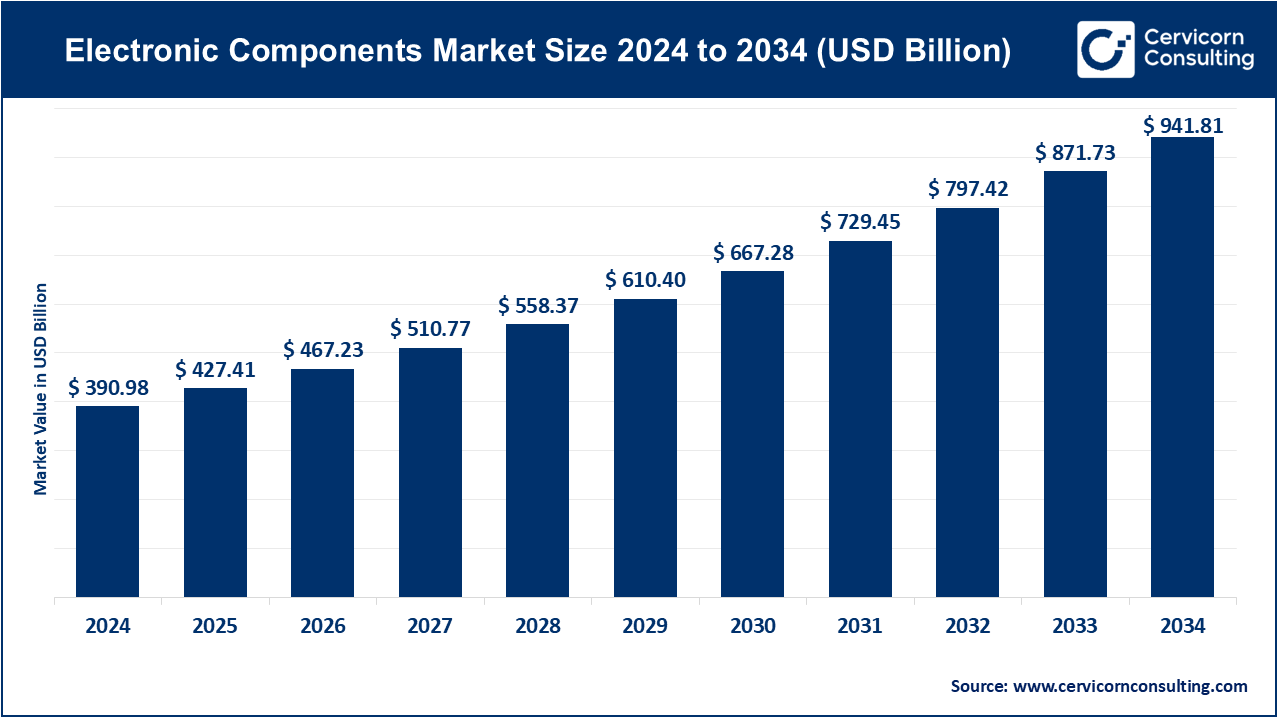

The global electronic components market size was valued at USD 390.98 billion in 2024 and is expected to be worth around USD 941.81 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 9.31% over the forecast period 2025 to 2034.

The electronic components market is experiencing rapid growth due to increasing demand for smart devices, automation, and IoT-enabled products. The rise of electric vehicles (EVs), 5G technology, and artificial intelligence (AI) is driving significant innovation in this sector. Governments worldwide are also investing in semiconductor manufacturing to reduce dependency on imports, boosting local production. Furthermore, consumer demand for high-performance gadgets and increased industrial automation is accelerating market expansion. The shift toward renewable energy and smart infrastructure also plays a crucial role. As companies focus on sustainability, eco-friendly components with lower power consumption are gaining traction. This continuous evolution ensures a steady rise in the market’s growth potential.

What is an Electronic Component?

Electronic components are basic building blocks used in electronic circuits to control and process electrical signals. These components include resistors, capacitors, diodes, transistors, and integrated circuits (ICs). Each serves a specific function: resistors limit current, capacitors store and release energy, diodes control the flow of current, and transistors amplify or switch electrical signals. ICs combine multiple components into a single chip, enabling complex functionalities in small devices. Electronic components are essential in various industries, including consumer electronics, automotive, telecommunications, and industrial automation. Devices like smartphones, laptops, medical equipment, and smart home appliances rely on these components for efficient performance. With advancements in technology, modern components are becoming smaller, more efficient, and highly durable.

Key Insights Beneficial to the Electronic Components Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 427.41 Billion |

| Projected Market Size (2034) | USD 941.81 Billion |

| Growth Rate (2025 to 2034) | 9.31% |

| High-impact Region | Asia-Pacific |

| Highest Growth Region | North America |

| Key Segments | Type, Application, Region |

| Key Companies | TDK Corporation, KYOCERA AVX Components Corporation, Murata Manufacturing Co., Ltd., Samsung Electronics Co., Ltd., Panasonic Corporation, Texas Instruments Incorporated, NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, Advanced Micro Devices, Broadcom Inc., STMicroelectronics N.V., Amphenol Corporation, Littelfuse, Inc., Monolithic Power Systems, Inc., Intel Corporation, ON Semiconductor Corporation, Renesas Electronics Corporation, Hitachi Ltd., Watts Electronics Pvt. Ltd., Toshiba Corp., TE Connectivity Ltd., ABB Ltd., Amphenol Corporation |

Increased Government Support and Incentives

Growing Advancement in Manufacturing and Industry 4.0

Failure Associated with Electronic Components

Strict Environmental Regulations

Rising Integration of AI Across Industries

Miniaturization and Integration of Electronic Components

Rising Uncertainty in Demand and Economics

Disruption in Supply Chain

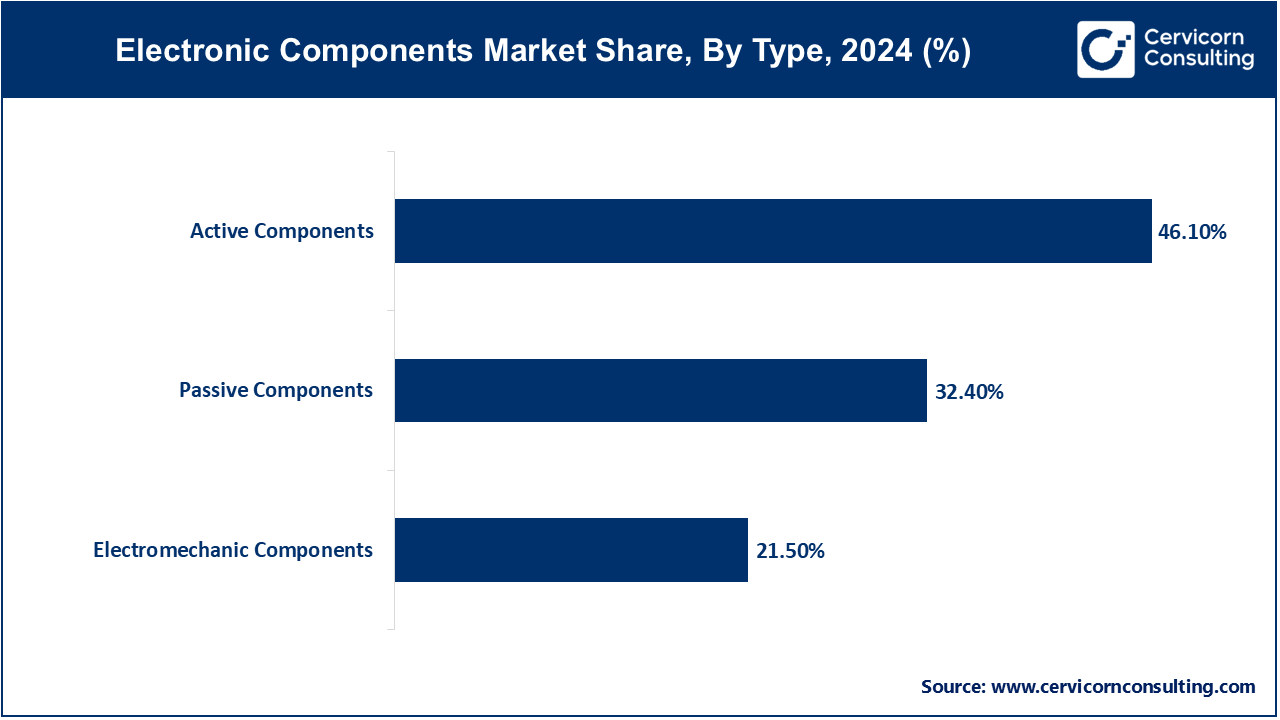

Active Components: The active components segment was leading region and accounted share of 46.10%. The growing use of active components across a wide range of sectors, such as consumer electronics, industrial automation, automotive, and telecommunications is anticipated to drive market growth. Furthermore, it is also anticipated that the growing number of product launches by market players is expected to propel market expansion. Renesas unveiled a brand-new automotive intelligent power device (IPD) in January 2023 that adapts and securely regulates power distribution in automobiles to satisfy the demands of the upcoming E/E (electrical/electronic) designs.

Passive Components: The passive components segment accounted for 32.40% of the total revenue share in 2024. A passive component can only receive energy, it can either dissipate, absorb, or store in an electric or magnetic field. Passive elements do not require any electrical energy to operate. Passive components receive the electrical energy and either convert it or store it in the form of a magnetic or electric field. An electrical signal cannot be produced, amplified, or oscillated by passive components. The passive components primarily resist, store, or control the flow of electrical current or voltage in a circuit without actively generating or amplifying signals. Some examples of passive components are resistors, capacitors, inductors, diodes, and coils.

Electromechanic Components: The electromechanic components segment has garnered share of 21.50%. Components that contain both mechanical and electrical components are known as electromechanical components. These components work by converting electrical signals into mechanical motion. They help in building a bridge that connects the mechanical and electronic domains so that motion or data can be transmitted. They are an essential component in numerous electronic systems and find use in a vast range of applications, right from basic switches to intricate motors.

Automotive: The automotive segment has dominated the market in 2024 with revenue share of 26.10%. There has been a rise in the usage of electronic components in automobiles owing to the dependence of automobiles on safety systems and other electronic components. The usage of electronic components for boosting the propulsion systems' efficiency and performance is a standard procedure. The electronic components facilitate communication between the powertrain systems of an automobile and enable the sharing of sensor signals while managing the operations of the systems. Powertrain systems use sensors for turbine speed, transmission oil temperature, and throttle position.

Telecommunication: The telecommunications segment has held share of 23.40% in 2024. Technological developments in the telecommunications industry are constantly expanding, from 4G to Voice over Long-Term Evolution (LTE/4G) and 5G. Telecommunications applications include things like network equipment, base stations, mobile phones, landlines, set-top boxes, and remote controls. In addition, the telecommunications industry is using more and more electronic components due to the remarkable expansion of the smartphone industry and the resulting rise in the mobile phone market.

Consumer Electronics: The consumer electronics segment accounted for 20.30% of the total revenue share in 2024. The rising demand from emerging markets is driving the rapid growth of the consumer electronics industry. As a result of the global increase in consumer spending, many countries are producing more consumer electronics, which is in turn fueling the sector's rapid expansion. Some of the most frequently used electronic components in the consumer electronics industry are microcontrollers, LEDs, transistors, sensors, operational amplifiers, capacitors, integrated circuits (ICs), inductors, resistors, batteries, connectors, power converters, and others.

Healthcare: Electronics have become an important part of established and commonly used medical innovations around the world. From patient monitors to diagnostic imaging systems to infusion devices, the use of electronics is widespread. Electronics has made a positive and valuable contribution to the medical field. Knowledge of the application of electronics in medical technology contributes to the development of medical electronic devices. The development of new medical electronic devices is based on the miniaturization and integration of technologies that lead to the production of portable, wearable, and unobtrusive devices at low cost.

Industrial Machinery: Many modern industrial machines use electronic components that enable automation in the production processes, help in controlling machines and equipment, collect and analyze huge amounts of data, and implement artificial intelligence-based systems. Resistors, capacitors, LEDs, transistors, inductors, diodes, crystals and oscillators, and electromechanical components such as relays and switches, ICs, and connectors are some of the most commonly used electronic components in industrial machinery.

Others: The others segment includes energy & utilities and aerospace & defense. The energy & utilities industry is accountable for the safe, reliable, sustainable generation, transmission, and distribution of resources for improving grid stability which is critical in ensuring that utilities maintain power despite several unexpected causes and risks. Electrical components are essential to the operation of power grids. Energy management systems, SCADA systems, and smart grid technologies all rely on microprocessors and communications devices to monitor and control power flow, balance supply and demand, and improve overall grid reliability. Batteries and control systems are two kinds of electronic components that are used for storing energy, which can be used in the future. The electrical components used in the aerospace industry are designed in a way that they can tolerate temperature, shock, vibration, and altitude extremes associated with high-altitude operations. Right from barrier terminal blocks for aircraft engines to RFI filters for communications systems, electrical components help the aerospace industry to grow. Land, sea, and air forces worldwide are purchasing cutting-edge technologies that include electronic warfare systems, targeting systems, night vision devices, thermal imaging systems, and missile defense systems to gain a competitive advantage. Electronic technology has therefore been essential to defense systems in applications such as missile launchers, aircraft systems, cockpit controls, space rocket launchers, and military radars.

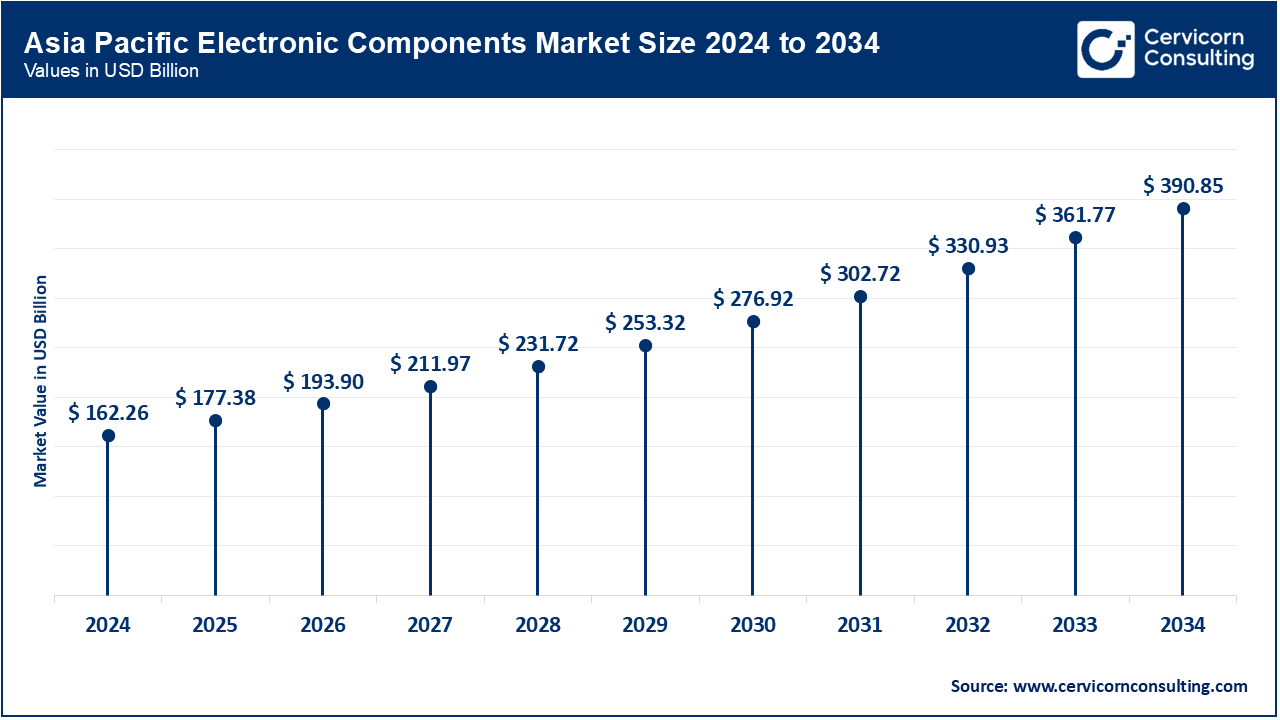

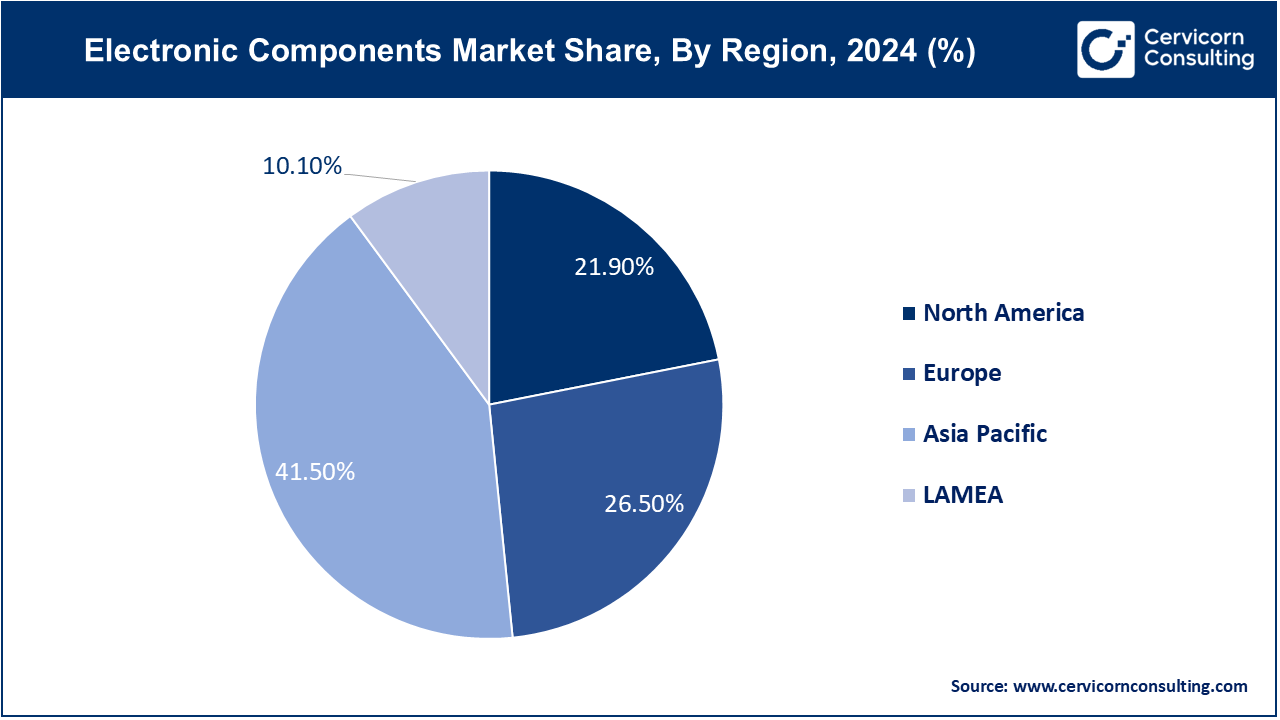

The Asia-Pacific electronic components market size was estimated at USD 162.26 billion in 2024 and is expected to reach around USD 390.85 billion by 2034. Asia Pacific is home to some of the world's largest semiconductor producers, including companies in China, Taiwan, South Korea, Japan, and Taiwan. Many nations are making significant infrastructure investments for the production of semiconductors. Advanced node technology is being led by Taiwan and South Korea, while China is making significant investments to move toward self-sufficiency. Furthermore, there's a boom in demand for consumer electronics like wearables, laptops, tablets, and smartphones in the local market. This increasing demand for the latest consumer electronics owing to the ever-growing population and rising income in countries like China, India, Japan, and South Korea.

The North America electronic components market size was reached at USD 85.62 billion in 2024 and is projected to hit around USD 206.26 billion by 2034. North America has various industries such as automotive, consumer electronics, aerospace, telecommunications, and healthcare present in the region, with an advanced technological infrastructure that is driving the electronic components market. Owing to the rising popularity of smartphones, tablets, laptops, wearable technologies, and other consumer electronics, there is a high demand for microprocessors, sensors, displays, memory chips, and other electronic components. Further, prominent manufacturers of semiconductors and electronic components, including Broadcom, Texas Instruments, NVIDIA, Qualcomm, and Intel, are also present in North America.

The Europe electronic components market size was accounted for USD 103.61 billion in 2024 and is predicted to surpass around USD 249.58 billion by 2034. Europe has a significant number of producers of electronic components and a well-established electronics industry. The UK, France, and Germany are among the countries in Europe that hold a significant market share. The region prioritizes cutting-edge manufacturing techniques, innovation, and high standards of quality. The three main industries driving the European market for electronic components are automotive, industrial, and telecommunications.

The LAMEA electronic components market was valued at USD 39.49 billion in 2024 and is expanding to USD 95.12 billion by 2034. The expanding automotive and healthcare industries in Latin America are driving up demand for electronic components. Brazil possesses an established automotive sector which is home to some prominent market players in automobiles, trucks, and motorbikes. Some of the companies operating in the Brazilian market include Volkswagen, Fiat, General Motors, and Ford. The nation's need for electric cars is also rising. In addition, owing to the expanding healthcare industry there are numerous prospects for growth within the United Arab Emirates (UAE). To enhance patient care and promote innovation, the UAE government has made substantial investments in healthcare infrastructure and technology.

Most companies are actively conducting research and development. They find that this will enable them to create the next generation of active electronic component products that can generate even more energy than the previous generations. In November 2023, Renesas Electronics expanded its 32-bit microcontroller with a new RX device for industrial sensor systems. The microcontroller is used for various applications that require quick and precise measurements of analog signals.

Players such as Infineon Technologies AG, ABB Ltd., and Murata Manufacturing Co., Ltd., have a wide range of products, and recent advancements propelling the market's expansion. For instance, Murata Manufacturing Co., Ltd. launched the GRM188D72A105KE01 in November 2023. It is a multilayer ceramic capacitor with a 1 µF capacitance used in 48 V power supply lines in data centers, servers, and base stations. This product is approximately 67% smaller in volume and 49% smaller in area than other 2012 M-size multi-dimensional ceramic capacitors because of Murata's new, proprietary technology. Therefore, such major players demonstrate leadership and impact the dynamic electronic components market through their strategic initiatives and creative thinking.

CEO Statements

Ian Mason, CEO of Electrocomponents:

P Raja Manickam, CEO of Tata Electronics OSAT:

Market Segmentation

By Type

By Application

By Region