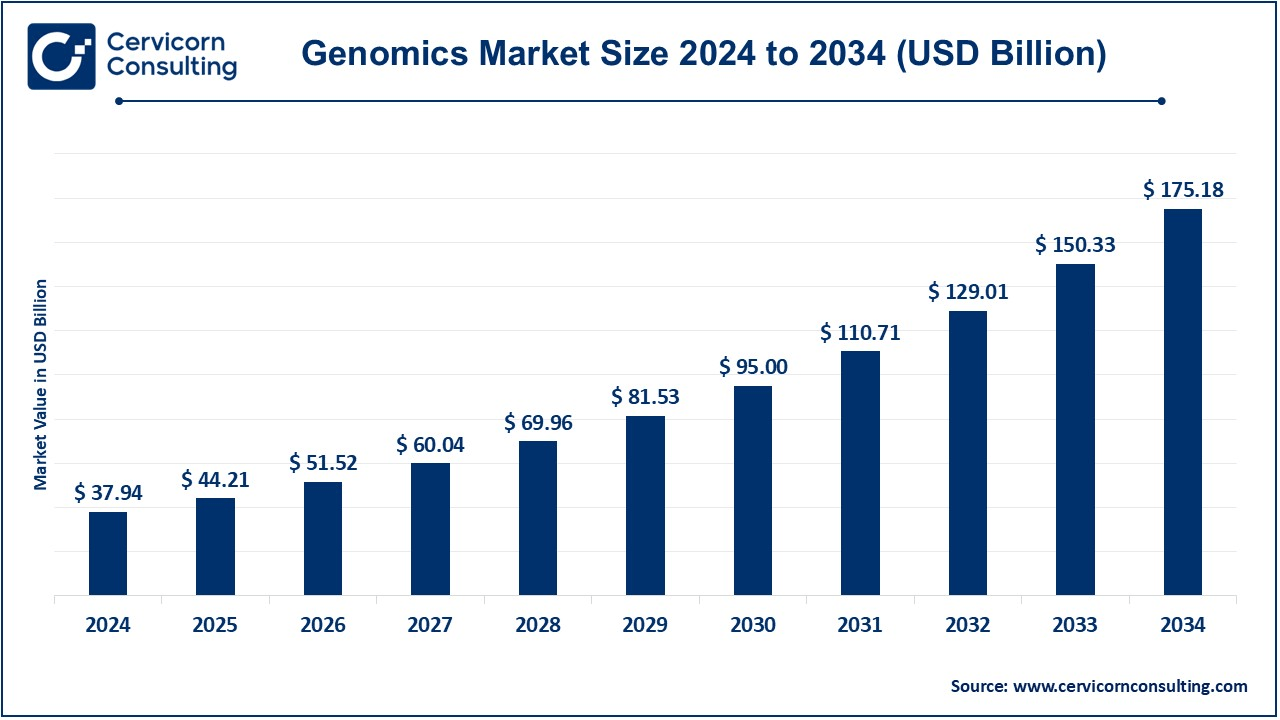

The global genomics market size was reached at USD 37.94 billion in 2024 and is expected to be worth around USD 175.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 16.53% over the forecast period 2025 to 2034. Technology, government funding, and a boom in the demand for personalized medicine have been causing an expansion of the genomics market. In recent times, improvements in NGS have reduced the time and costs associated with analyzing genomes. All governments worldwide have been investing in genomics research to improve healthcare outcomes of patients suffering from diseases like cancer and rare genetic disorders. The growing importance of precision medicine, using genetic information, to customize treatments is also fostering growth in the market. Along with that, with the trend of more incorporation of genomics in the development of drugs and prevention of diseases, it has gained much importance. Increasing public awareness about genetic testing and its benefits supports the growth. All these together make genomics a vital focus area in health care and research, propelling its fast growth.

Genomics is the scientific study of genes and their actions and interactions in living organisms, including the genetic variation that occurs within DNA related to health and disease or to aspects of biological traits. This, therefore, would include the use of DNA sequencing, gene editing, and the application of genomics bioinformatics tools in understanding genetic disorders; creating treatments adapted to an individual's genetic predisposition; agricultural improvements; and environmental sustainability. Direct-to-consumer genetic tests are becoming increasingly popular in that they educate people about their ancestry, health risks, and traits. Further, the genomics world is changing by analyzing large amounts of data through artificial intelligence and making research more rapid and quick in discovery. Governments and private organizations are funding genomics research, which gives a boost to innovation. Use of genomics in agriculture is improving crops and livestock, making it a widely applied field as well. Thus, these trends have not only changed healthcare but are also changing global challenges, with genomics acting as a fast-growing market in this regard.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 44.21 Billion |

| Expected Market Size in 2034 | USD 175.18 Billion |

| Projected CAGR 2025 to 2034 | 16.53% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Deliverables, Study Type, Application, End-User, Region |

| Key Companies | 23andMe, Agilent Technologies, Bio-Rad Laboratories, Eurofins, Roche, GE Healthcare, Illumina, Luminex, Myriad Genetics, Oxford Nanopore Technologies, Pacific Biosciences, PerkinElmer, QIAGEN, Quest Diagnostics, Thermo Fisher Scientific |

Increased demand for personalized medicine

Rapid Advancement in Genomic Technologies

High Cost of Genomics Technologies

Sophisticated Ethical and Legal Concerns

Advancements in Personalized Medicine

Increased demand for genomic data in drug development

Inadequate access to qualified professionals

Regulatory Challenges

The genomics market is segmented into technology, deliverables, study type, application, end-User and region. Based on technology, the market is classified into NGS, polymerase chain reaction, microarray, gene editing, flow cytometry, in-situ hybridization and others. Based on deliverables, the market is classified into products and services. Based on study type, the market is classified into functional genomics, biomarker discovery, pathway analysis, epigenomics and others. Based on application, the market is classified into diagnostics, drug discovery and development, agriculture and research and development. Based on end-user, the market is classified into healthcare and diagnostics, pharmaceutical and biotechnology companies, academic and research institutes and agriculture and food industry.

Next-Generation Sequencing (NGS): NGS is a disruptive technology that rapidly and inexpensively sequences large DNA or RNA segments. It does whole-genome sequencing, targeted sequencing, and transcriptome analysis. Applications range from cancer research and rare genetic diseases to infectious diseases. Its high processing speed and cost-effectiveness make it the most popular genomics tool.

Polymerase Chain Reaction (PCR): PCR is one of the main genomics tools, which amplifies a small sample of DNA to analyze. This tool is applied for diagnosing infectious diseases, detecting genetic mutations, and analyzing genes. The method is quite common in laboratories since it is easy, fast, and efficient.

Microarray Technology: Microarrays analyze gene expression and genetic variations across thousands of genes simultaneously. They are used in cancer research, pharmacogenomics, and personalized medicine. Microarrays help detect SNPs and copy number variations, vital for disease risk assessments.

Gene Editing (CRISPR): It's a very sharp tool that will cut and edit DNA sequences and modify genes in specific locations, and this tool has transformed the research of genetic diseases, therapies for cancer, and agriculture. For developing gene therapy and increasing crop yields, affordability and versatility in CRISPR are a necessity.

Diagnostics: Genomic technologies significantly aid in diagnosis, particularly in identifying genetic disorders and cancer as well as infectious diseases. It supports early detection and allows for risk assessment, thereby creating personalized treatment planning by the doctor. Examples are prenatal screenings, hereditary cancer testing, and pharmacogenomics.

Drug Discovery and Development: Genomics speeds up drug research by identifying the genes and proteins causing diseases. This accelerates the production of more effective and safe drugs for pharmaceutical companies. It is also used in predicting the responses of drugs to the body, thereby reducing trial-and-error treatment.

Agriculture: In agriculture, genomics enhances crop productivity and resistance to diseases. It is applied in livestock breeding for improvement in traits such as growth, fertility, and tolerance to diseases. Genomics also helps in the development of GMOs for food security.

Research and Development: The institutes of research and universities use genomics to determine genes, explain the mechanisms behind diseases, and discover new, innovative therapies. This segment enhances genomic tools as well as newer discoveries for health care, agriculture, and biotechnology.

Health care and diagnostics service providers: These consist of hospitals, clinics, and diagnostic labs that can utilize genomic testing in patients to enhance treatment. This also includes cancer diagnosis, genetic disorders, and pharmacogenomic tests for the most effective prescription according to the individual's genetic code.

Pharmaceutical and Biotechnology Companies: These companies use genomics for drug development and personalized medicines. By studying gene functions and mutations, they design therapies targeting specific diseases, such as gene-based treatments for rare genetic disorders.

Genomics Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2024 (%) |

| Healthcare and Diagnostics | 21% |

| Pharmaceutical and Biotechnology Companies | 48% |

| Academic and Research Institutes | 7% |

| Others | 24% |

Academic and Research Institutes: Universities and research organizations use genomics for various studies, such as discovering disease-causing genes and exploring gene-environment interactions. These institutions are pivotal in advancing genomics knowledge and its practical applications.

Agriculture and Food Industry: Companies in this sector use genomics to breed plants with better yields and livestock with improved health and productivity. Genomics also ensures food safety by identifying genetic markers for contamination or allergenic risks.

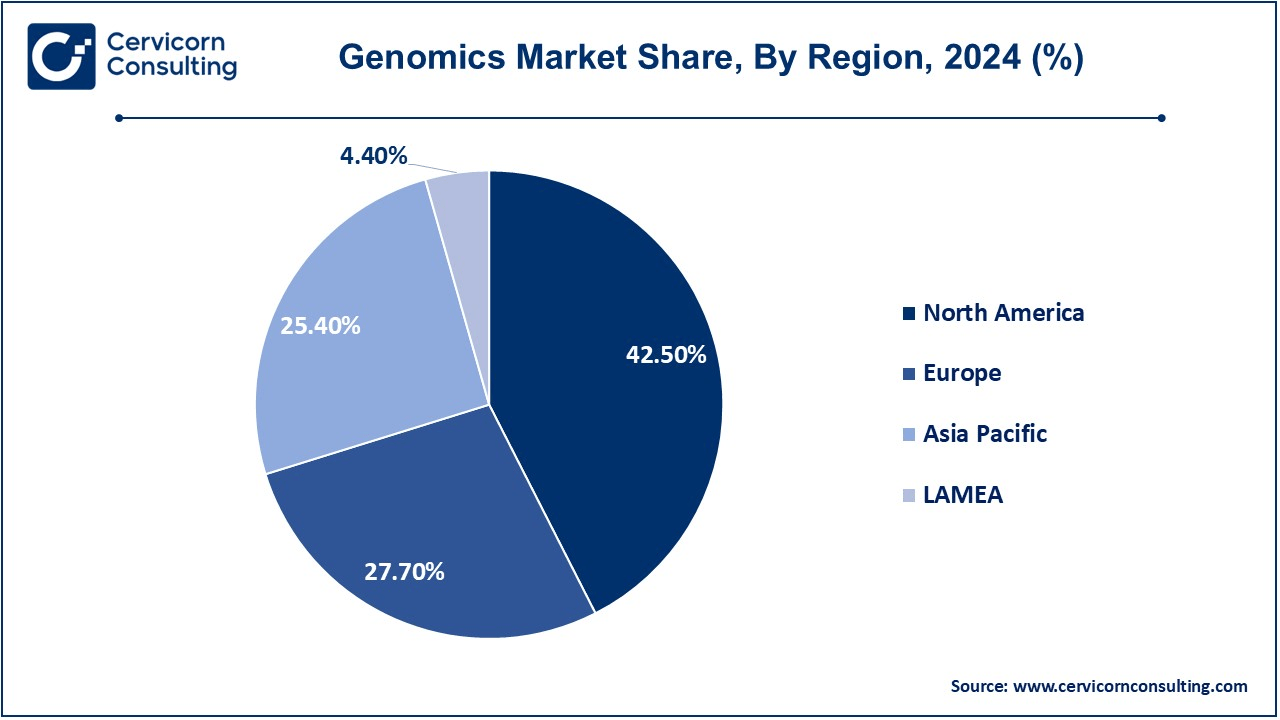

The genomics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

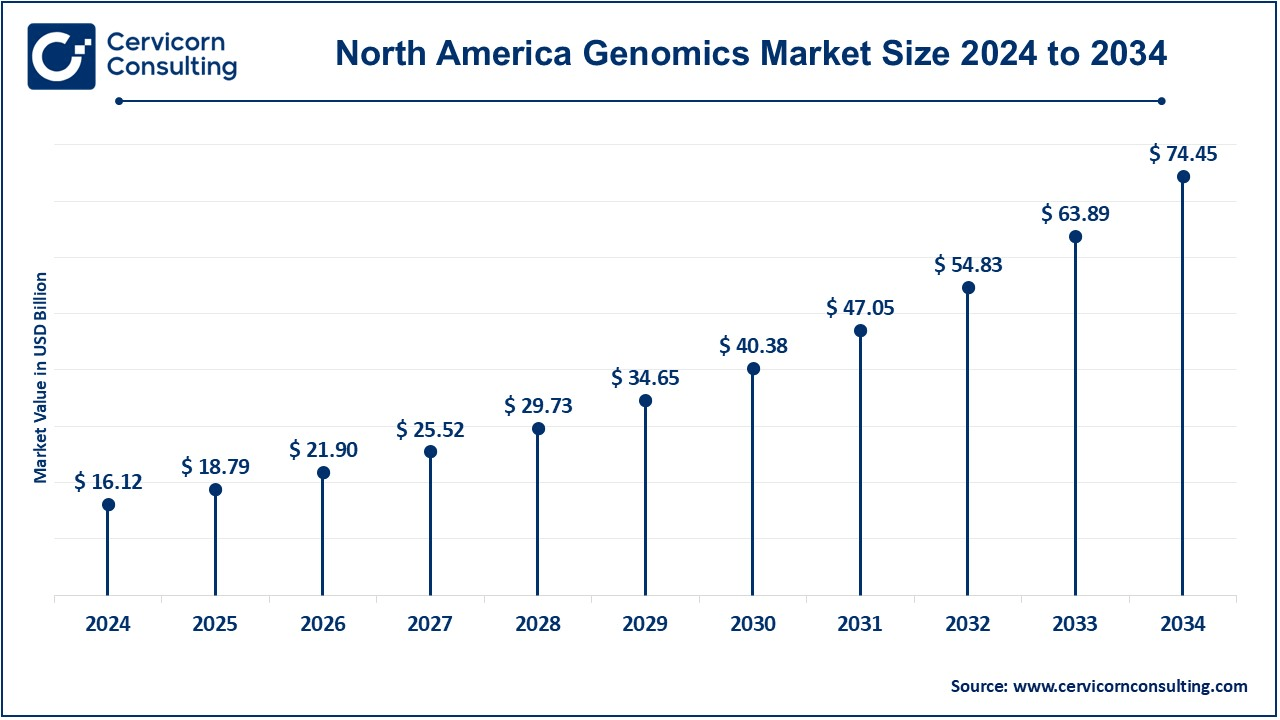

North America: The North America genomics market size was valued at USD 16.12 billion in 2024 and is expected to reach around USD 74.45 billion by 2034. North America is the largest genomics market because of its advanced healthcare infrastructure, leading research institutions, and high adoption rates of genomic technologies. The U.S. is a hub for innovations like NGS and gene editing, with strong government funding for genomic research.

Europe: The Europe genomics market size was estimated at USD 10.51 billion in 2024 and is reported around USD 48.52 billion by 2034. The genomics market is growing steadily in Europe, driven by investments made by countries like Germany, the UK, and France in genomic research and personalized medicine. Here, the emphasis is on genetic testing for diseases like cancer and projects such as the UK's 100,000 Genomes Project.

Asia-Pacific: The Asia-Pacific genomics market size was surpassed at USD 9.64 billion in 2024 and is forecasted to hit around USD 44.50 billion by 2034. The growth in this region is due to investments in healthcare and awareness of genomic medicine. The countries of China and India are building their genomics infrastructure and focus on genetic testing, agricultural genomics, and research collaborations.

LAMEA: The LAMEA genomics market size was reached at USD 1.67 billion in 2024 and is predicted to grow around USD 7.71 billion by 2034. For its part, regions like Latin America, the Middle East, and Africa are where this industry is at an embryonic state. Nevertheless, awareness about diagnostic genomics continues to rise alongside greater advancements in healthcare centers. The latter factors continue propelling the requirements for better study in these areas while conducting genetic analysis.

Market Segmentation

By Technology

By Deliverables

By Study Type

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Genomics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Deliverables Overview

2.2.3 By Study Type Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased demand for personalized medicine

4.1.1.2 Rapid Advancement in Genomic Technologies

4.1.2 Market Restraints

4.1.2.1 High Cost of Genomics Technologies

4.1.2.2 Sophisticated Ethical and Legal Concerns

4.1.3 Market Challenges

4.1.3.1 Inadequate access to qualified professionals

4.1.3.2 Regulatory Challenges

4.1.4 Market Opportunities

4.1.4.1 Advancements in Personalized Medicine

4.1.4.2 Increased demand for genomic data in drug development

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Genomics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Genomics Market, By Technology

6.1 Global Genomics Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Next-Generation Sequencing (NGS)

6.1.1.2 Polymerase Chain Reaction (PCR)

6.1.1.3 Microarray

6.1.1.4 Gene Editing

6.1.1.5 Flow Cytometry

6.1.1.6 In-Situ Hybridization

6.1.1.7 Others

Chapter 7. Genomics Market, By Deliverables

7.1 Global Genomics Market Snapshot, By Deliverables

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Products

7.1.1.2 Services

Chapter 8. Genomics Market, By Study Type

8.1 Global Genomics Market Snapshot, By Study Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Functional Genomics

8.1.1.2 Biomarker Discovery

8.1.1.3 Pathway Analysis

8.1.1.4 Epigenomics

8.1.1.5 Others

Chapter 9. Genomics Market, By Application

9.1 Global Genomics Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Diagnostics

9.1.1.2 Drug Discovery and Development

9.1.1.3 Agriculture

9.1.1.4 Research and Development

Chapter 10. Genomics Market, By End-User

10.1 Global Genomics Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Healthcare and Diagnostics

10.1.1.2 Pharmaceutical and Biotechnology Companies

10.1.1.3 Academic and Research Institutes

10.1.1.4 Agriculture and Food Industry

Chapter 11. Genomics Market, By Region

11.1 Overview

11.2 Genomics Market Revenue Share, By Region 2024 (%)

11.3 Global Genomics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Genomics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Genomics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Genomics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Genomics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Genomics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Genomics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Genomics Market, By Country

11.5.4 UK

11.5.4.1 UK Genomics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Genomics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Genomics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Genomics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Genomics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Genomics Market, By Country

11.6.4 China

11.6.4.1 China Genomics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Genomics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Genomics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Genomics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Genomics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Genomics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Genomics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Genomics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Genomics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Genomics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Genomics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 23andMe.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Agilent Technologies

13.3 Bio-Rad Laboratories

13.4 Eurofins

13.5 Roche

13.6 GE Healthcare

13.7 Illumina

13.8 Luminex

13.9 Myriad Genetics

13.10 Oxford Nanopore Technologies

13.11 Pacific Biosciences

13.12 PerkinElmer

13.13 QIAGEN

13.14 Quest Diagnostics

13.15 Thermo Fisher Scientific