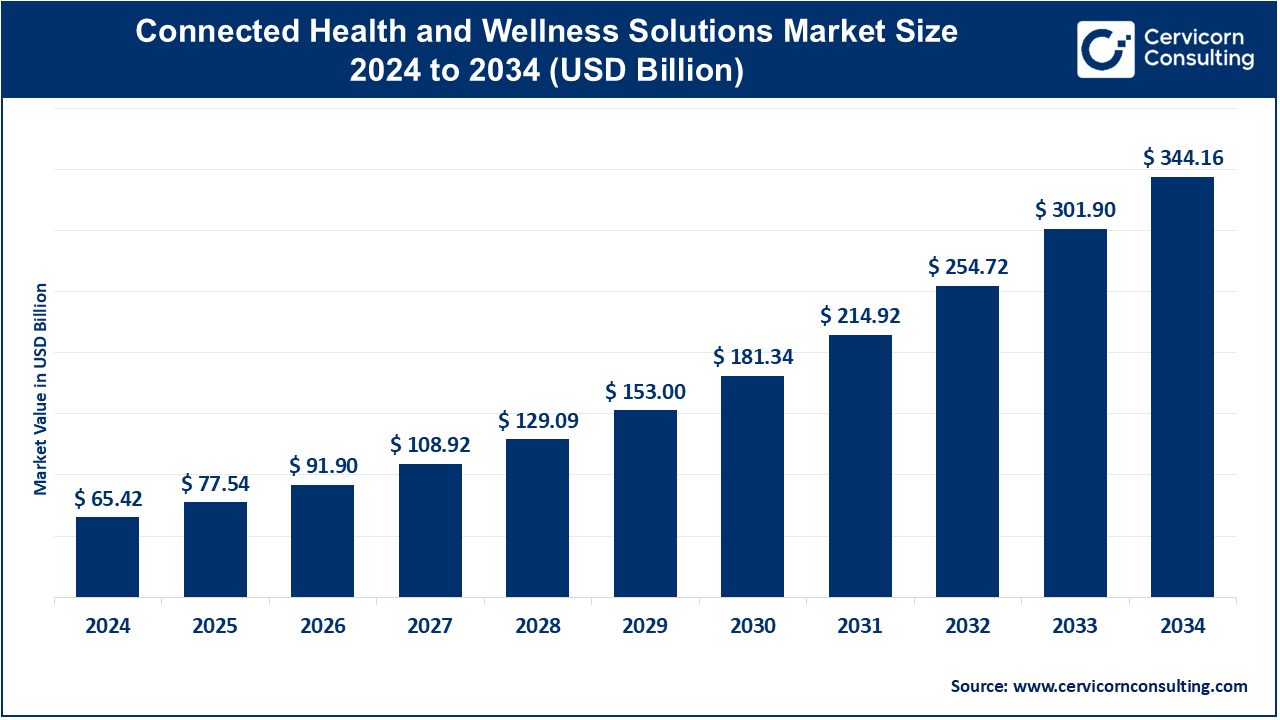

The global connected health and wellness solutions market size was valued at USD 65.42 billion in 2024 and is expected to hit around USD 344.16 billion by 2034, growing at a CAGR of 18.06% from 2025 to 2034.

The connected health and wellness solutions market has seen significant growth due to the increasing adoption of wearable technology, a growing focus on preventative healthcare, and the rising demand for personalized health services. As consumers become more aware of their health and wellness needs, the demand for digital health solutions, especially those that provide real-time monitoring and easy access to health data, has surged. The pandemic further accelerated the growth of this market, as telemedicine and remote monitoring became essential for healthcare delivery. The global connected health market is expected to continue its robust growth, driven by advancements in Internet of Things (IoT) technology, artificial intelligence (AI), and data analytics. These innovations are enhancing the capabilities of health devices, improving diagnosis, and optimizing treatment plans. In recent, Zoe, the UK-based wellness start-up received a USD 15 million investment from Coefficient Capital to expand its personalized nutrition app into the U.S. market.

Connected health and wellness solutions refer to digital technologies and services that integrate healthcare, fitness, and wellness data to improve an individual's overall health. These solutions typically involve wearable devices like fitness trackers, smartwatches, and mobile apps that monitor vital signs, physical activity, sleep, and other health metrics. These devices connect to the cloud, allowing individuals and healthcare professionals to access real-time data, track progress, and manage health conditions. Connected health solutions can also involve telemedicine, virtual health consultations, and digital therapy programs, enabling patients to receive care remotely.

The Connected healthcare market is seeing a rapid growth due to several significant factors associated with the digital transformation involved:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 77.54 Billion |

| Projected Market Size (2034) | USD 344.16 Billion |

| Growth Rate (2025 to 2034) | 18.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Technology, Application, End User, Region |

| Key Companies | Apple Inc., Google (Alphabet Inc.), Samsung Electronics, Fitbit, Philips Healthcare, Omron Healthcare, Medtronic, Cerner Corporation, IBM Watson Health, Microsoft Corporation, Qualcomm Life, Athenahealth, Allscripts Healthcare Solutions, Teleflex Incorporated, DarioHealth Corp. |

The connected health and wellness solutions market is segmented into product, technology, application, end-user, and region. Based on product, the market is classified into personal medical devices, wellness products, and software & services. Based on technology, the market is classified into telehealth solutions, wearable devices, mobile health (mHealth) applications, and artificial intelligence and data analytics. Based on application, the market is classified into chronic disease management, fitness and wellness, mental health, and preventive healthcare. Based on end-user, the market is classified into healthcare providers, patients and consumers.

Telehealth Solutions: Telehealth solutions are also new to the face of healthcare services delivery, where patients may be given advice and treatment through consultancy by remote healthcare providers over digital platforms. Such solutions allow virtual consultations in medical care where patients need not come physically, especially from remote and under-resourced areas. The communication modes supported by these platforms include video calls, audio chats, and messaging among others in ensuring timely delivery of medical expertise to patients.

Wearable Devices: Wearable devices have really changed the nature of personal health monitoring and wellness management. Fitness trackers are probably one of the most popular wearables used to monitor physical activities, heart rate, sleep patterns, or even stress levels. Such motivating wearable devices can give people feedback in real time in terms of their everyday activity levels and health metrics. This, however, is advanced by smartwatches in that they combine advanced health monitoring capabilities with smartphone connectivity where users will enjoy such things as receipt of notifications, tracking of fitness goals and even their health through different applications.

Mobile Health (mHealth) Applications: In addition to their numerous variations, mobile health applications, commonly referred to as mHealth, are increasingly becoming vital management tools for health and chronic diseases. Health management applications help users gain access to health information, track vital metrics and schedules of medication, and monitor wellness-related goals. Users are given a platform on which to access health information and receive reminders about medication, thus leading to improved medication adherence and lifestyle changes.

Artificial Intelligence and Data Analytics: Artificial intelligence (AI) and data analytics have been integrated with connected health solutions, providing new avenues for personalized healthcare. Using large amounts of data within predictive analytics tools, the trends are identified, potential health risks foreseen, and preventive measures suggested. Health providers can start early interventions that may prevent serious health issues.

Chronic Disease Management: The connected health and wellness solutions market is one of the largest markets in chronic disease management. In this category, diabetes management solutions are at the top, which perhaps do provide equipment for the monitoring of blood sugar, guiding patients as to what they could do with this information to have a better control over their condition. Such technologies combine devices in the form of glucose monitoring devices together with mobile applications wherein alerts notify the concerned individuals of the level of variation and also recommend changes in diet.

Fitness and Wellness: Applications and devices within the fitness and wellness segment of connected health solutions are designed to help the individual reach his/her fitness goals and support a healthy lifestyle. Exercise tracking applications will allow a user to see how active they have been physically by tracking the number of steps taken, distance covered, and workout plans.

Mental Health: Related health applications for mental health are increasingly coming to the front as knowledge about the area of mental health issues continues to grow. Teletherapy platforms bring mental health professionals directly in contact with the users for remote therapy and counselling sessions. This provides increased access to help reduce the barriers that people face when helping themselves.

Preventive Healthcare: These are the reasons why, in the connected health solution, this plays an essential role in the detection of risks at an early stage. Normally, the tool for a health risk assessment is an integral service that helps evaluate certain risks of health related to a specific individual based on their lifestyle, family history, and biometric data. This is personalized advice on preventive measures.

Healthcare providers: The healthcare providers segment has captured 56% of the total revenue share in 2024. Hospitals and clinics make up the largest group of adopting connected health solutions that promote patient care while fostering efficiency in operations. Institutional health settings can reach more patients with integrated telehealth services and remote monitoring technologies if needed by patients to be accessed in any other way.

Patients and Consumers: The patients and consumers segment has accounted revenue share of 44% in 2024. Connected health solutions are emphasized through increasing awareness in patients and consumers about personal health management. Health-conscious people seek technologies that help them control their health and wellness by monitoring and self-improvement of health and wellness. These solutions provide personalized insights and tools to support lifestyle decisions.

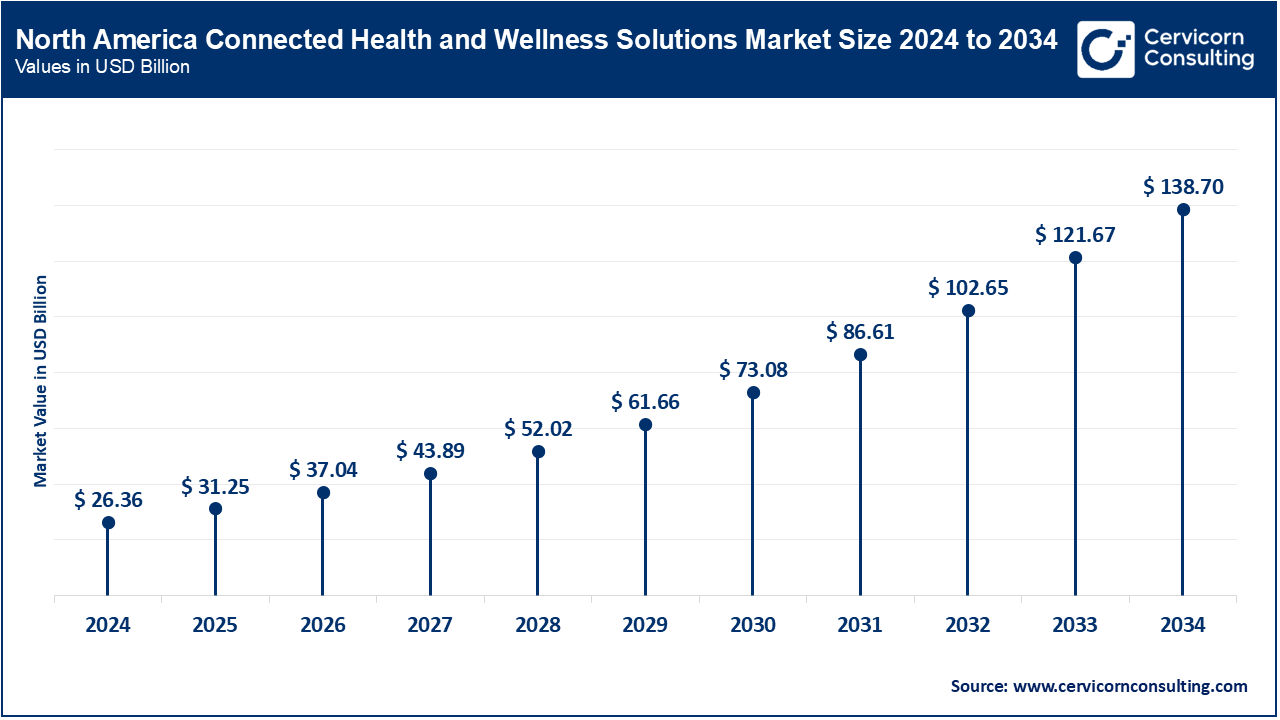

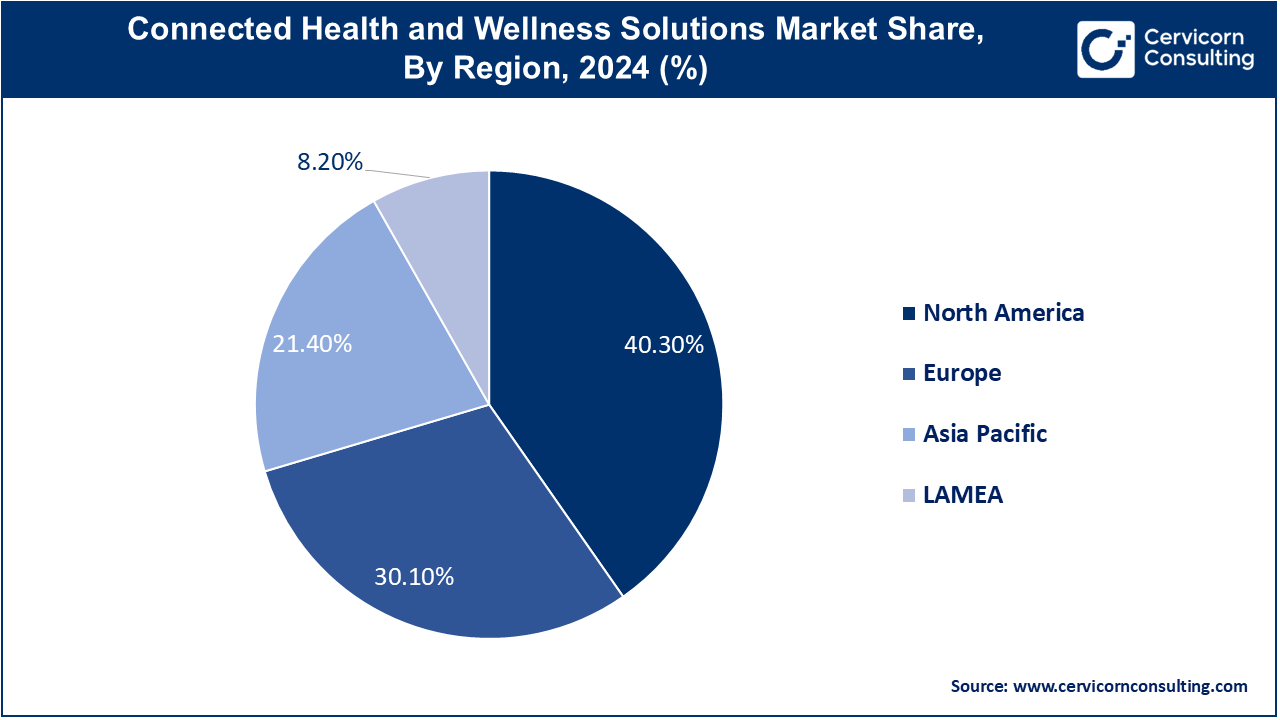

The North America connected health and wellness solutions market size was valued at USD 26.36 billion in 2024 and is projected to reach around USD 138.7 billion by 2034. It has well-developed health infrastructure and high penetration of digital health technologies. Government initiatives relating to telehealth and remote monitoring are driving its growth in this region.

The Europe connected health and wellness solutions market size was estimated at USD 19.69 billion in 2024 and is predicted to surpass around USD 103.59 billion by 2034. The Europe is growing rapidly, because there is an added emphasis put on healthcare digitization, and support from the government. Connection health solutions are key investments that have been made by countries such as Germany and the UK to enhance healthcare deliverable and improvement in patient outcome.

The Asia-Pacific connected health and wellness solutions market was valued at USD 14 billion in 2024 and is expanding to USD 75.65 billion by 2034. The Asia-Pacific region is expected to see healthy growth, pegged primarily on the trend of increasing healthcare expenditure and penetration of smartphones. Considering the population size and unfolding healthcare demands, China and India are turning out to be leaders in adopting connected health solutions.

The LAMEA connected health and wellness solutions market is aniticipated to reach around USD 28.22 billion by 2034, from valued at USD 5.36 billion in 2024. In Latin America, Middle East, and Africa, connected health solutions are increasingly being adopted for better healthcare access and management within the region. Emerging technologies are introduced to solve various local healthcare challenges; therefore, it can be very promising for future growth in this area of the market.

Innovation from not only emerging companies but established players is changing the scenario in healthcare and a part of this market. There are quite several notable emerging players such as Zebra Medical Vision, DarioHealth employing complex technologies, for instance, AI and ML, to manage health delivery issues, patient engagement, among others. Zebra Medical Vision offers high-end imaging analytics. It will help clinicians diagnose diseases at an early stage and increase the accuracy of diagnosis. DarioHealth focuses on digital therapeutics, which provides a personalized health management solution for improving patient control over chronic conditions.

Traditional leaders Philips Healthcare and IBM Watson Health retain their position due to strong research and development activities. Philips Healthcare is enhancing the monitoring of patients and real-time data analysis with connected devices and telehealth platforms without any hiccup. IBM Watson Health is leveraging the potential of AI and big data to provide actionable insights to its users, thereby empowering them towards more informed decision-making. Together, these players are driving the digital transformation in health care and promoting innovative solutions that enhance patient outcomes and streamline health care management.

CEO Statements

Robert Morcos, founder and CEO of Social Mobile:

"We are excited to work with KORE to showcase our combined solutions at the HLTH tradeshow,". "Together, we're addressing the critical needs of the healthcare industry with purpose-built mobile devices and seamless connectivity, enabling advancements in remote patient monitoring and clinical trials. Our collaboration underscores a shared commitment to innovation and improving patient outcomes through cutting-edge technology."

KORE President and CEO, Ronald Totton,

"People have always been at the heart of what we do at KORE, and the company is proud to blaze the trail when it comes to improving patient outcomes. KORE's connectivity, combined with healthcare-specific solutions made by Social Mobile, helps patients get better, more accessible care. We're excited to continue enabling innovative Connected Health solutions for our customers."

Strategic Launches and Expansions highlight the rapid advancements and collaborative efforts in the market. Industry players are involved in various aspects of Connected Health and Wellness Solutions, including technology, component, and AI, play a significant role in advancing the market. Some notable examples of key developments in the market include:

Market Segmentation

By Product

By Technology

By Application

By End-User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Connected Health and Wellness Solutions

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End-User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Connected Health and Wellness Solutions Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Adoption of Digital Health Solutions

4.1.1.2 Healthcare Cost Trimming

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Issues

4.1.2.2 Diverse Regulatory Environment

4.1.3 Market Opportunity

4.1.3.1 Growing Markets

4.1.3.2 Personalized Medicine

4.1.4 Market Challenges

4.1.4.1 Legacy System Integration

4.1.4.2 User Engagement

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Connected Health and Wellness Solutions Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Connected Health and Wellness Solutions Market, By Product

6.1 Global Connected Health and Wellness Solutions Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Personal Medical Devices

6.1.1.2 Wellness Products

6.1.1.3 Software & Services

Chapter 7 Connected Health and Wellness Solutions Market, By Technology

7.1 Global Connected Health and Wellness Solutions Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Telehealth Solutions

7.1.1.2 Wearable Devices

7.1.1.3 Mobile Health (mHealth) Applications

7.1.1.4 Artificial Intelligence and Data Analytics

Chapter 8 Connected Health and Wellness Solutions Market, By Application

8.1 Global Connected Health and Wellness Solutions Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Chronic Disease Management

8.1.1.2 Fitness and Wellness

8.1.1.3 Mental Health

8.1.1.4 Preventive Healthcare

Chapter 9 Connected Health and Wellness Solutions Market, By End-User

9.1 Global Connected Health and Wellness Solutions Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare providers

9.1.1.2 Patients and Consumers

Chapter 10 Connected Health and Wellness Solutions Market, By Region

10.1 Overview

10.2 Connected Health and Wellness Solutions Market Revenue Share, By Region 2024 (%)

10.3 Global Connected Health and Wellness Solutions Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Connected Health and Wellness Solutions Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Connected Health and Wellness Solutions Market, By Country

10.5.4 UK

10.5.4.1 UK Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Connected Health and Wellness Solutions Market, By Country

10.6.4 China

10.6.4.1 China Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Connected Health and Wellness Solutions Market, By Country

10.7.4 GCC

10.7.4.1 GCC Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Connected Health and Wellness Solutions Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Apple Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Google (Alphabet Inc.)

12.3 Samsung Electronics

12.4 Fitbit

12.5 Philips Healthcare

12.6 Omron Healthcare

12.7 Medtronic

12.8 Cerner Corporation

12.9 IBM Watson Health

12.10 Microsoft Corporation