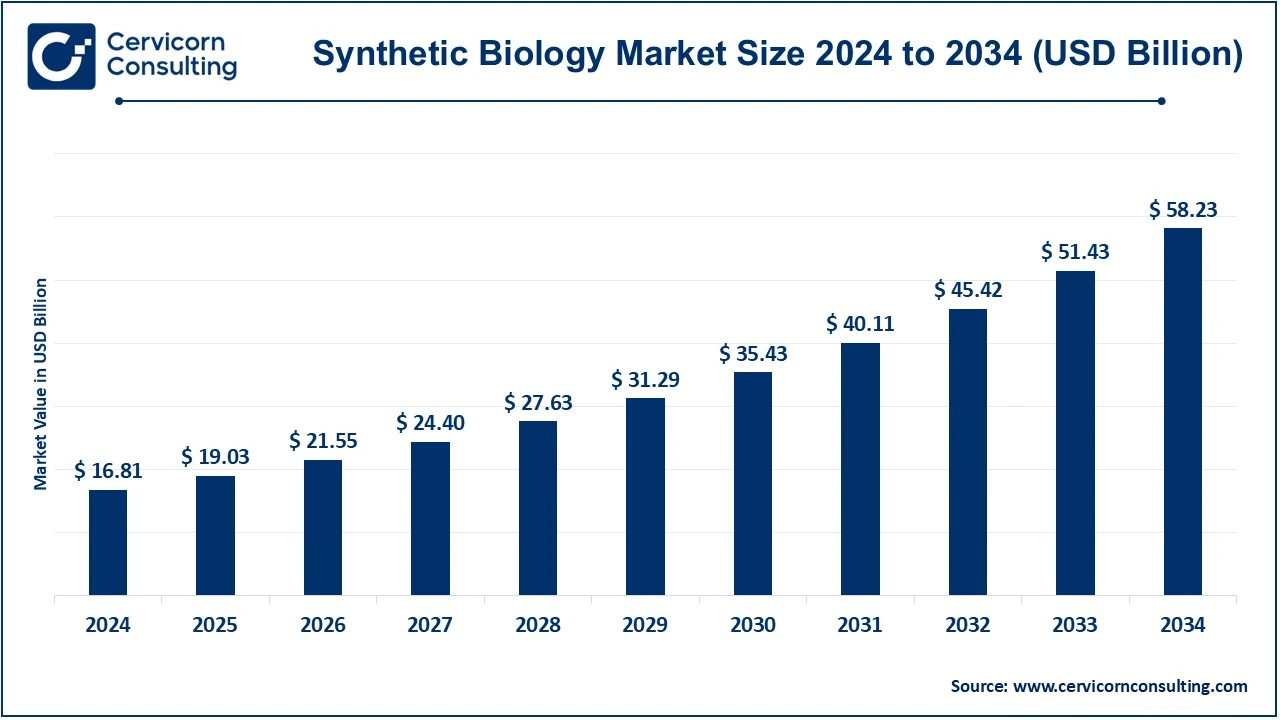

The global synthetic biology market size was valued at USD 16.81 billion in 2024 and is expected to be worth around USD 58.23 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 13.22% during the forecast period 2025 to 2034. The U.S. synthetic biology market size was estimated at USD 5.24 billion in 2024. The synthetic biology market has been witnessing substantial growth owing to the rise in applications of genetic engineering and biotechnological tools as well as the shift towards sustainable solutions in various industries.

Synthetic biology can be defined as an interface between biology and engineering, the application of which enables the design and building of new biological systems as well as modification of existing biological systems for one’s purpose. This technology has applications in medicine, agriculture, energy, and biomanufacturing and the interest in technologies such as gene therapy, biofuels and synthetic food production is on the rise. More So, government funding and joint ventures between universities and biotech industries have increased innovation in this sector. Nevertheless, environmental, ethical, and political factors, as well as research and development expenditure, are some of the factors that are likely to influence the market in the future.

CEO Statement

Dr. Jennifer Holmgren, CEO LanzaTech

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 16.81 Billion |

| Expected Market Size in 2034 | USD 58.23 Billion |

| CAGR 2025 to 2034 | 13.22% |

| Prime Region | North America |

| High Growth Region | Asia-Pacific |

| Key Segments | Product, Technology, Application, End User, Region |

| Key Companies | Thermo Fisher Scientific, Inc., Synthetic Genomics Inc., Synthego, Scarab Genomics, Llc, Pareto Bio, Inc., Novozymes, New England Biolabs, Merck Kgaa (Sigma-Aldrich Co. Llc), Illumina, Inc., Eurofins Scientific, Enbiotix, Inc., Creative Enzymes., Creative Biogene., Codexis, Inc., Bota Biosciences Inc. |

Expanding Synthetic Food Production

Reduction in DNA Sequencing and Synthetic Costs

Ethical Concerns and Public Perception

Regulatory and Safety Challenges

Rapid Growth in the Biotechnology Sector

Adoption in the Cosmetics Industry

Excessive Costs for Research and Development

Potential Threats to the Environment

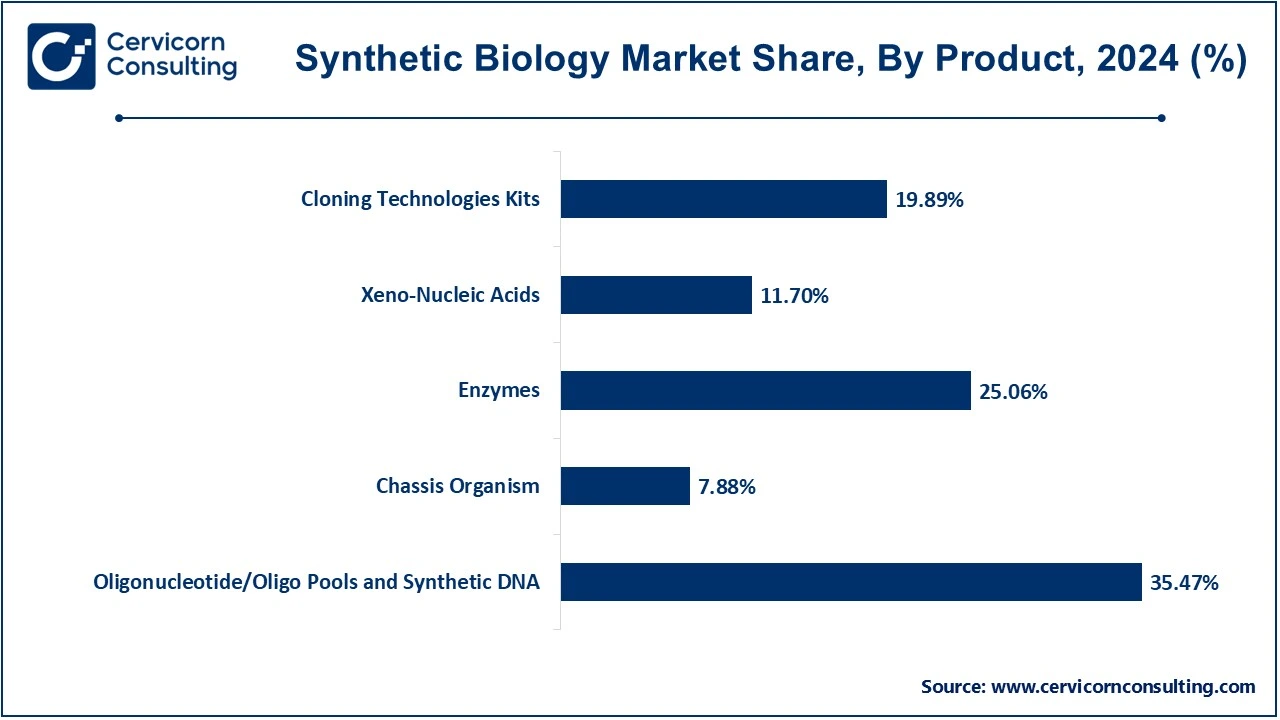

The synthetic biology market is segmented into product, technology, application, end user, and region. Based on product, the market is classified into oligonucleotide/oligo pools and synthetic DNA, chassis organism, enzymes, xeno-nucleic acids, and cloning technologies kits. Based on technology, the market is classified into NGS technology, PCR technology, genome editing technology, bioprocessing technology, microfluidics, bioinformatics, nanotechnology, and other. Based on application, the market is classified into healthcare and non-healthcare. Based on end use, the market is classified into biotechnology and pharmaceutical companies, academic and research institutes and others.

Oligonucleotide/Oligo Pools and synthetic DNA: This segment has dominated the market in 2024 (35.47%). Oligonucleotide and synthetic DNA products are crucial factors in the synthetic biology market. These small deoxyribonucleotide or ribonucleotide sequences are made to order for purposes of gene therapy, diagnostic tools and even for carrying out synthetic biology experiments. Oligo pools allow for the synthesis of thousands of varying sequences at once thus promoting high throughput screening and functional genomics. Complete genes or synthetic DNA structures that may include genetic pathways are essential in the creation of modified organisms for use in Industry, Agriculture and medicine.

Enzymes: Enzymes are very important when it comes to synthetic biology and act as biocatalysts for several biochemical activities that are needed for the process. They assist in processes such as synthesis, degradation, and alteration of DNA thus enabling the precise design of various genes. Enzymes like polymerase, ligase and harmful nucleases are of great relevance in gene editing, gene cloning procedures and also in metabolic engineering activities.

Chassis Organisms: Chassis organisms are host cells that are constructed like Escherichia coli, yeast, or algae and are used in turn for the development of synthetic biology. These organelles are engineered in particular to produce certain products, where biofuels and bioplastics lie within the parenthesis of drugs and food additives. Because of their potential to accommodate synthetic pathways with the optimization of metabolic processes, they are considered the backbone of the bio-manufacturing sector.

Xeno-Nucleic Acids(XNAs): Synthetic nucleic acid for stable DNA and RNA. Xeno-nucleic acids (XNAs) are similar to natural DNA or RNA but are conformed in a manner that they are more chemically stable and do not undergo any enzymatic degradation. In contrast to the natural nucleic acid XXX, made up of stable XNAs, it is possible to use XNAs in medicines and in making Xeno that contain the XX nucleic acid structures. They are also being developed for gene therapy instead of the standard nucleic acids and for designing new biopolymers as molecular machinery.

Cloning Technologies Kits: The cloning technologies kits segment is expected to witness the fastest CAGR during the forecast period. With the onset of synthetic biology, the core methodology of adding genetic material to organizing systems has received a lot of focus and cloning technologies kits have made it possible to develop and commercialize this process with ease. This kit helps the users with the reagents, tools and protocols to design the alteration of genes and design biological apparatus ready for use. They are essential in the production of therapeutic proteins and biomaterial development technologies.

NGS Technology: Synthetic biology involves next-generation sequencing (NGS) technologies which form the basis of the control of biological functions in synthetic biology due to their ability to analyze the genomes significantly faster. It facilitates the plasmid structure sequencing as well as genomes of interest over a certain population, which includes, for instance, sequencing of metagenomes. NGS not only aids in the design of synthetic pathways and the construction of organisms but also assists in the streamlining of genetic circuits.

PCR Technology: Polymerase chain reaction (PCR) technology is one of the most significant aspects of synthetic biology since it allows the multiplication of a specified DNA sequence that can be used for various purposes. When cloning, analyzing gene expression, or producing artificial assemblages, PCR is also necessary. PCR is the technique that is utilized when high sensitivity and accuracy are needed as in genetic diagnostics and genetic manipulation with the help of; qPCR or quantitative polymerase chain reaction and digital PCR.

Bioprocessing Technology: Every innovation in synthetic biology must eventually integrate into an industrial-scale biomanufacturing system and that is where bioprocessing technologies come into play. It includes activities such as growing genetically engineered organisms and harvesting products derived from biological sources for instance biofuels, bioplastics and therapeutics. With modern bioprocessing techniques such as fermentation optimization and downstream processing, it is possible to obtain products that have high yield and purity.

Genome Editing Technology: The development of genome editing tools CRISPR-Cas9, TALENs, and ZFNs, has had a very positive impact on the field of synthetic biology in that it has become possible to modify specific sites within a genetic material. These instruments enables the scientists to edit, delete or add DNA in the creation of an organism with a specifically designed trait. Improvement of the genome editing has led to the development of the gene therapy, enhancement of crops, and enhancement of the microbial production systems.

Healthcare: The application is revolutionizing the healthcare landscape with its potential in gene therapy, personalized medication, and vaccine manufacture. New genetically engineered vectors and genetic based systems are developed to treat genetic diseases, tumors, or infectious pathogens. Other techniques aimed at the treatment and prevention of a disease include CRISPR gene editing and synthetic biology applications such as targeted therapy and diagnostics development.

Synthetic Biology Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Healthcare | 56.97% |

| Non-Healthcare | 43.03% |

Non-Healthcare: In addition to healthcare, synthetic biology is changing the game for other sectors like agriculture, energy and materials. For agriculture, this helps in developing crops through genetic means with better yield, resist pest attacks and better nutrient usage. For biobased energy, synthetic biology is the application of modified microbes for producing fuels such as biofuels than using the traditional way of fossil fuels.

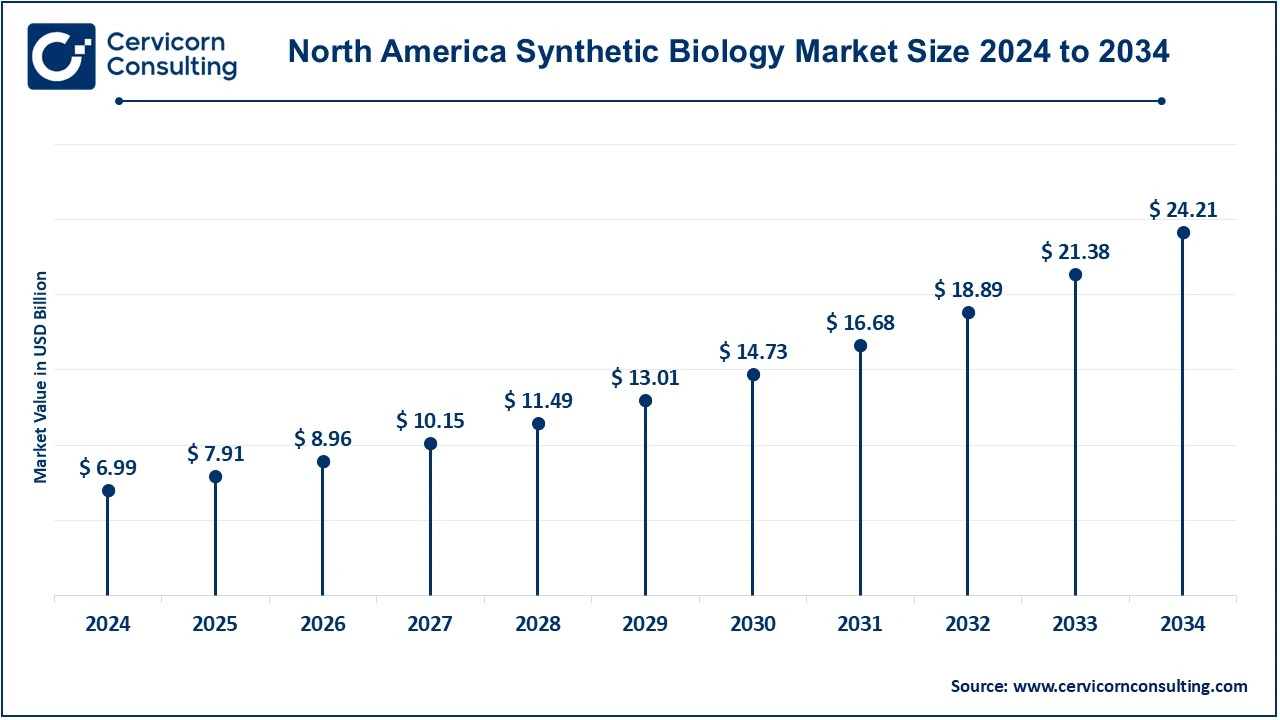

The North America synthetic biology market size was estimated at USD 6.99 billion in 2024 and is expected to reach around USD 24.21 billion by 2034. The region dominates the market thanks to a high level of R&D expenditure, development of relevant infrastructure, and existence of a thriving biotechnology market. Within this region, the U.S. holds the highest rank owing to its innovations in health care, agricultural biotechnology, and industrial bio-manufacturing.

The Europe synthetic biology market size was accounted for USD 4.63 billion in 2024 and is projected to hit around USD 16.02 billion by 2034. Europe is also a major region, standing out from others with a range of supportive policies and funding opportunities such as Horizon Europe. It strives for this goal while promoting bio-based materials and bioenergy, which are more sustainable. Germany, the UK, and France are prominent players in the industrial biotechnology area, where developments concerning healthcare sectors such as gene therapy and synthetic vaccines are becoming more prevalent.

The Asia-Pacific synthetic biology market size was exhibited at USD 4.05 billion in 2024 and is predicted to surpass around USD 14.03 billion by 2034. Asia-Pacific market is expected to grow owing to the rapid expansion in the investments related to the biotechnology sector and the rising demand for the eco-friendly options. Further, countries such as China, India, and Japan are implementing agricultural, health and energy-related biotechnology and synthetic biology strategies. State administration encourages such initiatives while academic institutions enter into active cooperation with businesses, which enables the growth of the region.

Synthetic Biology Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 41.58% |

| Europe | 27.52% |

| Asia-Pacific | 24.10% |

| LAMEA | 6.80% |

The LAMEA synthetic biology market was valued at USD 1.14 billion in 2024 and is anticipated to reach around USD 3.96 billion by 2034. Latin America, the Middle East, and Africa (LAMEA) are areas where the relatively new field of synthetic biology is gaining ground with the primary emphasis being on biofuels and sustainable agriculture. While Brazil and Argentina have sought to enhance the agricultural biotechnology for higher crop yields, countries in the Middle East are latching onto biomaterials for renewable energy. The lack of adequate infrastructure and financing remains an impediment. However, capacity building initiatives and partnerships among nations are slowly increasing the development of the market in these regions.

The new players in the synthetic biology industry are causing technological leaps due to their opportunities of focused application and advanced technologies. Newer and smaller firms are working towards the provision of the specific application like that of the provision of alternative proteins, precision gene therapies and bio plastics. Many of the players are also using CRISPR and AI, and automation to carry out genetic engineering more efficiently and cheaply than before. They often work with universities and big biotech companies who have resources to help in product development. Besides that, the new players are also tackling the issues of sustainability by coming up with environmental friendly solutions such as biodegradable plastics and biofuel.

Market Segmentation

By Product

By Technology

By Application

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Synthetic Biology

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Synthetic Biology Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Expanding Synthetic Food Production

4.1.1.2 Reduction in DNA Sequencing and Synthetic Costs

4.1.2 Market Restraints

4.1.2.1 Ethical Concerns and Public Perception

4.1.2.2 Regulatory and Safety Challenges

4.1.3 Market Challenges

4.1.3.1 Excessive Costs for Research and Development

4.1.3.2 Potential Threats to the Environment

4.1.4 Market Opportunities

4.1.4.1 Rapid Growth in the Biotechnology Sector

4.1.4.2 Adoption in the Cosmetics Industry

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Synthetic Biology Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Synthetic Biology Market, By Product

6.1 Global Synthetic Biology Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Oligonucleotide/Oligo Pools and Synthetic DNA

6.1.1.2 Chassis Organism

6.1.1.3 Enzymes

6.1.1.4 Xeno-Nucleic Acids

6.1.1.5 Cloning Technologies Kits

Chapter 7. Synthetic Biology Market, By Technology

7.1 Global Synthetic Biology Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 NGS Technology

7.1.1.2 PCR Technology

7.1.1.3 Genome Editing Technology

7.1.1.4 Bioprocessing Technology

7.1.1.5 Microfluidics

7.1.1.6 Bioinformatics

7.1.1.7 Nanotechnology

7.1.1.8 Others

Chapter 8. Synthetic Biology Market, By Application

8.1 Global Synthetic Biology Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Healthcare

8.1.1.2 Non-Healthcare

Chapter 9. Synthetic Biology Market, By End User

9.1 Global Synthetic Biology Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Biotechnology and Pharmaceutical companies

9.1.1.2 Academic and Research Institutes

9.1.1.3 Others

Chapter 10. Synthetic Biology Market, By Region

10.1 Overview

10.2 Synthetic Biology Market Revenue Share, By Region 2024 (%)

10.3 Global Synthetic Biology Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Synthetic Biology Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Synthetic Biology Market, By Country

10.5.4 UK

10.5.4.1 UK Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Synthetic Biology Market, By Country

10.6.4 China

10.6.4.1 China Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Synthetic Biology Market, By Country

10.7.4 GCC

10.7.4.1 GCC Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Synthetic Biology Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Thermo Fisher Scientific, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Synthetic Genomics Inc.

12.3 Synthego

12.4 Scarab Genomics, Llc

12.5 Pareto Bio, Inc.

12.6 Novozymes

12.7 New England Biolabs

12.8 Merck Kgaa (Sigma-Aldrich Co. Llc)

12.9 Illumina, Inc.

12.10 Eurofins Scientific

12.11 Enbiotix, Inc.

12.12 Creative Enzymes

12.13 Creative Biogene

12.14 Codexis, Inc.

12.15 Bota Biosciences Inc.