The global drug discovery market size was accounted for USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.25% during the forecast period 2025 to 2034. The drug discovery market is experiencing robust growth driven by factors such as increasing research and development (R&D) investments in the pharmaceutical and biotechnology sectors, the rising prevalence of chronic diseases, advancements in artificial intelligence (AI) and machine learning (ML) for drug discovery, and favorable government initiatives supporting drug development.

Drug discovery is the process of identifying and developing new medicines to treat diseases by understanding biological mechanisms and targeting specific molecules. It involves multiple stages, including target identification, lead compound discovery, preclinical testing, and clinical trials. Advances in technologies like artificial intelligence, genomics, and high-throughput screening have significantly accelerated the process, enabling faster and more cost-effective development of innovative therapies for various medical conditions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 86.18 Billion |

| Expected Market Size in 2034 | USD 161.84 Billion |

| Projected CAGR 2025 to 2034 | 7.25% |

| Dominant Region | North America |

| Fastest Expanding Area | Asia-Pacific |

| Key Segments | Drug Type, Technology, End-user, Region |

| Key Companies | Pfizer Inc., GlaxoSmithKline PLC, Merck & Co. Inc., Agilent Technologies Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Bayer AG, Abbott Laboratories Inc., AstraZeneca PLC, Shimadzu Corp |

The drug discovery market is segmented into drug type, technology, end-user and region. Based on drug type, the market is classified into small molecule drugs and biologic drugs. Based on technology, the market is classified into high throughput screening, pharmacogenomics, combinatorial chemistry, nanotechnology ands others. Based on end-user, the market is classified into pharmaceutical companies, contract research organizations and others.

Small Molecule Drugs: The drug discovery market share still stands the strongest since they are well-proven for their efficacy, relatively easy to synthesize, and can easily target intracellular pathways. Their application in treating chronic diseases like cancer, diabetes, and cardiovascular disorders is also extensive because of oral bioavailability and crossing cell membranes. Growth in the generics area coupled with innovative work in synthetic chemistry would add more to the growth in this area. However, the threat of biologic drugs is on the rise as biologics provide better specificity for complex diseases.

Drug Discovery Market Share, By Drug Type, 2024 (%)

| Drug Type | Revenue Share, 2024 (%) |

| Small Molecule Drugs | 22% |

| Biologic Drugs | 78% |

Biologic drugs: They are the fastest growth in drug discovery, driven by breakthroughs in biotechnology and an increased demand for precision medicine. These include monoclonal antibodies, vaccines, and cell therapies from living organisms and treat chronic and rare diseases effectively. It is fueled by rising prevalence rates of autoimmune disorders, cancers, and infectious diseases. Despite the very high cost of the development process, the market penetration would be sustained by innovative platforms and the increasing use of biosimilars as patents for biologic drugs fall. For example, in May 2024, the European Commission approved Opdivo-an antibody drug, though biological, to treat various types of cancers among adults who have unresectable or metastatic urothelial carcinoma.

High throughput screening: In the case of high throughput screening, potential drug candidates become identified much faster compared to other earlier drug discovery tools. This is the capability for researchers to assay thousands of chemicals against a set biological target rapidly by means of automated devices. This type of screening process is extensively followed for lead identification, thereby allowing reductions in time as well as investment in early discovery research. As it combines more with AI as well as robots for efficiency and also accuracy, further increases its utility in the marketplace.

Pharmacogenomics: Pharmacogenomics has turned the science of drug discovery by allowing personalized medications. By comparing genetic differences, it allows anticipating the reaction a person may undergo to drugs with reduced adverse effect and improved effectiveness. Precision medicine and technological enhancements in genomics have driven people to opt for pharmacogenomics, especially concerning cancer, cardiovascular diseases, and neurological disorders.

Combinatorial Chemistry: Combinatorial chemistry represents the very core drug discovery technology since it accelerates compound library syntheses. Screening vast chemical libraries for lead-compounds against selective biological targets expedites identifying candidates. A vital tool applied to optimize drugs in terms of potency and economical benefits, such has rendered it irreplaceable within most pharmaceutical companies' arms. Addition of AI, along with computational chemistry, gives it an extension in value, acting as a mechanism in fast-tracking drugs in accelerated stages.

Nanotechnology: Nanotechnology is revolutionizing drug discovery because it can design nanocarriers for targeted drug delivery. The technology enhances bioavailability and solubility and stabilizes drugs with very poor solubility. Nanotechnology is highly utilized in the treatment of cancer and infectious diseases, among others as in gene delivery. The accuracy of the treatments with low side effects has encouraged this application of nanotechnology in the market.

Other Technologies: Bioinformatics, proteomics, and AI-driven platforms are just a few of the other technologies involved. These other technologies are a major driver for drug discovery in today's world. This would include target identification, data analysis, and predictive modeling to increase more rapid and improved drug development. Advanced adoption is accelerating further with precision medicine as well as more cost-effective drug development solutions.

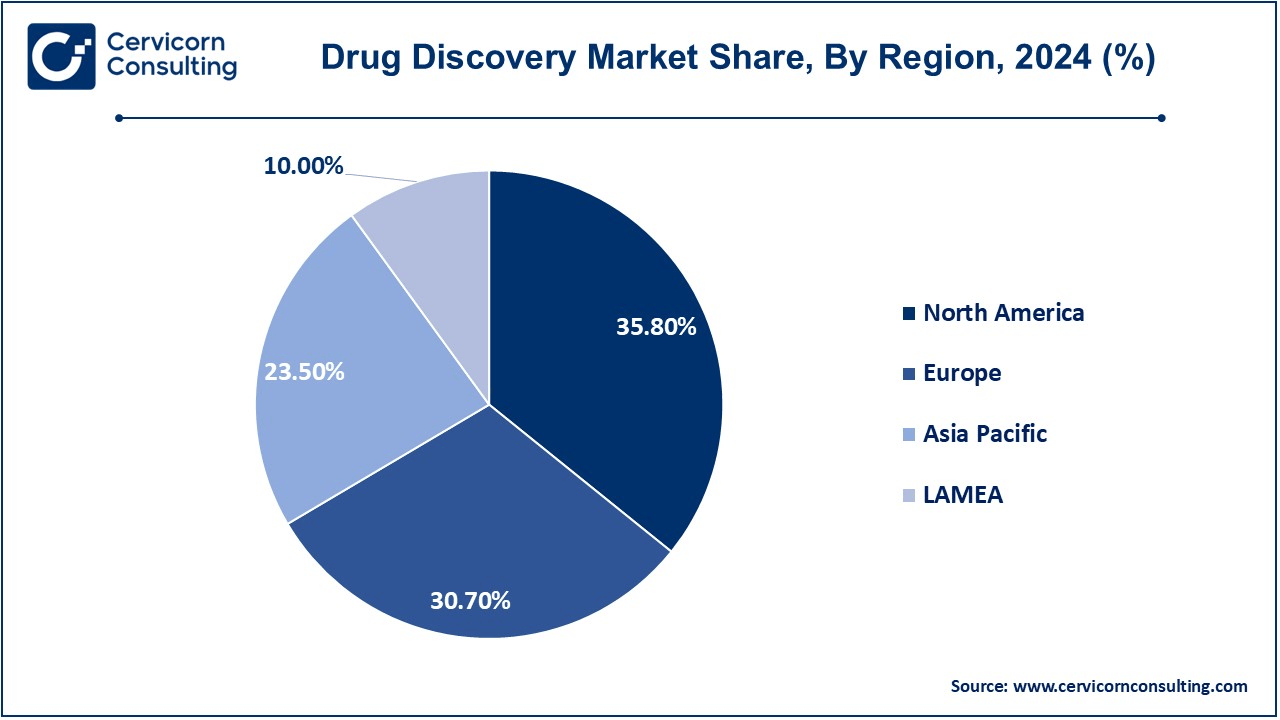

The drug discovery market is classified into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). There is a deeper analysis of the regions below:

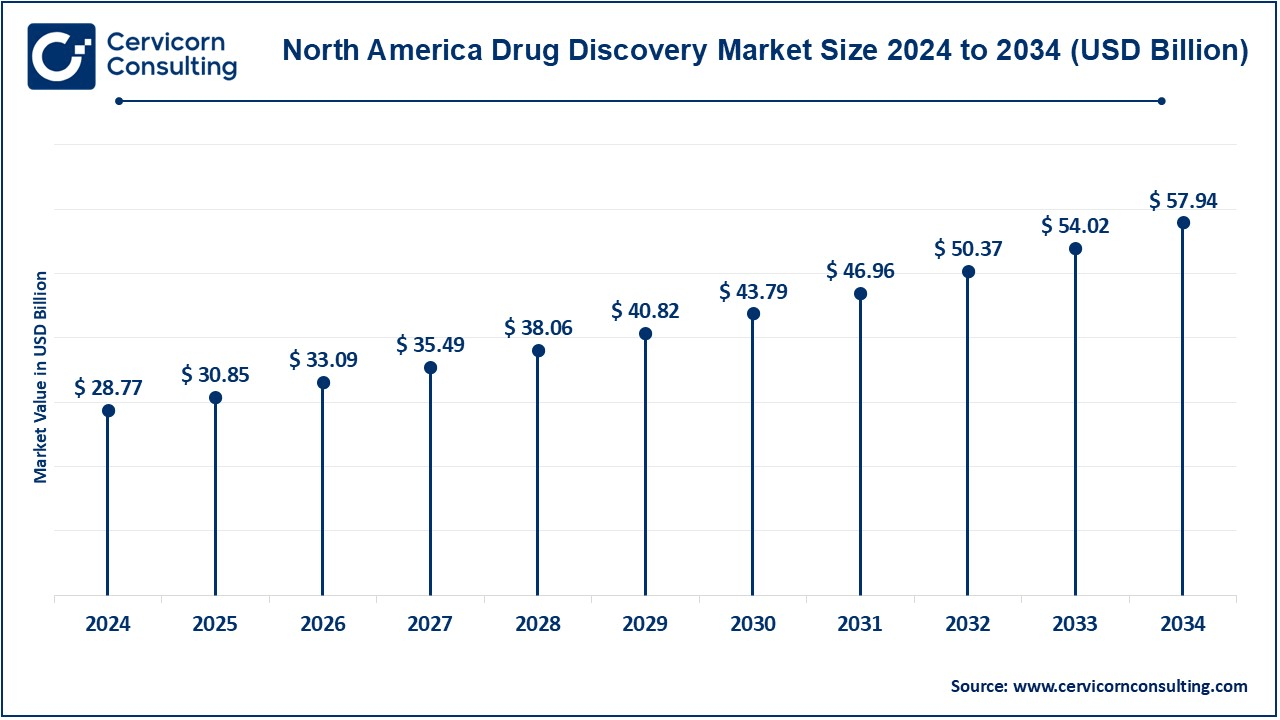

The North America drug discovery market size was valued at USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. North America holds the majority share of the market because of high investment in R&D, well-established healthcare infrastructure, and prominent pharmaceutical and biotechnology firms in the region. Increase in the prevalence of chronic diseases such as cancer and diabetes in the U.S. have necessitated more new drugs in the region. The fast-track approval of the FDA along with orphan drug incentives has added to the growth of this market at a high rate. Advanced technologies such as AI are well placed in the region, which enhances the efficiency of drug discovery and hence makes North America a high-value market.

The Europe drug discovery market size was estimated at USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. Europe is also holding a significant share. The supporting role comes from EMA, government funding, and a stable pharmaceutical sector. Countries which are more developed in R&D as well as for innovation in the area of biologics and biosimilars tend to do very well in this category; Germany, UK, and Switzerland, for instance, are good examples. The stronger results are brought out through cooperative research between academies and companies. Concentration on precision medicine and therapy for rare diseases, as well as the importance of developing advanced healthcare technologies, would have worked as a steady engager for the growth of the drug discovery sector within the Europe region.

The Asia-Pacific drug discovery market size was reached USD 80.35 billion in 2024 and is estimated to surpass around USD 161.84 billion by 2034. In the recent past, growth in the Asia-Pacific region due to health care and health spending that expands with growing chronic burden across different diseases, though on the anvil are high-activity rapid increases in their respective clinical activities in China, India, and Japan. Favourable conditions are provided by the governments and cost-competitive manufacturing benefits are further sustained through the advancements with high throughput screening. Skilled workforce, improving regulatory frameworks, and so on attract global pharmaceutical companies to set up R&D operations, making Asia-Pacific a huge hub for drug discovery innovation.

The LAMEA drug discovery market size was valued at USD 80.35 billion in 2024 and is anticipated to reach around USD 161.84 billion by 2034. Improving healthcare infrastructure and increasing access to innovative treatments are driving steady growth in the LAMEA region drug discovery market. Latin America, led by Brazil and Mexico, is increasing investments in healthcare and pharmaceutical R&D. Countries in the Middle East, such as the UAE and Saudi Arabia, are boosting their biotech and healthcare sectors as part of economic diversification. Africa is gradually but surely on the move with initiatives along infectious diseases and global pharma firms collaborations, even though this field still faces limited funding and weak infrastructure.

CEO Statements

Albert Bourla, CEO of Pfizer:

Robert Michael, CEO, of AbbVie.:

Chris Viehbacher, CEO, Biogen:

Market Segmentation

By Drug Type

By Technology

By End-user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Drug Discovery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Drug Type Overview

2.2.2 By Technology Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Discovery of the silico drug

4.1.1.2 Biologics and biosimilars adoption

4.1.1.3 More Contracting with CRO

4.1.1.4 More Contracting with CRO

4.1.2 Market Restraints

4.1.2.1 High Drug Development Costs

4.1.2.2 Intellectual Property Issues

4.1.3 Market Challenges

4.1.3.1 High Attrition Rates in Drug Development

4.1.3.2 Complex Regulatory Approvals

4.1.4 Market Opportunities

4.1.4.1 Growth in Biologics and Biosimilars

4.1.4.2 Orphan Drug Development

4.1.4.3 Growing Investment in Research and Development

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Drug Discovery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Drug Discovery Market, By Drug Type

6.1 Global Drug Discovery Market Snapshot, By Drug Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Small Molecule Drugs

6.1.1.2 Biologic Drugs

Chapter 7. Drug Discovery Market, By Technology

7.1 Global Drug Discovery Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 High Throughput Screening

7.1.1.2 Pharmacogenomics

7.1.1.3 Combinatorial Chemistry

7.1.1.4 Nanotechnology

7.1.1.5 Others

Chapter 8. Drug Discovery Market, By End-User

8.1 Global Drug Discovery Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical Companies

8.1.1.2 Contract Research Organizations

8.1.1.3 Others

Chapter 9. Drug Discovery Market, By Region

9.1 Overview

9.2 Drug Discovery Market Revenue Share, By Region 2024 (%)

9.3 Global Drug Discovery Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Drug Discovery Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Drug Discovery Market, By Country

9.5.4 UK

9.5.4.1 UK Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Drug Discovery Market, By Country

9.6.4 China

9.6.4.1 China Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Drug Discovery Market, By Country

9.7.4 GCC

9.7.4.1 GCC Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Drug Discovery Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Pfizer Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 GlaxoSmithKline PLC

11.3 Merck & Co. Inc.

11.4 Agilent Technologies Inc.

11.5 Eli Lilly and Company

11.6 F. Hoffmann-La Roche Ltd

11.7 Bayer AG

11.8 Abbott Laboratories Inc.

11.9 AstraZeneca PLC

11.10 Shimadzu Corp