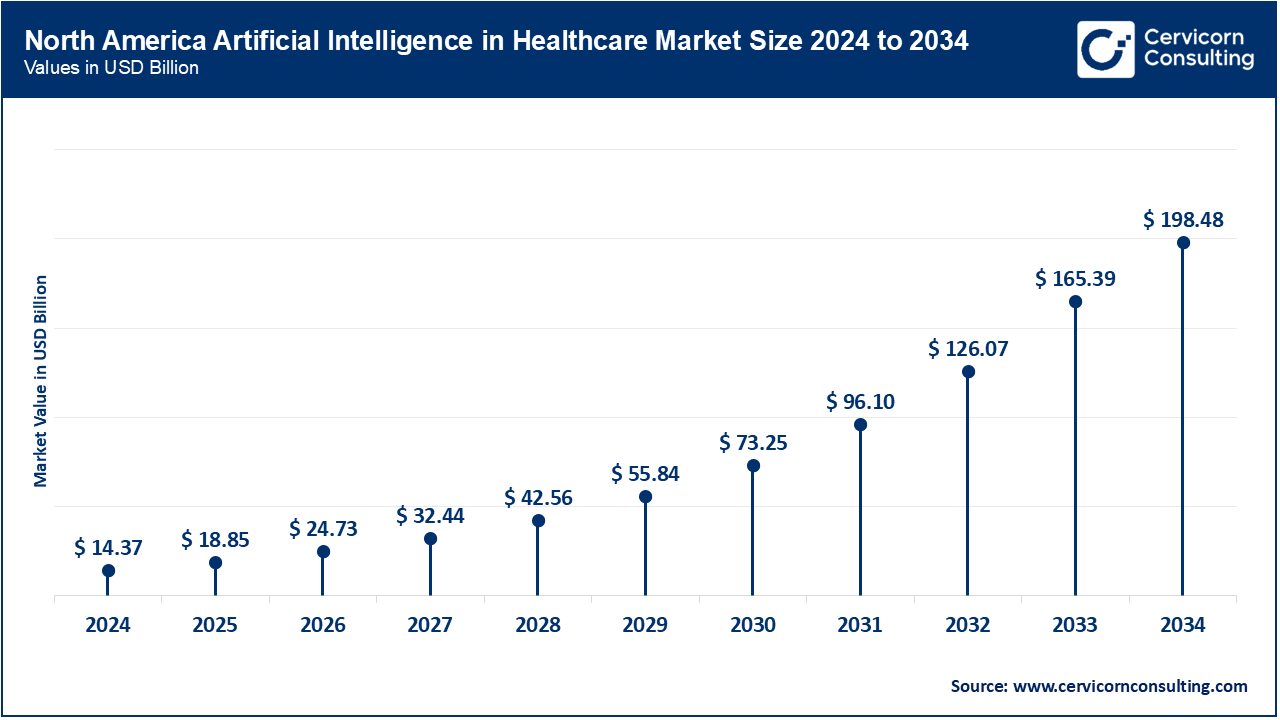

The North America AI in healthcare market size was valued at USD 14.37 billion in 2024 and is expected to reach USD 198.48 billion by 2034. AI adoption in healthcare is driven by robust investments in technology, regulatory support, and strong research collaborations. Trends include personalized medicine advancements, AI-driven diagnostics, and integration with electronic health records (EHR). North America leads in AI healthcare startups and innovations, focusing on improving patient outcomes and operational efficiencies.

The Europe AI in healthcare market size is expected to hit around USD 127.08 billion by 2034, increasing from USD 9.2 billion in 2024. AI in healthcare in Europe emphasizes data privacy, interoperability standards, and AI ethics. Trends include AI for elderly care, telemedicine expansion, and AI-powered clinical decision support systems. European countries focus on integrating AI into public health services and addressing healthcare access disparities through digital health initiatives.

The Asia Pacific AI in healthcare market size was estimated at USD 7.25 billion in 2024 and is projected to grow around USD 100.14 billion by 2034. Rapid AI adoption in Asia-Pacific is fueled by government initiatives, technological advancements, and rising healthcare demand. Trends include AI in disease surveillance, AI-driven telemedicine solutions, and AI for personalized medicine in densely populated regions. Asia-Pacific leads in AI-powered medical imaging and robotics, enhancing healthcare accessibility and quality across diverse populations.

AI in healthcare in LAMEA regions focuses on overcoming infrastructure challenges and enhancing healthcare access. Trends include AI for rural healthcare, mobile health solutions, and AI in public health emergencies. LAMEA countries prioritize AI in chronic disease management and healthcare innovation to address regional healthcare disparities and improve healthcare outcomes.

Market Segmentation

By Offering

By Technology

By Application

By End Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) in Healthcare

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Offering Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Artificial Intelligence (AI) in Healthcare Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Data Integration and Interoperability

4.1.1.2 Ethical and Regulatory Considerations

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Concerns

4.1.2.2 High Implementation Costs and Integration Complexity

4.1.3 Market Opportunity

4.1.3.1 Predictive Analytics for Disease Prevention

4.1.3.2 AI in Drug Repurposing and Clinical Trials

4.1.4 Market Challenges

4.1.4.1 Ethical and Legal Issues

4.1.4.2 Clinical Validation and Adoption

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) in Healthcare Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Artificial Intelligence (AI) in Healthcare Market, By Offering

6.1 Global Artificial Intelligence (AI) in Healthcare Market Snapshot, By Offering

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Service

Chapter 7 Artificial Intelligence (AI) in Healthcare Market, By Technology

7.1 Global Artificial Intelligence (AI) in Healthcare Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Machine Learning

7.1.1.2 Natural Language Processing

7.1.1.3 Context-Aware Computing

7.1.1.4 Computing Vision

7.1.1.5 Predictive Analysis

7.1.1.6 Others

Chapter 8 Artificial Intelligence (AI) in Healthcare Market, By Application

8.1 Global Artificial Intelligence (AI) in Healthcare Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Patient Data & Risk Analysis

8.1.1.2 Medical Imaging & Diagnostics

8.1.1.3 Precision Medicine

8.1.1.4 Drug Discovery

8.1.1.5 Research

8.1.1.6 Mental Health

8.1.1.7 Cybersecurity

8.1.1.8 Others

Chapter 9 Artificial Intelligence (AI) in Healthcare Market, By End Users

9.1 Global Artificial Intelligence (AI) in Healthcare Market Snapshot, By End Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Hospital & Healthcare Providers

9.1.1.2 Healthcare Payers

9.1.1.3 Pharmaceutical & Biotechnology Companies

9.1.1.4 Others

Chapter 10 Artificial Intelligence (AI) in Healthcare Market, By Region

10.1 Overview

10.2 Artificial Intelligence (AI) in Healthcare Market Revenue Share, By Region 2023 (%)

10.3 Global Artificial Intelligence (AI) in Healthcare Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Artificial Intelligence (AI) in Healthcare Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Artificial Intelligence (AI) in Healthcare Market, By Country

10.5.4 UK

10.5.4.1 UK Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Artificial Intelligence (AI) in Healthcare Market, By Country

10.6.4 China

10.6.4.1 China Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Artificial Intelligence (AI) in Healthcare Market, By Country

10.7.4 GCC

10.7.4.1 GCC Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Artificial Intelligence (AI) in Healthcare Market Revenue, 2021-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 IBM Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Microsoft Corporation

12.3 Google LLC (Alphabet Inc.)

12.4 NVIDIA Corporation

12.5 Intel Corporation

12.6 Siemens Healthineers AG

12.7 General Electric Company (GE Healthcare)

12.8 Medtronic plc

12.9 Philips Healthcare (Koninklijke Philips N.V.)

12.10 Cerner Corporation