The global biofuels market is at the forefront of the energy transition, providing cleaner alternatives across transportation, aviation, and maritime sectors. With rising concerns around energy security and carbon emissions, biofuels are increasingly mandated and incentivized worldwide, promising substantial contributions to decarbonization efforts.

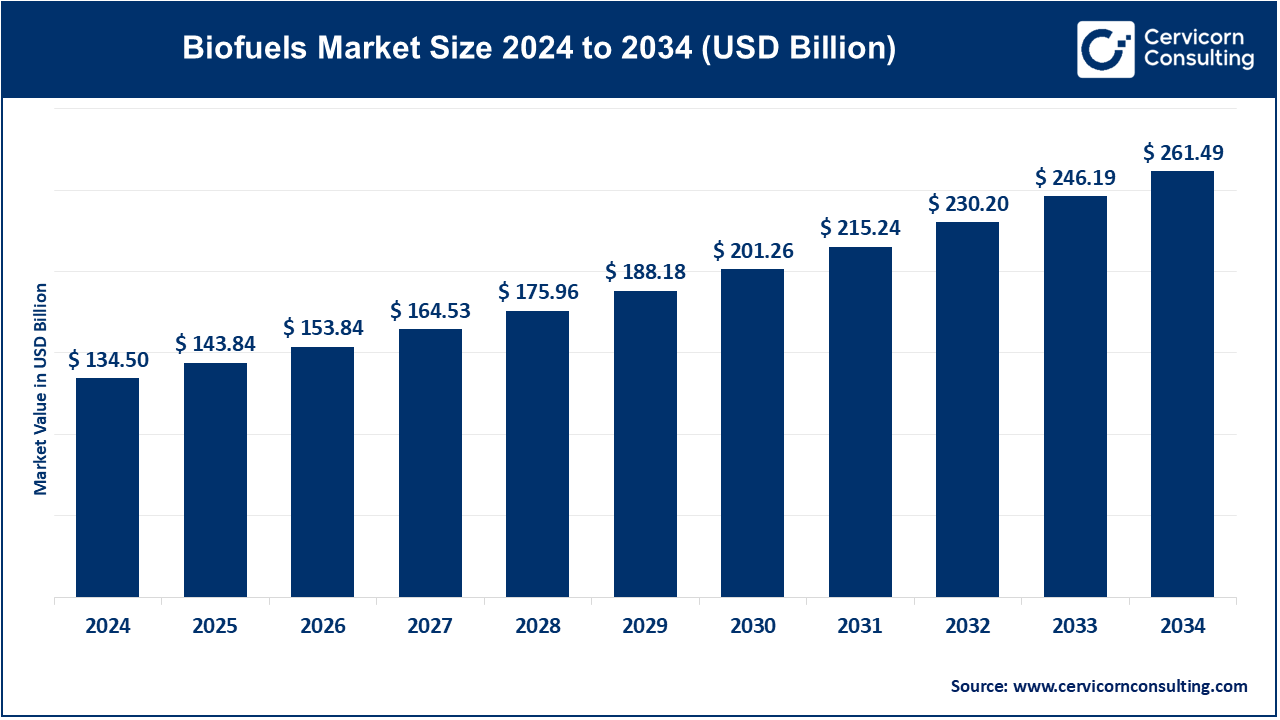

The global biofuels market size was accounted for USD 143.84 billion in 2025 and is expected to surpass around USD 277.25 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.94% over the forecast period 2026 to 2035.

The biofuel market is driven by increasing government support, environmental regulations, and the rising demand for renewable energy solutions. Governments around the world have implemented various mandates and subsidies to promote the production and consumption of biofuels as part of their efforts to reduce reliance on fossil fuels and combat climate change. For instance, countries in the European Union, the U.S., and Brazil have been leading biofuel adoption with policies that favor biofuel blending in transportation and energy sectors. Additionally, advancements in biofuel technology, such as second and third-generation biofuels (derived from non-food crops, algae, and waste materials), are expected to boost market growth by improving fuel efficiency and sustainability. From a market perspective, biofuels have significant growth potential, particularly in emerging economies like India, China, and Latin American countries, where demand for clean energy solutions is on the rise. The increasing focus on reducing carbon emissions and improving air quality has opened up opportunities for biofuels in sectors like aviation, agriculture, and industrial applications.

Biofuels are renewable energy sources derived from organic materials such as plants, algae, and waste. They are considered environmentally friendly alternatives to fossil fuels, as they help reduce greenhouse gas emissions. There are several types of biofuels, including ethanol, biodiesel, biogas, and bio-jet fuel. Ethanol is produced from crops like corn and sugarcane, while biodiesel is made from vegetable oils, animal fats, and waste oils. Biogas, primarily made from organic waste, is used for heating and electricity generation. Bio-jet fuel is used in aviation, derived from feedstocks like algae and non-food crops. These biofuels are used in various sectors, including transportation, energy production, and industrial applications.

International Trade & Production Snapshot of Biofuels Market

| Region/Country | Key Data (2023–2024) |

| Global Biodiesel Exports | 21.5 Mt exported (2015–23), valued at USD 39.7 Bn in 2023 |

| U.S. Exports (2024) | 585,000 Mt volume worth USD 5.11 Bn; top buyers: Canada (USD 2.21 Bn), UK, India, EU |

| Global Ethanol Trade | Trade around 10 Bn L, projected to reach 12 Bn L by 2032; US + Brazil ~70% market share |

| SAF Production | Global SAF reached ~1.3 Bn L in 2024; EU subsidies target ~200 Mn L of SAF |

| Biofuel Share in Transport | Biofuels constitute ~5.6% of liquid transport fuels in 2023; forecast to climb to 6.4% by 2030 |

Key Trends Reshaping the Biofuels Market

Report Scope

| Area of Focus | Details |

| Market size in 2026 | USD 153.84 Billion |

| Market size in 2035 | USD 277.25 Billion |

| Market Growth Rate | CAGR of 6.94% from 2026 to 2035 |

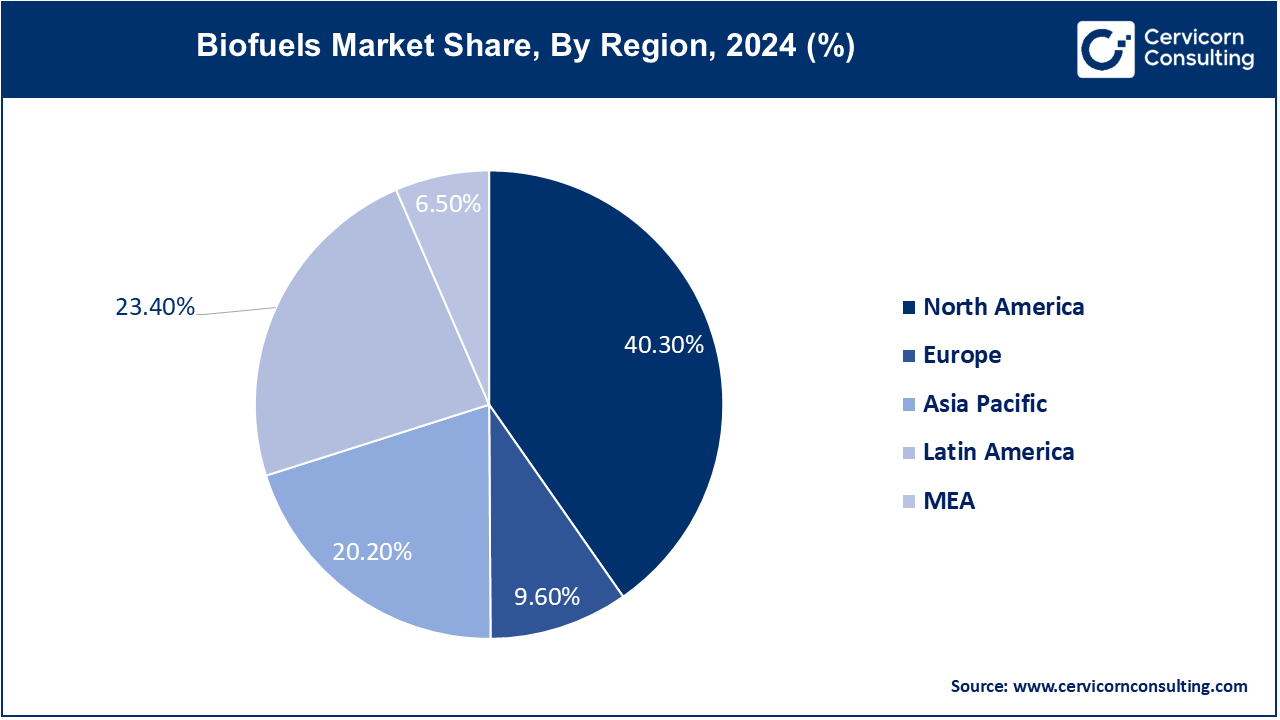

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Feedstock, Form, Generation, Product, Application, Region |

Volatility in Crude Oil Prices:

Consumer Awareness and Demand:

Feedstock Availability and Competition:

Infrastructure and Distribution Challenges:

Technological Advancements in Conversion Processes:

Policy Support and Incentives:

Land Use and Food Security Concerns:

Technological and Economic Viability:

Corn: Corn is a primary feedstock for biofuel production, especially ethanol. Corn-based ethanol dominates the U.S. biofuel market due to its abundance and established agricultural infrastructure. Trends indicate a growing shift towards genetically modified varieties to increase yields and efficiency. Despite debates over its sustainability and impact on food prices, technological advancements aim to enhance its eco-friendliness and energy output.

Sugarcane: Sugarcane is a vital feedstock for ethanol production, particularly in Brazil, where it serves as a key biofuel source. The high sugar content and efficient conversion process make it economically viable. Trends show an increasing adoption of advanced agricultural techniques and biotechnologies to boost yields and reduce environmental impact, aligning with global efforts to promote renewable energy and reduce carbon footprints.

Vegetable Oils: Vegetable oils, including palm, soybean, and canola oil, are crucial for biodiesel production. They offer a renewable alternative to fossil fuels with relatively high energy content. Trends in this sector focus on sustainable sourcing and reducing deforestation linked to oil production. Innovations in second-generation biofuels and waste oil recycling are emerging to improve sustainability and reduce competition with food resources.

Others: Other segment has dominated the market with revenue share of 48% in 2025. Other feedstocks for biofuel production include algae, agricultural residues, and municipal waste. These sources offer diverse advantages, such as high yield per acre for algae and waste reduction for residues. Trends highlight increasing research and development in converting non-food biomass to biofuels, aiming for higher efficiency and sustainability. These alternatives are gaining attention as part of a broader strategy to diversify energy sources and mitigate climate change impacts.

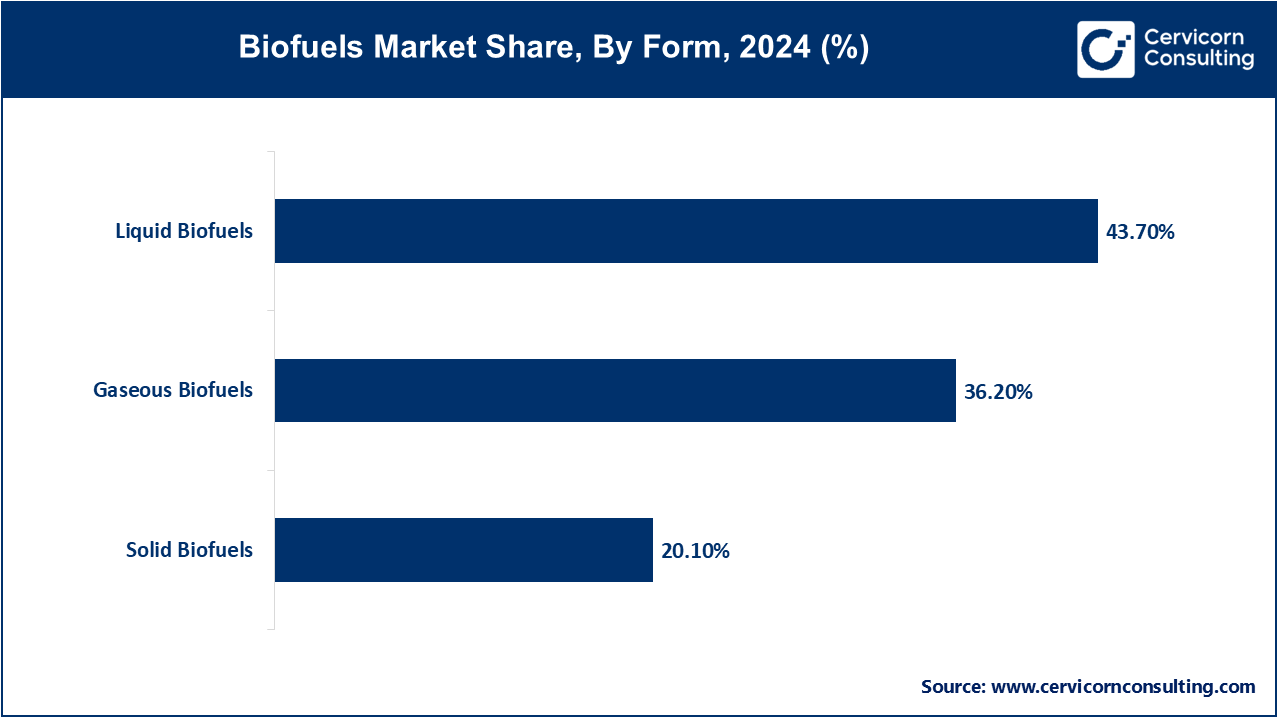

Solid Biofuels: The solid biofuels segment has captured market share of 20% in 2025. Solid biofuels, such as wood pellets, agricultural residues, and organic waste, are renewable energy sources used for heating and power generation. These fuels are gaining popularity due to their carbon neutrality and cost-effectiveness. The market is expanding as advancements in processing technologies and increasing environmental regulations drive demand for cleaner energy alternatives.

Liquid Biofuels: The liquid biofuels segment has dominated the market with highest revenue share of 44% in 2025. Liquid biofuels, like biodiesel and ethanol, are produced from crops, waste oils, and algae. They serve as renewable substitutes for petroleum-based fuels in transportation. The market is growing due to government mandates, technological innovations, and rising interest in sustainable practices, aiming to reduce greenhouse gas emissions and reliance on fossil fuels.

Gaseous Biofuels: Gaseous biofuels, including biogas and biomethane, are derived from organic matter through anaerobic digestion. These fuels are used for heating, electricity, and as vehicle fuel. The market is expanding due to increasing investment in renewable energy infrastructure, waste management solutions, and policies promoting carbon neutrality.

Other Biofuels: Other biofuels include advanced biofuels like biohydrogen and algae-based fuels, representing the next generation of renewable energy sources. These fuels have the potential for higher efficiency and lower environmental impact. The market for these advanced biofuels is emerging, driven by research and development efforts and the quest for sustainable, low-carbon energy alternatives.

First Generation Biofuels (Conventional Biofuels): First Generation Biofuels are derived from food crops such as corn, sugarcane, and soybeans. They include ethanol and biodiesel and are produced through conventional fermentation and transesterification processes. Despite their popularity, they raise concerns about food security and land use. The biofuels market sees a steady demand for these fuels, driven by renewable energy policies and blending mandates, though growth is constrained by sustainability issues.

Second Generation Biofuels (Advanced Biofuels): Second Generation Biofuels are produced from non-food biomass, including agricultural residues, wood chips, and energy crops. These advanced biofuels use more complex processing technologies like gasification and fermentation. They offer improved sustainability over first-generation biofuels, addressing food vs. fuel debates. The market trend shows increasing investments and research, aiming to enhance efficiency and lower costs, with significant interest from both governments and private sectors.

Third Generation Biofuels (Algae Fuels): Third Generation Biofuels are derived from algae, which can be grown in various environments and have high oil content. These biofuels offer potential for higher yields and lower environmental impact. The market for algae fuels is emerging, driven by advancements in cultivation and extraction technologies. Trends indicate growing interest in algae biofuels due to their scalability and minimal competition with food crops, although commercialization is still in its nascent stages.

Biodiesel: This segment has captured 20% revenue share in 2025. Biodiesel is a renewable fuel made from biomass materials, such as vegetable oils or animal fats, through a process called transesterification. It can be used in diesel engines with little or no modifications. The biodiesel market is growing due to increasing demand for sustainable energy, government mandates for cleaner fuels, and technological advancements in production. There's a notable shift towards using non-food feedstocks to enhance sustainability.

Green Diesel: Green diesel, also known as renewable diesel, is produced through hydrotreating plant oils or animal fats. Unlike biodiesel, it is chemically similar to petroleum diesel and can fully replace it in engines. Green diesel is gaining popularity for its compatibility with existing diesel infrastructure and engines. Investments in advanced refining technologies and increased governmental support for low-carbon fuels are driving market expansion.

Ethanol: The ethanol segment has accounted market share of 26% in 2025. Ethanol is a renewable fuel made primarily from corn or sugarcane through fermentation. It is commonly blended with gasoline to increase octane levels and reduce emissions. Ethanol's market is expanding due to renewable fuel mandates and its role in reducing greenhouse gas emissions. Innovations in cellulosic ethanol, derived from non-food plant materials, are also contributing to market growth.

Wood Pellets: The wood pellets segment has held market share of 24% in 2025. Wood pellets are a type of biomass fuel made from compressed sawdust or other wood waste. They are used primarily for heating and electricity generation. The demand for wood pellets is increasing due to their use in renewable energy production, particularly in Europe. Sustainable forest management practices and advancements in pellet production technology are supporting market growth.

Aviation Biofuel (Bio-jet Fuel): Aviation biofuel, or bio-jet fuel, is a sustainable alternative to conventional jet fuel, produced from biomass feedstocks such as algae, plant oils, or waste materials. The aviation biofuel market is driven by the aviation industry's commitment to reducing carbon emissions. Research and development in feedstock diversity and production processes are enhancing the viability and scalability of bio-jet fuel.

Biomethane: Biomethane is a renewable natural gas produced from organic materials like agricultural waste, manure, and food waste through anaerobic digestion or gasification. The biomethane market is expanding due to its role in reducing methane emissions and providing a renewable energy source. Policies promoting waste-to-energy solutions and advancements in purification technologies are boosting market growth.

Syngas: Syngas, or synthesis gas, is a mixture of hydrogen, carbon monoxide, and carbon dioxide produced from gasifying biomass or waste materials. It is used as a fuel or as an intermediate for producing chemicals. The syngas market is growing due to its versatility in generating electricity, heat, and synthetic fuels. Innovations in gasification technology and increased focus on waste-to-energy solutions are key drivers.

Green Hydrogen: Green hydrogen is produced through electrolysis of water using renewable energy sources like wind or solar power. It is a clean fuel that emits only water when used. Green hydrogen is gaining traction as a key component in the transition to a low-carbon economy. Investments in electrolyzer technology and large-scale production projects are driving market expansion.

Others: Other biofuels include advanced biofuels like bio-oil, biobutanol, and renewable natural gas (RNG), produced from diverse biomass sources and innovative conversion technologies. The market for other biofuels is characterized by ongoing research and development to improve efficiency, reduce costs, and enhance sustainability. Supportive policies and growing environmental concerns are fostering growth in this segment.

Transportation: The transportation segment has measured highest revenue share of 70% in 2025. Biofuels are widely used in transportation as an alternative to traditional fossil fuels. They reduce greenhouse gas emissions and dependency on oil imports. Recent trends highlight the growing adoption of biodiesel and ethanol blends in vehicles, driven by environmental regulations and technological advancements. The push for sustainable mobility and the development of advanced biofuels, such as algae-based fuels, are shaping the future of biofuels in transportation.

Aviation: In aviation, biofuels are being explored to decrease the industry's carbon footprint. Sustainable aviation fuels (SAFs), derived from biomass, are gaining traction. Recent trends include increased investments in bio-refineries and partnerships between airlines and biofuel producers. Innovations in feedstock, such as waste oils and agricultural residues, are being researched to make biofuels more economically viable and environmentally friendly for the aviation sector.

Energy Generation: Biofuels play a significant role in energy generation, providing a renewable source of power. They are used in biopower plants to produce electricity and heat. Current trends focus on integrating biofuels with other renewable energy sources, like wind and solar, to enhance grid stability. Advances in biomass conversion technologies and government incentives are propelling the adoption of biofuels in the energy sector, promoting a cleaner energy mix.

Heating: Biofuels are utilized for residential and industrial heating, offering a sustainable alternative to conventional heating fuels. Trends indicate a rise in the use of bio-oil, biogas, and pelletized biomass for heating purposes. Innovations in heating technologies, such as more efficient boilers and stoves, are improving the performance and cost-effectiveness of biofuels. Policy support and consumer awareness are key drivers in the increasing use of biofuels for heating.

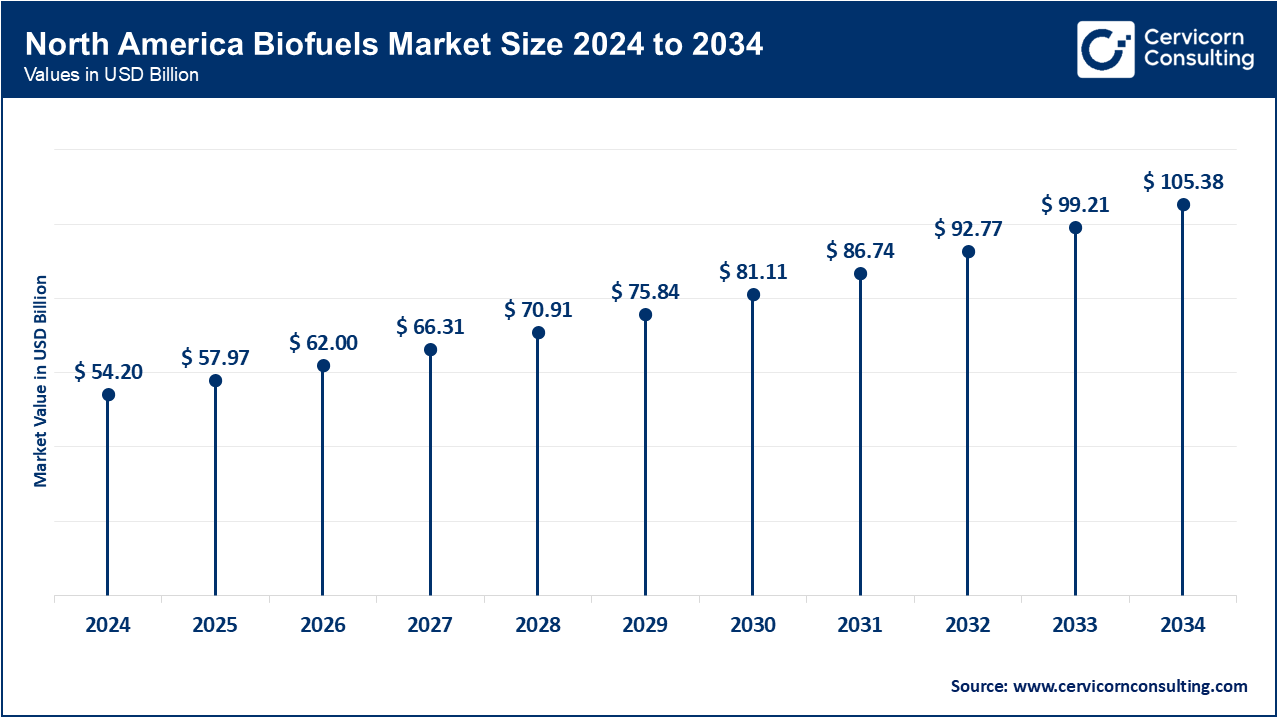

The North America biofuels market size is expected to hit around USD 110.90 billion by 2035 and expanding at a CAGR of 6.98% over the forecast period, driven by strong regulatory support and mandates for renewable fuel standards. Trends indicate a growing investment in advanced biofuels, particularly cellulosic ethanol and algae-based fuels. The U.S. and Canada are focusing on increasing biofuel production capacities and improving feedstock supply chains. Innovations in genetic engineering and biotechnology are also enhancing the efficiency and yield of biofuel production in the region.

The Europe biofuels market is propelled by stringent environmental regulations and climate targets. The European Union's Renewable Energy Directive (RED) mandates significant use of biofuels in transportation. Trends include the development of advanced biofuels from waste and residue feedstocks, and a focus on reducing land-use impact. The region is also seeing increased collaboration among countries to create a unified market for biofuels, promoting cross-border trade and innovation.

The Asia-Pacific biofuels market size is calculated at USD 28.77 billion in 2025 and is expanding around USD 55.45 billion by 2035, experiencing rapid growth is driven by increasing energy demand and government initiatives to reduce carbon emissions. Trends highlight significant investments in biodiesel and bioethanol production, especially in countries like China, India, and Thailand. The region is focusing on utilizing agricultural residues and non-food crops for biofuel production to ensure food security and sustainability. Technological advancements in bio-refineries are also playing a crucial role in this growth.

In the LAMEA region, biofuels are gaining traction as a means to diversify energy sources and boost rural economies. Trends show a strong emphasis on ethanol production in Brazil, one of the world's largest producers, using sugarcane as a primary feedstock. In the Middle East and Africa, biofuel initiatives are emerging to address energy access and sustainability challenges. Innovations in biomass conversion technologies and regional collaborations are driving the biofuels market forward in LAMEA.

Emerging companies like Viridos Inc. and Fulcrum BioEnergy, Inc. are entering the biofuels market with innovative technologies. Viridos focuses on algae-based biofuels, while Fulcrum BioEnergy converts municipal solid waste into biofuels. These new players are leveraging advanced biotechnologies and sustainable feedstock to carve out their market niches. Renewable Energy Group, Inc., Neste Corporation, and POET, LLC dominate the biofuels market through large-scale production, extensive distribution networks, and continuous innovation. They lead in producing biodiesel and ethanol, benefiting from economies of scale, strong R&D investments, and strategic partnerships to maintain their competitive edge.

Market Segmentation

By Feedstock

By Form

By Generation

By Product

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biofuels

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Feedstock Overview

2.2.2 By Form Overview

2.2.3 By Generation Overview

2.2.4 By Product Overview

2.2.5 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Biofuels Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Volatility in Crude Oil Prices

4.1.1.2 Consumer Awareness and Demand

4.1.2 Market Restraints

4.1.2.1 Feedstock Availability and Competition

4.1.2.2 Infrastructure and Distribution Challenges

4.1.3 Market Opportunity

4.1.3.1 Technological Advancements in Conversion Processes

4.1.3.2 Policy Support and Incentives

4.1.4 Market Challenges

4.1.4.1 Land Use and Food Security Concerns

4.1.4.2 Technological and Economic Viability

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Biofuels Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Biofuels Market, By Feedstock

6.1 Global Biofuels Market Snapshot, By Feedstock

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

6.1.1.1 Corn

6.1.1.2 Sugarcane

6.1.1.3 Vegetables Oils

6.1.1.4 Others

Chapter 7 Biofuels Market, By Form

7.1 Global Biofuels Market Snapshot, By Form

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

7.1.1.1 Solid Biofuels

7.1.1.2 Liquid Biofuels

7.1.1.3 Gaseous Biofuels

7.1.1.4 Other

Chapter 8 Biofuels Market, By Generation

8.1 Global Biofuels Market Snapshot, By Generation

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

8.1.1.1 First Generation Biofuels (Conventional Biofuels)

8.1.1.2 Second Generation Biofuels (Advanced Biofuels)

8.1.1.3 Third Generation Biofuels (Algae Fuels)

Chapter 9 Biofuels Market, By Product

9.1 Global Biofuels Market Snapshot, By Product

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

9.1.1.1 Biodiesel

9.1.1.2 Green Diesel

9.1.1.3 Ethanol

9.1.1.4 Wood Pellets

9.1.1.5 Aviation Biofuel (Bio-jet Fuel)

9.1.1.6 Biomethane

9.1.1.7 Syngas

9.1.1.8 Green Hydrogen

9.1.1.9 Others

Chapter 10 Biofuels Market, By Application

10.1 Global Biofuels Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

10.1.1.1 Transportation

10.1.1.2 Aviation

10.1.1.3 Energy Generation

10.1.1.4 Heating

10.1.1.5 Others

Chapter 11 Biofuels Market, By Region

11.1 Overview

11.2 Biofuels Market Revenue Share, By Region 2024 (%)

11.3 Global Biofuels Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Biofuels Market Revenue, 2022-2035 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Biofuels Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Biofuels Market Revenue, 2022-2035 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Biofuels Market Revenue, 2022-2035 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Biofuels Market Revenue, 2022-2035 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Biofuels Market Revenue, 2022-2035 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Biofuels Market, By Country

11.5.4 UK

11.5.4.1 UK Biofuels Market Revenue, 2022-2035 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Biofuels Market Revenue, 2022-2035 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Biofuels Market Revenue, 2022-2035 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Biofuels Market Revenue, 2022-2035 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Biofuels Market, By Country

11.6.4 China

11.6.4.1 China Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Biofuels Market Revenue, 2022-2035 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Biofuels Market Revenue, 2022-2035 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Biofuels Market, By Country

11.7.4 GCC

11.7.4.1 GCC Biofuels Market Revenue, 2022-2035 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Biofuels Market Revenue, 2022-2035 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Biofuels Market Revenue, 2022-2035 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Biofuels Market Revenue, 2022-2035 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Renewable Energy Group, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Neste Corporation

13.3 POET, LLC

13.4 Green Plains Inc.

13.5 Valero Energy Corporation

13.6 Royal Dutch Shell plc

13.7 Archer Daniels Midland Company

13.8 Amyris, Inc.

13.9 Gevo, Inc.

13.10 Aemetis, Inc.