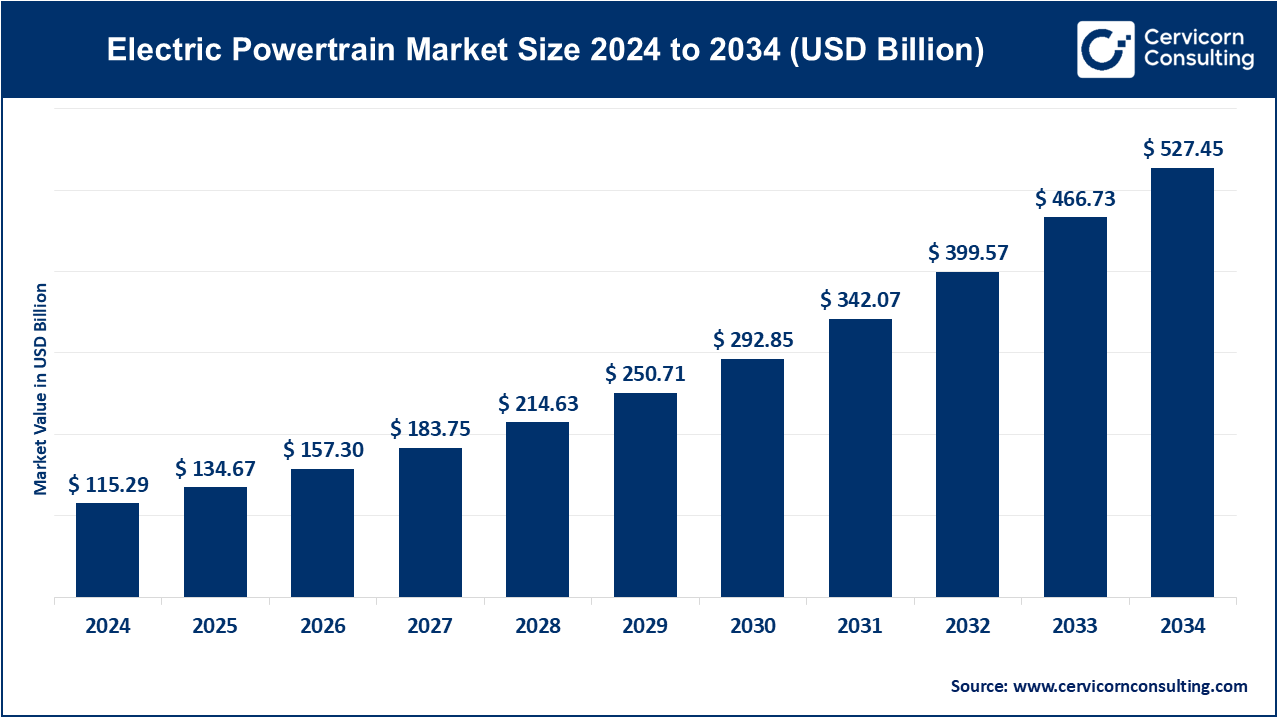

The global electric powertrain market size was valued at USD 115.29 billion in 2024 and is expected to be worth around USD 527.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 16.80% from 2025 to 2034.

The electric powertrain market has been expanding rapidly in recent years due to the increasing global demand for electric vehicles (EVs). Governments worldwide are encouraging the shift towards greener transportation by offering subsidies, incentives, and enacting stricter emissions regulations. As automakers focus on developing EVs, the adoption of electric powertrains is expected to continue growing, especially in regions like Europe and Asia-Pacific. In 2024, the market is expected to see significant growth in the electric vehicle segment, with advancements in battery technology and charging infrastructure further promoting the adoption of EVs. As more automakers make commitments to electrify their fleets, the electric powertrain market is forecasted to experience substantial growth. In 2023, China has emerged as the largest exporter of electric vehicles, with exports exceeding 1.2 million units. This marks an 80% increase from the previous year, underscoring China's pivotal role in the global EV market. The decreasing cost of batteries and improvements in charging infrastructure are key factors driving this shift. In addition to consumer demand for eco-friendly transportation, the rise in energy-efficient technologies is expected to push the market forward.

An electric powertrain refers to the system in an electric vehicle (EV) that generates and transmits power to the wheels, replacing the traditional internal combustion engine (ICE). It typically includes components like the electric motor, battery pack, power electronics, and transmission. The motor is powered by electricity stored in the battery, and the power electronics control the flow of electricity to the motor. The transmission helps regulate the motor’s speed and torque, ultimately driving the wheels. Since it doesn’t rely on gasoline or diesel, an electric powertrain offers greater energy efficiency and produces zero emissions during operation.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 134.67 Billion |

| Projected Market Size (2034) | USD 527.45 Billion |

| Growth Rate (2025 to 2034) | 16.80% |

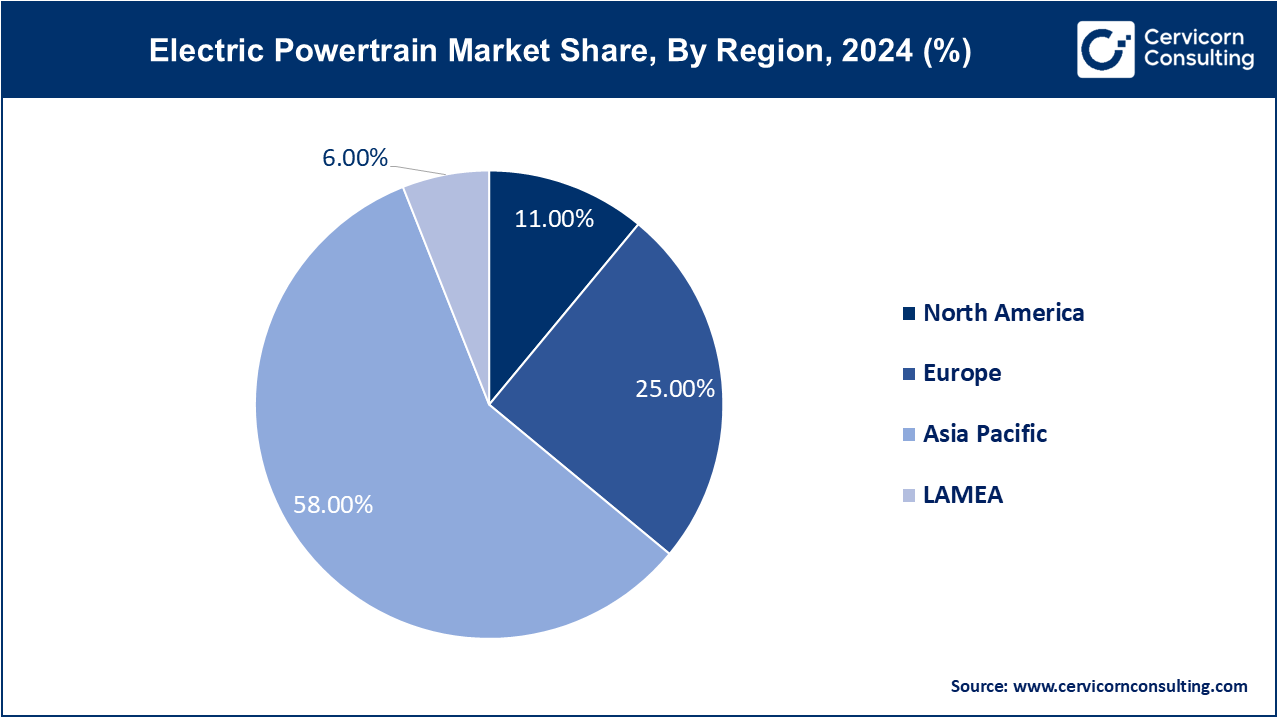

| Leading Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Type, Component, BEV Electric Powertrain By Component, FCEV Electric Powertrain By Component, Region |

| Key Companies | Mitsubishi Electric Corp, Magna International Inc., Nissan Motor Co., Ltd., Tesla Inc., Cummins Inc., Hitachi Astemo Americas, Inc., Schaeffler AG, ZF Friedrichshafen AG, BorgWarner, Hyundai Motor Company, Volkswagen, IET S.p.A., Bosch Limited, Valeo, Nidec Corporation, GKN PLC, Continental AG, Magneti Marelli Ck Holdings, Sigma Powertrain, Inc., Eaton, Delta Electronics, Inc., NXP Semiconductors |

Increased Government Support and Incentives

Growing Urbanization and Mobility

Lack of Charging Stations for EV

Fluctuating Raw Material Prices

Expansion into Emerging Markets

Use of Simulation Technology

Concerns Associated with EVs

Lack of Consumer Awareness

The electric powertrain market is segmented into type, component and region. Based on type, the market is classified into BEV, HEV, PHEV, and FCEV. Based on component, the market is classified into power electronics controller, motor/generator, converter, battery, transmission, and on-board charger.

BEV: The BEV segment is leading the electric powertrain market in 2024, accounted revenue share of 57%. The BEVs emit no emissions and hence rule the electric propulsion industry. They help abide by strict environmental regulations while reducing carbon footprints. Because BEVs are completely electric and produce no emissions, they are well-liked by customers who care about the environment. The simpler mechanical components of the BEVs and the ability to charge at home require less maintenance and operating money. As the infrastructure for charging BEVs keeps growing they are becoming a more practical option and popular vehicle type in the EV industry.

HEV: HEVs combine an internal combustion engine with an electric drivetrain, achieving improved fuel economy and performance compared to a conventional ICE vehicle.

HEVs are powered by electricity to varying degrees. Hybrid electric cars have several useful features, such as:

PHEV: PHEVs are a subclass of HEVs. They can be charged from external sources. PHEVs are ideal for short city trips as they have a driving range of 20 to 50 miles (30 to 80 km) on electricity alone. For longer trips, PHEVs can rely on gasoline or diesel. Examples of PHEVs include the Toyota Prius Prime, Chevrolet Volt, and Honda Clarity.

FCEV: The fuel cell electric vehicle (FCEV) is a fourth type of electric vehicle. Fuel cell electric vehicles (FCEVs) have a similar powertrain to electric vehicles, but use a fuel cell to generate electricity from hydrogen fuel cells instead of a battery. FCEVs are more efficient than vehicles with a traditional internal combustion engine and do not produce harmful exhaust gases, only water vapor and warm air. However, a major disadvantage of FCEVs is that hydrogen is expensive.

Battery Pack: The battery pack segment has garnered revenue share of 63% in 2024. The battery contains numerous cells (usually lithium-ion cells) that serve as the primary energy storage mechanism. Lithium-ion cells have a high energy density and can store a large amount of energy per unit volume. Fuel cells are another type of energy storage. The battery also contains a battery management system (BMS) that provides strategies that prevent overcharging or discharging to ensure the safe operation of the battery.

Power Electronics Controller: The power electronics controllers segment has accounted 13% of the total revenue share in 2024. Power electronics controllers are critical components of an electric vehicle (EV) that work together to control and convert electrical energy. The power electronics devices control and convert energy, making it available in the right form and amount when and where it is needed. Modern controllers regulate speed and acceleration through an electronic process called pulse width modulation. Switching devices such as silicon controlled rectifiers rapidly interrupt (turn on and off) the flow of current to the motor.

Motor/Generator: The motor generator segment has captured revenue share of 9% in 2024. The motor generator, in its role as a motor, provides the vehicle's electrical propulsion, while in its role as a generator, it converts mechanical braking energy into electrical energy. The need for motors is driven by the global increase in BEVs and HEVs. The electric motors/generators in these cars may be configured similarly. To capitalize on the increasing demand for electric powertrains, suppliers and OEMs are also likely to form joint ventures to develop motors/generators.

Converter: The converter segment has captured revenue share of 3% in 2024. The converter adapts the high-voltage DC output of the battery to provide the low-voltage DC needed to power auxiliary systems such as lighting, entertainment systems, or air conditioning. It integrates power electronics, including power semiconductors, diodes, capacitors, and magnets. A DC/DC converter can also be integrated into a power supply module (PDM) that contains a charger and a junction box.

Transmission: The transmission segment has held revenue share of 7% in 2024. Electric vehicles are often equipped with a single-speed transmission. However, there has been increased research and development to investigate the commercial viability of multi-speed transmissions, for example in the Porsche Taycan. Leading manufacturers in the EV transmission market are developing powershift and coasting capabilities with multi-speed transmissions for electric vehicles.

On-Board Charger: The on-board charger segment has held revenue share of 5% in 2024. The on-board charger converts alternating current (AC) from an external charging source (the grid) to direct current (DC) for storage in the battery. The on-board charger communicates with the vehicle control unit and the external charging station to regulate the power supply. It can also include cybersecurity features.

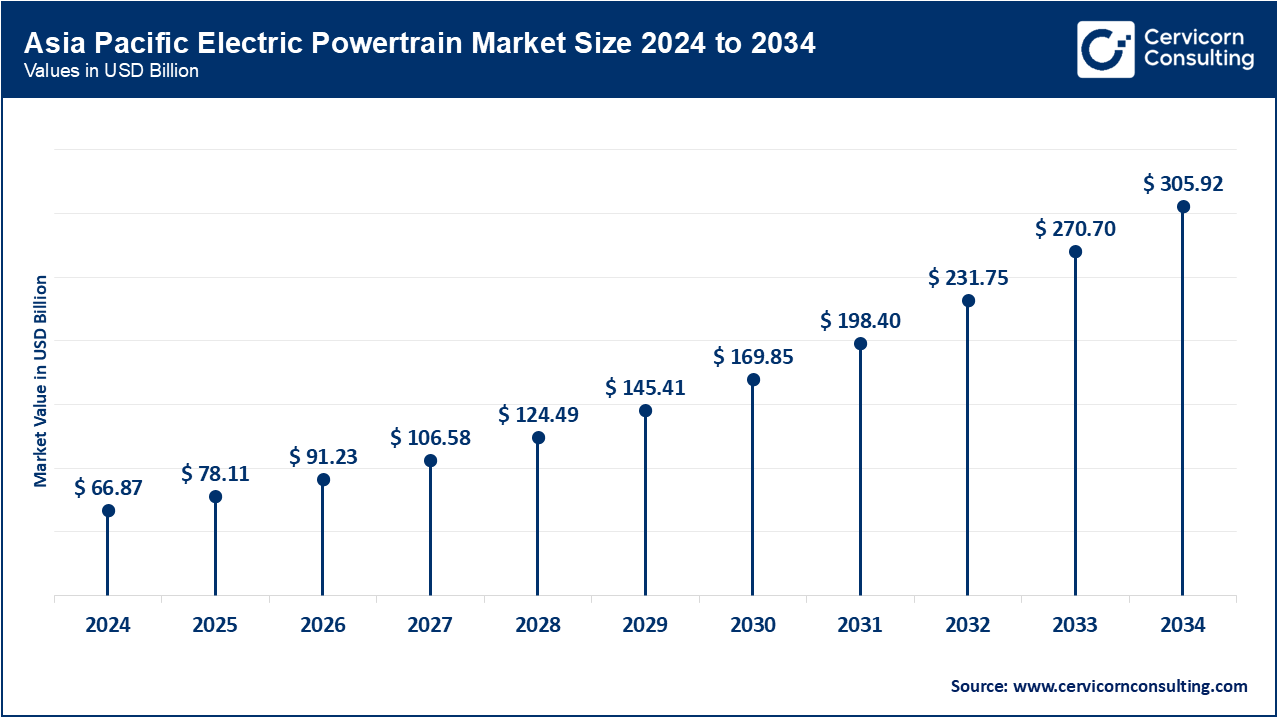

The Asia-Pacific electric powertrain market size was estimated at USD 66.87 billion in 2024 and is expected to be hit around USD 305.92 billion by 2034. A sharp rise in the demand for electric vehicles (EVs) in China, Japan, and South Korea, is one of the driving factors for the growth in the electric powertrain market in the Asia Pacific. Strong government support, rising environmental consciousness, and initiatives to cut down emissions in heavily populated areas are the causes of the increasing demand in the region. Rapid urban growth in these countries has worsened pollution and traffic, so their governments are pushing electric vehicles as a key solution. This focus on EVs is strengthening the electric powertrain system market and helping these countries strive for better sustainability and cleaner urban air.

The North America electric powertrain market size was accounted for USD 12.68 billion in 2024 and is projected to surpass around USD 58.02 billion by 2034. The North America market is driven by the high penetration of electric vehicles. The region is characterized by the presence of major players such as Tesla, Chevrolet, and Ford. Furthermore, the U.S. and other countries have developed electric vehicle infrastructure such as charging stations, also known as Electric Vehicle Supply Equipment (EVSE). These factors are expected to boost the demand in the market.

The Europe electric powertrain market size was recorded at USD 28.82 billion in 2024 and is predicted to reach around USD 131.86 billion by 2034. Europe is expected to emerge as a significant during the forecast period owing to the presence of numerous OEMs in the region. Countries such as the Netherlands, Norway, France, and Sweden have witnessed high penetration of electric vehicles, which is likely to contribute to the growth of the electric powertrain market in the region. Countries such as France, Norway, Sweden, and the Netherlands have witnessed high penetration of electric vehicles, which is likely to contribute to the market growth in this region. Germany is one of the largest automobile hubs globally. Most of the automobile manufacturers such as Audi AG, Volkswagen AG, and BMW AG are focusing on the production and sale of electric vehicles, which is leading to the increasing demand for electric powertrains.

The LAMEA electric powertrain market was valued at USD 6.92 billion in 2024 and is anticipated to reach around USD 31.65 billion by 2034. The LAMEA market is at the forefront of the automotive industry transformation, ushering in an era of more sustainable mobility solutions. The LAMEA market has experienced significant growth due to growing environmental concerns and government support. In 2020, as per the International Trade Administration, Saudi Arabia accounted for around 35% and 52% of the vehicle sales in the Gulf Cooperation Council and the Middle East and North Africa regions, respectively.

The introduction of electric vehicles in Dubai is propelled by innovations in electric vehicles, such as improvements in battery and housing technologies. According to the Dubai Water and Electricity Authority, the number of electric vehicles in Dubai is expected to be around 7,331 in 2023 and 12,852 in 2025. In September 2024, Horse, a joint venture between Geely and Renault, supplied an extended-range electric vehicle (EREV) powertrain to Brazil's newest electric vehicle manufacturer, Lecar. The Lecar 459 Hybrid, scheduled to launch in 2026, would be Lecar's first vehicle. In addition, EVM Africa is an East African company that assembles electric vehicles locally in Kenya and serves the COMESA region.

Dominant market players including Tesla Inc, Continental AG, Robert Bosch GmbH, Zf Friedrichshafen AG, and Borg Warner Inc are actively participating in strategic initiatives such as mergers and acquisitions, facility expansions, and partnerships to expand their product portfolio, reach a wider customer base and strengthen their market presence.

In January 2024, VinFast, a Vietnamese electric vehicle manufacturer, signed a memorandum of understanding with the state government of Tamil Nadu to develop electric vehicle manufacturing facilities in India.

In October 2020, Continental AG announced the launch of a new transmission control system from Vitesco Technologies under the Powertrain business unit of Continental AG. It is the world's first transmission control system of its kind owing to the application of over-molding control electronics technology.

In August 2020, Magna International Inc. declared intentions to grow its powertrain division. The Slovakian manufacturing facility was being built by the company for developing metal-forming solutions for powertrains.

The market players are making constant investments in R&D to enhance their electric powertrain systems and stay ahead of the competition.

CEO Statements

Akio Toyoda, CEO of Toyota:

"Just like the fully autonomous cars that we are all supposed to be driving by now, EVs are just going to take longer to become mainstream than media would like us to believe."

Patrice Haettel, of powertrain producer, HORSE:

"Internal combustion engines (ICE) and hybrids are expected to remain significant players in the automotive industry for many years. Our long-term projections suggest that by 2040, over 50% of passenger and light commercial vehicles globally will still rely on these technologies."

Key players in the electric powertrain market are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the electric powertrain market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Component

BEV Electric Powertrain, By Component

FCEV Electric Powertrain, By Component

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric Powertrain

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Component Overview

2.2.3 BEV Electric Powertrain, By Component Overview

2.2.4 FCEV Electric Powertrain, By Component Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Electric Powertrain Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Government Support and Incentives

4.1.1.2 Growing Urbanization and Mobility

4.1.2 Market Restraints

4.1.2.1 Lack of Charging Stations for EV

4.1.2.2 Fluctuating Raw Material Prices

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Use of Simulation Technology

4.1.4 Market Challenges

4.1.4.1 Concerns Associated with EVs

4.1.4.2 Lack of Consumer Awareness

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Electric Powertrain Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Electric Powertrain Market, By Type

6.1 Global Electric Powertrain Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 BEV

6.1.1.2 HEV

6.1.1.3 PHEV

6.1.1.4 FCEV

Chapter 7 Electric Powertrain Market, By Component

7.1 Global Electric Powertrain Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Power Electronics Controller

7.1.1.2 Motor/Generator

7.1.1.3 Converter

7.1.1.4 Battery

7.1.1.5 Transmission

7.1.1.6 On-Board Charger

Chapter 8 Electric Powertrain Market, BEV Electric Powertrain, By Component

8.1 Global Electric Powertrain Market Snapshot, BEV Electric Powertrain, By Component

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Motor/Generator

8.1.1.2 Battery Pack

8.1.1.3 Battery Management Systems

8.1.1.4 Power Electronics Controller

8.1.1.5 Converter

8.1.1.6 Transmission

8.1.1.7 On-Board Charger

Chapter 9 Electric Powertrain Market, FCEV Electric Powertrain, By Component

9.1 Global Electric Powertrain Market Snapshot, FCEV Electric Powertrain, By Component

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Fuel Stack

9.1.1.2 Fuel Processors

9.1.1.3 Power Electronics

9.1.1.4 Air Compressors

9.1.1.5 Humidifiers

Chapter 10 Electric Powertrain Market, By Region

10.1 Overview

10.2 Electric Powertrain Market Revenue Share, By Region 2024 (%)

10.3 Global Electric Powertrain Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Electric Powertrain Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Electric Powertrain Market, By Country

10.5.4 UK

10.5.4.1 UK Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Electric Powertrain Market, By Country

10.6.4 China

10.6.4.1 China Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Electric Powertrain Market, By Country

10.7.4 GCC

10.7.4.1 GCC Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Electric Powertrain Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Mitsubishi Electric Corp

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Magna International Inc.

12.3 Nissan Motor Co., Ltd.

12.4 Tesla Inc.

12.5 Cummins Inc.

12.6 Hitachi Astemo Americas, Inc.

12.7 Schaeffler AG

12.8 ZF Friedrichshafen AG

12.9 BorgWarner

12.10 Hyundai Motor Company