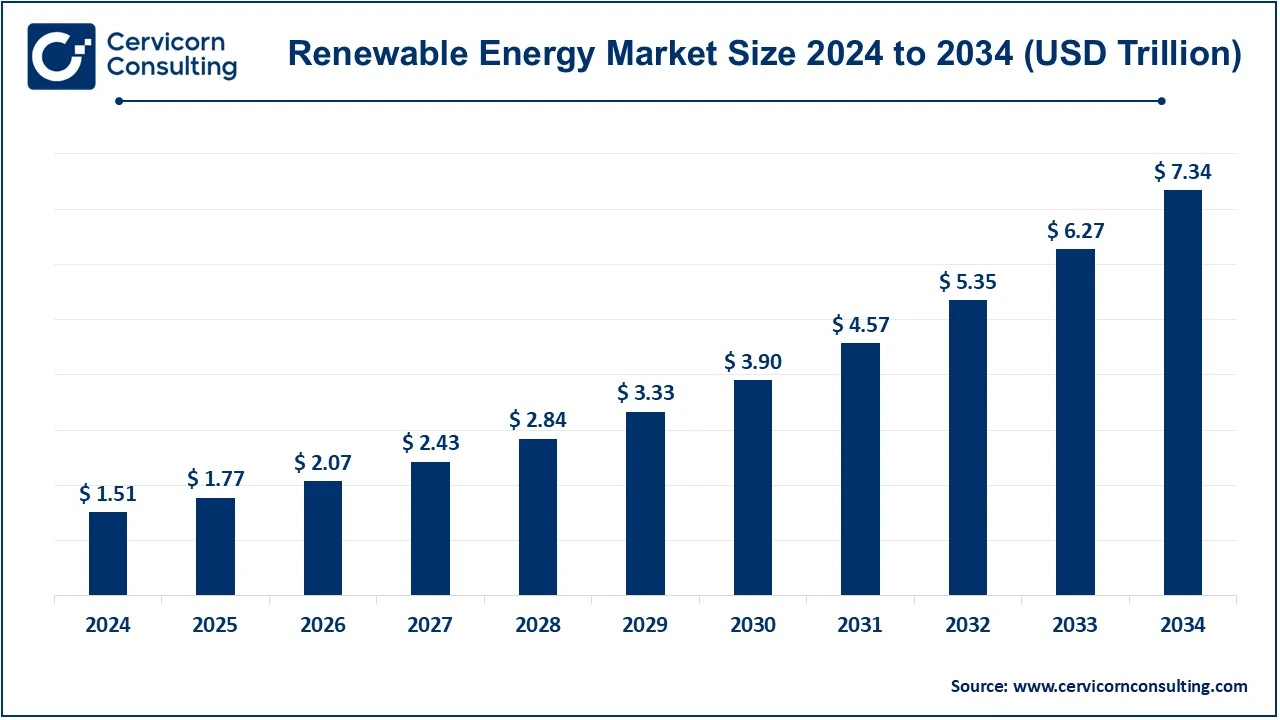

The global renewable energy market size was valued at USD 1.51 trillion in 2024 and is projected to hit around USD 7.34 trillion by 2034, growing at a compound annual growth rate (CAGR) of 17.13% over the forecast period 2025 to 2034.

The renewable energy market is thriving, driven mainly by increases in global demands for a cleaner source of energy; the technological gains made lately, as well as positive moves from governments; decarbonization of countries toward climate change, investments in hydroelectric and solar and wind power offering cleaner alternatives to fossil fuels. More so, innovations in energy storage and improvements in integrating it into the grid enhance these systems even more in terms of efficiency and reliability. Electrification in the transportation industry and manufacturing sectors is accelerating and increasing the demand for renewable power. The influence and push from the public as well as the private sector enhance widespread usage while further accelerating the growth process for this market.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.77 Trillion |

| Expected Market Size in 2034 | USD 7.34 Trillion |

| Projected CAGR 2025 to 2034 | 17.13% |

| Leading Region | Asia-Pacific |

| Significant Growth | North America |

| Key Segments | Product, End User, Region |

| Key Companies | ABB, Siemens Gamesa Renewable Energy, S.A., Schneider Electric, Xcel Energy Inc., EDF, National Grid Renewables, Acciona, Enel Spa, Innergex, The Tata Power Company Limited, General Electric, Suzlon Energy Ltd., Invenergy |

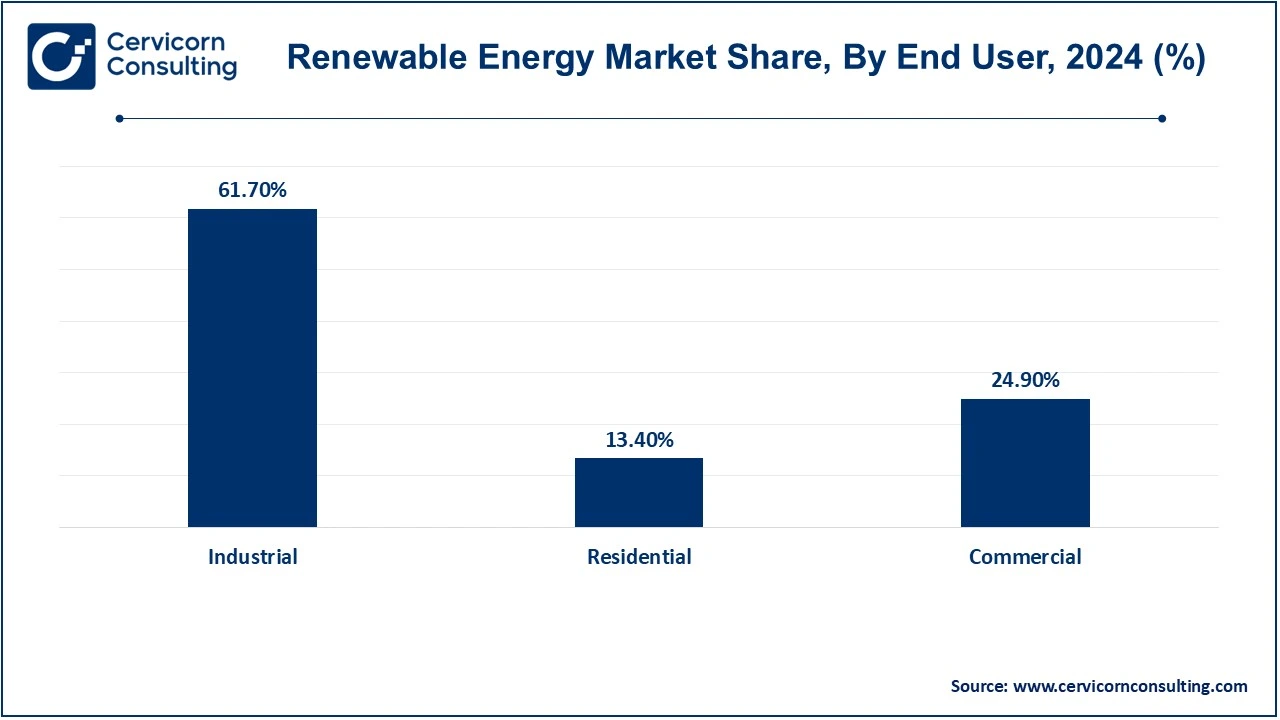

the renewable energy market is segmented into product, end user and region. Based on product, the market is classified into hydropower, wind power, solar power, bioenergy, geothermal energy, and ocean energy. Based on end user, the market is classified into industrial, residential, and commercial.

Solar Power: The solar power is dominating segment in 2024. It involves converting sunlight into electricity by using photovoltaic (PV) cells on rooftops or through huge solar farms. Concentrated solar power (CSP) systems produce power by concentrating sunlight to heat a medium which produces steam to run the turbines. Solar power is available in abundant supply and it is a renewable source, especially in sunny areas. It can be applied to both centralized generations, with solar farms, and decentralized generation, through residential and commercial solar installations, reducing significantly the environmental impact and decreasing reliance on traditional power supplies.

Hydropower: Hydroelectricity is produced by using flowing water energy. Large-scale power plants like dams and reservoirs with hydropower are controlling the flow of water for producing a large amount of electricity. Small-scale hydropower systems, micro as well as pico power plants, provide local or isolated power supply for rural and distant areas. Hydropower is flexible to meet the base-load electricity demand and support the grid stability. The pumped-storage hydropower is also covered, which stores energy during periods of low demand and releases it during peak demand times to add reliability to the grid.

Wind Power: Wind power is generated through turbines that transform kinetic energy from the wind into electrical energy. There are onshore wind farms, which are typically placed on land, and offshore wind farms, which harness stronger, more consistent winds at sea. Offshore wind projects cost more to install but will offer greater capacity and energy. As such, wind power forms an important growth segment of the renewable energy sector and contributes toward energy diversification efforts with its scalable potential toward less reliance on fossil fuel usage and decreased greenhouse gas emissions.

Bioenergy: Bioenergy is made from organic sources such as plants, wood, agricultural waste, and even algae that have been processed into producing either heat, electricity, or biofuels. Biomass energy is essentially the combustion of organic matter to generate power, whereas biogas, which results from anaerobic digestion of organic wastes, can be used either for electricity or heating purposes. Biofuels, such as ethanol and biodiesel, are made from crops and waste materials, serving as renewable alternatives to gasoline and diesel. This segment plays a key role in reducing carbon emissions and supporting energy security by utilizing waste materials.

Industrial: The industrial segment is dominating segment in 2024. Renewable sources are used to power huge industrial processes, heavy-duty machinery, and production lines in the industrial sector. The operational cost is greatly reduced and the carbon footprint comes down by using solar, wind, or biomass energy sources by industries. Renewable sources can be generated on-site with solar installation or small turbines wind or purchased through the PPA from the energy service provider. Increasingly regulatory incentives, the need to be energy independent, as well as growing environmental sustainability goals, are driving industries to adopt clean energy.

Residential: This is a source where households are using renewable energy sources to generate electricity. More common technology applied is using solar panels; however, it is pretty common among families to have rooftop systems with clean electricity and reduce household bills on energy consumption. The other option includes small turbines or in-home energy storage. Government incentives and rebates, coupled with consumer interest in sustainable energy, assist in the incorporation of renewable energy into residential applications. In this category, consumers are made more energy-independent as part of the grander scheme of reducing their dependency on the grid.

Commercial: The commercial sector refers to businesses, offices, and retail properties using renewable power sources. Commercial companies tend to invest in solar energy sources for both economic and environmental reasons, especially when power prices become too high. Many of them also use wind power or biomass energy, with some through direct generation and others through PPAs with renewable suppliers. The motivation of the commercial sector beyond cost savings in energy is through corporate sustainability goals, such as LEED green building certifications. The sector has a high contribution towards the widespread penetration of clean energy technologies.

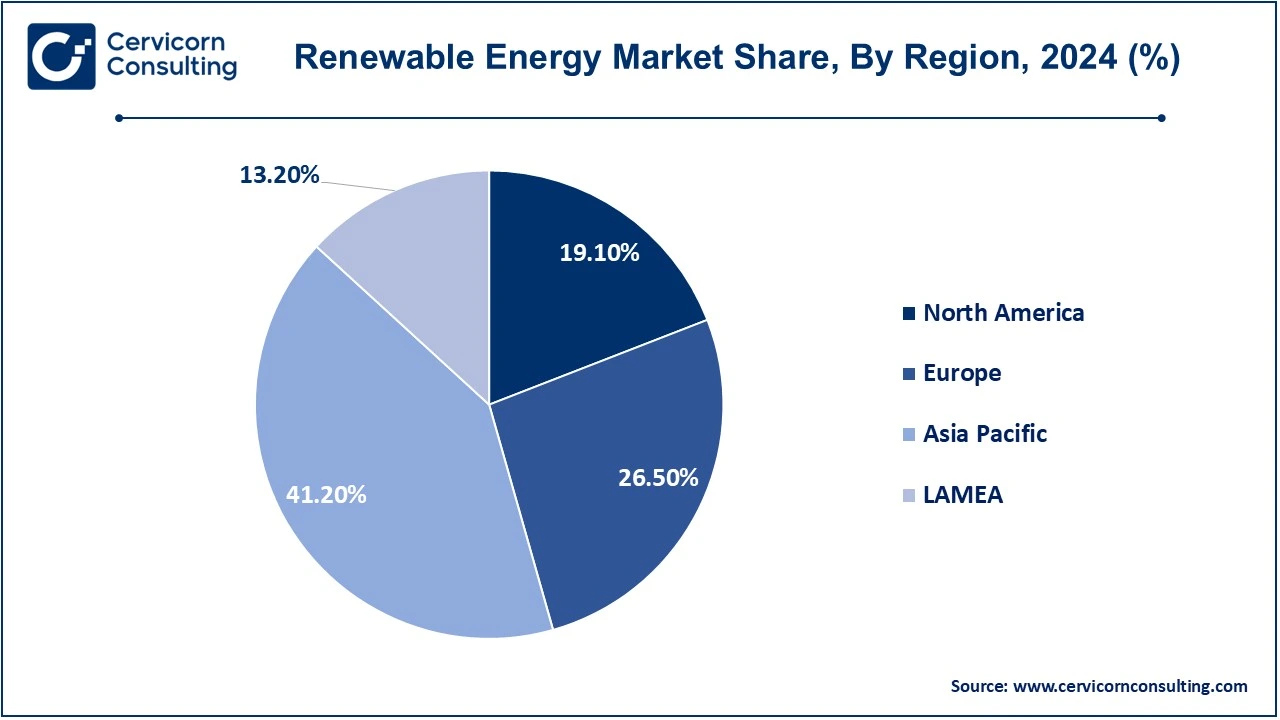

The renewable energy market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The North America renewable energy market size was valued at USD 0.29 trillion in 2024 and is expected to reach around USD 1.40 trillion by 2034. The U.S. remains the biggest leader in wind and solar energy to make the power sector greener and decarbonize the power sector. For instance, last year, according to data issued by the U.S. Energy Information Administration, for example, in 2023, January 2024, the U.S. electric power sector produced a total of 4,017 billion kWh of electricity; renewables—wind, solar, hydro, biomass, and geothermal—accounted for 22% of that output, or 874 billion kWh. Renewable power generation surpassed nuclear for the first time since 2021 and coal for the first time since 2022. Canada is a significant power generator in hydroelectricity and also ranks among the world's top producers of renewable energy. Mexico has recently become active on the world solar and wind energy scene by formulating government policies that can positively aid renewable energy uptake in this area. The regional diversities and resources bring high chances of increasing renewables in the future years.

The Europe renewable energy market size was estimated at USD 0.40 trillion in 2024 and is projected to surpass around USD 1.95 trillion by 2034. Europe leads the best-performing prime regions; the largest four countries involved are Germany, the UK, France, and Spain. This region is known to be the world leader in the development of wind and solar power and to be very strict in climate policies, most importantly, through its "Energiewende”. The UK focuses on offshore wind, making tremendous progress in carbon emissions reductions. For instance, in the UK, Sofia already gave about £760 million in economic value. This incorporates employment that is local and also includes investing in the necessary infrastructures. It presents the vital example of renewable energy and underlines their role and importance in supporting regional sustainability and community development as the nuclear power base of France begins gradually introducing solar and wind energy into their systems. High growth rates were recorded for solar and wind power not only in the southern regions like the climate encourages, in Spain.

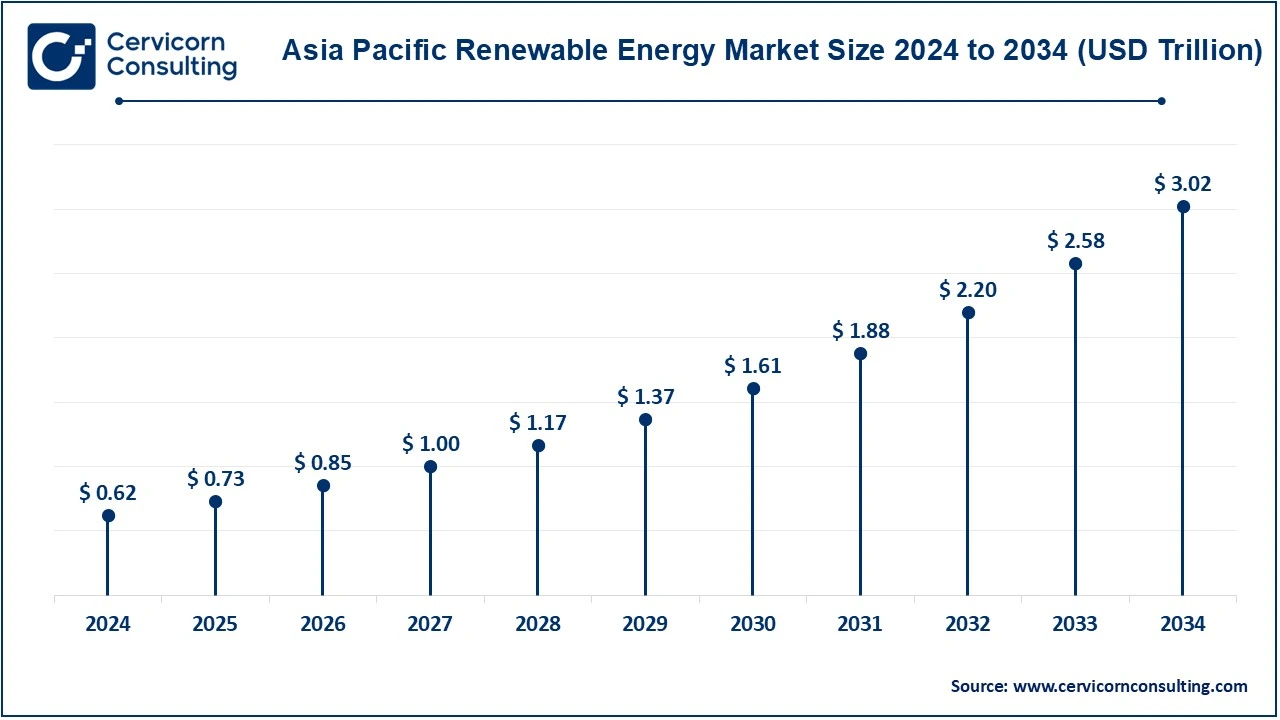

The Asia-Pacific renewable energy market size was accounted for USD 0.62 trillion in 2024 and is forecasted to grow around USD 3.02 trillion by 2034. Asia-Pacific is the largest and fastest-growing in the world, dominated by China, Japan, India, and South Korea. China leads globally in solar and wind capacity backed by government support and large-scale renewable projects.In India, solar power has grown at a rapid growth trajectory and is aiming at very ambitious renewable energy targets. Japan is prioritizing more solar and offshore wind expansion. South Korea is prioritizing green hydrogen and energy storage. These are massive potential pools for expanding renewable energy sources given the region's large populations and expanding economies.

The LAMEA renewable energy market was valued at USD 1.20 trillion in 2024 and is anticipated to reach around USD 0.97 trillion by 2034. The LAMEA region consists of Latin America, the Middle East, and Africa. It is becoming very open to renewable energy sources. Latin America is also prominent, with Brazil showing huge bioenergy resources and several hydroelectric power projects. Countries in the Middle East, including the UAE and Saudi Arabia, are investing heavily in solar power as part of diversification away from oil. Africa, with plenty of solar and wind power resources, plans to spend more in the renewable energy sector to increase energy supply in the face of ever-growing energy demand and the resultant energy poverty. Investments in the region's clean energy are huge and have room for more growth.

CEO Statements

Morten Wierod, CEO of ABB

Bob Frenzel CEO of Xcel Energy Inc.,

Blake Nixon, CEO of National Grid Renewables

Recent strategic initiatives and acquisitions in the renewable energy industry indicate a strong trend toward innovation and strategic collaboration between the industry's major players. The key firms ABB, Xcel Energy Inc., EDF, National Grid Renewables, Acciona, and Enel Spa have built up their technological strength by creating new high-performance energy storage systems, smart grids, and integrated platforms of renewable generation. These innovations aim to develop efficiency, reliability, and the ability to scale within systems of renewable energy while helping accelerate that transition toward a low-carbon economy. Joint ventures and other partnerships will work toward this, and it will lead to such a company developing its position as one of the leaders in the global transition to renewable energy with implications on all the sustainability goals as well as energy security

Market Segmentation

By Product

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Renewable Energy

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Private Investment and Funding

4.1.1.2 Public-Private Partnerships

4.1.1.3 Dependency reduction from fossil fuels

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Costs

4.1.2.2 Challenges to Renewable Energy in Transmission Infrastructure

4.1.2.3 Environmental and Ecological Impact

4.1.3 Market Challenges

4.1.3.1 Land acquisition and permitting

4.1.3.2 Supply Chain Constraints

4.1.3.3 Unpredictable Weather Conditions

4.1.4 Market Opportunities

4.1.4.1 Electric Cars and Charging Stations

4.1.4.2 Microgrids and Distributed Energy Systems

4.1.4.3 Green Finance and Renewable Investment

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Renewable Energy Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Renewable Energy Market, By Product

6.1 Global Renewable Energy Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hydropower

6.1.1.2 Wind Power

6.1.1.3 Solar Power

6.1.1.4 Bioenergy

6.1.1.5 Geothermal Energy

6.1.1.6 Ocean Energy

Chapter 7. Renewable Energy Market, By End Use

7.1 Global Renewable Energy Market Snapshot, By End Use

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Industrial

7.1.1.2 Residential

7.1.1.3 Commercial

Chapter 8. Renewable Energy Market, By Region

8.1 Overview

8.2 Renewable Energy Market Revenue Share, By Region 2024 (%)

8.3 Global Renewable Energy Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Renewable Energy Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Renewable Energy Market, By Country

8.5.4 UK

8.5.4.1 UK Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Renewable Energy Market, By Country

8.6.4 China

8.6.4.1 China Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Renewable Energy Market, By Country

8.7.4 GCC

8.7.4.1 GCC Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Renewable Energy Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 ABB

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Siemens Gamesa Renewable Energy, S.A.

10.3 Schneider Electric

10.4 Xcel Energy Inc.

10.5 EDF

10.6 National Grid Renewables

10.7 Acciona

10.8 Enel Spa

10.9 Innergex

10.10 The Tata Power Company Limited

10.11 General Electric

10.12 Invenergy

10.13 Suzlon Energy Ltd.