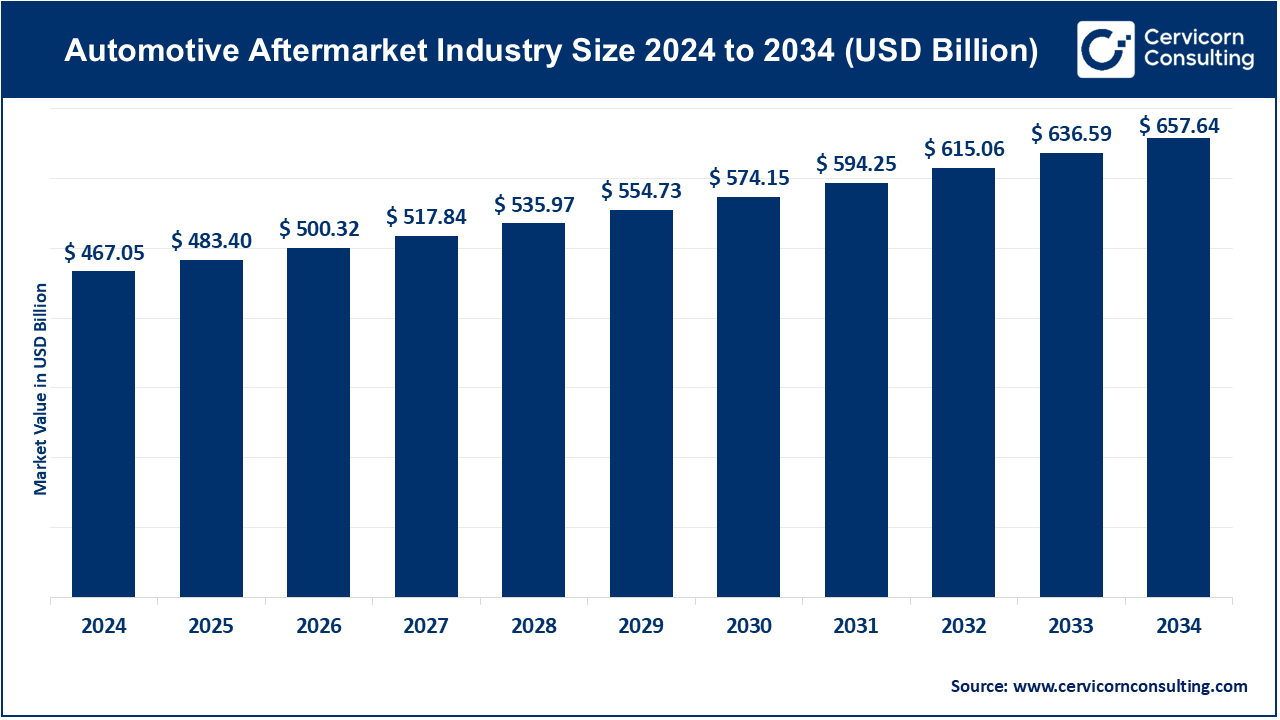

The global automotive aftermarket industry size was valued at USD 467.05 billion in 2024 and is expected to reach around USD 657.64 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.48% over the forecast period 2025 to 2034.

The automotive aftermarket industry is expanding, due to an increasing average age of vehicles and rising consumer awareness regarding vehicle maintenance. With technological advancements, modern vehicles are equipped with more sophisticated systems, necessitating frequent servicing and part replacements to maintain performance and safety. Additionally, the growing preference for customized vehicles has driven demand for aftermarket accessories like performance parts, aesthetic enhancements, and in-car entertainment systems. In 2023, Germany led automotive parts exports with a value of USD 61.8 billion. The rise of electric and hybrid vehicles (EVs) is transforming the aftermarket industry, introducing new opportunities in EV-specific components, such as battery management systems, charging solutions, and software-based diagnostics. Furthermore, digitalization is playing a critical role, with e-commerce platforms offering consumers easy access to aftermarket products and services.

The automotive aftermarket is a secondary market for vehicles, encompassing all products, services, and solutions after the original sale of an automobile. This includes replacement parts, accessories, equipment, and services for vehicle maintenance, repair, and upgrades. Components like tires, batteries, lubricants, filters, and collision repair parts are critical parts of the aftermarket. Service providers such as mechanics, body shops, and retailers play a significant role in delivering these offerings to consumers. The aftermarket is vital to extending the lifespan of vehicles, ensuring their safety, performance, and compliance with environmental regulations. It is supported by vehicle owners who want to personalize or repair their cars beyond what manufacturers provide. With the rise of electric vehicles (EVs) and advancements in automotive technology, the aftermarket is adapting to new demands, such as EV charging equipment, software updates, and advanced diagnostics.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 483.40 Billion |

| Market Growth Rate | CAGR of 3.48% from 2025 to 2034 |

| Market Size by 2034 | USD 657.64 Billion |

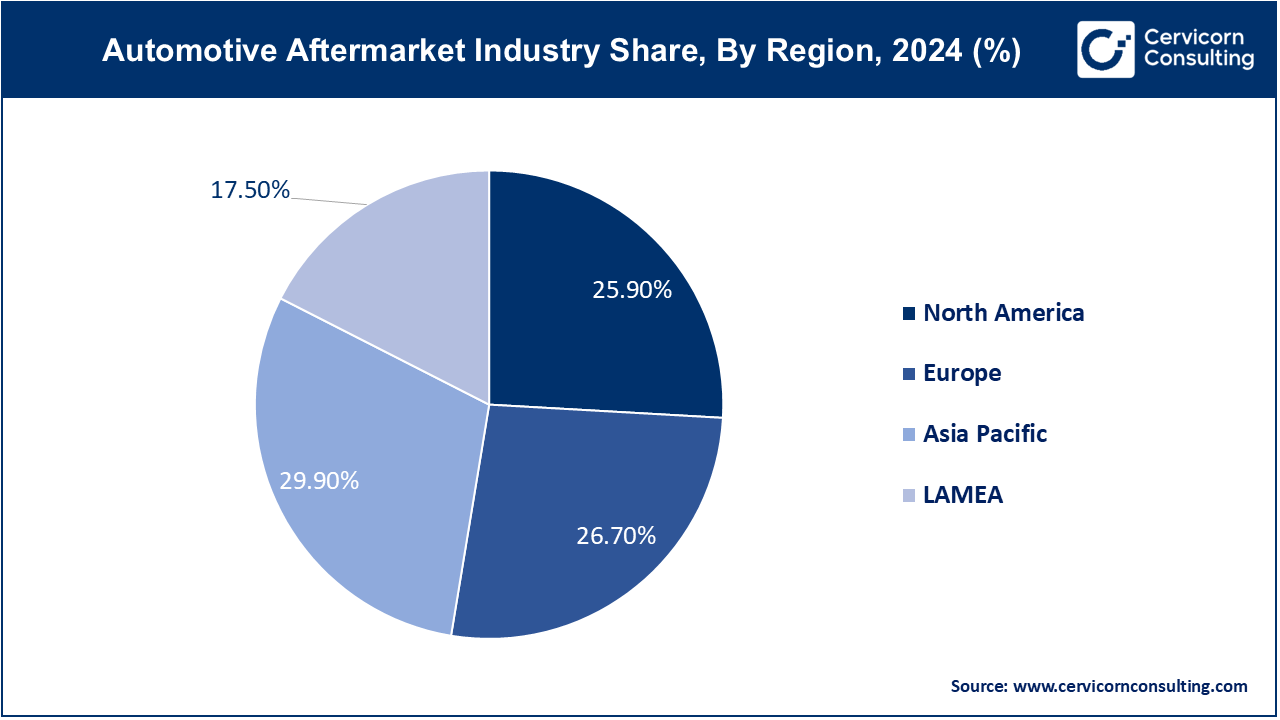

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | Replacement Parts, Distribution Channel, Certification, Service Channel, Region |

Increase in Vehicle Ownership:

Technological Integration in Vehicles:

Economic Uncertainty:

Increasing Complexity of Modern Vehicles:

The growing complexity of modern vehicles, with their advanced technologies and integrated systems, can pose challenges for the aftermarket industry. Independent service providers may struggle to keep up with the latest diagnostic tools, repair techniques, and specialized parts required for new vehicle models. This can limit their ability to effectively service and repair newer vehicles, potentially driving customers to OEM service centers and reducing market share for aftermarket providers.

Sustainability and Green Products:

Digital Transformation and Smart Solutions:

Counterfeit Parts:

Supply Chain Disruptions:

Tire: This segment has reported market share of 22.15% in the year of 2024. Tires are essential automotive components that ensure vehicle safety, performance, and fuel efficiency. They include different types like all-season, winter, and performance tires. Growing demand for durable, high-performance tires and increasing popularity of eco-friendly and low-rolling-resistance tires drive the market. Advancements in tire technology, such as run-flat and self-sealing tires, and the rise of online tire retailing are notable trends in the aftermarket.

Battery: Automotive batteries provide the electrical power necessary to start the engine and support vehicle electrical systems when the engine is off. The shift towards electric vehicles (EVs) has spurred demand for advanced batteries like lithium-ion. Additionally, advancements in battery technology, such as enhanced durability and faster charging capabilities, along with increasing sales through online platforms, are prominent trends in the aftermarket battery segment.

Brake Parts: Brake parts include components such as brake pads, rotors, calipers, and brake fluid, essential for vehicle safety and performance. Trends: Increasing focus on vehicle safety drives demand for high-quality, durable brake components. Trends include the development of low-dust and noise-reducing brake pads, the rise of ceramic brake parts, and the growing popularity of electronic braking systems, contributing to the segment's evolution.

Filters: Filters in vehicles, such as oil, air, fuel, and cabin filters, remove contaminants and ensure optimal engine performance and air quality inside the vehicle. Rising awareness of air quality and engine efficiency drives demand for high-performance and eco-friendly filters. Trends include the adoption of nanofiber technology in filters, increasing preference for washable and reusable filters, and growth in online sales channels.

Body Parts: Body parts include components such as bumpers, fenders, doors, and hoods, essential for vehicle aesthetics and protection. The demand for customized and high-quality body parts is rising, driven by consumer preference for vehicle personalization. Trends include advancements in lightweight materials, such as carbon fiber and aluminum, and the growing popularity of aftermarket body kits and accessories for aesthetic enhancement.

Lighting & Electronic Components: This category includes headlights, taillights, interior lighting, and electronic systems like infotainment and navigation units. Advancements in LED and OLED technology are driving growth in the lighting segment, while increasing integration of smart electronics and connectivity features boosts demand for electronic components. Trends include the rise of adaptive lighting systems and the growing popularity of aftermarket infotainment and connectivity upgrades.

Wheels: Wheels, including rims and tires, are crucial for vehicle performance, aesthetics, and safety. The aftermarket wheel segment is driven by consumer desire for customization and performance enhancement. Trends include the rise of lightweight alloy wheels, the popularity of larger diameter wheels for aesthetic appeal, and increasing sales through online platforms offering a wide range of customization options.

Exhaust Components: Exhaust components, such as mufflers, catalytic converters, and exhaust pipes, are essential for controlling vehicle emissions and noise. Stricter emissions regulations drive demand for advanced exhaust components. Trends include the development of high-performance and eco-friendly exhaust systems, the increasing popularity of aftermarket performance exhausts, and growing consumer preference for stainless steel components for durability and aesthetics.

Turbochargers: Turbochargers are forced induction devices that increase engine power and efficiency by forcing more air into the combustion chamber. Rising demand for fuel-efficient and high-performance vehicles drives the aftermarket turbocharger segment. Trends include the development of advanced turbocharging technologies, such as variable geometry turbochargers (VGTs), and the growing popularity of turbocharger upgrades among performance enthusiasts.

Others: This category includes miscellaneous aftermarket components such as suspension parts, engine components, and interior accessories. The demand for high-performance and customized components drives growth in this diverse segment. Trends include the rise of advanced suspension systems for better handling, increasing adoption of performance-enhancing engine parts, and the growing popularity of interior upgrades such as custom seats and infotainment systems for enhanced comfort and connectivity.

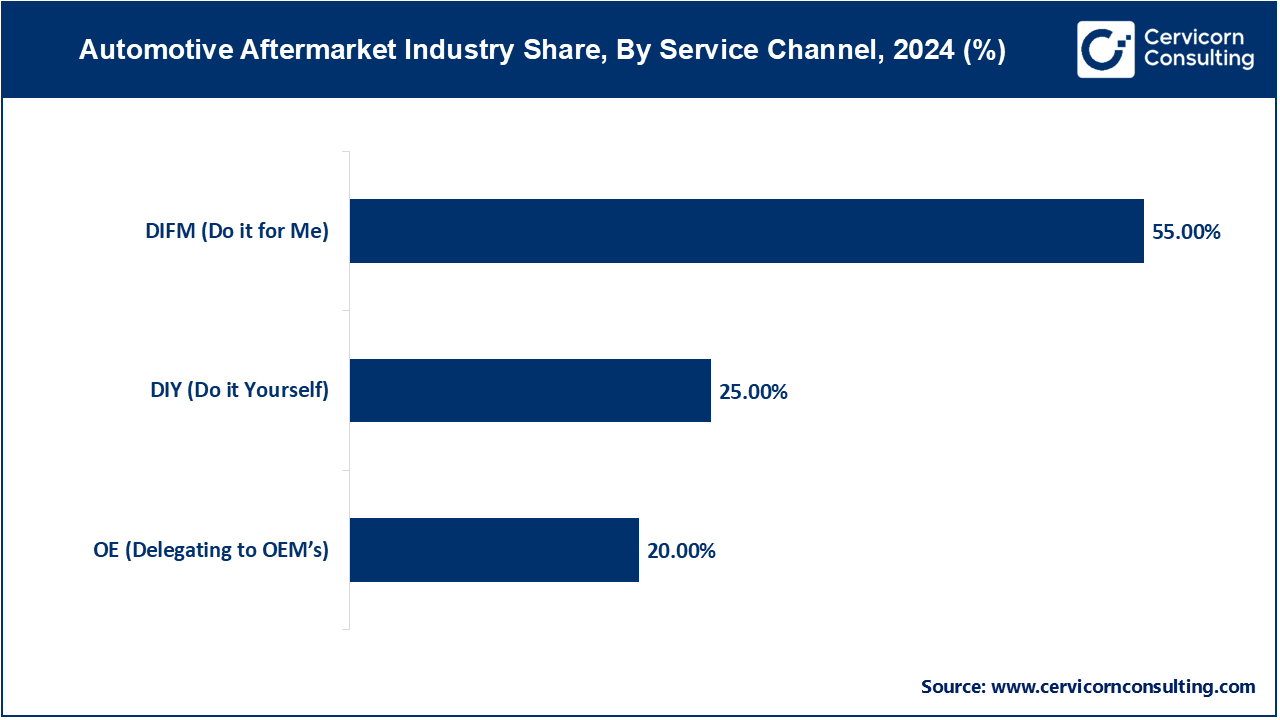

DIY (Do it Yourself): This channel segment has registered market share of 25% in 2024. DIY in the automotive aftermarket industry refers to vehicle owners performing maintenance, repairs, and upgrades themselves, using tools and parts purchased from retailers. The DIY segment is growing due to increased access to online tutorials, instructional videos, and readily available parts through e-commerce platforms. Enthusiasts and cost-conscious consumers are driving demand for user-friendly products and comprehensive repair kits, contributing to the segment's expansion.

DIFM (Do it for Me): The DIFM channel segment has garnered highest market share of 55% in 2024. DIFM involves vehicle owners outsourcing maintenance, repairs, and upgrades to professional service providers, such as mechanics and auto repair shops. The DIFM segment is expanding as vehicles become more technologically complex, requiring specialized knowledge and tools for repairs. Convenience and the assurance of professional expertise are driving more consumers to opt for professional services. Additionally, the growth of service chains and franchises is enhancing accessibility and trust in DIFM services.

OE (Delegating to OEMs): The OE service channels segment has considered a small market share of 20% in 2024. OE service channels refer to vehicle owners delegating maintenance, repairs, and parts replacement to Original Equipment Manufacturers (OEMs) and their authorized service centers. The OE segment benefits from consumer trust in OEM quality and warranty assurances. As vehicles incorporate advanced technology, the need for specialized diagnostics and genuine parts increases, driving more consumers to OEM service centers. OEMs are also expanding their service offerings and investing in customer loyalty programs to retain and attract customers.

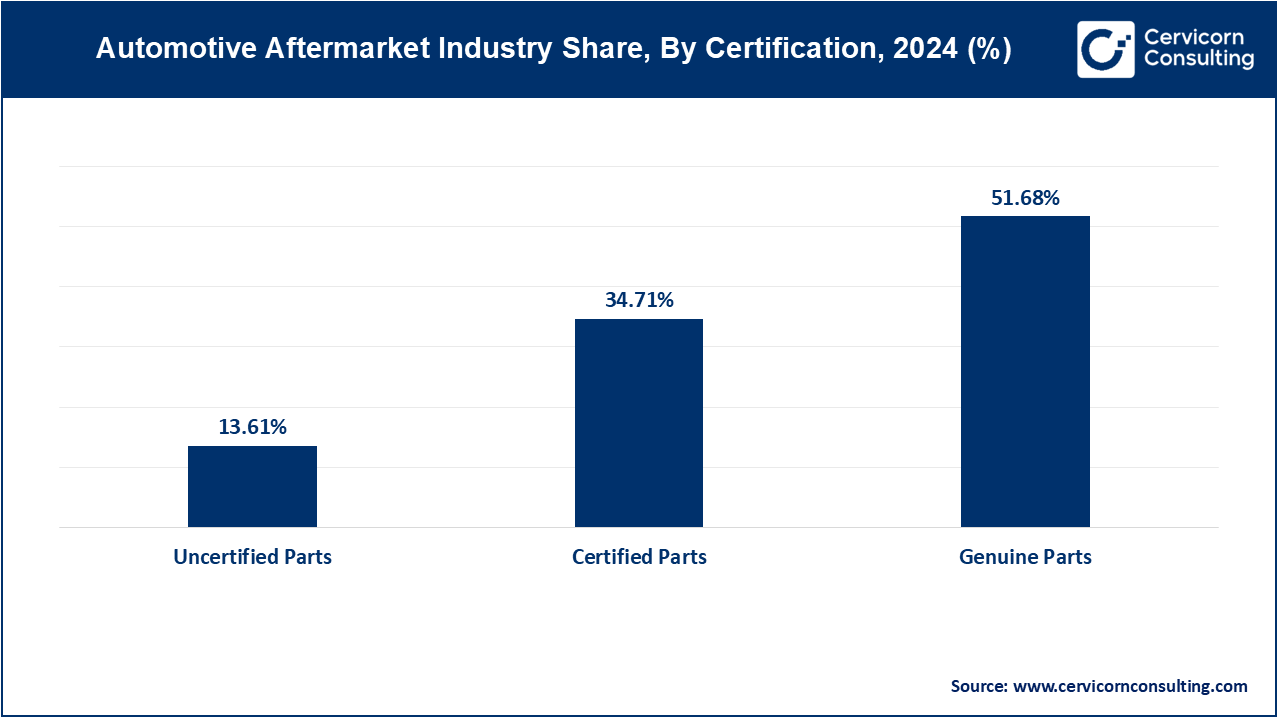

Genuine Parts: The genuine parts segment has confirmed highest market share of 51.68% in 2024. Genuine parts are OEM (Original Equipment Manufacturer) components produced by the vehicle’s manufacturer or authorized suppliers. These parts are designed to meet the exact specifications and quality standards of the original equipment. Trends indicate a growing preference for genuine parts due to their reliability and compatibility, often backed by warranties and a higher assurance of performance and safety.

Certified Parts: This segment has captured market share of 34.71% in the year of 2024. Certified parts are aftermarket components that have been tested and approved by a recognized third-party organization for quality and performance. These parts meet specific industry standards and are often endorsed by manufacturers. Trends show increasing consumer trust in certified parts as they offer a balance between quality and cost, and are increasingly available through reputable suppliers.

Uncertified Parts: In 2024, the uncertified parts segment has recorded market share of 13.61%. Uncertified parts lack formal testing and approval by recognized organizations. They are typically less expensive but may vary widely in quality and performance. Trends reveal that while some consumers seek these parts for cost savings, the risk of poor performance and safety issues poses significant concerns, leading to growing industry efforts to increase awareness and regulation of these components.

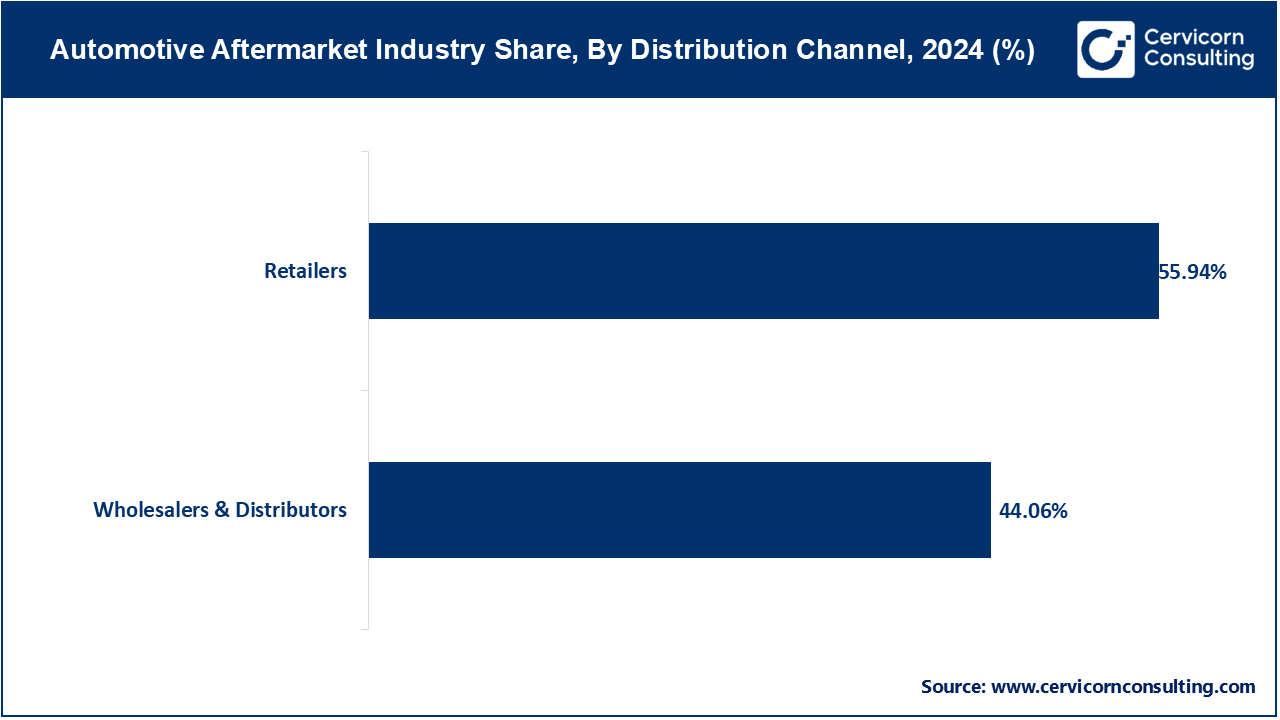

Retailers: The retailers segment has generated largest market share of 55.94% in 2024. Retailers in the automotive aftermarket industry sell parts and accessories directly to consumers. Trends include the rise of online retail platforms offering convenience and competitive pricing, and an increase in physical store formats focusing on personalized customer service. Retailers are also expanding their product ranges to include more advanced and high-tech automotive products.

OEMs: Original Equipment Manufacturers (OEMs) produce parts and components that are used in new vehicles and also provide replacement parts. Trends include a growing focus on high-quality, reliable components and expanding product lines to include advanced technologies. OEMs are increasingly involved in the aftermarket to ensure parts compatibility and maintain vehicle performance standards.

Repair Shops: Repair shops provide maintenance and repair services for vehicles, using aftermarket parts. Trends show a rise in specialized repair shops focusing on advanced technologies, such as electric and autonomous vehicles. There is also growth in mobile repair services, offering convenience and immediate service to consumers at their locations.

Wholesalers & Distributors: Wholesalers and distributors act as intermediaries between manufacturers and retailers or repair shops, managing bulk inventory and logistics. The wholesalers and distributors segment has covered market share of 44.06% in the year of 2024. Trends include the adoption of digital platforms for inventory management and order processing, and enhanced focus on supply chain efficiency to meet the increasing demand for automotive parts promptly.

Others: This segment includes e-commerce platforms, aftermarket service providers, and automotive parts manufacturers. Trends involve the expansion of digital marketplaces, integration of smart technologies for better diagnostics and services, and growth in subscription-based models for regular maintenance and upgrades, reflecting evolving consumer preferences and technological advancements in the automotive sector.

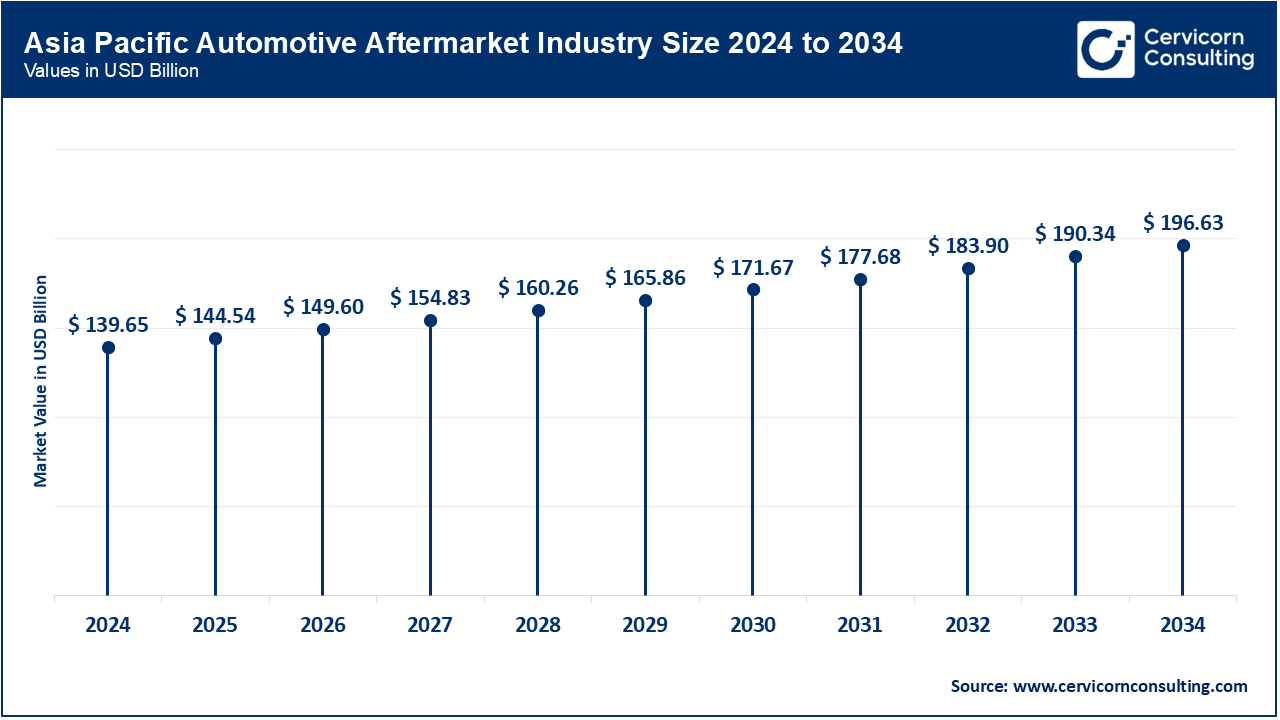

The Asia Pacific market size is calculated at USD 139.65 billion in 2024 and is projected to grow around USD 196.63 billion by 2034 with a CAGR of 3.49%. In the Asia-Pacific region, the automotive aftermarket is expanding rapidly due to rising vehicle ownership and urbanization. Trends include a surge in demand for affordable and locally produced parts, increased investment in e-commerce platforms, and significant growth in repair and maintenance services. The region also faces challenges related to counterfeiting and supply chain issues.

The North America market size is expected to reach around USD 170.33 billion by 2034 increasing from USD 120.97 billion in 2024 with a CAGR of 4.10%. In North America, the automotive aftermarket is characterized by a high demand for advanced automotive technologies and performance parts. Trends include significant growth in online sales platforms, reflecting a shift towards digital purchasing, and an increasing focus on sustainability with eco-friendly parts and services. There is also a rise in premium and specialty parts due to higher consumer spending power.

The Europe market size is measured at USD 124.70 billion in 2024 and is expected to grow around USD 175.59 billion by 2034 with a CAGR of 3.37%. Europe’s automotive aftermarket industry is driven by stringent environmental regulations and a strong focus on sustainability. Trends include a growing emphasis on green and recyclable parts, adherence to strict emission standards, and the expansion of electric vehicle (EV) aftermarket services. The region also sees high adoption rates of advanced driver-assistance systems (ADAS) and other technology upgrades.

The LAMEA market size is forecasted to reach around USD 115.35 billion by 2034 from USD 81.92 billion in 2024. In LAMEA (Latin America, Middle East, and Africa), the automotive aftermarket is experiencing growth driven by increasing vehicle fleets and improving economic conditions. Trends include a rising preference for cost-effective and durable parts, expansion of repair services in underserved markets, and growing adoption of digital and mobile technologies. Challenges include logistical difficulties and varying regulatory environments across countries.

Companies like Rival Technologies and LumenField are leveraging innovation by integrating advanced technologies like AI and blockchain into their automotive aftermarket solutions, enhancing diagnostics and parts traceability. AutoZone, O'Reilly Automotive, and Advance Auto Parts dominate through extensive distribution networks, strong brand recognition, and broad product offerings. They lead with innovations in e-commerce platforms, robust supply chains, and extensive customer service networks, ensuring comprehensive coverage and convenience for consumers across diverse markets.

Market Segmentation

By Replacement Parts

By Service Channel

By Certification

By Distribution Channel

By Region