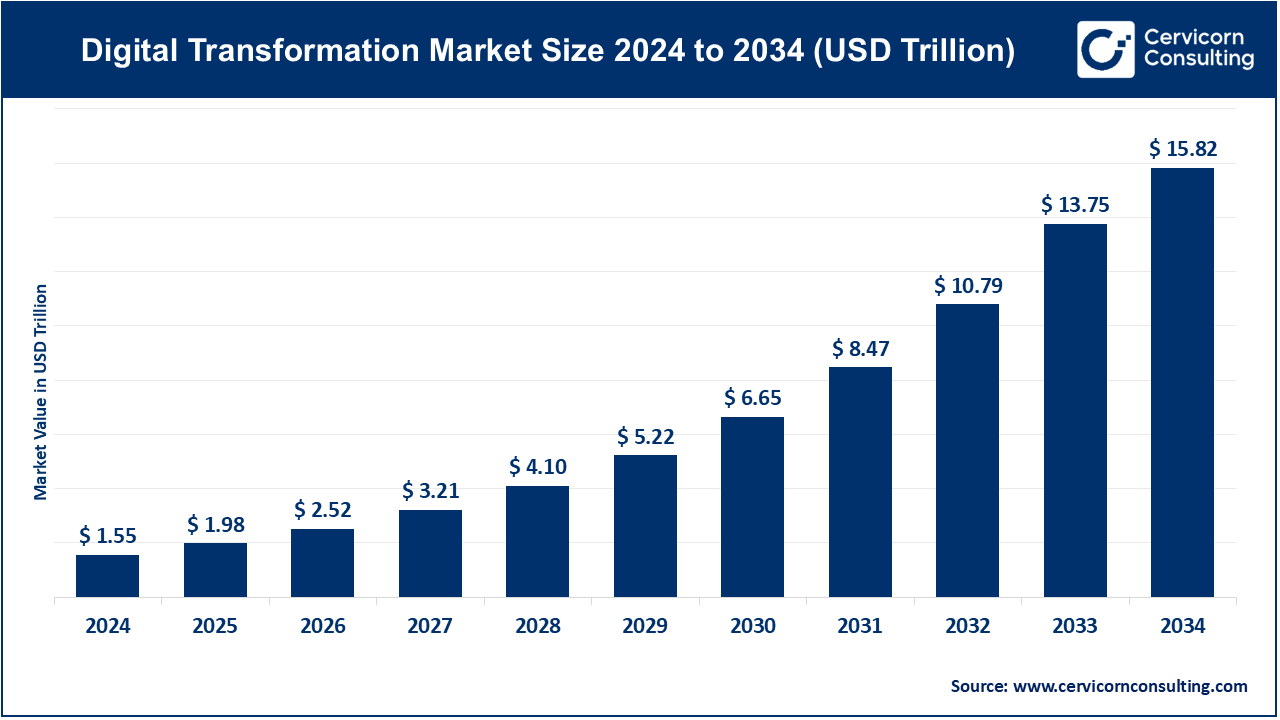

The global digital transformation market size was accounted for USD 1.55 trillion in 2024 and is estimated to reach around USD 15.82 trillion by 2034, growing at a compound annual growth rate (CAGR) of 26.15% over the forecast period 2025 to 2034.

The digital transformation market is experiencing significant expansion as businesses across various industries recognize the need to modernize their operations and embrace technology-driven solutions. Key drivers of this growth include the increasing adoption of cloud technologies, advancements in artificial intelligence (AI) and machine learning (ML), the rise of automation tools, and the shift towards data-driven decision-making. As organizations strive to enhance operational efficiency, improve customer engagement, and innovate their business models, the demand for digital transformation services continues to rise. Market analysis shows that sectors such as healthcare, finance, retail, and manufacturing are particularly focused on digital transformation initiatives, using technologies to enhance customer experiences, optimize supply chains, and improve overall performance. The increasing reliance on digital tools for collaboration, especially in light of remote work trends, has also accelerated digital transformation efforts.

Digital transformation refers to the integration of digital technologies into all aspects of a business, fundamentally changing how organizations operate and deliver value to customers. It involves leveraging tools like cloud computing, data analytics, artificial intelligence (AI), and automation to improve efficiency, enhance customer experience, and create new business models. Companies undergo digital transformation to stay competitive, improve decision-making, streamline processes, and foster innovation. There are several types of digital transformation, including process transformation, business model transformation, and organizational transformation. Process transformation focuses on optimizing internal operations using technology. Business model transformation involves creating new revenue streams or entirely new business models through digital innovation. Organizational transformation relates to changing the company culture and structure to embrace digital technologies effectively.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 1.98 Trillion |

| Market size in 2034 | USD 15.82 Trillion |

| Market Growth Rate | CAGR of 26.15% from 2025 To 2034 |

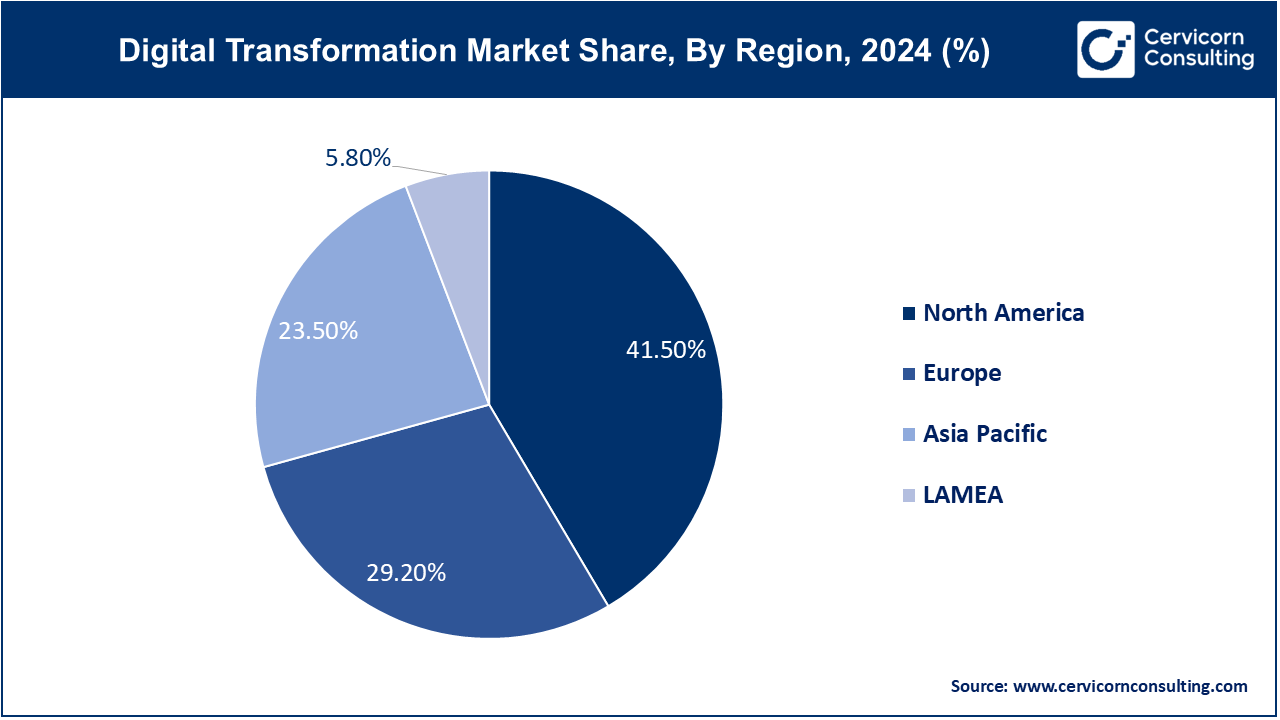

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Offering, Technology, End Users, Regions |

Regulatory Compliance:

Customer Expectations:

Legacy Systems Integration:

Organizational Resistance and Culture:

Enhanced Customer Engagement:

Internet of Things (IoT) Expansion:

Cybersecurity Risks:

Skill Shortages and Talent Acquisition:

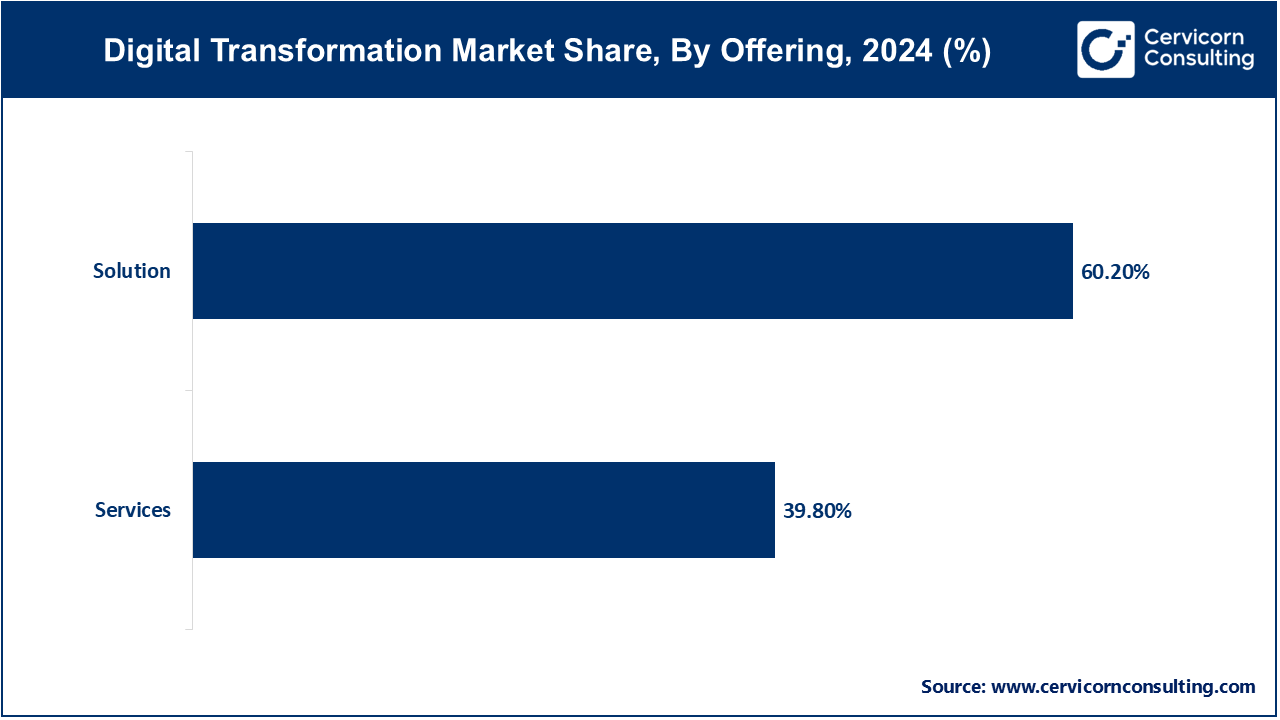

Solutions: The solution segment has accounted market share of 60.2% in 2024. Digital transformation solutions encompass software and platforms designed to streamline and enhance business operations through automation, analytics, and digitalization. These solutions often include enterprise resource planning (ERP) systems, customer relationship management (CRM) tools, cloud computing services, and cybersecurity solutions. They enable organizations to achieve operational efficiency, improve customer experience, and adapt quickly to market changes by leveraging advanced technologies such as AI, IoT, and big data analytics.

Services: The services segment has captured market share of 39.8% in 2024. Digital transformation services involve consultancy, implementation, and support provided by experts to help organizations navigate and execute their digital strategies effectively. These services range from IT consulting and system integration to digital marketing, training, and managed services. They are essential for businesses aiming to leverage new technologies and optimize their processes to stay competitive in the digital age, ensuring smooth transitions and ongoing support for sustainable digital initiatives.

Cloud Computing: Cloud computing continues to grow as businesses shift towards scalable, cost-effective IT solutions. Key drivers include the need for flexibility, remote work capabilities, and digital scalability. Trends show increasing adoption of hybrid and multi-cloud strategies, emphasizing data security and compliance. Cloud computing enables faster deployment of digital transformation initiatives and supports innovations like AI and IoT integration, enhancing organizational agility and efficiency.

Big Data & Analytics: Big Data and analytics are pivotal for deriving insights from vast amounts of data, driving informed decision-making and personalized customer experiences. Growth is fueled by the exponential increase in data volumes, advancements in machine learning algorithms, and the push towards data-driven strategies. Trends include real-time analytics, AI-powered predictive modeling, and a focus on data governance and ethics to ensure accuracy, privacy, and regulatory compliance.

Block chain: Blockchain technology is transforming industries by providing secure, transparent, and immutable transactions. Market growth is propelled by applications in supply chain management, finance, and healthcare, driven by demand for enhanced traceability, security, and efficiency. Emerging trends include interoperability between different blockchain platforms, tokenization of assets, and integration with IoT and AI for enhanced automation and trustless transactions.

Cybersecurity: Cybersecurity remains critical as digital transformation expands attack surfaces and data vulnerabilities. Drivers include increasing cyber threats, regulatory compliance requirements, and the adoption of cloud and IoT technologies. Trends involve AI-driven threat detection, zero-trust architectures, and a shift towards proactive cybersecurity measures. Organizations prioritize robust cybersecurity strategies to safeguard data, maintain trust, and mitigate risks associated with digital initiatives

Artificial Intelligence (AI): Artificial Intelligence (AI) revolutionizes digital transformation by automating processes, enhancing decision-making, and personalizing user experiences. Growth is fueled by advancements in deep learning, natural language processing, and computer vision. Trends include AI-driven chatbots, predictive analytics, and AI-powered automation across industries like healthcare, finance, and retail. Ethical AI usage, data privacy concerns, and regulatory frameworks shape the landscape as organizations integrate AI to innovate and compete.

Internet of Things (IoT): The Internet of Things (IoT) connects devices, enabling data collection, automation, and efficiency improvements across sectors like manufacturing, healthcare, and smart cities. Growth is driven by demand for real-time insights, operational efficiency, and predictive maintenance capabilities. Trends include edge computing for faster data processing, IoT security protocols, and AI integration for enhanced decision-making. IoT adoption continues to expand, driving digital transformation by optimizing processes and enabling new business models.

BFSI: Digital transformation in banking and finance is driven by customer demand for seamless digital experiences and regulatory pressures for security and compliance.

Retail & eCommerce: Growth in digital transformation is fueled by the shift to online shopping, personalized customer experiences, and demand for omnichannel retail solutions.

IT/ITES: Digital transformation in IT and IT-enabled services is propelled by cloud adoption, AI integration, and the need for agile, scalable business solutions.

Healthcare, Life Sciences & Pharmaceuticals: Adoption is driven by telemedicine, electronic health records (EHR), personalized medicine, and regulatory requirements for data security and interoperability.

Government & Defense: Digital transformation in these sectors is driven by efficiency, cybersecurity enhancements, citizen services digitization, and defense innovation initiatives.

Media & Entertainment: Growth is fueled by streaming platforms, digital content distribution, personalized advertising, and virtual reality/augmented reality (VR/AR) experiences.

Manufacturing: Industry 4.0 adoption includes IoT, AI-driven automation, predictive maintenance, and supply chain optimization for enhanced productivity and cost efficiencies.

Energy & Utilities: Digital transformation is driven by smart grid technologies, renewable energy integration, IoT for asset management, and energy efficiency initiatives.

Telecommunications: Growth is fueled by 5G adoption, IoT connectivity, network virtualization, and digital customer engagement strategies.

Education: Adoption is driven by e-learning platforms, virtual classrooms, personalized learning experiences, and digital tools for student engagement and administrative efficiency.

Agriculture: Digital transformation includes precision farming, IoT-enabled smart agriculture, data-driven decision-making, and supply chain transparency for sustainable agriculture practices.

Automotive, Transportation, & Logistics: Growth is fueled by IoT in vehicle connectivity, autonomous vehicles, supply chain visibility, and predictive maintenance for operational efficiency.

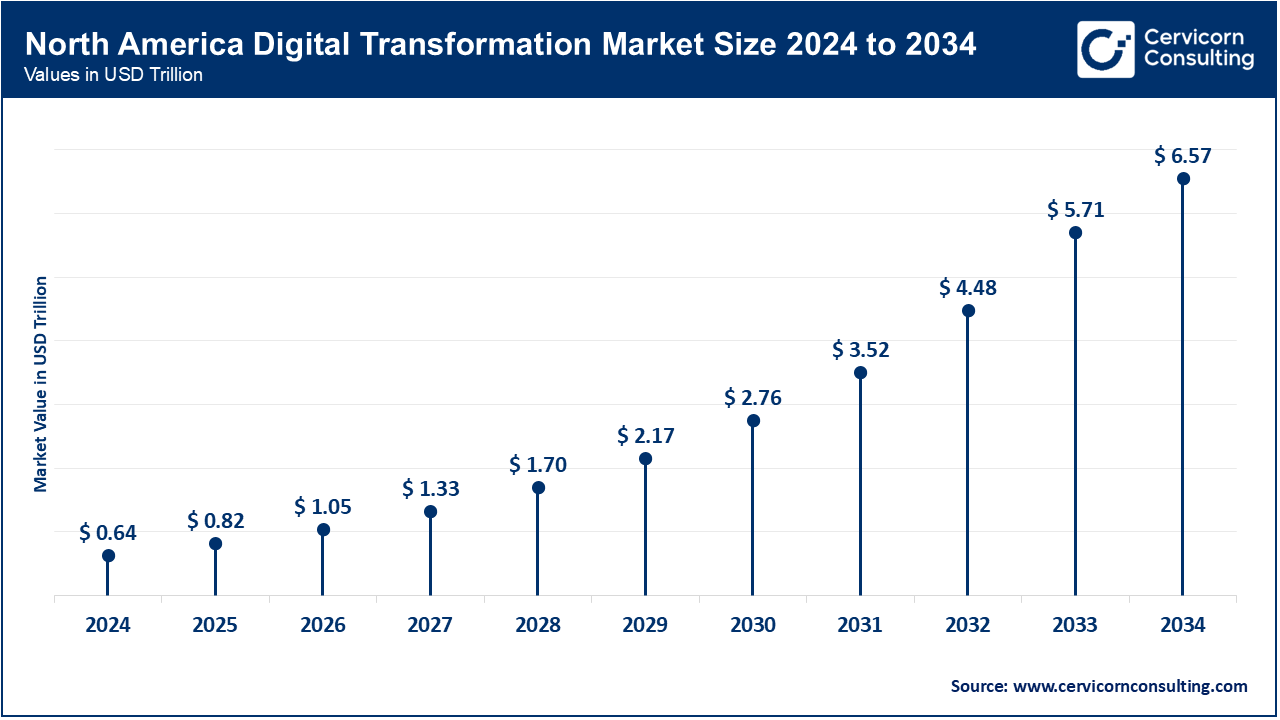

The North America digital transformation market size is measured USD 0.64 trillion in 2024 and is forecasted to hit around 6.57 trillion by 2034. North America leads the market, due to robust technological infrastructure and early adoption of advanced technologies. The region is characterized by a strong focus on innovation, particularly in sectors like IT, finance, and healthcare. Major tech hubs such as Silicon Valley drive continuous evolution in AI, cloud computing, and IoT. Regulatory frameworks like GDPR and CCPA influence data privacy practices. Investments in digital initiatives across industries propel growth, with a high demand for cybersecurity solutions and digital customer experiences driving market expansion.

The Europe digital transformation market size is registered USD 0.45 trillion in 2024 and is estimated to reach around USD 4.62 trillion by 2034. Europe embraces digital transformation with a focus on sustainability and regulatory compliance. The region prioritizes digital initiatives in healthcare, manufacturing, and automotive sectors, integrating IoT and AI for operational efficiency and environmental impact reduction. GDPR compliance drives data protection measures, fostering trust in digital services. Innovation hubs in cities like London, Berlin, and Paris lead advancements in fintech, smart cities, and e-commerce. Government support and investments in digital infrastructure encourage widespread adoption of cloud computing and cybersecurity solutions.

The Asia-Pacific digital transformation market size is accounted USD 0.36 trillion in 2024 and is projected to surpass around USD 3.72 trillion by 2034. Asia-Pacific is a dynamic region driving through rapid adoption of mobile technology and internet penetration. Leading in e-commerce and fintech innovation, countries like China, India, and Singapore leverage AI, blockchain, and IoT to transform industries. Government initiatives like Digital India and China's Internet Plus promote digital inclusion and smart city development. The region's diverse markets encourage technological experimentation and entrepreneurship, supported by growing investments in digital infrastructure and cybersecurity measures to mitigate emerging threats.

LAMEA is accelerating digital transformation with increasing investments in ICT infrastructure and digital literacy programs. The region adopts technologies like cloud computing and AI to enhance economic diversification and improve public services. In Latin America, fintech and e-commerce thrive, driven by digital payment solutions and mobile banking. Middle Eastern countries focus on smart city initiatives and digital government services. Africa sees growth in mobile connectivity and e-learning platforms, bridging educational gaps. Challenges include cybersecurity threats and varying digital maturity levels across countries.

Among the dominating players in the digital transformation industry, Microsoft stands out with its Azure cloud platform and comprehensive suite of enterprise software solutions. Microsoft's driving factor lies in its widespread adoption across industries, supported by AI and IoT integrations to enhance operational efficiencies and customer experiences. Collaboratively, Microsoft partners with Adobe to innovate in customer experience solutions and leverages its extensive network to foster cloud adoption globally. Similarly, Amazon Web Services (AWS) leads with its robust cloud infrastructure and extensive service offerings, driving innovation through collaborations with tech giants and continuous advancements in cloud computing technologies.

CEO Statements

Satya Nadella, CEO of Microsoft

Andy Jassy, CEO of Amazon Web Services (AWS)

Sundar Pichai, CEO of Alphabet Inc. (Google)

Arvind Krishna, CEO of IBM

Christian Klein, CEO of SAP SE

Market Segmentation

By Offering

By Technology

By End Users

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Transformation

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Offering Overview

2.2.2 By Technology Overview

2.2.3 By End Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Digital Transformation Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Compliance

4.1.1.2 Customer Expectations

4.1.2 Market Restraints

4.1.2.1 Legacy Systems Integration

4.1.2.2 Organizational Resistance and Culture

4.1.3 Market Opportunity

4.1.3.1 Enhanced Customer EngOfferingment

4.1.3.2 Internet of Things (IoT) Expansion

4.1.4 Market Challenges

4.1.4.1 Cybersecurity Risks

4.1.4.2 Skill ShortOfferings and Talent Acquisition

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Digital Transformation Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Digital Transformation Market, By Offering

6.1 Global Digital Transformation Market Snapshot, By Offering

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Solutions

6.1.1.2 Services

Chapter 7 Digital Transformation Market, By Technology

7.1 Global Digital Transformation Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Cloud Computing

7.1.1.2 Big Data & Analytics

7.1.1.3 Blockchain

7.1.1.4 Cybersecurity

7.1.1.5 AI

7.1.1.6 IoT Digital

Chapter 8 Digital Transformation Market, By End Users

8.1 Global Digital Transformation Market Snapshot, By End Users

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 BFSI

8.1.1.2 Retail & eCommerce

8.1.1.3 IT/ITES

8.1.1.4 Healthcare, Life Sciences & Pharmaceuticals

8.1.1.5 Government & Defense

8.1.1.6 Media & Entertainment

8.1.1.7 Manufacturing

8.1.1.8 Energy & Utilities

8.1.1.9 Telecommunications

8.1.1.10 Education

8.1.1.11 Agriculture

8.1.1.12 Automotive, Transportation, & Logistics

Chapter 9 Digital Transformation Market, By Region

9.1 Overview

9.2 Digital Transformation Market Revenue Share, By Region 2023 (%)

9.3 Global Digital Transformation Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Digital Transformation Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Digital Transformation Market, By Country

9.5.4 UK

9.5.4.1 UK Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Digital Transformation Market, By Country

9.6.4 China

9.6.4.1 China Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Digital Transformation Market, By Country

9.7.4 GCC

9.7.4.1 GCC Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Digital Transformation Market Revenue, 2021-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Microsoft

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Amazon Web Services (AWS)

11.3 Google

11.4 IBM

11.5 SAP

11.6 Cisco Systems

11.7 Oracle

11.8 Salesforce

11.9 Adobe

11.10 Dell Technologies