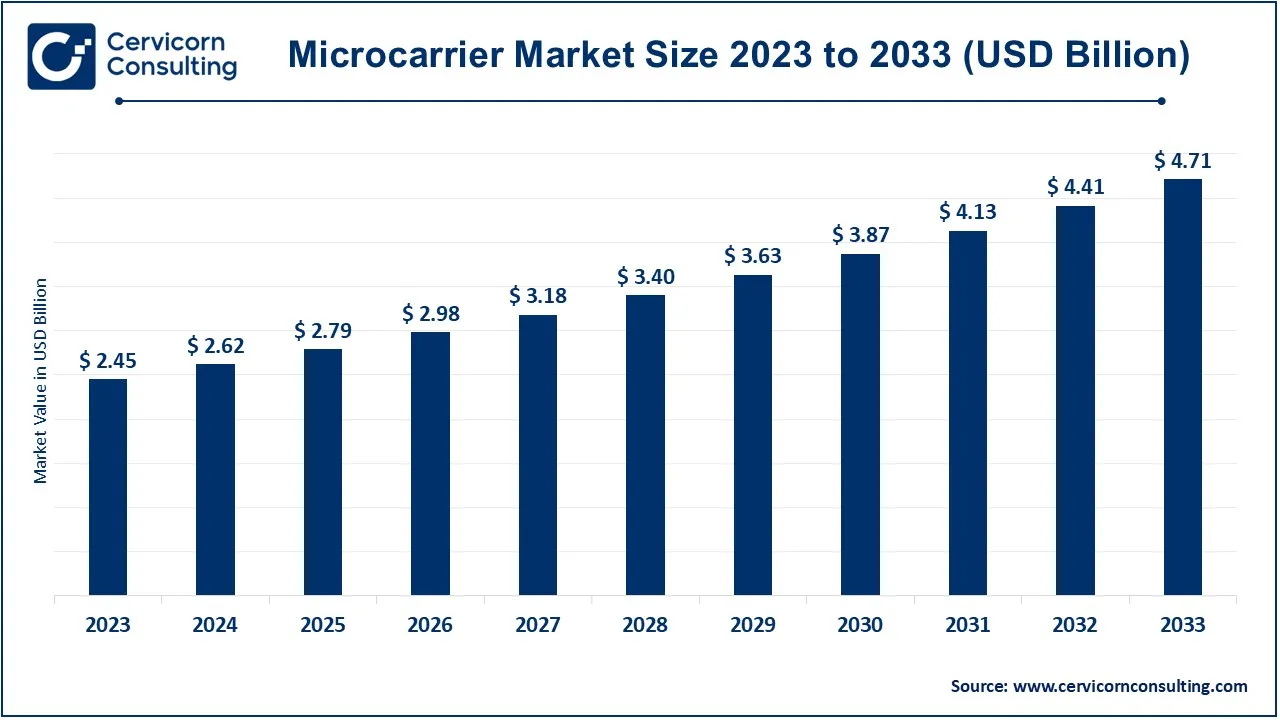

The global microcarrier market size was valued at USD 2.62 billion in 2024 and is expected to be worth around USD 4.71 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.30% from 2024 to 2033.

The microcarriers market has seen significant growth in recent years, driven by the increasing demand for biopharmaceuticals, cell therapies, and vaccine production. With the rising adoption of cell-based therapies, including regenerative medicine, the market is expected to continue expanding. The growing need for personalized medicine, which involves using the patient's own cells for treatment, is further propelling the use of microcarriers in cell culture applications. Additionally, advancements in microcarrier technology are enhancing their efficiency and suitability for a broader range of applications, further boosting market growth. Moreover, the rising investment in research and development, coupled with regulatory support for biopharmaceutical manufacturing, is anticipated to accelerate the adoption of microcarriers in both clinical and commercial settings. In May 2024, Sartorius AG partnered with Sanofi to develop and commercialize a platform aimed at streamlining and optimizing downstream bioprocessing operations. This collaboration seeks to enhance efficiency and productivity in the production of biopharmaceuticals, potentially leading to more sophisticated microcarrier-based bioprocessing technologies.

A microcarrier is a small, spherical support material used in bioreactors for cultivating cells in biotechnological processes. These tiny beads or particles, typically made from materials like polystyrene, collagen, or dextran, provide a surface area for cells to attach and grow. Microcarriers are commonly used in cell culture for the production of vaccines, antibodies, and other biologic drugs. The advantage of using microcarriers lies in their ability to maximize cell growth in a limited space, offering a high surface-to-volume ratio that enhances cell proliferation. Microcarriers are generally suspended in culture media, allowing cells to grow in a three-dimensional structure, mimicking the natural environment of tissues.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.79 Billion |

| Projected Market Size in 2033 | USD 4.71 Billion |

| Growth Rate 2024 to 2033 | 9.30% |

| Top-performing Region | North America |

| Quickest Growing Region | Asia-Pacific |

| Key Segments | Product, Cell Type, Therapy, Application, End User, Region |

| Key Companies | Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, Corning Incorporated, Eppendorf SE, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., DenovoMATRIX GmbH |

The microcarrier market is segmented into product, application, therapy, cell type, end user and region. Based on product, the market is classified into equipment, and consumables. Based on application, the market is classified into vaccine manufacturing, cell therapy, biologics manufacturing, and other. Based on therapy, the market is classified into cell & gene therapy, and other (Tissue Engineering and Regenerative Medicine Applications). Based on cell type, the market is classified into stem cells, immune cells, and other. Based on end user, the market is classified into pharmaceutical & biotechnology companies, research institutes, and contract research organizations.

Based on product, the microcarrier market is segmented into equipment and consumable. The cell-therapy segment has dominated the market in 2023. The equipment segment has dominated the market in 2023 and accounted highest revenue share.

Equipment: The equipment segment has accounted revenue share of 56% in 2023. The equipment segment provides for devices which are used in the microcarrier market, including bioreactors, and cell culture systems, and ancillary hardware for growing large-scale cultures of cells. Such machinery is thus a necessary basis in terms of ensuring optimal conditions for cell proliferation as well as product yield in vaccine production, biologics, and any other therapies. The growing demand for large-scale cell culture systems is projected to strengthen this segment as biopharmaceutical companies are broadly expanding their production capabilities for biologics and regenerative medicine.

Consumables: The consumables segment has accounted revenue share of 44% in 2023. The consumables consist of microcarriers, culture media, and reagents used during cell culture processes. Microcarriers provide a large surface area for cell attachment; thus, they are useful for developing small- and large-scale high-density biomanufacturing. The continued demand for consumables during a single production cycle provides stability for the market. As industries focus on biopharmaceuticals, cell therapy, and vaccine production, consumables have become critical to large-scale high-quality cell cultures.

Based on application, the microcarrier market is segmented into vaccine manufacturing, cell-therapy, biologics manufacturing (Conjo), and others. The cell-therapy segment has dominated the market in 2023.

Vaccine Manufacturing: The vaccine manufacturing segment has captured revenue share of 33.40% in 2023. Microcarriers are widely used in vaccine production for further and additive production of viruses, as they allow high-density cultures of the adherent cells required for viral vaccines. With vaccines gaining the advantage of throbbing demand in the wake of emerging infectious diseases requiring rapid production, microcarriers emerged to become popular due to their flexibility and efficiency in producing viral vectors and vaccine components on large scales.

Cell-therapy: The cell-therapy segment has generated revenue share of 48.90% in 2023. Used in cell-based therapeutics, stem cells and immune cells are expanded in high numbers using microcarriers. Cell engineering for regenerative medicine and cancer therapy are also parts of cell therapy. As such microcarrier-based systems emerge in propelling the clinical application needs for large cell yields with growing need of advanced therapies, this segment would probably witness tremendous growth as cell-based therapies gain traction globally.

Biologics Manufacturing (Conjo): For monoclonal antibodies and therapeutic proteins, efficient cell culture techniques for mass production of biologics operate. In this respect, microcarriers forcefully support large-scale biomanufacturing due to a good high-cell-density growth inside bioreactors. As with the increase in demands for unique biologics in treating chronic diseases, this particular application drives the microcarrier market towards newer and advanced cell culture systems.

Other: The "Other" segment includes diverse research and industrial applications for microcarriers, such as gene therapy, tissue engineering, and diagnostic research. High-density cell cultures for testing, development, and commercialization require these applications, and microcarriers are essential in this regard for scale-up and efficiency demanded by the market. Meanwhile, expanding R&D efforts across the biotechnology and pharmaceutical industries are attributing to soaring shares of this segment.

Based on end user, the microcarrier market is segmented into pharmaceutical & biotechnology companies, research institutes, and contract research organizations (CROs). The pharmaceutical & biotechnology companies segment has dominated the market in 2023.

Pharmaceutical & Biotechnology Companies: The pharmaceutical & biotechnology companies segment has accounted 44% of the total revenue share in 2023. These companies are the principal users of microcarriers in large-scale biomanufacturing processes, including the production of biologics and vaccines. Given the concentrated investment of pharmaceutical companies in biopharmaceuticals, there is a concurrent rise in the demand for efficiently scalable cell-culture systems like microcarriers. This segment currently is a key focus area for growth in the microcarrier market due to a steeper emphasis on biologics and cell therapies.

Research Institutes: The research institutes segment has accounted revenue share of 33% in 2023. Research institutes employ microcarriers for experimental cell culture, pushing for advances in cell therapy, vaccine research, and biomanufacturing technologies. These entities are chiefly responsible for innovation, exploring new microcarrier applications in drug development and regenerative medicine. The expansion of this end-user segment continues with further amplified academic and government-funded research.

Contract Research Organizations (CROs): The CROs segment has reported revenue share of 23% in 2023. CROs play a very important and critical role as outsourcing bodies in research and development services for biopharmaceutical companies by employing microcarriers for vaccine development, biologics production, and cell-therapy studies. The increasing trend of outsourcing R&D to specialized CROs has intensified demand for microcarrier systems to enable these organizations to yield efficient high-powered research results to their clients.

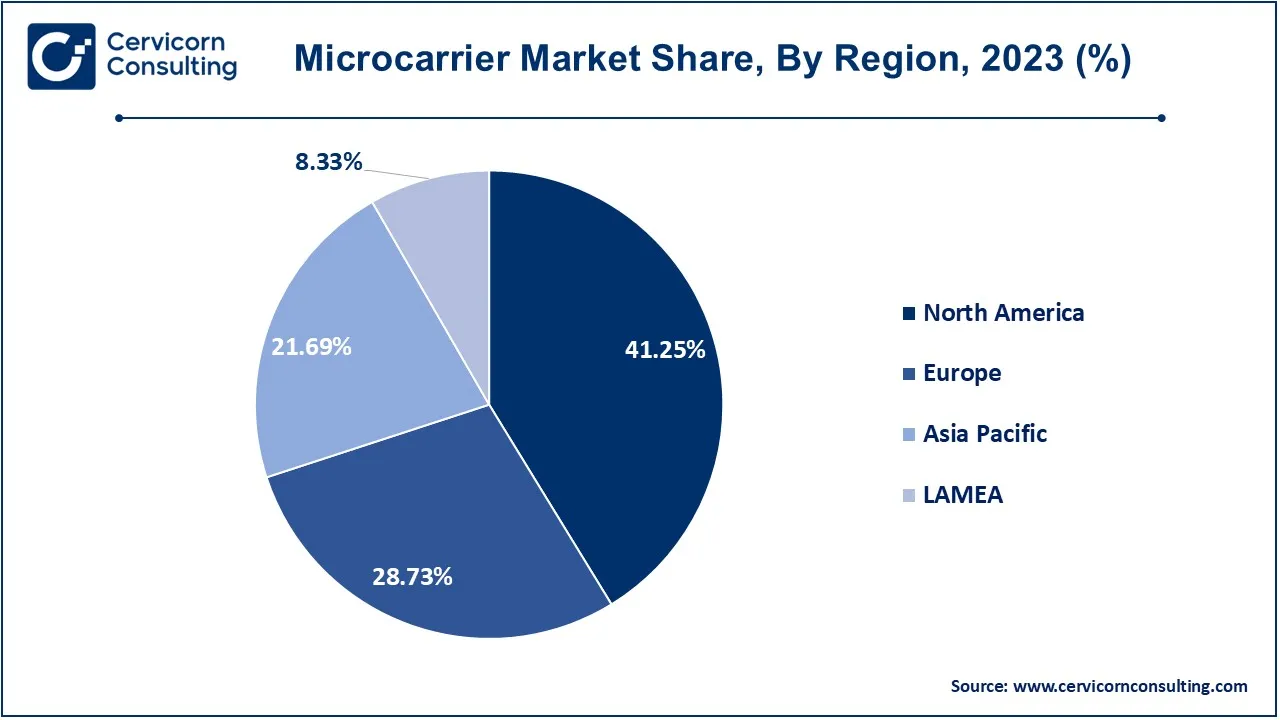

The microcarrier market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). North america has dominated the market in 2023. Here’s an in-depth look at each region.

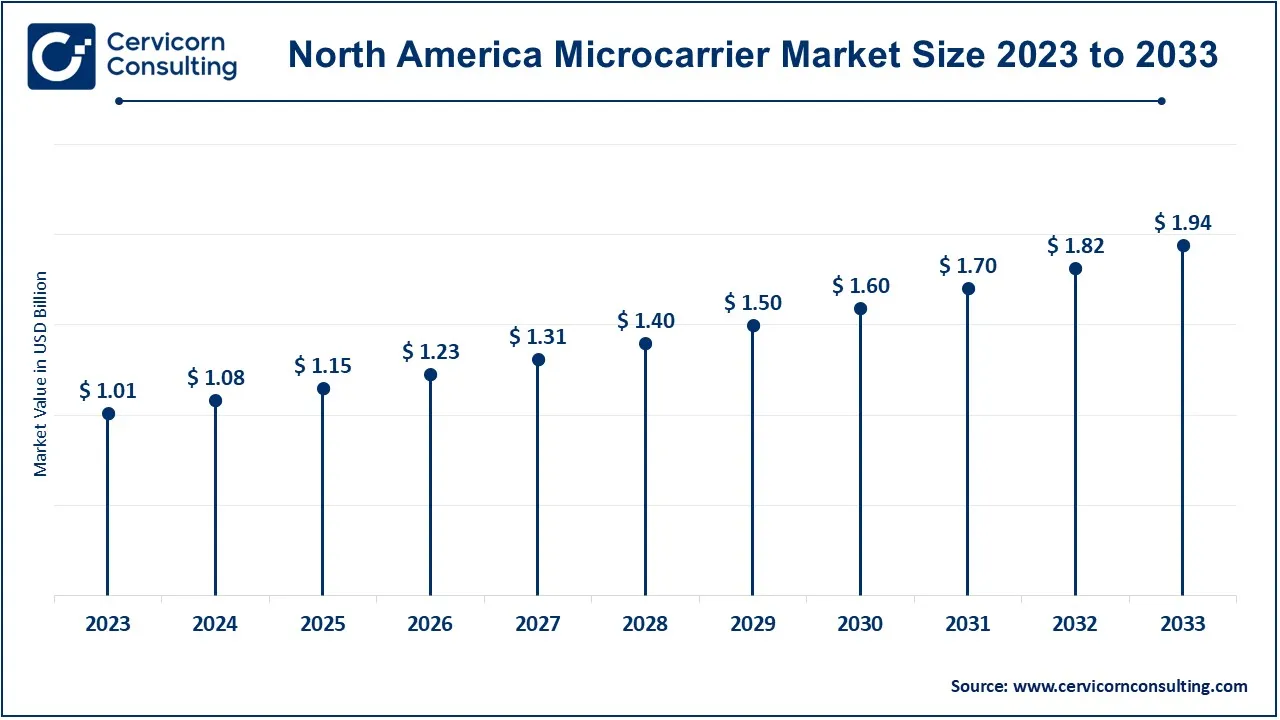

The North America microcarrier market size was valued at USD 1.01 billion in 2023 and is projected to hit around USD 1.94 billion by 2033. North America serves as a major market for microcarriers driven by affluent biopharmaceutical industries operational in the U.S. and Canada. This market is further boosted by advanced healthcare infrastructure, increasing biologics demand, and increased investments in R&D. U.S. leads in the region, supported by many biotech companies and research institutions, using microcarriers for vaccine production and cell therapy. Support from government initiatives for biologics manufacturing and innovation also bolsters the growth of this market, establishing North America as a focal point for microcarrier development.

The Europe microcarrier market size was estimated at USD 0.70 billion in 2023 and is predicted to reach around USD 1.35 billion by 2033. The European microcarrier industry is primarily contributed to by Germany, France, and the U.K., the major players in biopharmaceutical and vaccine development. In response to the innovative health care technologies spearheaded by a strong biotechnology sector, there is a growing demand for microcarrier systems within the region. Moreover, state support for biologics and cell-based therapies serves to bolster growth for the market. The investment in life-sciences R&D within the European Union, along with the expansion in biologics manufacturing capability, further spark an increasing demand for effective cell culture solutions such as microcarriers.

The Asia-Pacific microcarrier market size was accounted for USD 0.53 billion in 2023 and is expected to be worth around USD 1.02 billion by 2033. Asia-Pacific is an emerging microcarrier market with countries like China, India, and Japan witnessing acceleration in growth. Rapidly developing healthcare investments create a situation where these developing countries turn their focus on biologics manufacturing, cell therapy development, and vaccine manufacturing thanks to government support. With the growing biopharmaceutical industry in China and the high-end R&D strength from Japan, the market demand for scalable microcarrier systems gets a fillip from these developments. Earlier, the increasing interest in regenerative medicine and biotechnology in this region is expected to considerably boost market growth in the next few years.

The LAMEA microcarrier market was valued at USD 0.20 billion in 2023 and is anticipated to reach around USD 0.39 billion by 2033. In LAMEA, the microcarrier market is expanding gradually, notably in Brazil, Mexico, South Africa and UAE. Infrastructure and other investments in biotechnology basically underpin the Industrial Yuan; especially, this in tune particularly with Latin Americas and the Middle East. Hence, Brazil and Mexico are experiencing an increase in biopharmaceutical activities including the production of vaccines. For UAE and South Africa, it is imminent that they serve as likely hubs for biomanufacturing and cell therapy research, buoyed by government efforts to deepen local healthcare and life sciences capacities.

The microcarrier market is significantly dominated by some of the key players include Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, and Corning Incorporated.The companies extensively utilize their strong distribution networks, cutting-edge products, and a competitive edge via strong research and development capabilities. Heavily relies on technological innovation and strategic partnerships in extending their microcarrier solutions in accordance with the changing needs in biopharmaceutical industries. The high product quality and customer support which these players stay focused on would take on the market advancement to allow the drive of core developments in cell culture technologies and biomanufacturing processes.

CEO Statements

Marc N. Casper, CEO of Thermo Fisher Scientific, Inc:

Belen Garijo, CEO of Merck KGaA:

Joachim Kreuzburg, CEO of Sartorius AG:

Recent product launches in the microcarrier industry illustrate a trend toward innovation and strategic collaboration among key industry players. Companies like Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, and Corning Incorporated are actively enhancing their technologies to support the growing demand for efficient cell culture solutions. This includes the introduction of novel microcarriers designed for improved scalability and performance in cell therapy and vaccine manufacturing. The competitive landscape is characterized by significant investment in R&D, aiming to meet the complex requirements of biopharmaceutical applications. Some notable examples of key developments in the microcarrier industry include:

These developments underscore significant advancements in the microcarrier market, with companies like Thermo Fisher Scientific, Inc. and Merck KGaA leveraging innovative technologies to enhance cell culture efficiency. These firms are focusing on the design and production of next-generation microcarriers that promote better cell attachment and growth, catering to the increasing demand in biopharmaceuticals and regenerative medicine. Their commitment to research and development is evident in new product offerings aimed at improving scalability and yield, positioning them as leaders in a rapidly evolving market.

Market Segmentation

By Product

By Application

By Therapy

By Cell Type

By End user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Microcarrier

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Overview

2.2.2 By Industry Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Microcarrier Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing reliance on biologics and biosimilars

4.1.1.2 Increased efficiency and cost-effectiveness in large-scale production

4.1.1.3 High incidence of chronic diseases

4.1.1.4 Surge in demand for vaccines

4.1.2 Market Restraints

4.1.2.1 High initial cost of microcarrier systems

4.1.2.2 Technical challenges with cell detachment

4.1.2.3 Limited Knowledge on Microcarrier Technology

4.1.3 Market Challenges

4.1.3.1 Compatibility between microcarrier and cell

4.1.3.2 Prospective Costs

4.1.3.3 Non-biodegradable carriers have a negative impact on the environment

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Microcarrier Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Microcarrier Market, By Product

6.1 Global Microcarrier Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Equipment

6.1.1.2 Consumables

Chapter 7. Microcarrier Market, By Application

7.1 Global Microcarrier Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Vaccine Manufacturing

7.1.1.2 Cell Therapy

7.1.1.3 Biologics Manufacturing

7.1.1.4 Others

Chapter 8. Microcarrier Market, By Therapy

8.1 Global Microcarrier Market Snapshot, By Therapy

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Cell & Gene Therapy

8.1.1.2 Other

Chapter 9. Microcarrier Market, By Cell Type

9.1 Global Microcarrier Market Snapshot, By Cell Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Stem Cells

9.1.1.2 Immune Cells

9.1.1.3 Other

Chapter 10. Microcarrier Market, By End User

10.1 Global Microcarrier Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 Pharmaceutical & Biotechnology Companies

10.1.1.2 Research Institutes

10.1.1.3 CROs

Chapter 11. Microcarrier Market, By Region

11.1 Overview

11.2 Microcarrier Market Revenue Share, By Region 2023 (%)

11.3 Global Microcarrier Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Microcarrier Market Revenue, 2021-2033 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Microcarrier Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Microcarrier Market Revenue, 2021-2033 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Microcarrier Market Revenue, 2021-2033 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Microcarrier Market Revenue, 2021-2033 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Microcarrier Market Revenue, 2021-2033 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Microcarrier Market, By Country

11.5.4 UK

11.5.4.1 UK Microcarrier Market Revenue, 2021-2033 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Microcarrier Market Revenue, 2021-2033 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Microcarrier Market Revenue, 2021-2033 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Microcarrier Market Revenue, 2021-2033 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Microcarrier Market, By Country

11.6.4 China

11.6.4.1 China Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Microcarrier Market Revenue, 2021-2033 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Microcarrier Market Revenue, 2021-2033 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Microcarrier Market, By Country

11.7.4 GCC

11.7.4.1 GCC Microcarrier Market Revenue, 2021-2033 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Microcarrier Market Revenue, 2021-2033 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Microcarrier Market Revenue, 2021-2033 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Microcarrier Market Revenue, 2021-2033 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2021-2023

12.1.3 Competitive Analysis By Revenue, 2021-2023

12.2 Recent Developments by the Market Contributors (2023)

Chapter 13. Company Profiles

13.1 Thermo Fisher Scientific, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Merck KGaA

13.3 Danaher Corporation

13.4 Sartorius AG

13.5 Corning Incorporated

13.6 Eppendorf SE

13.7 Bio-Rad Laboratories, Inc.

13.8 HiMedia Laboratories Pvt. Ltd.

13.9 DenovoMATRIX GmbH