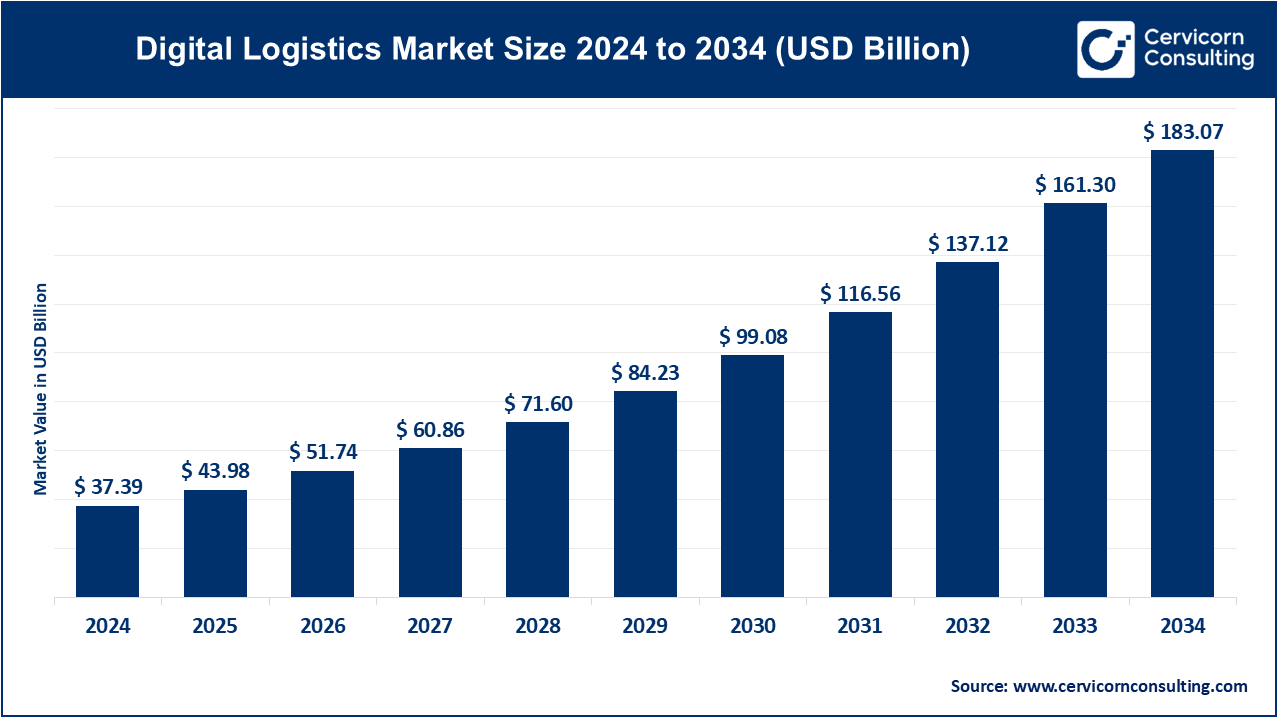

The global digital logistics market size was valued at USD 37.39 billion in 2024 and is expected to be worth around USD 183.07 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 17.21% from 2025 to 2034.

The digital logistics market has been experiencing rapid growth due to the increasing demand for efficient and transparent supply chain solutions. Companies across various industries are adopting digital technologies to streamline their logistics operations, reduce delays, and improve cost efficiency. With the rise of e-commerce and the need for faster delivery times, digital logistics plays a crucial role in meeting consumer expectations. Moreover, the global push towards sustainability is encouraging businesses to adopt more eco-friendly and efficient logistics practices, further fueling the growth of digital logistics solutions. As of recent years, the digital logistics market is projected to continue expanding. Innovations such as AI, blockchain, and automation technologies are further transforming the logistics landscape, enabling predictive analytics, real-time tracking, and enhanced route optimization. The surge in e-commerce has been a significant driver for digital logistics, with business e-commerce sales growing nearly 60% from 2016 to 2022.

Digital logistics refers to the use of technology to improve and optimize the management of supply chains and logistics operations. It involves integrating digital tools such as software, data analytics, automation, and the Internet of Things (IoT) to streamline processes like inventory management, transportation, warehousing, and delivery tracking. By utilizing technologies such as cloud computing and artificial intelligence, digital logistics aims to reduce operational costs, enhance efficiency, and provide real-time visibility into the movement of goods. This allows businesses to make data-driven decisions and improve customer satisfaction through faster and more reliable services.

According to an article titled “Digital Transformation in Logistics Statistics: Revolutionizing Operations and Customer Experience” published in WifiTalents, statistics show a meteoric rise in digital usage and future-oriented strategies. The industry is moving towards a future where the supply chain will be ruled by bytes and bots.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 43.98 Billion |

| ProjectedMarket Size (2034) | USD 183.07 Billion |

| Growth Rate (2025 to 2034) | 17.21% |

| Dominating Region in 2024 | North America |

| Fastest Growing Region in 2024 | Asia-Pacific |

| Key Segments | Component, Application, Organization Size, Deployment Mode, End User, Region |

| Key Companies | Bosch Inc., SAP SE, Infosys, ORBCOMM, Tech Mahindra, Oracle Corporation, HighJump Software Inc., HCL Technologies, Honeywell International Inc., AT&T Inc., UTI Worldwide Inc.(DSV Group), IBM Corporation, Huawei Technologies Co. Ltd., C.H. Robinson Worldwide, Inc., Hexaware Technologies, DigiLogistics Technology Ltd, Samsung Group, Blue Yonder(JDA Software Group Inc.), Advantech Co., Manhattan Associates Inc., Vinculum Group |

Surging E-Commerce Industry

Growing Capabilities of Generative AI

Regulatory Compliance

Infrastructure Dependence

Growing Technological Investments

Integration of Predictive Analytics

Cybersecurity Concerns

Shortage of Skilled Professionals

The digital logistics market is segmented into component, organization size, deployment mode, application, end-users and region. Based on component, the market is classified into solution, and services. Based on organization size, the market is classified into large enterprises, and SMEs. Based on deployment mode, the market is classified into cloud, and on-premises. Based on application, the market is classified into transport management, warehouse management, workforce management, and others. Based on end-users, the market is classified into retail and consumer goods, energy and utilities, manufacturing, healthcare, automotive, and others.

Tracking and Monitoring System

Real-time tracking tools offer increased efficiency, transparency, and dependability, due to which tracking and monitoring systems have experienced a remarkable transformation. In logistics, the process of tracking the movement and state of goods using cutting-edge technologies like RFID, GPS, and Internet of Things devices is referred to as real-time tracking. Furthermore, as companies are starting to implement lean logistics and timely inventory management, the error rate has drastically dropped.

Data Management and Analytics

In terms of logistics management, the process of enhancing logistics operations through gathering, storing, organizing, analyzing, and applying data is known as data management. This covers data about customers, suppliers, warehouses, inventory, transportation, and other logistics-related topics. Data analytics is a very important tool for revolutionizing the logistics sector as it uses insights that are derived from data required for boosting customer happiness, cutting expenses, and increasing efficiency. Players in the market are evaluating both historical and current data to increase overall efficiency, optimize operations, and streamline supply chains. Through these data-driven insights, businesses can find bottlenecks, save money on transportation, cut down on delivery delays, and allocate resources properly.

Electronic Data Interchange System

Electronic Data Interchange (EDI) is a standard format protocol that minimizes the possibility of human error and enhances the efficiency of business-to-business communication. For ease of use, logistics companies rely on EDI data. Logistics companies require an effective EDI logistics software strategy for receiving an EDI quote, interacting with customers, and onboarding new trading partners. EDI software and services are at the core of efficient supply chain operations, enabling the fast and secure file transfer that promotes collaboration and increases revenue between trading partners.

Fleet Management System

Fleet management is the process within a company that aims to collect information and control all vehicles from the time of purchase to the end of their useful life. The purpose of this process is to control costs, use the fleet efficiently, and comply with applicable laws and regulations. A cloud framework helps provide a scalable infrastructure to manage data from electronic logging systems, communication devices, and vehicle sensors.

Real-time monitoring of vehicles, driver behavior, cargo, and traffic streamlines logistics while increasing asset utilization. In particular, it helps optimize freight costs and make informed procurement decisions to replace aging vehicles.

Others

The Others segment includes information-integrated systems and database management systems. A business management strategy called integrated logistics is being used more and more to boost customer service and expedite product delivery. Within this model, all departments, resources, and processes function as a cohesive, well-oiled unit. By using analytics and data aggregation, digital logistics solutions can create a networked ecosystem of interconnected technologies that facilitate process automation, deliver relevant insights in real-time, and improve customer satisfaction.

For the connection of data to different databases in logistics relational databases are used for managing different entities, including customers, shipments, transportation, and routes. It helps to facilitate operations like tracking shipments, planning the best route, and efficient resource management. Companies can henceforth easily increase operational efficiency and enhance customer service by creating databases that adhere to these specifications.

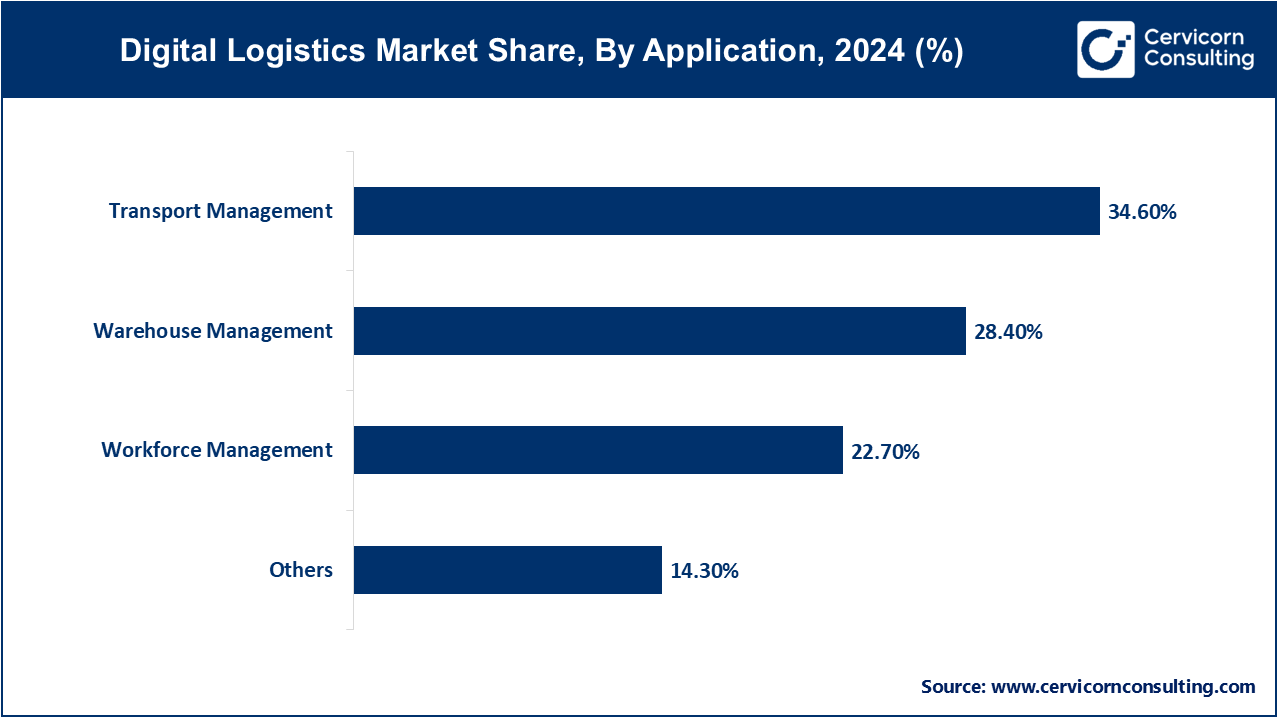

Transportation Management

The transportation management segment has held highest revenue share of 34.60% in 2024. To optimize supply chain operations, digitalization of transportation management is essential in this market as it brings together technology, data analytics, and automation. Since it directly impacts efficiency, cost, and speed, companies can improve their overall supply chain performance. Transportation needs have grown with time owing to globalization and e-commerce, making digital logistics solutions highly important for on-time delivery and effective management.

Warehouse Management

The warehouse management segment has garnered revenue share of 28.40% in 2024. Digital warehouse technology is rapidly gaining traction in the world of logistics and supply chain management. Companies can benefit from digital warehouse solutions by optimizing their processes to increase efficiency and save costs. Warehouse digitalization involves leveraging the power of data and technology to transform traditional warehouse operations, streamlining and automating manual processes such as inventory management, and order fulfillment and shipping by using new technologies such as artificial intelligence (AI), robotics, and the Internet of Things (IoT). With the advent of digital commerce and modern technology-enabled businesses, there is an increased need for smart and automated warehouses.

Workforce Management

The workforce management segment has reported revenue share of 22.70% in 2024. To make information more readily available, human resource management solution providers rely on web and mobile user interfaces and user-configurable dashboards. Gamification functionality builds on this and displays the current performance levels of individual users. Gamification, a trend in human resource management, provides real-time insights into user performance by sharing information with users so that they can adjust their performance throughout the work process.

Others

The others segment accounted for 14.30% of the revenue share in 2024. The others include security and network management. One of the main concerns in digital logistics is the security of data and systems. Since sensitive information such as shipping details, customer addresses, and financial transactions are transmitted over digital networks, protecting this data from unauthorized access is of utmost importance. Data security plays an important role in ensuring the confidentiality, integrity, and availability of data while ensuring compliance with legal and ethical standards. Implementing robust cybersecurity measures such as encryption, firewalls, and multi-factor authentication helps reduce the risk of data breaches and cyberattacks. Regular security audits and updates of software and hardware systems ensure that vulnerabilities are promptly identified and fixed, strengthening the overall security posture of logistics operations. Digital logistics networks act as global communities of freight forwarders who interact with each other according to established policies to promote their businesses and increase their business generation by connecting with other members. Joining a digital logistics network provides a suitable environment to build partnerships and share business opportunities easier and faster.

Cloud

The cloud segment has captured revenue share of 76% in 2024. Cloud-based solutions and applications are used by several organizations across the globe. They offer flexibility, the ability to scale applications, and easy management features. The increasing use of cloud services in SMEs is due to the high competition and unavailability of several resources present in large enterprises. Digital logistics solutions are integrated individually according to the needs of the business, which leads to higher customer satisfaction thanks to the cloud-based services.

On-Premises

The on-premises segment has generated revenue share of 24% in 2024. The use of on-premises deployments has increased with an on-premises strategy that allows users to monitor their site through desktops or other systems. When a program is installed on-site at the company, on-premises digital logistics solutions give users complete control or administrative access to their logistics processes.

Retail and Consumer Goods

The retail and consumer goods segment has accounted highest revenue share of 33% in 2024. The rising development of omnichannel retail and e-commerce is anticipated to drive market growth. To effectively handle intricate supply chains, that can guarantee timely customer deliveries, and enhanced inventory control, retailers specifically need efficient logistics solutions. The digital logistics tools can help retailers meet the everchanging consumer demands thereby improving operational efficiency.

Energy and Utilities

To stay competitive in the market the energy and utility sector needs to digitally transform its operations, finance, customer service, and other departments. For efficient asset management, AI-powered solutions for the energy and utilities sectors help in tracking and monitoring every asset, including workers, mobile devices, endpoints, and equipment that is located on-site. The advanced analytics and monitoring features can identify or anticipate equipment failures and plan maintenance accordingly to minimize equipment downtime. Furthermore, AI-powered applications in the utilities and energy sectors can also help in monitoring possible infringements of safety protocols and accordingly recommend suitable measures for enhancing worker safety of the employees operating in potentially hazardous circumstances. Therefore, utility and energy companies can make decisions to increase overall efficiency by using precise data.

Manufacturing

Timely completion and cost-effective production and shipping processes are essential for manufacturing companies to remain competitive. Digital manufacturing logistics solutions, including cloud, IoT, and autonomous RPA, are required to be integrated into the complex market to achieve a precise and seamless process right from order placement and tracking to last-mile delivery. Digital logistics is an important part of modern manufacturing to ensure the right arrival time of raw materials, which helps companies to correctly predict inventory levels. The data gained from such insights helps in a company's production, purchasing, and sales decisions. Digital technologies have streamlined operations such as automated assembly lines, real-time warehouse management, decreased expenses, and enhanced quality of products. Digitization has further introduced automated procedures, real-time data analytics, and cutting-edge technologies like AMRs, in the manufacturing industry that have in turn improved operational agility, product quality, and efficiency.

Healthcare

The adoption of digital logistics in healthcare is expected to increase the demand for medicines and medical devices. Digitalized logistics solutions make it easier to track equipment and supplies to increase productivity, improve communication between departments, maintain compliance, or reduce the time required for inventory checks by medical professionals. The healthcare sector can look forward to an even more efficient and patient-focused future as technology continues to evolve.

Automotive

Automotive production needs many elements to be perfectly aligned such as proactively planning resources, automating order and transport management, optimizing networks, and synchronizing internal and external processes. There is an urgent need for solutions to make automotive supply chains more resilient that help industry players intelligently manage logistics and production processes while being fast and flexible enough to compensate for fluctuations. Software solutions further enable end-to-end planning from procurement to warehousing to shipping to customers by sharing order and transport data globally, integrating suppliers and logistics partners, and managing inbound and outbound logistics at production sites.

Others

Other industries include aerospace, defense, and consumer electronics. The aerospace logistics sector is undergoing rapid changes due to the incorporation of innovative practices and state-of-the-art technology. Logistics companies are leading this transformation owing to the growing need for the efficient, dependable, and quick transportation of aerospace equipment. Since the cargo involved during transit is often of high value and sensitive, the aerospace industry prioritizes accuracy, speed, and security. The freights are becoming more efficient because of the introduction of various cutting-edge technologies like blockchain, the Internet of Things, and artificial intelligence (AI). Aerospace logistics is increasingly becoming dependent on modern warehouse management systems (WMS) and inventory management solutions. Warehouse environments are becoming more responsive and efficient due to the widespread application of IoT and AI. The technology must also function while sending and receiving data in an intermittent cyber environment.

A digital logistics system comprises an intricate network of subsystems and systems that work together to process and manage the Department of Defense (DOD) supply chain, DOD cyberinfrastructure, and DOD digital logistics supply chain systems. Each of these systems has a variety of data components that are used to monitor and control the flow of products and services. Each system contains a variety of data elements, some of which are essential to all DOD digital logistics supply chain systems. Artificial intelligence, machine learning, and distributed ledger technology—which secures data and transactions in blockchain or as a directed acyclic graph—are among the most promising technologies. Additionally, the technology needs to function in an erratic cyber environment for data transmission and reception.

Consumer electronics companies have some of the most globally distributed design, operations, and distribution channels. They contend with fluctuating demand and inventory levels, as well as inbound and outbound freight, which can lead to a lack of visibility into operations. Consumer electronics companies are leveraging modern cloud platforms, the Internet of Things, predictive intelligence, artificial intelligence, blockchain, and supply chain tools. This helps consumer electronics players optimize manual and automated warehouse flows, predict the efficiency of picking and packing flows, predict and perform equipment maintenance, correlate product quality issues with environmental factors in storage, correlate picking and packing quality errors with worker and flow factors, anticipate and monitor worker safety issues, reduce downtime, and improve overall safety, quality, and efficiency.

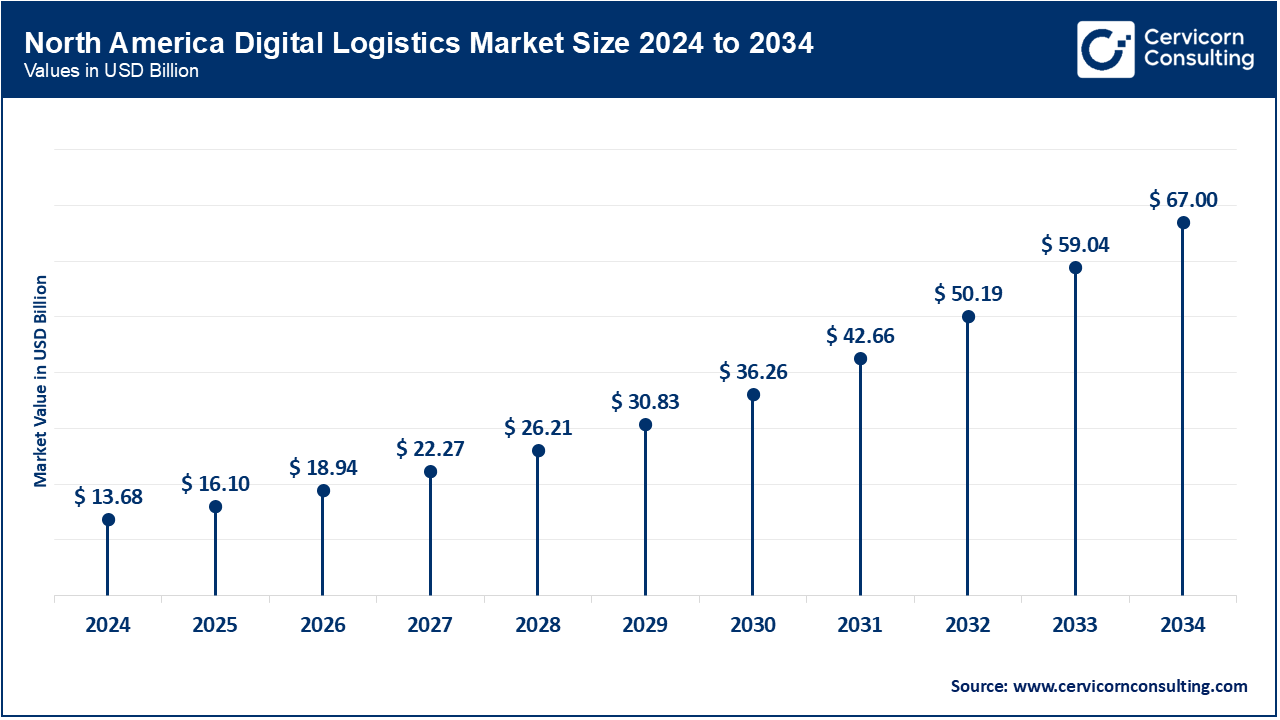

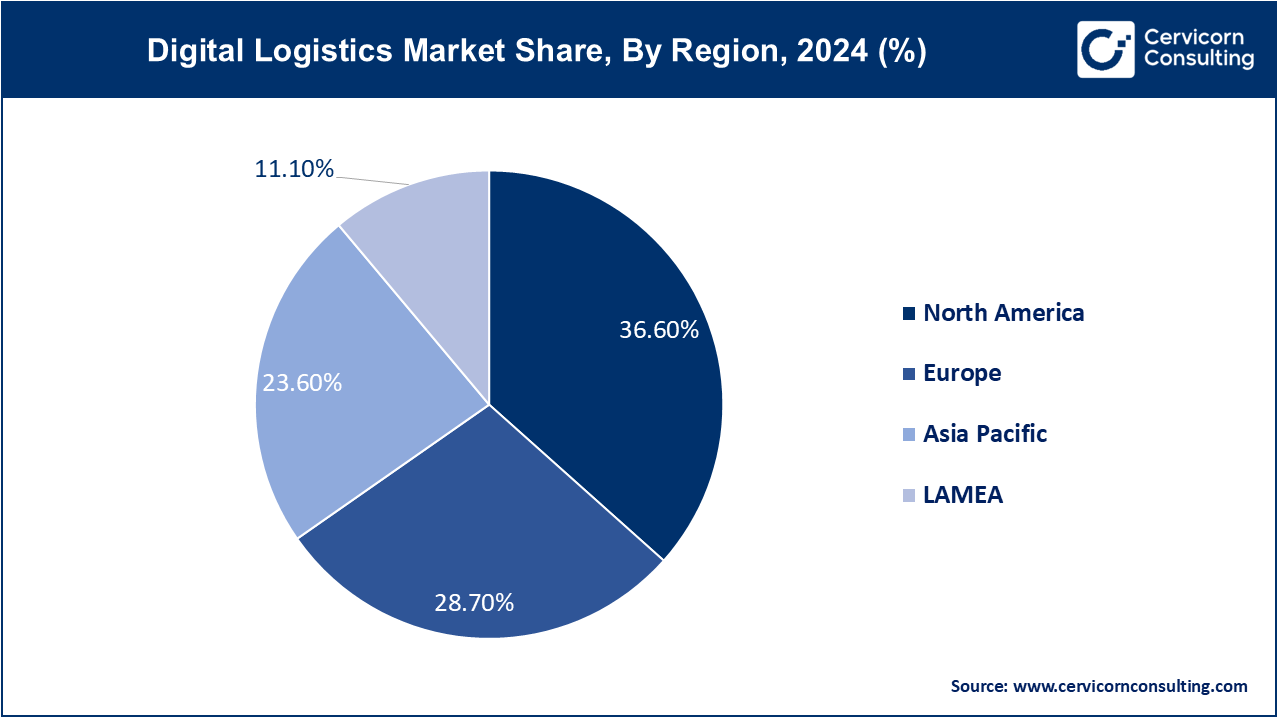

The North America digital logistics market size was estimated at USD 13.68 billion in 2024 and is expected to reach around USD 67 billion by 2034 with a CAGR of 17.40% from 2025 to 2034. The market for digital logistics in this region is further expanding because of the various government initiatives that support digital transformation across industries, which in turn also helps North America to maintain its dominance in the world.

The North American market is driven by the presence of large IT industries and growing technological advancements. Increasing use of digital systems and technologies, including radio frequency identification, electronic data interchange, and others. The U.S. and Canada are key markets where robust infrastructure and high levels of technological adoption across industries facilitate the implementation and integration of digital logistics solutions. By utilizing digital technologies like artificial intelligence (AI), the Internet of Things (IoT), and big data analytics North American businesses are increasingly optimizing warehouse operations, boosting inventory management, and expanding last-mile delivery capabilities. The region's innovation culture and benevolent regulatory environment led to the adoption of modern logistics technologies.

The Europe digital logistics market was valued at USD 10.73 billion in 2024 and is projected to hit around USD 52.54 billion by 2034. Europe mainly focuses on the number of people who are becoming more acquainted with digital logistics owing to the region's growing trend toward cloud services. The development of digital logistics is also being supported by large expenditures related to logistics infrastructure and transportation throughout the region. Companies in the region are utilizing digital logistics technologies for employing environmentally friendly logistics practices, enhancing routes, and reducing carbon emissions, all of which contribute to the EU's sustainability goals. Enhancements of ports, railways, and roads are furthermore simplifying the integration of digital technologies into logistics operations.

Market growth is being driven by countries like Germany, France, and the UK adopting advanced digital logistics at a rapid rate. Germany is a good place to expand into new markets because of its advanced industrial capabilities, strong manufacturing sector, and advantageous location in Europe. The increasing focus on Industry 4.0 principles automation and digitalization has also led to significant investments in smart logistics solutions.

The Asia-Pacific digital logistics market size was valued at USD 8.82 billion in 2024 and is expected to be worth around USD 43.2 billion by 2034, is expanding at a CAGR of 18.90% from 2025 to 2034. The main factors that are propelling the market expansion are rapid infrastructure development and urbanization. The demand for digital logistics is also rising due to the technological boom in emerging economies like China, India, and Southeast Asia. The growing adoption of digital technologies and the existence of developing countries in the region are further driving market expansion.

China's economy is growing swiftly owing to the country's developing e-commerce industry, technical developments, and government support for digital transformation. Artificial intelligence, the Internet of Things, and blockchain are a few of the technologies that China's logistics industry uses to increase supply chain visibility, optimize delivery routes, and increase operational efficiency.

Furthermore, it is anticipated that expanding government initiatives in Japan, such as the "Society 5.0" vision, will propel digital transformation and incorporate digital technologies into logistics procedures. Furthermore, to improve supply chain operations, many South Korean-based companies are also utilizing AI for demand forecasting, IoT for asset tracking, and robotics for warehouse automation.

The LAMEA digital logistics market size was accounted for USD 4.15 billion in 2024 and is antipated to hit around USD 20.32 billion by 2034. The development of cloud computing technologies that facilitate automation and digital transformation is driving the growth of the market in the LAMEA region. Demand in Latin America is driven by sustainability and modern construction techniques, while the Middle East is reaping the rewards of substantial investments in large-scale projects and cutting-edge technologies. However, although Africa lacks resources, efforts to increase access to cutting-edge technology throughout the continent are progressing owing to international collaborations and funding.

One of the emerging players in the digital logistics market is Infosys, a multinational company with headquarters in Bangalore that focuses on providing outsourcing consulting services and cutting-edge technologies to assist customers with digital transformation. In September 2023, Infosys collaborated with Economist Group's Economist Impact to create the Value Chain Navigator (VCN).

A leading company like Bosch Inc. is also propelling the market's expansion with its extensive range of products and innovations, which includes carbon-reducing solutions for commercial buildings. Maersk also hopes to accelerate its digital transformation by collaborating with Microsoft and get a foothold in this market too. With their creative solutions and calculated moves, these major players are demonstrating their leadership and impact in the developing digital logistics market.

CEO Statements

Matt Elenjickal, CEO of FourKites:

"There is no specific playbook that you can deploy when these disruptions happen. They’re all happening at different places, and the impacts they have on shipping lines and shipping routes are very different. But there are some foundational elements that could if companies can adopt them help mitigate some of these supply chain shocks."

Arvind Krishna, Chairman and CEO of IBM:

"As AI becomes a top priority, our clients are using Watsonx – IBM’s flagship AI and data platform – to help revolutionize customer service, modernize countless lines of code, and automate enterprise tasks to boost employee productivity. IBM is more capable and more productive. We have a strong portfolio and a solid foundation to support sustainable growth. And we are delivering on our promise to be the catalyst that makes the world work better."

Key players in the digital logistics industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the digital logistics market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Component

By Organization Size

By Deployment Mode

By Application

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Logistics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Organization Size Overview

2.2.3 By Deployment Mode Overview

2.2.4 By Application Overview

2.2.5 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Digital Logistics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Surging E-Commerce Industry

4.1.1.2 Growing Capabilities of Generative AI

4.1.2 Market Restraints

4.1.2.1 Regulatory Compliance

4.1.2.2 Infrastructure Dependence

4.1.3 Market Opportunity

4.1.3.1 Growing Technological Investments

4.1.3.2 Integration of Predictive Analytics

4.1.4 Market Challenges

4.1.4.1 Cybersecurity Concerns

4.1.4.2 Shortage of Skilled Professionals

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Digital Logistics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Digital Logistics Market, By Component

6.1 Global Digital Logistics Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Solution

6.1.1.2 Services

Chapter 7 Digital Logistics Market, By Organization Size

7.1 Global Digital Logistics Market Snapshot, By Organization Size

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Large Enterprises

7.1.1.2 SMEs

Chapter 8 Digital Logistics Market, By Deployment Mode

8.1 Global Digital Logistics Market Snapshot, By Deployment Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cloud

8.1.1.2 On-premises

Chapter 9 Digital Logistics Market, By Application

9.1 Global Digital Logistics Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Transport Management

9.1.1.2 Warehouse Management

9.1.1.3 Workforce Management

9.1.1.4 Others

Chapter 10 Digital Logistics Market, By End-Users

10.1 Global Digital Logistics Market Snapshot, By End-Users

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Retail And Consumer Goods

10.1.1.2 Energy And Utilities

10.1.1.3 Manufacturing

10.1.1.4 Healthcare

10.1.1.5 Automotive

10.1.1.6 Others

Chapter 11 Digital Logistics Market, By Region

11.1 Overview

11.2 Digital Logistics Market Revenue Share, By Region 2024 (%)

11.3 Global Digital Logistics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Digital Logistics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Digital Logistics Market, By Country

11.5.4 UK

11.5.4.1 UK Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Digital Logistics Market, By Country

11.6.4 China

11.6.4.1 China Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Digital Logistics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Digital Logistics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Bosch Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 SAP SE

13.3 Infosys

13.4 ORBCOMM

13.5 Tech Mahindra

13.6 Oracle Corporation

13.7 HighJump Software Inc.

13.8 HCL Technologies

13.9 Honeywell International Inc.

13.10 AT&T Inc.