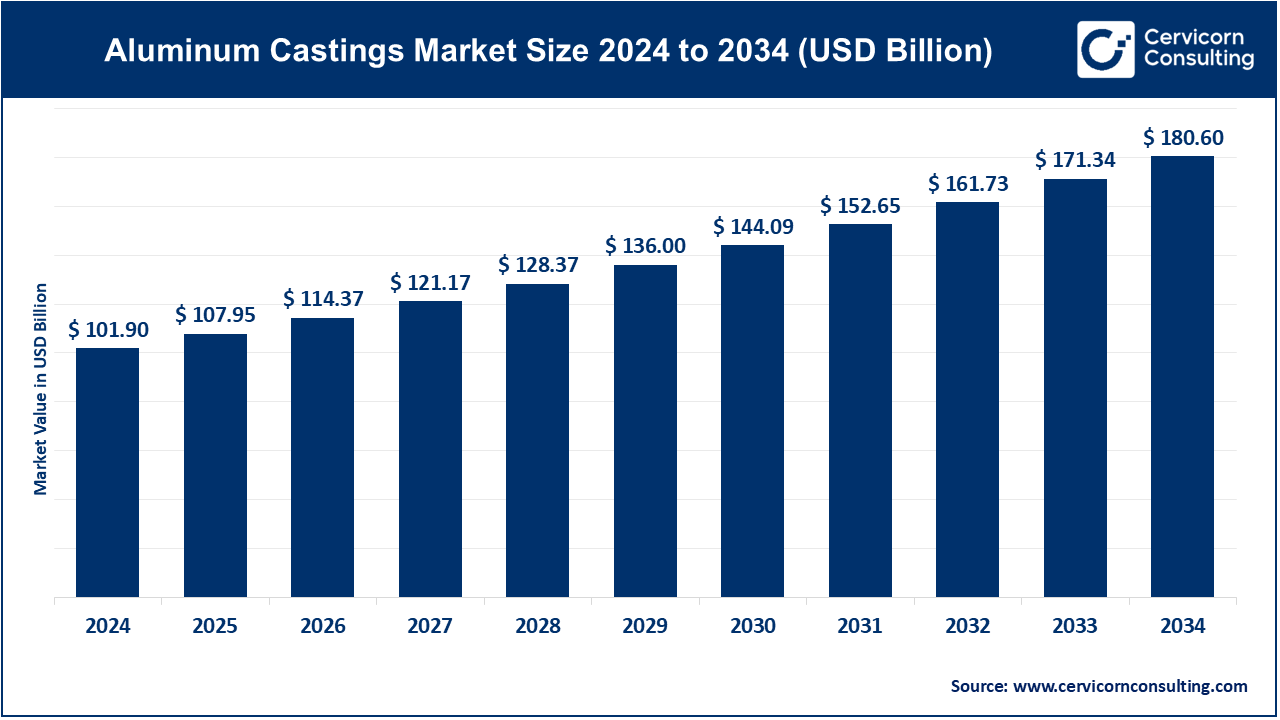

The global aluminum castings market size was reported for USD 101.90 billion in 2024 and is estimated to reach around USD 180.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.89% from 2025 to 2034.

The aluminum casting market has been experiencing steady growth, driven by increasing demand from various industries, particularly automotive, aerospace, and construction. The shift toward lightweight and fuel-efficient vehicles has significantly boosted the automotive sector’s use of aluminum castings. Furthermore, the growing trend of electric vehicles (EVs) and hybrid vehicles is creating new opportunities for aluminum casting manufacturers. As these vehicles require lighter components to enhance efficiency, the need for aluminum castings continues to rise. Additionally, the demand for aluminum castings in the aerospace industry is also growing due to the material’s lightweight properties and its ability to withstand extreme conditions. Moreover, the expanding construction sector in emerging economies is also contributing to the increased demand for aluminum castings in building materials, machinery, and infrastructure projects. In 2023, India exported aluminum castings valued at USD 448.32 million, totaling 46,997,400 kg. Major export destinations included the United States (USD 206.24 million), Germany (USD 50.40 million), and the United Kingdom (USD 25.35 million).

Aluminum casting is the process of pouring molten aluminum into a mold to create specific shapes, typically used for manufacturing parts or products. This process allows aluminum to be molded into intricate shapes and is highly effective for producing components like engine blocks, wheels, and housings. Aluminum casting can be done using different techniques such as sand casting, die casting, and permanent mold casting. The process starts with melting aluminum at high temperatures, after which it is poured into a mold. Once the molten metal cools, it solidifies into the desired shape. Aluminum castings are widely used because of aluminum's lightweight, corrosion resistance, and good thermal and electrical conductivity properties. These characteristics make aluminum castings ideal for industries like automotive, aerospace, and electronics.

Report Scope

| Area of Focus | Details |

| Estimated Market Size (2025) | USD 107.95 Billion |

| Projected Market Size (2034) | USD 180.60 Billion |

| Expected CAR 2025 to 2034 | 5.89% |

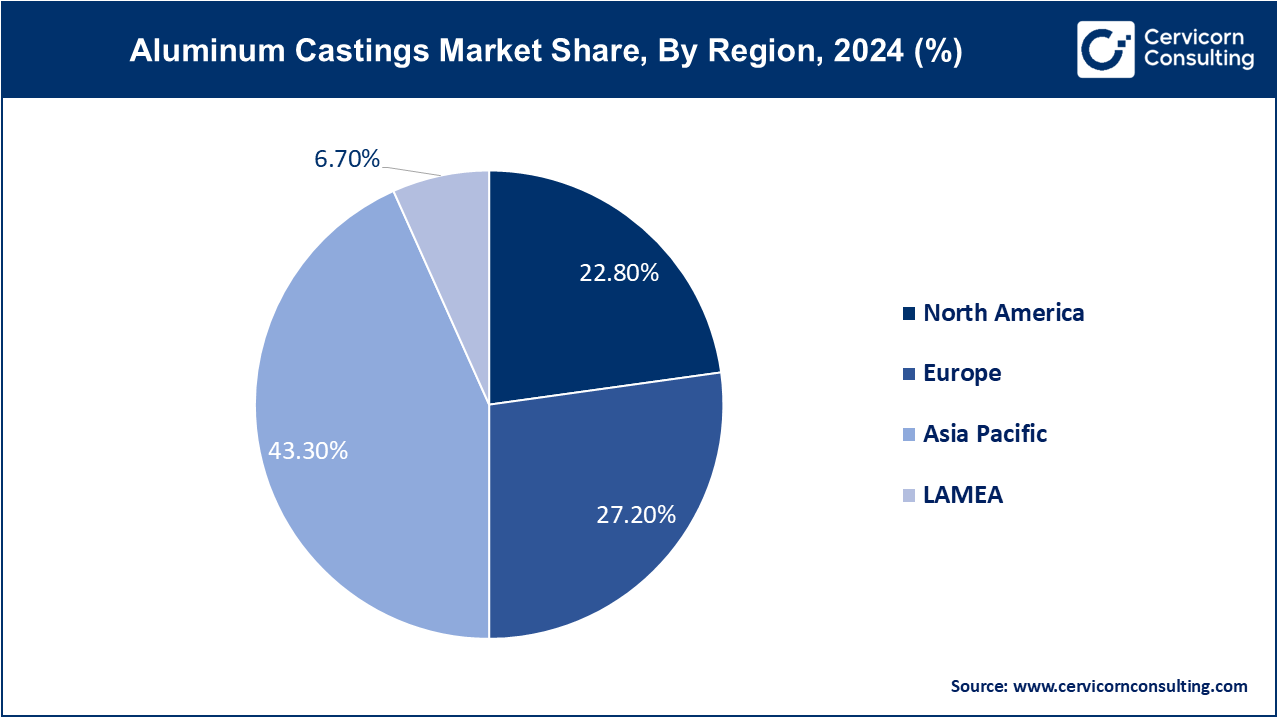

| Largest Revenue Holder | Asia Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Casting Process, Application, End Users, Regions |

| Top Companies | Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, Nemak S.A.B. de C.V., Dynacast, Endurance Technologies Ltd., Gibbs Die Casting Corporation, Ryobi Limited, Consolidated Metco, Inc. (ConMet) and Shiloh Industries, Inc. |

Increased Funding and Investment

Workplace Flexibility and Adaptability

Economic Volatility

Regulatory and Compliance Challenges

Emerging Technologies

Growing Awareness and Education

Supply Chain Disruptions

Skilled Labor Shortages

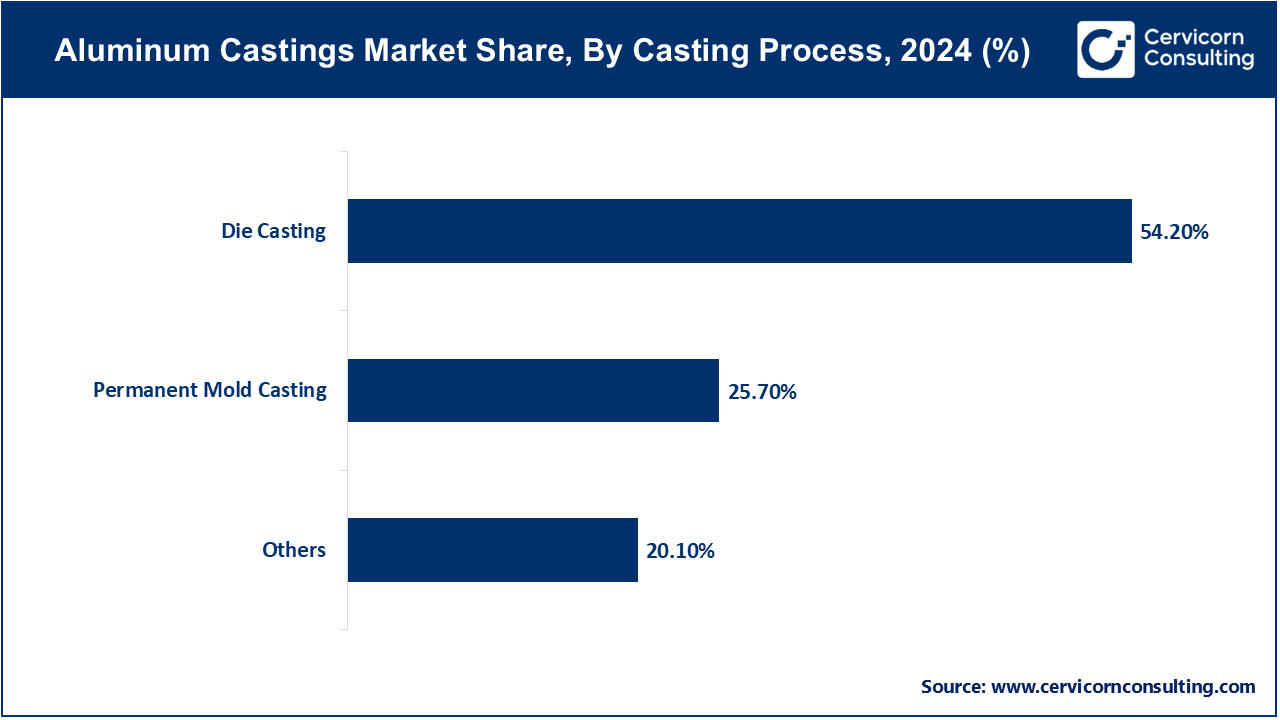

Die Casting: Die casting is a widely used process in the market, favored for its ability to produce high-volume, precision components. This process is particularly dominant in the automotive and aerospace industries due to its efficiency and the excellent surface finish it provides.

Permanent Mold Casting: Permanent mold casting involves reusable molds and is known for producing high-strength aluminium parts with a fine-grain structure. This method is commonly used in manufacturing components that require durability and resistance to wear, such as in the transportation and heavy machinery sectors.

Sand Casting: Sand casting is versatile and widely used for producing large, complex aluminium components. It is a cost-effective method for low to medium production runs and is prevalent in industries like construction, heavy equipment manufacturing, and general engineering.

Investment Casting: Investment casting, also known as precision casting, is used for producing intricate components with high dimensional accuracy. This process is particularly important in aerospace, defence, and medical sectors where precision is crucial.

Automotive Components: Aluminum casting are extensively used in the automotive industry for engine blocks, transmission housings, wheels, and other critical components. The demand in this segment is driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions.

Aerospace and Defence: The aerospace and defence sectors rely on aluminum casting for various applications, including aircraft structures, engine components, and military hardware. The emphasis on lightweight, high-strength materials is a key factor driving growth in this segment.

Construction and Infrastructure: Aluminum casting are used in the construction industry for structural components, windows, doors, and facades. The material's durability, corrosion resistance, and aesthetic appeal make it a preferred choice in modern architecture and infrastructure projects.

Industrial Machinery: In the industrial sector, aluminum casting are employed in the production of heavy machinery, equipment housings, and other mechanical components. The demand in this segment is driven by the need for durable, lightweight, and corrosion-resistant materials.

Automotive Industry: The automotive industry is the largest consumer of aluminum casting, utilizing them for a wide range of components to reduce vehicle weight and improve fuel efficiency. The shift towards electric vehicles (EVs) is further boosting demand in this sector.

Aerospace Industry: The aerospace industry requires aluminum casting for their lightweight, high-strength properties, which are crucial for both commercial and military aircraft. The demand for fuel-efficient and high-performance aircraft is driving growth in this segment.

Construction Industry: The construction sector uses aluminum casting for various architectural and structural applications, including building facades, frameworks, and decorative elements. The focus on sustainable and energy-efficient building practices is enhancing the demand for aluminum casting industry.

Heavy Machinery: Heavy machinery manufacturers use aluminum casting for components that require strength, durability, and resistance to corrosion. This segment covers industries like mining, agriculture, and industrial manufacturing, where robust equipment is essential.

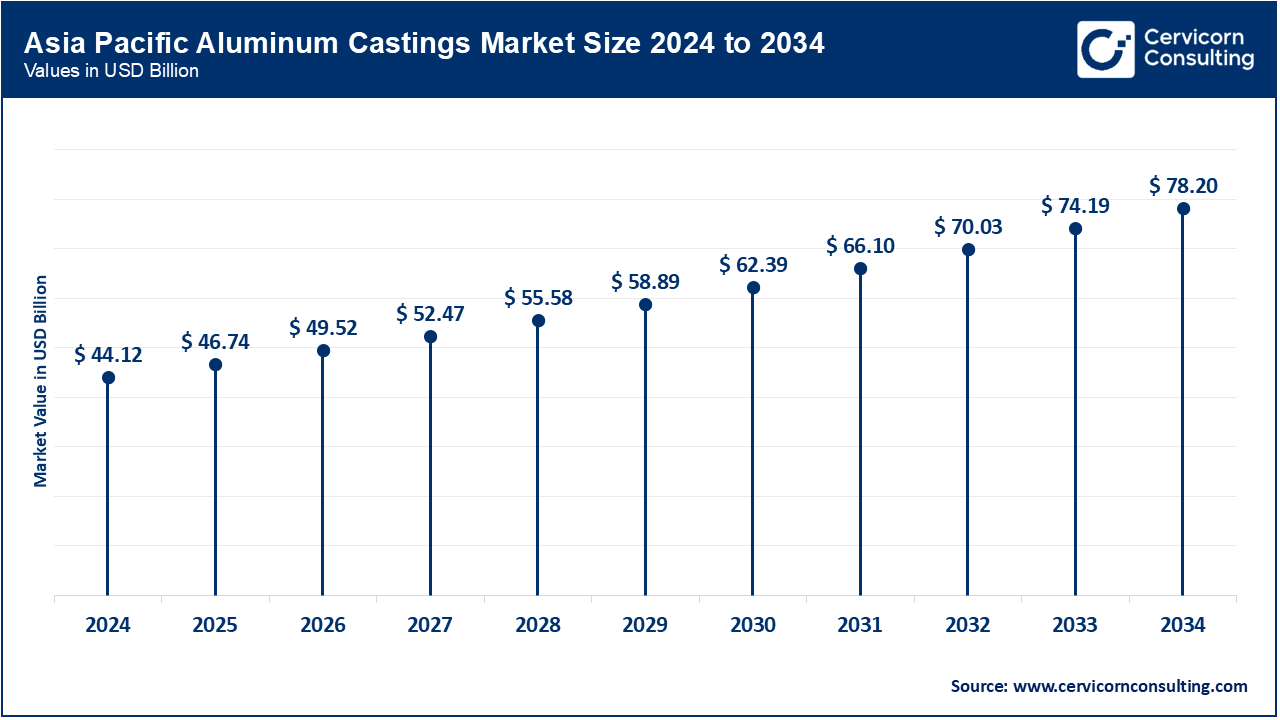

The Asia Pacific aluminum castings market size was valued at USD 44.12 billion in 2024 and is expected to reach around USD 78.2 billion by 2034, expanding at a CAGR of 6.40% from 2024 to 2033. The Asia-Pacific region is experiencing rapid growth in the aluminium casting industry, fueled by the expansion of the automotive and construction industries. Countries such as China, Japan, and India are seeing significant investments in infrastructure projects and the adoption of new manufacturing technologies. The region’s increasing focus on vehicle electrification, coupled with government initiatives to promote energy efficiency and reduce industrial emissions, is driving the demand for aluminum casting. The growing consumer base and rising disposable incomes also contribute to the market's expansion in this region.

The North America aluminum casting market size was estimated at USD 23.23 billion in 2024 and is projected to hit around USD 41.18 billion by 2034 with a CAGR of 5.50%. The North America is growing faster due to its robust automotive and aerospace industries, which are the primary consumers of aluminum casting. The U.S. and Canada are at the forefront of adopting advanced manufacturing technologies, including automation and precision casting techniques. Significant investments in lightweight automotive components, sustainable building practices, and stringent environmental regulations drive market growth. Additionally, the region's emphasis on energy-efficient solutions and reducing carbon emissions further boosts the demand for aluminum casting in various industrial applications.

The Europe aluminum casting market size was valued at USD 27.72 billion in 2024 and is predicted to surpass around USD 49.12 billion by 2034, growing at a CAGR of 5.70% from 2024 to 2033. Europe is driven by strong automotive, aerospace, and industrial sectors. The region’s focus on reducing vehicle emissions and improving fuel efficiency has led to a higher demand for lightweight aluminium components. Countries like Germany, the UK, and France are leaders in integrating advanced manufacturing technologies, such as high-pressure die casting, to produce complex and high-quality aluminium parts. Government initiatives promoting sustainability and circular economy practices, along with expanded infrastructure projects, are key factors supporting market growth in Europe.

The Latin America, the Middle East, and Africa (LAMEA) aluminum castings market size was exhibited at USD 6.83 billion in 2024 and is projected to be worth around USD 12.10 billion by 2034 with a CAGR of 4.20% from 2024 to 2033. The Latin America, the Middle East, and Africa (LAMEA) are expanding due to increased awareness of lightweight and sustainable materials. In Latin America, the market growth is driven by modernization efforts in the automotive and construction sectors, with a heightened focus on improving industrial efficiency. The Middle East benefits from substantial investments in large-scale infrastructure projects and advanced manufacturing technologies, particularly in the automotive and construction industries. Although Africa faces challenges such as limited industrial infrastructure, international partnerships and funding initiatives are enhancing construction capabilities and improving access to aluminium casting technologies across the region.

Among the new players in the aluminum casting market, companies like Sundaram-Clayton Limited (SCL) are making significant strides by leveraging advanced die-casting technology to provide lightweight and high-strength aluminium components, which are crucial for automotive and aerospace applications. Endurance Technologies Ltd. focuses on enhancing sustainability by developing eco-friendly aluminum casting that reduce vehicle emissions and improve fuel efficiency.

Dominating players like Alcoa Corporation drive growth through their extensive product lines and recent innovations, including high-performance alloys for demanding applications. Norsk Hydro ASA integrates advanced technologies with its comprehensive range of aluminium products, enabling customized solutions for various industries. Innovations and collaborations, such as Endurance Technologies' new product developments and Alcoa's strategic partnerships, underscore their leadership in the evolving market.

CEO Statements

John Slaven, CEO of Vedanta Aluminium:

"I am delighted to accept the responsibility of Vice-Chairman of the International Aluminium Institute. Aluminium has already proven itself essential in the global transition to a Net Zero future. I believe the onus lies on us as global leaders of the collective industry to boost awareness of aluminium’s limitless potential and champion its applications in building a greener planet. The IAI has undertaken stellar efforts in this regard, and I look forward to working with my fellow board members and colleagues to reinforce aluminium as the definitive metal of the future."

Klaus Kleinfeld, Former CEO of Alcoa Corporation:

"Aluminum casting represent a critical component in the global drive towards lighter, more fuel-efficient vehicles and high-performance applications across industries. At Alcoa, we are committed to pushing the boundaries of aluminium casting technology, ensuring that our innovations meet the stringent demands of today's manufacturers. Our focus on sustainability and advanced manufacturing processes positions us as a leader in delivering solutions that not only enhance product performance but also contribute to a greener future."

Key players in the aluminum casting market are influential in providing a range of innovative construction solutions, including prefabrication, sustainable materials, and advanced digital technologies. Some notable examples of key developments in the market include:

These developments highlight a significant expansion in the Aluminiumcasting market through acquisitions and innovative projects aimed at enhancing sustainability, improving manufacturing efficiency, and broadening the range of product offerings for various industrial and construction applications. Companies are increasingly investing in advanced technologies and eco-friendly processes to meet the growing demand for high-quality, sustainable aluminum casting. This expansion is further supported by strategic partnerships and acquisitions that enable firms to leverage new technologies and enter new markets, ultimately driving growth and innovation within the aluminium casting industry.

Market Segmentation

By Casting Process

By Application

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Aluminum Castings

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Casting Process Overview

2.2.2 By Application Overview

2.2.3 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Aluminum Castings Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Funding and Investment

4.1.1.2 Workplace Flexibility and Adaptability

4.1.2 Market Restraints

4.1.2.1 Economic Volatility

4.1.2.2 Regulatory and Compliance Challenges

4.1.3 Market Opportunity

4.1.3.1 Emerging Technologies

4.1.3.2 Growing Awareness and Education

4.1.4 Market Challenges

4.1.4.1 Supply Chain Disruptions

4.1.4.2 Skilled Labor Shortages

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Aluminum Castings Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Aluminum Castings Market, By Casting Process

6.1 Global Aluminum Castings Market Snapshot, By Casting Process

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Die Casting

6.1.1.2 Permanent Mold Casting

6.1.1.3 Sand Casting

6.1.1.4 Investment Casting

Chapter 7 Aluminum Castings Market, By Application

7.1 Global Aluminum Castings Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Automotive Components

7.1.1.2 Aerospace and Defense

7.1.1.3 Construction and Infrastructure

7.1.1.4 Industrial Machinery

Chapter 8 Aluminum Castings Market, By End-Users

8.1 Global Aluminum Castings Market Snapshot, By End-Users

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Automotive Industry

8.1.1.2 Aerospace Industry

8.1.1.3 Construction Industry

8.1.1.4 Heavy Machinery

Chapter 9 Aluminum Castings Market, By Region

9.1 Overview

9.2 Aluminum Castings Market Revenue Share, By Region 2024 (%)

9.3 Global Aluminum Castings Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Aluminum Castings Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Aluminum Castings Market, By Country

9.5.4 UK

9.5.4.1 UK Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Aluminum Castings Market, By Country

9.6.4 China

9.6.4.1 China Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Aluminum Castings Market, By Country

9.7.4 GCC

9.7.4.1 GCC Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Aluminum Castings Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Alcoa Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Rio Tinto

11.3 Norsk Hydro ASA

11.4 Nemak S.A.B. de C.V.

11.5 Dynacast

11.6 Endurance Technologies Ltd.

11.7 Gibbs Die Casting Corporation

11.8 Ryobi Limited

11.9 Consolidated Metco, Inc. (ConMet)

11.10 Shiloh Industries, Inc.