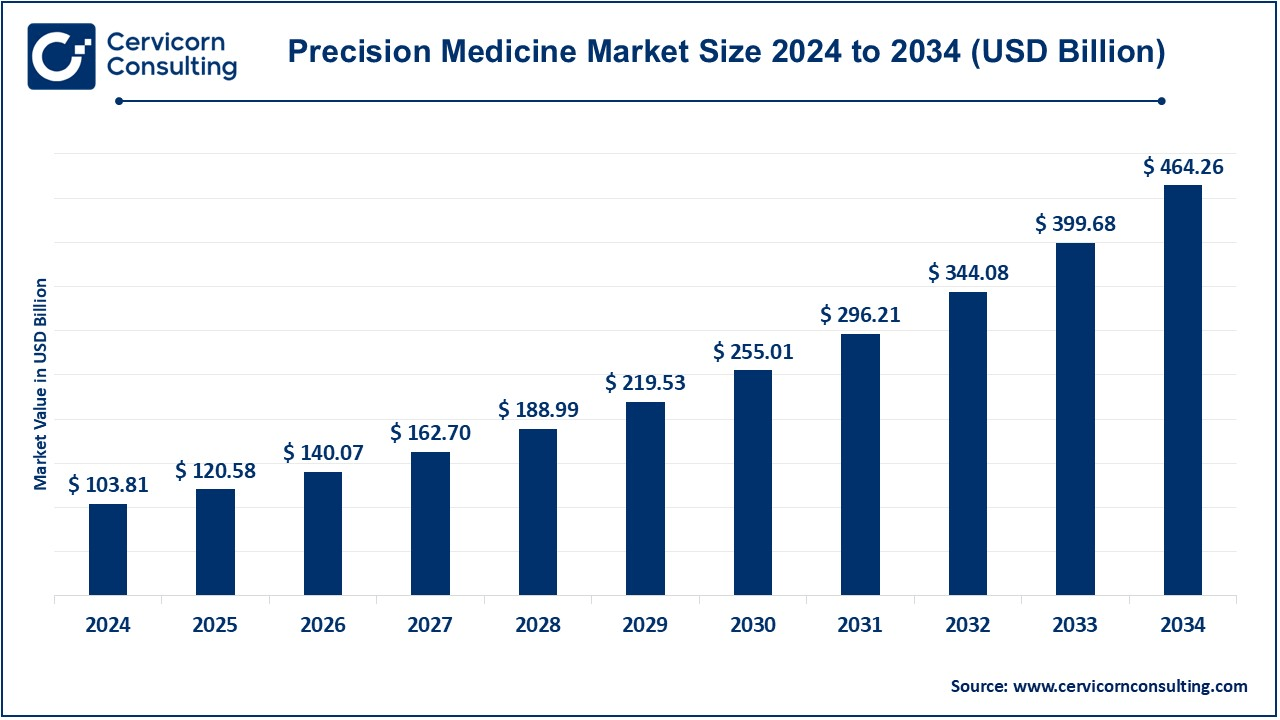

The global precision medicine market size was valued at USD 103.81 billion in 2024 and is estimated to reach around USD 464.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 16.15% during the forecast period 2025 to 2034. The precision medicine market is experiencing robust growth driven by factors such as increasing prevalence of chronic diseases, advancements in genomics and biotechnology, rising demand for personalized treatments, and growing healthcare infrastructure. Additionally, the expanding application of artificial intelligence (AI) and machine learning (ML) in drug discovery, along with greater collaboration between pharmaceutical companies and research institutions, is significantly contributing to the market's growth.

Precision medicine is the new approach toward health care; in this case, the treatment of medicine is delivered based on specific characteristics of individual patients, including genetic, environmental, and lifestyle determinants. Precision medicine stands in stark contrast to the old-fashioned "one-size-fits-all" model and has the intent to provide better therapeutic and intervention responses for a certain patient. Precision medicine uses the advances in genomics, biotechnology, and data analytics to achieve the precise diagnosis of diseases, proper prediction of potential risks, and selection of relevant treatments to improve patient outcomes and minimize adverse effects.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 120.58 Billion |

| Expected Market Size in 2034 | USD 464.26 Billion |

| Projected CAGR 2025 to 2034 | 16.15% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Application, Technology, Product, Route of Administration, Drugs, End-user, Region |

| Key Companies | F. Hoffmann-La Roche Ltd., Siemens, Janssen Global Services, LLC, Illumina, Inc., Quest Diagnostics Incorporated, 23andMe, Inc., NeoDiagnostix, Myriad Genetics, Medtronic, GE Healthcare, Abbott, QIAGEN |

Diagnostics: Precision medicine diagnostics encompasses a range of testing procedures used to identify specific biological markers in patients so that treatment may be adjusted accordingly. This encompasses a wide range of diagnostic tests that are used for the identification of genetic mutations, biomarkers, or patterns of a particular disease, thus enabling more accurate, individualized health care decisions.

Genetic Tests: Precision medicine, through genetic tests, determines a patient's inherited condition, predispositions, or diseases; hence, how physicians can collaborate with the patient on differentiated treatments based on one's genetic composition. These genetic tests may outline risks or a drug response because of the nature of the disease.

Precision Medicine Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Diagnostics | 21% |

| Therapeutics | 79% |

Biomarker-based tests: Such biomarker-based tests examine the biomarker to know disease presence or any progression to an advanced disease form or lack of response in diseases. The development of precision medicine finds a high involvement of biomarkers especially in chronic cases like cancers and cardiovascular-related.

Esoteric Tests: Esoteric tests are specialty testing used for diagnosis of rare conditions or complex clinical conditions that generally are not a part of common everyday clinical practice. These tests highly informative, specific treatment can thus be given to a patient afflicted with a distinctive or hard to identify disease.

Other Tests: These are other tests that would be included as opposed to those identified earlier but highly significant in the landscape of precision medicine. Ranging from among some of the new, emerging or exploratory tests, which serve toward solutions to care and a newly designed therapy.

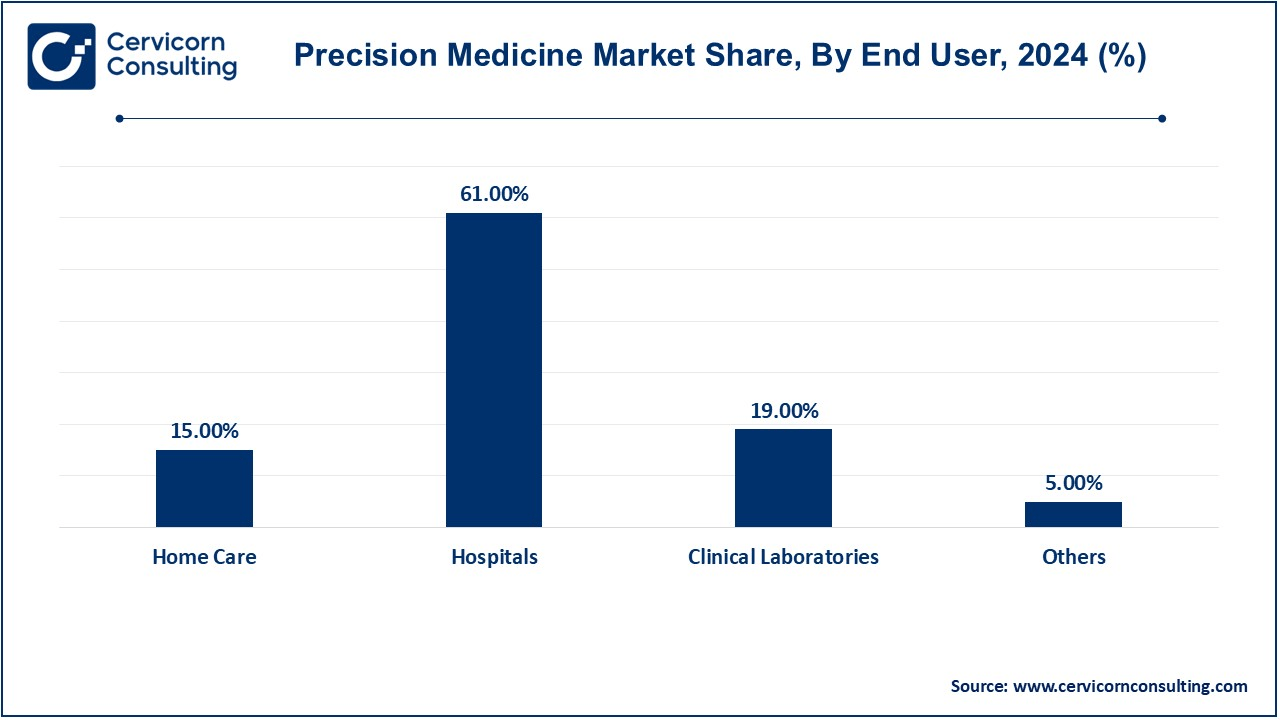

Hospitals: The Hospitals segment has dominated the market in 2024. Advanced diagnostic equipment, personalized treatment plans, and more are applied to patient care. The use of genetic and biomarker-based tests is provided for through hospitals, and this ensures that treatment approaches become customized, especially in oncology, cardiology, and rare diseases.

Diagnostic Laboratories: Diagnostic laboratories do genetic, biomarker, and esoteric tests, which are very important in precision medicine. These give diagnosis of specific health conditions, mutations of genes, and potential responses of drugs that help in prescribing drugs according to the needs of patients.

Others: These are broad categories of all other end-users. Such include research institutes, pharmaceutical firms, and clinics, among others. All these make tremendous contributions to the implementation of precision medicine. They conduct studies, clinical trails, and product development towards advancement in personalized approaches to health care.

The precision medicine market is further geographically analyzed under five key regions : North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here's a detailed description of each

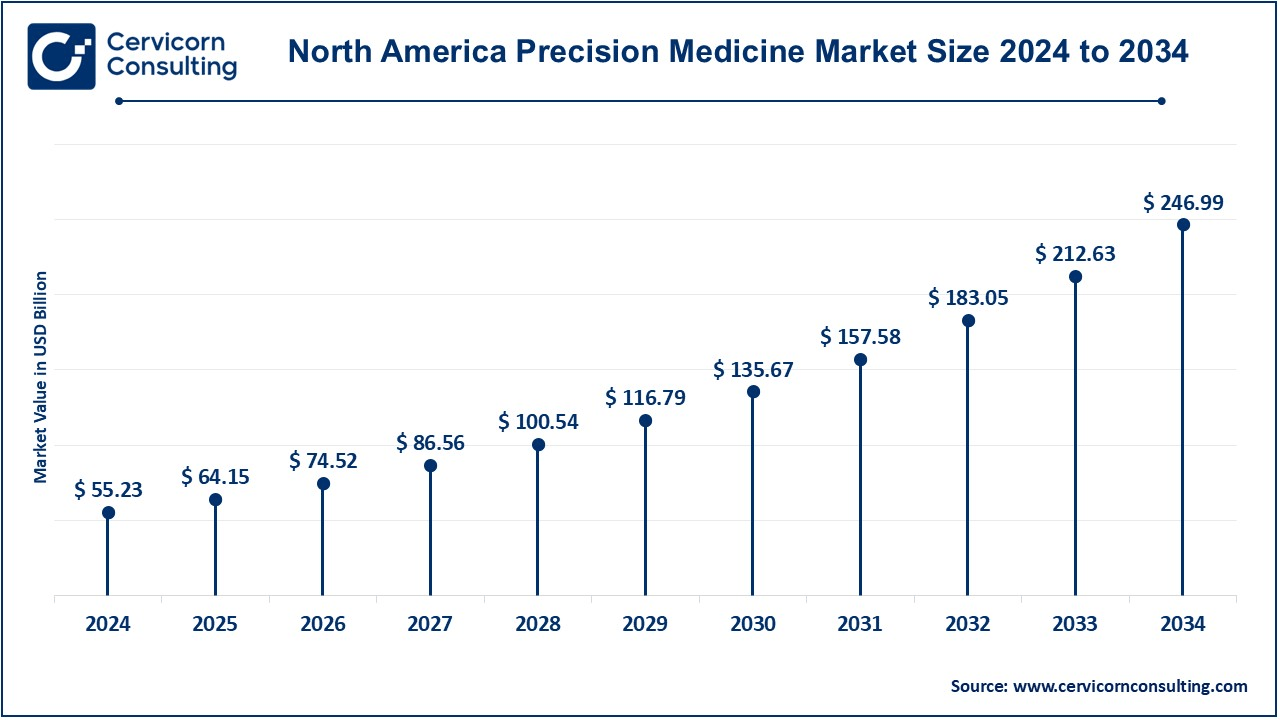

The North America precision medicine market size was valued at USD 55.23 billion in 2024 and is estimated to reach around USD 246.99 billion by 2034. North America, the country in question being the US, shows the maximum portion of the market. This is attributed to highly developed healthcare infrastructure, high health-care spending, and significant research and development investments. The U.S. has a vast number of leading healthcare companies, academic institutions, and biotechnology firms operating in genetic testing, biomarker research, and personalized drug development. The adoption of precision medicine in the treatment of cancer, cardiovascular diseases, and rare genetic disorders increases the growth of the market in the region. Regulatory support by the FDA along with the number of FDA-approved precision medicine therapies also supports the market.

The Europe precision medicine market size was valued at USD 24.50 billion in 2024 and is estimated to reach around USD 109.57 billion by 2034. Europe is one of the most advanced regions, because of the efforts in research and development and sound healthcare infrastructure of the region. Germany, UK, and France are the best in genetic tests and personalized medication, with Government initiatives to focus on innovation through healthcare. This would make the European Union more devoted to personalized medicine, especially with initiatives such as the European Reference Networks (ERNs). On the other hand, the diverse regulatory frameworks and economic constraints of a few countries could hinder the market expansion in the region as a whole.

The Asia-Pacific precision medicine market size was valued at USD 19.62 billion in 2024 and is estimated to reach around USD 87.75 billion by 2034. The Asia-Pacific region is projected to grow significantly, due to rising health care investments, prevalence of chronic diseases, and research on genetic discoveries. It has China, Japan, and India leading in its expansion as countries, developing infrastructures, and a booming biotechnology sector. Key drivers for this are advanced health care systems in Japan and China's increased investment in genomics and biotechnology research. The main drivers behind customized treatments include the expansion of middle-class populations in emerging economies, particularly in India and China, who also happen to boast a better health-conscious population.

Precision Medicine Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 53.20% |

| Europe | 23.60% |

| Asia-Pacific | 18.90% |

| LAMEA | 4.30% |

The LAMEA precision medicine market size was valued at USD 4.46 billion in 2024 and is estimated to reach around USD 19.96 billion by 2034. Growth in the LAMEA market has been slow. This is because of the weak economy and not so well-established healthcare infrastructure as compared to other regions. Increasing interest in precision medicine is seen in certain parts of Latin America and in parts of the Middle East: government initiatives and private investment already drive genetic testing, cancer therapies, and personalized treatments. In Africa, genetic diseases receive more attention and effort at improving overall health outcomes, but access and affordability issues remain a prominent concern.

Market Segmentation

By Application

By Technology

By Product

By Route of Administration

By Drugs

By End-user

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Precision Medicine

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.2.2 By Technology Overview

2.2.3 By Product Overview

2.2.4 By Route of Administration Overview

2.2.5 By Drugs Overview

2.2.6 By End-user Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Precision Medicine Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancement in Cancer Biology in Developed Regions

4.1.1.2 Portfolio of Precision Medicine Drugs

4.1.1.3 Rising Adoption of Gene Therapy

4.1.2 Market Restraints

4.1.2.1 High Costs of Precision Medicine

4.1.2.2 With scarce trained professionals and specialized

4.1.3 Market Opportunity

4.1.3.1 Precision Oncology

4.1.3.2 Expansion into Rare Diseases

4.1.3.3 Rising Patient Demand for Tailor-made Medication

4.1.4 Market Challenges

4.1.4.1 High implementation cost

4.1.4.2 Technological Barriers in Low-income Regions

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Precision Medicine Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Precision Medicine Market, By Application

6.1 Global Precision Medicine Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Diagnostics

6.1.1.2 Therapeutics

Chapter 7 Precision Medicine Market, By Technology

7.1 Global Precision Medicine Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Genomics

7.1.1.2 Bioinformatics

7.1.1.3 Big data analytics

7.1.1.4 Biomarker detection

7.1.1.5 High throughput screening

7.1.1.6 Others

Chapter 8 Precision Medicine Market, By Product

8.1 Global Precision Medicine Market Snapshot, By Product

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Consumables

8.1.1.2 Instruments

8.1.1.3 Services

Chapter 9 Precision Medicine Market, By Route of Administration

9.1 Global Precision Medicine Market Snapshot, By Route of Administration

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Oral

9.1.1.2 Injectable

Chapter 10 Precision Medicine Market, By Drugs

10.1 Global Precision Medicine Market Snapshot, By Drugs

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 Alectinib

10.1.1.2 Osimertinib

10.1.1.3 Mepolizumab

10.1.1.4 Aripiprazole Lauroxil

10.1.1.5 Others

Chapter 11 Precision Medicine Market, By End-user

11.1 Global Precision Medicine Market Snapshot, By End-user

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

11.1.1.1 Home Care

11.1.1.2 Hospitals

11.1.1.3 Clinical Laboratories

11.1.1.4 Others

Chapter 12 Precision Medicine Market, By Region

12.1 Overview

12.2 Precision Medicine Market Revenue Share, By Region 2023 (%)

12.3 Global Precision Medicine Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Precision Medicine Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Precision Medicine Market, By Country

12.5.4 UK

12.5.4.1 UK Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UK Market Segmental Analysis

12.5.5 France

12.5.5.1 France Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 France Market Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 Germany Market Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of Europe Market Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Precision Medicine Market, By Country

12.6.4 China

12.6.4.1 China Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 China Market Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 Japan Market Segmental Analysis

12.6.6 India

12.6.6.1 India Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 India Market Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 Australia Market Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia Pacific Market Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Precision Medicine Market, By Country

12.7.4 GCC

12.7.4.1 GCC Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCC Market Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 Africa Market Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 Brazil Market Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Precision Medicine Market Revenue, 2021-2033 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 13 Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2021-2023

13.1.3 Competitive Analysis By Revenue, 2021-2023

13.2 Recent Developments by the Market Contributors (2023)

Chapter 14 Company Profiles

14.1 F. Hoffmann-La Roche Ltd. (Foundation Medicine)

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Siemens

14.3 Janssen Global Services, LLC

14.4 Illumina, Inc.

14.5 Quest Diagnostics Incorporated

14.6 23andMe, Inc.

14.7 NeoDiagnostix

14.8 Myriad Genetics

14.9 Medtronic

14.10 GE Healthcare