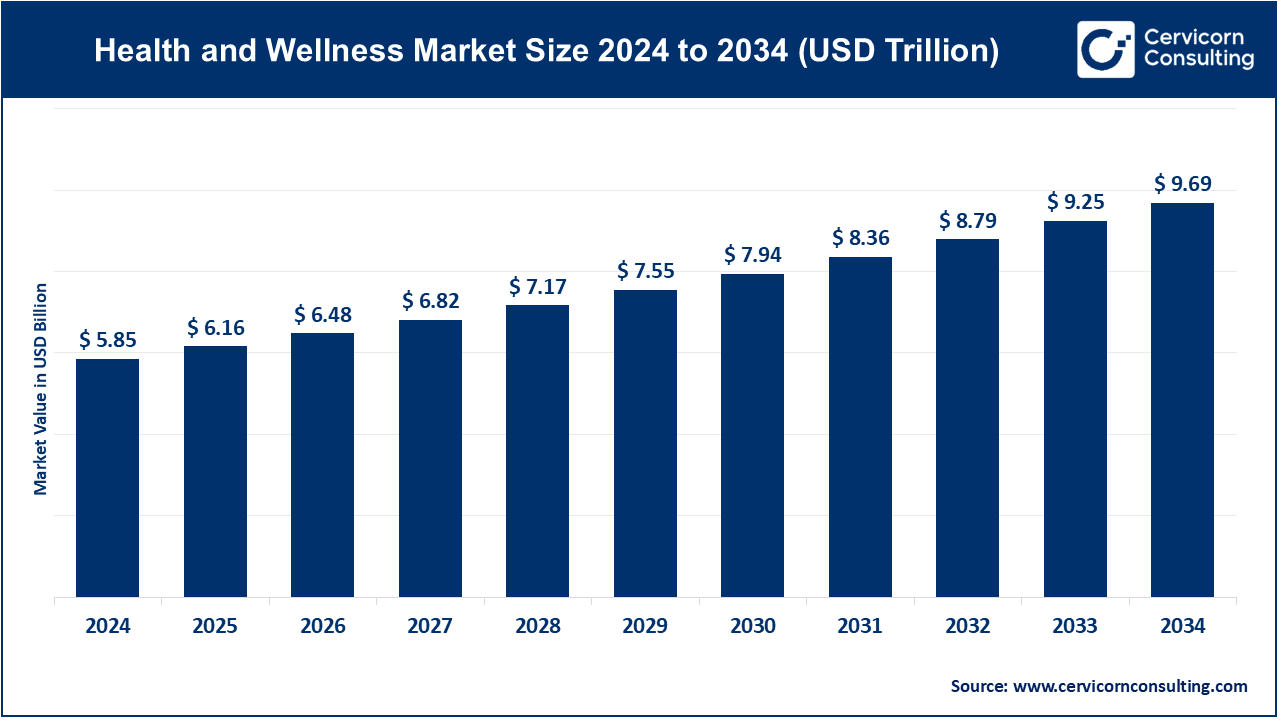

The global health and wellness market size was accounted at USD 5.85 trillion in 2024 and is projected to reach around USD 9.69 trillion by 2034, growing at a compound annual growth rate (CAGR) of 5.17% from 2025 to 2034.

The health and wellness market has experienced significant expansion due to growing consumer interest in holistic well-being. The demand for fitness products, services, and technologies has surged, driven by a shift toward prevention and lifestyle management rather than just disease treatment. Consumers are increasingly investing in fitness memberships, wellness apps, wearable health devices, and personalized nutrition. The rise of online platforms and digital health solutions has made wellness more accessible to a wider audience, with individuals able to track their health and fitness goals through apps and wearables. This digital transformation has created new opportunities for businesses to engage customers through virtual wellness services, such as online yoga and fitness classes. Moreover, the health and wellness sector is becoming more diverse, with products and services expanding into areas like mental health, sleep optimization, and personalized wellness plans. As awareness about the importance of mental well-being rises, services like therapy, meditation apps, and stress management solutions are gaining popularity.

Health and wellness encompass a broad range of practices, products, and services designed to promote physical, mental, and emotional well-being. It includes a combination of regular physical activity, balanced nutrition, mental health care, stress management, and preventive healthcare. As people become more health-conscious, the concept of wellness extends beyond the absence of illness, aiming for holistic well-being that includes personal growth and mindfulness. Activities like yoga, fitness classes, healthy eating, and mindfulness practices such as meditation are integral to the wellness movement, helping individuals improve their quality of life and maintain optimal health.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 6.16 Trillion |

| Market Growth Rate | CAGR 5.17% from 2025 to 2034 |

| Market Size by 2034 | USD 9.69 Trillion |

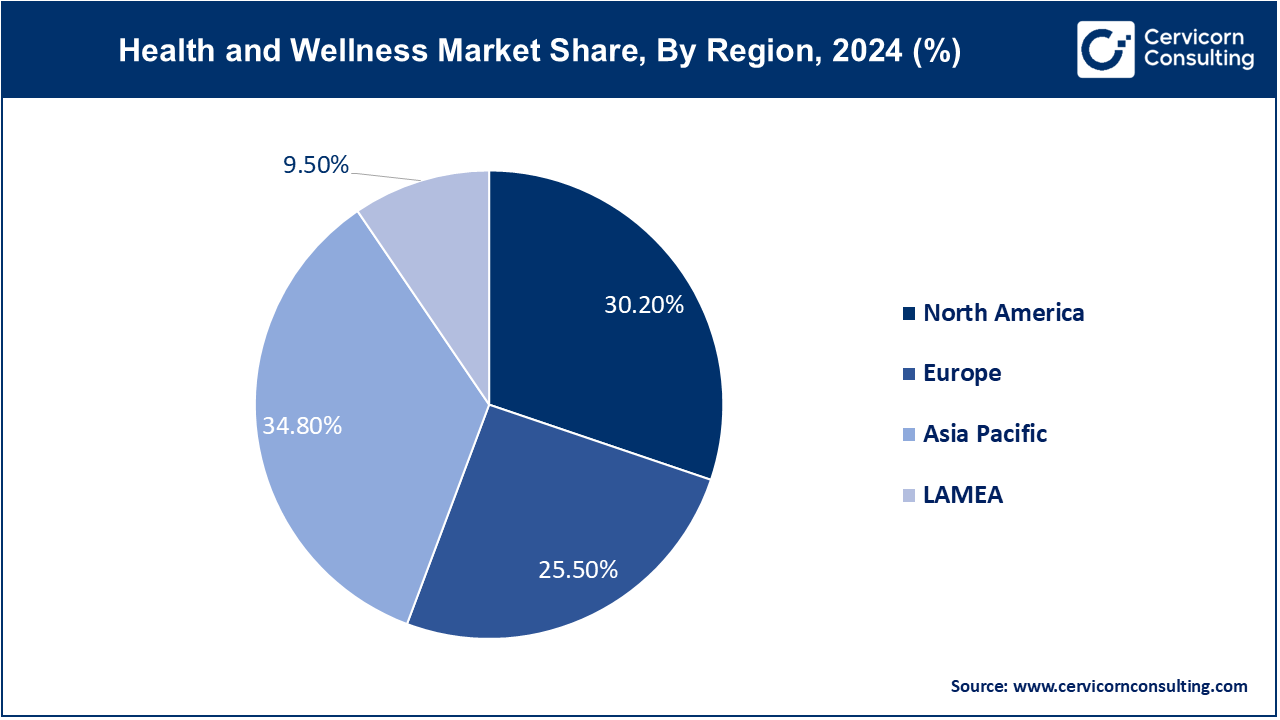

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Application, Regions |

Regulatory Support and Standards

Corporate Wellness Programs

Cost and Affordability

Regulatory Challenges

Growing Aging Population

Digital Health Advancements

Consumer Education and Awareness

Competitive Fragmentation

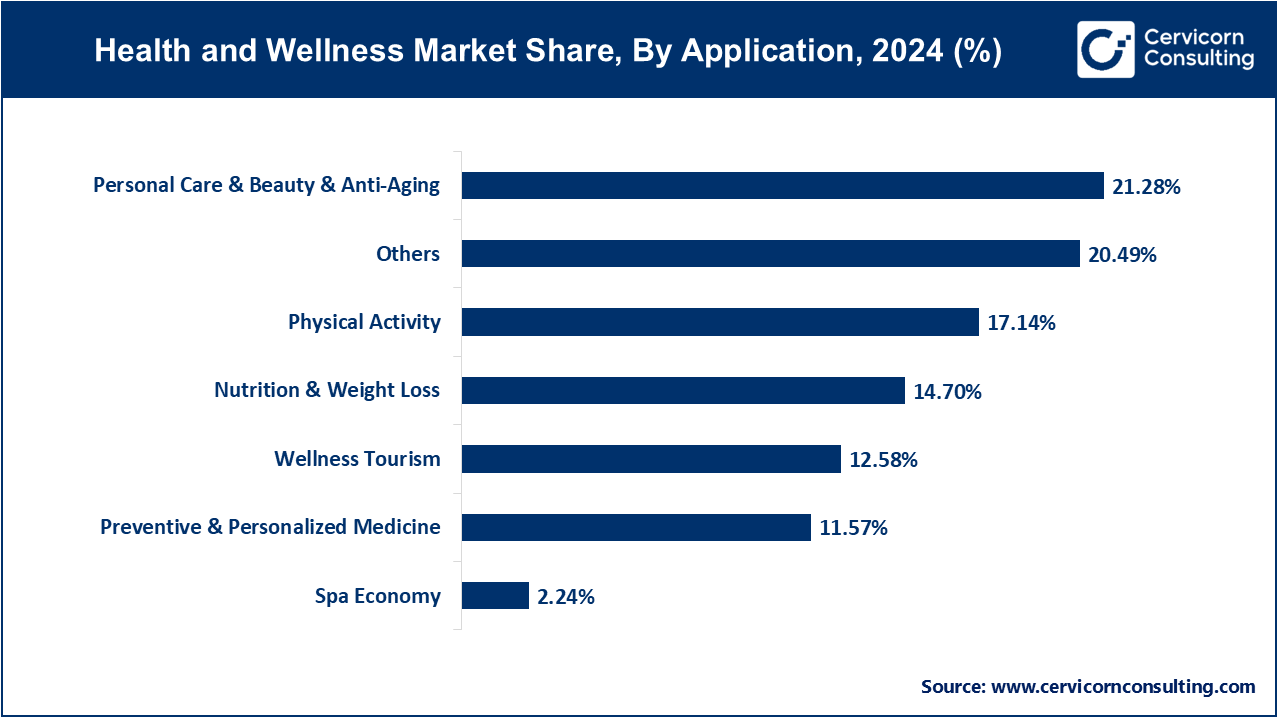

Personal Care & Beauty & Anti-Aging: The segment is driven by increasing consumer demand for skincare, haircare, and anti-aging products. Trends include the rising popularity of natural and organic ingredients, personalized skincare solutions, and advanced anti-aging technologies. This segment has acquired market share of 21.28% in 2024. Key drivers include growing beauty consciousness, aging populations, and innovations in cosmetic science.

Nutrition & Weight Loss: In 2024 the nutrition & weight loss segment has covered market share of 14.7%. Consumers are increasingly focused on nutrition as a cornerstone of overall wellness. This segment sees trends in functional foods, dietary supplements, and meal replacements designed for health and weight management. Drivers include rising obesity rates, health-conscious lifestyles, and trends towards personalized nutrition plans and diets.

Physical Activity: The emphasis on fitness and physical well-being drives demand for gym memberships, sports apparel, fitness equipment, and digital fitness solutions. Physical Activity segment has recorded market share of 17.14% in 2024. Trends include the integration of technology in workouts, such as fitness apps and wearable devices, and the popularity of group fitness classes and outdoor activities. Drivers include increasing health awareness, fitness trends, and urbanization promoting sedentary lifestyles.

Wellness Tourism: The wellness tourism segment has captured market share of 12.58% in 2024. This involves travel focused on enhancing health and well-being, encompassing spa retreats, yoga retreats, wellness cruises, and medical tourism. Trends include wellness-themed vacations, holistic retreats, and wellness-focused accommodations. Drivers include stress relief, desire for relaxation, and growing interest in experiential travel that promotes physical and mental rejuvenation.

Preventive & Personalized Medicine: Preventive & Personalized Medicine segment has measured market share of 11.57% in 2024. Drivers include rising chronic disease rates, aging populations, and healthcare cost containment strategies. The shift towards preventive healthcare and personalized medicine is driven by advancements in genomics, diagnostics, and preventive health screenings. Trends include genetic testing, personalized treatment plans, and lifestyle medicine focusing on disease prevention.

Spa Economy: The spa economy segment has generated market share of 2.24% in 2024. The spa economy includes a range of wellness services such as massages, facials, aromatherapy, and wellness consultations. Trends include luxury spa experiences, wellness-focused spa treatments, and integrative wellness therapies. Drivers include stress management, increasing disposable incomes, and the pursuit of holistic health and relaxation therapies.

Others: The others segment has garnered market share of 20.49% in 2024. This segment includes emerging trends and niche segments within the health and wellness market, such as mental wellness apps, mindfulness programs, alternative therapies (e.g., acupuncture, Ayurveda), and wellness-focused technology solutions (e.g., sleep trackers, biofeedback devices). Drivers vary widely but often include consumer demand for holistic health solutions, technological innovation, and shifting attitudes towards well-being and self-care.

The Asia-Pacific region showcases rapid growth in the health and wellness market, driven by increasing disposable incomes, urbanization, and changing lifestyles. Asia Pacific market size is calculated at USD 2.04 trillion billion in 2024 and is projected to grow around USD 3.37 trillion by 2034. Consumers are increasingly health-conscious, driving demand for fitness products, dietary supplements, and wellness services. Traditional medicine practices such as Ayurveda and Traditional Chinese Medicine (TCM) complement modern health solutions. Wellness tourism is expanding, with destinations offering cultural and wellness experiences. The market benefits from technological advancements in healthcare and a growing focus on preventive health measures.

North America leads the global health and wellness market, driven by high consumer awareness and expenditure on fitness, nutrition, and preventive healthcare. North America market size is expected to reach around USD 2.93 trillion by 2034 increasing from USD 1.77 trillion in 2024. The region benefits from a robust healthcare infrastructure, extensive wellness tourism offerings, and a strong market for organic and natural products. Trends include a preference for personalized health solutions and technological innovations in digital health. Key players emphasize wellness lifestyles, contributing to sustained market growth.

Europe market size is measured at USD 1.49 trillion in 2024 and is expected to grow around USD 2.47 trillion by 2034. Europe is characterized by a mature health and wellness market with a focus on sustainable living and organic products. The region's consumers prioritize holistic health practices, including preventive medicine and wellness therapies. Wellness tourism is prominent, with spa destinations and wellness retreats popular among Europeans. Regulatory support for health products and services ensures high standards and consumer trust. Emerging trends include personalized nutrition and digital health solutions aimed at enhancing lifestyle choices and overall well-being.

LAMEA represents a diverse health and wellness market with varying economic developments and cultural influences. In Latin America, there is a rising trend towards natural and organic products, driven by increasing consumer health awareness. The Middle East features a growing market for luxury wellness tourism and premium health services. Africa's market is characterized by traditional healing practices and a burgeoning interest in modern health solutions. Regional growth is supported by infrastructure development and rising middle-class populations seeking improved health outcomes.

Emerging players like Beyond Meat, focusing on plant-based meat alternatives, and CureFit, integrating digital fitness and wellness services, are leveraging trends towards vegetarian diets and personalized health solutions. Dominating players such as Johnson & Johnson and Nestlé Health Science lead with extensive R&D and strategic collaborations. Johnson & Johnson partners with academic institutions for medical research, while Nestlé Health Science invests in personalized nutrition through acquisitions and biotech partnerships. Their innovations include new drug formulations and advanced nutritional products, addressing global health challenges and consumer preferences for preventive healthcare, thereby shaping the industry landscape with cutting-edge solutions and strategic alliances.

Alex Gorsky, Chairman and CEO of Johnson & Johnson

"We remain committed to advancing health for everyone, everywhere, through innovative healthcare solutions that improve lives globally."

Greg Behar, CEO of Nestlé Health Science

"Our focus is on pioneering nutritional therapies that transform the management of health conditions and enhance quality of life."

David Taylor, Chairman, President and CEO of Procter & Gamble

"P&G is dedicated to delivering superior health and personal care products that meet the evolving needs of consumers worldwide."

Emma Walmsley, CEO of GSK

"We are committed to leveraging scientific innovation to tackle global health challenges and improve access to healthcare for all."

Albert Bourla, Chairman and CEO of Pfizer Inc.

"At Pfizer, our mission is to bring therapies that significantly improve patients' lives, focusing on prevention, treatment, and cure."

These statements reflect the companies' dedication to innovation, healthcare solutions, and improving global health outcomes through their products and services.

Market Segmentation

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Health and Wellness

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Health and Wellness Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Support and Standards

4.1.1.2 Corporate Wellness Programs

4.1.2 Market Restraints

4.1.2.1 Cost and Affordability

4.1.2.2 Regulatory Challenges

4.1.3 Market Opportunity

4.1.3.1 Growing Aging Population

4.1.3.2 Digital Health Advancements

4.1.4 Market Challenges

4.1.4.1 Consumer Education and Awareness

4.1.4.2 Competitive Fragmentation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Health and Wellness Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Health and Wellness Market, By Application

6.1 Global Health and Wellness Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Personal Care & Beauty & Anti-Aging

6.1.1.2 Nutrition & Weight Loss

6.1.1.3 Physical Activity

6.1.1.4 Wellness Tourism

6.1.1.5 Preventive & Personalized Medicine

6.1.1.6 Spa Economy

6.1.1.7 Others

Chapter 7 Health and Wellness Market, By Region

7.1 Overview

7.2 Health and Wellness Market Revenue Share, By Region 2024 (%)

7.3 Global Health and Wellness Market, By Region

7.3.1 Market Size and Forecast

7.4 North America

7.4.1 North America Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.4.2 Market Size and Forecast

7.4.3 North America Health and Wellness Market, By Country

7.4.4 U.S.

7.4.4.1 U.S. Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.4.4.2 Market Size and Forecast

7.4.4.3 U.S. Market Segmental Analysis

7.4.5 Canada

7.4.5.1 Canada Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.4.5.2 Market Size and Forecast

7.4.5.3 Canada Market Segmental Analysis

7.4.6 Mexico

7.4.6.1 Mexico Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.4.6.2 Market Size and Forecast

7.4.6.3 Mexico Market Segmental Analysis

7.5 Europe

7.5.1 Europe Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.5.2 Market Size and Forecast

7.5.3 Europe Health and Wellness Market, By Country

7.5.4 UK

7.5.4.1 UK Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.5.4.2 Market Size and Forecast

7.5.4.3 UK Market Segmental Analysis

7.5.5 France

7.5.5.1 France Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.5.5.2 Market Size and Forecast

7.5.5.3 France Market Segmental Analysis

7.5.6 Germany

7.5.6.1 Germany Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.5.6.2 Market Size and Forecast

7.5.6.3 Germany Market Segmental Analysis

7.5.7 Rest of Europe

7.5.7.1 Rest of Europe Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.5.7.2 Market Size and Forecast

7.5.7.3 Rest of Europe Market Segmental Analysis

7.6 Asia Pacific

7.6.1 Asia Pacific Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.2 Market Size and Forecast

7.6.3 Asia Pacific Health and Wellness Market, By Country

7.6.4 China

7.6.4.1 China Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.4.2 Market Size and Forecast

7.6.4.3 China Market Segmental Analysis

7.6.5 Japan

7.6.5.1 Japan Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.5.2 Market Size and Forecast

7.6.5.3 Japan Market Segmental Analysis

7.6.6 India

7.6.6.1 India Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.6.2 Market Size and Forecast

7.6.6.3 India Market Segmental Analysis

7.6.7 Australia

7.6.7.1 Australia Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.7.2 Market Size and Forecast

7.6.7.3 Australia Market Segmental Analysis

7.6.8 Rest of Asia Pacific

7.6.8.1 Rest of Asia Pacific Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.6.8.2 Market Size and Forecast

7.6.8.3 Rest of Asia Pacific Market Segmental Analysis

7.7 LAMEA

7.7.1 LAMEA Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.7.2 Market Size and Forecast

7.7.3 LAMEA Health and Wellness Market, By Country

7.7.4 GCC

7.7.4.1 GCC Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.7.4.2 Market Size and Forecast

7.7.4.3 GCC Market Segmental Analysis

7.7.5 Africa

7.7.5.1 Africa Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.7.5.2 Market Size and Forecast

7.7.5.3 Africa Market Segmental Analysis

7.7.6 Brazil

7.7.6.1 Brazil Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.7.6.2 Market Size and Forecast

7.7.6.3 Brazil Market Segmental Analysis

7.7.7 Rest of LAMEA

7.7.7.1 Rest of LAMEA Health and Wellness Market Revenue, 2022-2034 ($Billion)

7.7.7.2 Market Size and Forecast

7.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 8 Competitive Landscape

8.1 Competitor Strategic Analysis

8.1.1 Top Player Positioning/Market Share Analysis

8.1.2 Top Winning Strategies, By Company, 2022-2024

8.1.3 Competitive Analysis By Revenue, 2022-2024

8.2 Recent Developments by the Market Contributors (2024)

Chapter 9 Company Profiles

9.1 Johnson & Johnson

9.1.1 Company Snapshot

9.1.2 Company and Business Overview

9.1.3 Financial KPIs

9.1.4 Product/Service Portfolio

9.1.5 Strategic Growth

9.1.6 Global Footprints

9.1.7 Recent Development

9.1.8 SWOT Analysis

9.2 Nestlé Health Science

9.3 Procter & Gamble (P&G)

9.4 GSK (GlaxoSmithKline)

9.5 Pfizer Inc.

9.6 Unilever

9.7 Abbott Laboratories

9.8 Danone SA

9.9 The Coca-Cola Company

9.10 Herbalife Nutrition Ltd.