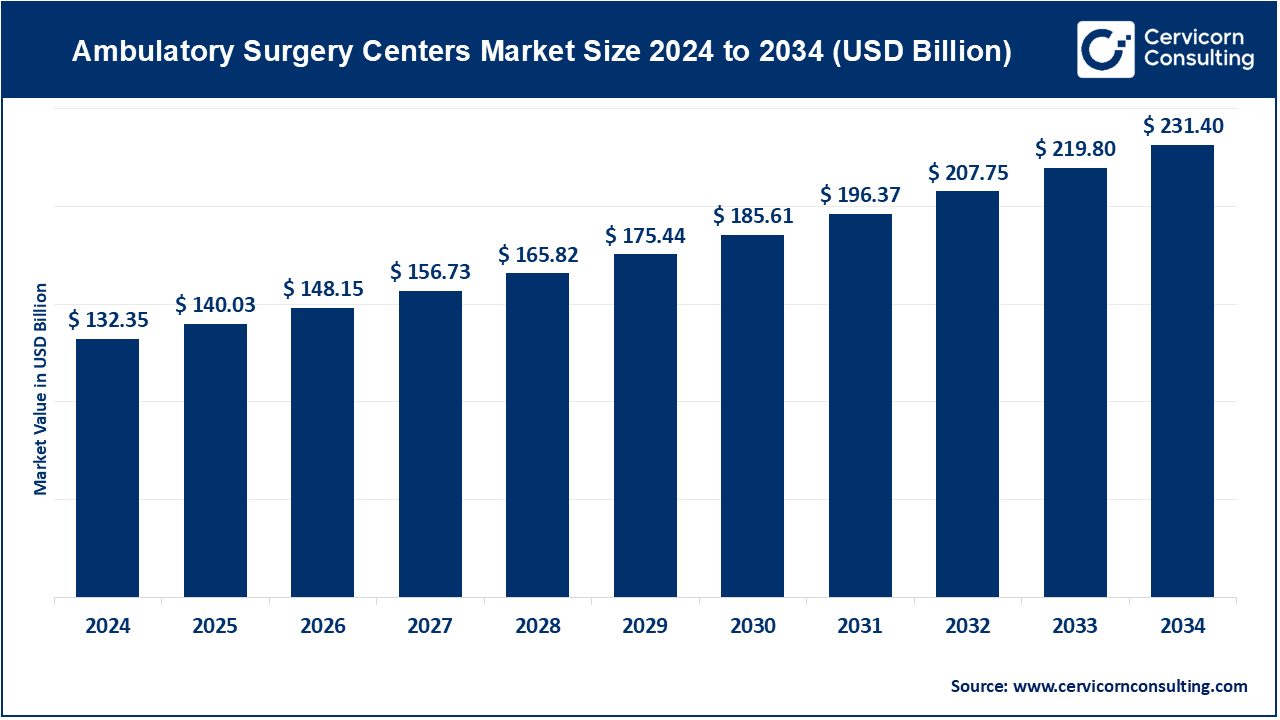

The global ambulatory surgery centers market size was valued at USD 132.35 billion in 2024 and is expected to surpass around USD 231.40 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

The ambulatory surgery centers market growth is driven by increasing patient demand for outpatient procedures and a shift toward cost-effective healthcare options. The growing preference for minimally invasive surgeries and advancements in surgical technology have contributed to this rise. Patients benefit from reduced recovery times and lower costs, which has made ASCs an attractive option for both individuals and healthcare insurers. The aging population, which requires more surgeries, is another factor driving the demand for ASCs, as elderly patients prefer the convenience and lower costs compared to traditional hospital settings. In addition, ASCs have benefited from increased healthcare reimbursement rates and improved insurance coverage. The expansion of healthcare insurance programs, particularly those under government initiatives like Medicare and Medicaid, has made ASCs more accessible to a broader patient base. The number of businesses in the U.S. ASC industry has grown at an average annual rate of 5.9% over the five years leading up to 2024, reaching an estimated 6,052 businesses.

Ambulatory Surgery Centers (ASCs) are healthcare facilities that provide same-day surgical care, including diagnostic and preventive procedures. They are designed to perform less complex surgeries that do not require an overnight hospital stay. ASCs have become popular because they offer patients a convenient, cost-effective, and efficient alternative to traditional hospitals for certain types of surgeries. The range of procedures performed in ASCs can vary widely and typically includes orthopedic surgeries, eye surgeries, cosmetic surgeries, gastroenterology, urology, pain management, and diagnostic procedures. The specialized nature of ASCs allows for high-quality, personalized care in a more relaxed and less intimidating environment compared to a hospital.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 140.03 Billion |

| Market Growth Rate | CAGR of 5.79% from 2025 to 2034 |

| Market Size by 2034 | USD 231.40 Billion |

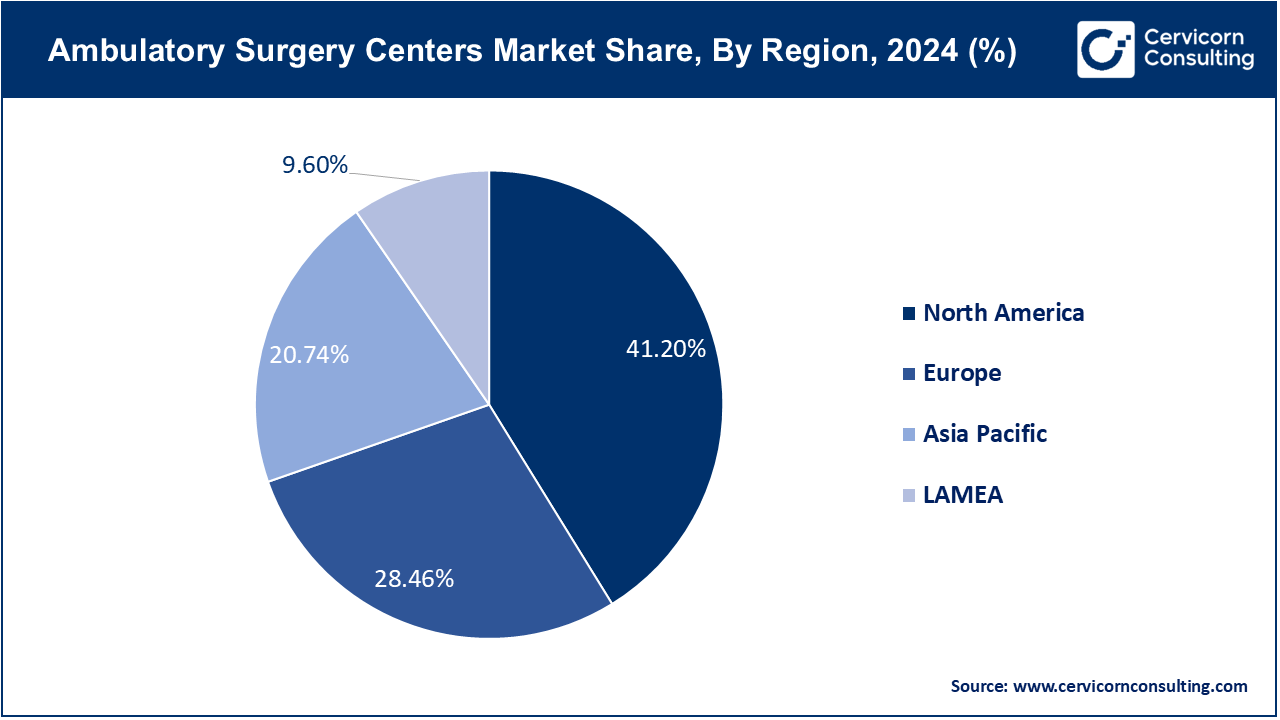

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Application, Ownership, Center Type, Services and Regions |

Increased Physician Involvement and Ownership:

Growth in Elective Surgeries:

Regulatory and Accreditation Challenges:

Limited Complex Procedure Capabilities:

Partnerships with Hospitals and Healthcare Networks:

Adoption of Advanced Technologies:

Competition with Hospitals:

Insurance Reimbursement Issues:

The ambulatory surgery centers market is segmented into application, ownership, center type, services, region. Based on application, the market is classified into orthopedics, pain management/spinal injections, gastroenterology, ophthalmology, and others. Based on ownership, the market is classified into physician owned, hospital owned, corporate owned, and others. Based on center type, the market is classified into single-specialty and multi-specialty. Based on services, the market is classified into treatment and diagnosis.

Orthopedics: Orthopedic ASCs focus on surgeries related to the musculoskeletal system, including joint replacements, sports medicine procedures, and fracture repairs. The rising prevalence of orthopedic conditions, such as arthritis and sports injuries, is driving demand for orthopedic surgeries in ASCs. Technological advancements, like minimally invasive surgical techniques and robotic-assisted procedures, are enhancing patient outcomes and expanding the types of orthopedic surgeries that can be performed in an outpatient setting.

Pain Management/Spinal Injections: This segment addresses pain management procedures, including spinal injections and nerve blocks, to treat chronic pain conditions. The increasing incidence of chronic pain conditions, such as back pain and neuropathy, is fueling growth in pain management services at ASCs. There is a trend toward using image-guided techniques to improve the precision and effectiveness of spinal injections, offering patients relief with minimal recovery time.

Gastroenterology: Gastroenterology ASCs perform procedures like colonoscopies and endoscopies to diagnose and treat gastrointestinal disorders. The demand for screening procedures, such as colonoscopies for colorectal cancer detection, is boosting growth in gastroenterology services at ASCs. Advances in endoscopic technology, including capsule endoscopy and endoscopic ultrasound, are expanding the diagnostic and therapeutic capabilities of ASCs in this specialty.

Ophthalmology: Ophthalmology ASCs provide surgical eye care, including cataract surgeries, glaucoma treatments, and corrective vision procedures. The increasing prevalence of eye disorders, such as cataracts and glaucoma, is driving demand for ophthalmic procedures at ASCs. Innovations in laser technology and intraocular lens implants are enhancing surgical outcomes and enabling more complex eye surgeries to be performed on an outpatient basis.

Plastic Surgery: Plastic surgery ASCs offer cosmetic and reconstructive procedures, including facelifts, breast augmentations, and liposuction. Growing consumer interest in cosmetic enhancements and minimally invasive procedures is driving growth in plastic surgery ASCs. Advances in surgical techniques and technologies, such as laser treatments and fat grafting, are increasing the safety and efficacy of plastic surgery, making it more accessible to a broader range of patients.

Otolaryngology: Otolaryngology ASCs specialize in ear, nose, and throat (ENT) surgeries, including sinus surgeries, tonsillectomies, and cochlear implants. The increasing prevalence of ENT disorders, such as chronic sinusitis and hearing loss, is boosting demand for otolaryngology procedures at ASCs. Technological advancements, such as image-guided surgery and endoscopic techniques, are improving surgical precision and patient outcomes in ENT procedures.

Obstetrics/Gynecology: This segment provides surgical care for women’s health, including hysterectomies, laparoscopies, and fertility treatments. The demand for minimally invasive gynecological surgeries, such as laparoscopic and robotic-assisted procedures, is growing in ASCs. These procedures offer shorter recovery times and reduced hospital stays, appealing to women seeking efficient and effective surgical solutions for their health needs.

Dental: Dental ASCs perform oral surgeries, including extractions, implants, and corrective jaw surgeries. The increasing demand for dental implants and orthodontic surgeries is driving growth in dental ASCs. Advances in dental technology, such as digital imaging and computer-aided design, are improving the precision and outcomes of dental surgeries, making them more suitable for outpatient settings.

Podiatry: Podiatry ASCs specialize in foot and ankle surgeries, including bunion corrections, fracture repairs, and tendon surgeries. The growing prevalence of foot and ankle disorders, particularly among the aging population and individuals with diabetes, is driving demand for podiatric surgeries in ASCs. Minimally invasive techniques and enhanced imaging technologies are expanding the range of podiatric procedures that can be performed in outpatient settings.

Others: This category includes a variety of other surgical specialties, such as urology, dermatology, and general surgery, offered at ASCs. The trend toward outpatient surgeries across various specialties is driven by advancements in surgical techniques and anesthesia, which allow for safe and efficient procedures outside the hospital setting. The focus on patient convenience and cost-effectiveness is further fueling the expansion of services in diverse surgical fields within ASCs.

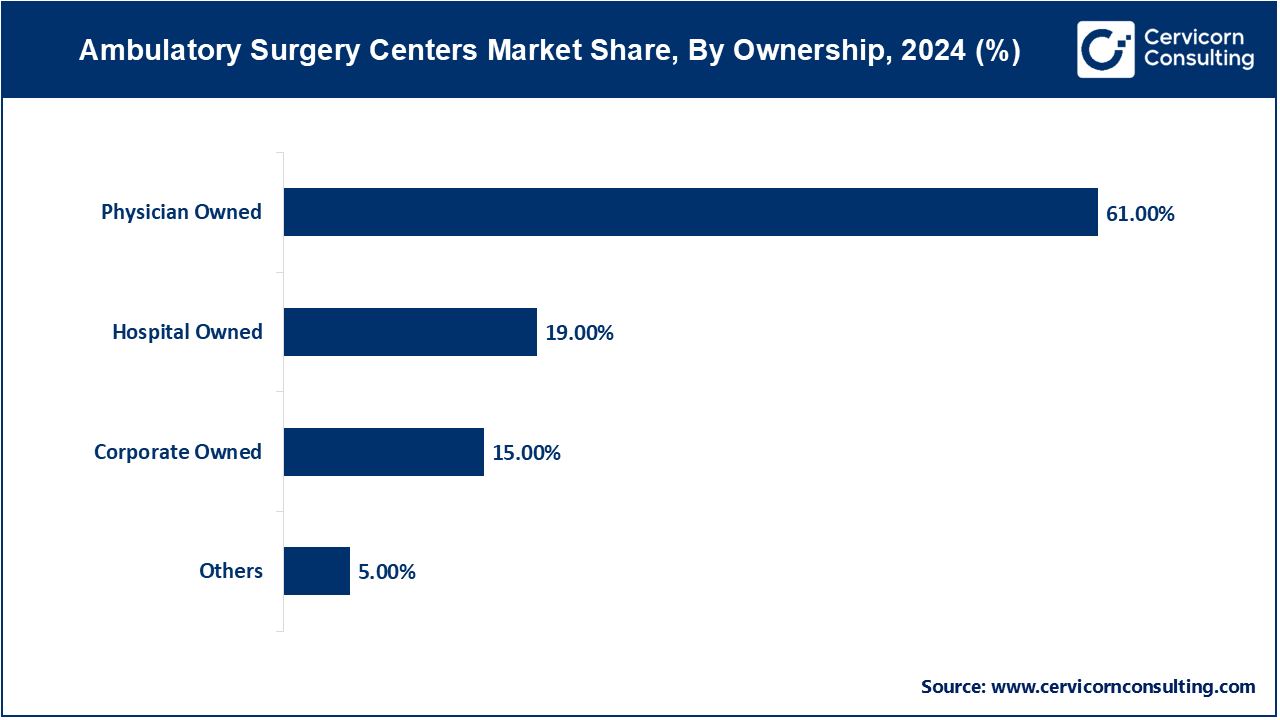

Physician Owned: This segmet has calculated highest market share of 61% in 2024. Physician-owned ASCs are facilities where practicing doctors hold majority ownership. This model aligns financial and clinical incentives, promoting high-quality care and operational efficiency. Trends indicate an increase in physician ownership due to greater autonomy and profitability. However, regulatory scrutiny around self-referrals and potential conflicts of interest remains a challenge, pushing physician owners to navigate complex legal landscapes.

Hospital Owned: The hospital-owned segment has acquired market share of 19% in 2024. Hospital-owned ASCs are facilities directly owned or partnered with hospitals. This ownership structure allows hospitals to extend their outpatient services and optimize surgical capacity, offering more cost-effective care. The trend is driven by hospitals seeking to capture outpatient surgical volume and reduce inpatient costs. These centers benefit from integrated care models and streamlined patient referrals, enhancing service quality and coordination.

Corporate Owned: This segment has garnered market share of 15% in the year of 2024. Corporate-owned ASCs are operated by for-profit companies or healthcare management organizations. These entities leverage economies of scale, standardized protocols, and extensive networks to enhance operational efficiency and profitability. The trend shows increased corporate consolidation in the ASC market, with large healthcare companies acquiring independent centers to expand their market share and negotiate better payer contracts.

Others: The others segment has registered a small market share of 5% in 2024. This category includes ASCs owned by joint ventures between physicians, hospitals, and corporations or other unique ownership models such as partnerships with venture capital firms. The trend is toward innovative ownership structures that combine the strengths of different stakeholders, facilitating access to capital and expertise. These hybrid models aim to balance quality care with financial sustainability, adapting to the evolving healthcare landscape.

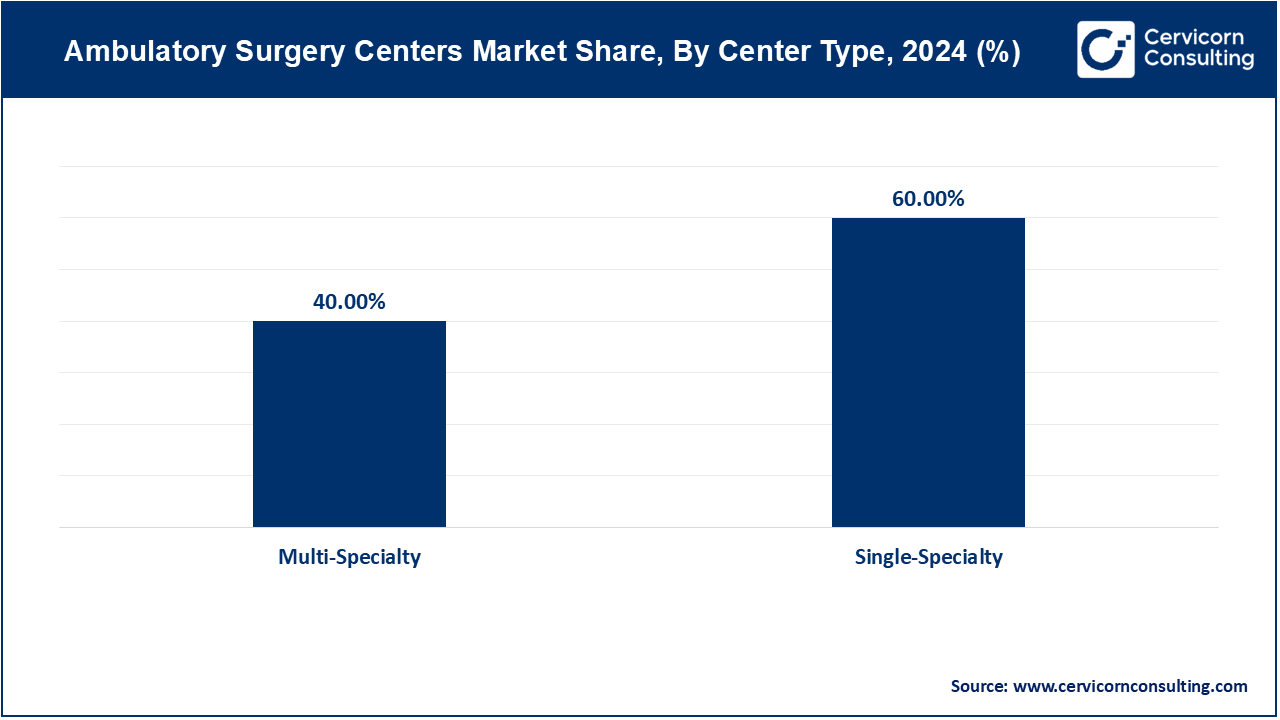

Single-Specialty: This segment has captured highest market share of 60% in 2024. Single-specialty ambulatory surgery centers (ASCs) focus on one specific area of medical procedures, such as orthopedics, ophthalmology, or gastroenterology. These centers benefit from streamlined operations and specialized expertise, allowing for high efficiency and lower costs. A growing trend is the increase in patient preference for these centers due to their specialized care, leading to faster procedure times and shorter recovery periods compared to general hospitals.

Multi-Specialty: The multi-specialty segment has recorded market share of 40% in 2024. Multi-specialty ASCs offer a wide range of surgical procedures across various specialties, such as cardiology, neurology, and urology, under one roof. This model attracts a diverse patient base and allows for resource sharing among different specialties, improving overall efficiency. The trend toward value-based care and bundled payment models has led to increased demand for multi-specialty ASCs, as they provide comprehensive services that align with holistic patient care approaches and cost-effective treatment options.

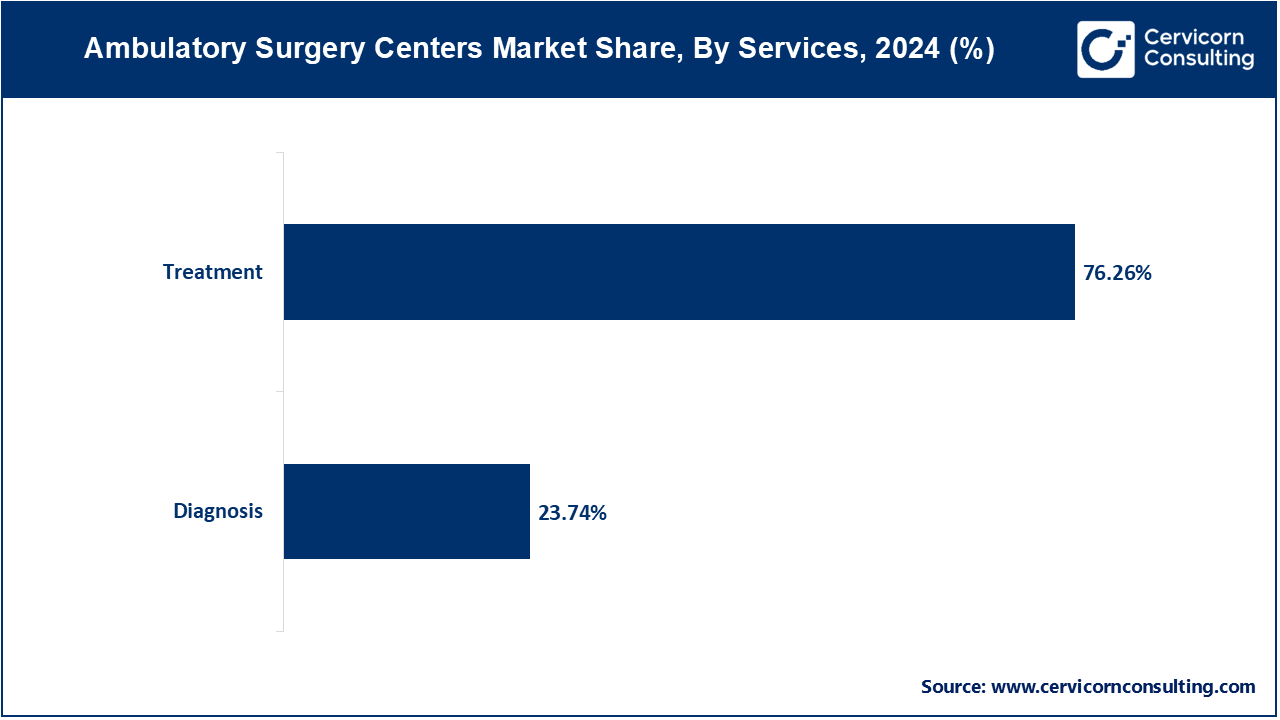

Treatment: The treatment segment has generated dominating 76.26% market share in 2024. In Ambulatory Surgery Centers (ASCs), treatment services encompass a range of outpatient surgical procedures, including orthopedic, ophthalmic, and gastroenterological interventions. The trend is toward minimally invasive techniques that reduce recovery time and costs. Advances in surgical technology and techniques, such as robotic-assisted surgeries, are enhancing the efficacy and scope of treatments available in ASCs, making them a preferred choice for many patients.

Diagnosis: In 2023 the diagnosis services has covered market share of 23.74% in 2024. Diagnosis services in ASCs include pre-operative assessments and imaging procedures essential for accurate surgical planning. Trends indicate a growing integration of advanced diagnostic technologies, such as high-resolution imaging and molecular diagnostics, to improve pre-surgical evaluations. Enhanced diagnostic capabilities within ASCs contribute to better patient outcomes and more efficient care, supporting the shift towards outpatient surgical services.

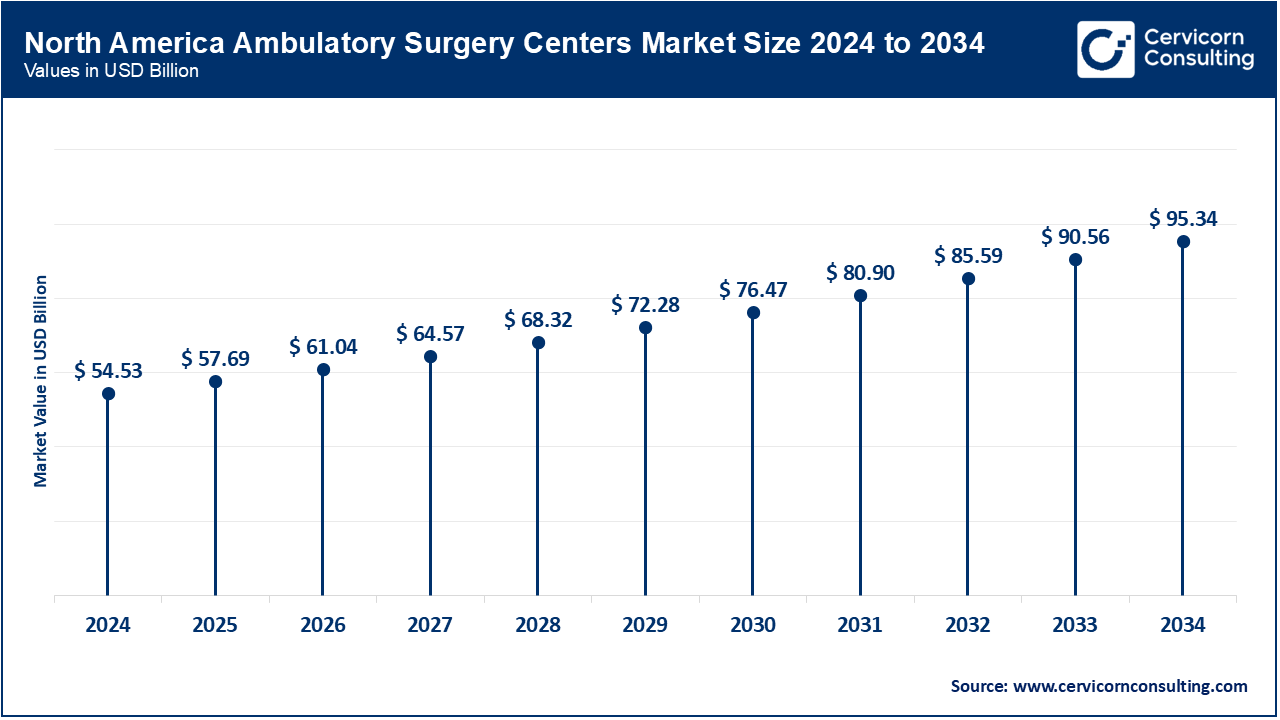

In North America, the Ambulatory Surgery Centers (ASCs) market is experiencing robust growth driven by increasing patient preference for outpatient procedures due to cost-effectiveness and shorter recovery times. The North America market size is expected to reach around USD 95.34 billion by 2034 increasing from USD 54.53 billion in 2024 with a CAGR of 5.81%. The region also sees a high adoption of advanced technologies and surgical techniques. Moreover, the shift towards value-based care and bundled payment models is encouraging the expansion and integration of ASCs within larger healthcare networks.

The Asia-Pacific region is witnessing rapid growth in ASCs due to rising healthcare demand, increasing disposable incomes, and expanding healthcare infrastructure. The Asia Pacific market size is calculated at USD 27.45 billion in 2024 and is projected to grow around USD 47.99 billion by 2034 with a CAGR of 5.87%. There is a significant trend towards adopting advanced medical technologies and enhancing the scope of outpatient services. Additionally, governments in the region are investing in healthcare reforms that support the growth of ASCs.

In Europe, ASCs are expanding as a result of growing government support for outpatient care to reduce healthcare costs and improve patient accessibility. The Europe market size is measured at USD 37.67 billion in 2024 and is expected to grow around USD 65.86 billion by 2034 with a CAGR of 5.83%. The trend includes an increase in partnerships between ASCs and hospitals, and a focus on standardizing regulations and accreditation processes across countries to streamline operations and enhance service quality.

The LAMEA market size is forecasted to reach around USD 22.21 billion by 2034 from USD 12.71 billion in 2024 with a CAGR of 5.76%. In the LAMEA(Latin America, Middle East, and Africa) region, the ASC market is growing slowly but steadily, driven by rising healthcare access and demand for outpatient services. There is a notable trend towards improving healthcare infrastructure and increasing private investment in ASCs. Challenges such as regulatory inconsistencies and limited healthcare funding are being addressed to support market growth and development.

Emerging entrants like HealthDrive and Nueterra Capital are adopting innovative models, focusing on integrating advanced technologies and expanding service offerings to differentiate themselves in the ASC market. Their emphasis on technology-driven solutions and strategic partnerships is helping them gain a foothold. Surgery Partners, Inc. and United Surgical Partners International, Inc. dominate the market by leveraging their extensive networks of centers and comprehensive service portfolios. They maintain their leadership through large-scale operations, advanced surgical technologies, and strong relationships with healthcare networks and insurance providers.

Market Segmentation

By Application

By Ownership

By Center Type

By Services

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Ambulatory Surgery Centers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.2.2 By Ownership Overview

2.2.3 By Center Type Overview

2.2.4 By Services Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Ambulatory Surgery Centers Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Physician Involvement and Ownership

4.1.1.2 Growth in Elective Surgeries

4.1.2 Market Restraints

4.1.2.1 Regulatory and Accreditation Challenges

4.1.2.2 Limited Complex Procedure Capabilities

4.1.3 Market Opportunity

4.1.3.1 Partnerships with Hospitals and Healthcare Networks

4.1.3.2 Adoption of Advanced Technologies

4.1.4 Market Challenges

4.1.4.1 Competition with Hospitals

4.1.4.2 Insurance Reimbursement Issues

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Ambulatory Surgery Centers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Ambulatory Surgery Centers Market, By Application

6.1 Global Ambulatory Surgery Centers Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Orthopedics

6.1.1.2 Pain Management/Spinal Injections

6.1.1.3 Gastroenterology

6.1.1.4 Ophthalmology

6.1.1.5 Plastic Surgery

6.1.1.6 Otolaryngology

6.1.1.7 Obstetrics/Gynecology

6.1.1.8 Dental

6.1.1.9 Podiatry

6.1.1.10 Others

Chapter 7 Ambulatory Surgery Centers Market, By Ownership

7.1 Global Ambulatory Surgery Centers Market Snapshot, By Ownership

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Physician Owned

7.1.1.2 Hospital Owned

7.1.1.3 Corporate Owned

7.1.1.4 Others

Chapter 8 Ambulatory Surgery Centers Market, By Center Type

8.1 Global Ambulatory Surgery Centers Market Snapshot, By Center Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Single-Specialty

8.1.1.2 Multi-Specialty

Chapter 9 Ambulatory Surgery Centers Market, By Services

9.1 Global Ambulatory Surgery Centers Market Snapshot, By Services

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Treatment

9.1.1.2 Diagnosis

Chapter 10 Ambulatory Surgery Centers Market, By Region

10.1 Overview

10.2 Ambulatory Surgery Centers Market Revenue Share, By Region 2024 (%)

10.3 Global Ambulatory Surgery Centers Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Ambulatory Surgery Centers Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Ambulatory Surgery Centers Market, By Country

10.5.4 UK

10.5.4.1 UK Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Ambulatory Surgery Centers Market, By Country

10.6.4 China

10.6.4.1 China Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Ambulatory Surgery Centers Market, By Country

10.7.4 GCC

10.7.4.1 GCC Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Surgery Partners, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Envision Healthcare Corporation

12.3 United Surgical Partners International, Inc.

12.4 HCA Healthcare, Inc.

12.5 Ambulatory Surgical Centers of America, Inc.

12.6 Tenet Healthcare Corporation

12.7 Mednax, Inc.

12.8 HealthDrive

12.9 Nueterra Capital

12.10 Beverly Hills Physicians