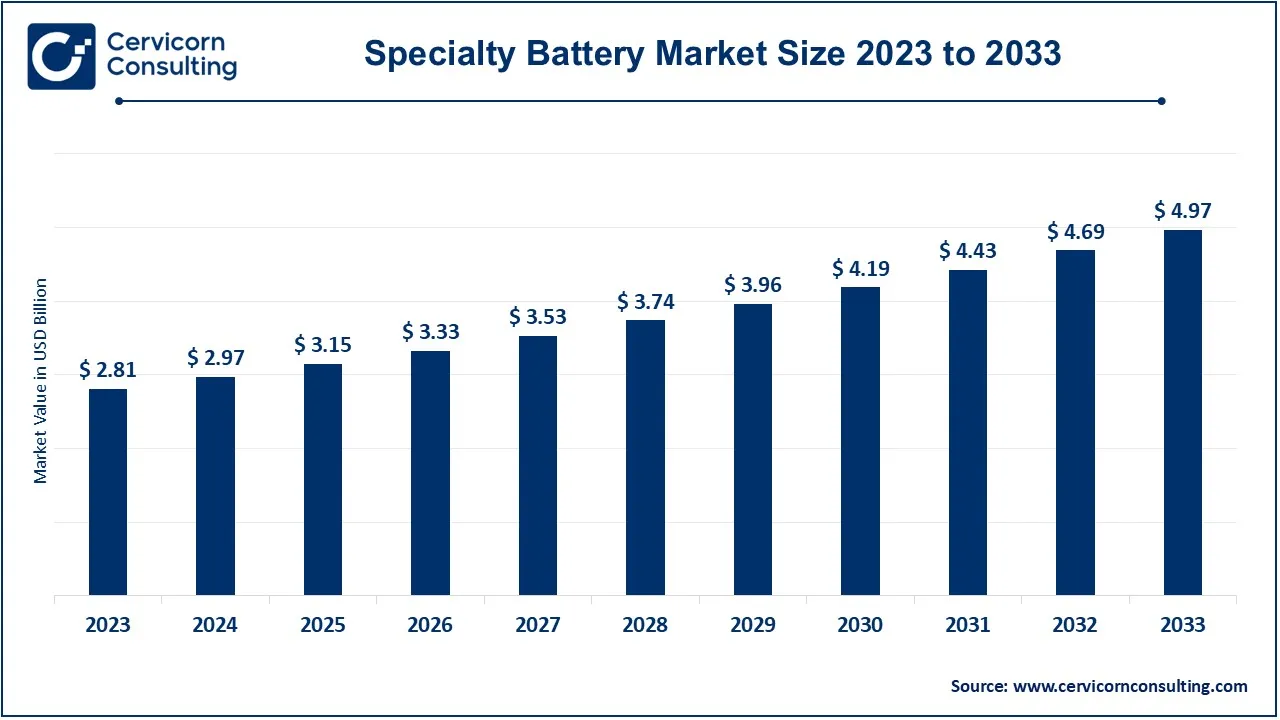

The global specialty battery market size was valued at USD 2.97 billion in 2024 and is expected to be worth around USD 4.97 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.86% from 2024 to 2033.

The specialty battery market is experiencing rapid growth, driven by increasing demand from various sectors, including electric vehicles (EVs), renewable energy, medical devices, and military applications. As the world shifts towards sustainable energy solutions, the need for high-performance, efficient batteries has risen significantly. The electric vehicle market, in particular, is a major contributor to this growth, as automakers and consumers prioritize longer-lasting, quicker-charging batteries. Additionally, industries like healthcare and defense are continuously pushing for innovative solutions that can provide reliable energy in critical situations, further expanding the demand for specialty batteries. Over the coming years, the specialty battery market is expected to witness substantial growth, with advancements in battery chemistry, such as lithium-sulfur and solid-state batteries, offering promising improvements in performance and safety. Government initiatives promoting clean energy and green technologies are also driving investments in the development of these specialized power sources. Between 2021 and 2022, global exports of electric batteries surged by 35.5%, rising from USD 95.9 billion to USD 130 billion. This growth underscores the escalating demand for advanced battery technologies worldwide.

A specialty battery is a type of battery that is designed for specific, high-performance applications that require unique characteristics, such as high energy density, long-lasting power, or specific voltage levels. Unlike general-purpose batteries, specialty batteries are engineered to meet the demanding needs of industries like aerospace, medical, military, automotive, and consumer electronics. Examples include lithium-ion batteries used in electric vehicles, pacemaker batteries, and those used in hearing aids or military equipment. These batteries often have advanced technology and materials that enable them to function under extreme conditions, such as high temperatures, pressure, or moisture, ensuring reliability and long-term performance in specialized environments. Specialty batteries also come with features such as faster charging times, greater durability, and higher efficiency compared to standard batteries.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.15 Billion |

| Estimated Market Size (2033) | USD 4.97 Billion |

| Growth Rate (2024 to 2033) | 5.86% |

| Dominant Region | North America |

| Rapidly Growing Region | Asia-Pacific |

| Key Segments | Battery, Industry, Region |

| Key Companies | Enersys, EaglePicher Technologies, Exide Technologies, LLC, Toshiba Corporation, Saft, Leoch International Technology Limited, GS Yuasa Corporation, Camel Group Co. Ltd., Banner Batteries, Shandong Sacred Sun Power Sources Co., ltd., Ultralife Corporation, Panasonic Corporation, Samsung SDI Co., Ltd., BYD Company Limited, Contemporary Amperex Technology Co. Ltd. (CATL), Hitachi Chemical Co., Ltd. |

The specialty battery market is segmented into battery, industry, and region. Based on battery, the market is classified into lead-acid batteries, lithium-ion batteries, nickel-cadmium batteries, and others (nickel-metal hydride, strong state, stream batteries). Base on industry, the market is classified into aviation, marine, defense, and space.

Lead-Acid Batteries [Flooded, VRLA-Gel, and VRLA-AGM]: Due to their cost-effectiveness and dependability, lead-corrosive batteries, like VRLA-Gel, VRLA-AGM, and Overflowed, are frequently employed. VRLA-Gel and VRLA-AGM are maintenance-free and permanent, which makes them ideal for renewable energy storage and reinforcement power systems. In contrast, overwhelmed batteries are frequently employed in automobiles and modern applications. The market is being driven by the increasing interest in these areas, particularly in the context of UPS frameworks and energy capacity. Their appeal in fundamental applications is further enhanced by their ability to manage high-power surges.

Lithium-Ion Batteries: Lithium-Ion batteries are favoured due to their lightweight design, extended lifespan, and high energy density. These batteries are extensively employed in the production of electric vehicles (EVs), consumer electronics, and sustainable energy storage. Significant development drivers include the expanding market for versatile devices and the increasing popularity of electric vehicles. Additionally, the interest in lithium-particle batteries in energy capacity applications is being bolstered by the drive for greener energy arrangements and the rise of intelligent networks, thereby solidifying their position as a key player in the speciality battery market.

Nickel-cadmium batteries: Nickel-cadmium (Ni-Album) batteries are renowned for their durability, ability to operate in extreme temperatures, and extended lifespan in comparison to other battery-powered batteries. They are typically employed in modern applications, clinical devices, and avionics, where consistent quality is essential. The demand for Ni-Album batteries is increasing due to their ability to operate consistently over extended periods and withstand harsh environmental conditions. Nevertheless, ecological regulations regarding the removal of cadmium are a constraint; however, advancements in recycling have kept pace with the demand in specific industries.

Other (Stream Batteries, Strong State, Nickel-Metal Hydride): Nickel-Metal Hydride (NiMH), solid-state, and stream batteries are all included in this segment, each of which is utilised for specific high-performance applications. NiMH batteries are employed in crossbreed vehicles and consumer devices, while strong state batteries, which are renowned for their security and increased energy density, are gaining popularity in electric vehicles (EVs) and wearables. Stream batteries are emerging in large-scale energy capacity frameworks for environmentally favourable power. The demand for these battery varieties is increasing due to their unique advantages in energy productivity, security, and adaptability in contemporary and consumer markets.

Aviation: In the aeronautic trade, specialty batteries are fundamental for driving airplane frameworks, flying, crisis reinforcement frameworks, and in-flight activities. The developing interest for lightweight, high-limit batteries to help longer flights and expanded airplane charge is driving business sector development. Lithium-particle and strong state batteries are particularly esteemed for their energy thickness and unwavering quality. The ascent of electric and half-breed airplane, joined with the business' emphasis on supportability and productivity, further lifts the requirement for cutting edge battery advancements, making aviation a critical driver in the specialty battery market.

Marine: Specialty batteries in the marine business are utilized in different applications, from fuelling locally available gadgets and route frameworks to electric and half-breed drive frameworks in vessels. The shift toward eco-accommodating and eco-friendly marine vessels is driving interest for cutting edge battery arrangements. With administrative tensions to decrease discharges in the sea area, there is an expanded spotlight on electric drive and energy stockpiling frameworks. Furthermore, progressions in battery duration, security, and strength in unforgiving marine conditions are adding to the rising interest for specialty batteries in this area.

Defense: The defense area depends intensely on specialty batteries for strategic applications, including compact warrior frameworks, automated vehicles (drones), specialized gadgets, and military vehicles. The interest is expanding as current fighting and defense activities become all the more innovatively progressed, requiring solid, lightweight, and high-energy batteries. Specialty batteries should fulfill thorough guidelines for toughness, security, and execution in outrageous circumstances. The continuous shift toward additional energy-proficient and independent frameworks in guard further fills the requirement for superior execution battery advances.

Space: In the space business, specialty batteries are significant for fueling satellites, space tests, wanderers, and space apparatus frameworks. The rising number of satellite send-offs for correspondence, Earth perception, and logical missions has driven up interest for enduring, high-energy-thickness batteries that can act in the brutal states of room. Lithium-particle batteries are ordinarily utilized because of their effectiveness and unwavering quality. As privately-owned businesses and legislatures extend their space investigation endeavors, the interest for cutting edge, sturdy battery frameworks keep on developing, making it a basic fragment of the specialty battery market.

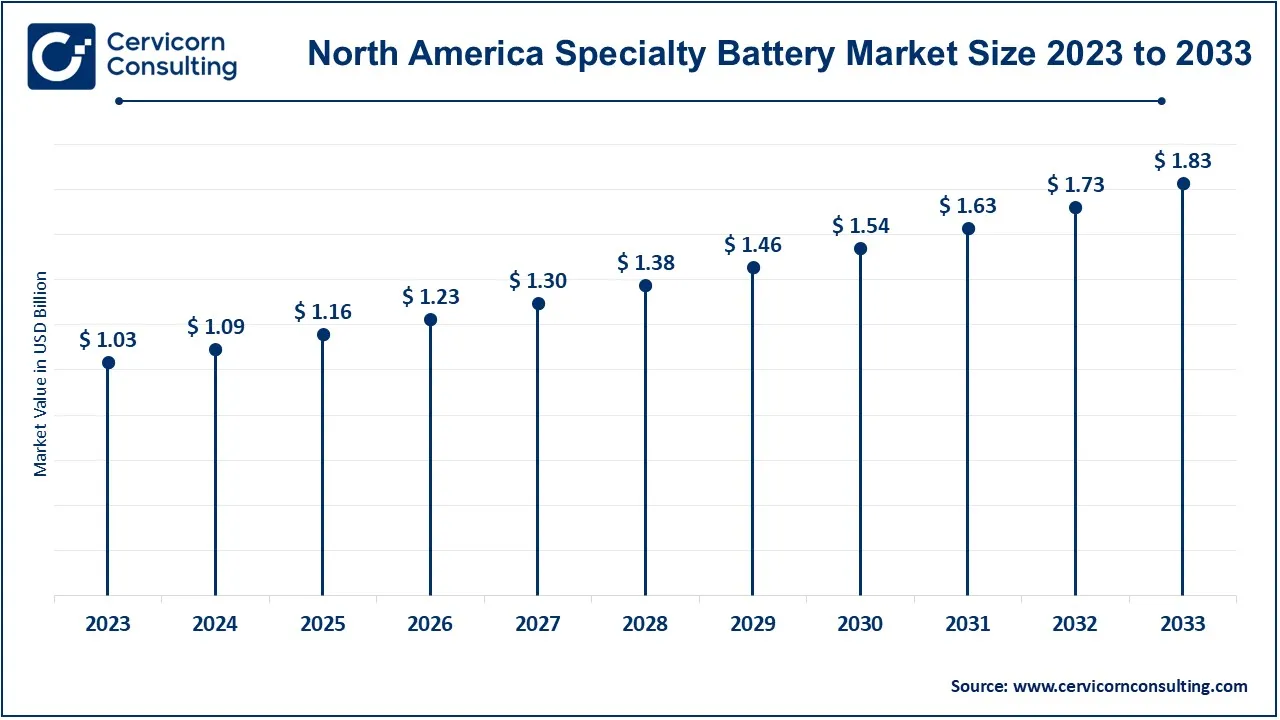

The North America specialty battery market size was estimated at USD 1.03 billion in 2023 and is expected to reach around USD 1.83 billion by 2033. The North America dominates the market due to its usage in industries like as aviation, guard, and cars. The United States is a major beneficiary, with a strong focus on electric vehicles (EVs), ecologically friendly power storage, and high-level defense frameworks. Government initiatives promoting the adoption of sustainable energy and EVs are accelerating business sector development. Furthermore, advances in battery research and the presence of major companies contribute to the district's competitiveness in the specialty battery industry.

The Asia-Pacific specialty battery market size was valued at USD 0.70 billion in 2023 and is projected to hit around USD 1.24 billion by 2033. The Asia-Pacific is the fastest growing region for specialty batteries, with China, Japan, and South Korea leading the way. The district is a global innovator in electric car manufacturing, particularly in China, which significantly contributes to the demand for lithium-particle batteries. Furthermore, rapid industrialization, urbanization, and mechanical advancements in consumer electronics and environmentally friendly power are propelling business sector growth. Asia-Pacific also benefits from significant areas of strength for the battery materials chain, making it a key player in the global specialty battery industry.

The Europe specialty battery market size was accounted for USD 0.78 billion in 2023 and is predicted to surpass around USD 1.38 billion by 2033. The Europe is rapidly growing due to strict environmental regulations and a strong drive for sustainable energy solutions. The region is a hub for electric car production, particularly in Germany, France, and the United Kingdom, which is fueling demand for lithium-particle and other high-level batteries. Furthermore, Europe's concentration on ecologically friendly power storage and aviation drives market expansion. The European Association's rules on battery reuse and supportability are also shaping the development of specialty battery technologies.

Specialty Battery Market Revenue Share, By Region, 2023 (%)

| Region | 2023 (%) |

| North America | 36.80% |

| Europe | 27.70% |

| Asia-Pacific | 24.90% |

| LAMEA | 10.60% |

The LAMEA specialty battery market was valued at USD 0.30 billion in 2023 and is anticipated to be reach around USD 0.53 billion by 2033. LAMEA is a growing market, with interest in fields such as automotive, renewable energy, and media communications. In Latin America, countries such as Brazil and Mexico are focusing on electric vehicles and ecologically friendly power storage systems. The Middle East's push for sustainable energy operations, as well as Africa's need for reliable energy storage arrangements in off-lattice regions, are both contributing to the market's expansion. However, limited infrastructure and hefty production costs may pose challenges to widespread reception in the region.

The specialty battery industry is dominated by a few central members, including Enersys, Saft, and GS Yuasa Enterprise, among others. These organizations are perceived for their high-level battery advancements, broad item portfolios, and huge interests in innovative work.

Enersys is an innovator in modern applications, giving elite execution energy capacity answers for areas like aviation, defense, and media communications. Saft, a central part in energy capacity and reinforcement frameworks, is eminent for its lithium-particle battery innovations and spotlight on enduring, solid arrangements. GS Yuasa Company succeeds in the car and energy stockpiling markets, utilizing its mastery in lead-corrosive and lithium-particle batteries to take care of electric vehicles and sustainable power frameworks. The cutthroat scene is additionally advanced by organizations like Exide Advances, Toshiba Enterprise, Samsung SDI Co., Ltd., and BYD Organization Restricted, close by territorial players and arising organizations embracing inventive innovations to fulfill the developing need from electric vehicles, sustainable power, aviation, and guard ventures.

CEO Statements

David M. Shaffer, President of Enersys

"As the interest for energy capacity arrangements keeps on ascending across areas like electric vehicles, aviation, and broadcast communications, we are focused on pushing the limits of advancement in battery innovation. Our emphasis stays on giving solid, dependable, and feasible energy stockpiling arrangements that meet the developing worldwide requirement for productive power."

Ghislain Lescuyer, President of Saft

"At Saft, we are driving the progress toward cleaner energy arrangements. Our high level lithium-particle battery advancements are empowering forward leaps in electric portability, environmentally friendly power stockpiling, and modern applications. We stay focused on manageable development, lessening our carbon impression while conveying state of the art energy capacity frameworks that power what's in store."

Osamu Murao, President of GS Yuasa Organization

"Our main goal is to lead the worldwide energy stockpiling market with items that help the fast development of electric vehicles and sustainable power. We are constantly putting resources into Research and development to upgrade our battery advancements, especially in the space of energy thickness, security, and execution. GS Yuasa stays at the bleeding edge of this industry change.

Strategic partnerships highlight the rapid advancements and collaborative efforts in the specialty battery industry. Industry players are involved in various aspects of battery innovation, including energy storage, electric vehicles (EVs), and renewable energy integration, playing a crucial role in advancing the market. Some notable examples of key developments in the market include:

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global specialty battery sector.

Market Segmentation

By Battery

By Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Specialty Battery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Overview

2.2.2 By Industry Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Specialty Battery Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Interest for Electric Vehicles (EVs)

4.1.1.2 Developing Shopper Hardware Industry

4.1.2 Market Restraints

4.1.2.1 High Assembling Expenses

4.1.2.2 Natural and Wellbeing Concerns

4.1.3 Market Opportunity

4.1.3.1 Power Reconciliation in an Environmentally Friendly Manner

4.1.3.2 Advancements in Battery Innovation

4.1.4 Market Challenges

4.1.4.1 Store network Reliance

4.1.4.2 Administrative Consistence

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Specialty Battery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Specialty Battery Market, By Structure

6.1 Global Specialty Battery Market Snapshot, By Structure

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Planar Specialty Battery

6.1.1.2 Mesoporous Specialty Battery

Chapter 7. Specialty Battery Market, By Battery

7.1 Global Specialty Battery Market Snapshot, By Battery

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Lead-Acid Batteries

7.1.1.2 Lithium-Ion Batteries

7.1.1.3 Nickel-Cadmium Batteries

7.1.1.4 Others (Nickel-Metal Hydride, Strong State, Stream Batteries)

Chapter 8. Specialty Battery Market, By Industry

8.1 Global Specialty Battery Market Snapshot, By Industry

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Aviation

8.1.1.2 Marine

8.1.1.3 Defense

8.1.1.4 Space

Chapter 9. Specialty Battery Market, By Region

9.1 Overview

9.2 Specialty Battery Market Revenue Share, By Region 2023 (%)

9.3 Global Specialty Battery Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Specialty Battery Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Specialty Battery Market, By Country

9.5.4 UK

9.5.4.1 UK Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Specialty Battery Market, By Country

9.6.4 China

9.6.4.1 China Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Specialty Battery Market, By Country

9.7.4 GCC

9.7.4.1 GCC Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Specialty Battery Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11. Company Profiles

11.1 Enersys

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 EaglePicher Technologies

11.3 Exide Technologies, LLC

11.4 Toshiba Corporation

11.5 Saft

11.6 Leoch International Technology Limited

11.7 GS Yuasa Corporation

11.8 Camel Group Co. Ltd.

11.9 Banner Batteries

11.10 Shandong Sacred Sun Power Sources Co., ltd.

11.11 Ultralife Corporation

11.12 Panasonic Corporation

11.13 Samsung SDI Co., Ltd.

11.14 BYD Company Limited

11.15 Contemporary Amperex Technology Co. Ltd. (CATL)

11.16 Hitachi Chemical Co., Ltd.