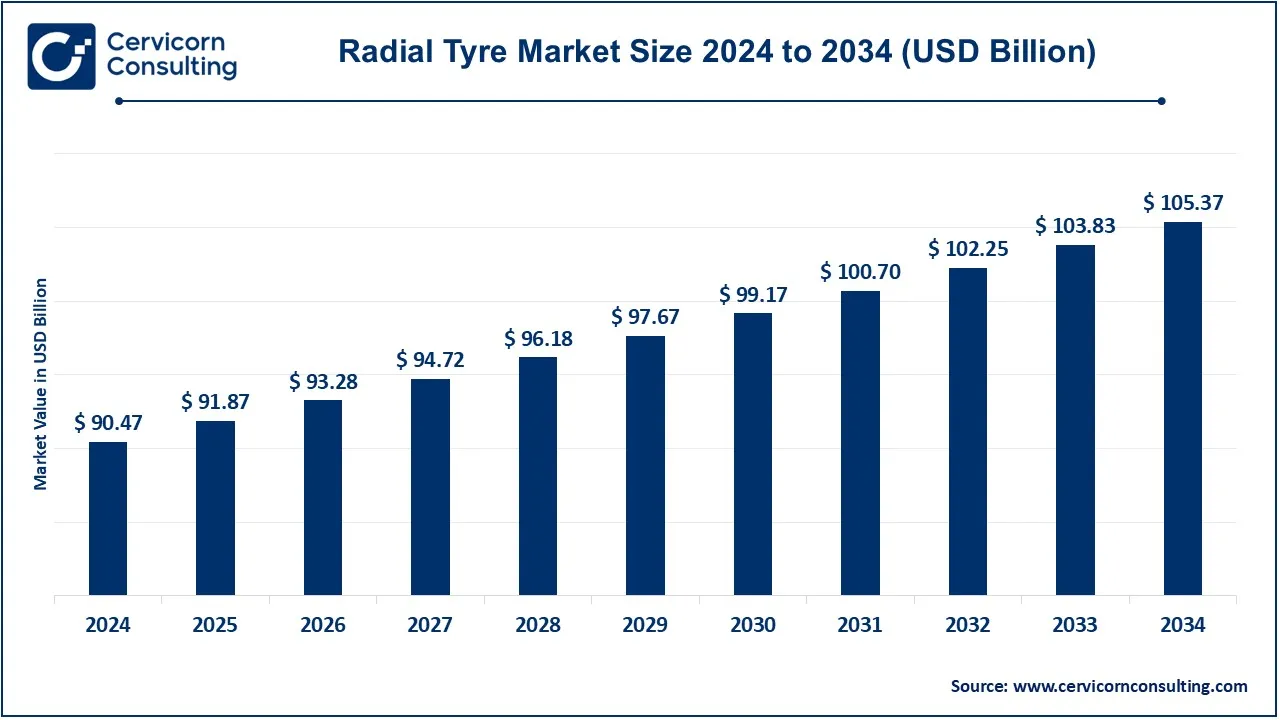

The global radial tyre market size was valued at USD 90.47 billion in 2024 and is expected to be worth around USD 105.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034.

A radial tire is similar to a pneumatic tire. Ply cords constitute internal layers arranged radially in a 90-degree angle to the line of travel or indeed along the direction of the radial line of the wheel. Such construction methods differentiate them from bias-ply tires that have their plies layered diagonally. The belts, which are usually made of steel, are situated beneath the tread and around the tire circumference, endowing them with increased stability, reduced rolling resistance, and improved fuel mileage. Radial tires are generally fitted on passenger cars, trucks, and off-road vehicles because of better traction, durability, and performance on a variety of terrain.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 90.47 Billion |

| Expected Market Size in 2034 | USD 105.37 Billion |

| Projected CAGR 2025 to 2034 | 4.10% |

| Prime Region | Asia Pacific |

| Key Segments | Type, Material, Application, Region |

| Key Companies | GT Radial, Finixx Global Industry, Goodyear, Bridgestone, Michelin, BFGoodrich, Otani Tyre, JK Tyre, Balkrishna Industries, Tianli |

The radial tyre market is segmented into type, material, application, distribution chennel and region. Based on type, the market is classified into whole steel wire, half-steel wire, and whole fiber. Based on material, the market is classified into natural rubber, fabrics, steel, and synthetic rubber. Based on application, the market is segmented into vehicle and others. Based on distribution channel, the market is segmented into online stores and offline stores.

Whole-steel Wire: Whole steel wire radial tyres use steel reinforcement throughout the carcass and belt, conferring remarkable durability and an ability to carry a load. Such tyres generally find favour in heavy-duty and high-performance applications like commercial trucks and construction vehicles where stability and long-lasting strength are key. The whole steel wire construction equips such tyres to take up extreme conditions, hence increasing their lifespan and making them fit for rugged environments and high mileage applications.

Half-steel wire: Half-steel wire radial tyres use steel reinforcement on the belt area while using other materials like fiber in the carcass. This sort of design provides an equilibrium of durability and flexibility, which results in optimum performance in various terrains. Half-steel tyres are commonly used in light commercial vehicles and passenger cars, as they give a comfortable ride with adequate strength. Their structure offers versatility and adaptability that allows them to be used without difficulty in urban and semi-rough conditions without sacrificing durability.

Whole Fiber: Whole fiber radial tires have the whole body made of fiber; thus they are quite weightless and far superior in flexibility when compared with fully steel-reinforced types. This kind of tire is mostly used for cars that prioritize effortlessly of ride view and fuel efficiency-for instance, passenger cars in urban areas. Whole fiber tires will cut down rolling resistance tremendously, which helps with fuel economy. Well, they can also be rather big; hence their ability to carry weight and lifespan might really not be equivalent to steel-reinforced radial tires in terms of their delivery-suited particularly for heavy-duty applications.

Vehicle: The application segment includes all road vehicles inclusive of passenger cars, light commercial vehicles, and heavy-duty trucks. The vehicle segment forms the primary driver of demand in the radial tyre market, as radial tyres become the standard for modern vehicles. High stability of construction, owing to the specific knobbly patterns introduced for off-road tires, guaranteed better traction on gradients, less fuel consumption, and higher longevity. The emerging economies are beginning to see a lot of growth in the automotive sector and, hence, the demand for radial tires.

Radial Tyre Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Vehicle | 69% |

| Others | 31% |

Other: It covers off-road and specialist vehicles involved in farming, mining, and construction: applications that are inexorable and divergently situated concerning standard road vehicles. These tyres are often engineered and designed to maximize features like durability, traction, and abusive environment resistance. Radial tyres for this kind of application are designed for rugged environments while promoting stability and comfort of operation, characterized by their widespread need in industries where the equipment operates in difficult terrain. This segment demonstrates high flexibility of the application of radials in nonautomotive use.

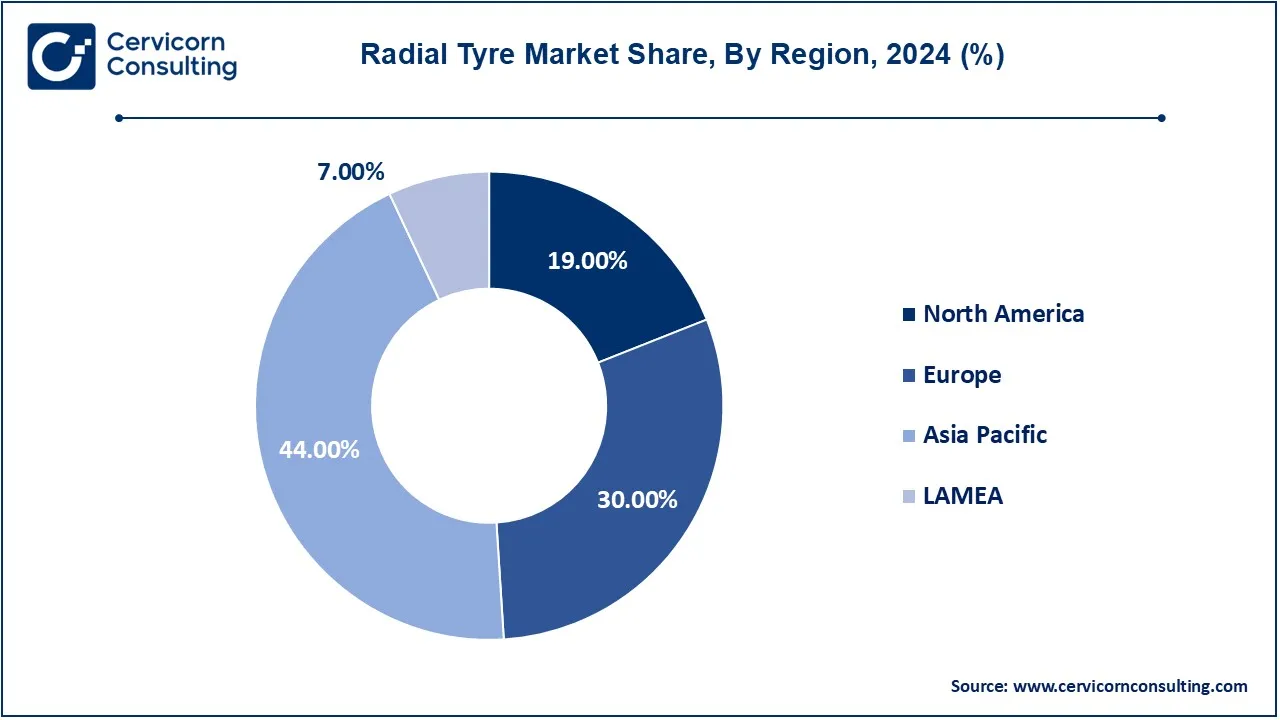

The radial tyre market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

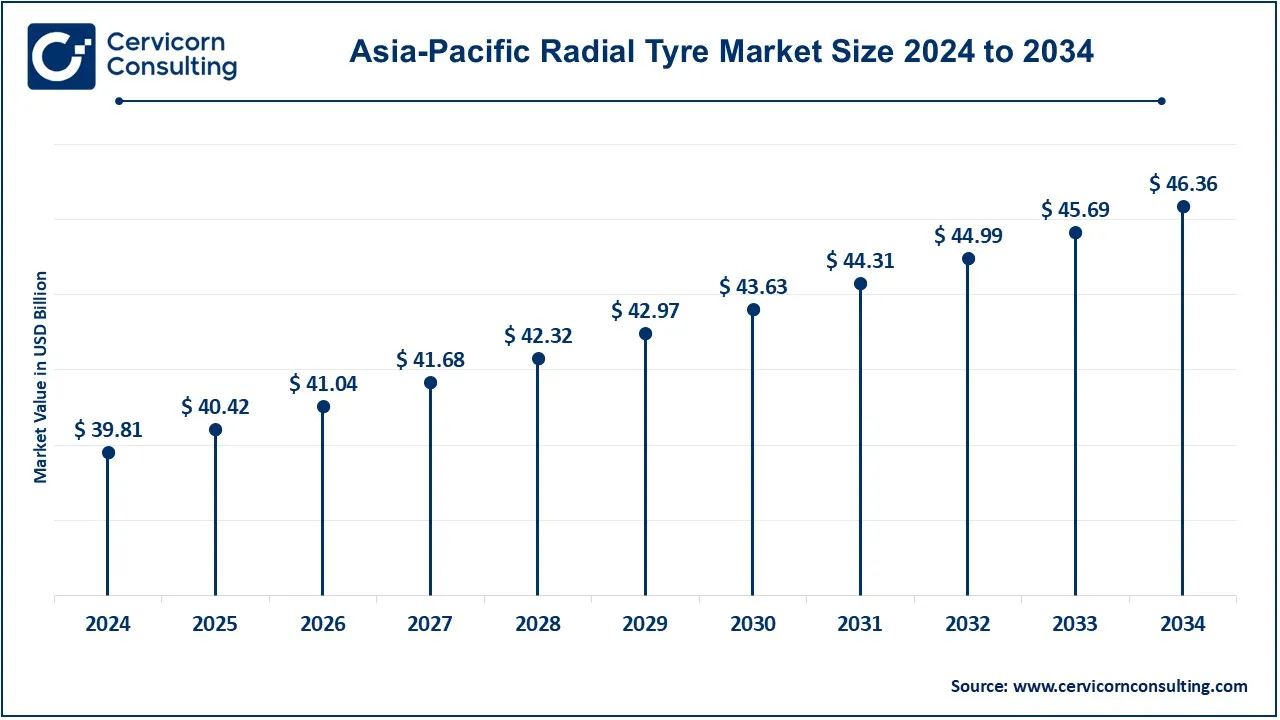

The Asia-Pacific radial tyre market size was accounted for USD 39.81 billion in 2024 and is predicted to surpass around USD 46.36 billion by 2034. Asia-Pacific has emerged as the largest segment and is projected to grow with high growth rates owing to rapid industrialization and urbanization. China, India, and Japan significantly grow. China is the highest producer and consumer of tyres, supported by an ever-booming automotive industry. With vehicle ownership and infrastructure development on the upswing, the radial tyres are seeing increased demand in India. Further contributing to the region's economic growth and a burgeoning middle-class population, which is steeply contributing to the demand for passenger and commercial vehicles.

The North America radial tyre market size was valued at USD 17.19 billion in 2024 and is expected to reach around USD 20.02 billion by 2034. North America finds impetus in radial tyre business with its major contributor being the US and Canada. Substantial demand for passenger and commercial vehicles drives the production vigour to the investment support. Other forces driving the vigorous automobile are steep consumer preferences for fuel-efficient tyres. Further, the United States benefits from massive investments in tyre manufacturing and innovation. Demand for radial tyres in the commercial segment is also spurred on by the growth of e-commerce and logistics services.

The Europe radial tyre market size was estimated at USD 27.14 billion in 2024 and is projected to hit around USD 31.61 billion by 2034. Europe is influenced by stringent regulations on vehicle emissions and safety that hasten the uptake of advanced tyre technologies. Major players like Michelin, Continental, and Pirelli are headquartered in this region, especially countries such as Germany, France, and Italy. The European market has laid particular emphasis on sustainability and burgeoning demand for eco-tyre options. In addition, with the growing inclination for electric-vehicle (EV) market development, the radial tyre segment will be presented with another promising opportunity in providing new solutions.

The LAMEA radial tyre market was valued at USD 6.33 billion in 2024 and is expected to reach around USD 7.38 billion by 2034. The LAMEA radial tyre market is gradually expanding, due to increasing vehicle production and sales in Brazil and South Africa. The factors driving the passenger vehicle demand in Latin America include urbanization and increasing disposable income. Coupled with developed logistics and transportation in the Middle East, that has bolstered the demand for commercial tyres, the African market continues to develop due to improved infrastructure and the increasing volume of vehicles being used. However, challenges arising from economic instability that threaten to hinder progress abound.

CEO Statements

Michelin CEO of Florent Menegaux

Bridgestone CEO of Shuichi Ishibashi

Goodyear CEO of Rich Kramer

Recent product launches and expansions in the radial tyre market highlight a significant trend toward innovation and strategic partnerships among major industry players. Companies like GT Radial, Finixx Global Industry, Goodyear, and Bridgestone are actively developing advanced tyre technologies that enhance performance, safety, and sustainability. These firms are focusing on eco-friendly materials and smart tyre solutions that integrate sensors for real-time data on tyre health. Additionally, collaborations with automotive manufacturers and technology firms aim to create tailored products that meet the specific needs of electric and high-performance vehicles, positioning them for growth in a competitive landscape. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Material

By Application

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Radial Tyre

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Tyre Overview

2.2.2 By Material Overview

2.2.3 By Application Overview

2.2.4 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Radial Tyre Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Longer Tyre Life

4.1.1.2 Better Stability and Comfort

4.1.1.3 Increased Automotive Production

4.1.2 Market Restraints

4.1.2.1 Initial High Cost

4.1.2.2 Lack of Awareness in Emerging Markets

4.1.2.3 Complex Manufacturing Requirements

4.1.3 Market Challenges

4.1.3.1 Sustainability Demands

4.1.3.2 Volatility in the supply chain

4.1.3.3 Climate-induced wear and tear

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Radial Tyre Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Radial Tyre Market, By Type

6.1 Global Radial Tyre Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Whole Steel Wire

6.1.1.2 Half-Steel Wire

6.1.1.3 Whole Fiber

Chapter 7. Radial Tyre Market, By Material

7.1 Global Radial Tyre Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Natural Rubber

7.1.1.2 Fabrics

7.1.1.3 Steel

7.1.1.4 Synthetic Rubber

Chapter 8. Radial Tyre Market, By Application

8.1 Global Radial Tyre Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Vehicle

8.1.1.2 Others

Chapter 9. Radial Tyre Market, By Distribution Channel

9.1 Global Radial Tyre Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Online Stores

9.1.1.2 Offline Stores

Chapter 10. Radial Tyre Market, By Region

10.1 Overview

10.2 Radial Tyre Market Revenue Share, By Region 2024 (%)

10.3 Global Radial Tyre Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Radial Tyre Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Radial Tyre Market, By Country

10.5.4 UK

10.5.4.1 UK Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Radial Tyre Market, By Country

10.6.4 China

10.6.4.1 China Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Radial Tyre Market, By Country

10.7.4 GCC

10.7.4.1 GCC Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Radial Tyre Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 GT Radial

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Finixx Global Industry

12.3 Goodyear

12.4 Bridgestone

12.5 Michelin

12.6 BFGoodrich

12.7 Otani Tyre

12.8 JK Tyre

12.9 Balkrishna Industries

12.10 Tianli