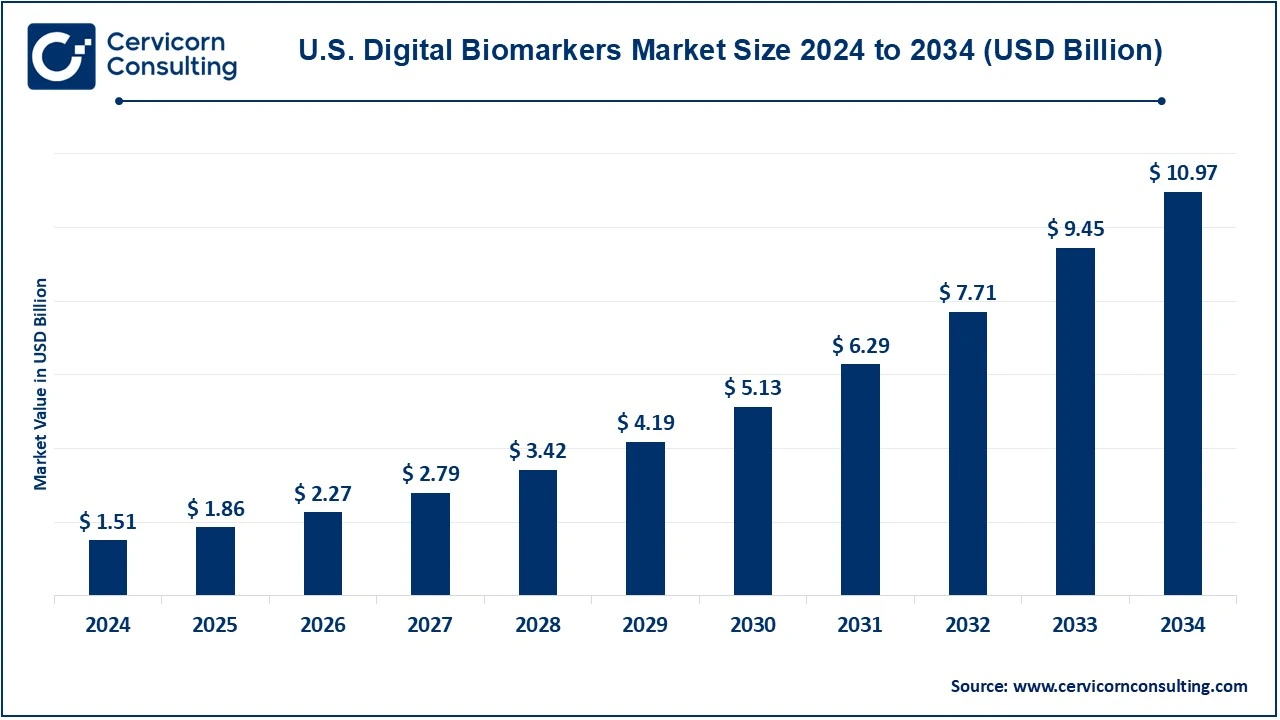

The U.S. digital biomarkers market size was valued at USD 1.51 billion in 2024 and is expected to reach around USD 10.97 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.93% over the forecast period 2025 to 2034.

The growth in the market is mainly driven by technological advancements, mainly wearables, mobile health applications, and sensors that make continuous health data monitoring feasible at the point of time in a real-time manner. They make for more accurate and personal information about an individual's health enable better control of chronic diseases and can anticipate illnesses in advance. Additionally, factors like increased demand for remote patient monitoring, lifestyle-related diseases' growing prevalence, and value-based healthcare models are changing the scene. The clinical trials become more efficient, thus expediting the new treatment's development, due to digital biomarkers.

CEO Statements

Padraig McDonnell, CEO of Agilent Technologies, Inc.

Norman Schwartz, CEO of Bio-Rad Laboratories, Inc.

Dirk Bontridder, CEO of PerkinElmer Inc.:

Report Scope

| Are of Focus | Details |

| Market Size in 2025 | USD 1.86 Billion |

| Expected Market Size in 2034 | USD 10.97 Billion |

| CAGR | 21.93% |

| Key Segments | Type, Disease, Clinical Practice, End-use |

| Key Companies | Bio-Rad Laboratories, Inc., Abbott, Agilent Technologies, Inc., Johnson & Johnson Services, Inc., Thermo Fisher Scientific, Inc., PerkinElmer Inc., General Electric, MESO SCALE DIAGNOSTICS |

The U.S. digital biomarkers market is segmented into type, disease, clinical practice and end user. Based on type, the market is classified into validation, efficacy, and safety. Based on disease, the market is classified into neurological diseases, cancer, immunological diseases, respiratory diseases, musculoskeletal diseases, cardiovascular diseases, and others. Based on clinical practice, the market is classified into personalized medicines, drug discovery & development, and diagnostics. Based on end-use, the market is classified into healthcare companies, healthcare providers, payers, and others.

Validation: To be validated, the digital biomarkers have to ensure the reflection of data produced by devices or sensors in digital settings is precise, representing the state of biology they are purported to measure. This is fundamental to ensuring that the biomarkers generated are reliable and clinically applicable. Extensive validation studies are required for approval by regulatory bodies such as the FDA for the use of these digital biomarkers in clinical settings. The use of such biomarkers without validation can be prone to misdiagnosis and ineffective treatment, thereby lowering the utility of these biomarkers in medicine.

Efficiency: Efficacy here refers to the ability of digital biomarkers to predict or monitor the effects of a medical intervention or progression of a disease. Because clinical practitioners have real-time data, they can assess the efficacy of treatment and even change treatment plans.It is possible with real-time tracking of health metrics, which allows insight into whether treatments are indeed optimized, and patients receive positive responses. The clinical adoption and regulatory approval of digital biomarkers in healthcare practices require demonstration of efficacy.

Safety: Safety is the top issue when digital biomarkers are used in healthcare because inaccurate readings or faulty devices can expose the patient to harm. In ensuring the success of clinical use, it is crucial that the digital biomarkers do not, either by false readings or failing of devices. The safety issues are primarily overcome through stringent testing, regulatory oversight, and constant monitoring of the digital devices so that they function in accordance with the stipulated safety standards. The long-term safety of the digital biomarkers should have no harmful influence on the patients' physical and psychological conditions.

Neurological Diseases: With increasing care and monitoring in cases of neurological diseases-from Alzheimer's to Parkinson's, and multiple sclerosis-they now have more of a need for digital biomarkers. All these diseases require constant observation for knowing the progress the disease is making or whether the patient is responding positively to treatment. It follows that digital biomarkers - through activity trackers and cognitive tests of the patient - are an important tool for monitoring and possibly improving motor functions, the level of cognitive abilities and behavioral patterns. It thus also allows for better calibration of treatment and provides qualitative improvements to the lives of neurologic disease patients by delivering an immediate view into a patient's state of health.

Cancer: The digital biomarkers for approaching early detection, management of therapy, and surveillance of growth of the tumor in cancer would be any physiological changes pointing toward molecular markers associated with growth of the tumor or response and potential metastasis. The digital tools are those like wearables and diagnostic apps that can detect even slight changes in patient health reflecting a change in status of the cancer. Continuous monitoring by digital biomarkers allow clinicians to catch recurrences early, better tailor treatments, and improve patient outcomes in the fight against cancer.

Immunological Disorders: Immunological diseases that are categorized under autoimmune and chronic inflammatory conditions benefit due to digital biomarkers since they are able to measure the activities of the immune system as well as exacerbations. Digital biomarkers can be monitored in a real-time basis with devices such as wearable devices on physical metrics or sensors assessing the cytokine level in patients' bodies.This stream of continuous data enables tracking of the progress of diseases, individualized treatment plans, and forecasting flare-ups for patients suffering from immunological diseases.

Cardiovascular Diseases: Digital biomarkers that monitor the below-mentioned vital parameters, such as heart rate, blood pressure, and oxygen levels, are helpful in cardiovascular diseases like heart diseases, hypertension, and arrhythmias. Wearable devices with sensors are capable of continuous and noninvasive monitoring of cardiovascular health by providing early warnings regarding such potential heart-related problems.Digital biomarkers provide timely interventions for health professionals, adjustments in medication regimens, and improved outcomes of long-term heart health. Feedback from cardiovascular biomarkers also helps in averting frequent hospital visits or emergency cases, thus enhancing the quality of life in patients.

Personalized medicines: Tailor-made medicine is a quickly evolving area, and biomarkers are the digital solutions in the process of personalized treatments for patients. Thus, with real-time data regarding a patient's disease status, digital biomarkers enable health care providers to design specific therapies based on patterns of health or genomic profiles. This ensures effective management of treatment with minimal adverse side effects. The use of digital biomarkers monitors the response of patients to medication and optimizes dosing along with progressing the disease process such that optimal treatment plans can be formulated, based on the requirement of each individual and health improvement.

Drug Discovery & Development: Digital biomarkers are one of the important players in drug discovery and development that help identify potential therapeutic targets, assess drug efficacy, and monitor adverse effects. Digital biomarkers will thus offer researchers very precise, real-time data for a deeper understanding of biological processes involved in disease conditions. They make clinical trials easier to conduct by virtue of increased accuracy in recruiting patients and tracking responses to treatments. Digital biomarkers further allow for the monitoring of biomarkers in early-stage clinical trials and thus provide more reliable data in making decisions regarding drug development.

Diagnostics: Diagnostics have totally altered the scenario of diagnosis as it presents non-invasive, constant monitoring through which diseases would be found out in a very initial phase of life. A lot of movement and related signs along with other types of physiological signals are nowadays measured by means of wearable gadgets and mobile apps that signify the concept of digital biomarkers. Biomarkers help clinicians detect anomalies that manifest before the symptoms become clinically apparent, hence earlier interventions are brought and result in better patient outcomes. Digital diagnostics on biomarkers are also cheaper than traditional diagnostic tools, making healthcare much more accessible.

The new entrants in the digital biomarkers sector are using sophisticated technologies, such as AI, machine learning, and real-time data analytics, to improve precision and efficiency in patient monitoring and disease management. The companies are making use of wearable devices, mobile health apps, and remote sensing technologies to capture continuous real-time health data, analyze to identify patterns, predict disease progression, and customize treatments. This drives many to focus on collaboration with healthcare providers and pharmaceutical companies to integrate digital biomarkers into clinical trials, enable quicker drug development, and improve the outcomes of patients. These innovations are what are making the market grow and change rapidly and position digital biomarkers as the leading tool in precision medicine.

Market Segmentation

By Type

By Disease

By Clinical Practice

By End-use

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Biomarkers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Disease Overview

2.2.3 By Clinical Practice Overview

2.2.4 By End Use Overview

2.3 Competitive Overview

Chapter 3. U.S. Impact Analysis

3.1 Russia-Ukraine Conflict: U.S. Market Implications

3.2 Regulatory and Policy Changes Impacting U.S. Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Adoption of Personalized Medicine

4.1.1.2 Regulatory Approaches for Digital Health Solutions

4.1.1.3 Cost-Efficiency in Healthcare

4.1.2 Market Restraints

4.1.2.1 Lack of knowledge among healthcare providers

4.1.2.2 Lack of Fragmentation in Market

4.1.2.3 Complexity of Data Interpretation

4.1.3 Market Challenges

4.1.3.1 Cost of Development

4.1.3.2 Clinical Integration

4.1.3.3 Technical Challenges

4.1.4 Market Opportunities

4.1.4.1 AI & Machine Learning Integration

4.1.4.2 Healthcare Reaching Remote Rural Areas

4.1.4.3 Better Patient Engagement

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Digital Biomarkers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Digital Biomarkers Market, By Type

6.1 U.S. Digital Biomarkers Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Validation

6.1.1.2 Efficacy

6.1.1.3 Safety

Chapter 7. Digital Biomarkers Market, By Disease

7.1 U.S. Digital Biomarkers Market Snapshot, By Disease

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Neurological Diseases

7.1.1.2 Cancer

7.1.1.3 Immunological Diseases

7.1.1.4 Respiratory Diseases

7.1.1.5 Musculoskeletal Diseases

7.1.1.6 Cardiovascular Diseases

7.1.1.7 Others

Chapter 8. Digital Biomarkers Market, By Clinical Practice

8.1 U.S. Digital Biomarkers Market Snapshot, By Clinical Practice

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Personalized Medicines

8.1.1.2 Drug Discovery & Development

8.1.1.3 Diagnostics

Chapter 9. Digital Biomarkers Market, By End Use

9.1 U.S. Digital Biomarkers Market Snapshot, By End Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare companies

9.1.1.2 Healthcare Providers

9.1.1.3 Payers

9.1.1.4 Others

Chapter 10. Digital Biomarkers Market, By Region

10.1 Overview

10.2 U.S. Digital Biomarkers Market Revenue, 2022-2034 ($Billion)

10.3 Market Size and Forecast

10.4 U.S. Market Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Bio-Rad Laboratories, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 U.S. Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Abbott

12.3 Agilent Technologies, Inc.

12.4 Johnson & Johnson Services, Inc.

12.5 Thermo Fisher Scientific, Inc.

12.6 PerkinElmer Inc.

12.7 General Electric

12.8 MESO SCALE DIAGNOSTICS