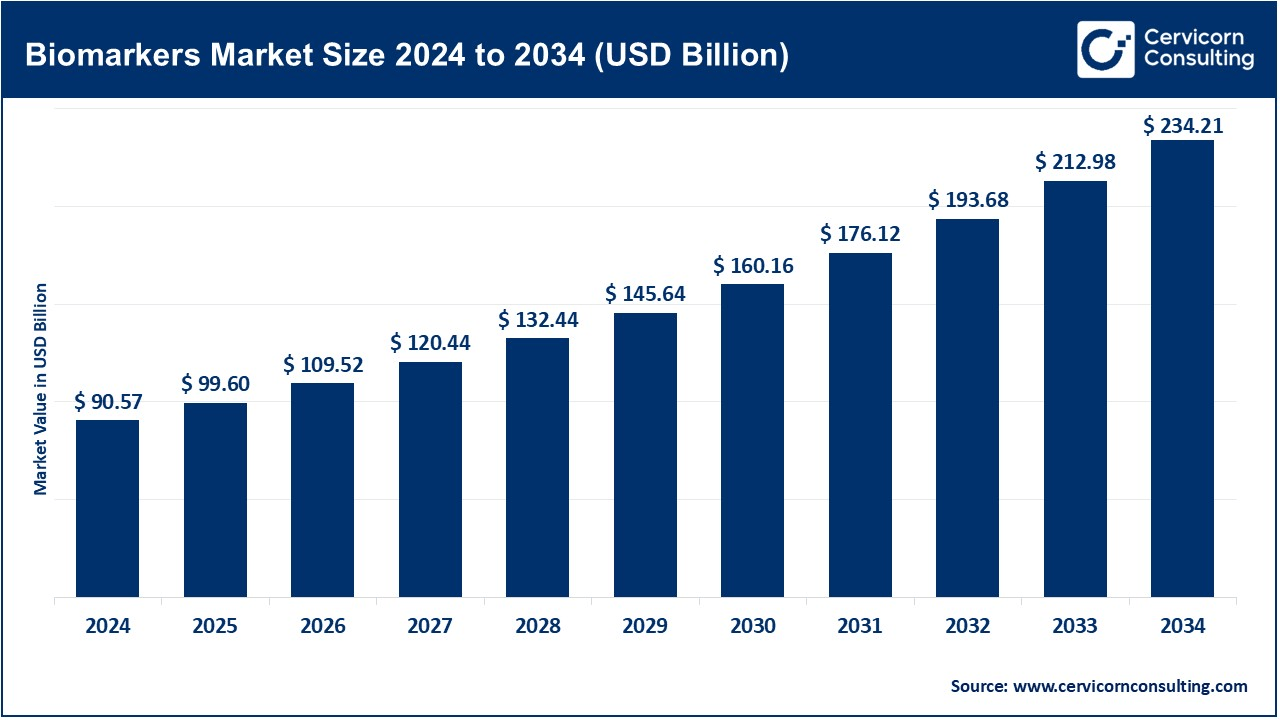

The global biomarkers market will grow at a compound annual growth rate (CAGR) of 9.96% during the forecast period 2025 to 2034. The biomarkers market across the globe was valued at USD 90.57 billion in 2024 and is expected to reach around USD 234.21 billion by 2034. The market future for biomarkers seems bright as a great improvement in health care, rising incidences of chronic diseases, and increased focus on personalized medicine make the market promising. Because the patient population comprises more people with cancer, heart disorders, and neurological diseases, the demand for early detection and diagnosis and better treatment modalities keeps growing. Biomarkers help in early diagnosis, thereby having better therapeutic outcomes. Pharmaceutical companies are harnessing biomarkers in developing targeted medicines to ensure conclusively and minimize adverse events. New technologies such as AI and large data sets accelerate biomarker identification and significantly enhance its quality. Several organizations and governments, therefore, fund research committed to developing new biomarkers that could be even more effective for diseases not easily detected. The biomarker market is bound to grow very fast with greater awareness, health system improvements, and funding.

Biomarkers are biological indicators of the presence of disease, response to treatment, and prediction of health outcome. Research and development in this field improve early detection, personal medicine, and drug development. Future advances will yield highly accurate diagnostics and targeted therapies with better disease management, ultimately improving patient care and reducing health care costs. At the same time, burgeoning investments in biomarker research, such as government funding for otherwise innovative projects, show how important this tool is becoming in shaping the future of health and medicine.

Rising incidence of chronic ailments

Technological Advances Making A Mark Recently In Genomics

Increasing Focus on Personalized Medicine

increasing growth of the older population

Expansion of Liquid Biopsy Technologies

Increased Investment in Research and Development

Better Regulatory Support

Biomarker Discovery through AI and ML

Rise of Liquid Biopsy for Cancer Diagnostics

Growth of Companion Diagnostics

Multiomics Biomarkers are in the Ascendant Multi-omics

Growing Demand for Wearable and Digital Biomarkers

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 99.60 Billion |

| Expected Market Size in 2034 | USD 234.21 Billion |

| Projected CAGR 2025 to 2034 | 9.96% |

| Key Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product Type, Type, Disease, Application, End User, Region |

| Key Companies | Abbott Laboratories, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Charles River Laboratories International Inc, Epigenomics AG, Eurofins Scientific SE, F. Hoffmann-La Roche Ltd, GE Healthcare, Illumina, Inc., Johnson & Johnson Services, Inc, Merck KGaA, Qiagen N.V, Quanterix Corporation (Aushon Biosystem), Siemens Healthcare Private Limited/Siemens AG, Thermo Fisher Scientific Inc. |

Increasing breast cancer among the population

Enhance advanced technologies developed in treating breast cancer

Treatment is very costly

Side effects of treatment

Increased support from the government

Increased research and development

A side effect of the treatment involved in breast cancer

High cost of the treatment

The biomarkers market is segmented into product type, type, disease, application, end user and region. Based on product type, the market is classified into consumables, instruments and software & services. Based on application, the market is classified into diagnostics, drug discovery & development, personalized medicine and risk assessment & disease monitoring. Based on end-user, the market is classified into pharmaceutical & biotechnology companies, hospitals & diagnostic centers, research institutes & academic laboratories and contract research organizations.

Consumables: The consumables segment has dominated the market in 2024. Consumables take the crown when it comes to biomarkers. They include reagents, assay kits, or even the materials in laboratories for biomarker research and testing. This means that these are permanent fixtures in the laboratories, being used once and immediately thrown away and replaced. Thus, they serve as a never-ending source of income for manufacturing companies. Demand for consumables is rising since more hospitals, labs, and research centers are using biomarkers for disease detection. Companies are focusing on better-quality reagents to ensure better accuracy in testing. The rising demand for personalized medicine and drug discovery, in turn, is feeding the demand for consumables.

Instruments: Instruments such as PCR machines, immunoassay analyzers, and mass spectrometers find a key place in biomarker research. With the advent of these tools, the detection of biomarkers in blood, tissues, and other samples is possible. The market is currently on the rise with advancements in automation and AI-based diagnostics. Although expensive, these machines are too accurate and efficient to ignore. The recent rise in the application of biomarkers for the detection of early diseases and monitoring of therapy has greatly increased the market for ultramodern instruments.

Software & Services: The software & services segment is anticipated to exhibit a lucrative CAGR over the projected period. Software and services aid biomarker research in analyzing extensive medical data. AI-based software is used to find patterns and improve diagnosis accuracy. Biomarker data analysis is being offered by a multitude of companies so that laboratories do not have to develop their systems. These solutions are relied upon by the pharmaceutical industry and academic institutions for drug trials and personalized treatment plans. Cloud platforms are becoming increasingly attractive due to the security and rapid access they provide to medical data.

Diagnostics: The diagnostics segment is projected to register the fastest CAGR over the forecast period. Biomarkers are very useful in the detection of diseases. They are usually used by doctors to diagnose cancer, heart-related diseases, or infections in the early days. Biomarkers aid in non-invasive testing, causing less inconvenience through fewer biopsies or surgeries. Hence, the diagnostic biomarker market is growing fast as a lot of people look for early detection for an improved treatment outcome. Governments and health organizations are supporting biomarker-related research in the interests of better public health.

Drug Discovery & Development: The drug discovery & development segment dominated the market in 2024. Pharmaceutical companies work on new drugs by using biomarkers. Biomarkers are used to determine whether the drug is reasonably safe and effective for use before marketing. Thus, it helps in reducing drug development costs and time. Many companies have invested in biomarker research for the development of targeted therapies. The increasing acceptance of personalized medicine will further drive the demand for biomarker applications in drug development.

Personalized Medicine: Biomarkers allow for treatment customization according to a person’s unique biological profile. This improves treatment success and reduces side effects. Cancer and genetic disorders are the primary areas of development in personalized medicine. Pharmaceutical companies are developing drugs for groups of patients defined by biomarkers. Governments and research institutions are funding studies to increase personalized medicine-wide application.

Risk Assessment & Disease Monitoring: Biomarkers also forecast the risk for a person to develop other diseases like diabetes or heart disease. They also monitor disease progression and the effectiveness of treatment. Blood test biomarkers can show whether the cancer treatment works or not; therefore, it reduces unnecessary treatment and enhances patient outcomes. This demand is going higher because risk assessment markers came into greater need with the constant increase in chronic diseases.

Pharmaceutical & Biotechnology Companies: Pharmaceutical companies use biomarkers for new drug discovery and testing. A biomarker is useful in helping to identify the right patients during clinical trials, and drug response is monitored to speed up approval and reduce costs. This has encouraged companies to invest heavily in biomarker research to enhance personalized medicine and target-oriented therapies.

Hospitals and Diagnostic Centers: Biomarkers enable hospitals to make a quick and accurate diagnosis of diseases. The blood tests of biomarkers indeed help doctors rule out conditions caused by heart attacks and cancer at an early stage. Such trends will continue since the new patient demand for tests to be availed in hospitals acts as a pull for such testing. This also includes biomarker tests as part of routine check-ups offered by diagnostic centers.

Research Institutes and Academic Laboratories: Research has been done in universities and research labs to discover more new biomarkers. Research on the capacity of biomarkers to improve the diagnosis and treatment of diseases is ongoing. The area of research is government and private funding for support. Most new biomarkers are first validated in research labs before they find their way to hospitals and drug companies.

Contract Research Organizations (CROs): Better named contract research organizations, CROs conduct biomarker research on behalf of pharmaceutical companies and biotech firms. They offer all services for managing clinical trials and biomarker validation studies. Many companies prefer outsourcing biomarker research activities to CROs to save themselves the trouble of completing and accelerating the development of drugs. Thus, this increases the CRO segment because the demand for trials on drugs developed using biomarkers increases.

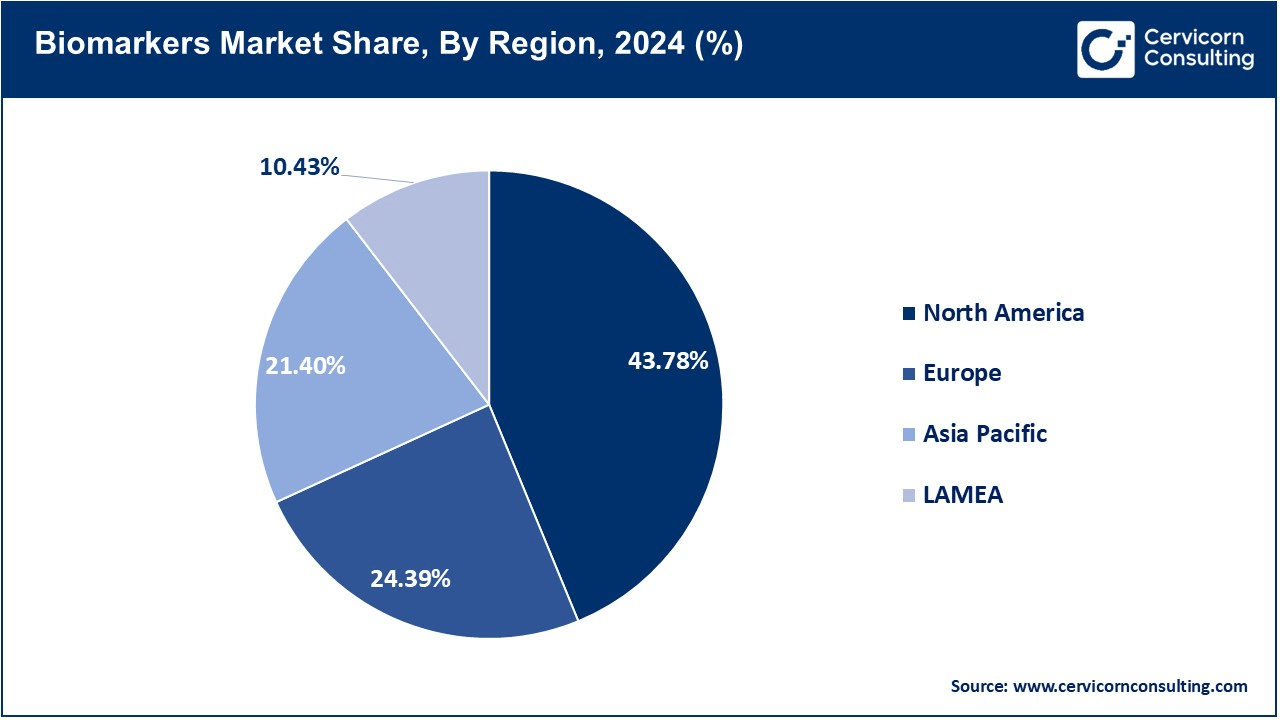

The biomarkers market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

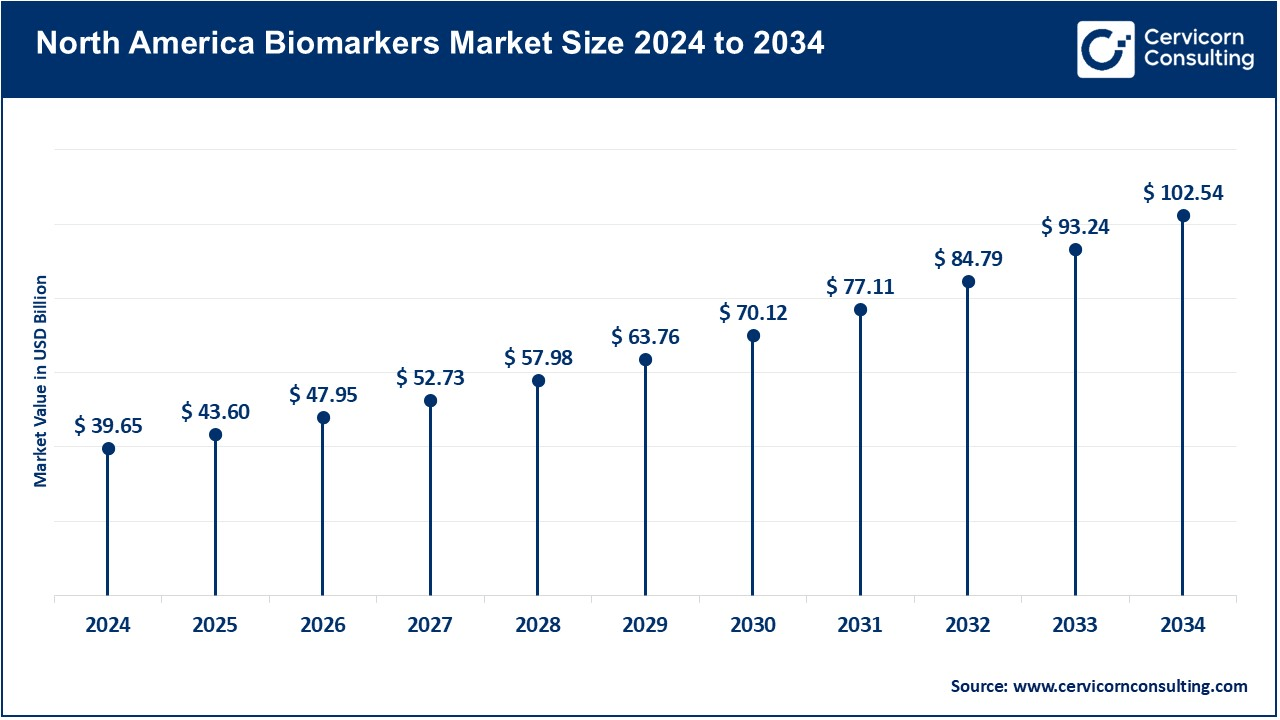

The North America biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. North America is the largest market worldwide. The country's lead in biomarker research is backed by high funding, development in healthcare systems, and the presence of large pharmaceutical sectors. There is a government policy on biomarker-based medicine. These are the main diseases driving the use of biomarkers in this region: cancer and heart disease.

The Europe biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. Biomarkers are well established in Europe as the European healthcare system supports biomarker research. Pharmaceutical businesses from Germany, the UK, and France are investing heavily in biomarker-based drug research. European regulations encourage the use of biomarkers in clinical trials. The market is growing due to the demand for personalized medicine.

The Asia-Pacific biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. The Asia-Pacific region is the fastest-growing market. Countries like China, India, and Japan are raising funds for health and medical research. There will be a rise in the number of cancer and heart disease diagnoses, which increase the biomarkers' demand. More government funding is being provided, along with partnerships with biotech companies.

The LAMEA biomarkers market size was valued at USD 90.57 billion in 2024 and is expected to hit around USD 234.21 billion by 2034. Latin America, an emerging market, is being improved by countries such as Brazil and Mexico to enhance healthcare infrastructure. The use of biomarkers in the detection of infectious diseases is growing. Smaller than North America or Europe, this market already has strong potential for growth. The MEA region has a developing market for biomarkers. Investments by governments in healthcare innovation are evidenced in the UAE and Saudi Arabia. Biomarkers are mainly for infectious disease detection. Limited research facilities slow down development, but international partnerships are helping expand biomarker uptake.

CEO Statements

Guido Baechler, CEO of Mainz Biomed

Tempus and Genialis Collaboration Announcement

Strategic Vision from PPD (Thermo Fisher Scientific)

Market Segmentation

By Product Type

By Type

By Disease

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biomarkers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Type Overview

2.2.3 By Disease Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing breast cancer among the population

4.1.1.2 Enhance advanced technologies developed in treating breast cancer

4.1.2 Market Restraints

4.1.2.1 Treatment is very costly

4.1.2.2 Side effects of treatment

4.1.3 Market Challenges

4.1.3.1 A side effect of the treatment involved in breast cancer

4.1.3.2 High cost of the treatment

4.1.4 Market Opportunities

4.1.4.1 Increased support from the government

4.1.4.2 Increased research and development

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Biomarkers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Biomarkers Market, By Product Type

6.1 Global Biomarkers Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Consumables

6.1.1.2 Instruments

6.1.1.3 Software & Services

Chapter 7. Biomarkers Market, By Type

7.1 Global Biomarkers Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Safety Biomarkers

7.1.1.2 Efficacy Biomarkers

7.1.1.3 Predictive Biomarkers

7.1.1.4 Surrogate Biomarkers

7.1.1.5 Pharmacodynamic Biomarkers

7.1.1.6 Prognostics Biomarkers

7.1.1.7 Validation Biomarkers

Chapter 8. Biomarkers Market, By Disease

8.1 Global Biomarkers Market Snapshot, By Disease

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cancer

8.1.1.2 Cardiovascular Diseases

8.1.1.3 Neurological Diseases

8.1.1.4 Immunological Diseases

8.1.1.5 Others

Chapter 9. Biomarkers Market, By Application

9.1 Global Biomarkers Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Diagnostics

9.1.1.2 Drug Discovery and Development

9.1.1.3 Personalized Medicine

9.1.1.4 Risk Assessment & Disease Monitoring

Chapter 10. Biomarkers Market, By End-User

10.1 Global Biomarkers Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Hospitals & Diagnostic Centers

10.1.1.2 Pharmaceutical and Biotechnology Companies

10.1.1.3 Academic and Research Institutes

10.1.1.4 Contract Research Organizations (CROs)

Chapter 11. Biomarkers Market, By Region

11.1 Overview

11.2 Biomarkers Market Revenue Share, By Region 2024 (%)

11.3 Global Biomarkers Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Biomarkers Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Biomarkers Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Biomarkers Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Biomarkers Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Biomarkers Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Biomarkers Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Biomarkers Market, By Country

11.5.4 UK

11.5.4.1 UK Biomarkers Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Biomarkers Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Biomarkers Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Biomarkers Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Biomarkers Market, By Country

11.6.4 China

11.6.4.1 China Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Biomarkers Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Biomarkers Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Biomarkers Market, By Country

11.7.4 GCC

11.7.4.1 GCC Biomarkers Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Biomarkers Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Biomarkers Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Biomarkers Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Abbott Laboratories

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Agilent Technologies Inc.

13.3 Bio-Rad Laboratories

13.4 Charles River Laboratories International Inc

13.5 Epigenomics AG

13.6 Eurofins Scientific SE

13.7 F. Hoffmann-La Roche Ltd

13.8 GE Healthcare

13.9 Illumina, Inc.

13.10 Johnson & Johnson Services, Inc

13.11 Merck KGaA

13.12 Qiagen N.V

13.13 Quanterix Corporation (Aushon Biosystem)

13.14 Siemens Healthcare Private Limited/Siemens AG

13.15 Thermo Fisher Scientific Inc.