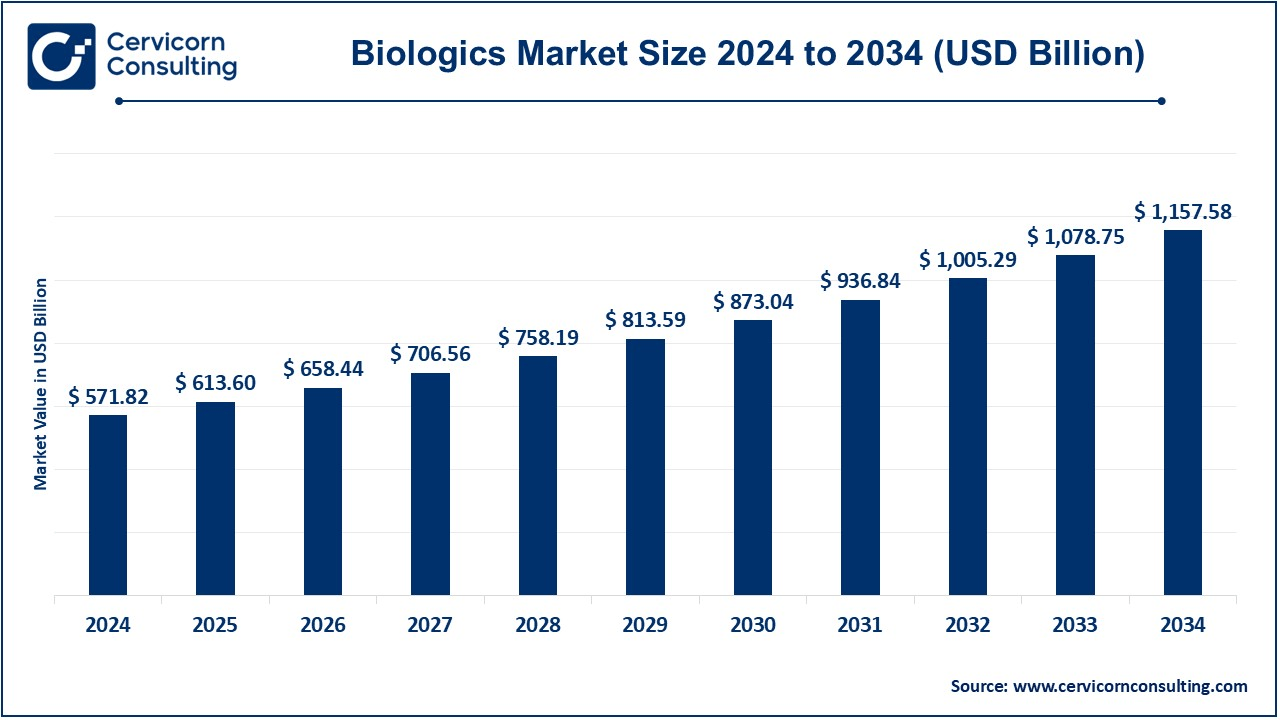

The global biologics market size was estimated at USD 571.82 billion in 2024 and is expected to be worth around USD 1,157.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.30% over the forecast period 2025 to 2034. The U.S. biologics market size was valued at USD 187.74 billion in 2024 and is expected to reach around USD 380.06 billion by 2034

Biologics represent the growing sector due to the surging cases of chronic diseases and the bourgeois demand for personalized medicines. The inclusion of biologics like monoclonal antibodies and gene therapy has become a significant part of management with respect to chronic medical conditions like cancer, autoimmunity, and one that might be genetic. Developments in biomanufacturing technology and a favorable environment for relevant pharma regulatory affairs involve an important role in the resultant growth within the market. In addition, other factors taken in conjunction, like greater efficacy and target when well administered, will also witness a better adoption trend for biologics, thus acting as a driving factor for the growth of the market.

Biologics are medicines considered to be of living origin or derived from any of its components like proteins, cells, or tissues. These diverse products are used to treat various disorders that range from vaccines, monoclonal antibodies, cell-based therapies, or gene therapies. Biologics treat complex conditions, including but not limited to cancer, autoimmune diseases, and inherited genetic disorders. Compared with traditional chemical drugs, biologics are much more complex to manufacture and require more specialized processes. Some examples of biologics range from monoclonal antibodies and vaccines to gene therapies and cell-based therapies. The market for biologics is expanding rapidly because of their power to target specific mechanisms of diseases closely and the increasing interest in personalized medicine.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 613.60 Billion |

| Expected Market Size in 2034 | USD 1,157.58 Billion |

| Estimated CAGR 2025 to 2034 | 7.30% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Application, Source, Manufacturing, Region |

| Key Companies | AbbVie Inc., Pfizer Inc., Novartis AG, Hoffman-La Roche AG, Bayer AG, Amgen, Sanofi, Eli Lilly and Company, GlaxoSmithKline Plc, Celltrion Inc., AstraZeneca, Samsung Biologics Co. Ltd., G. Chem Ltd. |

Monoclonal Antibodies: Monoclonal antibodies, also known as mAbs, are manufactured laboratory-based molecules intended to act as replacement antibodies to enhance or replace the attack on diseased cells by the immune system. These drugs have applications in a range of treatments, including treating cancerous conditions, autoimmune disorders, and chronic conditions. As these treatments selectively bind monoclonal antibodies to antigens presented on the surfaces of diseased cells, they present a minimal area of tissue destruction. This describes the reason behind their increased utilization in immunotherapy.

Recombinant Proteins: Recombinant proteins refer to manufactured proteins from recombinant DNA. It involves insertion of a gene that encodes a protein whose necessity is located within a host cell, upon which they then manufacture enormous levels of the said proteins for atherapeutic treatment. Recombinant proteins are extensively used in the therapeutic use in diseases of genetic origin, hemophilia, and metabolic disorders. Its usage continues to expand according to the degree of accuracy they can substitute or supplement the missing or deficient proteins of the body.

Vaccines: Vaccines are biological preparations that can offer immunity against certain diseases by stimulating the body's immune response. There are four main types of biologic vaccines, including live pathogen, weakened pathogen, inactivated pathogen, and recombinant DNA. The vaccines play a vital role in preventing infectious diseases, such as flu, COVID-19, and hepatitis. Growth in this segment comes largely from the global vaccination campaign that is burgeoning new vaccines, especially for emerging infectious diseases.

Cell & Gene Therapy: Cell and gene therapy involve the implantation of genes or living cells for treatment of incurable diseases. Such therapies can be further classified as modification of patient genes for gene therapy and live cells for cell therapy for the repair of damaged tissue. Such advanced treatment could be an incredible tool in the cure of inherited genetic disorders, selected cancers, and cardiovascular diseases within the perspective of personalized medicine.

Oncology: Oncology is the field of medicine dealing with cancer treatment. More and more, biologic therapies, including monoclonal antibodies, and gene therapies are applied in oncology to fight the cancer cells specifically, thus not damaging the normal tissue. It is applied to different types of cancers, such as breast, lung, and lymphoma, bringing forth new hope in cases where chemotherapy and radiation therapy alone are deemed insufficient. Immunotherapy is also a major part of the modern treatment for cancer.

Autoimmune & Immunological Disorders: Autoimmune and immunological diseases are a result of the immune system's wrong attack on the body's normal tissues. Biologic drugs include monoclonal antibodies, recombinant proteins, and cell therapies. Such therapies work to target particular parts of the immune system that would reduce inflammation and prevent more tissue damage; hence, there are more targeted and effective treatment options for patients with fewer side effects than those associated with other treatments.

Hematologic disorders: Biological disorders are such disorders that impact the blood and bone marrow directly, such as hemophilia, anemia, or leukemia. Biologic therapies are usually used to substitute either missing or defect proteins, clotting factors are used in replacement therapy for Hemophilia, but in leukemia; abnormal cells would be targeted to destroy them through biologic therapy. Monoclonal antibodies and recombinant proteins work significantly in diseases like these which improve the patient's quality of life and survivability, specifically with the innovation of precision medicines for blood-related cancer.

Infectious Diseases: A pathogen such as bacteria, viruses, fungi, and parasites has usually been given etiology of infectious diseases. The latest additions have been biologics, comprising vaccines and monoclonal antibodies, increasingly being used for prevention and treatment of infectious diseases. Vaccines are here to stay, and vaccination continues to play an important role in preventing the next outbreak, just like influenza or COVID-19. Monoclonal antibodies will be useful in treating a viral infection, for example Ebola or COVID-19, immediately. Their application continues to evolve with the emerging pathogens and global health challenges.

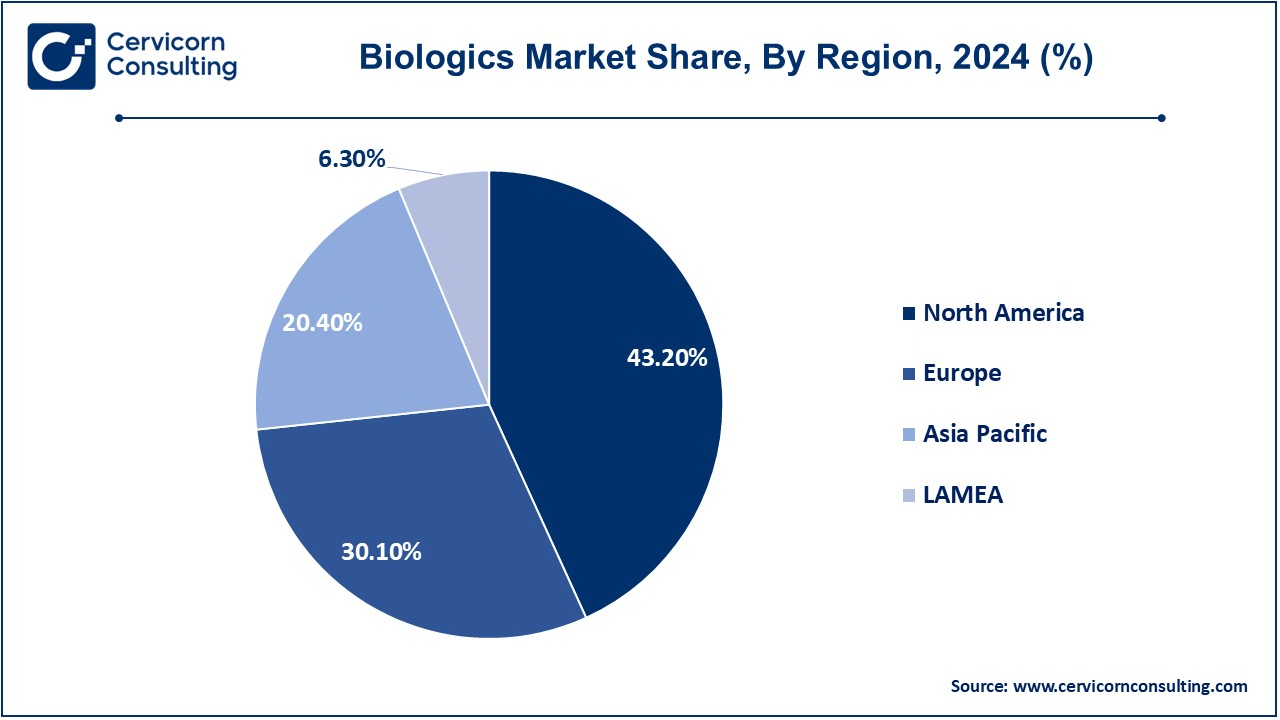

The biologics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here's an in-depth look at each region

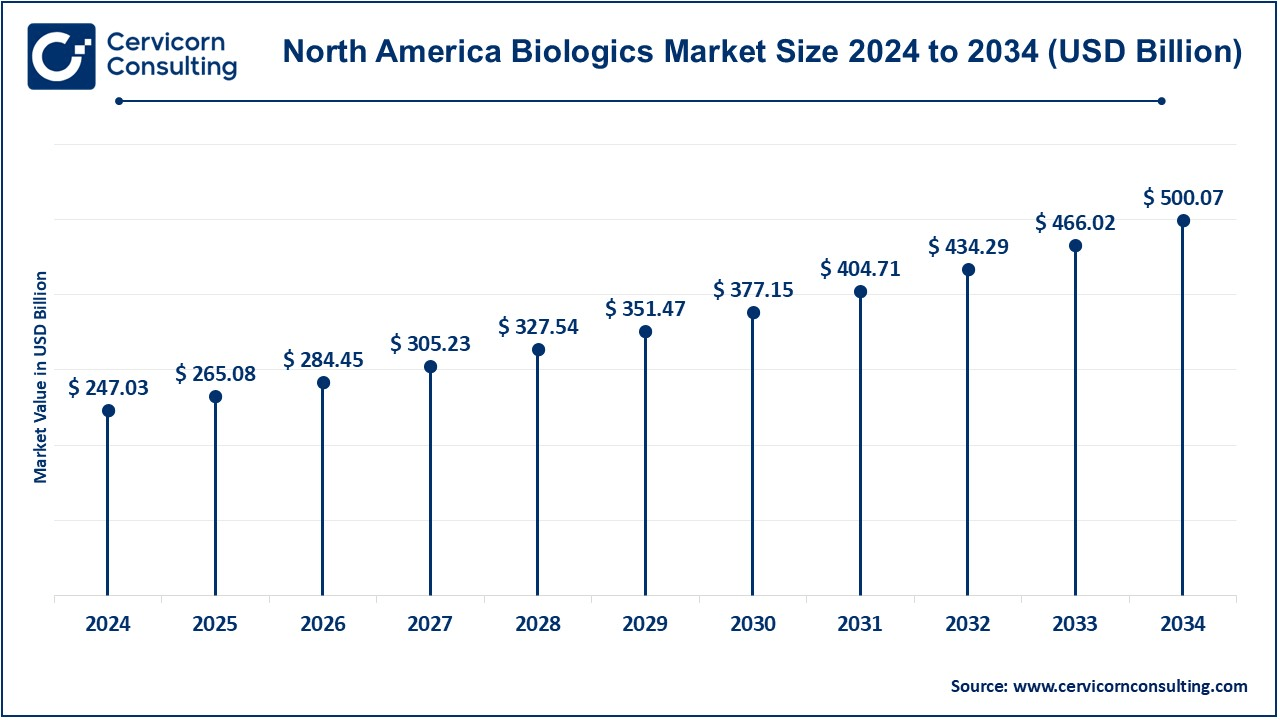

The North America biologics market size was estimated at USD 247.03 billion in 2024 and is expected to reach around USD 500.07 billion by 2034. North America holds the largest market share, primarily contributed by the United States and Canada. A technologically advanced healthcare system, stronger research and development structure, and several leading biopharmaceutical companies are contributing factors that have made it the leader in the biologics market. An example is in Tenvie which was released by using acquired assets in January 2025 under a focus area targeting neurological and metabolic diseases, thereby raising the firm USD 200 million in finance towards its work. This was part of strategic progression, driving this venture to greater accomplishments in combating illnesses such as Alzheimer's disease, and Parkinson's, and putting into action aggressive steps in expanding its scope and development across biopharma. Significant strength by strong reimbursement, efficient manufacturing space, and huge spending on health aids this venture.

The Europe biologics market size was valued at USD 172.12 billion in 2024 and is projected to hit around USD 348.43 billion by 2034. The largest share in the biologics market is held by Europe and dominated by Germany, the United Kingdom, France, Italy, and Spain. This region has a proper strong regulatory system under the EMA to protect and promote safe and effective biologics. Strong government support towards R&D in the healthcare sector, combined with the continually rising aging population and increased incidence of chronic diseases, fuels the growth in this market. In December 2024, EMA and the Heads of Medicines Agencies published new guidelines related to commercially confidential information and personal data in the marketing authorization dossiers. The new rules would make most of the data releasable by default, increase transparency, and bring them into line with current practice. The guidelines also relate to the protection of personal data in response to all the regulations that the EU has set in this regard, continuously striving toward data security and transparency. An increase in biosimilars has been seen in Europe as patents for biologic drugs expired, lowering their costs and making them more accessible to patients across this continent.

The Asia-Pacific biologics market size was accounted for USD 116.65 billion in 2024 and is forecasted to grow around USD 236.15 billion by 2034. Asia-Pacific (APAC) is a fast-emerging market for biologics. Key countries of the region are China, Japan, India, South Korea, and Australia. Particularly, China and India are on the list, given their significant population, increase in access to healthcare, and booming economies. The region sees considerable investment in biotechnology research and manufacturing. Japan, due to its very advanced healthcare structure, is considered one of the markets with the largest potential for the sale of biologics. For example, as of January 2025, the pharmaceutical companies are keener to pursue deals in China. It is attracted to improved data transparency and a more favorable regulatory environment. Owing to geopolitical tensions, it still manages to develop some massive partnerships in oncology and metabolic diseases. Analysts are now of the view that the global pharma industry will increasingly come under the influence of China. Its focus would be on next-generation assets and international standards for clinical trials.

The LAMEA biologics market was valued at USD 36.02 billion in 2024 and is anticipated to reach around USD 72.93 billion by 2034. In the LAMEA region, slow growth is being noticed by countries such as Brazil, Mexico, South Africa, Saudi Arabia, and the United Arab Emirates. Latin America is gaining increased attention from developing economies concerning improvement in healthcare infrastructure that is driving the demand for biologic therapies. Healthcare investments are starting to grow in the Middle East region led by the UAE and Saudi Arabia. The adoption of advanced treatments there is currently accelerating. In Africa, despite the fact that the market is still in its nascent stages, growing awareness and need for biologics in dealing with infectious diseases, cancer, and chronic conditions exists but challenges remain in terms of accessibility and cost toward good health.

CEO Statements

Rob Michael, CEO of AbbVie Inc.

Albert Bourla , CEO of Pfizer Inc.

Vasant Narasimhan, CEO of Novartis AG

Market Segmentation

By Product

By Application

By Source

By Manufacturing

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biologics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Source Overview

2.2.3 By Application Overview

2.2.4 By Manufacturing Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased use of monoclonal antibodies

4.1.1.2 Advances in biologics production technologies

4.1.1.3 The awareness and acceptance of biologic treatments among patients

4.1.2 Market Restraints

4.1.2.1 Manufactured with complex techniques and supply chains

4.1.2.2 Limited availability of trained professionals

4.1.2.3 Risk of adverse immune reactions

4.1.3 Market Challenges

4.1.3.1 High development costs

4.1.3.2 Limited access to biologics in low-income regions

4.1.3.3 Overcoming patient hesitancy and adverse public perceptions

4.1.4 Market Opportunities

4.1.4.1 Growth of the biosimilars segment

4.1.4.2 More emphasis on rare and orphan diseases

4.1.4.3 Strategic alliances and partnerships

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Biologics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Biologics Market, By Product

6.1 Global Biologics Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Monoclonal Antibodies

6.1.1.2 MABs by Type

6.1.1.3 Recombinant Proteins

6.1.1.4 Vaccines

6.1.1.5 Cell & Gene Therapy

6.1.1.6 Others

Chapter 7. Biologics Market, By Source

7.1 Global Biologics Market Snapshot, By Source

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Microbial

7.1.1.2 Mammalian

7.1.1.3 Others

Chapter 8. Biologics Market, By Application

8.1 Global Biologics Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Oncology

8.1.1.2 Autoimmune & Immunological Disorders

8.1.1.3 Hematological Disorders

8.1.1.4 Infectious Diseases

8.1.1.5 Others

Chapter 9. Biologics Market, By Manufacturing

9.1 Global Biologics Market Snapshot, By Manufacturing

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Outsourced

9.1.1.2 In-house

Chapter 10. Biologics Market, By Region

10.1 Overview

10.2 Biologics Market Revenue Share, By Region 2024 (%)

10.3 Global Biologics Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Biologics Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Biologics Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Biologics Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Biologics Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Biologics Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Biologics Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Biologics Market, By Country

10.5.4 UK

10.5.4.1 UK Biologics Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Biologics Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Biologics Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Biologics Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Biologics Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Biologics Market, By Country

10.6.4 China

10.6.4.1 China Biologics Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Biologics Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Biologics Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Biologics Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Biologics Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Biologics Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Biologics Market, By Country

10.7.4 GCC

10.7.4.1 GCC Biologics Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Biologics Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Biologics Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Biologics Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 AbbVie Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Pfizer Inc.

12.3 Novartis AG

12.4 Hoffman-La Roche AG

12.5 Bayer AG

12.6 Amgen

12.7 Sanofi

12.8 Eli Lilly and Company

12.9 GlaxoSmithKline Plc

12.10 Celltrion Inc.

12.11 AstraZeneca

12.12 Samsung Biologics Co. Ltd.

12.13 G. Chem Ltd.