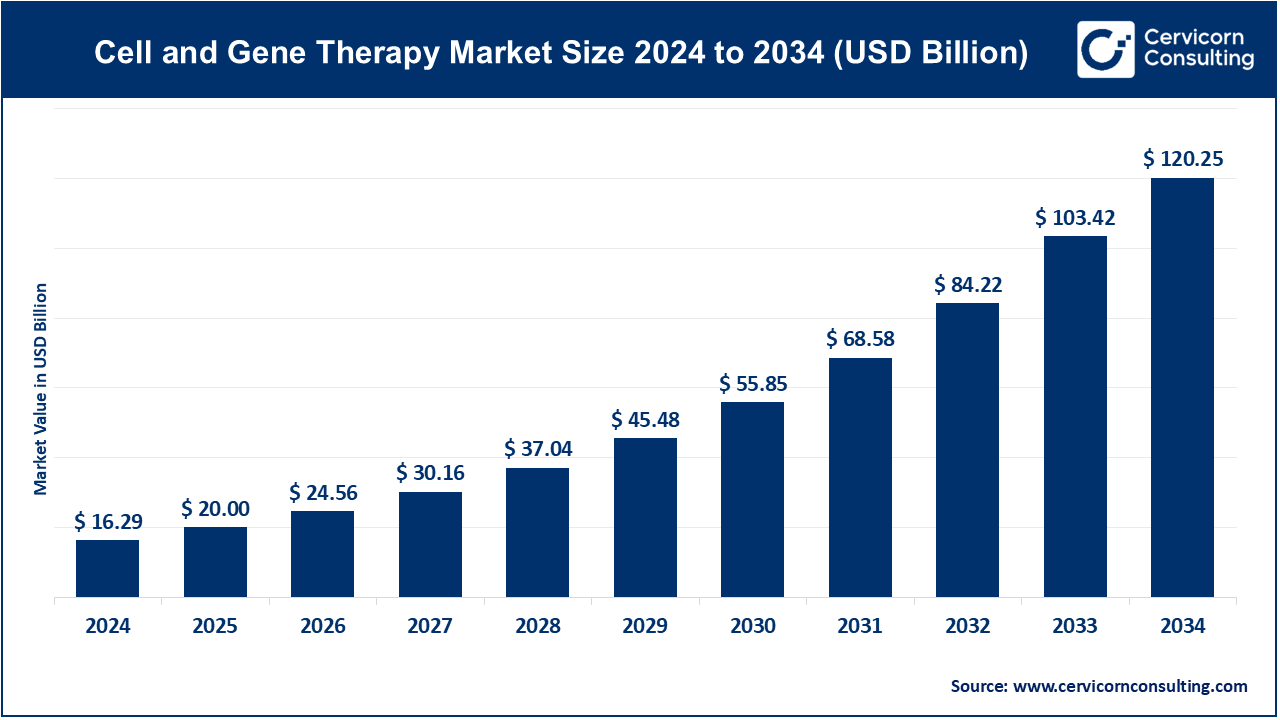

The global cell and gene therapy market size was accounted for USD 16.29 billion in 2024 and is expected to surge around USD 120.25 billion by 2034, expanding at a compound annual growth rate (CAGR) of 22.8% over the forecast period 2025 to 2034.

The cell and gene therapy market has witnessed remarkable growth in recent years, driven by advancements in personalized medicine and an increasing number of FDA-approved therapies. The growing prevalence of chronic and genetic disorders such as cancer, rare inherited diseases, and autoimmune conditions has heightened demand for innovative treatments that go beyond traditional drugs. Governments and private organizations are investing heavily in research and development, further propelling the industry's expansion. In addition, technological innovations in manufacturing, such as automation and improved vector delivery systems, are reducing production costs and enhancing scalability. The cell and gene therapy market are also seeing significant activity in mergers, acquisitions, and collaborations among biotechnology companies, pharmaceutical giants, and research institutions, aiming to accelerate development and commercialization. Regions like North America and Europe dominate the market due to strong regulatory frameworks, advanced healthcare infrastructure, and early adoption of novel treatments.

Cell and gene therapy are innovative medical treatments that involve manipulating cells or genetic material to treat or cure diseases. Cell therapy refers to the introduction of live cells into a patient's body to replace or repair damaged tissues or organs. Gene therapy involves the modification or insertion of genes into a patient's cells to treat or prevent disease, often targeting genetic disorders or cancers. Both therapies are considered cutting-edge treatments in the fields of oncology, genetic disorders, and regenerative medicine. They hold the potential to address previously untreatable conditions by repairing the root cause of the disease at a cellular or genetic level.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 20 Billion |

| Market size in 2034 | USD 120.25 Billion |

| Market Growth Rate | CAGR of 22.8% from 2025 to 2034 |

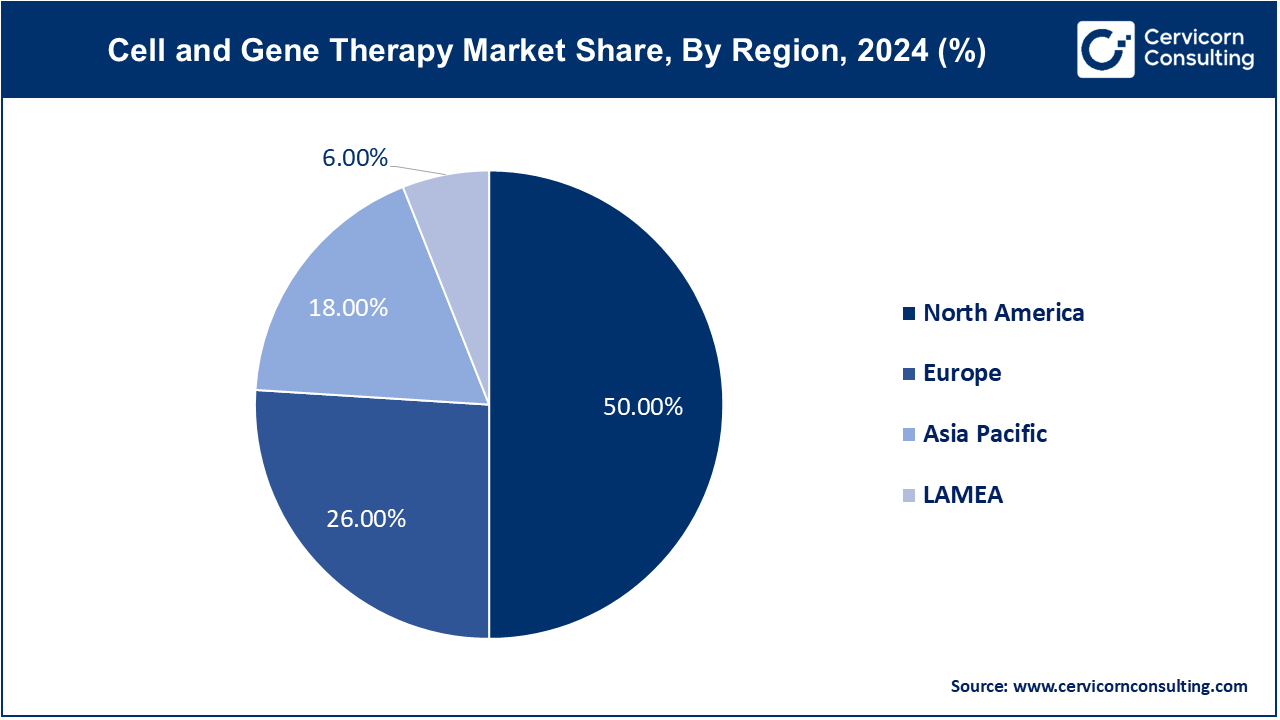

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Therapy Type, Therapeutic Class, Delivery Method, End-Users, Regions |

Aging Population and Associated Diseases:

Development of Innovative Business Models:

Complex Regulatory Challenges:

Manufacturing and Scalability Issues:

Technological Integration with Artificial Intelligence (AI) and Machine Learning (ML):

Orphan Drug Designation and Market Exclusivity:

High Development and Treatment Costs:

Logistical and Supply Chain Complexities:

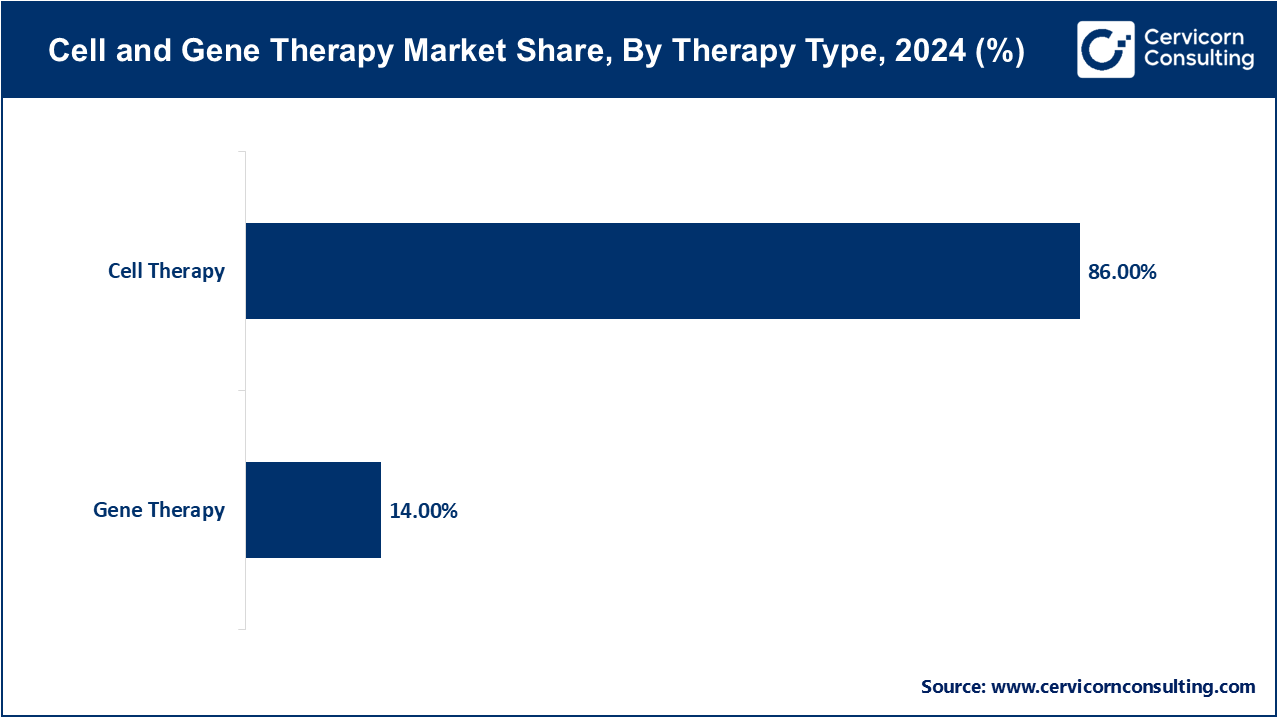

Cell Therapy: The cell therapy segement has dominated the market with the share of 86% in 2024. Cell therapy involves using living cells, either from the patient (autologous) or a donor (allogeneic), to treat medical conditions. It aims to replace damaged cells or stimulate repair. Recent trends show a focus on personalized treatments and advancements in manufacturing techniques to scale production.

Gene Therapy: The gene therapy segment has covered market share of 14% in 2024. Gene therapy aims to treat or prevent disease by modifying a patient's genes. It involves introducing genetic material into cells to correct genetic disorders or enhance therapeutic effects. Current trends include the development of viral vectors for efficient gene delivery and regulatory advancements supporting commercialization.

Cardiovascular Disease: The cardiovascular disease segment has recorded market share of 4.86% in 2024. Therapies target heart conditions by repairing or replacing damaged tissues. Market trends show a focus on regenerative treatments for heart failure and vascular diseases, leveraging stem cell therapies and gene editing to enhance efficacy and patient outcomes.

Cancer: Addressing malignancies by modifying genes or immune cells to target and destroy cancerous cells. Advances include personalized therapies and targeted genetic modifications, supported by robust clinical trials and regulatory approvals driving market expansion.

Genetic Disorder: Thegenetic disorder segment has accounted market share of 10.64% in 2024. Treatments correct defective genes causing inherited conditions like cystic fibrosis. Market growth emphasizes precision medicine and gene editing technologies, with increasing investment in rare disease therapies.

Rare Diseases: Targeting conditions affecting a small population with genetic therapies. Market expansion is driven by orphan drug incentives, breakthroughs in gene editing, and growing awareness of rare disease treatments.

Oncology: The oncology segment has calculated market share of 12.55% in 2024. Focus on cancers, leveraging gene therapy to enhance immune responses or directly target tumors. Market trends highlight CAR-T cell therapies, viral vector advancements, and emerging immunotherapies, driving transformative changes in cancer treatment paradigms.

Hematology: The hematology segment has captured market shar of 7.78% in 2024. Treating blood disorders through gene therapy, including hemophilia and sickle cell disease. Trends include gene editing for blood stem cells, expanded clinical trials exploring curative therapies, and improved patient access.

Ophthalmology: The ophthalmology segment has achived market share of 5.40% in 2023. Correcting genetic defects causing vision loss, with treatments like gene supplementation or editing. Market growth seen in gene therapies for inherited retinal diseases, supported by advances in ocular delivery methods and regulatory approvals.

Infectious Disease: The infectious disease segment has considered highest market share of 28.70% in 2024. Targeting viral infections by modifying host cells or immune responses. Trends include gene-based vaccines, antiviral gene editing technologies like CRISPR, and advancements in viral vector design for efficient gene delivery.

Neurological Disorders: The neurological disorders segment has held market share of 4.26% in 2024. Addressing conditions like Alzheimer's and Parkinson's by modifying brain cells or enhancing neuroprotection. Market focus on gene therapy delivery methods, neuroregeneration techniques, and innovative clinical trial designs to tackle complex neurological challenges.

Others: The others segment has generated second highest market share of 25.81% in 2024. Includes diverse conditions from metabolic disorders to autoimmune diseases. Market growth driven by expanding gene editing applications, novel gene therapies targeting specific disease pathways, and collaborations between biotech firms and academic research centers to accelerate therapeutic development.

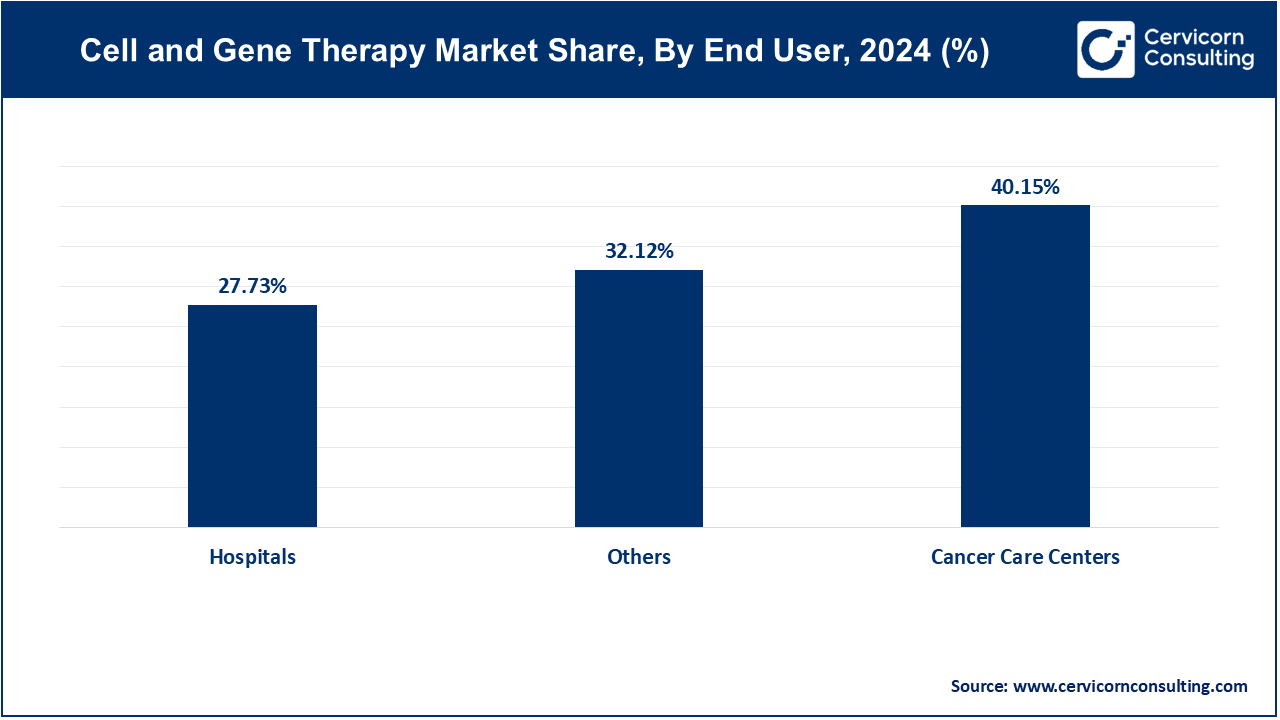

Hospitals: The Hospitals segment has covered market share of 27.73% in 2024. Hospitals play a critical role in the cell and gene therapy market, offering infrastructure for clinical trials and treatments, facilitating patient access to innovative therapies.

Cancer Care Centers: The cancer care centers segment has recorded markey share of 40.15% in 2024. These centers specialize in oncology, leading the adoption of personalized therapies such as CAR-T and gene editing to precisely target cancer cells, improving treatment efficacy and patient outcomes.

Wound Care Centers: Dedicated to chronic wound management, these centers integrate regenerative cell therapies to promote faster healing and tissue regeneration, addressing unmet medical needs with advanced treatment options.

Others: The others segemet has accounted market share of 32.12% in 2024. This category encompasses research institutions and biotech firms driving innovation in cell and gene therapies. They contribute to market growth through groundbreaking research, technological advancements, and regulatory developments, expanding treatment options and accessibility globally.

The North America market size is calculated at USD 8.15 billion in 2024 and is projected to grow around USD 60.12 billion by 2034. Known for robust regulatory frameworks and advanced healthcare infrastructure, North America leads in clinical trials and commercialization of cell and gene therapies. Significant investments in biotech and pharmaceutical sectors drive innovation, focusing on oncology and rare diseases.

Europe emphasizes collaborative research initiatives and regulatory harmonization, fostering a competitive landscape for cell and gene therapies. Europe market size is predicted to hit around USD 31.27 billion by 2034 from USD 4.24 billion in 2024. Countries like the UK, Germany, and Switzerland are prominent in biotech innovation and clinical development, with a focus on expanding treatment options for genetic disorders.

Rapidly evolving healthcare systems in countries like China, Japan, and South Korea drive growth in the Asia-Pacific region. Asia Pacific market size is expected to reach around USD 21.65 billion by 2034 increasing from USD 2.93 billion in 2024. Increasing investments in biopharmaceuticals and supportive regulatory reforms accelerate the adoption of cell and gene therapies, particularly in oncology and regenerative medicine.

The LAMEA market size is calculated at USD 0.98 billion in 2024 and is anticipated to reach around USD 7.22 billion by 2034. Emerging markets in LAMEA are witnessing a gradual uptake of cell and gene therapies, supported by improving healthcare infrastructure and rising healthcare expenditure. Focus areas include genetic disorders and infectious diseases, with growing investments in biotech and partnerships with global pharmaceutical firms.

New players like CRISPR Therapeutics, Intellia Therapeutics, and Fate Therapeutics have adopted innovative gene editing technologies, advancing their entry into the cell and gene therapy market. These companies focus on precision medicine and novel therapeutic approaches, attracting investment and partnerships. Key players dominating the market include established pharmaceutical giants like Novartis, Gilead Sciences, and Bristol-Myers Squibb, leveraging extensive R&D capabilities, global reach, and regulatory expertise. They lead through strategic acquisitions, pipeline expansions, and successful commercialization of therapies such as CAR-T treatments and gene therapies, reinforcing their market dominance and shaping industry standards.

Market Segmentation

By Therapy Type

By Therapeutic Class

By Delivery Method

By End-Users

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cell and Gene Therapy

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Therapy Type Overview

2.2.2 By Therapeutic Class Overview

2.2.3 By Delivery Method Overview

2.2.4 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Cell and Gene Therapy Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Aging Population and Associated Diseases

4.1.1.2 Development of Innovative Business Models

4.1.2 Market Restraints

4.1.2.1 Complex Regulatory Challenges

4.1.2.2 Manufacturing and Scalability Issues

4.1.3 Market Opportunity

4.1.3.1 Technological Integration with Artificial Intelligence (AI) and Machine Learning (ML)

4.1.3.2 Orphan Drug Designation and Market Exclusivity

4.1.4 Market Challenges

4.1.4.1 High Development and Treatment Costs

4.1.4.2 Logistical and Supply Chain Complexities

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Cell and Gene Therapy Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Cell and Gene Therapy Market, By Therapy Type

6.1 Global Cell and Gene Therapy Market Snapshot, By Therapy Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

6.1.1.1 Cell Therapy

6.1.1.2 Gene Therapy

Chapter 7 Cell and Gene Therapy Market, By Therapeutic Class

7.1 Global Cell and Gene Therapy Market Snapshot, By Therapeutic Class

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

7.1.1.1 Cardiovascular Disease

7.1.1.2 Cancer

7.1.1.3 Genetic Disorder

7.1.1.4 Rare Diseases

7.1.1.5 Oncology

7.1.1.6 Hematology

7.1.1.7 Ophthalmology

7.1.1.8 Infectious Disease

7.1.1.9 Neurological Disorders

7.1.1.10 Others

Chapter 8 Cell and Gene Therapy Market, By Delivery Method

8.1 Global Cell and Gene Therapy Market Snapshot, By Delivery Method

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

8.1.1.1 In Vivo

8.1.1.2 Ex vivo

Chapter 9 Cell and Gene Therapy Market, By End-Users

9.1 Global Cell and Gene Therapy Market Snapshot, By End-Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

9.1.1.1 Hospitals

9.1.1.2 Cancer Care Centers

9.1.1.3 Wound Care Centers

9.1.1.4 Others

Chapter 10 Cell and Gene Therapy Market, By Region

10.1 Overview

10.2 Cell and Gene Therapy Market Revenue Share, By Region 2024 (%)

10.3 Global Cell and Gene Therapy Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Cell and Gene Therapy Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Cell and Gene Therapy Market, By Country

10.5.4 UK

10.5.4.1 UK Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Cell and Gene Therapy Market, By Country

10.6.4 China

10.6.4.1 China Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Cell and Gene Therapy Market, By Country

10.7.4 GCC

10.7.4.1 GCC Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Cell and Gene Therapy Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Novartis International AG

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Gilead Sciences, Inc.

12.3 Bristol-Myers Squibb Company

12.4 bluebird bio, Inc.

12.5 Spark Therapeutics, Inc. (a Roche company)

12.6 Kite Pharma (a Gilead company)

12.7 Celgene Corporation (a Bristol-Myers Squibb company)

12.8 Sangamo Therapeutics, Inc.

12.9 Regeneron Pharmaceuticals, Inc.

12.10 Editas Medicine, Inc.